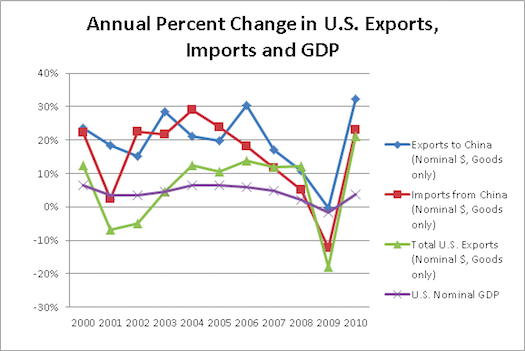

The bilateral U.S.-China trade deficit in goods is obviously quite large. At the same time, China's export engine has powered it to an astounding series of high-growth years. These two facts, however, create a discourse that sometimes obscures the underlying trend. The value of U.S.-made goods being exported to China is increasing very rapidly. More rapidly than the value of China-made goods that we're importing. More rapidly than overall US goods exports. And much more rapidly than overall US GDP:

An interesting analysis from the New York Fed says that Chinese currency revaluation would further increase the growth rate of American exports to China. The authors say that the net impact on the bilateral deficit would, however, be small. That's because "made in China" stuff includes lots of foreign inputs, and those inputs would get cheaper under revaluation. Consequently, the net price of Chinese-made goods would stay similar and U.S. exports are growing from a relatively small base, so the gap would stay large. Still, exporting to China has been a very high-growth segment for the American economy and revaluation could boost it into even higher gear.

Published on July 14, 2011 11:31