How to Start a Publishing Company in 7 Steps

Today’s post is one that has been highly requested, and that is: How To Start Your Own Publishing Company. This is something that I did as a self-publisher. I am the President and Owner of Black Falcon Press, which is what I decided to name my company. I want to share my experiences with you all and give you a step-by-step guide on how to do this, in case you’re thinking about starting your own publishing company. If you'd rather watch the video on this topic, feel free to click play below. Otherwise, read on!

Quick disclaimer: This post and corresponding video are for informational purposes only. I am not an account or a lawyer, and I am not giving legal advice. Before making any business decisions, it is recommended that you consult a tax professional and a lawyer.

With that out of the way, first, let’s get into whyit’s a good idea to create your own publishing company. And make sure to stay tuned at the end of this post, because I’ll announce the 3 winners for my 1K giveaway! So, the pros of setting up a publishing company are:

1. Professionalisma. With your own publishing company, you can register your ISBN with your company name as the publisher. This will show up on your book sales page and looks more professional than having “CreateSpace” or "Your Name" as the publisher. Also, if you want to use IngramSpark, it’s required that you sign up as a publishing company and not an individual. Just something to keep in mind.

2. Separation of church and statea. By this, I mean that having a publishing company separates your book publishing activities from your personal income and assets. It can be helpful to have your business and personal finances separate for tax purposes. There are even times when it can save you money.b. Also, if you decide to form an LLC or S-corporation (more about those in a little), these companies shield your personal income and assets from lawsuits that may occur. While lawsuits are pretty rare in this line of business, it’s nice to have that extra layer of protection in place, just in case.

3. Options galorea. Once you have your own publishing company, the sky is the limit! Down the road, you may want to offer your services to the public. You can offer not only publishing services and publish other author’s books (which hint, hint is something I’m thinking of doing in the future!), but also offer editing, revision, or marketing services. It’s your business, so you can make it whatever you want it to be!

Okay, so if all this sounds fine and dandy and you’ve made the decision to start your own publishing company, follow these 7 steps:

1. Research your optionsa. It’s important to know what options are available in your country. Since I live in the U.S., the steps in this video are for starting publishing companies in the U.S. There are three main options to choose from in the states: sole proprietorship, LLC, and an S-Corporation.b. A Sole proprietorship is an unincorporated business that you run yourself. You would claim this under your SSN (social security number) for taxes. This is the easiest way to start.c. An LLC is a limited liability company (this is the one I chose) that is taxed similarly to a sole proprietorship. However, an LLC is an incorporated business and separates and protects your personal assets from business assets under, you guessed it, limited liability.d. An S-Corporation is an incorporated business and gives more tax advantages and savings.

2. Decide on a name for your publishing companya. Once you’ve decided on the type of business you’re going to set up, you need to choose a name for your publishing company. You must make sure the name you’ve chosen is not trademarked or already taken in your state. Also, make sure to choose a business name that is professional and fits your brand. Don’t rush this step because your business name is one that will stick with you for a long time.

3. Finalize the business type and file the paperworka. Now that you have chosen a name for your publishing company, you need to finalize the set-up and file the paperwork. This step is difficult for me to explain because the filing process is different for every state, so I’m going to tell you how to do it in Texas since that is where my publishing company is set up. Really, all I did was Google “How to start an LLC in Texas”. LegalZoom was one of the first websites that popped up and I had seen commercials on TV, so I figured I’d check that out first to see exactly how much this was going to cost. I answered all the questions and finally got to the pricing page and HOLY COW. So first of all, just to file in the state of TX for an LLC is $300. And because LegalZoom is a third-party service that is going to do all of the filing and paperwork for you, they have three different Packages: Economy ($149 + $300 filing fee), Standard ($289 + $300), or Express Gold ($359 + 300). I was willing to spend $300 to set up my publishing company, but not $450-$660. I knew there had to be another way, so I googled again.b. By going to the Texas Secretary of State SOSDirect website, I was able to do all my paperwork and file my certificate online AND it only cost me $300. And on this website, I was even able to search other company names registered in the state of Texas to make sure Black Falcon Press wasn’t already taken. Bingo. So moral of the story here is, DO YOUR RESEARCH and be patient about finding the best way to file your paperwork. I recommend going to the Secretary of State’s website for whichever state you live in to truly find out what it costs to start your own company. Don’t jump the gun, it’ll save you a lot of money.

4. Set up your business bank accounta. It only took 48-72 hours for my publishing company to be approved and I was emailed a certificate right away with my EIN (or employer identification number) and was told the signed certificate was in the mail. Once you have your EIN, you can apply for a business bank account. I personally bank through Wells Fargo, but my business account is set up through Chase. Each bank has a different process and requirements for setting up a business account, so you’ll need to consult with your local bank for more details.b. I also recommend setting up a business Paypal account for online transactions, especially if you’re going to offer and sell signed copies of your book. You can use PayPal to send electronic invoices and receive payment directly into your business bank account.

5. Set up an accounting systema. I wouldn’t worry about this too much in the beginning, especially if you’ve only published 1 or 2 books, but as you start publishing more and start earning higher revenues, you’ll need to have an accounting system in place so that you’re not running around with your hair on fire when tax season rears its ugly head. I recommend buying the cheapest version of QuickBooks. And since this isn’t a QuickBooks tutorial, you’ll have to follow the instructions that come with the software or find a different YouTube video to learn how to use that :^) b. Also, it’s important that you implement a system for tracking your receipts. Never buy personal items with a business account and vice versa. You want to be organized and keep this separate.

6. Register a domain name for your businessa. Every company has a website nowadays, so it’s critical that you make one for your publishing company! Register a domain name for your business. Domain names are the .coms, .nets, .orgs, .infos, etc. By this, I mean that I’ve registered blackfalconpress.com, as well as blackfalconpress.net, .info, and .org. You can do this through domain registrars, like GoDaddy or 7. Learn the laws related to publishing companiesa. Make sure you learn the laws related to your business. For example, in the United States, there are laws about collecting sales tax when you sell books at live events and it differs from state to state. I just experienced this at Leviosa Con in Nevada. You may also need to register for a sales tax license in your state and/or your city. Again, your State’s Secretary of State website should be your starting point to find all of this information.

So there you have it, 7 steps to help you start your own publishing company. One quick thing I did want to mention is that if you’re nervous to set up a company because you’re worried about potentially owing a lot at tax time, don’t fret. You have to sell quite a few books before you’ll even get taxed, and this doesn’t normally happen to self-published authors with 1, 2 or even 3 books under their belt. But if it’s still a concern, make sure you visit the Small Business Administration Website at sba.gov. I’ll put the full link right here: https://www.sba.gov/blogs/how-calculate-and-make-estimated-tax-paymentsThey explain everything really well and will hopefully ease your mind a little.

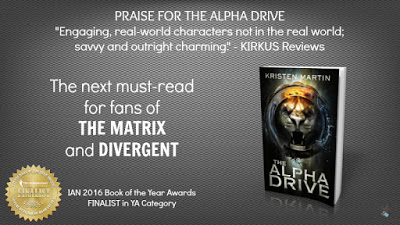

Just a couple of weeks ago, I reached 1,000 subscribers on my YouTube channel and promised that I would do my 1K giveaway drawing in a mid-August post. Three winners will get to choose from the following prizes: 1. A signed copy of The Alpha Drive; 2. A $15 Amazon gift card, and 3. A 1st chapter critique (to be used at anytime, it doesn’t have an expiration date!) So without further ado, the winners are:

1) Freda Cervantes2) Lara Tomasoa3) hihomatey10

Congratulations! Be sure to email me at authorkristenmartin@gmail.comto claim your prize. You can pick whatever you want, so if all three of you want one prize, like the $15 Amazon gift card, that’s okay by me. You can choose whichever prize your little heart desires.

Even if your name wasn’t picked for my 1K giveaway, you can still win a signed copy of THE ALPHA DRIVE during the Goodreads giveaway that starts today, August 9thand goes through Tuesday, August 16th. You can enter to win by clicking here.

That’s all I have for you guys today!

Until next time,

[source]

[source]

Published on August 10, 2016 07:06

No comments have been added yet.