IRS Reports a Summertime Surge in Robo Calls That Seek to Scam People with False Tax Bills

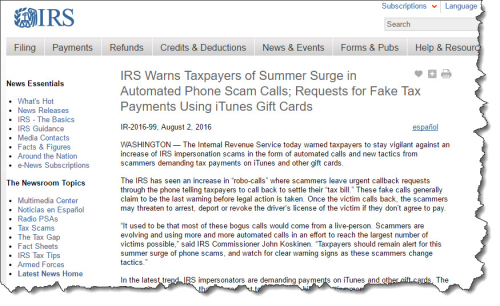

Earlier this week, the Internal Revenue Service warned taxpayers that IRS impersonation scams in the form of robo calls were on the rise during these summer months.

Tax-based scam phone calls have unfortunately been a part of the fraud landscape for some time now, and they remain popular with thieves for the simple reason that they work so well. Human nature being what it is, honest people tend to believe what others are telling them, so when you start from that point, and then add the compelling feature that the IRS is (supposedly) the entity on the other end of the line, the combination of an assumption of veracity and natural fear of the all-powerful taxing authority seems to incline the average call recipient to believe what he or she is being told.

The ���robo��� aspect is a new twist to this fraud effort. According to the IRS, the automated calls leave ���urgent��� messages for the recipients that they are to call back and resolve their ���tax bill.��� If a prospective victim does return the call, it will be to a live person on the other end, who will typically go through a litany of threats and ultimatums to leverage the caller into paying over the phone.

On the scammers��� move to robo calls, IRS Commissioner John Koskinen said, ���It used to be that most of these bogus calls would come from a live person. Scammers are evolving and using more and more automated calls in an effort to reach the largest number of victims possible. Taxpayers should remain alert for this summer surge of phone scams, and watch for clear warning signs as these scammers change tactics.���

Perhaps the single best defense to this garbage is knowing that the IRS will NOT contact you by phone or email about any tax issue, and particularly not about a sum that they say is owed to them (unless they have already contacted you by mail, and, even at that, unsolicited calls from the IRS are very rare). Additionally, the IRS, in any form of communication, will not threaten to have you arrested, demand you pay a bill without having the opportunity to challenge it, or request payment information, like a credit card number, over the phone.

My advice is that if you receive a call from someone identifying himself as an IRS representative and demanding that you pay a bill, hang up the phone right away; again, unless you have already been contacted in writing about a sum that���s due, there is really no chance the call is legitimate. That said, if you want additional peace of mind, you can call the agency yourself at 800-829-1040 to confirm that there is indeed no outstanding bill.

By Robert G. Yetman, Jr. Editor At Large