Heckuva Job, Nigel!

UK PMI collapses. Term spread moves toward inversion.

From yesterday’s FT:

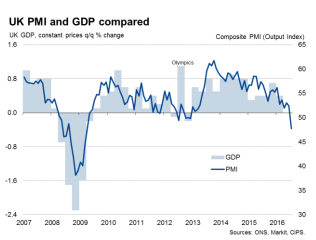

A special edition of the purchasing managers’ index (PMI) – a well-regarded survey of activity produced by research group Markit – has been published to provide a picture of how the UK economy has fared after the referendum. The picture is not pretty.

The PMI survey for Britain’s powerhouse services sector – which accounts for nearly 80 per cent of the economy – has dropped to a seven year low of 47.4 for July from 52.3 at the June survey. Any reading below 50 indicates contraction. The outcome was far lower than economists’ forecast of a reading of 48.8.

Here’s the relevant graph.

Source: “UK economy suffered ‘dramatic deterioration’ after Brexit vote – Markit,” FT, 22 July 2016.

The yield curve has not yet inverted.

Figure 1: Ten year minus three month UK Treasury spread. July observation for 7/22. UK recession dates shaded gray. Source: BoE, Economist, Wikipedia, accessed 7/23.

Note that, as discussed in this post, most of the flattening of the yield curve has been due to a falling long yield, rather than a rising short rate.

While the yield curve does not appear to be a reliable indicator of recessions in the UK (as defined by ECRI), there is a statistically significant correlation between yield curve and (real time measures of) GDP growth over the subsequent 4 quarters (see Chinn and Kucko, 2015).

Δyt+4 = 1.43 + 0.47spreadt + ut+4

Adj-R2 = 0.14, N = 104, 1987Q3-2013Q2. bold denotes significant at the 5% msl, using HAC robust standard errors.

A drop in the spread of about 0.5 (that’s the drop in the ten year since the Brexit vote) implies about a 0.25 deceleration in GDP growth.

Menzie David Chinn's Blog