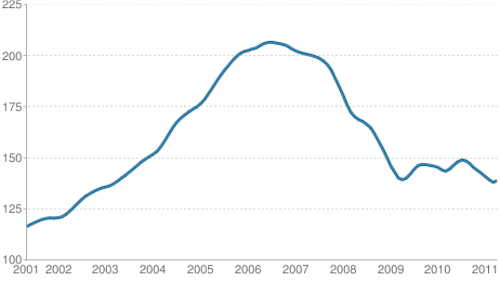

Here's the latest update to the Case-Shiller home price index:

What I think is interesting about this is that while we clearly are staying well-below peak, it also looks to me like there's no real reason to think we'll revert all the way to the index level of 100. It looks, in other words, like we had a lot of irrational exuberance and that we also did have an upward transformation in the equilibrium price of a home. The transformation, I suspect, would be driven by the increasing quality of life in a number of supply-constrained metropolitan areas (most notably the San Francisco/San Jose, Greater New York, DC/Baltimore, and Greater Boston Consolidated Statistic Areas). There's a story here about real estate prices, but also about the general phenomenon of financial bubbles. Looking at something and saying "This is out of whack" is much, much, much easier than figuring out exactly how out of whack it is or when the out-of-whackness will peak. We need systems that are more resilient to bubbles, but it's unrealistic to think we're going to build systems that are based around detecting and popping them.

Published on June 29, 2011 12:15