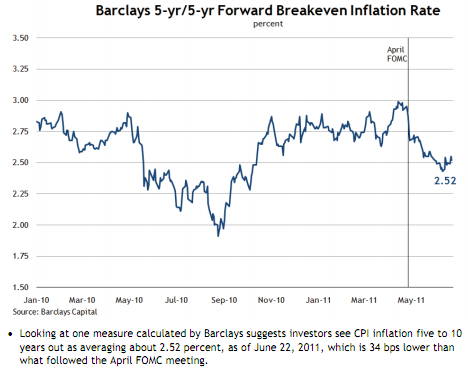

Nice chart from the Atlanta Fed's latest big set of charts (PDF) shows that inflation expectations have tumbled since the April FOMC meeting:

This is, again, a reminder of how bizarre the Fed's stand pat attitude is. If inflation expectations had gone up by a large amount since the last meeting, there's no doubt that the Fed would have responded with tighter money. So why doesn't a fall in inflation expectations lead to looser money?

Published on June 25, 2011 07:31