Corporate Profits Surging As Compensation And Asset Prices Both Lag Far Behind

Inspired in part my this post at Macro Resilience I wanted to do a bit more research on the theme of macroeconomic policymakers seeking to stabilize asset prices rather than wages, thinking that perhaps maintaining some slack in the labor market is good for asset-owners since it promotes wage moderation.

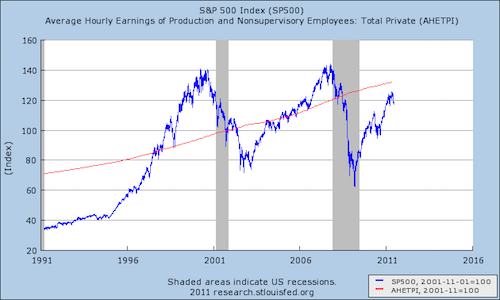

But it turned out that I couldn't actually make the case that stockholders have made out better than workers:

Don't get me wrong, stock is overwhelmingly owned by rich people, so it's not that stockholders aren't better off than workers. It's just that there's no interesting trend here. The value of the S&P 500 fluctuates a lot more than worker compensation, but it seems to gyrate around the same underlying trend.

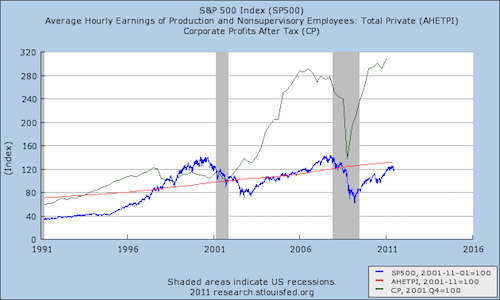

Things look different when you put corporate profits into the picture:

Thus, if not for Search Engine Optimization considerations, this post would be titled "Dude, Where's My Profits?" Why would profits go up in a way that enriches neither labor nor capital? Maybe the real value is accruing to private firms. Or maybe somehow the real value is accruing to bank managers. Or maybe the profits are somehow fake, the result of accounting trickery. I think the real story here is something more complicated than Bloomberg's optimistic "Surging Corporate Profits Should Feed U.S. Job Growth" headline.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers