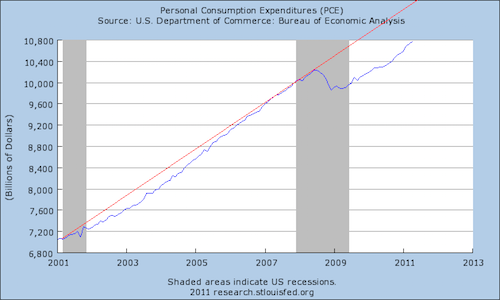

Here's what happens when you take a chart of personal consumption expenditures and draw a line connecting the last two pre-recession peaks:

As for the current recession, this just goes to emphasize how non-mysterious everything is. Note, for example, that the falloff in consumption doesn't really start until the recession had been ongoing for a while. That's because the initial recession was triggered by a falloff in construction employment. But then there's this whole other thing and we're still in it, way below trend.

A robust recovery would have to entail either growing PCE rapidly enough to catch up to trend, or else filling that gap somehow. The question to ask a policymaker about his proposed solution is which of those it's supposed to do and why. Spending-side fiscal stimulus is supposed to act, in part, to fill the gap with government purchases. Tax-side fiscal stimulus could work by increasing disposable income and thereby increasing personal consumption. But if we adopt a plan for balancing the long-term budget that's supposed to do—what? Lead to a surge in net exports? A surge in business investment? Why?

Published on June 08, 2011 13:46