Bretton Woods And The Impossible Trinity

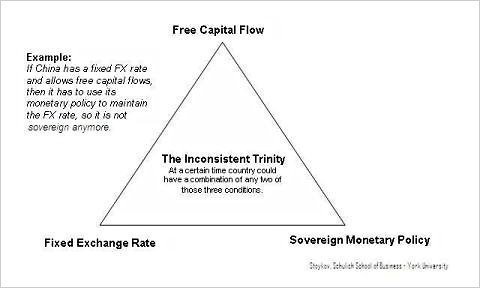

Another link to Paul Krugman, this time on the impossible trinity of independent monetary policy, free flow of capital, and fixed exchange rates noting that foreigners complaining about the fall in the value of the dollar are asking us to do something crazy:

All those accusation of hooliganism, currency wars etc. are in effect demands that the trilemma be resolved by having America give up having an independent monetary policy — basically, that the Fed give up on trying to stabilize the US economy so that emerging markets aren't faced with the uncomfortable tradeoff between massive appreciation and imported inflation. But this shouldn't and won't happen.

This is one reason why I've grown impatient with nostalgia for the good old days of the Bretton-Woods system.This system, which really was working great in its heyday, essentially involved the United States playing precisely the role that we now reject. The dollar was pegged to gold, other currencies were pegged to the dollar, foreign countries could change the dollar price of their currencies, and we couldn't reset the value of the dollar. This worked fine as a means of facilitating catch-up growth in Japan and Western Europe but that growth make it impossible to sustain, so it wasn't sustained and there's no practical method of bringing it back.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers