App-O-Rama: 4 New Cards and ~200,000 Points

Also see:

My First App-O-Rama 2.22.13

Oh man, looking back on my first AOR 3 years ago is such a stroll down memory lane.

Still the best high I’ve found

I was still newish to points and miles, new to blogging, still finding my voice and figuring out my travel goals.

I mentioned them at the time:

My travel goals for this round of apps are Toronto, Montreal, Boston, Dublin, Seattle, Alaska, and eventually, Australia. I’d also LOVE to fit in Vienna/Prague sometime this summer.

I made it to all of those places with the exception of Prague (which I mentioned recently as a possibility with Hilton points, so it’s still on my radar):

Trip Report: Riding On Amtrak Business Class NYP-BOS

Hotel Review: Radisson Blu Royal, Dublin

Off to Seattle & My First FTU!

Hotel Review: Dome Home B&B, Healy, Alaska

Hotel Review: InterContinental Sydney, Australia

It goes to show the power of setting a goal.

But I should take a little wisdom “Three Years Ago Harlan” because my recent round of applications were rather scattershot. After I get settled in Dallas, I’m gonna need to plan a lot of trips with all the points and miles I’ll earn from this newest AOR.

4 new cards!

This is my biggest AOR yet. I briefly considered going for 5, but then I thought… nah…

Slash what’s your biggest number for an AOR?

And also, I thought AORs were kinda dead but apparently they rage on.

Here’s what I picked up:

Amex Mercedes-Benz Platinum Card (75,000 Amex Membership Rewards points through June 22nd, 2016)

Another Bank of America Alaska Airlines Visa (25,000 Alaska Airlines miles and $100 statement credit)

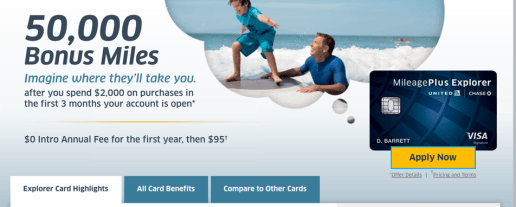

Chase United Explorer (50,000 United miles)

Citi ThankYou Premier (40,000 Citi ThankYou points)

In total, I’ll net nearly 200K points/miles after meeting the minimum spending requirements.

Not a bad haul.

The applications

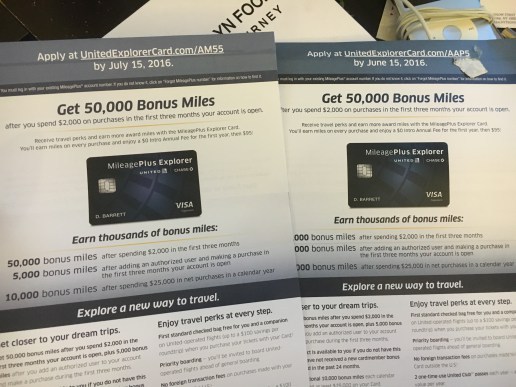

I got nice n schwasted on too much Tito’s vodka and had a thought to apply for the Chase United Explorer card. Chase sent me a targeted mailer – twice – and I heard co-branded cards were exempt from the 5/24 rule.

You want me, Chase?

After being brutally straight-up denied for the Chase Freedom Unlimited, I figured I’d grovel my way back.

Offer landing page

Considering the public offer is for 30K miles right now, it was worth a spin.

Yay!

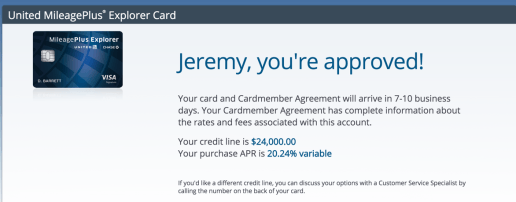

And take me back they did. I got a nice limit, higher than my other Chase cards. I’ll probably add an authorized user for those 5,000 bonus United miles.

Now that I’m heavily into the United Mileage Plus X app, I might as well score some extra miles, increased award availability, and 2 free United Club passes per year. Plus it’s free the 1st year anyway, so why not?

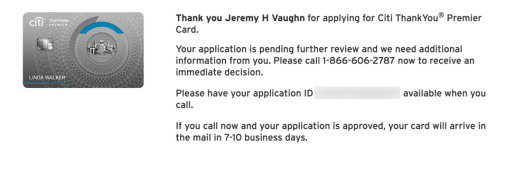

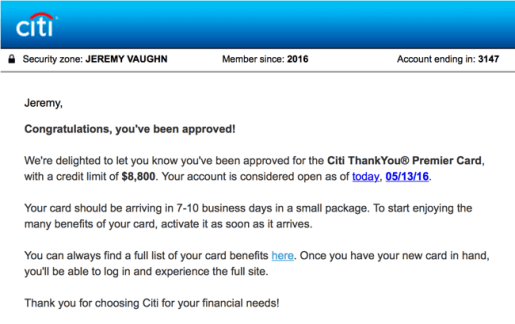

With that squared away, on to Citi.

I went for the Citi ThankYou Premier with a 40K sign-up bonus. To me, that’s worth $640 toward American Airlines flights because I also have the Citi Prestige card.

Although the bonus has been higher, $640 for a hard pull is still worth it to me. I can make use of the expanded 3X travel category which includes gas (now that I’ll be driving again) instead of Citi Prestige’s limited airfare and hotel direct-from-merchant 3X category.

Call required

The app went to a pending state. But I called right away and they pushed it through for me within 5 minutes.

Yay!

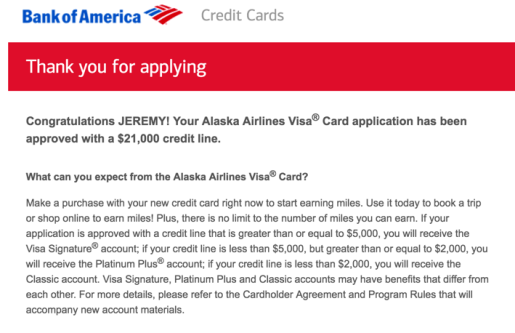

Next, another Bank of America Alaska Airlines Visa.

Easy, fast, 25K Alaska miles

Quickest app ever. Immediately approved. 25,000 more Alaska Airlines miles in the ol’ Mileage Plan account.

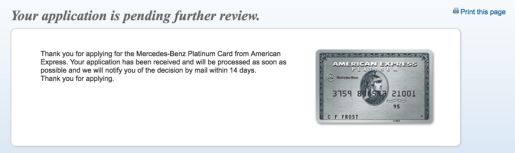

Then, I decided to push my luck with AMEX again with the Mercedes-Benz Platinum Card.

Grrrr

They needed further review. I used my new Dallas address, and apparently it triggered a fraud alert.

They said they needed a few more days to process the application, but I’m confident I’ll get it.

I’m not worried about the annual fee because I’ll immediately get $200 back in Amazon gift cards, which I’ll use to furnish my new place.

And I’ll cancel my other AMEX Platinum Card (regular version) and keep this one for Centurion Lounge access when I fly out of DFW. And to keep my existing Membership Rewards points alive.

Quick word about gas

About… what? Um, OK.

So this is unrelated, but…

$50 for my gas to Dallas (or groceries, restaurants, and drugstores)

I got targeted to get a $50 Alaska Airlines flight credit after spending $250 on my Bank of America Alaska Airlines Visa.

That’s a pretty good return on spending (that I will have to make anyway).

Perfect

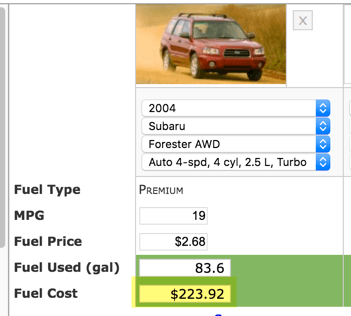

A fuel estimator let me know I’m looking at around that price in gas from NYC to Dallas. Plus, I figure, snacks and coffee to make $250.

Now, I could earn 750 Citi ThankYou points with my new Citi ThankYou Premier. But that’s worth $12 (750 x 1.6 toward American Airlines flights thanks to Citi Prestige).

So I come out way ahead with the $50 flight credit. And, I’ll actually use it.

I’m not worried about making the $3,000 minimum spending requirement on the Citi ThankYou Premier because the move will have all sorts of other costs to cover.

Just wanted to include this nugget to show that sometimes targeted offers can be extremely worthwhile.

Bottom line

Pretty soon, I’ll be 190,000 points/miles richer. And I can’t wait to put them to good use.

In fact, I value that many points at $3,800 – an excellent deal in exchange for a drunken AOR!

I’m reaching a point where I have more points and miles than time to spend them. So I need to get my travel goals together. Having the points is more than enough motivation/temptation for me.

I didn’t think AORs (app-o-ramas) were still a “thing,” but they very much are, apparently. And it felt so good to get those approvals in, one after the other.

I’m also keeping more things in mind. Using points and miles for a trip you wouldn’t have taken anyway doesn’t really mean you’re “saving” money. It means you’re going out and spending on food/taxis/incidentals were you otherwise wouldn’t have.

You’re only saving if you were going to take those trips anyway.

I’m mixing personal finance with my travel bug here. It’s an intriguing place to be. I know I’d travel regardless of points and miles. But having them lets me do it in more comfort.

It’s important to constantly question what you’re really “saving.” And 4 new cards in one night – sheesh. That’s more than some peeps have altogether.

We really do have an extremely niche little hobby, and there’s a certain temperament you need to make it worthwhile. Just please, whatever, you do, never pay a dime of interest. Unless it’s really, really worth it.

All that to say, this newest AOR felt so good. (Also, “bottom line” longer than any section. Hell yes, I’ll be a pro blogger soon!)

What about you guys? Any new cards planned?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!