Apple's Cash And The Corporate Commons

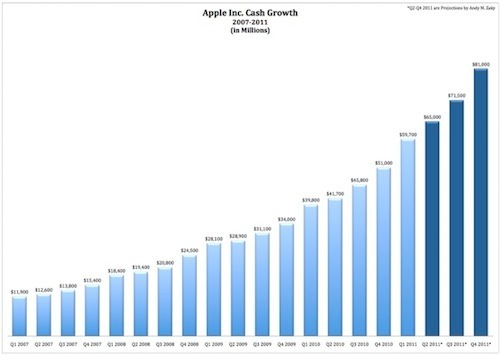

The standard assumption is that if I firm is earning an extraordinary level of profits, that will draw new entrants to compete with it and the profit margins will decline. But for years now Apple has been able to maintain extremely high margins in its various businesses and consequently it sits upon a giant and growing horde of cash:

Fortune's Andy Zaky argues that when you keep this in mind that means that Apple's share prices reflect an irrationally low estimate of its "enterprise value." An alternative interpretation is that they reflect a market assumption that this cash will eventually be wasted.

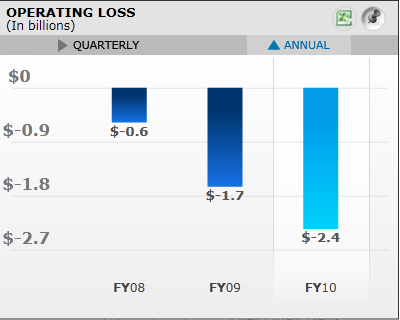

Microsoft, for example, seems to have decided that the best thing to do with its hugely profitable OS and Office businesses is lose stupendous sums of money trying to compete with Google via a stunningly profit-negative Online Services division:

Karl Smith calls this "burning the corporate commons" and it's a big impact on our economy. Not that firms never successfully launch new product lines. Microsoft's Online Services Division may lose tons of money, but the XBox is a successful product, and obviously Apple's decision to reinvest iPod profits into iPhone and then iPad development has paid off well. But firms that reinvest profits in smart ways only end up with what Apple has—an even bigger wad of cash to eventually waste.

I don't really think the impulse to burn the commons can be eradicated in a sustainable way. The fact that you need to be irrationally overconfident in your own business acumen to become a top executive at a major firm is only slightly paradoxical. But social norms around the wastage seem to change over time. Back in the proverbial day AT&T and IBM wasted a lot of money on funding basic scientific research, while today's firms seem to prefer to waste money by entering new product markets.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers