Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

Also see:

Confirmed: RadPad Earns 3X ThankYou Points With Citi AT&T Access More Card

RadPad has been a sweet deal these past few months thanks to their 1.99% fee for paying with a MasterCard.

You could earn 3X Citi ThankYou points by paying with the Citi AT&T Access More card (and still can until June 1st, 2016). Because I have 3 Airbnbs, it’s been a points-generating machine for me.

Even better, when you pair it with Citi Prestige, the 3X points are worth nearly 5% back when you redeem for American Airlines flights. Even with the fee considered, you still come out ahead.

Another one bites the dust-ah

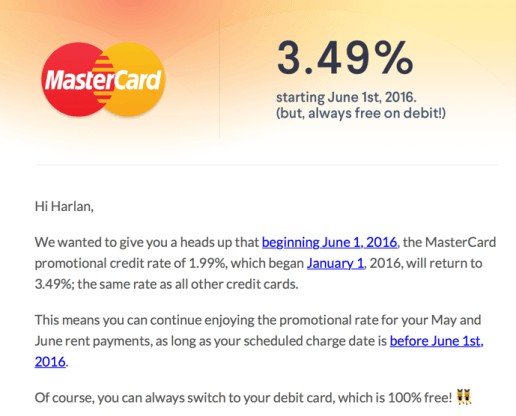

RadPad increases to 3.49%

So many deals are dying these days. When I got the email about the increase to a 3.49% fee, I didn’t feel anything. Just another one gone. Add it to the list (as of June 1st, 2016).

Their consolation seems to be “always free on debit!” (which still gets you 1% cash back). But with the Citi AT&T Access More/Citi Prestige combo, I was doing better than 1%. I was getting nearly 3% back.

Obvi, the rate increase eats into that margin.

I tweeted my displeasure, and got fed the line about debit being free as a reply.

@harlanvaughn Bummed to see you go! Don’t forget, debit’s always free!

— RadPad (@radpad) April 13, 2016

Hoookay. And also like, byeeee.

Enter Plastiq

Link: Plastiq

Link: Citi AT&T Access More card

I’ve always been trepidatious about Plastiq. But via Reddit, they’re now charging 2% fees for MasterCard bill payments, clearly in response to the RadPad move.

I’m ready to jump ship. And even better, you can pay not only rent, but also your mortgage, utility bills, and student loans.

According to FlyerTalk, you’ll get 3X Citi ThankYou points on mortgage payments with the Citi AT&T Access More card. I just joined the ranks of mortgage-payers, so this is excellent news!

When combined with Citi Prestige, that’s like 2.8% back when redeeming for American Airlines flights even after Plastiq’s fee (3X Citi ThankYou points X 1.6 cents with Citi Prestige – 2% Plastiq fee).

By the same logic, it should also work for rent payments, as they’re coded the same way.

But before you jump ship…

I was ready to be like RadPad who? until I plugged in my mortgage into. I was able to get the 2% rate to show with certain merchants, but not others. Here’s what I mean.

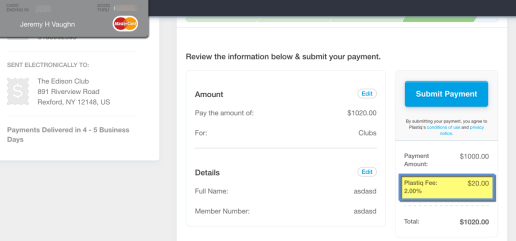

2% shows up fine for this club payment

I found a completely random merchant and set up a test payment. The 2% rate shows up with a MasterCard set for payment.

Great!, I thought. It works!

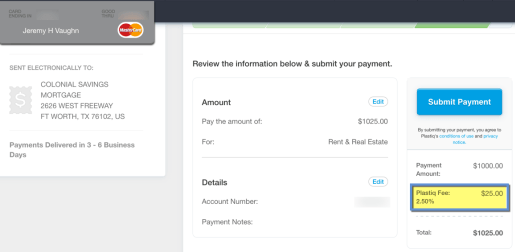

Jigga wha? 2.5%?

I was easily able to find my mortgage company, Colonial Savings, via the search tool. They’re available for ACH payments. But the fee was 2.5%, which isn’t as good as 2%. I have no idea why.

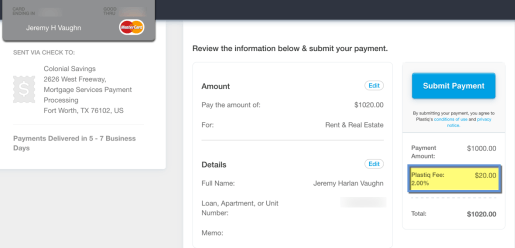

2% when added manually

But, a manual add yielded a 2% fee with a MasterCard.

As you can see, the difference for a $1,000 payment is $5, which isn’t a lot of points OR cash.

But the crucial difference in this case is the ACH payment has a 2.5% fee and it’s delivered in 3 to 6 business days. And the mailed check payment has a 2% fee and is delivered in 5 to 7 business days.

For $5 more, I’d rather spring for the ACH payment because I don’t want a late fee assessed to my mortgage.

And, even still, I’m coming out ahead with the Citi AT&T Access More/Citi Prestige combo.

All this to say, YMMV and do what’s best for you.

I have a mortgage payment due May 1st, and I’m gonna try this out and watch it like a hawk to see how fast Plastiq pays and how it codes with the Citi AT&T Access More card. I expect it to go smoothly.

By the numbers

Per $1,000 you’ll:

Pay $1,020 with a 2% fee and earn 3,060 Citi ThankYou points worth ~$31 at 1 cent each or ~$49 on American Airlines with Citi Prestige

Pay $1,025 with a 2.5% fee and earn 3,075 Citi ThankYou points worth ~$31 at 1 cent each or ~$49 on American Airlines with Citi Prestige

The difference is marginal. And either way, you’re basically doubling your return on the fee payment. Even with the 2.5% example, you pay $25 but get back $49. That’s an extra $288 per year and your mortgage gets paid with a credit card.

Not to mention you can also use this for rent, utilities, student loans, etc. So with the Citi AT&T Access More and Citi Prestige card, you can pair them and score a nice haul – again, assuming they code correctly. Start small and see how it codes and what posts.

Of course, you could also transfer your Citi ThankYou points to travel partners and get outsized value, too. That’s an extra ~37,000 Citi ThankYou points per year per $1,000 in Plastiq payments at the 2% rate.

Bottom line

Interesting stuff. I’m glad I found a way to effectively replace RadPad AND pay my mortgage and still come out ahead.

I’m not sure if the 2% fee on MasterCard payments with Plastiq is being rolled out slowly or is just glitchy at the moment. Either way, it seems you’ll come out ahead when you use the Citi AT&T Access More card for 3X Citi ThankYou points. And then pair it with Citi Prestige (or even Citi ThankYou Premier) for more redemption options. Here’s my link if you decide to apply for either one.

My utility company charges 3% for credit card payments, so payments via Plastiq are actually cheaper anyway. And in most scenarios, you’re more than recovering the fee thanks to the 3X category of online purchases on the Citi AT&T Access More card.

I love geeky stuff like this, so I’m gonna try it for my next mortgage payment and see how it goes.

Also, I love how the same day RadPad announced an increase, Plastiq matches their old rate. If anything, it’s made me want to try it and see how it goes.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!