A Long Way To Go

Decent job report today, I guess. But Mark Thoma offers this from the San Francisco Fed:

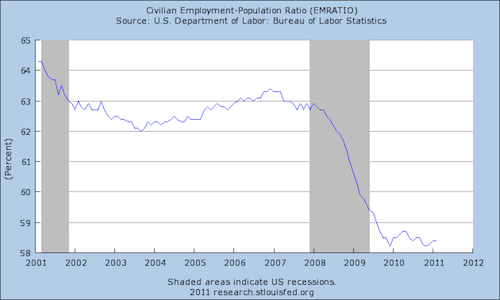

And there's this from Brad DeLong:

Like Kevin Drum, I think the main issue here is that policymakers in Washington have an exaggerated sense of their own impotence.

So consider. The federal government can hire unemployed people to do things. It can also just give money to people, whether unemployed or not. And if people had more money, they would increase their demand for goods and services. And if demand for goods and services rises, then firms will increase the pace of their own activity—with additional hiring or longer hours for existing staff—to meet the demand. But doesn't the money have to come from somewhere? No, it doesn't, the Federal Reserve can conjure money up on computers any time it likes. But if we just print money won't we have runaway inflation?

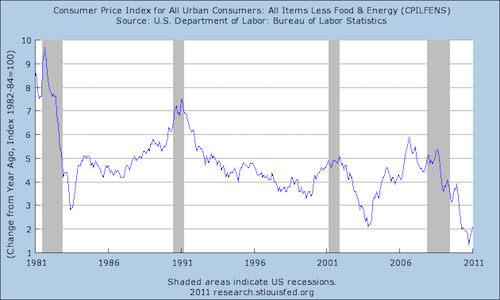

At some point, yes. But right now the inflation rate is well below the levels associated with Ronald Reagan's "Morning in America" recovery or the Clinton boom of the late-1990s and it has been for some time. We could engage in a great deal more monetary expansion before we reach problemas in that regard and because we can engage in monetary expansion we have the capacity to engage in fiscal expansion. And recall that "less unemployment" isn't just a private benefit for the currently unemployed. Employed people produce goods and services for the rest of us to consume. Employed people are our customers and our neighbors, the potential purchasers of the assets we own and taxpayers who contribute to the collective costs of public services.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers