In Closing: My Experience Buying a House

Also see:

Dallas: Buying a House and a Move Toward FIRE

My posts about FIRE

Is Living In Cities Worth It?

Back in November, I wrote about wanting to close on a house in Dallas. I did, in fact, close on a house in Dallas right on schedule, on December 15th, 2015.

My new living room!

That was almost 3 months ago, but it’s taken me this long to write about it.

A friend of mine said it best. We had lunch when she was scheduled to close on a house a few days later.

“OMG!” I exclaimed. “Are you like, so excited to be closing?”

“Not really, actually. I’m just sort of… ready for the process to be over.”

I didn’t think much of it at the time because I still was excited to be moving toward a closing.

That is, until I got there.

Hurry up and wait

The process started easily enough.

All through late October and November, I stayed friendly with my closing team. They’d ask me for things every week or so, which, I’d never closed before, felt like they were on top of it.

I get that I was closing between a string of holidays (Thanksgiving, Christmas, New Year), and that December 15th was right in the middle of post-Thanksgiving and pre-Christmas craziness.

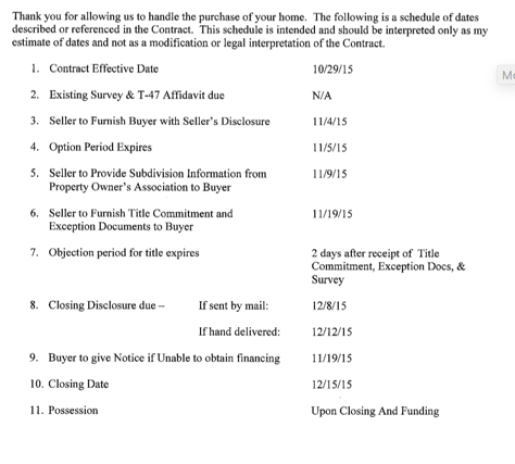

The “Schedule”

I actually told them from the beginning – we can push this to mid-January. I’m not in a hurry.

Oh no, they said. We must close on the earliest possible date.

Texas has a law that you have to wait 45 days to close. So December 15th was almost 45 days… to the day.

I started out friendly, like I said. Until it got to be December and didn’t feel like… it was actually happening.

And then, it was like everyone woke up. And the shit hit the fan.

The bonanza to actually close

I think I have mild PTSD, which is how my friend must’ve felt when I asked if she was “so excited.” Because near the end, I definitely wasn’t “so excited” about closing either.

Every day, frantic calls. Must have this today. ASAP. This can’t wait! Now now now! #stressy

They had me pulling out files from 3 or 4 years ago, reconnecting with old employers for copies of forms.

They called them all, too. My current and former employers. They verified my employment like 20 times. Eventually, I gave them access to the Evernote notebook with all my bank statements from the past 3 years. It was just easier than having to send them in individual emails with frantic requests. (Thank god for FileThis!)

They wanted to know about every deposit. Some of which, I couldn’t even remember.

It got to the point where they had literally every piece of paper I’ve ever signed in my entire life (at least it felt that way).

The hitch

Two weeks from closing, my loan officer told me they’d have to switch my loan to different, more unfavorable, terms.

“You have the choice of Option A or Option B.”

At that point, the friendliness went away.

“Uhhh, how about the loan terms we agreed upon when you wrote my pre-approval letter?”

“Yeah, about that… [blah blah blah.]”

“Actually, I won’t go with either option. If you can’t close it on the terms we agreed on, forget it. I’ll find another company.”

A few hours later, he called me back, breathless. “Great news! My supervisor says we can push it through with the original terms.”

“Good.” Click.

Wrapping it up

The days leading up to December 15th were stressy AF.

They managed to locate forms they “suddenly needed” up till the very end.

Their data managers called me with my student loan company already on the other end. To verify my student loan. That was a surreal experience. What if I’d, like, been in the shower or something?

They called me at all hours, 7am, 9pm, to ask more questions. They demanded to speak to one of my former employers, who was cool with it.

THANK GOD for being on good terms with old employers

He described them as “very pushy.” When we spoke again, he used more colorful terms.

Then they started combing through my credit history.

And, it was explained to me over and over, but:

They demanded I close my Barclaycard Aviator Red card.

I really didn’t want to close it. I mean, WHY? It had no balance. It had been that way for… months.

But, they’d isolated THAT card as the one they wanted me to close.

Professional!

Above is the exact email my loan officer sent me. With “Sorry but this is the difference b/w getting the condo and not.”

Closing that particular Barclaycard was the make-or-break? Really?

You can see my other accounts, the FIA Fidelity AMEX, and a Citi, AMEX, and Chase card. Dunno which ones or why they shows such weird, round amounts. Exactly $10 on two different cards?

I hemmed and hawed and told them this was the LAST thing that I was willing to deal with on a last-minute basis before closing.

They swore up and down that, yes, this was it. Then called Barclaycard to close the card.

RIP, old friend

“You know once you close it, it’s gone forever, right? You can’t reopen it.”

“Yep, I know. Yes, please close it.”

Then they called me again with Barclaycard on the other end to make sure I’d actually closed it.

At that point, no, I was not excited to be closing. I was just ready for the process to be over.

The closing

I closed in New York. It was too close to Christmas and flights back from Dallas were through the roof.

I met the notary, who was so patient, so thorough. Even with questions and explanations, I was done in 45 minutes.

“So that’s it?”

“The check.”

“Oh, right.” I handed her a cashier’s check made out for the amount of the mortgage, property taxes, fees, fees, and other fees.

She left. The money was transferred. The seller was paid and the loan was funded.

That was it.

Bottom line

I rate my closing experience somewhere between really easy and absolute hell.

It closed on time, smoothly, and for the original terms. It was just every step in between that was like pulling teeth.

I’ll be out of New York between April 30th and May 15th. And from that point forward, living in Dallas. I plan on driving down there – more on that soon.

So what’s next? I’d like to buy another place already. A true investment property.

But I’m torn between buying more property and going really damn hard on my student loan.

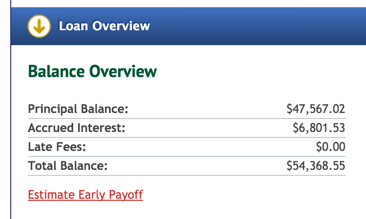

Left to pay on the ol’ student loan *middle fingers*

I still owe about $54K. Which is so stupid. I hate having that hang over me.

Ugh

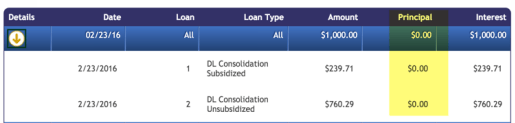

I made a $1,000 payment on it last week. None of it touched the principal.

It felt like throwing a glass of water on a fire. Useless.

It’s baby steps.

I’ve decided to keep two of my Airbnb rentals and sink the profits into a combination of:

Funding my Solo 401(k)

Paying down this student loan

Saving toward another property

Putting a *little* extra toward my mortgage

It’s all a move toward FIRE. And I’m already looking into new side hustles for when I get down to Dallas.

Just like closing on this house consumed me for a couple of months, now leaving New York is consuming me. There’s SO MUCH to wrap up.

But, here goes nothin’. Dallas, here I come!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!