Loving Citi More Than Ever – Time to Cancel Other Cards?

The credit card landscape is shifting fast:

Chase will apply the 5/24 to all its cards starting in April 2016, including co-branded and business cards

Citi has been shutting peeps down for usage they don’t like (multiples of any 1 card, money order payments, etc.)

Barclays had a good product with the Arrival Plus card, then butchered it. That was pretty much the only good card they had

US Bank is useless

Bank of America is only good for the Alaska Visa

Wells Fargo is a cantankerous little beast

There are a few other niche cards, like the Fidelity Visa and BBVA NBA card, worth looking into, but not many

Card offers come and go. Benefits change. Mergers happen and shake things up. Revenue-based elite status throws a wrench into points-earning calculations.

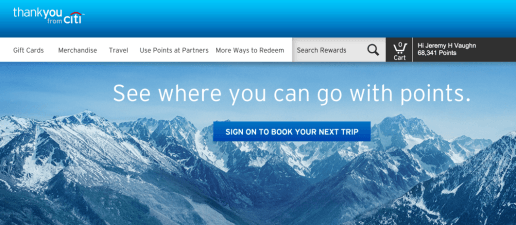

Could ThankYou become the go-to?

Lately, I’ve been using my Citi cards for most of big purchases. And my trusty Chase Sapphire Preferred for dining.

Non-bonused spend goes on the Fidelity AMEX (I still have the AMEX version). And that’s pretty much it. All the other cards I have are for niche benefits or very specific spending (Chase Hyatt Visa, for example).

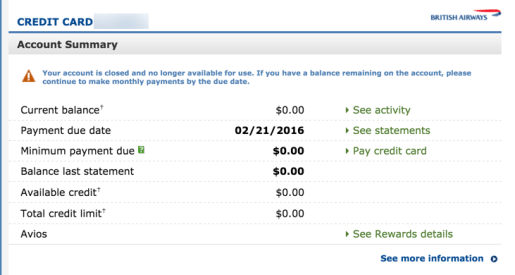

Recently, I went ahead and canceled the Chase British Airways Visa.

Bye, you useless thing

And downgraded my US Bank Club Carlson Visa Signature to the no annual fee version just to keep the credit line and history intact (here’s my recent offer to increase my credit line in exchange for 250 Club Carlson Gold points).

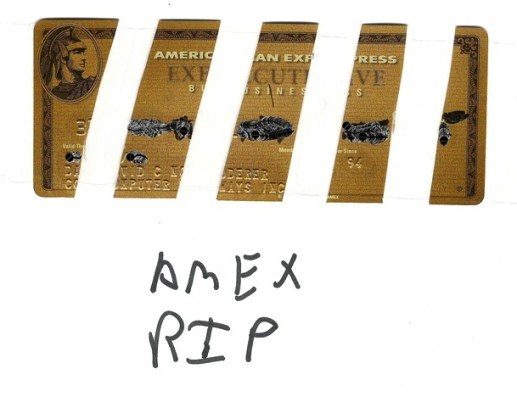

Poor AMEX

AMEX in particular keeps taking the hits left and right:

Costco gone to Citi

JetBlue gone to Barclays

SPG merger with Marriott gone to Chase

But they’ve thrown a few punches, too. Terrible sign-up bonuses and restricting all cards to 1 sign-up bonus per LIFETIME.

Dead to me

You could reward customers with a bonus every few years, at least. Once per lifetime seems unnecessarily harsh.

I explored the topic of switching away from AMEX and over to Citi a few months ago.

As I shift more spend to Citi (and specifically to my new Citi AT&T Access More card – which is also the best card for shopping at Costco), I’m now thinking of canceling other cards to earn ThankYou points. Because I haven’t been hitting 30 transactions per month on my AMEX EveryDay Preferred card, which means no 50% bonus.

And let’s be honest, Membership Rewards is kind of a mess.

What’s coming and going

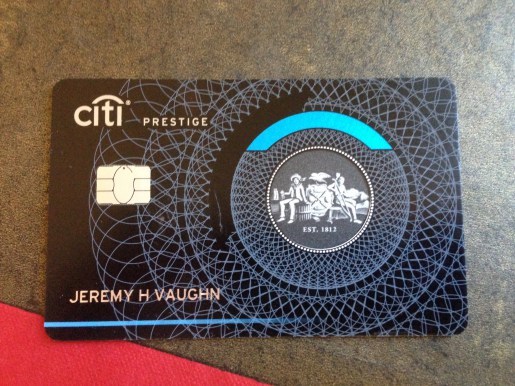

I’m loving my Citi cards more than ever. Citi Prestige is the gift that keeps on giving and Citi AT&T Access More is amazing for online shopping. I still use my Chase Sapphire Preferred for travel other than airfare and hotels, and for dining.

Picture of bae

Until Citi adds a meaningful domestic airline partner, ThankYou won’t be my program of choice. I still use Ultimate Rewards for British Airways, United Airlines, and Hyatt transfers the most.

I might get one more Chase card before the 5/24 rule goes into effect, with the understanding it will likely be my last.

And other cards have to go, including:

AMEX EveryDay Preferred (not worth the $95 annual fee if I’m not triggering 50% bonus)

Barclaycard Arrival Plus (no better than a 2% cash back card now. $89 annual fee not worth it)

Chase British Airways (already canceled. When they cut 1.25 points on purchases, it became useless)

US Bank Club Carlson Visa (no more BOGO and $75 annual fee – downgraded)

I’d like to add the Citi ThankYou Premier to my staple at some point. And maybe another AAdvantage card just for the miles. Wouldn’t mind the extra Hilton points with the AMEX Hilton Surpass, either.

Or the Chase British Airways card for another 100K Avios. This will likely be the last Chase card I get. :/

But that still leaves Citi cards getting the bulk of my actual ongoing spending. Which is kind of surprises me.

My favorite way to redeem Citi ThankYou points is for flights on American Airlines through my Citi Prestige card.

And I need to look into Singapore Airlines’ KrisFlyer a little more… because there are good values for domestic award flights, and flights to the Caribbean. Citi ThankYou points are also crazy easy for me to earn. So it might be worth paying a little more for award flights because of how easy it is to accumulate them.

Bottom line

Citi cards have become the dark horse in my wallet lately. And increasingly, I’m finding it’s more worthwhile to cancel other cards, like the AMEX EveryDay Preferred, or downgrade them, like the US Bank Club Carlson Visa, and keep Citi cards in rotation.

The Citi AT&T Access More card has unexpectedly become my jam.

And I’m loving getting free flights on American Airlines to earn Alaska Airlines elite status with Citi Prestige.

I’m also finding lately I want more Citi cards than Chase or AMEX or any other bank… which is also something new.

Have any Citi cards moved up in your wallet? Are there any others you’re looking to downgrade or cancel?

And… any thoughts on Citi’s ThankYou program? What would you like to see change or added?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!