Gea Elika's Blog, page 147

April 24, 2017

Lighting Solutions for NYC Apartments

While space is a challenge in most NYC apartments, so is lighting. The most common issue with the light in NYC apartments is that there is not enough of it!

With the help of New York City lighting designer Ryan Curtis of Marras Illumination Inc, we’ve compiled some creative, relatively inexpensive fixes NYC apartment-dwellers can make to help solve common lighting issues that won’t come at the cost of losing space.

Image: Pexels.com

Curtis says a huge issue about finding lighting solutions is the tangled web of regulations regarding electrical work in the city. These issues are often structural, he says. For example, your ceiling is your overhead neighbor’s cement floor. This makes drilling impossible as well as a violation of building code regulations.

So, what can residents do to detour around this type of roadblock?

Curtis says floor lamps are an easy fix. But make sure the lamp has a shade or is torchiere style. Otherwise, you will experience glare. Another solution Curtis says is very popular is to use fake sconces. These are sconces that hang and plug into an exterior outlet rather than being run through an electrical line inside a wall. Curtis says the best general rule of thumb for placement on a wall for a sconce is that the center of the lamp should be at about 5 feet 5-1/2 inches high.

Lighting artwork with overhead picture lights is the best way to display your paintings, says Curtis. If you have ceiling gimbals (hanging track lights or adjustable recessed lights) pointing toward the art can work too. However, many apartments don’t have gimbals, so another way is to display your artwork in natural light. In this case, the painting will display beautifully, but Curtis cautions that UV rays from the sun will eventually damage the work. Some folks now light artwork (and other areas) with LED lighting, but this can be problematic, says Curtis. Because LED lighting is manufactured lighting, it generally only reaches about 85 percent of brightness on the Color Rendering Index compared to incandescent or natural light.

We’ve all had a closet that is so badly lit it’s impossible to distinguish your black shirt from your purple one. That is because, according to Curtis, most closets have a light (if at all) in the dead center that shines down on your clothing. An easy and inexpensive fix is to install a light just inside the doorframe that shines upward to illuminate your apparel. This is a surface treatment that generally won’t run afoul of either electrical codes or building remodeling regulations.

To solve more challenging lighting issues, Curtis recommends turning to professionals. Hiring an excellent licensed electrician to do a job can be a make or break situation. Always seek permission from your coop or condo board or landlord first. Since most walls are plaster and you don’t know what is behind them, those folks can guide your electrician to the right placement for your new lights. While this type of job is a relatively easy one for a professional, says Curtis, it’s also very noisy. Opening a wall, doing the necessary electrical work takes a day while closing the wall and replastering takes yet another day with an additional day for sanding and painting.

If you are lucky enough to have a terrace, one of the lighting problems you will likely encounter is the lack of outdoor electricity. Since there are now concrete conduits, you can light your terrace without metal lines and poles. However, outdoor lighting, at which Curtis and his company are experts, is best left to the professionals.

If you intend to hire a lighting designer, Curtis recommends reaching out to three different companies. Find out how each works, their history, pricing, etc., and go with whatever firm matches your style and with which you feel comfortable.

NB: How can you save money on lighting? One simple way is switching to Phillips energy saver bulbs in all of your lighting fixtures. These range between $4-$8 at Home Depot and last a very long time. You will save on electricity as well as obviate the need to continually purchase new light bulbs.

The post Lighting Solutions for NYC Apartments appeared first on - Elika Real Estate.

April 21, 2017

The Best Movers in NYC

Moving is stressful, but the one thing you can do to provide yourself some pressure relief is to use the best movers in NYC. Hiring a highly rated, affordable and reliable mover that is also insured and bonded is a must—and there are hundreds of movers in NYC who meet these basic criteria. So how do you choose the best movers to transport your belongings door to door safely and who are also friendly and accommodating in the process? We’re here to provide assistance!

Following are our top picks for the best of the best local NYC movers.

Nicolas Huk /Flickr

All Star Moving and Storage – is a star. I’ve used them half a dozen times. All-Star moving guys are quick and efficient and can carry twice their weight in your furniture, clothes and other stuff with belts strapped to wardrobe boxes full of your belongings that they load on their backs. I’ve never even had to empty or remove drawers from file cabinets or dressers! And they are affordable as well.

LIFT NYC – has been in business for more than 30 years and provides moving services from Greenwich Village to The Hamptons. A family owned business with a small organization business model; LIFT is known to provide exceptional service at affordable rates.

Movers, Not Shakers! – Is a Brooklyn-based green moving company with trucks fueled by biodiesel. Their trademarked GothamBoxes are reusable plastic bins they drop off before your move that they then recycle. Mover, Not Shakers! Takes special care of your belongings and also offers terrific customer service.

Oz Moving & Storage – is the wizard of NYC movers. Aside from offering superior service, the company invests in the community. From their Oz Moving Scholarship and special offers for veterans and active-duty members of the military, Oz supports Toys for Tots, NY Cares Coat Drive, MS Walk New York City, and the Susan G. Komen Race for the Cure, Oz is a community member in every sense. They are also highly recommended for moves in and around NYC.

Rabbit Movers – is a Brooklyn-based collective comprised exclusively of artists, writers and other creatives living and working in New York City. Being writers, their website proclaims, “Our aim is to do this [moving] with the grace and confidence of a Beatrice leading Dante from the Moon to the Sun, and with the same quirky cuteness of a Rabbit leading Alice to Wonderland.” How can you beat being moved by a poet?

FlatRate Moving Company – bills itself as NYC’s most recommended moving company. And with their, yes, flat-rate guarantee, you can see why. The FlatRate folks take an inventory of your home and then provide you with an all-inclusive rate that won’t change even if there is a traffic snarl during your move, an underestimate of time or any other factor.

JP Urban Moving – is a highly-regarded company that promises clear and continuous communication throughout your move. Small enough to give personalized attention, JP Urban Moving will contact you immediately if there are any issues that arise and send you updates by text as well.

Imperial Moving – Respect, transparency, and honesty are the three pillars of Imperial’s interaction with colleagues and clients. It’s also nice that Imperial has been voted NYC best movers again and again. If New Yorkers say they’re good – they must be great!

Clean Cut Moving – is a Tri-state local and long distance operation moving people and their stuff 365 days a year. With flat rate pricing and a service that efficiently provides their certificate of insurance to your building, Clean Cut is a professional, reliable and affordable choice.

In addition to perusing moving company websites, you should always comparison shop and get bids from at least three different companies. And, to lessen your stress about moving and choosing the right mover for you, take a look at Yelp reviews, testimonials on Angie’s List and other sites, and also ask around your group of friends and colleagues for their recommendations.

Moving is stressful, and there’s no way around it so. So, give yourself a break by hiring one of the best movers in NYC.

Share your moving experience. If you have had a successful stress free move or a nightmare of a move we would love to hear your comments below.

The post The Best Movers in NYC appeared first on - Elika Real Estate.

April 17, 2017

A Practical Guide to Understanding Distance in NYC

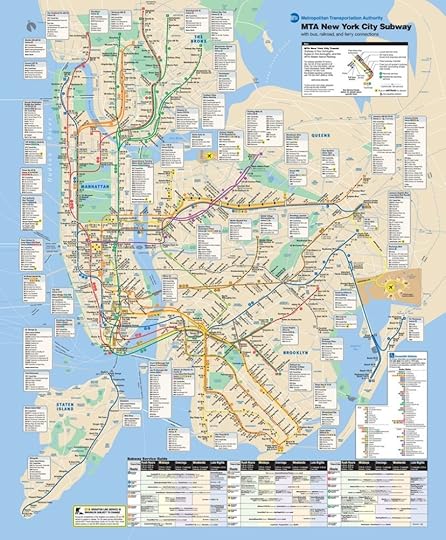

If you’re trying to figure out the distance in NYC from one place to another, the subway map can present you with a very distorted and misleading image. Brooklyn and Queens seem far-far away from Manhattan, when in fact, many neighborhoods in those boroughs are closer via subway than Inwood at the Northern tip of Manhattan or Battery Park City at the Southern tip.

Ryan Hoffman/Flickr

But what about Google Maps, you might ask? As helpful as that app is calculating times and finding directions while you are on the fly, using Google Maps for a full picture of NYC on a phone or laptop screen does not obviate the issue of scale. I’ve never been able to use Google Maps to get a holistic spatial sense from place-to-place within the context of the five boroughs.

This post will help you to seek out and find information about real-time distance, travel time, and other ideas for deciphering distances/calculating travel time in NYC. And, this knowledge might make the difference in where you decide to look for your next coop, condo or apartment and may serve to assist you in broadening your real estate search to neighborhoods (or even boroughs) you might not have previously considered.

Since the island of Manhattan is only 13.4 miles long and 2.3 miles wide, you’d think getting from one place to another would be easy. But sometimes, public transit can be a, well, train wreck.

The MTA’s Subway Map is deceiving because it makes many locations look farther away than they actually are while other spots may seem closer than they really are. Let’s pick, for example, Times Square as a destination. The Q train from Ditmas Park in Brooklyn (the Church Avenue stop) is an approximately 32-minute direct ride to Times Square whereas, from Battery Park in Manhattan, the subway ride is 25 minutes. However, you must change from the subway to the Grand Central Shuttle train or walk about 4 minutes to get to Times Square. It’s six of one, a half dozen of another as the saying goes. So, Ditmas Park in Brooklyn is as close to Times Square as Battery Park City in travel terms.

Karen Green/Flickr

It sounds old-fashioned, but there’s nothing like securing a to-scale map and spreading it out on your kitchen table to take a look at what distances – walking, commuting and otherwise – really look like.

Do you want to live close to a specific train line? In proximity to any subway? Maybe you have a car and don’t care for the subway, but need to ensure that there is easy parking at your new place, or that your morning and evening commute aren’t so long and hectic that you are frazzled by the time you arrive at work and at home.

With a scaled map, you can see how far from or near to one place really is to another. To-scale maps have a legend on them, which indicates, for example, ¼ inch on the map is an actual mile, or similar. You can use a ruler (again old-fashioned, but oh-so-useful) and lay it down on the map to measure distances in real miles. You can find these types of maps at Barnes & Noble, other bookstores or order them online.

Another good example of misperceptions of distance on the NYC subway map is the L train. It looks as though if you lived in, say, the Jefferson stop on the L train, you’d be a long way from Union Square – nine stops! Seems like a lot of stops, right? And, really far into Brooklyn. Wrong! The L train stops are so close together that you can walk from the Jefferson Street stop over to the previous stop, Morgan Avenue, in 10 minutes or less. From Morgan Avenue, you can walk to Montrose Avenue in less than10 minutes…and so on. You get the idea. It’s basically a 20-minute ride from Jefferson Street to Union Square, but you’d never know it based on looking at the MTA’s subway map.

If you want to rent or buy further out in Brooklyn where prices are lower, and there is often more space, you might consider choosing a place near an express train. Then, it’s no big deal getting into Manhattan for work – or play. Check out this geographically accurate NYC subway map for comparison.

If you’ve found a new tool or application that helps to understand distance in NYC, please write and let us know!

The post A Practical Guide to Understanding Distance in NYC appeared first on - Elika Real Estate.

April 12, 2017

10 Famous Writers Who Live in NYC

Ever wonder which writers live in New York City and where? Well, we’ve rounded up 10 writers who reside here, but we’re not all that sure exactly where. Why? Unlike musicians, actors, and other celebrities, writers play things much closer to the vest. They are also likely to earn a lot less money, be more frugal spending on their abodes and stay in one place longer.

David Shankbone/Flickr

Colson Whitehead just won a Pulitzer Prize for his novel Underground Railroad, “an inventive and searing take on slavery in 1850s Georgia,” according to USA Today. Whitehead, who grew up in Manhattan and lived in Fort Greene, Brooklyn for a long while, now resides somewhere deep in Brooklyn.

Sara Holliday/Flickr

Well-known for her multicultural award-winning books for young adults (Newbery Medal, Coretta Scott King Book Award, Caldecott Medal, and so many more), Jacqueline Woodson is a longtime Brooklynite. Her 2014 book, Brown Girl Dreaming, was a multiple award winner, including The National Book Award. It was also one of the books President Barack Obama bought and highlighted on a trip to his local bookstore while in office.

David Shankbone/Flickr

Novelist, short story writer, essayist, and critic, Francine Prose lives in the Hudson Valley. She is still, however, a fixture on the NYC literary scene. With various awards, fellowships, grants, and other honors, including a Guggenheim and a Fulbright, Prose is very much a writer’s writer. She divides her time between teaching and writing and has published more than 20 works of fiction.

New America/Flickr

New America/Flickr

Literary, arts, mental health, and LGBT rights activist, author, and journalist Andrew Solomon is also a multiple award-winning writer. Along with the National Book Award, National Book Critics Circle Award, Wellcome Book Prize, and Lambda Literary Award, Solomon has also secured a Pulitzer Prize. Solomon, the current President of PEN American Center, lives in Greenwich Village.

UnitedWarVeterans/Flickr

UnitedWarVeterans/Flickr

Somewhere in New York City, the prolific author Walter Mosely lives to write. Known for his bestselling mystery series featuring East Rawlins, Mosely also writes science fiction, political texts, short fiction, and plays. Among other honors, he has been awarded the O. Henry Award, a Grammy and Pen America’s Lifetime Achievement Award.

Sapphire/Facebook

Sapphire/Facebook

NYC-based author and performance poet, Sapphire, had her novel Push turned into the film “Precious.” Sapphire’s poetry, fiction, and essays have appeared in The New York Times Magazine, The New York Times Book Review, The Black Scholar, The New Yorker, and other publications.

Elena Torre/Flickr

Jonathan Safran Foer, Best known for his novels Everything Is Illuminated and Extremely Loud & Incredibly Close, lives somewhere in Brooklyn. He is a creative writing instructor at NYU and published the novel, Here I Am, in 2016.

Wikimedia Commons

Sloane Crosley, a contributing editor to both Vanity Fair and Interview Magazine, lives in the West Village. Known for her two collections of essays, I Was Told There’d Be Cake and How Did You Get This Number, she published the novel The Clasp in 2015.

Deschutes Public Library/Flickr

Siddhartha Mukherjee, an Indian-American physician, biological scientist, and author is best known for his 2010 book, The Emperor of All Maladies: A Biography of Cancer. For that book, Mukherjee won the Pulitzer Prize for General Non-Fiction in 2011. An assistant professor of medicine at Columbia University, his other books are The Gene: An Intimate History and The Laws of Medicine: Field Notes from an Uncertain Science.

By Amy Sohn via Wikimedia Commons

By Amy Sohn via Wikimedia Commons

Park Slope, Brooklyn-based novelist, and journalist Amy Sohn’s books include Run Catch Kiss, My Old Man, Prospect Park West and its sequel Motherland, and Sex and the City: Kiss and Tell, a companion guide to the television series. Sohn also appears on TV as a commentator on popular culture

So, if you’ve ever wondered which writers live in New York City and where we hope this helps bring you up to date on NYC literary doings even if not necessarily dwellings.

The post 10 Famous Writers Who Live in NYC appeared first on - Elika Real Estate.

April 11, 2017

NYC Coop Board Application: How to Prepare and Submit

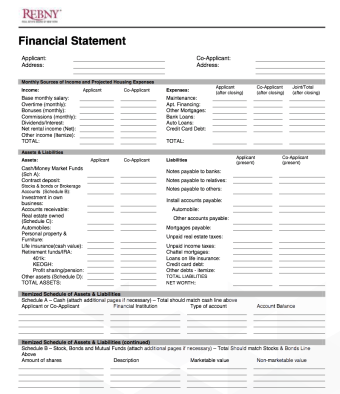

New York City co-op boards are notoriously discerning in approving aspiring applicants. While laws, such as those barring discrimination, cannot be broken, the board has wide latitude in accepting applicants. While part of the package includes an REBNY financial statement, other key components should be presented. We are going to go through the application step-by-step for you to have a thorough understanding.

Organization your Coop application is key

The application is more than a batch of papers. Think of it as you would a presentation at work. Whether the board is filled with those with old-fashioned ideas or you are facing a younger, hipper audience, an easy to follow presentation is always appreciated. It should be well-organized and easy to follow. A table of contents with different sections is a good idea. The information should be correct and consistent. Proofread your work. Then, have others review the information.

Image by / Flazingo Photos

A management company may require a specific way the application should be bound. In any event, using blue pages subtitled based on the table of contents is the perfect way to package it clearly, with each section properly noted in the same order. Remember, neatness counts.

Example of Coop Application Table of Contents:

1. Purchase application (attached)

2. Fully Executed Contract of Sale

3. Landlord/managing agent reference letter

4. A letter from the prospective purchaser’s employer verifying annual salary, a position held & length of employment. If self-employed please provide a letter from your accountant detailing the same.

5. Letter from bank(s) stating types of account, and amounts on deposit. Please include account numbers.

6. Statement of Financial Condition showing all personal assets and liabilities with documentation (brokerage statements, bank statements, etc.) supporting all assets listed for the most recent two months (attached)

7. Three personal reference letters

8. Submission of the preceding two (2) years Federal Income Tax returns (complete with schedules and W-2’s).9. Three (3) recent and consecutive pay stubs

9. Three (3) recent and consecutive pay stubs

10. Consent Form (attached)

11. Two (2) forms of personal identification must be submitted with this application

12. Fully executed certificate of foreign status

13. Lead Based Disclosure Form

14. Window Guard Form

15. Door Protocol form

16. Emergency Contact Information

An overview

Needless to say, your application should also be complete. Any missing information could delay or even kill your chances of getting the co-op unit. Remember, your buyer’s agent can be an immense help. He or she has helped many people compile and complete board applications and knows what information to highlight. Your agent will sit down with you and walk you through the package, asking for the documentation. He or she enters the data by typing into a pdf, and forwards for your signature. This is a time-consuming process, but your agent is on your side and will get you through the process.

Although it varies by the co-op board, there are typically a lot of sections to fill out, which is why an organization is a key to making your life easier. There will likely be a purchase application. This includes basic information, such as your name, the unit number, number of shares, contact information, employment information, housing history, mortgage information, educational history, and your business and personal reference contact information. A contract of sale should be part of your package.

An REBNY financial statement is a crucial component. The financial statement should have all the necessary backup documentation needed for verification following the statement in order of data entries. This includes bank/brokerage statement. On the subject of financials, the board will need to see a copy of the loan commitment letter, if financing.

An REBNY financial statement is a crucial component. The financial statement should have all the necessary backup documentation needed for verification following the statement in order of data entries. This includes bank/brokerage statement. On the subject of financials, the board will need to see a copy of the loan commitment letter, if financing.

You also need three originals of a Recognition Agreement. Two are kept by the lending bank, and the building’s property manager retains the other. This is a three-way agreement between you, the bank, and the board. The co-op pledges to alert the bank if you fail to pay the maintenance fees, along with other items, such as if you seek to sublet or sell your apartment.

A letter from your employer verifying your employment is also needed. This should include how long you’ve worked there and your compensation history. All employment and reference letters should be on letterhead and contain signatures and contact information.

You are also going to need copies of your tax return.

You likely need business and personal references. Many boards require you to include photo identification with your package.

The nuts & bolts

Using a real life example should illustrate the application process better. The first two sections are the purchase application (which we discussed previously) and the fully executed contract of sale. These should be straightforward.

Next, come reference letters from your landlord/managing agent. Again, remember this should be on official letterhead and signed. The letter should discuss the type of tenant you have been and how long you have been at the residence. This board requires a letter from your employer verifying your salary, the position you hold, and the length of employment. If you are self-employed, a letter from your accountant should provide the same information. However, since your earnings may be more volatile, we suggest providing more information, such as a description of your business, several years worth of profit/loss statements, and major clients. A letter from your bank showing the types of accounts, including account numbers, and the amount of the deposit is also required. Bank letters can be obtained by asking the branch manager.

The sixth item is a Statement of Financial Condition. This shows your assets and liabilities, and you need to provide back-up documentation (e.g. brokerage and bank statements) supporting the amount shown for the past two months.

You should have three personal references for this building (sometimes only two are needed. These should not be overlooked. The personal letters should be detailed and include the length of time you have known each other, and character traits with examples.

Personal Reference Letter Sample

This board also seeks to check your past earnings history, requiring your federal income tax returns for the prior two years. You need to include the full return, with schedules and W-2 statements. Remember, if it was filed with the IRS, the board wants to see it.

A co-op board also wants to see three consecutive pay stubs, ensuring you remain gainfully employed. Many employers have online statements, making this easy to obtain. Otherwise, make copies of your paystubs. If necessary, ask your payroll department.

The next section calls for a consent form. It is easy to forget, but in this example, you need two forms of personal identification to be submitted with your application? Why two. Remember, an incomplete application delays your purchase.

Sections 12-16 are a fully executed certificate of foreign status (if applicable) along with a lead based disclosure form, window guard form, door protocol form, and emergency contact information.

Coop Application Fees

New York City is not cheap, and the board typically applies fees to review your application. This includes those for processing your application, a credit check, and a criminal background check. There is not much you can do about these fees, but at least you should know what to expect ahead of time.

The fees vary by building, but using the same real life example provides a basis for what you can expect. There is a $125 credit report fee, a $600 application fee, and a $1,000 move in fee plus a $1,000 move in deposit. Once you are approved, there are payments due at closing. There is a $300 Recognition Agreement fee, and, if you are closing after the 15th of the month, you are required to pay the following month’s maintenance fee.

How long does this take?

Once you put this together, your agent likely will take a final look. Typically, the board will contact you in two to three weeks to schedule an interview. This varies widely, however. If you want the apartment, you are going to have to be patient and let the process run its course. While waiting for hopefully for an interview it would be prudent to prepare yourself for the questions that may be asked.

Coop Board Application Sample

Subscribe to our newsletter and get a 127 page Home Buyers eBook for free!

Email Address

First Name

Last Name

Subscribe now

The post NYC Coop Board Application: How to Prepare and Submit appeared first on - Elika Real Estate.

How to Prepare and Submit a NYC Co-op Application

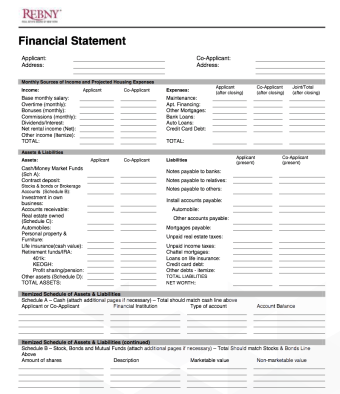

New York City co-op boards are notoriously discerning in approving aspiring applicants. While laws, such as those barring discrimination, cannot be broken, the board has wide latitude in accepting applicants. While part of the package includes an REBNY financial statement, other key components should be presented. We are going to go through the application step-by-step for you to have a thorough understanding.

Organization your Coop application is key

The application is more than a batch of papers. Think of it as you would a presentation at work. Whether the board is filled with those with old-fashioned ideas or you are facing a younger, hipper audience, an easy to follow presentation is always appreciated. It should be well-organized and easy to follow. A table of contents with different sections is a good idea. The information should be correct and consistent. Proofread your work. Then, have others review the information.

Image by / Flazingo Photos

A management company may require a specific way the application should be bound. In any event, using blue pages subtitled based on the table of contents is the perfect way to package it clearly, with each section properly noted in the same order. Remember, neatness counts.

Example of Coop Application Table of Contents:

1. Purchase application (attached)

2. Fully Executed Contract of Sale

3. Landlord/managing agent reference letter

4. A letter from the prospective purchaser’s employer verifying annual salary, a position held & length of employment. If self-employed please provide a letter from your accountant detailing the same.

5. Letter from bank(s) stating types of account, and amounts on deposit. Please include account numbers.

6. Statement of Financial Condition showing all personal assets and liabilities with documentation (brokerage statements, bank statements, etc.) supporting all assets listed for the most recent two months (attached)

7. Three personal reference letters

8. Submission of the preceding two (2) years Federal Income Tax returns (complete with schedules and W-2’s).9. Three (3) recent and consecutive pay stubs

9. Three (3) recent and consecutive pay stubs

10. Consent Form (attached)

11. Two (2) forms of personal identification must be submitted with this application

12. Fully executed certificate of foreign status

13. Lead Based Disclosure Form

14. Window Guard Form

15. Door Protocol form

16. Emergency Contact Information

An overview

Needless to say, your application should also be complete. Any missing information could delay or even kill your chances of getting the co-op unit. Remember, your buyer’s agent can be an immense help. He or she has helped many people compile and complete board applications and knows what information to highlight. Your agent will sit down with you and walk you through the package, asking for the documentation. He or she enters the data by typing into a pdf, and forwards for your signature. This is a time-consuming process, but your agent is on your side and will get you through the process.

Although it varies by the co-op board, there are typically a lot of sections to fill out, which is why an organization is a key to making your life easier. There will likely be a purchase application. This includes basic information, such as your name, the unit number, number of shares, contact information, employment information, housing history, mortgage information, educational history, and your business and personal reference contact information. A contract of sale should be part of your package.

An REBNY financial statement is a crucial component. The financial statement should have all the necessary backup documentation needed for verification following the statement in order of data entries. This includes bank/brokerage statement. On the subject of financials, the board will need to see a copy of the loan commitment letter, if financing.

An REBNY financial statement is a crucial component. The financial statement should have all the necessary backup documentation needed for verification following the statement in order of data entries. This includes bank/brokerage statement. On the subject of financials, the board will need to see a copy of the loan commitment letter, if financing.

You also need three originals of a Recognition Agreement. Two are kept by the lending bank, and the building’s property manager retains the other. This is a three-way agreement between you, the bank, and the board. The co-op pledges to alert the bank if you fail to pay the maintenance fees, along with other items, such as if you seek to sublet or sell your apartment.

A letter from your employer verifying your employment is also needed. This should include how long you’ve worked there and your compensation history. All employment and reference letters should be on letterhead and contain signatures and contact information.

You are also going to need copies of your tax return.

You likely need business and personal references. Many boards require you to include photo identification with your package.

The nuts & bolts

Using a real life example should illustrate the application process better. The first two sections are the purchase application (which we discussed previously) and the fully executed contract of sale. These should be straightforward.

Next, come reference letters from your landlord/managing agent. Again, remember this should be on official letterhead and signed. The letter should discuss the type of tenant you have been and how long you have been at the residence. This board requires a letter from your employer verifying your salary, the position you hold, and the length of employment. If you are self-employed, a letter from your accountant should provide the same information. However, since your earnings may be more volatile, we suggest providing more information, such as a description of your business, several years worth of profit/loss statements, and major clients. A letter from your bank showing the types of accounts, including account numbers, and the amount of the deposit is also required. Bank letters can be obtained by asking the branch manager.

The sixth item is a Statement of Financial Condition. This shows your assets and liabilities, and you need to provide back-up documentation (e.g. brokerage and bank statements) supporting the amount shown for the past two months.

You should have three personal references for this building (sometimes only two are needed. These should not be overlooked. The personal letters should be detailed and include the length of time you have known each other, and character traits with examples.

Personal Reference Letter Sample

This board also seeks to check your past earnings history, requiring your federal income tax returns for the prior two years. You need to include the full return, with schedules and W-2 statements. Remember, if it was filed with the IRS, the board wants to see it.

A co-op board also wants to see three consecutive pay stubs, ensuring you remain gainfully employed. Many employers have online statements, making this easy to obtain. Otherwise, make copies of your paystubs. If necessary, ask your payroll department.

The next section calls for a consent form. It is easy to forget, but in this example, you need two forms of personal identification to be submitted with your application? Why two. Remember, an incomplete application delays your purchase.

Sections 12-16 are a fully executed certificate of foreign status (if applicable) along with a lead based disclosure form, window guard form, door protocol form, and emergency contact information.

Coop Application Fees

New York City is not cheap, and the board typically applies fees to review your application. This includes those for processing your application, a credit check, and a criminal background check. There is not much you can do about these fees, but at least you should know what to expect ahead of time.

The fees vary by building, but using the same real life example provides a basis for what you can expect. There is a $125 credit report fee, a $600 application fee, and a $1,000 move in fee plus a $1,000 move in deposit. Once you are approved, there are payments due at closing. There is a $300 Recognition Agreement fee, and, if you are closing after the 15th of the month, you are required to pay the following month’s maintenance fee.

How long does this take?

Once you put this together, your agent likely will take a final look. Typically, the board will contact you in two to three weeks to schedule an interview. This varies widely, however. If you want the apartment, you are going to have to be patient and let the process run its course. While waiting for hopefully for an interview it would be prudent to prepare yourself for the questions that may be asked.

Coop Board Application Sample

Subscribe to our newsletter and get a 127 page Home Buyers eBook for free!

Email Address

First Name

Last Name

Subscribe now

The post How to Prepare and Submit a NYC Co-op Application appeared first on - Elika Real Estate.

April 10, 2017

10 Famous Musicians Who Live in NYC

If you’ve ever wondered about famous musicians who live in NYC, this post is for you! Whether you love the blues, dig rock ‘n’ roll, adore jazz, live on hip-hop, you’ll find live music events to suit your taste every night of the week in NYC. Many musicians tour pretty consistently so you’re likely to see your faves on a regular basis, including these artists who reside in NYC:

Jay-Z and Beyonce

Miss Erica via Wikimedia Commons

Aside from various vacations homes around the country, and perhaps the world, entertainment power couple Jay-Z and Beyonce dwell in an 8,000-square-foot loft in Tribeca that has a balcony in every bedroom. Their building, located at 195 Hudson Street, features a private roof deck in every apartment as well. The couple got married in the space for which Jay-Z paid $6.85 million in 2004.

Lady Gaga

Philip Nelson, Live Streaming Expert

Lady Gaga recently moved recently into a mansion in Malibu, but when she’s in NYC, she stays at her 1,985-square-foot penthouse at 40 Central Park South. The former Stefani Joanne Angelina Germanotta is a native New Yorker who grew up on Manhattan’s Upper West Side.

David Byrne

Alterna2/flickr

David Byrne is a private type of guy. And, it’s a bit of a secret where he lives. He’s got a pad in LA but also lives in New York City. Known for his activism in support of increased cycling and using a bike as his main means of transport throughout his life, the musician is also a critic of the high cost of housing and other expenses making it hard for artists to survive and thrive in NYC.

Madonna

MissChampers / Flickr

No doubt the Material Girl has several residences around the globe, but her place – or rather places – in New York City are legendary for the lengths she has gone to protect her privacy. Her Upper East Side mansion at 152 E 81st Street is gated with other protections from both paparazzi and fans. Meanwhile, a new documentary, Emmy, and the Breakfast Club, about Madonna’s early years, will be released soon.

Cyndi Lauper

Lucas Jork / Flickr

The Tony- and Grammy-winning songwriter and lyricist for “Kinky Boots” who has enjoyed a steady musical career since her 1983 debut album “She’s So Unusual,” Cyndi Lauper is a lucky beneficiary of NYC’s rent stabilization laws. Lauper, who lives with her husband at 390 West End Avenue in the Apthorp Building, won a lawsuit in 2005 to stave off a fourfold rent increase. It was reported at the time that she was paying just under a thousand bucks a month for her four-bedroom apartment on the Upper West Side.

Art Garfunkel

Official Art Garfunkel Facebook Page

Art Garfunkel of 60’s folk-rock duo Simon & Garfunkel fame, calls The Upper East Side home. His penthouse is in a swanky building at 9 East 79th Street. Currently, on a comeback tour, the singer has been nursing his voice as well as a grudge again Paul Simon for an extended period.

Norah Jones

Whistling in the Dark from Bright Eyes/Wikimedia Commons

Brooklyn native Norah Jones is still living in Brooklyn. Along with her husband and two children, Jones resides in a renovated carriage house at 172 Pacific Street in Cobble Hill. The nine-time Grammy award winner is touring this year with her 2016 release, “Day Breaks”.

Jon Bon Jovi

Artur Bogdanski (Bodzio16) via Wikimedia Commons

Rocker Jon Bon Jovi has a snazzy 10-room pad at 150 Charles Street in the Meatpacking District of the West Village for which he paid $12.88 million in 2015. The front man for the band Bon Jovi, he is also the founder of The Jon Bon Jovi Soul Foundation, which works to combat issues that force families and individuals into economic hardship.

Yoko Ono

Very often relegated to sole status of John Lennon’s widow, Yoko Ono is a musician in her own right. She lives in The Dakota on Manhattan’s Upper West Side. The musician, multimedia artist, and peace activist, continues her music, art and activist work and is reportedly working on a movie about her life with John Lennon.

So, if you’re out having coffee, brunch or taking a stroll, keep your eyes peeled for these famous musicians who live in NYC. They might hang out in one of your favorite haunts, or even be your neighbor!

The post 10 Famous Musicians Who Live in NYC appeared first on - Elika Real Estate.

April 6, 2017

NYC Real Estate Investors: Don’t Chase Yield

Baseball season is upon us, so you sit down to watch your favorite team. The star player is at the plate, and he is ready to hit the ball with a cricket bat. Of course, this scenario is ridiculous, but we equate this to New York City real estate investors playing the wrong game. Instead of hunting for yield, capital appreciation is the main game in the city.

Historical yield

The yield, or cap rate, is your net cash flow divided by your purchase price. In this city, it has historically been 3%-4%. This is much lower than yields across the country. For instance, multi-family properties in Atlanta and Chicago are about 4.75% at the low end and over 6% in Indianapolis, according to a study done by Cushman in 2013.

Image by Philip Taylor / Flickr

There are many cities that offer a higher yield, making rents an attractive source of steady income. However, despite the high rents commanded in New York City, this is not the major factor generating returns. This naturally leads to the question: why invest in New York City? After all, an investment in the 10 year Treasury note currently has a 2.3% yield, but this has been an unusually low period for rates. Since it is backed by the full faith and credit of the United States government, repayment of the principal is considered risk free. Unlike real estate, it is a passive investment that does not involve inconvenient calls for emergency repairs and unruly tenants.

Since real estate involves more risk, there must be a higher potential return. There is a missing piece to the return equation.

Capital appreciation

The answer is that investors have generated a large portion of their gains from rising prices. For instance, real estate appraisal and consulting firm Miller Samuel examined Manhattan prices for 100 years, from the 1910s through 2010s. In the 1970s, the sale price was $45 per square foot for luxury properties, rising to $1,200 in the 2000s. In a narrower period covering 2004 to 2013, the median sales price for Manhattan rose from about $606,000 to $855,000. This is a 141% rise or a 3.5% compounded annual growth rate.

There are a couple of things to note. The 2004-2013 includes part of the build-up during the bubble and sharp contraction during the recession. But, over a decade, these large swings balanced out to a 3.5% annual gain. While this is about equal to the historical yield, it includes data across the entire borough. Doing some homework would have helped you outpace this gain. As an investor, you are going to be more discriminate in examining trends. For instance, if you invested when you noticed gentrification in certain Brooklyn and Queens neighborhoods, your appreciation was notably higher.

To see how much it varies, StreetEasy is predicting the median price will rise 4.4% in Queens this year, 3% in Brooklyn, while Manhattan trails these two with a 0.6% increase.

New York City is also a liquid market compared to other parts of the country, which is appealing for investors. There is demand from global buyers, meaning it is not solely dependent on the local economy. This provides a measure of support in a recession as foreign buyers step up to bargain hunt.

Putting it together

We do not mean to dismiss rent collection. Hopefully, it provides you with a steady annual cash flow. However, for those that are patient and astute, capital appreciation can be the real wealth generator.

The post NYC Real Estate Investors: Don’t Chase Yield appeared first on - Elika Real Estate.

NYC Investors: Don’t Chase Yield

Baseball season is upon us, so you sit down to watch your favorite team. The star player is at the plate, and he is ready to hit the ball with a cricket bat. Of course, this scenario is ridiculous, but we equate this to New York City real estate investors playing the wrong game. Instead of hunting for yield, capital appreciation is the main game in the city.

Historical yield

The yield, or cap rate, is your net cash flow divided by your purchase price. In this city, it has historically been 3%-4%. This is much lower than yields across the country. For instance, multi-family properties in Atlanta and Chicago are about 4.75% at the low end and over 6% in Indianapolis, according to a study done by Cushman in 2013.

Image by Philip Taylor / Flickr

There are many cities that offer a higher yield, making rents an attractive source of steady income. However, despite the high rents commanded in New York City, this is not the major factor generating returns. This naturally leads to the question: why invest in New York City? After all, an investment in the 10 year Treasury note currently has a 2.3% yield, but this has been an unusually low period for rates. Since it is backed by the full faith and credit of the United States government, repayment of the principal is considered risk free. Unlike real estate, it is a passive investment that does not involve inconvenient calls for emergency repairs and unruly tenants.

Since real estate involves more risk, there must be a higher potential return. There is a missing piece to the return equation.

Capital appreciation

The answer is that investors have generated a large portion of their gains from rising prices. For instance, real estate appraisal and consulting firm Miller Samuel examined Manhattan prices for 100 years, from the 1910s through 2010s. In the 1970s, the sale price was $45 per square foot for luxury properties, rising to $1,200 in the 2000s. In a narrower period covering 2004 to 2013, the median sales price for Manhattan rose from about $606,000 to $855,000. This is a 141% rise or a 3.5% compounded annual growth rate.

There are a couple of things to note. The 2004-2013 includes part of the build-up during the bubble and sharp contraction during the recession. But, over a decade, these large swings balanced out to a 3.5% annual gain. While this is about equal to the historical yield, it includes data across the entire borough. Doing some homework would have helped you outpace this gain. As an investor, you are going to be more discriminate in examining trends. For instance, if you invested when you noticed gentrification in certain Brooklyn and Queens neighborhoods, your appreciation was notably higher.

To see how much it varies, StreetEasy is predicting the median price will rise 4.4% in Queens this year, 3% in Brooklyn, while Manhattan trails these two with a 0.6% increase.

New York City is also a liquid market compared to other parts of the country, which is appealing for investors. There is demand from global buyers, meaning it is not solely dependent on the local economy. This provides a measure of support in a recession as foreign buyers step up to bargain hunt.

Putting it together

We do not mean to dismiss rent collection. Hopefully, it provides you with a steady annual cash flow. However, for those that are patient and astute, capital appreciation can be the real wealth generator.

The post NYC Investors: Don’t Chase Yield appeared first on - Elika Real Estate.

April 5, 2017

4 Lessons of the Great Recession

The Great Recession experienced last decade seems like a distant and unpleasant memory. As New York City home prices have rebounded, it might be tempting to forget about that unpleasant time. You should refrain from doing so, however. There are valuable lessons to be gained. As the saying goes, “Those who fail to learn from history are doomed to repeat it.” With that in mind, we set about reminding readers, so they do not get fooled again.

Image Via Flickr

Lesson 1: Use an exclusive buyer’s agent

Many buyers thought their agent was on their side. However, in reality, there might have been a dual agency. In this case. A buyer and seller had separate agents, but both worked for the same company. It was in their economic interests to obtain the highest price, and earn the highest commission. Even in cases where your agent did not work for the same real estate broker, he/she still wanted the highest price to earn a larger commission.

There is another way. An exclusive buyer’s agent owes his/her fiduciary duty to you, the buyer. This means the agent is legally obligated to help you obtain the best price, using information that is helpful to you (e.g. pending divorce situation) and conducting a thorough market analysis.

Lesson 2: Don’t let your emotions carry you

Many people get emotional when buying (or selling) an apartment. After all, it is more than walls and floors. It is a home. In the years leading up to the bubble bursting, many buyers wound up in bidding wars, paying far more than the fair market value.

There were several psychological reasons this was done. Buyers were afraid of losing out on a property, fearing the price on the next apartment would be higher. People did not want to lose, viewing it is a game. Lastly, some were emotionally connected to the property, getting that “homey” feeling.

Remember, there is more than one apartment for you. New listings crop up all the time. The best way to avoid overpaying is to have a budget beforehand and understand the current fair market value.

Lesson 3: Financing matters

It is important to look beyond your monthly payment and truly understand the loan terms. Many were suckered by a low initial monthly mortgage payment, only to discover the payment ballooned after the teaser rate expired for these adjustable rate mortgages. Lenders advised people not to worry, since housing prices always go up, and the principal balance could be refinanced. Other questionable financings were interest only mortgages. There were also questionable documentation practices, with loans made with little or no income and asset verification.

What can you do? Understand your mortgage options. In the wake of the aftermath, the Consumer Financial Protection Bureau (CFPB) was created. Certain protections were put in place to make it easier for you. There is a Know Before You Owe mortgage disclosure rule. Two forms are meant to be easier to understand than the four disclosure forms these replaced. This is the Loan Estimate form, which makes it easy to compare loans from different lenders, and the Closing Disclosure. You are required to have three business days to review your Closing Disclosure.

Lesson 4: Patience pays off

Many people that bought apartments in the years leading up to the recession saw large paper losses in the ensuing years. Granted, it is not easy to continue paying a mortgage on an apartment that has declined in value to the point where you have negative equity (mortgage balance is more than the apartment’s value). But, remember, it is not a loss until you sell. Provided you have the right financing in place and have done the proper budgeting to afford your place, the best thing might very well be to ride out the economic malaise. In order to pass muster with the co-op board, you had to show adequate reserves and assets, meaning you should be able to ride out the storm.

Generally, real estate is not a get rich scheme. Historically, over the long-term, it has risen at the pace of inflation. That is what you should expect, although it may be a bumpy ride in the short-term.

Final thoughts

We hope never to experience such a severe recession again in our lifetime. However, the economy has been expanding for several years, and a recession sometime in the future is inevitable. Hopefully, these tips provide guidance in order for you to avoid making a costly mistake.

The post 4 Lessons of the Great Recession appeared first on - Elika Real Estate.