Rian Nejar's Blog, page 16

February 14, 2015

Markets at Record Highs this week…

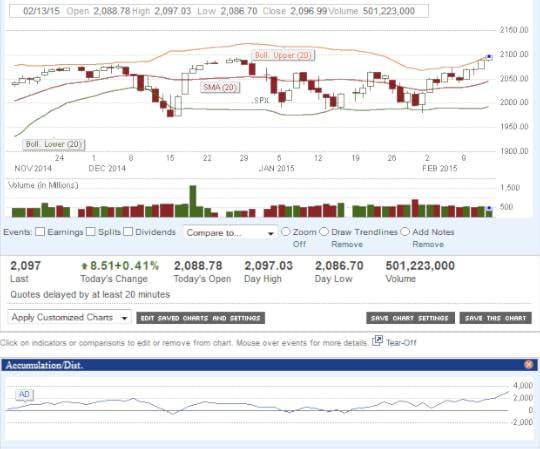

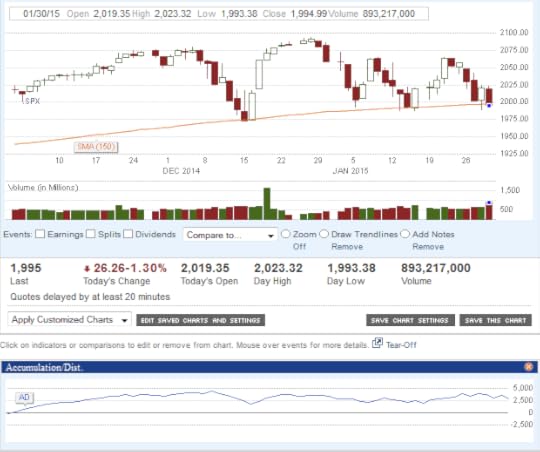

Figure 1: SP500 3-month Chart with Simple Technical Analysis (CNBC charts)

The SP500 has broken out and above its recent trading channel, heading to an all-time record high of 2097. The Dow Jones index is above a psychological 18,000 level, and the Nasdaq-100 index is very close to its all-time high of ~5000 made during the internet bubble Y2K. Markets are cheering something with diminished volatility; perhaps a good earnings season, that beat diminished expectations due to the strength of the dollar against other world currencies.

The chart above shows this state of affairs: the SP500 Accumulation/Distribution indicator is rising with the index. There is more buying than selling…though trading volume is about average. Strong volume is a necessary confirmation of a decisive move. A break-out and close for the index value beyond Bollinger Band limits is similarly helpful in determining continuation of a new trend. These indications are not seen; one may say that the upward move is tentative. Market Bulls will explain that away as diminished volume before a long weekend (the coming Monday is a national holiday for Presidents Day) here.

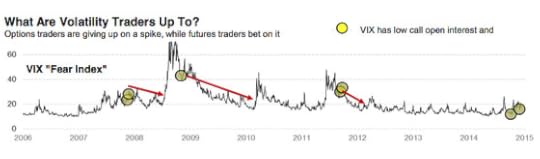

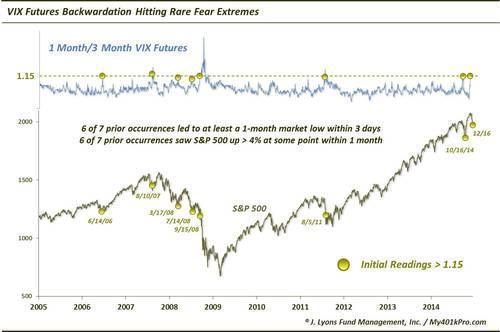

As always, there are all sorts of interesting predictions…more are bullish, favoring a rising market. One such view, referring to Fig. 2 below, points to lows in VIX call option contracts as reflective of a few months’ diminishing volatility.

Figure 2: VIX, and Call Options Lows (Source: web/unknown)

Flip side arguments, to the volatility trend indicated in Fig. 2 above, include the fact that in two of three cases above, VIX rose sharply immediately after such lows, in VIX call option contracts, were registered. One may also note that the present situation, at a possible top of an extended bull market, or after a long period of diminished volatility and short-term rising volatility, is akin to that in late 2007.

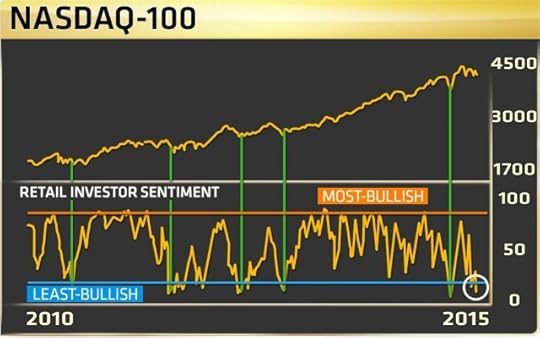

Another such bullish view points to retail investor sentiment being the least bullish in the near past as an indication of a possible rise in the near future. Fig. 3 below shows this for the Nasdaq 100 index.

Figure 3: Nasdaq-100 chart with Retail Investor Bullishness Sentiment (Source: web/unknown)

Note that Fig. 3 plots the index for the bull phase of the markets over the past five years. In such a rising market, one may point to any condition of the indicator (retail investor sentiment in this case) and associate it with the desired upward market action. For instance, note, in Fig. 3 above, that rising segments of the index plot correspond with high retail investor sentiment near the “most bullish” level.

It is said that retail investors are the last to jump into a perceived rising market before it corrects substantially. It is also reasonable to assume that retail investor sentiment may be quite bullish as they pile on… A “least bullish” indication then may be associated with minimal participation by such investors.

Yet, note that retail investor sentiment fell in response to market falls in at least four instances in Figure 3, or it fell as a result of high volatility, as seen in the early 2010, and in the present. This most recent fall, in retail investor sentiment, could therefore be more due to extreme swings in the market seen at a possible top of an extended bull market – the jagged nature of the recent fall in retail investor sentiment appears to attest to this possibility. It is therefore just as reasonable to see the fall in retail investor sentiment as an effect rather than a cause for the unknown next phase of the market.

So what does all this mean, you ask? I took a look again at the VIX and VVIX (volatility of volatility) to get a sense of where things may go.

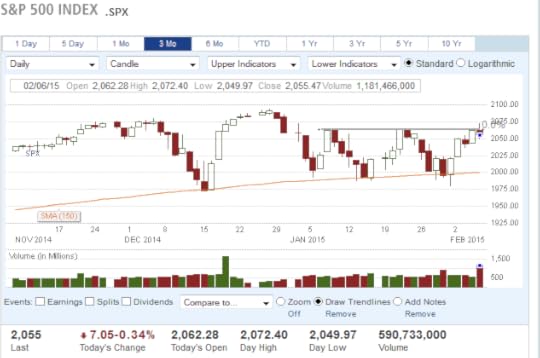

Figure 4: VIX and the VVIX for the past 3 months (CNBC charts)

Other than that both fear and sensitivity to the fear index are at near-term lows, Fig. 4 does not provide me with any more insight. Geo-political concerns for the market such as Grexit, Ukraine, and economic concerns with commodity price swings and a strong dollar remain as detractors to rampant bullishness. Most recent economic indicators in the US, released this past week, have also not been promising, with jobless claims rising, and consumer sentiment falling more than expected. Besides, the FED raising interest rates mid-2015 is a higher probability now, given two voting members voicing their support for such move, which should also be a headwind for the markets.

I have, therefore, added to my long VIX positions.

~~~~~~~~~~~~

February 8, 2015

Life, Consciousness, Thinking and Feeling: Lines of Code?

Gray Goo Paranoia

Recall, in the early days of Nanotechnology development, an irrational fear of gray goo taking over the world? That was all about tiny self-replicating inorganic thingies – nano-sized – multiplying rapidly and taking over the world. We have those things in the organic world already, actually. They are called viruses, but they work only inside organic cells. Gray goo fears built upon ideas of inorganic replicating entities that some imagined to be capable of rapid, malevolent multiplication and destruction.

But though nanotechnology is ubiquitous these days, it is largely invisible, and rather helpful. Gray goo has not, this far, taken over the world. Unless you mean the ubiquitous manufactured waste that we seem to clog and harm our environment with.

Pundits, pontificators, and pernicious protectors are at it once again. Now it is machines that think and feel that they wish to save us from. All the while, of course, some vociferous prevaricators surreptitiously continue and fund development of the very same technology that they beat their public drums on…in anticipation of windfall gains. Protectors of profit is a more apt label for such champions of capitalism, perhaps. Whipping up the consuming public’s fancy and interest with predictions of dire threats and doom that they lap up eagerly.

But how real is this fear? Will machines that think, feel, and learn, take over humanity and the living world? That seems to be the villainous stand in the movie, Chappie, to come in March…while an endearingly human (obviously) robot becomes a champion of progress, of a next step in evolution as the film calls it, an advancement of human thought and philosophy implemented in technology.

Before making the quantum leap to a conclusion that a combination of thinking, feeling, and learning, in entities different from us, will result in an inevitable (rather human?) desire in them for world dominion, let’s ask this: how real is it to realize an entity that does all this that humans (or even the simplest of tetrapod lifeforms) do? Can some lines of software code do this, as is so casually assumed in some Follywood depictions? Romantic and imaginative such moving works of art may be, but this ready realization of consciousness, and self-awareness, or even feeling, or imagining, is something I’ve argued against in a blog post recently.

But I’ll concede this: I’ll start to be concerned if we ever develop an inorganic brain that functions at the size, capacity, and speed of a flea’s brain while consuming only as much energy as the flea brain does in similar activities. Rest assured that this efficiency and capability is very many orders of magnitude away at the present.

More significant than such advanced development, though, are some fundamental questions. Will any such intelligence that develops self-awareness successfully replicate and multiply, if self-interest is its principal drive? Can there be an entity that thinks, feels, and learns, that will only show malevolence towards all others? Is continuation and evolution of life, in any form, only competitive, or is it a balance between competition and cooperation?

~~~~~~~~~~

February 7, 2015

Violent Volatility in the SP500

SP500 3-Mnth Chart with simple technical indicators

Headlines on market news sites scream: “The market is up 3% for the week!” And, “The losses of January erased!” Yes, it is up 3% for the week…but hasn’t changed much at all since the beginning of the year as you may see in the picture above. It was only five weeks ago that I’d thought we may be in for some volatility. We’ve seen 3% moves every week since then. Shouldn’t the market headlines be “Market volatility of 3% every week?”

As for the past week’s action, sure, we bounced off a short-term trend line and near a psychological level for the SP500, but we are not seeing new highs in the market. This past Friday saw such an attempt with a sell-off (at the end of the chart above) at almost twice normal trading volume – which, at the top of this past five-week channel, technicians will tell you, is an indication that we may be seeing another turnaround. Besides, this action ensued despite a very strong US jobs and wage growth number with significant upward revisions for past months.

What may we expect ahead? Market “experts” claim that FED comments and another jobs number is expected the next week…and the situation with Greece is nearing a decision juncture soon (before the end of this month) with strong implications for Europe and the US markets. Retail sales numbers are also anticipated, with a slight reduction in January relative to the December holiday month. None of these are necessarily good news; the FED raising rates mid-2015 is once again in play given the strong jobs and wages number, and Greece defaulting or exiting the European union, given a new government set against prior compromises for bailout loans extended, is a higher probability. What may be certain is that uncertainty awaits…

Some say that the market will break out of this channel and head on upward…but I think we may see more volatility ahead, and am long the VIX again with a small position.

February 1, 2015

Conduct Unbecoming: “Get out of here, you low life scum!”

Another Politician Mouths Obscenities

Isn’t the Congress the house of The People? Isn’t any proceeding in congress held for the people, and conducted by their representatives? Are people not allowed to express themselves in their own house, in proceedings held for their common good? Or have they given up any right to expression, having elected politicians to represent them?

So-called disciplined enforcers of the law have expressed their utter disrespect for elected leaders in recent gatherings in New York. Recall the behavior by cops at gatherings to pay due respect to those killed in the line of duty? If a senator of a State can, in a respectful proceeding of The People, insult common people who actively participate as low-life scum, what should we, the people, call servants of the law who so insult elected leaders?

I have been a citizen of the United States of America for many years now…this is a first for me. A honorable senator, a representative of the people, calling people who voice their helpless frustration in vocal protest low-life scum. What is astonishing is the lack of emotion with which this label is uttered, and the smug smile on the senator’s mug upon a brief smattering of applause that arose after his statement.

This was clearly intentional, not impassioned or emotional. This was something this senator, war-veteran, prisoner-of-war, one who was tortured by those we waged war against, wanted to say to war protesters for some time now. Something he really wanted to get off his chest. This pleased him. It was all about him. Was he angry that a committee proceeding he chairs was disrupted by protesters calling for prosecution of those who have waged war upon people all over the globe? Perhaps…but does that in any manner permit his disgraceful conduct? Is this legal in a senate hearing?

The State of Wariduna has many such politicians…I’ve written about at least a couple in HnH, one of who may face Federal contempt of court charges for his treatment of local immigrants soon.

What do you think this senator deserves for his conduct in the people’s proceedings? Applause and an award for diplomatic excellence and humility? Or rebuke, and a recall?

Comment, blog, write!

-rn

January 31, 2015

Another Down Week and January: Volatility Takes Over

SP500 3-mnth Chart with Basic Technical Analysis

I was wrong in my expectation of market action this past week.

It turned out to be far more exciting than imagined. Earnings numbers have been generally quite good, with more than 70% of SP500 beating expectations, some spectacularly so, and numbers for the economy good as well, such as the consumer sentiment, and a gross domestic product growth of 2.6% for the past quarter. But US markets saw selling this past week that brought the indices down about 3%. The month of January, similarly, also ended down ~3% after five strong swings in market direction.

So – statistics, that implied that late January is typically a good time to buy into the market, proved wrong in this instance. And did so despite good earnings results that should have provided a strong tailwind. Curiously, there is another saying in the market, “As goes January, so goes the rest of the year,” which too is based upon the statistical fact that markets behave over the year as they do in the January of that year more than 80% of the time. But the last year, which also gave us a negative January, proved this statistical expectation a lie! What will we see this year?

I do not like the action in the market seen in January. If you subscribe to the theory that an uncertain market that has good tailwinds (earnings, economic growth, supportive fiscal and monetary policies) will oscillate in a rising trading range, you may believe that the market will once again bounce off the lower Bollinger Band (the outlier excursion expected based upon a standard deviation or statistical analysis), which is just about where selling has brought the market to this past week. Or, looking at the figure above, it may bounce off around that simple moving average trend line drawn under the daily candles of market action. But I am not so confident…such rapid variations in the market, as seen this January, are often signs of a top, and may well be followed by a plunge.

As for the fear index, which I use in various ways to get a feel for the market, here’s a plot of the VIX (SPX volatility index) and the VVIX (volatility of volatility) as of the past week:

Fear Index and its Volatility at end-January

The VIX is above 20 again, or fear remains elevated. The VVIX, on the other hand, has been declining as in the figure above. But the market does not seem to be making higher highs and higher lows, which one may expect in an upward trend…and it could be a matter of much concern if market action next week takes it below ~1975 on the SP500.

In the current scenario, I’d feel more comfortable if the market took a good breather: a correction of ~10 to 15% and a strong rise after that. A ‘V’ dip that exhausts much of the selling negativity. Given market action this January, that may well be expected in the near future.

Disclaimer and Disclosure: I share my thoughts about the market in such blog posts. This is provided only as thoughts of an active trader/investor; it must not be construed as investment advice or recommendations in any manner whatsoever. As of this posting, I am long select equities/funds, and am neutral with respect to the VIX.

January 26, 2015

Growing Up in America: Boy to Man and being a Father

Fatherhood

My son bet me five bucks that Boyhood will win ‘Best Picture’ at the Oscars. I took the bet; I think the story is really more about fatherhood…have you listened to the wonderful song in the background? “Let me go…I don’t want to be a Hero. I don’t want to be a Big Man. …so let me go.” Does that not resonate with fatherhood?

I must admit I was a bit taken aback by the twelve year long story. It isn’t only that the story resonated so much with HnH; it paints a gentle picture of life that is rather removed from reality. Oh, they do provide peripheral references to wrist-cutting, teenage pregnancies, and rather more visible depictions of domestic violence, alcoholism, and wanton sexual conduct, but the story is a feel-good one, whereas I struggle with fears any pragmatic father may have in a similar context. Yes, I’ve heard of wrist-cutting – from my son who spoke of a couple of his friends doing it. His friends! And yes, I’ve written about DV, betrayal by a partner, and dire consequences for a father. But ask this: is life really such a feel-good story? Is parenting discipline best depicted as abuse? Or is that what sells a movie?

But I am immensely grateful that I got to watch this movie, at home, with my son. We’d argued about allowing it – it is rated R, with explicit statements and conduct within – since he is an early teen, but he was determined to watch it. He won the argument given that a responsible adult was watching it with him. And he watched it with an intensity that led him to move closer to the I-box (you know, the idiot box) and sit on the carpet near it.

Did it affect him deeply? He did have a couple of questions for me during the movie…and did listen carefully to the almost grown boy telling his father, summarizing his custodial parent’s conduct, “…and I could’ve avoided the parade of drunken as@les.” He said it was the best movie he’d seen, and went to decompress with humorous YouTube videos. Uncharacteristically for him, as he left for the night, he came to me, hugged me goodnight, and messaged me later that his sister, who had not come to see me all weekend, was quite alright.

Can you guess my little secret? I’d pretended to argue about letting him watch Boyhood! How could challenges fathers face, in the conflict between freedom and restraint, and wanton behavior and disciplined conduct, be conveyed any better than through a feel-good story of the time and place? I thought Ethan Hawke played the part of an easygoing, loving dad very well.

If you haven’t seen this movie…I do recommend that you watch it. I think it is unpretentious (though some of what I call dime-wisdom is occasionally thrown in), humble, and gentle in its treatment of serious social flaws in contemporary culture.

As for my son’s bet…we’ll know by the end of February!

January 25, 2015

Politician Reveals Last Page of Good Book: “Our God Wins”

Pillars of Creation (The Eagle Nebula, courtesy NASA/ESA/Hubble Heritage Team)

On ‘Face the Nation’ again today, or was it ABC’s ‘This Week’ by George Stephanopoulos, I heard something bordering on sacrilege, blasphemy, but not heresy…for a secular, democratic, tolerant nation. A politician claimed, at prayer gathering where he announced exploring a run for the American presidency, something he believes is revealed in the last page of his good book: “Our God Wins.” As the program host questioned this potential candidate, I turned the idiot box off and moved on to more important things: feeding birds in my backyard, and doing my laundry.

I’d normally not pay any heed to politician-speak, but two things he said stuck in my mind, and need resolution. One, he mentioned spirituality, that we need a new spirituality in America. And two, that his god wins.

My laundry is drying out…I have a half hour to multitask! Let’s take his second statement and understand it a bit.

His god wins. And he saw that revealed in the last page of his good book. It matters not what good book – for there are many – but what is noteworthy is that he is thumping it as the revelation critical to his thinking. But it is what he reveals that is significant, methinks. He exposes his narrow thinking, and projects his personal desire to win, perhaps.

But what does a god, any god, win? Money? Power? A competition with peers? A fight against others who’d dethrone him, the king? Or lots and lots of giggles? Pleasures? What exactly? No, let’s take the high road – this god wins a battle with his opposite, the devil. In the great battle of good against evil, good wins, and good personified (and made very very exclusive, “Our”) in this politician’s mind as his god wins the battle against evil.

Sounds like this politician deals very much in absolutes (good, evil, white, black), perpetuating differences and stark distinction, rather than with the continuum that is society, nature, and life. Now what was that in Star Wars? Only a Sith deals in absolutes? Heck, even Hollywood attempts to get their take right. For instance, Avatar: “The Great Mother does not take sides, Jake. She protects only the balance of life.” But this politician may not watch such movies…or messages within may not percolate down into his single-minded consciousness.

But what bothers me even more, than his puerile idea that god wins anything at all, is that he makes it exclusive: it is his god that wins. Not any other gods and goddesses. No, his god. Granted he may mean a compassionate and loving personification, an anthropomorphism for benevolence (hey, that reminds me, I’d said this in the dedication in my Master’s thesis: “To the benevolence in all that lives, which, I firmly believe, in aggregation, is God”), but he excludes a very large segment of humanity in his assertion. Whatever he means, I think he demeans everything else; he disrespects other believers and non-believers alike.

My laundry is almost dry…and the NBA double header on ABC is about to start. My son will be coming over to watch it with me – I think! Let me close out my thoughts on this topic.

The other point – spirituality – is a valid one. I’ve often wondered what and where America’s spiritual leadership is…and have looked for it. It is not within our constitution, for I’ve argued that indirectly in Humbling and Humility. It is definitely not in our justice – no, legal – system, or the courts, and certainly cannot be in the big houses occupied by politicians of all shades. But it may well be in our hearts and minds…and may reveal itself in our humility, empathy, and compassion.

I’d love to hear your thoughts on this subject so dear to my heart…comment, blog, write! :-)

-rian

January 23, 2015

Surfing Waves of Market Volatility Late January

VIX and VVIX with volatility relative strength for Jan. 23, 2015

I have to admit to breathing a sigh of relief over the past week and a half…in a prior analysis on market volatility, I’d put my money on volatility easing in the short term. The blue ellipse in the picture above isolates this wave down that eased my worries… It was no tube, but yes, I did surf it down okay. I hope you did too.

After many weeks of increased volatility, even Jim Cramer (of ‘Mad Money’ on CNBC) has taken to talking about the VIX… I can’t find a link to his article, but the screenshot below gives a gist.

Cramer on the VIX, Jan. 20, 2015

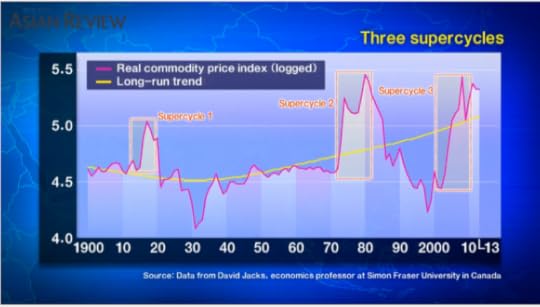

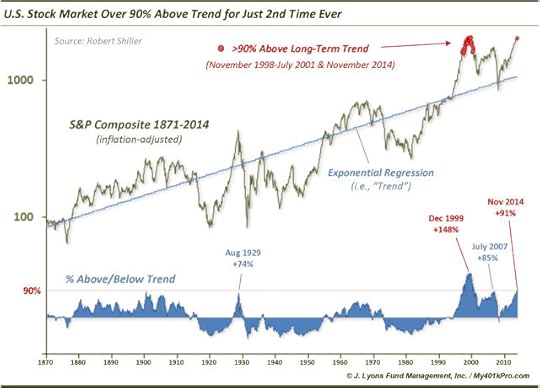

There are many indicators of unusual conditions in the market. Some point to backwardation, a unique market term that relates to a greater than unity ratio of near term to longer term VIX futures (1 month / 3 month VIX futures as in the picture below) indicating increased concerns in the near term. Others point to the plunge in commodity prices, calling it a commodity supercycle that appears to be ending. And Robert Shiller points to a market top indicator, 9 of 10 stocks above the long-term trend line. View these in all their picturesque splendor below…

VIX Futures Backwardation / Fear

Commodities Supercycle

Nine of ten above trend

��Most unusual of all, of course, is the dramatic low in oil prices attributed to oversupply in the global market. But that is an economic vice (the mechanical sort) that squeezes those for whom oil extraction isn’t very efficient or low-cost, and who depend upon oil for their revenues. Countries such as Russia, Iran, and Venezuela are hurt, while US and EU consumers should benefit from lower energy costs. Some experts say that this effect could come into play in the market in the next couple of quarters in the form of improved consumer sentiment.

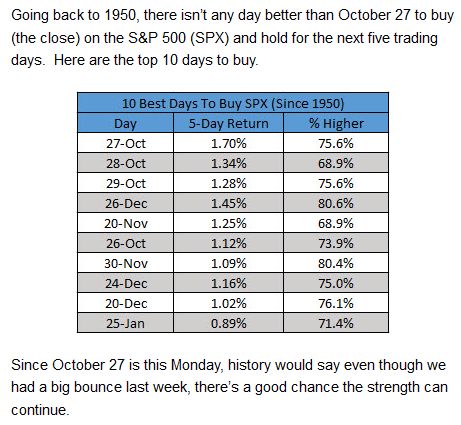

As for the near term, it would seem that central banks are rather enthusiastic about quantitative easing and relaxed monetary policies. The European Central Bank announced a ~1 Trillion Euro QE program spread out until September 2016 this week. Other national reserve banks are engaged in interest-rate reductions, increasing liquidity in markets. US economic indicators have been positive in recent weeks, and the earnings season in full swing indicates a potential for higher-than-expected earnings growth. While the VIX (the fear index) trend remains elevated, I’ll take refuge in simple statistics (despite the ‘lies, damn lies, and statistics‘ saying) in the table below, and venture that the next week may see a market breaking out to new highs…

Ten Best Buy Days in a Year (from an article in 2014, source unknown)

We’ve had a decent pull-back today, Friday the 23rd, after a good four day stretch of a rising market, and the 25th falls on the day of the Sun. With your acquiescence, therefore, let’s apply the above statistics to Jan. 26th, and say that an earnings and positive news (ECB, US economic growth) driven rally may continue on beginning the 26th of January.

Full disclosure: I am long equities, and neutral VIX, having exited my short positions.

January 22, 2015

A Probationary Officer’s Interest in Indian Culture

A sequential excerpt from Humbling and Humility

Sid’s query, about clarifications members may need regarding the counseling group and sessions, pulled me back to the day’s session from troubled memories. No, I thought, recalling Sid’s wife-in-bed-with-another question, I had not reacted violently to the discovery of my wife’s affair and plans. I had instead felt a deep sense of betrayal, and overwhelming shock������how could she do such a thing? In our own home? In a home we raise our children in? How could she stoop so low������wait until the children and I fell asleep, to engage in her salacious conduct������in our home? My home, that sheltered my family, that gave me refuge and comfort through many family tragedies, was sacred to me. I felt viscerally violated. John and Parvathi could scarcely respond to my emotions; they had no words to alleviate my shock and sense of outrage.

But this was two full years before I landed in the grips of this legal system. Two long years before I became someone who’d engaged in unlawful, disorderly conduct, falling into a court-mandated re-education program. A program where I’d come to hear that my life partner may sleep with anyone she chooses to, and that I may do the same, regardless of our marriage and its vows.

I was required to follow up with my probationary officer, Lauren Smith-Green, after classes began. I was placed on probation������like any other convicted criminal in this system������until successfully completing the intervention program. Lauren had a second role as an additional counselor. She was a small, short and stocky, white-haired older lady, and quite pleasant to talk to. She seemed sympathetic toward agonies endured in passing through the process. It was within her authority to recommend that I leave this process and the country altogether. But she did have a condition for such release, that I successfully complete such an intervention program in any country I moved to. And though another had taken this route in the past, it seemed simpler for me to stick with the process here, and with her as my probationary supervisor.

Lauren was taken aback by my description of the first group session. ���You are definitely in the wrong group,��� she said. ���Are you sure there isn’t a better group to move to?���

I wondered why she thought the group was a wrong one to be in. Did the group determine results of counseling? I rather liked the idea of a group that tested the limits of their intervention program. I spoke with Lauren instead about a continuing impasse at home, and about accusations of threats made from my spouse.

���Threats? What threats could you have made?��� she asked.

���I said to my wife that I’d take her to task in a court of law, given a chance,��� I clarified. ���She knows that I’ve prosecuted and won civil cases. I am engaged at the moment in a case against a company that stole some of my intellectual property.���

Lauren asked if I felt constrained or burdened by not being free. I wasn’t sure what she meant, the legal process or my marital nightmare. I replied that I’ve always felt free in my heart and mind. I left with her a copy of My Experiments With Truth, by Mohandas K. Gandhi, that I brought along to the meeting. You may know of him as an Indian who stood for non-violence, who taught generations before us to be non-violent and yet effective. Freudian thinkers may label such non-violent but provocative methods as being passive-aggressive.

I brought the book along because Lauren seemed genuinely interested in learning about Indian culture in discussions with me. The book could help more; I didn’t feel or think much like an Indian after a decade and seven years in America. Besides, India has always been a complex melting pot, of diverse cultures and races, in a relatively small geographical area, hemmed in by massive mountain ranges along its northern boundaries and oceans around its peninsular body. There isn’t any specific culture that could be called distinctly Indian.

Nevertheless, this topic could make for interesting conversations with Lauren. An influx of a large number of new Indian immigrants, into this region of the state, may have aroused in her a desire to learn more about this eastern, ancient cultural tapestry. I knew it to be a complex social fabric, that birthed and assimilated multiple religions, and gave rise to much independent thinking and spiritual pursuits together.

��� ��� ���

January 16, 2015

Marital Infidelity: Shock of Discovery

An excerpt from Humbling and Humility

My own thoughts drifted to that mid-July night in 2007 when I chanced upon my wife’s extra-marital affair. It was a hot monsoon night, and a lightning storm was active over a part of the metropolis Dilbut belongs to. I recall that it was about 11pm, beyond my usual bed time, and I’d come back down to the kitchen for a drink of cold water. Hearing the fan running in the half-bath downstairs, I headed to turn it off when I noticed the bathroom light on with the door closed. Passing by the door, I overheard my wife talking������something was strange about her voice, and the conversation, and I stood silently by the door listening. I could hear only her voice.

���I’ll make some egg curry and bring it over to you.���

���������

���Yes! I wasn’t sure if I should have sent you that message,��� my wife giggled.

���������

���Yeah! That was so nice������ she continued giggling.

���������

���Yes! I too really like it in the dark!���

Listening to these late night sweet nothings and declarations from my life partner, I felt a wave of nausea spread in me, overpowering me, enraging me simultaneously. There was no mistaking the tone and substance of her conversation. I knocked hard on the bathroom door and demanded to know who she was talking with.

A quiet, almost whispered, ���I’ll talk to you later������ emanated from within, followed by a louder���������I’m coming!��� in response.

As I waited, I imagined she was deleting suspect messages from her phone. When she came out a few minutes later, I demanded to know who it was she was messaging and talking with, but she would neither reveal that, nor give me her cell phone. As this conversation became more heated by the minute, I knew I needed help������and called our common friends, another local family, and requested their immediate presence.

I had sensed something strange in my wife’s behavior in the few months before this incident������but never suspected that a mother of two little children could take such a step outside the family. Or that she could betray any and all promises and her responsibilities toward our children and the marriage. Not after all that we’d been through in the past together���but that remains to be revealed.

When the friends I called������John and Parvathi, also from India������came by, they pressed her to reveal the number called, and the circumstances of the call. Maybe she thought there wasn’t anything to lose and gave us the number, which I called in the presence of these friends. On the other end was a fellow who was rather nonchalant about his conduct with another man’s wife. When questioned, and asked of his intentions, he said he’d enjoyed a level of intimacy with my wife already, and could make it long term after she divorced me. Very glib, very matter of course, and very disturbing.

��� ��� ���