Helen H. Moore's Blog, page 241

November 13, 2017

Ta-Nehisi Coates just explained why white people shouldn’t use the n-word in the perfect way

Ta-Nehisi Coates (Credit: Getty/Anna Webber)

Ta-Nehisi Coates is known for his poignant writing on race and politics. But apparently his oral addresses are equally as moving and perhaps a bit more charming.

During a public event to promote his new book “We Were Eight Years in Power: An American Tragedy,” a white audience member asked Coates what she should tell her white friends who insist on saying the “n-word.” His response was as funny as it was biting and profound.

“Words don’t have meaning without context,” Coates said. “My wife refers to me as ‘honey.’ That’s accepted and okay between us. If we were walking down the street together and a strange woman referred to me as honey, that wouldn’t be acceptable.”

“It’s the same thing with words within the African-American community, or within any community. My wife with her girlfriends will use the word ‘bitch.’ I do not join in,” he added. “And perhaps, more importantly, I don’t have the desire to.”

Coates mentioned how he feels similarly about LGBTQ slurs or the term “white trash.” So, “We understand that it’s normal, actually for groups to use words that are derogatory in an ironic fashion, why is there so much hand-wringing when black people do it?,” he questioned. “The question one must ask is why so many white people have difficulty extending things that are basic laws of how human beings interact to black people?”

Coates has a eminently reasonable guess. “When you’re white in this country, you’re taught that everything belongs to you. You think you have a right to everything,” he said. “You’re conditioned this way.”

He continued, “So here comes this word that you feel like you invented. And now somebody’s going to tell you how to use the word that you invented.” Coates then mimicked the stale talking points used to argue this concept: “‘That’s racism that I don’t get to use it, that’s racist against me. I have to inconvenience myself and hear this song and I can’t sing along. How come I can’t sing along?'”

“I think for white people, I think the experience of being a hip-hop fan and not being able to use the word n****r is actually very, very insightful,” he said, returning to his normal voice. “It will give you just a little peak into the world of what it means to be black. Because to be black is to walk through the world and watch people doing things that you cannot do, that you can’t join in and do,” Coates powerfully concluded. “And so I think there’s actually a lot to be learned from refraining.”

Watch the whole exchange below.

A white student asks author @tanehisicoates if it’s cool to rap along to songs with the n-word in it, and Coates responds brilliantly. pic.twitter.com/2NGf81oK8o

— Matt (@mattwhitlockPM) November 10, 2017

While you weren’t looking, Trump just appointed a tax evasion expert to head the IRS

(Credit: AP/Susan Walsh)

Monday was the first day on the job for David Kautter, the former big-shot corporate accountant that the White House has installed as the interim head of the Internal Revenue Service. As he was previously serving as Assistant Secretary of the Treasury, Kautter’s temporary position means that he will not be subjected to a Senate confirmation hearing to examine his record.

Under federal law, the president is given unilateral power to make temporary appointments to various federal agencies in the event that a formal nominee has not been found. The interim appointments can last up to 120 to 190 days.

Kautter’s elevation to the top IRS post is significant for several reasons, the most prominent of which is that he is the first agency leader not to have come from within the ranks since at least 1955, according to the progressive group Demand Progress.

“From demanding the Department of Justice investigate his political opponents to urging the Federal Communications Commission to revoke broadcast licenses for media outlets critical of his presidency, Trump has worked to exert control over independent government bodies in unprecedented ways,” said Kurt Walters, a campaign director with the group’s Rootstrikers project.

“Trump has created an inescapable conflict between Kautter’s role driving politically motivated tax reform at the Treasury Department and his new duty to impartially enforce the law at the IRS.”

While he has no IRS experience, Kautter is intimately familiar with the tax code, having run the tax compliance department of EY, the accounting giant formerly known as Ernst and Young. Kautter directed the firm’s efforts for ten years, beginning in 2000. During his time there, he and his subordinates worked to figure out a series of complex ways to restructure extremely wealthy clients’ incomes so as to avoid up to $2 billion in taxes.

The IRS eventually figured out what was going on and launched a lawsuit against the firm. Two partners pleaded guilty to obstructing justice. Kautter was not a named party to the case.

Being able to determine who will head up the IRS is likely to be of particular significance to President Donald Trump considering that, by his own admission, he and his companies are currently under audit by the agency and have been for many years. Trump has cited the IRS’ dispute with him as justification for refusing to release his personal income tax records — even though tax experts have said that publicly disclosing them would create no legal liability for him.

Another person who is highly likely to be interested in who becomes the IRS commissioner is Trump’s most significant financial backer, former hedge fund operator Robert Mercer. Although he and his family strongly supported the presidential candidacy of Trump’s former rival Ted Cruz, they abruptly switched sides once it became evident that the Texas senator was doomed to lose the Republican nomination in 2016.

Mercer is the former co-CEO of Renaissance Technologies, a $50 billion private fund which earns most of its money from high-speed trading powered by mathematical formulae. During his time leading the company, Renaissance was sued by the IRS over claims that it had failed to pay at least $7 billion in taxes.

Both Trump and Mercer are among several administration figures who were named in the recent “Paradise Papers” leak consisting of stolen documents from a Bermudan law firm which illustrate how the uber-wealthy around the world utilize tax shelters and offshore investments to legally avoid paying trillions of dollars in taxes.

Why America’s future could look like a Renaissance painting

People look at Rembrandt's painting Portrait of a Couple as Isaac and Rebecca, known as 'The Jewish Bride.' (Credit: AP Photo/Kirsty Wigglesworth)

Bias for the super-rich, at the expense of everyone else, lies at the heart of the tax bill that Republicans hope to rush into law without public hearings. The most outrageous example of this is a plan to make sure that the richest of the rich never have to pay taxes on their investment gains.

The tax bill would not just eliminate the estate tax. It would do something far more outrageous.

The GOP/Trump tax plan would exempt all capital gains taxes from taxation at death.

That means Bill Gates, who started Microsoft with a $50,000 loan from his parents, would never be taxed on the increased value of stocks and other appreciated property he owns when his time runs out. Nor would his children, nor his children’s children. Ditto Warren Buffett, Jeff Bezos and Donald Trump.

This is how Old World-style, inherited aristocracies are created.

There is no policy justification for forgiving all capital gains at death. People should be demanding that this not come to pass unless they think the rich need more and are overly burdened by taxes—taxes they currently can defer until after they die. (For married couples, the taxes can be deferred until after the second spouse dies.)

The George W. Bush-era estate tax changes allowed an exemption for capital gains owed at death. But it was only for the taxes on $1.3 million of gains ($2.6 million for a married couple). That was bad policy, but at least it is limited to the modestly successful who saved and invested, not to people with fortunes in the billions and even tens of billions of dollars.

The reason the richest of the rich benefit is that only a minority of Americans own investments.

Most people who own stocks, real estate and other property that increases in value over time cash in their investments at various points in their lives. They pay capital gains taxes and on the after-tax balance they then pay for college for their children or pay off their mortgage or cover medical bills or cover living expenses in old age.

But if you own tens of millions or more in stocks—and a few Americans own tens of billions—you never need to sell these shares.

Indeed, during your lifetime you can borrow against them to cover your living expenses and never pay income taxes. Under the GOP and Trump tax plan, the super-rich can live tax-free and then pass their gains on to their heirs tax-free while you keep paying taxes.

This planned favor to the super-rich shifts the burden of supporting government off those who got the greatest economic benefit and adds it to the burdens of Americans who did less well in financial terms. It reminds us of what the late Leona Helmsley, a billionaire hotelier, said, according to a former housekeeper who testified at Helmsley’s 1989 income-tax evasion trial: “We don’t pay taxes; only the little people pay taxes.”

One of the most prominent tax advisers to the super rich is appalled by the bill. Jonathan Blattmachr is an estate tax lawyer so well known in his field that just mentioning his first name triggers recognition among the other 16,000 or so trust and estate lawyers. I featured Blattmachr in the opening of my book Perfectly Legal, still in print 14 years later.

Blattmachr, a card-carrying Republican, says the bill is rife with “bad, bad aspects” that amount to “a super giveaway to the rich and super-rich.”

The tax plan would add to the federal debt, which Trump ran against and which House Republicans have complained for years is a terrible economic monster that must be slain. But instead of a tax bill that would reduce the annual federal budget deficit or at least not add more than currently projected, the GOP plan will add an extra $1.5 trillion to the federal debt over a decade. The federal debt now stands at more than $20 trillion.

The increased debt will almost surely be used as justification by Republicans to cut spending. Their past plans have focused on reducing services for children, the disabled, the elderly, the hungry and the poor. In other words, the most vulnerable and least likely to fight back.

And if you own stocks through your retirement account, like an IRA or a 401(k), you not only get taxed on the gains when you sell, you pay at the higher rates for labor income rather than the lower rates applied to capital.

So, in simple terms, the plan is no taxes on the wealth of the richest of the rich, while you take on the added burden of supporting the government through more taxes, fewer services or more federal debt. Keep in mind these wise words from Blattmachr, an adviser to many of the super-rich:

“There is no such thing as tax reduction, only tax burden shifting. When you reduce taxes on the richest Americans, those less rich will pay the difference.”

After Hannity fans smash Keurig machines, CEO loses his nerve

Sean Hannity (Credit: AP/Carolyn Kaster)

In a companywide memo obtained by the media, Keurig CEO Bob Gamgort apologized to employees for attracting national, negative attention to the coffeemaker by creating the appearance that the brand was “taking sides” by pulling its advertising from Sean Hannity’s Fox News program.

The memo also placed the blame for the considerable backlash the brand has experienced since that decision on both Hannity and on the way it announced the move via social media.

Last week, Keurig made the not-unreasonable decision to stop advertising its products on “Hannity” after the host appeared to downplay allegations that Alabama Senate candidate Roy Moore had engaged in improper and illegal sexual relations with a 14-year-old girl.

On Saturday, the company announced the decision via a reply to an inquiry by Media Matters President Angelo Carusone, sent to the brand’s official Twitter account.

Angelo, thank you for your concern and for bringing this to our attention. We worked with our media partner and FOX news to stop our ad from airing during the Sean Hannity Show.

— Keurig (@Keurig) November 11, 2017

The company was only one of several that suspended its relationship with the host on a short or long-term basis for this very reason.

Fans of Hannity, Fox News, Moore and conservatism in general responded to the move with a flood of angry, polemical Twitter posts, some of which included videos and images of individuals smashing their Keurig coffeemakers.

Donald Trump Jr., son of President Donald Trump, joined this online groundswell by suggesting that the aggrieved instead purchase their grounds from Black Rifle Coffee Company, a pro-Trump, pro-gun, openly right-wing roaster.

Hannity, for his part, reveled in this outpouring of anger against the departed advertiser (and pledged to snap up some Black Rifle beans).

Now it appears that Keurig may be buckling under the pressure applied by these angry Keurig smashers.

The internal memo from Gamgort reveals that the CEO believes that, yes, Hannity is to blame, but concedes that it was a mistake to give consumers the impression that the brand was “‘taking sides'” on the fairly unnuanced issue of whether child rape is acceptable or not.

First, Gamgort addressed Hannity’s defense of Moore in the face of the accusations:

The catalyst for the current situation was commentary made by Sean Hannity on his TV and radio programs last week, which sparked a significant number of consumer complaints directed to us as advertisers on his TV program. Hannity himself later apologized for his comments in his own tweet: “As I said on TV tonight, I apologize when I misspoke and was not totally clear earlier today.”

The CEO added that:

In most situations such as this one, we would “pause” our advertising on that particular program and reevaluate our go-forward strategy at a later date. That represents a prudent “business as usual” decision for us, as the protection of our brand is our foremost concern.

Which all makes quite a lot of sense. From there, however, Gamgort blamed the particular Twitter rollout of Keurig’s “prudent ‘business as usual’ decision” for the negative backlash to its move:

However, the decision to publicly communicate our programming decision via our Twitter account was highly unusual. This gave the appearance of “taking sides” in an emotionally charged debate that escalated on Twitter and beyond over the weekend, which was not our intent.

I want you to know the decision to communicate our short-term media actions on Twitter was done outside of company protocols. Clearly, this is an unacceptable situation that requires an overhaul of our issues response and external communications policies and the introduction of safeguards to ensure this never happens again. Our company and brand reputations are too valuable to be put at risk in this manner.

There is some truth to the idea that announcing the decision via a reply to a pointed, opinionated tweet can give the impression that the brand did indeed “take a side” against Hannity and what he represents. However, the specific rollout of Keurig’s move isn’t why red meaters are smashing their pod machines like piñatas.

In truth, that has less to do with strategic marketing positioning and optimized brand engagement than it does with the unbridled fury some of Hannity’s viewers feel when they find their positions countered at any time in any way.

Moreover, Gamgort’s notion that the appearance that Keurig was “‘taking sides'” was problematic is a questionable one. It seemed fairly clear that Keurig had dropped Hannity due to his initial comments in defense of a candidate who is, again, accused of sexually assaulting a legal minor against her will (and has been accused by more women since). Exactly how a brand would benefit from not upsetting those on the other “side” of that particular issue is unclear.

Of course, in our the current, highly polarized, completely gamified political discourse, making a stand against Hannity’s initial comments mounts to taking stand against conservatism itself. This is the way things work now.

Monday afternoon, Hannity, claimed a measure of victory after Gamgort’s memo came to light, saying incorrectly that Keurig now understood that it was “misled” by Carusone, who he has labeled an “anti free speech bigot.”

Hold on to your coffee machines @keurig has recognized it got caught up & misled by a bigot. Still giving away coffee machines, which brand has yet to be determined. Stay tuned. https://t.co/Af1FUCa3Br — Sean Hannity (@seanhannity) November 13, 2017

Again, this is the way things work now.

November 12, 2017

10 most violent video games of 2017 (and what to play instead)

(Credit: AP Photo/M. Spencer Green)

It’s a dark night. You’ve just escaped from a sprawling mansion deep in the Louisiana bayou. You’re terrified. You’ve been shot at, bludgeoned, and stabbed as you try to escape this life-or-death situation. What’s worse, it looks like you’re on your own, because a sheriff’s deputy was killed in front of your eyes. You take a break in an upstairs bathroom to catch your breath, but something doesn’t feel right. You should go, but as you get to the door, it swings open, and you’re face to face with the man you killed minutes before. How is he still alive, and worse, how are you ever going to escape if you have to kill him again and again?

This is only one of the many nightmare-inducing, pulse-pounding, and incredibly violent moments from the horror-survival game Resident Evil 7 Biohazard. RE7, as it’s known to fans, tosses an ordinary guy into a macabre setting full of monsters and mayhem that terrifies even the most hardcore horror gamers. But it’s more than just jump scares and shrill music that’s designed to make players uneasy. Sometimes, the content of the game itself can be too much for many gamers to handle.

Every year, game graphics become more realistic and immersive, bringing players closer to the action and story than ever before. With violent video games, this realism ratchets up the brutality. Despite that, video game promotions target kids way younger than the games’ age rating. Trailers, demos, blogs, and more air on TV, go viral on social media, and are discussed endlessly on game sites. Marketers advertise the excitement, the depth of realism, and the cool gameplay — but they often don’t tell you exactly how violent the games are. The truth is, the majority of the hyper-realistic, hyper-popular games are best left to mature players. The impact of violent media on kids is still being studied — especially as game violence jumps from the screen to virtual reality. But research shows that heavy exposure to violent media is associated with aggressive behavior, desensitization, and violent thoughts.

Many parents whose kids ask for these games (or set up a line of credit on game sites such as Steam) may know that the games are violent, but not the specific kinds of violence they contain. Here’s where you can find out. Below, we’ve gathered 10 of the most extreme titles to come out this year. A lot of them are well-designed gameplay experiences, but they’re definitely not for kids. The thing is, instead of saying no all the time, we think you’ll be more successful if you say, “Wait,” and offer kids alternatives in the same genre that are a little less violent and more age-appropriate. Note that we offer two alternatives for each game, one for younger players and one for older players.

If you don’t want any violence in your games, be sure to check out our list of nonviolent games, Nonviolent Games for Xbox One, Nonviolent Games for Wii U, and Nonviolent Games for PS4 — and always check out our reviews on the latest games.

Bulletstorm: Full Clip Edition

Few sci-fi action games push the envelope as much as Bulletstorm, which focuses on players using guns, kicks, and an electric whiplike device to destroy their opponents. There’s plenty of blood, gore, and dismemberment, and players get points for killing enemies in extreme ways.

Alternative sci-fi action: ReCore: Definitive Edition (12+), Gravity Rush 2 (14+)

Conan Exiles

This massively multiplayer online role-playing game is full of bloody, gory hack-and-slash action that includes decapitations and dismemberment. Other game events highlight the brutality of Conan’s world, its environment, and its subject matter, which includes cannibalism, torture, and human sacrifice.

Alternate MMOs: Guild Wars 2: Heart of Thorns (12+), Marvel Heroes 2016 (13+)

Dark Souls III: The Ringed City

The end of this incredibly difficult action role-playing game franchise doesn’t skimp on the blood, gore, or shock factor, as fantasy creatures moan and gush blood when struck by medieval weapons. Bodies are frequently seen scattered throughout the environment, and players will slash, impale, and smash enemies to pieces.

Alternate action RPGs: The Legend of Zelda: Breath of the Wild (10+), Horizon Zero Dawn (13+)

Dead by Daylight

In this slasher game, a remorseless killer hunts down survivors to sacrifice them to an evil entity, using a variety of weapons to hack, stab, and impale characters. Injured players may crawl on the ground leaving pools of blood behind and can be hung on meat hooks in brutal death sequences.

Alternative scary games: Five Nights at Freddy’s 4 (12+), Darkest Dungeon (16+)

For Honor

Combat between three factions plays a major role in this action fighting game set in a medieval fantasy world. Each entity tries to assert its dominance over the others using melee weapons, such as swords, pikes, and spears. Kills are frequently shown in close-up with large splashes of blood, while plenty of arenas show severed heads on spikes and other gruesome imagery. Players also slaughter dozens, if not hundreds of computer-controlled enemies wholesale with no ability to negotiate peace.

Alternate multiplayer action games: Portal Knights (10+), Fortnite (13+)

Friday the 13th: The Game

Like a digital version of the horror movie franchise, this multiplayer slasher game places one player in the role of Jason hunting down and killing opponents, who assume the roles of different camp counselors. Adding a sexual angle to the violence (a potentially harmful combination for tweens and teens), the female characters are scantily clad or skinny-dipping while they are being hunted down. Grisly violence abounds as characters are killed with weapons, environmental objects, or even Jason’s bare hands. The cut scenes and gameplay feature tons of blood and gore.

Alternative action games: Cuphead (10+), Alan Wake (14+)

Outlast II

Gory scares run throughout this bloody horror game, which forces players to try their best to escape from cultists wielding weaponry and farm implements. These enemies only want to catch and torture the player in bloody, gruesome ways, and multiple scenes of viscera and stabbing are frequently shown, as well as the violent birth of the Antichrist.

Alternate scary games: Luigi’s Mansion: Dark Moon (9+), Zombie Vikings (13+)

PlayerUnknown’s Battlegrounds

Gamers try their best to be the last one standing in this online shooter, which throws up to 100 players into a constantly shrinking arena. Whether using firearms, cars, melee weapons, or bare hands, you have to try to kill everyone you come across to ensure your safety. Even alliances between players can quickly be tossed aside in favor of points and survival, undermining the concepts of cooperation, loyalty, and teamwork.

Alternative shooters: Hard Reset Redux (10+), Destiny 2 (13+)

Resident Evil 7 Biohazard

Scares aren’t the only thing to shock gamers in this violence-packed game that glorifies cruelty as players use shotguns, chainsaws, explosives, and other weapons against human and inhuman creatures. There are plenty of disturbing images of open wounds and injuries, and characters are dismembered, impaled, or killed in brutal ways.

Alternative survival action games: Plants Vs. Zombies: Garden Warfare 2 (10+), Adr1ft (13+)

Sniper Elite 4

War games frequently highlight massive casualties, but this World War II shooter casts the player as a sniper. Using knives, explosives, and a variety of firearms, you travel to some of the most dangerous locations of the war to conduct stealthy attacks against Nazi soldiers. Unfortunately, there aren’t any nonviolent attack options, so these strikes are simply ways to kill enemies without poking the ant hill of enemies that scour the grounds looking for you once they’ve detected something’s amiss. On top of this, some kills are slowed down and highlighted with graphic X-ray visuals indicating the brutality of the damage inflicted on its target from a fired bullet.

Alternative shooter games: Splatoon 2 (10+), Overwatch (13+)

Chinese philosophers can teach us about dealing with grief

(Credit: Leah Hogsten /The Salt Lake Tribune via AP)

November 2 is All Souls’ Day, when many Christians honor the dead. As much as we all know about the inevitability of death, we are often unable to deal with the loss of a loved one.

Our modern-day worldview could also make us believe that loss is something we should be able to quickly get over, to move on with our lives. Many of us see grieving as a kind of impediment to our ability to work, live and thrive.

As a scholar of Chinese philosophy, I spend much of my time reading, translating and interpreting early Chinese texts. It is clear that dealing with loss was a major concern for early Chinese philosophers.

So, what can we learn from them today?

Eliminating grief

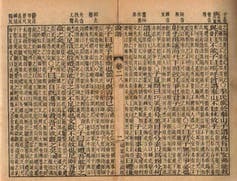

Zhuangzi butterfly dream.

Ike no Taiga (Japan, 1723-1776), via Wikimedia Commons

Two influential philosophers who reflected on these issues were Zhuang Zhou and Confucius. Zhuang Zhou lived in the fourth century B.C. and is traditionally credited with writing one of the most important texts of the Daoist philosophy, “Zhuangzi.” Confucius, who lived more than a century before Zhuang Zhou, had his teachings compiled in a text written by later students, commonly known in the West as the “Analects of Confucius.”

On the face of it, these two philosophers offer very different responses to the “problem” of death.

Zhuang Zhou offers us a way to eliminate grief, seemingly consistent with the desire to quickly get beyond loss. In one story, Zhuang Zhou’s friend Hui Shi meets him just after Zhuang Zhou’s wife of many years has died. He finds Zhuang Zhou singing joyously and beating on a drum. Hui Shi upbraids him and says:

“This person lived with you for many years, and grew old and died. To fail to shed tears is bad enough, but to also beat on drums and sing – is this not inappropriate?”

Zhuang Zhou replies that when his wife first died, he was as upset as anyone would be following such a loss. But then he reflected on the circumstances of her origins – how she came to be through changes in the elements that make up the cosmos. He was able to shift his vision from seeing things from the narrowly human perspective to seeing them from the larger perspective of the world itself. He realized that her death was just another of the changes of the myriad things constantly taking place in the world. Just as the seasons progress, human life generates and decays.

In reflecting on life in this way, Zhuang Zhou’s grief disappeared.

Why we need grief

Analects.

Confucius and his disciples, via Wikimedia Commons

For Confucius, though, the pain of grief was a natural and necessary part of human life. It demonstrates commitment to those for whom we grieve.

Confucius suggests a three-year mourning period following the death of one’s parent. In a passage from the Analects, one of Confucius’s students, Zaiwo, asks him if it is possible to shorten this mourning period, which seems excessively long.

Confucius responds that a person who honestly cared about his parent would simply be unable to bring himself to mourn in any less serious way. For such a person, the usual joys of life just had no attraction for three years. If, like Zaiwo, someone considers shortening this period, it reveals for Confucius a lack of sufficient concern. Early Confucians, thus, followed this practice of a three-year mourning period.

Remembering our ancestors

There is more to the Confucian response to death than grief. Our encounter with others inevitably changes us. Those closest to us, according to the early Confucians, particularly family members, play the greatest role in determining who we are. In that sense, we are representatives of particular communities than detached and autonomous individuals.

After all, many of our physical features and personalities originate from our ancestors. In addition, we learn many of our attitudes, preferences and characteristic ways of acting from our families, friends and neighbors – the creators of our culture. So, when we consider the question of what we are as individuals, the answer necessarily encompasses members of our closest community.

A Chinese funeral.

Scan by NYPL, via Wikimedia Commons

According to the early Confucians, this acknowledgment suggested how to deal with the death of those close to us. To grieve was to honor your parent or another person who died and to commit to following their way of life .

Even if their way of life involved flaws, Confucius notes that individuals were still duty-bound to follow their way while doing their best to eliminate the flaws. In Analects 4.18, Confucius says:

“In serving your parents, you may lightly remonstrate [if your parents stray from the virtuous way]. But even if your parents are intent on not following your advice, you should still remain respectful and not turn away from them.”

Developing an understanding of grief

So how do the seemingly contrasting Daoist and Confucian approaches to grief apply to us today?

From my perspective, both views are helpful. Zhuangzi does not eliminate grief, but offers a way out of it. The Daoist response could help people find peace of mind by cultivating the ability to see the death of loved ones from a broader perspective.

The Confucian response could challenge assumptions that devalue grief. It offers us a way to find meaning in our grief. It reveals our communal influences, tests our commitments and focuses us on the ways in which we represent and carry on those who influenced us and came before us.

Ultimately, both philosophers help us understand that enduring grief is a necessary part of the process of becoming a fully thriving person. It is not something we should look to eliminate, but rather something we should appreciate or even be thankful for.

Ultimately, both philosophers help us understand that enduring grief is a necessary part of the process of becoming a fully thriving person. It is not something we should look to eliminate, but rather something we should appreciate or even be thankful for.

Alexus McLeod, Associate Professor of Philosophy and Asian/Asian American Studies, University of Connecticut

Are the Syrian Kurds next for betrayal by the Trump administration?

(Credit: Mursel Coban/Depo Photos via AP, File)

Iraqi Kurds were attacked in Kirkuk by Iranian-backed Shiite militias on October 15. Despite decades of close cooperation between Iraqi Kurdistan and the United States, the U.S. abandoned Iraqi Kurds who, at America’s behest, have fought bravely against the Islamic State. Syrian Kurds fear they are next for betrayal by the Trump administration.

Abandoning the Syrian Kurds would be a flawed and short-sighted move. Flawed because the Peoples Protection Units (YPG), who number 40,000 men and women under arms, are proven and effective fighters against the Islamic State (ISIS). Short-sighted because it would align the United States with Iran and its allies in Baghdad and Damascus as primary partners in the coalition to defeat ISIS.

YPG fighters have served as America’s boots-on-the-ground in Syria. They liberated Raqqa, the self-declared ISIS caliphate. U.S. Special Forces, weapons, and air power coordinated with the YPG and were invaluable.

Cooperation dates back to the battle for Kobani in October 2014. About 80 percent of Kobani, a Kurdish city in Northern Syria, had been seized by ISIS. Kobani’s heroic defenders were outmatched and almost out of ammunition. U.S. officials initially believed that Kobani had no strategic value, but they reconsidered. The Obama administration decided it would be a recruitment bonanza if Kobani fell and its defenders were beheaded for all the world to see. Turning the tide, the U.S. airlifted weapons to the YPG and bombed ISIS positions.

Recognizing the YPG’s battlefield prowess, America supported the YPG’s march against ISIS territory. The YPG seized the strategic border crossing at Tal-Abyad, preventing Turkey from sending weapons to ISIS in Raqqa. It secured the main road to Raqqa in June 2015. Then it took a border town in northwestern Syria called Azaz, before pivoting towards Raqqa.

Turkey’s President Tayyip Erdogan was furious. He fumed, “Is it me who is your partner or the terrorists in Kobani?” Erdogan alleged that the YPG and the PKK were one and the same organization. Both Turkey and the United States consider the PKK a foreign terrorist organization (FTO). However, the State Department does not list the Democratic Union Party, the YPG’s political arm, as an FTO.

Over Erdogan’s objections, the Pentagon decided to provide heavy and offensive weapons directly to the YPG in May 2017. U.S. military commanders concluded that arming the YPG was the fastest way to take Raqqa. The Syrian Democratic Forces (SDF) served as a fig leaf, engaging anti-Assad Arabs.

The decision was pivotal. On October 20, 2017, after 130 days of intense fighting, the YPG/SDF declared the “total liberation” of Raqqa. YPG ground forces paid a steep price. Since 2014, nearly four thousand YPG members died fighting ISIS. About a quarter of the casualties were women fighters.

U.S. Brigadier General Jonathan Braga praised “a highly effective, professional operation in a difficult urban area to free the city.” Secretary of State Rex Tillerson extolled Raqqa’s liberation as a “new phase” in Syria.

Syrian Kurds are cautious. They fear that the new phase may be to their disadvantage. Is the Trump administration’s betrayal of Iraqi Kurds a harbinger of what may happen to them?

Syrian Kurds worry Washington could bend to Turkey’s demand and declare the YPG a terror group. In this event, the Pentagon would discontinue the supply of weapons and air power. U.S. Special Forces would withdraw. Abandoning the Syrian Kurds would further stain America’s standing. Moreover, it would be a strategic blunder. Without U.S. backing, Syrian Kurds could turn to Russia for protection or seek common cause with Syria’s President Bashar al-Assad. Cutting the Kurds loose would be interpreted by Turkey as a green light to invade Northern Syria in a bid to undermine Rojava, an autonomous area in the provinces of Afrin, Kobani, and Jazeera.

Kurds are uncertain. Can they trust the Trump administration? Is America’s cooperation simply expedient? The specter of betrayal will make Syrian Kurds and other partners think twice when called upon to fight and die for the United States.

How the proposed budget could stunt new affordable housing

(Credit: AP Photo/Bebeto Matthews)

Low-income Americans are already struggling to keep a roof over their heads due to a growing affordable housing shortage.

But budgets drafted by the Trump administration and Congress, along with provisions in the tax cut package, are bound to make matters worse.

As a researcher who studies the intersection of tax law and housing policy, I am concerned about how these proposed changes would reduce the volume of new housing for low-income people and cut aid that people facing economic hardship use to cover their rent.

Spending on housing

The federal government stopped building public housing two decades ago after years of declining construction. Although it has demolished many of these homes, the government continues to own and rent out about 1.1 million of these units.

Nowadays, the government mostly seeks to help make privately owned and operated housing affordable by providing rental assistance to low-income tenants. The main way it does that is by funding the US$19.3 billion Housing Choice Voucher program through which eligible tenants get help paying their rent.

The federal government also subsidizes the construction of privately owned and operated housing units that are officially designated as “affordable.” Private sector developers who build or rehabilitate affordable housing projects do so with the aid of the federal low-income housing tax credit.

In the U.S., affordable housing is defined as dwellings that cost less than 30 percent of low-income tenants’ income for rent and utilities or the owners’ mortgage, property taxes, homeowners’ insurance and utilities — based on regional median income levels.

The tax credit, which has provided about $8 billion in subsidies for new affordable housing projects each year, has financed about 3 million new or rehabbed homes since 1987.

In addition, municipal and state debt governments often issue “private activity bonds” to finance low-income housing — as well as student loan programs, hospitals and big infrastructure projects like bridges and highways. Until now, these bonds have been exempt from federal taxes.

Not enough

The supply of affordable housing is so low that there is no state, city or county in the country where a full-time minimum wage employee can afford to rent a two-bedroom unit, according to the National Low Income Housing Coalition, an advocacy group.

And the department of Housing and Urban Development says that the number of low-income families paying more than half their income for rent or living in severely inadequate housing conditions without help from the government is nearing record levels.

As of 2015, roughly 20 million American households (excluding the homeless) were officially eligible for housing assistance. But nearly 75 percent of them did not get this help because of a lack of funds.

Meanwhile, a new study by Freddie Mac, a government-owned company that buys mortgages from lenders, found that the number of affordable housing units has plunged over the last 15 years. The study focused on the affordability of rental units in buildings that were both financed by Freddie Mac and refinanced during that same period.

In those buildings, the share of rental units affordable to very low-income renters — people living on an income that is less than half of their area’s median, adjusted for their household size and local economy — dropped from 11.2 percent to 4.3 percent.

Calling the results “striking,” Freddie Mac speculated that the trend reflected a combination of increasing rents, stagnant incomes and potential changes to housing subsidies.

Curbing help

These housing woes are sure to become more dire.

One reason for this is that the proposed tax-cut package would abolish private activity bonds. These bonds currently help pay for the construction of more than 40 percent of new affordable housing units.

Less obviously, current tax reform proposals also stand to reduce the effectiveness of the low-income housing tax credit. While GOP lawmakers are not aiming to end the tax credit as part of their package of tax changes, the low corporate tax rates proposed in the tax bill before Congress would surely reduce the value of the tax credits.

The reason for this grim outlook has to do with the complicated way low-income housing tax credits work.

To spur new affordable housing projects, the tax credits must deliver a meaningful subsidy to housing developers. But developers usually don’t use the tax credits directly. Instead, they sell the right to use the credits to banks and other investors. The investors essentially purchase the tax credits at a discount. The lower the price falls, the less value the developer receives.

The price that investors are paying to use the tax credits has already plummeted in anticipation of reduced tax rates, leaving developers unable to secure the funding they need to produce affordable housing. One expert analysis estimates that the proposed tax cuts could lead to 1 million fewer affordable housing units being produced over the next 10 years — about a third of what is currently produced.

Simple and stark

While the budget bills approved by the House and the Senate do not slice $6 billion from HUD’s budget, as the Trump administration tried to do in its spending proposal, they would still leave more American families unable to afford a roof over their heads.

The relatively generous Senate version of the housing line items appears likely to prevail as a way to make way for the tax overhaul. Even so, every state would have less money for housing vouchers, according to the Center for Budget and Policy Priorities, a think tank that researches safety net programs.

Perhaps this all sounds technical and complicated. But the outcome for many low-income Americans will be simple and stark.

The proposed tax changes that make it harder to finance new affordable housing units, combined with proposed cuts to tenant voucher programs, will increase the risk of becoming homeless and take a toll on the poor.

The proposed tax changes that make it harder to finance new affordable housing units, combined with proposed cuts to tenant voucher programs, will increase the risk of becoming homeless and take a toll on the poor.

A cheat sheet for the trickiness of shopping for Obamacare

FILE - This Oct. 24, 2016, file photo, shows the HealthCare.gov 2017 website home page on a laptop in Washington. Health insurance costs will be on the rise again in 2017, just like they have been for several years now. Experts say we should get used to these annual rises, unless we’re ready to accept significant changes in how we consume health care. (AP Photo/Pablo Martinez Monsivais, File) (Credit: AP)

Health care is complicated. Shopping for an individual health plan just got even more so, with President Donald Trump’s decision last month to block $7 billion in Affordable Care Act subsidies.

Known as cost-sharing reduction payments (CSRs), these federal funds had helped insurers offset the costs of the discounts they are required to offer to some lower-earning customers to help them pay for deductibles and copays.

We’ll spare you the details. But because of how state regulators responded to the chaos and how insurers are trying to recover the money through higher premiums, common-sense rules of shopping may no longer apply.

A high-coverage “gold” plan in many states might now be cheaper than a medium-coverage “silver” plan. The reported 15 or 20 percent premium spikes resulting from Trump’s move might nail you right in the wallet. Or, weirdly, it could save you hundreds of dollars next year if you play your cards right.

Experts’ advice, in brief, is: SHOP AROUND. Play with different options on healthcare.gov or state marketplaces. Don’t just renew this year’s plan. More than ever, for 2018 that might not be the best deal.

Find your situation here:

Household income is between $12,060 and $30,150 for an individual, $16,240 and $40,600 for a couple and $24,600 and $61,500 for a family of four.

By law, insurers still must pass along the cost-sharing reductions, even though Trump cut off the reimbursement. And you are probably eligible for them.

But to qualify for the cost-sharing reductions, which lower deductibles and copays when you seek care, you must purchase a silver plan on the marketplace. People buying the other metal levels — the more comprehensive gold or platinum plans or less generous “bronze” plan — cannot get this benefit. So unless you hardly ever see a doctor, get a silver plan.

However, if you’re healthy and at the lower end of these income ranges, a bronze plan might make the most sense.

That’s because of the other Obamacare subsidy, which reduces premiums.

These subsidies are paid directly to qualifying consumers in the form of tax credits. The premium subsidy is so generous for 2018 (we explain why, below) that, for many people, they could cover the entire cost of bronze plans.

Cost-sharing reductions help only if you expect to pay out-of-pocket costs for docs and hospitals. If you don’t — and if you feel like gambling that you won’t need expensive care — a free or super-cheap bronze plan might be better.

At the lower ranges of this income group, you might be eligible instead for Medicaid — in states that expanded that program under the ACA. This online subsidy calculator can help you figure it out.

Household income is between $30,150 and $48,240 for individuals, $40,600 and $64,960 for a couple and $61,500 and $98,400 for a family of four.

You’re eligible for subsidies to reduce premiums but not the cost-sharing reductions. Even so, Trump’s decision to cut them may affect you — in a good way.

To recover the missing $7 billion, most insurers are jacking premiums for silver plans — an estimated 20 percent extra.

The good news is that higher premiums don’t hurt most marketplace consumers. Obamacare caps how much eligible consumers are expected to pay for health insurance — even if premiums go to the moon. The federal premium subsidies cover the difference.

But that’s not all. Trump’s move makes the premium subsidy more generous. Here’s how.

The level of premium subsidy you receive is based not just on your income but also on silver-plan prices, and now silver premiums are going up a lot. The higher the silver premiums, the more generous the subsidies. But that subsidy is not limited to use on a silver plan.

Anybody eligible can take those subsidies and shop for any kind of plan on the marketplace. That’s why in Texas, Pennsylvania, Michigan and other states a high-benefit gold plan might be less expensive next year or not much more than a silver plan. It’s why many consumers could see their premium bills fall in 2018 — in some cases, to zero.

To repeat: Shop around. Shop early. The plan you have now probably won’t be cheapest next year.

Household income is more than $48,240 for individuals, $64,960 for a couple and $98,400 for a family of four.

More than 7 million of these folks buy individual health insurance plans through or outside the ACA’s online marketplaces.

If this is you, you’re ineligible for any Obamacare subsidies. That means your chances of getting slammed by premium increases for 2018 are high. Silver-plan premiums are soaring by 35 percent or more because of high claims and Trump’s decision to stop cost-sharing reimbursement to insurers.

But there are ways to limit the pain. Generally avoid silver plans and look at bronze and gold. Those premiums are probably rising less.

However, California and about a dozen other states allowed insurers to sell a separate class of silver plans without the cost-sharing money built into premiums. These may be available only outside the official, online ACA marketplaces, so to find them you have to ask a broker or check websites of insurers or online brokers such as eHealth or GetInsured.

Household income is less than $16,643 for an individual, $22,411 for a couple and $33,948 for a family of four.

You may qualify for Medicaid, the federal and state health program for low-income people. However, 19 states, mostly in the South, did not expand the program under the health law.

Medicaid eligibility in those places is much narrower, especially for adults, than in the rest of the country. That accounts for many of the 28 million uninsured Americans.

The subsidy calculator shows whether your income makes you eligible for Medicaid and whether your state has expanded Medicaid.

How a fossil–finding competition ruined two paleontologists’ lives

(Credit: Getty Images)

Toward the end of his life, the legendary 19th-century paleontologist Edward Drinker Cope was so broke that he sold his house and moved in with his fossil collection. Cope slept on a cot, surrounded by fossils and bones, financially ruined by his rivalry with fellow fossil hunter Othniel Charles Marsh. The fierce competition between the two men became something of a legend, and is known today as the Bone Wars.

Both Cope and Marsh were major players in early paleontology, a field of science concerned with fossilized remains. Although people had collected fossils throughout human history, the formal science of classifying and describing them really started in the 1700s, during the Age of Enlightenment. The word “paleontology” was first used in 1822, in a French scientific journal. While many dinosaurs had been studied in Europe, when Cope and Marsh entered the field there were only nine known dinosaur species in North America.

Edward Drinker Cope was born in 1840, to a wealthy Quaker family. He was a scientific prodigy at a young age, but didn’t pursue a formal education in the way you might expect. He took only one year of college, at the University of Pennsylvania. In his mention in “Dinosaurs, the Grand Tour,” Cope is described as a “dandyish character” with a fantastic mustache. He also apparently had a fiery temper. To keep him out of the Civil War, his father sent him for further studies in Europe, which led to him meeting a man who was nearly his opposite.

Othniel Charles Marsh was born in 1831, and came from more modest roots than Cope. His father was a farmer, but the young Marsh had the advantage of having a rich uncle, George Peabody. Peabody paid for Marsh’s education, sending him to Yale, and later financing the Peabody Museum of Natural History at Yale (where Marsh became the curator). Marsh later became the first professor of Paleontology in North America. He was a bit of a loner, and never married (though that may be in part due to his uncle’s controlling nature). Marsh met Cope in Berlin in 1864, and while many have said the two were friends, I think friendly colleagues is probably more accurate.

Perhaps because they were so different, and working in such a small field, competition was inevitable. However, there were two things that really set off their rivalry. In 1868, Cope was doing field work in New Jersey, where the first Hadrosaurus had been found by his mentor Joseph Leidy. Cope happily showed Marsh around the fossil bed. Unbeknownst to Cope, however, Marsh had bribed the New Jersey quarry owners to send fossil finds to him first, sabotaging Cope’s work.

Then, the same year, Cope discovered a brand-new plesiosaur (an ancient marine reptile). Naming rights were given to whoever first published a find, so he was in a hurry. He named the creature Elasmosaurus. It was Marsh who pointed out, perhaps a bit too gleefully, that in his haste Cope had made a serious error. Cope had mounted the creature’s skull on the tip of its tail, rather than the end of the neck. To add insult to injury, when Cope tried to hunt down and destroy all of the copies of the journal that his find had been published in, Marsh refused to let go of his copy.

The Bone Wars had begun. For Marsh, it would mean the discovery and naming of the triceratops, stegosaurus, diplodocus, and ultimately a total of 80 new species of dinosaur. Cope named fewer dinosaurs — 64 species — but named more than 1,200 vertebrate species and published more than 1,400 scientific papers, more than anyone to this day.

The competitive spirit between the two likely led to more discoveries, but it also led to mistakes and some pretty unscientific behavior. Marsh mounted a camarasaurus skull on an apatosaurus body and called it a brontosaurus, creating a classic fake dinosaur that haunts paleontology to this day. There were reports of both men filling dig sites with dirt, or even blowing them up, likely destroying priceless fossils simply to prevent the other from finding them. Marsh even went so far as to have unrelated bones deposited in one of Cope’s sites, in order to confuse him. The Bone Wars culminated in a vicious letter-writing campaign, in which both men rehashed their history and attempted to destroy the other’s reputation. With the prestige of Yale backing him, Marsh managed to inflict more damage to Cope’s reputation.

So how did the Bone Wars finally end? Well, Cope died at age 57 from renal failure. The Bone Wars had financially destroyed him, his wife had left him, and he was living alone with his fossils. Marsh died two years later at 68, in a similar, if less dramatic, state of financial ruin. The feud had consumed both of their lives, and death was the only release. But Cope wanted his body donated to science… and some think he was hoping that, after his death, his skull would be found to be larger than Marsh’s. For his part, Marsh left no specific instructions regarding his remains, so his skull was never measured.

Who won the Bone Wars? One answer is the field of paleontology itself: more than 130 North American dinosaurs were discovered vis-à-vis the Bone Wars, pushing scientific progress, and the whole ordeal served as a PR campaign for the nascent discipline.

On the other hand, much of the two men’s science was sloppy, irreplaceable fossils were destroyed in the name of their rivalry, and many finds (including the brontosaurus) were later reclassified. Ultimately, the Bone Wars serves as a cautionary tale: Everyone, even scientists, has an ego; but to do good science, it’s best to let your ego inspire you rather than destroy you.