Meredith Angwin's Blog

April 26, 2023

Movie Time for Nuclear Energy

Oliver Stone has won Academy Awards for best screenplay, best director, and best film. Quite a record! His latest film is Nuclear Now.

Nuclear Now is coming soon to a theater near you!

When I say “soon,” I mean May 1.When I say “near you,” I mean “near you.”As you can see by this list, the film is showing in every state in the country. In most states, there will be at least one venue with a film discussion. For example, it will be shown at eighteen venues in Virginia, and there will be a discussion at the theater in Lynchburg. In Vermont, Robert Hargraves and I will lead the discussion at the Savoy Theater in Montpelier. In most states, it is only shown once per venue. I hope you will plan to see it, at a Theater Near You.

Nuclear Now is about a bright future, with abundant energy. Hope for the future!

I encourage you to see Nuclear Now at a Theater Near You. Meanwhile, here’s the trailer on Youtube.

Moving Forward with NuclearMuch of the film is about how old and new nuclear can mitigate climate change. Even if you are not concerned with climate change, the film shows the hope for new nuclear developments, and the importance of keeping our existing fleet nuclear fleet in operation.

I live near Joshua Goldstein. He is co-author of the book, A Bright Future, on which the movie is partially based. In the trailer, you can hear him say something very important: “What is scary is not the same as what is dangerous.” We have been trained to be scared of anything connected with nuclear energy, but that does not mean that nuclear energy is dangerous.

Not About HopeThere’s another film released recently, which is also about energy and climate change and hope and despair. Well, it is mostly about despair.

A group of students, depressed about climate change, decide to blow up an oil pipeline in Texas. They didn’t give up using oil. They are usually shown in their cars. However, they decide to travel to Texas and blow up a pipeline. They have many complex talks about whether violence is justified, and whether it will be a good or bad thing when they are called “terrorists.” They seem to love these discussions. Then, they go ahead and blow up the pipeline.

The young people How to Blow Up a Pipeline are the opposite of the young people in Nuclear Now. Young people in Nuclear Now are shown in labs, trying to make new things. They are knowledgeable about energy and engineering. Many of them talk about their children. Nuclear Now is about hope.

I will not link to Pipeline. Judging by the trailer and the reviews, I do not recommend seeing it. However, Kevin Killough reviews both Pipeline and the NYT review of the movie. Killough’s review appears in in the Cowboy State Daily. ” ‘To Blow Up A Pipeline’ Glorifies Terrorism…”

My adviceGo see Nuclear Now. You will be glad you did.

The post Movie Time for Nuclear Energy appeared first on Meredith Angwin.

September 19, 2022

A Blizzard of LNG

The winter energy situation in New England has led to a blizzard of meetings, including an all-day meeting sponsored by FERC and held in Vermont, the New England Winter Gas-Electric Forum. The last time FERC held a meeting of this kind in New England was ten years ago.

Quoting Utility Dive on the conclusion from this meeting:

“We’re going into this winter basically crossing our fingers and hoping,” FERC Commission James Danly said

A Mild Winter with Sky-HIgh PricesThe best explanation for all these meetings is the graph at the head of this post. This slide was part of a slide deck that ISO-NE staff presented to the NEPOOL Markets Committee on July 8, 2022: “Considerations for Winter 2022-2023 ISO Presentation.” I discussed this presentation before, in my blog post LNG for the Winter in the Northeast. I am discussing it again because all the recent meetings (the FERC meeting was 9 hours!), presentations, and discussions are people explaining their opinions of this situation in the Northeast for this winter. They have informed opinions, interesting opinions, and so forth. But the actual situation is described in that slide deck.

The slide at the head of this post shows what the Northeast can expect, The chart shows projected forward prices for several types of energy, based on S&P research. The highest line is for the future wholesale price of electricity at the Mass Hub in New England. The electricity price rises to almost $300 per MWh, which is 30 cents per kWh (price on the left side of the chart). The other prices are for different types of hydrocarbon fuel: those prices are shown by energy value: $ per MMBtu. The natural gas price, for pipeline gas at the Algonquin Hub in New York, goes up to around $35 MMBTU.

For context, about natural gas. At the Henry Hub in Louisiana, natural gas has spent most of the last twenty years between $2 and $6 per MMBtu. and is now over $8. (It reached prices higher than $8 in 2008. It has never been higher than $14.)

Other fuelsWhat about other fuels? The chart in the slide contains two more lines: the cost per MMBTU of distillate (think diesel fuel) and residual oil (think heating oil). Neither of these prices shows any dramatic change. Both prices fall below the natural gas prices, starting in December of this year.

Looking at this chart, we can see the reasons why ISO-NE decided not to bother with a winter reliability project this year. With sky-high prices for electricity and high prices for natural gas, power plants will buy oil as the economically reasonable thing to do. This assumes of course, that enough power plants can burn oil. My recent post on this subject started with a graphic of the MW of power plants with stored fuel that have shut down since 2013. Five thousand MW of power plants with fuel on site have shut, and three thousand MW have opened. Unfortunately, the new plants (dual-fueled) can store far less fuel on-site. The closed plants (including nuclear plants) kept much more fuel on-site.

Once Again, LNGWe need LNG in the Northeast. Slide 11 (of the slide deck described above) says that the average LNG use in New England has been 32 BCF per year. That is about eleven 3 BCF LNG tankers. Assuming we use the same amount this year, we will be using more BTUs of LNG than fuel oil. Many of these tankers unload cargo at the Everett LNG port in Massachusetts. The Everett LNG port is scheduled to be shut down in two years. It would be shut down because Mystic Station (located conveniently near the LNG port) would no longer be operating.

As I noted above, the recent meetings were full of opinions on what this all means. In the FERC meeting, Chairman Richard Glick wanted a broader focus on the future. Glick was a lobbyist for Iberdrola in the past, and he is a great champion of the Energy Transition. As quoted in RTO Insider, Glick said: “If we spend all our time thinking about how we’re going to keep the Everett LNG facility open … today will be a failure,”

Everett LNG port: A resourceIn contrast, ISO-NE is thinking very hard about keeping the LNG facility open. Shortly before the September 8 forum, ISO-NE issued the following Problem Statement and Call to Action on LNG. A quote from that statement:

Most immediately, the region must ensure the continued operation of the Everett LNG Facility to maintain reliable electric and natural gas service for New England consumers. (emphasis in the original.)

So what will happen to Mystic and its LNG facility? Mystic has a Cost of Service agreement (a Reliability Must Run type of agreement) until May 2024. For this winter, Mystic will be open, and the LNG port will be open. LNG can be imported to the Northeast this winter. We will be competing with the whole world for the LNG, but at least we will be in the game. The LNG facility may close in 2024. Or it may not.

At least for this winter, I taking FERC Commissioner Danly’s advice. I am crossing (my) fingers and hoping.

The post A Blizzard of LNG appeared first on Meredith Angwin.

September 5, 2022

Reality and Possibilities in Australia. Do renewables need their own grid?

On June 15 of this year, the Australian grid operator (AEMO) suspended trading on the Australian National Electricity Market (NEM). This is a long story with many particulars, and as usual, Sonal Patel of Power Magazine has a fine article. The problems on the Australian grid have led some consultants to ask if renewables just need their very own grid, separate from the dispatchable grid.

Australian Energy Crisis Prompts Suspension of National Electricity Market

But from my point of view, it is just a typical RTO story of auctions with intermittent resources “applying downward pressure on prices.” And therefore, more-reliable merchant generators go offline when the prices are too low.

The Australian breakdown was followed by the usual parade of market tweaks. Thirty-minute auctions went to five-minute auctions. Existing price caps gave way to a new kind of administered price cap (APC) etc. I could write a book on this stuff!

Well, I already have written a book on this stuff, though not about this exact scenario. The grand auction scheme is giving way to an administered scheme in which the APC compensation process is “aimed to ensure generators continue to bid into the market and they do not face losses during this period.” (Quote from the Australian Energy Market Commission, AEMC.) To some extent, this is a replay of tne New England winter woes, when gas prices become too expensive for the electricity generators, and some generators just drop out of the market. (See New England Was Barely Ready for Winter.)

The Australian Regulator ConsidersTo update the situation, it looks like Australia has eliminated the earlier price cap AND the Administered Price Cap. On June 23, Sonal Patel once again has a strong article.

Meanwhile, the Australian Energy Regulator (AER) is concerned that registered market participants must comply with their obligations. “Should the AER detect material breaches of obligations by registered participants, enforcement action will be considered.” ( AER quote from Patel’s June 23 article.) Nothing automatic will happen, but the regulator will consider action.

Australia will be interesting to watch.

Tweaking in AustraliaAEMO Begins Cautious Lift of Australian Electricity Market Suspension

A while back, a friend of mine asked me about the probable fate of the RTOs. These Regional Transmission Organizations manage the grid with real-time energy auctions. As you probably know, I think the RTOs are a failed experiment. (My book, Shorting the Grid, describes the problems at length.) They don’t keep the lights on, and they don’t keep retail prices down. I told my friend that I thought the RTOs would revert to something like a vertically integrated utility, but not all at once. You can’t just fire all the people that make up the RTO structure. After all, they plan the markets! (Oops. “Plan the markets” is an oxymoron. An oxymoron, but unfortunately not a joke.)

The RTOs will change, and they will revert to a guaranteed Rate of Return. But they will revert one Reliability Must Run contract at a time. As Australia seems to be doing.

A Big Tweak: Two Energy MarketsThese are all small tweaks, so far. Well, suspending the market wasn’t all THAT small a tweak. Still, price caps go on and price caps go off and regulators imagine new kinds of ways to get merchant generators to live up to their obligations. Just another day at another RTO.

Meanwhile, an international consulting firm, FTI, was inspired by the problems in Australia. It has suggested a really big tweak. Are two energy markets better than one?

Here’s the basic idea. There will be two classifications of generators. One is “Available” (variable renewables, which are available only when they are available, end of story) and the other is “Dispatchable.” The Dispatchable generators can be called on as needed. The idea is that the renewables will have their very own grid.

This idea is based on a research paper from a think tank at Oxford University: The Decarbonized Electricity System of the Future.

The two types of generators will be on different payment schedules, but somehow, they will all be made whole financially. (Redundancy, anybody?) Ratepayers can save money by not buying Dispatchable or only buying limited amounts of Dispatchable. Ratepayers will therefore choose how much reliability they are willing to pay for.

Success! Victory! Give the market a chance, and it will succeed! (end sarcasm)

Complex ProblemsIt is unclear how this will be paid for. Dispatchable plants will still be last in the dispatch queue because renewables are supposedly cheaper. Will renewables still be cheaper? Will they still get subsidies? Plus, the dispatchable plants will not be chosen by thrifty ratepayers. How much will the dispatchable plants have to be paid to be made whole?

More importantly, let’s look at the people in the dispatch center. How do they deal with reliability? Do they dispatch the dispatchables to keep reliability, even for the consumers who didn’t pay for reliability? Or will they never dispatch the dispatchables, because some consumers don’t pay for them? Or is there some scheme where the dispatch center turns off selected individual consumers (the ones who didn’t pay for reliability), and then they figure out how much dispatchable to dispatch?

And then the consumers. Let’s say that Joe decided not to pay for the dispatchables, thinking that “I don’t need no stinking air conditioning.” Is he going to change his mind when there’s a one-week wind lull in very hot weather? Can he change his mind and get electricity if he is on a cut-this-guy-off-power list at a control center?

Based on a Simple MistakeIt was a simple mistake. The think tank at Oxford didn’t seem to understand the difference between the policy grid and the physical grid. Electrons do not have labels attached. You can’t let Joe’s house have intermittent electricity (no matter what Joe paid for) while keeping the rest of the grid reliable.

In fairness to the thinkers at Oxford, they do suggest two grids as a possibility, though they don’t explain their suggestion. A quote from the Oxford paper: “that ‘as available’ customers would have separate metering for this sort of supply (which, depending on the functionality of existing meters, might require new meters to be installed or new software to be programmed).”

The Oxford program does not explicitly acknowledge that if a household has two meters to two separate types of power, the grid will need more than new meters and new software. Two lines to every house. Two distribution and two transmission systems. No wonder they don’t want to go beyond “separate meters” in their description!

Seeking SherryThe people who wrote the consultant article and the Oxford paper are probably invited to more genteel parties than I am invited to. But we can change that! I would like to meet with some of my friends one afternoon and have some sherry in elegant (consultant) or shabby-chic (Oxford-type) surroundings. I hope I can arrange that.

Meanwhile, I will just be envious of all that sherry.

A related story. A friend of mine had a philandering husband. She divorced him. Around the time she was filing for divorce, she told me, “Why should I get to wash the dirty socks while she gets the roses?”

When I read such a confused plan from such esteemed groups, I do wonder how the socks and the roses are apportioned in the energy world.

The schematic that heads this post comes from the Oxford paper. https://www.oxfordenergy.org/wpcms/wp-content/uploads/2017/06/The-Decarbonised-Electricity-Sysytem-of-the-Future-The-Two-Market-Approach-OIES-Energy-Insight.pdf

The post Reality and Possibilities in Australia. Do renewables need their own grid? appeared first on Meredith Angwin.

August 28, 2022

When is a Breakthrough Not a Breakthrough

The latest and greatest press release about batteries! A press release on the falling price of solar cells! An article on the brave new world of offshore wind!

People share these releases with me on social media, send them to my Gmail address, and have other ways to be sure that I see them. In some cases, they finish their communications with a question such as “Are you going to revise your book now?”

These comments are evidence of the prevalence of writing about the “Could” grid. People have a hard time finding out much about the actual grid, but information on breakthroughs is the backbone of the usual energy reporting. It’s all about the “Could” grid. Better reporting is available in books, trade journals, some places on the internet, and the Wall Street Journal. But you have to seek out this material. Meanwhile, the “Could” grid appears in every Sunday newspaper.

So of course, people will send me information about the “Could” grid. My general response is that “I don’t have time to educate everybody. I need time to write.” I generally ignore this correspondence. But the other day, one of the “Are you going to revise your book now” comments got to me. I had the madly egotistical mental response, “Does this person KNOW who he is talking to?”

Alas, he doesn’t. And it is my fault that people don’t know much about me. They don’t know because, when discussing my background, I usually talk about Me as a Chemist, or Me as a Pioneering Woman (one of the first women project managers at EPRI).

Today, I am going to talk about Me as an Evaluator of Energy Research.

Energy Research and MeI was a project manager at the Electric Power Research Institute. What does a project manager at EPRI do? We evaluate and direct energy research. We look for areas that will “pay off” and other areas where we will choose not to invest research funds. The first thing I need to say is that these decisions are a team sport. It’s not “me,” it’s the team. When evaluating a proposed project area, or putting together a Request for Proposal for a new area, there are meetings. The chemist (me) reviews potential materials problems, while the economist (not me) does projections on costs. Consultants may be hired. Discussions ensue. It is a team effort.

However, when you get right down to it, even as part of a team, I was responsible for many aspects of research evaluation. I need to write about that part of my background. Because people don’t know about it.

First of all, the team has to be methodical. It cannot accept breathless plans as “sure to work.” All research groups have a limited amount of money, and they need to put that money where it will be most effective. And (shocking) there is a certain amount of politics, even in this high-minded endeavor. Let me give you an example.

Geothermal Energy in New Mexico and CaliforniaWhen I was in the geothermal group at EPRI, Los Alamos National Lab wanted our group to contribute to their Hot Dry Rock project. Los Alamos National Lab wanted our group to join them in co-funding this project. This was not because EPRI had so much money. Compared to a national lab, the geothermal group at EPRI was a shoestring operation! But we were well respected. If we joined the project, this would have been a powerful endorsement.

We visited, reviewed papers, and looked at other areas of mineral chemistry. Due Diligence, that was us! And EPRI decided not to join it. The mineral chemistry of HOT rock and water was difficult. Intractable. At least, that was our opinion.

In contrast, we did invest in the Heber binary cycle project, but that would be a whole other blog post. It did not turn out to be cost-effective, but (looking back) it was worth investing in. Or maybe it wasn’t. Hindsight is perfect, of course.

I don’t want to make this into a hugely long blog post, so I will just mention that I was also involved in evaluating the geopressured zones (geothermal group), various water chemistries for secondary side water for PWR plants (nuclear group), methods for preventing stress corrosion cracking in tubes near the tube sheet in PWRs, test comparisons between Alloy 600 and Alloy 690 (all nuclear group). There’s more, lots more, I had a long career. I won’t bore you with it.

I was always part of a team. Being part of a team means taking your part seriously. We all knew that money and research dollars and future technologies depended on our choices, and we made them as thoughtfully as we could. We did our best. We felt pressures to join projects, and pressures to not-join projects.

We were always aware that we could be wrong.

Research and PRThis is a more personal post than I usually write. Too much about me. But I felt I had to write it.

The problem is that many people don’t know that thoughtful professionals spend time evaluating the latest-and-greatest thing. And those professionals get into a habit of thought that could be described as “Show Me the Data.” Don’t show me a projection. Don’t talk down to me. Don’t assume I won’t ask you hard questions.

I have been in groups that made hard choices. I am still in such groups, but they are informal now. I have a list of experts, and I consult them. Sometimes I can’t name them (if they work for a big company) but they are there for me.

I have been thinking about “what is my next book?” I’m not sure.. But I do know that a possible title is “Could is a Four-Letter Word.” And “Breakthrough” is a public relations word.

Post Script: Travel and ResearchI have to tell you, I loved visiting Los Alamos. That is some of the most gorgeous high desert that exists on this earth. I think heaven might look a lot like the Jemez Mountains. If we had chosen our research projects on the basis of travel destinations, Hot Dry Rock at Los Alamos would have been a winner.

Instead, we spent our time in the Imperial Valley with the Heber Project. The Imperial Valley is below sea level: it is fiercely hot. It’s a terrific place for growing truck crops. It wasn’t much fun to visit the Imperial Valley.

But I did learn the history of the Salton Sea, and learned about The Winning of Barbara Worth. The book is partially based on the engineering catastrophe which led to the flood that created the Salton Sea. I believe the movie is available on YouTube.

The illustration for this post is a film poster from Wikipedia.

The post When is a Breakthrough Not a Breakthrough appeared first on Meredith Angwin.

July 30, 2022

LNG for the Winter in the Northeast

Summer afternoon. I stare at the huge yellow blossoms of my daylily patch. I am always amazed by their generous beauty. Midsummer is wonderful in Vermont.

However, in Vermont, winter is always on your mind.

Looking back at winter oilIn the deeply cold weather of 2017/2018, oil saved the grid. Gas-fired power plants could not always get fuel. (I described this situation at the beginning of my book, Shorting the Grid: The Hidden Fragility of Our Electric Grid.)

Some gas-fired power plants were able to burn oil, and they did. The oil they burned saved the grid, and it was part of ISO-NE “Winter Reliability Program.” which assured an oil supply to power plants that could burn oil or natural gas (dual-fuel power plants). Our grid was operating on 30% oil for about a week.

The Winter Reliability Program was subsequently scrapped by FERC as being “out of market” and not “fuel neutral.” However, it kept the lights on in New England.

I have argued that we need such a program again, whatever FERC thinks of it. I have the sad history of the Winter Reliability Program in an earlier blog post.

Looking forward to winter oilTime to look forward to the coming winter. In February of this year, I spoke at a forum of the energy committees of the Connecticut Legislature. (New England Was Barely Ready for Winter.) The next speaker at the forum was Gordon van Welie, the CEO of ISO- NE, our grid operator. Van Welie said that a Winter Reliability Project would not be effective this coming winter.

I could think of several reasons that such a project would not be effective. For one thing, several large base-load plants have shut down, and so oil would have to supply even more electricity in order to keep the lights on. The graphic at the head of this blog post is from a recent ISO-NE presentation. It shows that more than 5000 MW of reliable plants have closed in New England since 2013. Meanwhile, 3000 MW of dual-fuel plants have been added. But can the dual-fired plants get fuel without a Winter Reliability Program? Or is this just more dependency on Just-In-Time natural gas?

To put this in context, our New England grid runs as low as 10,000 MW at night and has rare peaks of about 23,000 MW. (In contrast, ERCOT of Texas is expecting today’s peak to be over 70,000 MW.) Shuttering 5000 MW of reliable power has affected a major part of our power supply.

Facts and figures for this winterThe figure at the head of this post is slide 3 from an ISO-NE presentation in July that described the choices for the coming winter. In this presentation, ISO-NE described their choices and attempted to justify their plan to NOT implement a Winter Reliability Program. I have reviewed the ISO-NE presentation carefully and attempted to understand the potential choices.

I cannot link directly to the presentation: it is a PowPoint that simply downloads when you click on it. However, if you follow this link to Markets Committee materials and scroll down to 2022-07-12-14 MC A09 Considerations for Winter 2022-2023 – ISO Presentation, you can download the entire presentation.

I found the ISO-NE choices confusing, and the ISO-NE arguments contradictory at some level.

Oil will save us anyway?In the presentation, Slide 22 claims that a Winter Reliability Program this year would be too expensive. ISO-NE projects the winter cost of oil at $61/bbl, which is about six times larger than the price during the 2017-2018 winter program. An oil-based reliability program this year would cost $179 million, while it only cost $25 million in 2017.

Then comes the good news (sort of). In the next slide, Slide 23, ISO-NE looks at forward prices for electricity. Their projections for electricity prices in winter show that oil is “in the money.” That is, electricity prices are expected to be high enough to give power plants an incentive to buy oil and sell very expensive electricity. To assure that power plants will have oil available, New England will not need a “Winter Reliability Program” stepping into the market.

To quote slide 23 “fuel oil is a less expensive fuel than natural gas in the forward markets.”

Okay. So far, I understand the situation. I don’t like it, but I understand it. The winter of 2022/23 will be a very expensive winter for consumers, due to natural gas prices. The only good news is that the high natural gas prices should increase reliability. Power plants will want to stock oil. The plants will want to be “in the money,” selling high-priced electricity.

LNG to the rescue?But then…slide 24 describes some more reasons ISO-NE thinks we should NOT to have a Winter Reliability Program. ISO-NE notes that such a program would discourage LNG purchases.

Huh? Discouraging LNG purchases is bad?

Slide 24 has Pros and Cons for a Winter Reliability Program. The second Con is quoted below.

“Con 2: May Undermine LNG procurement – The fuel-oil subsidy may adversely impact LNG contracting by suppressing the energy market’s prices and reducing LNG-procurement profitability.”

This winter, I would personally like to see energy market prices suppressed. But that’s just me.

Why would ISO-NE be concerned with “reducing LNG-procurement profitability”? Their presentation explains their reasoning. LNG is more flexible than oil.

On the other hand, LNG is delivered from foreign countries on foreign-flagged ships. Also, LNG is almost always more expensive than pipeline natural gas. And ISO-NE expects pipeline natural gas to be more expensive than oil.

At this point, my head is spinning. Does ISO-NE want to encourage LNG procurement? I gather LNG is more flexible. But LNG is an international market. The Northeast would have to outbid the rest of the world for LNG. Why would a policy hurting LNG imports be a bad thing?

A real case of LNG rescueISO-NE has a cost-of-service agreement (a sort of Reliability Must Run agreement) with Mystic Station in Massachusetts. Slide 4 boasts of this agreement:

“(ISO-NE has retained) Mystic 8 & 9 under a Cost-of-Service agreement when retirement of that facility posed unacceptable energy adequacy risk to the region.”

I don’t want unacceptable energy adequacy risks! Still, Mystic is very dependent on LNG. Indeed, a few years ago there was concern that if Mystic closed, the LNG receiving facility would also close. Now, ISO-NE had a cost-of-service agreement with Mystic, and the station and the LNG port will keep functioning.

It seems to me that every two years there is a move to shut down Mystic Station, and then it is continued for two years for reliability reasons. This way, nobody has to admit that we need such natural gas stations in the future. (Especially when we shut down nuclear stations.) In a recent Grid Brief, Emmet Penney has a cynical comment on this common phenomenon:

It’s always two years later somewhere!

The measured move back to vertical integrationGetting back to the ISO-NE presentation. I found the discussions of forward prices for gas, electricity, LNG, and fuel oil were easy to follow. That is, they were easy to follow if I followed them one at a time. But it was very hard to take this information and put together a coherent story about the future of our grid.

I see this entire scenario, including Mystic Station, as a step away from markets, and toward vertical integration of utilities. And I think a step away from markets will also be a step toward reliability.

How is the Northeast stepping away from markets? First, ISO-NE has guaranteed cost recovery for a major plant. Next, ISO is not planning to take any action that would discourage LNG imports, because LNG is so flexible. These are choices on ISO-NE’s part.

Looking at these choices, I suspect other plants will be crying “foul” and insisting on similar deals to the Mystic deal. Cost recovery agreements will begin to happen plant by plant, to ensure reliability but in order not to disturb the “markets.” Guaranteed cost recovery is a hallmark of vertical integration. In my opinion, vertical integration is coming back to our grid.

It’s going to be an expensive winter up here. But perhaps there will be reliable electricity, as ISO-NE begins to encourage reliability, and the region moves away from just-in-time gas delivery. Not that LNG and oil are better, but they are more reliable.

In My OpinionWhat we need is a few new nuclear plants!

The post LNG for the Winter in the Northeast appeared first on Meredith Angwin.

June 21, 2022

Restarting an Industry: Nuclear and Nevil Shute

Whenever the price of natural gas rises, nuclear begins to look more attractive. The most recent Nuclear Renaissance was in 2008, just before fracking lowered the price of natural gas.

Once again, we have another edition of “gas prices are high and people are looking at nuclear energy.” This is not just a replay of 2008. Today, our power grids are massively dependent on natural gas. Since many things can interfere with natural gas delivery, the term “rolling blackout” has joined “cost of natural gas” in the discussion about the grid.

In contrast, because it has fuel stored on site, a nuclear power plant has a built-in fuel security.

The good news is that the U.S. government is sort-of supporting development of many sizes of nuclear plant. There is a project underway to replace a coal plant with a nuclear plant (TerraPower plant) in Wyoming. There are venture capital firms (such as Nucleation Capital) specializing in nuclear energy. There are new-nuclear companies (such as ThorCon Power) in America signing memorandums of understanding to supply electricity to other countries. The U.S. also has a new six billion dollar fund to support American nuclear plants that are in danger of closing for economic reasons. (These threatened plants are usually on RTO grids, as I note in Shorting the Grid.)

Mixed News at BestDespite all these plans, there is definitely bad news for nuclear in the United States. As I see it, the current administration is confused about nuclear energy. With one hand they support it: with another hand they try to to kill it.

Let’s look at license extensions for existing plants. For example, two large nuclear stations jumped through all the hoops and had all the inspections that the NRC requires, in order to get their licenses extended. (Turkey Point and Peach Bottom.) Having watched one license extension (Vermont Yankee) very carefully, I know that there were many opportunities for public comments and intervenor comments. I am sure that the work toward the extensions cost the plants tens of millions of dollars. After years of effort, Turkey Point and Peach Bottom had their licenses officially extended.

Then an anti-nuclear group raised another set of objections. The license extensions were cancelled, and the NRC required new research and new reports. Companies must pay the NRC $291 an hour for any review of license extensions. Withdrawing the license extensions can be considered blackmail. It is certainly not the rule of law.

Would any company invest anything in getting a nuclear license extension after these incidents?

I hate to think about the issues around our Georgia new builds, the Vogtle plants. I am sure they will be completed, and their power will even be cost competitive. But the huge overruns on these new builds are another factor that argues against new nuclear energy in the United States.

Will the new generation of nuclear plants, the smaller ones, be the answer? I hope so. But it is not easy to restart an industry

Ruined City: A NovelI am a fan of Nevil Shute, and I have just finished re-reading Ruined City. The novel is about trying to re-start an industry, in this case, ship-building.

A little about the plot, hopefully without spoilers. A wealthy British banker, Henry Warren, has a miserable home life with an unfaithful wife. He asks his wife to give up her lover. She replies that she wants a divorce. Henry is overworked, overwrought and miserable. He cannot sleep without pills, and he has no appetite.

After the conversation with his wife, Henry decides he needs to get away for few days. He decides to take a walking tour, as he did when he was younger. He has his chauffeur drop him near Hadrian’s Wall. Henry tells nobody where he is going. He is dressed like a banker (which he is) and eager to walk. But he is no longer a young man. While walking, he collapses. He is rescued by a group of men. They help him into a truck which takes him to a nearby hospital. Once in the truck, he notices that the men have also stolen his wallet, including his identification.

Soon he is hospitalized, fuzzy from anesthetic, and recovering from emergency surgery. He decides not to tell anyone that he is a banker, at least for a while. There are many men walking the roads in search of work (1938) so he is not unusual in having little money with him.

As he recovers, he begins to learn things. He realizes that when the local shipyard closed, it ruined the small city. The men are on the dole, and they are not eating enough to stay healthy. They are also in despair at not being able to support their wives and families. Any sickness in the family can knock the whole family into total penury and near-starvation.

The hospital Almoner (a sort of social worker) is convinced that good times will come again. After all, people will want to replace old ships. One person after another tells him that seven destroyers from their shipyard were at the Battle of Jutland in WWI. It’s a good shipyard, and it will come back!

The Shipbuilding Won’t Come BackHenry Warren knows better. He knows that shipbuilding will not come back to the town. He is a banker. He frequently advises industry clients. He knows that new ships will be built at places that are still building ships, not at places that have ceased to build them. In the town where Henry has been in the hospital, men are physically weak from poor food and idleness. The young men have not gone through apprenticeship programs in shipbuilding skills. Any banker would recommend a client to go to a shipyard with a sturdier workforce and more recent experience.

New ships will be built. But not in this town.

More stuff happens, of course. And there’s even a sort-of happy ending. But I promised “no spoilers.”

Fiction That Tells the TruthRuined City shows “supply chain problems” and “workforce problems” from a human angle.

Even with a nuclear renaissance, will plants be built in America? I don’t know. I hope so. But there are so many people who think we are prosperous because…well, you know…we just are prosperous. We always have been prosperous. And now we can devote ourselves to plans for net-zero or battery development or whatever, and we will still be prosperous.

It is not easy to counter magical thinking. The kind of thinking where the president announces that he plans to shut down the fossil industry in ten years. And then he gets upset that the fossil companies are not investing in drilling and in new infrastructure. China and South Korea are top-notch at building new reactors on time and on budget. However, most people in our government don’t seem too concerned with this fact. We may have supply chain and workforce problems, but we will win the game because…we always win the game.

The small companies, the nuclear startups, give me hope. But if they want to succeed, I suggest that they use their excellent designs to build overseas.

It is not easy to counter magical thinking. It is not easy to restart an industry.

——-

Warning and End NoteFirst, the warning.The initial chapters in Ruined City are difficult to read in an important way. The protagonist, Henry Warren, is well-off English banker, who has inherited a respected bank. His home life is very unhappy. This is the part that is very hard to read. Henry is particularly unhappy that his unfaithful wife is sleeping with a black man. (Actually, her lover is a wealthy Arab.)

To read this book, I have to remind myself that this book was written in 1938, and Shute’s views of race relations underwent a huge change by the time he wrote Chequer Board after WWII. I like Shute’s later books better in many ways. But Ruined City feels very relevant to American nuclear.

To make myself feel better about recommending the book, I have decided that the whole black-man-unfaithful-wife thing is just a plot device to get Henry Warren so depressed that he finds himself in a hospital in a town far from London. Ruined City is not about adultery. It is about a ruined city.

End Note:Let me recommend that people download Jack Devanney’s “Low CO2 Electricity: the Options for Germany” at his The Gordian Knot Book website. The first two pages show that nuclear at $2000/kW installed can be effective at decarbonizing the grid. At $8000/kW nuclear is too expensive. If you want to dig deeper, you will find that Devanney is very clear about his assumptions and modeling.

In 2012, Robert Hargraves wrote Thorium: energy cheaper than coal. Devanney’s work is more up to date, but Hargraves work is also important, and it led the way.

The post Restarting an Industry: Nuclear and Nevil Shute appeared first on Meredith Angwin.

May 30, 2022

Thinking about Energy on Memorial Day

When we talk about American’s wars, there is a phrase that we often use. The phrse was used in the Gettysburg Address, though I doubt that was the first use.

“That these dead shall not have died in vain.“

We don’t want the bravery and the suffering to be useless. We hope that the sacrifice of those who died in the wars, and those who were affected by the wars, shall not be in vain. We want the country for which they fought to remain a strong, independent, democratic nation.

I have many connections with those who fought in America’s wars. My uncle Phil, who used to joke that there is a beautiful woman behind every tree in the Aleutian Islands. (No trees.) My husband, a tin can sailor (U.S.S. Wedderburn, DD 684), steaming off the coast of Taiwan. My many friends from the Silent Service. Most of the men in George’s family, including his father, brother and cousins. My friend from my breast cancer survivors’ group, who was career military. My dear friend at Vermont Yankee, with his burns and his Purple Heart. The boy from my high school class who died in Vietnam.

I am grateful for all of them. That they did not suffer (or die) in vain is important to me, especially today.

The Threat is About EnergyWhat is the greatest threat, right now, to the United States remaining a strong, independent and democratic nation? In my opinion, we can look at Europe and see a threat playing out. The threat is about energy. The more a country relies on Russia for energy….the less willing that country is to confront Russia about Russian aggression.

In my opinion, to truly be sovereign, a country needs a strong military, and self-sufficiency in food and energy. That is a tall order. Small countries can’t achieve it. Big countries can achieve this, and they need to achieve these goals. Why do big countries need to do this? Because big countries need to make formal or informal alliances with small countries, in order to keep the world peaceful. Why hasn’t China invaded Taiwan already? China is not afraid of the Taiwanese army. However, China does not want to tangle with the U.S. Navy. (I recommend Greg Easterbook’s The Blue Age, which describes the role of the U.S. Navy in keeping the peace.)

Today’s world is heavily connected and there is a world-wide market for goods. That is mostly a Good Thing. Among other things, people like me can travel all around the world for comparatively little time and cost. This was not true when I was a child. Jet travel to Europe started in 1958. It started out rocky, for sure, with too many crashes. Nevertheless, jet travel was an improvement for many people. Before the transatlantic jet service, middle class people might take one trip abroad in their lifetimes. If they were lucky.

I like our connected world. But I remember that the world is a dangerous place. Other countries do not necessarily have our best interests at heart.

Energy, Food, the MiltaryIt will not surprise people that I am in favor of reliable nuclear energy for America. We need our own supply chain for nuclear builds and nuclear fuel. And for hydrocarbons, which remain absolutely essential. (I recommend Alex Epstein’s recent book, Fossil Future.) It may surprise people that I am not just writing about energy, but I am writing about the military, and about food. But all these issues are related.

Let’s be honest. The world has abundant food because of abundant fertilizer, which depends on abundant energy. In terms of food, this Robert Bryce interview with Doomberg is frightening. Lack of energy circles around to lack of food which circles around to civic unrest which circles around to the military again. If you watch the Bryce-Doomberg interview, be prepared.

Meanwhile, I will think loving and grateful thoughts about all the people I know who served in the military. Thank you all. With a strong military, and self-sufficiency in food and energy, your service will not be in vain.

The post Thinking about Energy on Memorial Day appeared first on Meredith Angwin.

March 12, 2022

Maginot, Ukraine, and Sun Tzu

As I write this, the city of Kyiv is being encircled by Russian forces. As Mike Lillis wrote in The Hill yesterday, the Ukraine siege leaves (U.S.) lawmakers horrified, unified—-and feeling helpless. Why are they feeling helpless? Lillis quotes Biden, who was speaking to House Democrats:

“The idea that we’re going to send in offensive equipment and have planes and tanks and trains going in with American pilots and American crews, just understand — don’t kid yourself — no matter what you all say, that’s called World War III, OK?” he said.

The thought that our actions to help the Ukraine would start WWIII is enough to make anyone feel helpless. And frankly, we are mostly helpless. Due to decisions made long ago, and decisions made last week.

Or, as Sun Tzu famously said in the Art of War:

Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.

NATO was founded after WWII as an alliance mainly concerned with defending Europe against Soviet aggression. Ukraine and Georgia are republics that are former members of the Soviet block (USSR—Union of Soviet Socialist Republics). The Soviets are gone, sort of gone. Still, President Putin of Russia has made it very clear that if Ukraine and Georgia are allowed to join NATO, their joining would be seen as aggression against Russia.

Ukraine and Georgia are thus listed as “aspiring members” of NATO. These countries have been listed as “aspiring” for a long time. When Ukraine saw Russian forces massing on its borders a few weeks ago, it again asked to join NATO. It asked with some urgency. Ukraine was turned down. Therefore, NATO has no treaty obligation to defend Ukraine from Russian attack. This is what I mean by decisions made a long time ago (who could join NATO) and decisions made last week.

The Maginot LineDo treaties even matter? I took a course at OSHER Dartmouth on the Treaty of Versailles. This treaty ended WWI and set the stage for WWII. In fact, there were a whole raft of treaties at that time, as described in the book we used as an outline: Michael S. Nieberg’s book, The Treaty of Versailles: A Very Short Introduction, published by Oxford University Press..

One aspect of these treaties was that Poland and France had mutual obligations to come to each other’s aid if attacked. When Poland was attacked by Hitler, France did declare war on Germany. And that is just about all that France did. The Germans could have predicted France’s lack of actions, because of the Maginot Line.

In the period between the wars, France built the Maginot Line, a series of fortifications that was meant to defend France from Germany. As we discussed in class, as soon as Hitler saw that line going up, he could make a pretty good guess that France would not send its forces east to repel an invasion of Poland. France would be sitting pretty (the French thought) behind the Maginot Line.

Evolving Ideas about MaginotWhen I first learned about the Maginot Line, back in school, I learned that it was ineffective in stopping Hitler’s armies. This was true. The Maginot Line was ineffective. The German armies went through the Forest of Ardennes. The Maginot Line did not stop them.

But, when I was younger, I only learned about what happened DURING the battles. As Sun Tzu would point out, the existence of the line was the real problem. When Germany decided to attack Poland, Hitler had every reason to believe that he could send all his forces to the East. He didn’t need to keep part of his army in the West to defend against France. Because France would do nothing.

While Hitler invaded Poland, he left very few forces in Germany. If the French had attacked at that time, the story of WWII might well have been different. The French did not attack.

Once again, it wasn’t about the battle itself. The Maginot line sealed the fate of Poland, long before any troops were on the move.

Gloomy Gus HereIt’s pretty easy (especially for me, because I’m an Energy Wonk) to look at this whole thing as being about Nord Stream 2, the German need for gas, the importance of energy independence, and so forth and so on. And all these things played a part. But when you get right down to it, if you tell a dictator that you won’t defend a country (Ukraine is not allowed into NATO), you can be pretty sure he will attack that country.

I am usually upbeat, but I am feeling more like Churchill in the 1930s. Promising nothing but blood, sweat and tears for the future. I think Ukraine will be overrun by Russia, and the West will do nothing about it.

Energy Wonk Note:This is an unusual blog post for me. However, today, I could not turn my mind to when or whether ISO-NE would end the MOPR rule.

Doug Sandridge is another energy wonk, and I was pleased to see his first post on Energy Ruminations (his new blog) was The Truman Doctrine Redux. Sandridge describes weak leadership in the West as the first problem that led to war. He puts energy in second place. I agree. You can also see Sandridge and Irina Slav discuss a more traditional energy topic (Hurdles to Net Zero) on this link to her blog.

The post Maginot, Ukraine, and Sun Tzu appeared first on Meredith Angwin.

February 26, 2022

New England Was Barely Ready for Winter

On February 1, the Connecticut General Assembly sponsored the hearing “Staring into the Storm” through their Energy Committees. The legislators wanted to know whether the New England electric grid was ready for a winter cold snap. I was the first speaker, and Gordon van Welie, CEO of ISO-NE (our grid operator) was the second speaker. You can see the entire forum at this link. My presentation starts at about seven minutes into the video; van Welie’s presentation starts at about 52 minutes. The video includes many questions from the legislators.

(The graphic above is a screen shot from my presentation.)

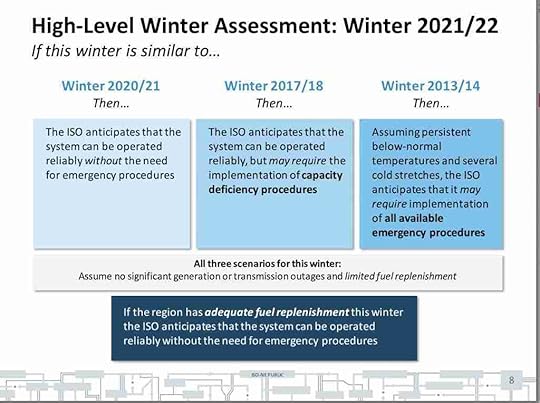

What Does “Ready for Winter” mean?It is always cold in the winter in New England. To determine if the grid is ready for winter, we have to start with the question: What is a cold snap? What do we have to be ready for? In an earlier presentation, Anne George, Vice President of ISO-NE, answered this question. (One of the viewgraphs from that presentation is shown below.) She compared several winters. If we have a cold snap like the cold snap of winter 2013-14, our grid may require “all emergency procedures” to be employed. Emergency procedures can include rolling blackouts.

ISO-NE grid readiness for winter

Not readyIn other words, the New England grid wasn’t ready for winter. We were ready for a mild winter, but not a severe winter. The winter that happened less than ten years ago was the “severe winter” example in the ISO-NE chart. We are not talking about a “100-year storm” here. Luckily, this winter has not been as bad.

Perhaps the earlier ISO-NE presentation led to the legislators to decide to hold this forum.

Shorting at the ForumAt the forum, Senator Needleman introduced me. He praised the insights and readability of Shorting the Grid. (A huge thank-you to Senator Needleman.) I also noticed that many of the questions (especially for van Welie) were based on topics I covered extensively in Shorting. For example, the issue of transparency. As van Welie explained, ISO-NE is not strictly speaking a regulatory body. Therefore, it does not have to open its meetings to the public. On the other hand, as van Welie said, FERC (the Federal Energy Regulatory Commission) is a regulatory body. Therefore, FERC holds many public meetings and asks for written comments on proposed rulings. FERC also has an extensive on-line presence.

My personal comment on this is the Russian saying that “God is too high, and the Czar is too far.” In other words, there is no source of help that a mere peasant can count on. Similarly, people in New England are closed out of ISO-NE meetings, and can only access FERC meetings. FERC is located in Washington D.C. In my opinion, ISO-NE is actually a regulatory agency, since it keeps the “queue” of new plants that want to join the grid, and it files for FERC approval of payment methods and so forth. And, also in my opinion, Washington D.C. is too far away for decisions on many local issues. I covered this topic in an earlier blog post: Reliable Electricity in Winter? FERC, Are You Listening?

However, I was very happy to see that several of the legislators had read Shorting! When I wrote it, I hoped that reading it would lead to a more robust grid, and to more transparency on the grid. I feel the book is beginning to accomplish some of things things that I had hoped for.

Helping your legislatorsIf you would like me to speak to your local legislators, please contact me at meredithangwin@gmail.com

Shorting is available through Amazon, and at your local bookstore. If you buy it locally, you will have to ask your local bookstore to order it, but they should be able to get it easily through Ingram Spark.

The post New England Was Barely Ready for Winter appeared first on Meredith Angwin.

September 4, 2021

What Surprised You About the Grid?

Eric Meyer of Generation Atomic has started a new on-line book club. Eric starts the conversation with a very important question: “In this book, what surprised you?”

Great question! The club meetings started with my book, Shorting the Grid. I wrote the book because I realized that most people don’t have any idea about how electric grids are organized. Most people know about types of power plants, and they know something about transmission lines. However, knowledge tends to stop there. How the entire grid works is a mystery. How the grid is managed is a bigger mystery!

Therefore, I hoped to shed a little light on grid management by writing Shorting

Many SurprisesWe mostly discussed RTO grids (Regional Transmission Organization grid) but we also talked about vertically integrated areas.

Here are some of the group’s answers to Eric’s question: What Surprised You.

De-regulation caused more regulation!Overall impression is that grid policy is a tangled web of imposed “fairy tale ” fairness between generators.The rules appear FAIR to all generators. especially from the outside.Most surprising – the grid was never deregulated – one regulatory scheme was substituted for another.I had to re-read the auction price setting process over and over.For me most surprising thing was that no single group is responsible for reliable power.No accountability for the grid.Vermont got away with selling the same clean electricity to multiple different customers for year and years!?!Beyond surpriseWe went from “what surprised you?” to “what can be done about this situation?” There’s a sticky subject, unsuited for simple bullet points. Are vertically integrated areas just as messed as RTO areas? Our tentative conclusion was that the vertical utilities were not as messed up, because they had clear responsibility for reliability. However, in terms of payments and transparency, the vertical utilities were also messed up.

Reliability matters. Robert Bryce asks the fundamental question. Can you turn your lights on in the morning? He poses this question at the beginning of his eye-opening movie, Juice: How Electricity Explains the World.

Book and Book ClubI am grateful to Eric for organizing and chairing these book club meetings. I know that not everyone can attend the meetings. Therefore, it would be great if you could comment on “the most surprising thing” in the comment section of this blog post.

Oh, and if you haven’t read Shorting, this would be a great time to buy a copy! Link below:

There will be more meetings of the Atomic Book Club. I think the meetings are going to be a lot of fun. Our next book is Jack Devanney’s Why Nuclear Power Has Been A Flop. It is available as a free download at that link.

The next meetings will be on September 13 and September 27. Here’s a link to receive the invite. You can email me for more information, also.

The post What Surprised You About the Grid? appeared first on Meredith Angwin.