Mohit Tater's Blog, page 536

November 22, 2019

4 US Tax Return Filing Nightmares for Expats and How to Avoid Them

Filing your US tax return as an expat isn’t exactly a walk in the park since it will require you to have a good grasp of the process, forms, requirements, and more.

Plus, because of how complex the filing procedures can get, you might make some mistakes that will be a nightmare to sort through and end up with heavy penalties.

If you don’t want to face the horrors of US tax return filing for expats, then you’ll need to know the “Fails” that you seriously need to steer clear of.

To help you do just that, here are four US tax return filing nightmares and how you can avoid them.

Let’s get started.

1. Failing to file your expat US tax return in years.

If you missed the April 15 tax return filing due date or the or the June 15 automatic extension for expats, you could still request for an extension until October 15.

Keep in mind, though, that you still need to pay the value of your tax returns on time; otherwise, you’ll be paying interest and penalties.

However, failing to file and pay your expat tax return in years can result in bigger penalties, and you will have to determine the equivalent amount of back taxes you need to file and pay.

Plus, you’ll need to prepare all the documentation you need to complete the required reports and returns to be compliant with the IRS.

This could mean a long and painful process, but the good news is, the best step you can take to avoid it is to file your taxes on time.

To help ensure that you file your expat tax return within the deadline, you’ll need to have the necessary documents and forms – such as Form 1040 ready.

If you do find yourself in a situation where you’ve gone way past the tax return due date, you can still file and use streamlined procedures.

With the Streamlined Foreign Offshore Compliance Procedures, you can catch up on your delinquent returns by filing only the last three years of your late expat tax returns, including six years of Foreign Bank Account Reporting forms and a questionnaire.

2. Not complying with Foreign Bank Account Reporting (FBAR)

There are small mistakes you can make when it comes to filing your US tax returns – such as not knowing how to deduct business expenses on your federal taxes – but there are also critical errors that you seriously need to avoid making at all costs.

If you are a US citizen who has or owns signature authority over financial accounts overseas – including foreign branches of banks who have headquarters in the US – then you are required by the IRS to file the FBAR form.

The reporting threshold for you to file FBAR is if the value of all your foreign accounts exceeds $10,000 at any time throughout the year.

If you fail to comply with this mandatory form, you can face severe penalties of up to $12,000 for each non-willful violation.

For willful violations, though, you could be looking at a penalty of around $124,000 or fifty percent of the balance in your account – whichever amount is higher.

Now that’s a nightmare come true that you wouldn’t want to be stuck in.

To avoid getting penalized, you’ll need to file your FBAR if you meet the qualifications for it.

Here are three ways that you can file.

Electronic filing. The IRS requires you to file your FBAR electronically through the BSA E-Filing System of the Financial Crimes Enforcement Network (FinCEN).

Just go on the website and click on the FBAR form button. Keep in mind that you don’t file this with your federal tax return.

Paper Filing. If you choose to paper-file, you’ll need to call the FinCEN Regulatory Helpline and request for an e-filing exemption and wait for your approval.

Filing on your behalf. You can have someone else file your FBAR on your behalf using the FinCEN Report 114a to authorize the other person to do so.

3. Non-submission of the Statement of Specified Foreign Financial Assets (Form 8938)

You are required to file your Statement of Specified Foreign Financial Assets (Form 8938) with your federal tax return if (at the end of the calendar year) your specified financial assets reach over $200,000.

Be warned, though, that not filing this form will result in a $10,000 penalty that could reach up to $50,000.

Plus, if you don’t declare on your tax return your income relating to your specified foreign assets, you’ll get a 40% on your attributable tax.

Your solution to avoid getting penalized then would be to look at the conditions that will determine whether or not you need to submit Form 8938.

You can also go on the IRS.gov website to get an electronic copy of the form and complete filing instructions.

If you’re unsure if you need to file Form 8938, take a look at some of the conditions.

You have interests in specified foreign financial assets that need to be reported.

You are a specified person, either a domestic entity or a specified individual.

The accumulated worth of your specified foreign financial assets exceeds the reporting thresholds applicable to you.

Once you establish that the conditions apply to you, start gathering all the other forms and documents required so you can file this form along with your federal tax returns.

4. Claiming for the foreign earned income exclusion incorrectly.

You might consider claiming the Foreign Earned Income Exclusion (FEIE), so you can exclude the about $100,000 (figures can differ from each year) of your income from being taxed.

However, you can make some of the common mistakes that many expats also commit when claiming the FEIE.

Here are a few of them.

You’re not sure what type of income does or doesn’t qualify. You incorrectly calculate the days that you spent outside the US. If you fail to provide enough evidence to pass the Bona Fide Residence Test.If you don’t look for other options – such as claiming the Foreign Tax Credit instead of the FEIE – that will give you more benefits.

Making these mistakes can get your FEIE claim denied, which can lead to getting double taxation for you.

One of the best ways to ensure you don’t make the mistakes mentioned above and avoid double taxation is to work with US expat tax professionals.

Doing so can help you make sure you file your taxes on time and have the peace of mind of knowing you’re working with experts who can make the process smoother and more efficient.

Final Thoughts

Filing your US expat tax return can be confusing and challenging, but it doesn’t have to be that way.

By knowing the possible horrors you can face when filing your tax returns and learning from them, you’ll be better equipped to make the process less painful for you.

Although there are more US tax return horror stories you can gain insights from, considering the four discussed here is definitely a step in the right direction.

If you learned something from this guide, please share it with your network. Cheers

The post 4 US Tax Return Filing Nightmares for Expats and How to Avoid Them appeared first on Entrepreneurship Life.

November 21, 2019

Between Job Budgeting Tips – How to Scale Back

If you’re currently between jobs and looking for ways to scale back your spending, you’ll appreciate these tips and ideas on steps you can take to save money.

Try Freelancing or Start a Side Hustle

It can be difficult paying your bills when you’re not receiving a steady income from a primary job. When this occurs, you may want to try freelancing or start a side hustle. If you have the skills to go out on your own and provide assistance to people who need jobs done that you can complete, it’s a great way to make extra money. You can also think about ways that you can operate a side hustle such as renting out a spare room, selling items at online auction sites that you already have around your house or find at a thrift shop. The possibilities are endless.

Reduce Your Energy Bill

Reducing your energy bill is another fantastic way to scale back and not spend so much money. Move your thermostat 10 to 15 degrees lower when you’re sleeping or away from home. Take shorter showers and adjust your hot water heater to a lower temperature. You can also cut your energy usage by a great deal just by utilizing cold or warm water when you wash your clothes, and make sure you’re doing a big load of laundry each time you use your washing machine.

Cut Transportation Costs

When you live close to areas that you need to travel to, consider taking your bike or walking. You can also utilize carpools more often to cut down on your transportation costs. If you live in a city where there is a public transportation system, start utilizing it for job interviews, grocery shopping and any other time when you need to travel inside your local area. Saving extra cash when you’re unemployed can help make your lifestyle easier.

Have Days Where You Spend Zero Dollars

Another way to cut back on spending is by just declaring days where you decide that you’re not going to spend any money. When you have a day where you commit to not spending any cash, you become more aware of times when you may have spent money frivolously. This can help you create a new habit, which can even be used after you get your new job. It’s a great way to eliminate bad spending habits and find ways to create solutions that don’t cost anything.

Create Rules for Grocery Shopping and Cooking

When you need to go to a grocery store, find one that sells in bulk or has discounted prices. Be sure to create a shopping list before you go so that you can catch yourself quickly if you try to buy something impulsively. It can help to go grocery shopping after you’ve eaten a full meal so that you don’t feel hungry and get the urge to buy everything in sight. Also, try and find unbranded products in the supermarket, which will probably taste the same but cost less. When you get home, bulk cook your meals and set aside your favorite dishes in the freezer for other days during the week.

Reduce Entertainment Costs

If you currently have a cable bill, consider eliminating it. There are plenty of inexpensive streaming services that offer several movies and television shows. Think about other ways that you can spend your free time by joining in on activities that don’t cost any money such as taking a walk with your friends or enjoying a concert in the park. Getting out and meeting people is also a way that you can start networking for another job. You won’t find work if you just stay in your home most of the day.

Use Discount Codes

Discount codes and coupons can be your best new friend when you’re trying to cut corners and scale back on spending. Use a search engine on the internet to find deals on products that are necessities. You’ll also find coupons in the mail from companies that will reduce the cost of their services if you use a coupon. This might help if you need to have your oil changed or fix the brakes on your car.

Downgrade Your Health Insurance

When you’re in between jobs, you’ll still need to have health insurance. If your old employer was footing the bill, you may be able to save money and cut back by downgrading your temporary health insurance. If you have children, check to see if they have any family options and consider a high deductible plan if you don’t take regular medications or make frequent visits to a doctor.

Know that unemployment sometimes happens, but it won’t last forever. If an unexpected emergency does occur there are Personal installment lenders that offer loans, sometimes with shorter term, to help you get through a tougher time in between jobs. While most lenders will require proof of income to qualify, consider seeking out a supplemental source of income during this interim period to help you with any unexpected financial expenses that come your way. You’re not totally alone during this time, so know what’s out there that can help, in addition to cutting back on your normal spending habits.

The post Between Job Budgeting Tips – How to Scale Back appeared first on Entrepreneurship Life.

November 19, 2019

The Indicators of a Good Franchise Business

If you’re considering investing in a franchise, you must do your research before signing that deal, as not every franchise opportunity that looks attractive is a good business to go into. Written in collaboration with F45 Training, here are four indicators of a good franchise opportunity.

1. A growing franchise

Ongoing growth in the number of franchise units is a good sign. This shows that the franchise has a successful business model. Unlike establishing a business from scratch, one major benefit of investing in a franchise is that you are buying something that already has brand recognition. It’s a good sign if the franchise you’re eyeing already has a lot of franchise units in existence.

2. Sufficient support from the franchisor

Before buying a franchise, you should know what type of training and assistance you will receive from the franchisor to get your franchise off the ground. A franchise opportunity that offers a strong support system could be a good opportunity. The F45 franchise, for example, has a global support model for franchisees.

3. Marketing and advertising support

Find out what type of marketing and advertising programs the franchisor has in place. Does the brand do any advertising on social media and is it up-to-date with the latest trends in the industry? Most franchisors require you to pay a monthly advertising royalty; ensure you’ll get what you’ll be paying for. Also, look out for transparency about all other fees.

4. Satisfied franchisees

Another sign of a good franchise opportunity is satisfied franchisees. Approach both current and former franchisees to find out what they think of the franchise system. If all franchisees are unhappy with the company, that’s not a good sign. But if the franchisees you talk to are satisfied with the franchise and would recommend it to anyone, that’s a good indicator that you’re making the right choice.

While a franchise may meet all the above factors, the most important thing is that it should suit your personality, skills, and passion. Building a successful franchise requires a lot from you, and if you don’t enjoy what you’re doing, you may find it too challenging to build a successful franchise.

The post The Indicators of a Good Franchise Business appeared first on Entrepreneurship Life.

Your New Company – LLC or Corporation?

Starting a small business is no easy feat. While it is an exciting time, startup founders have a lot to think about when it comes to developing a company. One of the first decisions that need to be made is what type of company structure to choose a corporation or a Limited Liability Company (LLC).

Corporations have generally been more attractive to investors for a number of reasons and startups seeking investment typically choose this structure. But in recent years, many startups have formed that don’t seek unlimited growth, or that seek alternative financing. When financing is not the central issue startups tend to choose to become an LLC. There are pros and cons to each structure, so it is important to do the due diligence to figure out which one makes the most sense.

Benefits of an LLC

The LLC structure provides numerous benefits for startups. Aside from being simple to set up, there is also a great deal of flexibility and financial benefits. Additionally, when there are partners in a startup, an LLC offers an easy way for people to join in a mutual enterprise.

Double Taxation

In corporation structures, double taxation is an issue, while in LLC structures, it is not. Double taxation in a corporation means that both the owner and company are taxed separately. An LLC, however, is not taxed as a company. More along the lines of a sole proprietorship, the members are taxed individually on their personal income or loss from the enterprise.

Location

Delaware has been a popular state to choose for incorporation, as costs are low, and the paperwork is not as complex as other states. The cost of setting up an LLC varies from state to state. That said, many startups choose the same location where they will be working because regardless of the state the LLC is formed in, it may still have to pay taxes for operating in any other state.

Making Changes

With an LLC structure, companies do not have to worry about too much ongoing maintenance. This makes it fairly easy to add partners in the future, as well as changes or offer interests in the company to others. Making decisions to implement changes is also easier, as there is no need for a formal board process and there are not as many restrictions on administrative matters.

Protecting Assets

In the event that a startup finds itself being sued, having an LLC will prove to be beneficial. If the lawsuit is directed at the LLC, the owner’s assets are protected. This is unlike in a sole proprietorship or general partnership, where a lawsuit against the company can cost owners their personal assets.

Registering

The most notable thing about registering as an LLC is that the process itself is very easy. All state laws will have their individual differences, but as a general guide to the procedure, here’s a simple 10-step guide to forming an LLC in California that offers a good idea of what is involved. Registering with your chosen state and then applying for a Tax Identification Number with the IRS can be the end of initial paperwork for most enterprises

One thing to note, however, is that if a startup wants to change its name at some point down the line, it may be met with some difficulty. With that in mind, picking a name should be given time and much thought before registration.

Benefits of a Corporation

While choosing an LLC structure may seem like the best idea for a startup, a C-Corp structure is still seen as the norm. There are also numerous advantages to forming a corporation, including stock options and venture capitalist (VC) preferences.

Stocks and Control

Stock is one of the biggest benefits of choosing a corporation structure. LLCs do not have stocks, although they have the ability to buy and sell stakes in the company. Stocks can carry decision-making power in a corporation, while in the LLC this power is established for each member by the Operating Agreement.

Venture Capital Prefers Corporations

VCs prefer the corporate structure to invest in. Not only because they receive stock, but some investors simply do not have the ability within their own business structure to invest in an LLC. The relationships are much simpler for VCs if the companies in their portfolio have the same structure. Additionally, investors prefer corporations because the laws and tax positions are so well-defined and bullet-proof for the investor receiving stock.

Employee Equity

With a corporation structure, a company can offer its employees equity in the business. It can easily put a certain number of stock shares aside for employees to receive at any point in the future.

An LLC can offer membership stakes to employees or new partners, but cannot subdivide company ownership unless current members give up a portion of their ownership to the potential new member. From a tax and reporting standpoint, this scenario can get complicated. Creating interests in an LLC is a tricky business, and some LLCs convert to a corporate structure to achieve further growth.

Seek Legal and Professional Advice

When it comes to making important business decisions for the future, it is always a good idea to seek legal and accounting advice. Those with extensive experience in a company’s particular industry can also provide a deeper insight into best practices when it comes to decision-making. This will give a business owner more confidence in the future of the company moving forward.

The post Your New Company – LLC or Corporation? appeared first on Entrepreneurship Life.

How Virtual Data Rooms Are Turning Due Diligence into a Painless Process for SMBs

The workplace has changed immensely over the last few decades, as have the practices and workflows that are employed within our businesses. At the forefront of these changes, technology has pushed various aspects of our working lives into a new era, where speed and efficiency are front and center for our working days.

With more and more complex regulations being deployed in a vast array of business sectors, no company can afford to be lax with the new rules being imposed upon them from above. Those who do play fast and loose with the stricter ways in which we must now do business can easily find themselves on the end of a rather unsavory lawsuit or two.

Does your business enter partnerships with other organizations on a regular basis? Are local tax authorities scrutinizing your every move? Do you use service providers who need to access sensitive information about your company? Are you in the market to be acquired? Then you’ll need to have all the files required for due diligence evaluations updated, ready, easy to share and with strong, safe access permissions.

The old methods of in-person meetings for reviewing hard copies, or simply emailing attachments, just aren’t practical anymore.

Indeed, with so much more due diligence needed these days in regards to legal practices, the old ways of preparing and sharing documents are no longer relevant. When you consider how different the laws are today around data privacy, facilitating due diligence using a virtual data room (VDR) is paramount to keeping processes running smoothly, keeping documents organized and within arm’s reach, and keeping everything stored and shared securely.

Here are some of the ways in which VDRs make this possible.

All your sensitive data in one place

The reasons for needing to find such information quickly can range from company to company, but one such reason that can apply to everyone is an audit.

If a company is asked to provide information for tax purposes, a virtual data room becomes an extremely useful way to keep your documents organized. While the more old-fashioned analogue ways of filing this data will still provide the information needed (most of the time), searching and deploying data from a virtual data room is far quicker, and when time is so precious for the majority of us working in SMBs, any opportunity to cut down on admin time is generally welcomed.

Another aspect of why these virtual data rooms are becoming so popular is one of safety. With all the information being stored in one place, on servers that are highly protected, the worry of the data held within the digital vault falling into the wrong hands is reduced. This is especially true if you’re using a SaaS platform that takes data privacy and cloud cybersecurity seriously.

A physical data room with a similar layer of security creates a level of inconvenience that can be troublesome and time-consuming for those involved. If the business using these data rooms is a legal one, having lawyers travelling in from their current location every time they need to access some sensitive legal documents is not exactly advantageous, especially in a modern world where files and documents may need to be viewed and edited readily.

Secure, customizable access

Virtual data rooms allow you to keep an eye on who has access to certain files, when they viewed them, and from what location.

You also reserve the right to revoke access at any time, and the use of multi-factor authentication allows companies to give access to only those who they deem fit to view certain data.

They can even design bespoke permission-based roles, in which employees of a certain level can view some data but not others, allowing all staff to automatically be allowed access to only the data they need, and nothing more.

When you take into consideration the convenience, simplicity, and lack of expense virtual data rooms provide in comparison to their physical counterparts, it is easy to see why this trend is growing exponentially right now. This is especially so in the enterprise sector, where streamlining any business practice can make a huge difference in operating costs.

VDRs are the future of due diligence

While physical data rooms were the only option twenty years ago, the rise of cloud computing has given us an option that is almost irresistible to ignore in the modern age. In almost every industry sector across the working world, the digital cloud is taking over localized data storage in virtually all capacities. It is more convenient, it helps streamline workflow, and is extremely secure.

Whether it is legal documents that a lawyer needs to peruse, a new contract an employee needs to sign, or a tax investigation needing to collate information for inspection, virtual data rooms are making life easier for everyone across the board.

The post How Virtual Data Rooms Are Turning Due Diligence into a Painless Process for SMBs appeared first on Entrepreneurship Life.

A Guide To Moving Your Business to Another State

When you’re an entrepreneur, there are different reasons you might consider moving your business. With that decision comes a host of other decisions and things to remember. There are the lifestyle logistics of moving to another state—for example, where will you live and will you get a driver’s license in your new state?

Then, there are the things you’ll have to do with regards to moving your business in particular.

The following is a guide to the core things you should know about moving your business to another state.

Can You Transfer Your LLC To Another State?

You could have many reasons that you’re moving your business to another state, or at least thinking about it. A big reason is because of taxes. Often business owners in high-tax states will move to a low-tax state to save money.

It may be easier to operate a business in some states rather than others because of regulations and things like employment law.

There are of course, also personal reasons that might lead you to move and to take your business with you.

So, can you even move an LLC to another state?

You do have to register your current LLC to do business in the new state you move to.

If you move your LLC to another state, then it’s classified as a foreign LLC in the state you move to. You can do it, and it’s done frequently.

In order to make the change, you will need to submit a form to the state agency where you’re moving that deals with business filings.

In some situations, you may just want to register your LLC in the new state you move to and leave it at that. Examples would be if you think your move is only going to be temporary or you think you’ll change states again.

If you’re going to continue doing business in your previous state, then you would probably register your LLC as well. This allows you to keep a lot of things the same such as your employer ID number and your permanent business address.

However, if you are located in one state and do business in another, you’ll have to appoint a registered agent who can keep up with everything, and you may have to pay taxes in both states.

Another option is to transfer the LLC to your new state altogether. This is a process usually called domesticating an LLC. This would keep your bank and tax information the same, but you’d only have an official registered location in one state.

Yet another option if you’re an entrepreneur contemplating a move would be to dissolve your old LLC and create a new one in your new state. There are various ways to put this into action.

What About Moving a Corporation?

So what if you’re an entrepreneur and you have a corporation?

Typically if you’re moving corporate offices to a new state, you have three main options. One is to continue operating as a corporation in your old state and then register in your new state as a foreign corporation. Another option is to dissolve your corporation in your old state and establish it where you move.

If you decide that you’re going to keep your old organization but register to do business as a foreign corporation in your new state, you’re going to have to pay double franchise taxes and possible duplicative annual report taxes.

If you liquidate as part of your move, you may have to pay income taxes on the part of the corporation itself as well as shareholders.

If you’re a C-corporation and you decide to reorganize instead, you may not have any tax liability with this option.

If you dissolve a corporation including either an S or C-corporation and then make a new one or merge it, you’re going to have to go through the process to dissolve the old one. That can include preparing certain documents and submitting a filing with your old state.

Is Merging From Your Old State To Your New State the Best Option?

Sometimes tax and financial experts will advise that merging is the best option if you want to move your business.

To make this happen, the first step is to close your business in your old state, and as was touched on, that process is different for every estate. You’ll probably need to file a final tax return as you close it out in your old state.

Then, once you close out your business in your previous state, you merge the business into your new state, and in many states, you can do this online. You would register the business online, and then you would be given the option to indicate you’re merging your current company from another state.

Some states don’t have the online option, but you can just do it with hard copy documents and mail them.

If you merge your business, you avoid potential penalties and consequences from the IRS in terms of the taxes you pay, but you still need to tell them you’ve moved your business.

What About a Sole Proprietorship?

If you’re a sole proprietorship, which people increasingly are, then you have the same legal status as yourself. In these situations, the business and the owner are the same entity.

Therefore, if you move your business to another state, then you, as the owner let the IRS know that you’re moving.

When you do move a business, if you’re an LLC you can decide how you’re going to be taxed. If you’re making a move, the most advantageous tax option in your old state might not be the same in your new state, so you want to compare the personal and corporate income tax rates in each state. You’ll also likely need to talk to a professional before you make any major decisions if you’re able to.

The post A Guide To Moving Your Business to Another State appeared first on Entrepreneurship Life.

Certified Translation: Man VS Machine

There is no doubt in this world that technology has created a better world for us. It has made many tasks activities done quicker and more efficiently compared to human work. As we all know, humans are prone to error. There are a lot of factors that contributes to this idea. We may have the brains to process any kind of information but our emotions can cloud our thinking. These feelings can create a rift or bridge to the logical part of our minds. We function well if both logic and emotion can work together but this is not the case most of the time. This is why machines are now considered to be superior, especially in manual work. Read about this here.

You may have heard of this phenomenon

before: When man is being replaced by machine. This has been a very popular

topic in science fiction and other literatures. Authors always say that their

story is happening in the distant future. However this might be out now. There

is a lot of fear growing in many industries these days. Employees are wondering

whether they are going to be sacked or eventually replaced anytime soon because

new equipment was introduced. These machines can do the work of two or more

people with even minimal mistakes and it is becoming a trend in many fields.

Technology &

Translation Services

One of the sectors that was said to be really affected by the introduction of technology is translation. After all, there are a lot of apps that can do this with minimal effort. You just have to copy the document into the application and then it will do all the translating for you. Almost all tech companies have a version of this kind of program and it is improving day by day. There was a time that this was thought to be impossible, but now you can have an easy translation service at the tip of your fingers.

Is it

though?

You might be thinking that machines have already overrun the translation industry. You don’t even need to learn the language anymore as these various apps can do the translation for you. However, language is such a fickle thing. You may notice that there are instances that these apps give a rather bizarre response to the statement you want to translate. This is probably alright in a friendly or informal scenario. You can just laugh off the mistakes and move on. However, what if you are trying to negotiate a business or other important and sensitive matters? Are you willing to trust a free yet questionable computer application?

This is just one of the many cases that you really need to hire an expert on languages. A bad translation can actually make you lose a business deal just because it can be an insult to the other party. There are also sensitive situations like legal cases that you really need to be accurate with all the details. Having a dedicated human translator can help you out with the many nuances of several languages around the world. Even languages that originated from the same mother tongue can actually differ on how they have developed. Also, the same language can be interpreted differently by various regions of the same place. It is a very intricate thing, really. Learn more about it here: https://www.techwell.com/techwell-insights/2016/08/language-differences-and-challenge-communication.

For example, one of the most common

examples is French. If you think that this is spoken in France, then you are in

for a surprise as many Canadians are fluent in French. Quebec, one of the

provinces of Canada, is actually a predominantly French-speaking region. You

may think that French can totally understand Quebecois (they even sound alike)

but there are a lot of words that can spark confusion.

On the other hand, Canadian French is said to sound more ancient than French but there are also a lot of words that were borrowed from the First Nations in Canada. Both of them can understand each other on the basic level, but it gets more complicated as the conversation goes on. Now, imagine this type of scenario but it involves legal documents. It will be le désordre, eh? This is why accurate translation is so important.

This is why it is important to have a

human translator that can help you with your documents. They can be a great

help in trying to make sense of some confusion that the conversion in language

can cause. Also, they can help you understand that some words may have varying

meanings depending on the situation, tone, choice etc.

The post Certified Translation: Man VS Machine appeared first on Entrepreneurship Life.

November 18, 2019

5 Strategies for Paying Off Major Credit Card Debt

As of the year 2019, Americans surpassed $1 trillion in credit card debt. And, this figure is expected to continue on an upward trajectory over time. According to a report from WalletHub, the average credit card debt per household in Q2 of 2019 reached $8,602.

This all goes to show it’s common for U.S. households to carry credit card debt, and lots of it. But at some point it’s smart to start paying down your balances so you can avoid racking up even more interest on your balances over time.

Credit: LendingMemo

Credit: LendingMemoHere are five strategies for paying off major credit card debt.

Balance Transfers

Credit cards have notoriously high interest rates, sometimes upwards of 20 percent. Thus, your outstanding balance can keep growing month over month even if you stop buying things on your card. One way to get a break from these high interest rates is to transfer your balances from high-interest credit cards to ones with a zero-percent annual percentage rate (APR).

The catch? Well, you’ll likely pay a fee of three to five percent per balance transfer. And balance transfer cards have an introductory period; when it ends, APR bounces back up to its usual levels. You may also have to pay interest on any new purchases you make on the card. Only pursue this strategy if you’re confident you can really chip away at your debts during the promotional period, and that the benefit you’ll gain outweighs the cost of the fees.

Debt Settlement

Wondering how to pay off debt over $10,000? Enrolling in a debt settlement program may be an option. First you’ll make monthly deposits into a special account until you’ve saved up a certain percentage of your outstanding balances. Then negotiators will contact your creditors to ask them to agree to accept less than what you originally owed because they’re at risk of getting nothing.

Through a program like Freedom Debt Relief, some participants have been able to settle debts by paying 30 to 60 percent of their original balance — and that’s including the fee they owe to the program for each successful settlement. However, there’s no way to guarantee any particular outcome. While creditors may choose to settle, they’re not obligated to do so.

Debt Consolidation

Struggling to stay on top of multiple high-interest credit card payments month in and month out? You could take out a debt consolidation loan, which allows you to pay them all off at once. Then you’ll only have to make one monthly payment to your lender until you’ve repaid it in full.

The upside is that you may be able to reduce how much interest you pay because credit cards tend to have higher APRs than consolidation loans. But you must make sure you’re able to commit to making payments on the loan for years to come, otherwise you’ll find yourself back in hot water.

Debt Management

A debt management plan (DMP) is a possible route to paying off your debts in three to five years through a credit counseling agency. You’ll make one monthly payment to your agency and they in turn pay your creditors.

Creditors may agree to lower your interest rates and waive certain fees when they see you’re enrolled in a DMP. It’s up to you to weigh the fees you’ll pay to the agency to participate against how much you could potentially save in interest over the years.

Snowball/Avalanche

Want to try paying off your credit card debts at home? Get a plan rather than making payments willy-nilly.

Snowballing your debts means paying the minimum on all your balances while targeting your smallest balance more aggressively. Once it’s paid off, you move onto your next-smallest balance, and so on. This approach provides quicker victories, which can be great for morale and willpower.

Avalanching your debts means paying the minimum on all your balances while targeting your account with the highest interest rate more aggressively. Once it’s paid off, you move onto your next-highest interest rate, and so on. This approach helps you pay off your debts for the least amount of interest, saving you money in the long run.

Only you can decide which of these five strategies for paying off major credit card debt is right for you. Do your research and weigh all the pros and cons.

The post 5 Strategies for Paying Off Major Credit Card Debt appeared first on Entrepreneurship Life.

SaleSource: How To Find Best-selling Products For Your Dropshipping Business

Below is an unbiased SaleSource Review. We’ve tested the tool’s associated features and dashboard. After looking at the pros and cons of this software, I’ve created this piece to discuss what SaleSource is and how it can help your business.

For eCommerce businesses, insights and metrics are vital. From tracking down the details of your product traffic to fine-tuning email sequences, these insights allow business owners to track the day-to-day performance of their storefronts.

Insights and data are building blocks that impact decisions about planning and marketing. If you leverage these analytics and market research tools, you can enhance the buying experience of your customers and create targeted recommendations to enhance their purchases.

SaleSource Review – Successful Products for Your Dropship Store

SalesSource is a full-service AI SaaD eCommerce platform that has become popular with eCommerce marketers and dropshippers. The software can help with boosting store conversions and provides merchants with detailed insights to encourage decisions that make improvements.

Without further ado, let’s have a look into the features, pros, cons, and many other things that makes this tool so useful.

SaleSource: Introduction

SalesSource is an AI-powered application, which is fully compatible with Shopify and other top-notch e-commerce platforms. For the marketers who source products from AliExpress, the tool is excellent. The platform provides 1.5+ million inventories in the top product niche. SaleSource also integrates four major components:

Store CenterSale CentreMarketing CenterProduct Center

These tools allow marketers to complete a number of tasks while using the platform, including:

Finding highly rated online suppliersFinding the most profitable locations for some specific product(s)Identifying products that are bestsellersAnalyzing market data to identify viral productsDwelling into competitor statistics for identifying revenue statistics and top-selling products.Comparing product prices among top-rated suppliers

Chrome Extension:

SaleSource offers a chrome extension tool that lets empowers merchants to analyze rival products. No import data or images are required to do this; It triggers automatically when a user navigates to browse product listings on the SaleSource platform.

The extension offers product specifications, sales charts, supplier details, and important data on product pricing. This information is very specific and could be invaluable in helping you to figure out which products could be profitable for your store.

SaleSource Platinum Services:

Salessource’s Platinum services work as add-ons that can be used on-demand to improve the performance of your store. Some of these services assist with logo creation, basic design, Google analytics, fixing bugs and errors, and more.

There are many platinum services to choose from. Click on a service to be directed to a corresponding landing page for additional information. Once you’ve viewed the details and pricing, you can purchase the service.

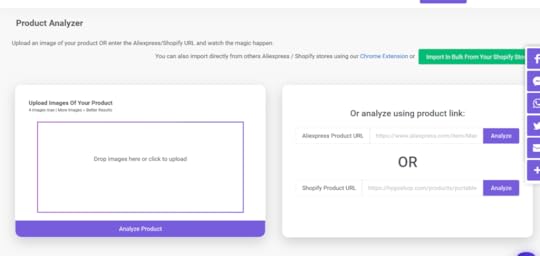

Product Analyzer:

Using the product analyzer, the merchants can access information about potential products they may want to add in their stores. The SaleSource Chrome extension can help them to import or upload an image of a product.

This

feature is probably SalesSource’s best USP in many ways. It considerably helps

to reduce the time it takes when manually searching for a single product.

Merchants

can use this feature to gather lists of rival sellers, marketing videos for

products, sales locations, and more.

This

feature has a range of tags; each is labeled for ease of use and accessibility;

these include:

Product Analyzer, News and Trending, Best Sellers (by niche), Best Sellers (all time), and Saved Products.

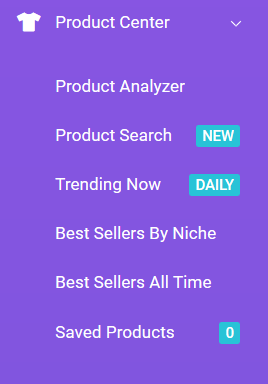

News

and Trending: The tab provides a list of

popular products and is updated daily

Best Sellers (by niche):

The

tab contains many products that arranged into categories and subcategories

pertaining to different types of products, product descriptions, and selling

locations.

Best

Sellers of All Time: offers data on product prices, the total number of real

sales, potential sales, and more.

Users

can click the heart icon to save products for viewing and analysis at a later

date.

Bestsellers all time: This SaleSource tab, located in the product center, provides insights and comprehensive data on product prices, sales, potential sales, and more.

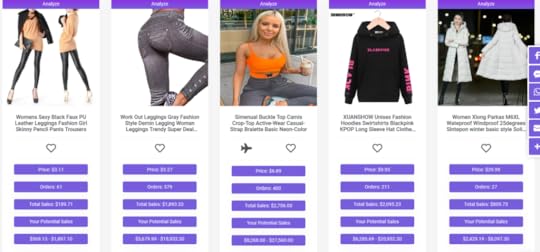

Store Center:

Store

Center is another essential element of the SaleSource eCommerce platform.

It

contains sections including Top Stores, Store Analyzer, Store Tracker, and

Store Checklist.

The Top Stores feature gives a list of the most successful dropshipping sellers currently on Shopify. This list is refreshed and updated weekly.

There

are three buttons under this feature.

View

Best Sellers’ ‘Analyze Store’ and ‘Track Store.’

‘View

best sellers’ shows top -listed stores, along with their estimated revenue

statistics. To offer deeper insights into these specific stores, the Analyze

Store process gives detailed information on many matrices, including the length

of operation, how much traffic the store receives, and what apps it uses.

Using these feature merchants cam access and analyze sales estimates for a wide range of stores, best selling products, ad campaigns, apps used and the theme used, etc.

This

can help merchants with market research, pricing, and design changes as they

strive to be the market leader in their field.

Marketing Center:

This

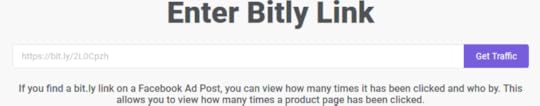

element of SaleSource includes Product Video Finder, product Traffic Checker,

and Facebook Video Ad Finder

Facebook Video Ad Finder:

As the name implies, this feature gives access to top-performing marketing videos that will help you to view existing marketing campaigns that are successful. You can use SaleSource to learn from the videos from the best sellers and use them as inspiration.

Traffic

Checker:

SaleSource’s Traffic Checker feature provides information on visitor traffic. The traffic can be grouped according to specific product pages, hourly, daily, or weekly. This is probably the fastest way to access crucial info about the store traffic levels.

Sale Center:

The sales center offers a number of professional training videos that can help merchants to learn how to use SaleSource to find premium products and sell and view the products of their competitors.

They are three pricing brackets $49, $99, or $299 per month.

For $49 you can analyze 50 products a month,

For $99 you can analyze 200 products per month

For $299, you can have access to over 1000 products.

There are professional or elite plans available to access the SaleSource’s in-house team support. With an elite plan, users have access to virtual assistants.

SaleSource Review: Final Verdict

SaleSource is an excellent tool, which is 100% worth implementing on your eCommerce store. The marketing competitor analysis and store tracking features are phenomenal.

Analyzing the best selling products has never been easier.

Just type in your competitors URL into SaleSource, and you can access key information regarding their most valuable products, estimated sales revenue, and other critical information.

In addition, all other features that we have explained above can help you grow your store exponentially. That’s all with our SaleSource Review. If you have just launched your dropship store and looking for an analytics / SaaS tool to measure metrics and grow, SaleSource is a fantastic product.

At $69 per month, it’s a bargain. Purchase your subscription today; you won’t be disappointed As we also have tried and tested SaleSource. It won’t disappoint you.

The post SaleSource: How To Find Best-selling Products For Your Dropshipping Business appeared first on Entrepreneurship Life.

What is Private Label Branding and How Does it Work?

The term private label branding refers to a practice whereby a company’s products are sold by a different company under another brand name. From private label protein shakes and makeup products to clothes and perfume, the world of private labelling is a massive business.

Many people are familiar with it for grocery items, such as breakfast cereals and ketchup, that are sold as a supermarket’s own brand products but are actually manufactured by a well-known supplier that also sells the products under its own brand name.

The manufacturer’s brand tends to be the best known since it usually benefits from a national marketing campaign that keeps it firmly in the public’s eye. Consequently, the private label versions are generally sold as budget products at a cheaper price.

The Many Benefits of Private Label Branded Products

Any retailers should seriously consider selling private label products since they offer a number of benefits that include:

The ability to establish a range of own branded products, even though you don’t have the capability to manufacture them yourself. They avoid the need for setting up your own development, production, quality control and packing facilities, as the original manufacturer can handle all of that for you.Improved profit margins since you will be able to purchase the products cheaper than their branded equivalents. You’ll also be able to avoid the marketing and other costs, and offer your customers products at lower prices while still achieving a better margin.Increased sales overall from an increased product range. The lower cost base also adds scope to offer incentives to your sales team and still retain greater profitability.Better customer loyalty by offering something different and establishing a brand that they can relate to. Customers are more likely to stick with you if you are able to offer exactly what they need.

This type of arrangement also has benefits for the manufacturer. It enables additional products to be sold, makes better use of manufacturing and distribution facilities and means the marketing budget can be focused more precisely.

Depending on the deal you negotiate with the manufacturer, they can provide the products with your own brand labelling or free of any labels. You can then create your own design labels and attach them to each product to establish a consistent brand.

Plan and Prepare Before Making a Decision

Whilst private label branding has many attractions for a business, it’s not something you should leap into without serious consideration. Before committing yourself, you need to analyse your customers buying patterns and establish if they are likely to buy your own branded products. If they don’t, you won’t be able to return them and may be either left with unsold stock or have to sell them off at a loss.

You will have to place a minimum order quantity, which will generally be higher than for regular brands, so make sure you’re able to stock and sell them, especially if it’s time-limited stock. Check also any restrictions imposed by the manufacturer, such as not being able to place the private label products alongside their regular equivalents.

With all of that said; it is an area that can be extremely beneficial for your business so make enquiries and get started — slowly at first and then start gathering pace as the profitability builds up.

The post What is Private Label Branding and How Does it Work? appeared first on Entrepreneurship Life.