Lisa London's Blog, page 3

February 20, 2015

Finding the Location of Your QuickBooks Company File

I hope you are staying warm with this very chilly weather

roaring through the US. But being stuck

indoors is sometimes motivation to organize our files (or thoughts). One of those files may be your QuickBooks company

file.

Why do you care where your company file is? Perhaps you are setting up a new company file and early in the

process you realize you've made some errors and you just want to start from

scratch. You will want to delete the old company file for you don't get it

confused with the new company file you are creating. If you don't delete it, you when you bring up QuickBooks, it may show you two companies with very similar names.

To do this, first backup your system just in case you change

your mind. Then go to the system's default location, Public/Public Documents/Intuit/QuickBooks/Company Files

and find the file with your organization's name and a QuickBooks Company file type. Right click on the file to delete. Next, go back into QuickBooks and select

File, New Company which will give you the Express Start menu. Then follow the

screens to set up your organization.

If, instead of deleting the file, you want to move the file to a different location, back up the file first and then right

click on the Company Files folder. Select Cut. Use the paste function to place it in the

desired location. The next time you bring up

QuickBooks, it will not know where the file is.In this case, you will select the box Open or restore an existing company . A pop-up box will appear.

[image error]

Select Open a company

file. Another box will appear with a

drop down arrow.

[image error]

Using the drop-down arrow, select the location where the

file resides. Click on the file and select Open.

The next time you bring up QuickBooks,

it will remember the last location.

February 5, 2015

Recording Credit Card Donations

Does your organization receive donations

through a website or via credit cards? Recording the discount charged by the

card processor can sometimes be frustrating. If you are using QuickBooks, I

recommend the following:

would for cash, giving the donor the full credit for the gift.

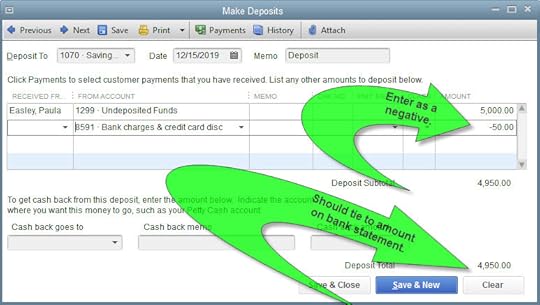

Go to the Make Deposits screen, select the donation or donations that make up

the funds received in the bank.

merchant fees, and enter the CLASS.

The AMOUNT will be entered as a negative number.

This should make the deposit

total agree to the bank statement. You can now reconcile your bank statement and have your donor records reflect the full amount of the donation.

January 29, 2015

Five Crucial Elements for a Strong Nonprofit Accounting System

With the start of a

new year, many nonprofit organizations and churches are considering new

accounting systems. If you are working with a nonprofit organization you feel

passionate about, it is natural to focus on the mission and the programs. But

equally important is the need to accurately track the financial tasks. I’ll be

reviewing with you the five crucial elements necessary to maintain a strong

financial system to fund your nonprofit’s mission.

Internal accounting controls. Donors to

an organization want to know systems are in place to keep the money and other

assets safe and that they are being used as intended. No organization is too

small to develop a system of internal controls. Bookkeeping system. Whether this is

done with a simple checkbook and spreadsheet or on a computerized accounting

program, the system needs to be able to track money in and out by donor, program,

and account category. Checking accounts should be easy to reconcile. Money owed

by members or others must be tracked. Money owed to vendors and others must

also be accounted for. Donor acknowledgements. If the

organization is a 501(c)( 3), there are specific rules the nonprofit

organization must follow to acknowledge the donation in order for it to be tax

deductible for the donor. If your organization does not follow these rules,

your donors may lose their tax deduction.Management reporting. The Board,

executive director, and program directors need information from the financial

system to oversee operations and plan programming.These needs must be understood and designed

into the processes.External reporting. Donors, grantors, lenders,

auditors, and government agencies may require specialized reporting.Is your system designed to handle this?

First, we'll review

the basics of internal accounting controls and bookkeeping systems. Then we

will cover donor acknowledgements and the differences between management and

external reporting.

#1

Internal

Accounting Controls

Internal

accounting controls are the procedures you set in place to safeguard against

fraud, theft, and errors. If you are thinking, "We don't have to worry

about that. No one in our organization would steal," search the Internet

with the phrase "stealing from nonprofits."The stories of seemly nice people who stole

hundreds of thousands of dollars from nonprofits will shock you. By

implementing a few basic controls, it is fairly easy to prevent fraud.

When designing your

controls, remember this basic concept:

[image error]

In

a nutshell, this means that the person collecting the cash or signing the

checks should not be the person recording the transactions in the accounting

system. It also means the treasurer should not also be the bookkeeper.

I

can hear you say, "But wait.That

is what the treasurer does.Our

organization is too small to have a bookkeeper separate from the

treasurer."If that is the case,

you will simply need to rethink how you use your treasurer.

For

example, if you have a small association or civic group with members who pay

their dues at the meeting, have a second person sit next to the

treasurer/bookkeeper as the money is being collected. At the end of the

meeting, count up the checks and cash, record it on a piece of paper, and have

both people sign it. This signed paper is later reconciled to the bank deposit

to assure all the money received was deposited.

When

paying bills, have the treasurer/bookkeeper write the checks, but the check

signers would be the president, secretary, or board members and not the

treasurer. The check signers must review the invoices before signing to assure

themselves it is a legitimate expense of the organization. This allows the

treasurer to record the transactions but not be able to withdraw the money.

# 2 Bookkeeping Systems

Nonprofit

accounting is a bit different than for-profit accounting. Instead of profits

and retained earnings, a nonprofit has net assets. Money or items donated for a

specific purpose are tracked through restricted funds. So the bookkeeping

system you select must be able to handle these types of transactions.

Bookkeeping

systems can be very basic with simply a checkbook and a spreadsheet to track

the types of income and expenses. Or they can be quite elaborate with nonprofit

specific software which accounts for funds and restrictions on donations as

well as donor management databases. Often nonprofits take an off-the-shelf accounting

package geared towards for-profit businesses and try to make it work.

Which

you decide to use depends on the organization's budget, needs, and expertise of

the staff. If you are starting a small sports league with a dozen members and

very little money, a spreadsheet will probably be sufficient.If you have several million dollars of grants

with specific reporting requirements, you'll probably want to purchase a

nonprofit-specific accounting program. Many nonprofits use QuickBooks® as it is

easy to learn and, with some manipulation, can be utilized for the specifics of

nonprofit accounting.

When

selecting or upgrading your accounting system, you'll need to evaluate the

following:

How much

can I spend? Is it better to spend more on the system if it will save time?

Spreadsheets are cheap, but it takes time to set up the system and formulas and

errors are more likely.Are you going to

spend so much time working with it that your program work suffers?If so, you would be better off looking at a

computerized accounting system. Check out www.techsoup.org for discounts and free

software for nonprofit organizations.For example, a $300 QuickBooks package can be purchased by an eligible

nonprofit for only $45. How many

donors and transactions do I have? If the organization's money comes from thousands of donors, you'll want a system that can handle them. If

you only have one or two sources of income, a simpler system will be adequate.Do I want

it cloud based on or on a computer in an office? Cloud-based (Internet-based)

accounting packages are very convenient, especially for organizations without a

physical location. But they tend to cost a bit more as you pay for them monthly

for as long as you use them instead of a one-time cost up front. Your internet

reliability is a major factor.If you

live in an area without consistent access, you will be very frustrated if you

can't get into the system when you want.Additionally, the internal controls have to be taken into

consideration.Does the package allow

for users to access reports only? You may want the board members to see the

data, but not to manipulate it.Is the

system intuitive? If the organization changes treasurers and bookkeepers on

a regular basis, the system has to be easy to learn. I wrote my first books, QuickBooks

for Churches and Other Religious Organizations and Using QuickBooks for Nonprofit Organizations, Associations, & Clubs, after helping a church

try to reconcile their accounts on a large expensive system that was difficult

to use. I realized that churches (and other nonprofits) often have volunteers,

and so switching to an accounting system many people are familiar with (like

QuickBooks) makes training new treasurers and bookkeepers much easier. QuickBooks isn't designed for nonprofits, so

you have to learn a few tricks to make it work, but it is a user-friendly

program.Is it

easy to perform the daily/monthly tasks? Entering donations, writing

checks, and reconciling the bank account should be easy.

Once

you have found a system in your price range that will easily keep your books,

take the time to learn the system. Ask for advice from a CPA or members and

supporters with accounting experience. If you set up your accounting system

correctly from the beginning, it will run so much smoother, leaving you more

time to focus on your nonprofit’s mission.

#3 Donor Acknowledgements

The

third crucial element in my list is donor acknowledgements. The IRS requires the

donor to keep a written record of any gift over $250 in order maintain the

deductibility.

From the IRS website:

A donor can deduct a

charitable contribution of $250 or more only if the donor has a

written

acknowledgment

from the charitable organization. The donor must get the

acknowledgement by the earlier of:

1.

The date the donor files the original

return for the year the contribution is made,

or

2.

The due date, including extensions, for

filing the return.

The donor is

responsible for requesting and obtaining the written acknowledgement from the

donee.

A donor cannot claim

a deduction for any contribution of cash, a check or other monetary gift made

on or after January 1, 2007, unless the donor maintains a

written record

of the contribution.

From Church

Accounting: The How-To Guide to Small & Growing Churches, the

written acknowledgment must contain the following information:

Name of the organizationAmount of cash contributionDescription (but not value) of non-cash

contributionStatement that no goods or services

were provided by the organization, if that is the caseDescription and good faith estimate of

the value of goods or services, if any, that the organization provided in

return for the contribution.

An organization

should have procedures in place to thank donors as soon as possible after

receipt of the donation. Some accounting programs will allow you to email the

donor directly from the donation receipt screen. There is a free video at my

website, www.accountantbesideyou.com

showing how to do this in a QuickBooks program.

[image error]

Accounting packages

frequently do not have strong donor management functions. You may want to

investigate donor management programs that will interface with your accounting

system. The interface is important as you do not want to have to enter data

twice.

#4 Management Reporting

If

you speak to an accountant, you may hear a strange language that references words

like GAAP or FASB. These are not science fiction terms, but relate to the accounting

rules financial reports need to follow if being reported to the public.The management of a nonprofit may need to

look at things differently than these rules require. For example, one of the

accounting rules requires pledges to be recorded as income when the pledge is

received, not when the cash is received. If it is a multi-year pledge, this can make

the financial statements look very good, but it does not show the management

when to expect the cash.

A

few of the reports the board, the executive director, development director, or

the program directors may need include:

Budget vs Actual Statement of Activities (income

and expenses) for the organization Budget vs Actual Statement of Activities for

each program/grantDonor/Grant report to summarize the related

income and expenses for a grantStatement of Financial Position (Balance Sheet)Cash reports including restricted vs

unrestricted cash and cash projectionsList of largest donors or grants

These

reports provide the management an overall view of how the programs are raising

and spending money related to expectations and donor wishes, if cash will be

available for the expected expenses, and the overall financial health of the

organizations.

Most

importantly, talk to the staff and board about what information they need to do

their jobs well and design the reports around these needs. Ask if the reports

should be on a cash basis (i.e. income and expenses are recorded only when

received or paid) or on an accrual basis (recorded when pledge is received and

when expenses are incurred regardless of when the cash is received or

paid). How detailed should the expense

line items be? How often should a new

forecast be prepared? Is the system capable of doing the necessary reporting

without having to use too many spreadsheets?

#5 Outside Reporting

Besides

management, other groups may have reporting requirements for your organization.

These are usually required to follow the stringent financial reporting rules. Reports

are required for outside auditors or an audit committee, any lenders,

foundations from which you have received or are requesting grants, etc.

Each

group will have their own requirements, but the basic financial statements are:

Statement of Activities (Income Statement) for

the entire organizationStatement of Financial Position (Balance Sheet)Statement of Cash FlowsStatement of Functional Expenses (report showing

expenses by major programs, administrative costs and fundraising costs). Required

for larger organizations filing Form 990.

Make

certain your accounting system can handle the required reports in an

easily-accessible manner to keep your life easier.

An

accounting system which addresses these five major areas -- internal controls,

bookkeeping, donor acknowledgements, management reporting, and outside

reporting -- will give you the tools you

need to better focus on the mission of the organization.

January 25, 2015

Who is an Independent Contractor for a Nonprofit or Church?

As the end of January approaches, there is still so much to

do with the accounting records. It is

time to get the IRS required 1099s to the vendors whom we paid throughout the

year. For each non-incorporated vendor

whom your organization paid over $600/year, Forms 1099 Misc. are required to be submitted to the IRS.

Copies of these forms must be sent to the vendors by the end of January. The

IRS must receive a transmittal (Form 1096) and the 1099s by the end of

February.

The most difficult part of the 1099s is determining who

should receive them.The IRS assumes

individuals working for the organization are employees unless proven

otherwise. When auditing an

organization, they have a list of 20 questions to determine if the worker is an

independent contractor or not.

In case you are wondering why it matters, income tax and

payroll taxes are withheld on employees but not independent contractors.Independent contractors have to pay the full

(employee and employer) Social Security and Medicare taxes on their earnings.

The IRS is concerned that businesses may classify workers as independent contractors

to save on the additional employer payroll taxes.

The IRS gives some guidance on their website to help you

determinewho is an independent

contractor.

Facts that provide evidence of the degree of

control and independence fall into three categories:

1.

Behavioral

: Does the company

control or have the right to control what the worker does and how the worker

does his or her job?

2.

Financial

: Are the business

aspects of the worker’s job controlled by the payer? (these include things like

how worker is paid, whether expenses are reimbursed, who provides

tools/supplies, etc.)

3.

Type of Relationship

: Are there written

contracts or employee type benefits (i.e. pension plan, insurance, vacation

pay, etc.)? Will the relationship continue and is the work performed a key

aspect of the business?

Businesses must weigh all these factors when

determining whether a worker is an employee or independent contractor. Some

factors may indicate that the worker is an employee, while other factors

indicate that the worker is an independent contractor. There is no “magic” or

set number of factors that “makes” the worker an employee or an independent

contractor, and no one factor stands alone in making this determination. Also,

factors which are relevant in one situation may not be relevant in another.

The keys are to look at the entire relationship,

consider the degree or extent of the right to direct and control, and finally,

to document each of the factors used in coming up with the determination.

For a church, the following are some examples of contractors

and employees from my book, Church Accounting The How-To Guide for Small

& Growing Churches.

[image error]

Revival ministers, supply preachers and guest speakers are

usually classified as independent contractors and should be issued a 1099 if

the total paid to them in the year was over $600.

For each person you determine is an independent contractor,

you must have on file Form W-9 Request for Taxpayer Identification Number and

Certification. This is the form that the vendor fills out with his address and

SSN or business EIN. Your church or nonprofit uses this information to complete the 1099s.

If you realize that you should have been paying the person

as an employee instead of an independent contractor, you will need to revise

your 941 and pay the employment taxes due. Please note the IRS website states, "An EO can be held liable for

employment taxes, plus interest and penalties, if a worker is incorrectly

classified as an independent contractor." So if you are unsure, play it safe by treating the person as an

employee.

I hope that helps clarify some of the confusion over who is

an independent contractor. In the next few weeks, I'll be cover what to look

for in a new accounting system and some different ways to set up pledges for a

new year.

January 19, 2015

Preparing Year-end Contribution Statements in QuickBooks

You've cleaned up the old pledges or tithes that we

discussed last week and now it is time for year-end contribution statements. I

know I promised to talk about independent contractors this week, but I've been

getting a number of questions regarding the year-end contribution statements, so 1099s will wait until next time.

If

you are using QuickBooks, you can design

an annual contribution statement letter to print out for all donors and then attach

the list of donations from the Sales by Customer Detail report. It isn't as smooth as using a designated

donor database-type system, but it does save time from doing it manually.

To get started, go to the top menu and select Company, Prepare Letters with Envelopes,

Customer Letters. The system will ask you to select the customers you would

like to send the letter to. Mark Active,

and then select Next.

You will be taken to a Letter

Template screen. Choose Create or

Edit a letter template and select Next.The system will ask you to choose what

you want to do. Select View or Edit

Existing Letter Templates.

The Customer type should already be selected. Scroll down

the list at the left to select Nonprofit Thank You. If your version of

QuickBooks does not include that option, select the Thanks for the business

template. Select Next and a word

document will open.

[image error]

In the example above, I've changed the wording for a church

and reference a list of donations to be attached. The list comes from the Sales

by Customer Detail report as discussed in Chapter 15 of QuickBooks for Churches & Other Religious Organizations.The other option is to run the Sales by

Customer Summary and manually input the total amount in each donor's letter.

Please also note the line on the letter stating no goods or

services were provided. This is a required IRS statement.The statutory requirements for acknowledgements

are explained in detail in ChurchAccounting The How-To Guide for Small & Growing Churches.

Once you have the

form letter formatted, go back to QuickBooks and select Use Template. It will once again ask you which customers (donors) you

would like to send the letters to, then default to the template you just

completed. You will then enter the name and title of the person signing the

letters.

You may see a pop up box warning you that some information

is missing. This may be as simple as not

having selected the Mr. or Mrs. box on the customer file. Don't worry about this. It can

be fixed on the individual letters or by revising the template.

The system will then bring up letters for each of the donors

you selected. Review the letters and edit any of the individual letters in Word

(i.e. add a personal note, fill in missing information, etc.) These revisions

will not go back to the template.

If you would like to revise the template, go back to

QuickBooks and select the Back button

until you are at the Choose a Letter

Template screen. Select Create or

Edit and then revise as desired. Rerun the letters, edit the individuals,

attach each donor's Sales by Customer Detail list, and you are ready to go.

Next week, we'll talk about independent contractors and

1099s. Until then,

Lisa London

January 14, 2015

Cleaning Up Unpaid Pledges at Year End.

It is the end of the year for

your religious or small nonprofit organization and you may find some of your

well-intentioned donors could not fulfill their pledges. Rather than carry the

uncollectible pledges forward in the following year, you will want to issue

credit memos in QuickBooks to write off the balances.

First, set up a new item (Lists, Item List, right click, New)called Uncollectible Pledges or Uncollectible

Tithes and have it link to your Pledges/Tithes/Offerings

Income Account. By using items, your organization can track the amount of

write-offs each year.

[image error]

Next you'll need to determine

which pledges should be written off. Print out your year-end A/R Aging summary

report by going to Reports, Customers

& Receivables, A/R Aging Summary. Select the end of the year for the date and if

you have more than one receivable account (i.e. operating pledges vs building

fund pledges), select Customize Report,

Filters, Account, and use the drop down arrow to select the specific pledge

receivable account.Print out this list

and mark the donor accounts you feel are not likely to be received.

Now you will issue credit

memos to apply to the invoices. A credit memo tells QuickBooks to treat the

invoice as fulfilled, so it will no longer show up as outstanding. Go to Customers, Create Credit Memos/Refunds. Enter the donor name, the class the pledge

originally went to, and the pledge receivable account across the top. Change

the Date to the year-end date.

Under Item, put your new Uncollectible

Pledge item and under Amount,

put the amount to be written off.

[image error]

Near the top of the screen,

you will see a couple of green icons. Select Use credit to apply to invoice. This screen lets QuickBooks know which invoice your are wanting to write off. The following screen will appear.

[image error]

Click the box near the invoice

you would like to write off and select Done.

Repeat this process for the remaining uncollectible pledges. Rerun the

year-end aging to be sure all of the uncollectible accounts were written off.

You can track how much your organization is

writing off each year, by running a Sales

by Item Detail report (Reports,

Sales, Sales by Item Detail) customized for the Uncollectible Pledge item.

[image error]

Now you are ready to start

the new year.If one of the donors pays

the pledge in the next year, enter it through Sales Receipts, instead of Receive

Payments and code the revenue to a Pledge income sub-account called Last Year's Pledge Rec'd This Year.

This keeps the revenues separate from the normal pledges received and, over

time, allows you to see how much of the pledge dollars written off your organization

recovers.

I hope that helps your

year-end closings. Next week I'll talk about independent contractors and 1099

filings.

January 7, 2015

Cleaning up the Chart of Accounts by Merging Accounts in QuickBooks

Cleaning up the Chart of Accounts by Merging

Accounts in QuickBooks

Over the year, you may

have wished you had set up your QuickBooks chart of accounts differently. Perhaps

there are too many account numbers or the information doesn't consolidate on

the financial statements the way you would like. Look at the reports you are

giving to the executive director, pastor, or governing board and listen to the

questions they have been asking. If you find yourself having to prepare

spreadsheets or answer the same questions each month, ask yourself, "Could

I use the chart of accounts to group this information better?".

When changing the

church or nonprofit's chart of accounts, you will want the new account

structure to include the data in the old accounts. Otherwise any comparisons to

last year information will be compromised. To do this in QuickBooks, you will

simply merge the new account with the old one. This works as long as both

accounts have the same account type (i.e. expense, income, etc.).

First back up your system. Then go to Lists, Chart of Accounts. Find the

account you would like to move the information into and write down the account

number. Now go to the account you would like to move the data out of.Right click on this account and select Edit. Change the account number to the

number of the account you want to move it to and hit Save. The system will warn you it is in use and ask if you are

sure. Select Yes and you can click

on the merged account to see the new data.

There is also a video

to take you through the process under FAQs,Video Tutorials. You can also subscribe to my YouTube channel https://www.youtube.com/user/accountantbesideyou to be notified as more videos are added.

If you have purchased

a chart of accounts iif file to upload for a nonprofit or church from my

website, the system will do the merging automatically, taking your old numbers

and moving them into the new imported numbers. Any of the accounts it cannot

find a natural match for will be left alone for you to determine if you would

like change.

Next week, I'll go

over how to clean up year-end pledge and tithe balances. Hope your New Year is

a happy one.

December 29, 2014

Can I use QuickBooks for my Nonprofit or Church?

As the new year starts, I know there are a number of organizations thinking about changing their accounting systems. In case you are wondering whether you can use QuickBooks in a nonprofit environment, I recorded this video to show both the pros and cons. It is focused towards churches, but covers most of what other nonprofit organizations have to consider.

Though the system isn't for every organization, if you think QuickBooks may work for you, please consider my books, Using QuickBooks for Nonprofit Organizations, Associations, & Clubs or QuickBooks for Churches & Other Religious Organizations. The step-by-step instructions and hundreds of illustrations make setting up and running the system much easier.

December 18, 2014

Help Your Donors by Encouraging Donations of Stock

Tis the

season for charitable donations and for non-profits to reassess their ability

to accept appropriate contributions. Transferring stock for a charitable

contribution may give the donor a significant tax advantage. With the stock

market at all-time highs, many donors may have stock that has appreciated in

value over the last few years. Donating this stock, in lieu of cash, may allow

the donor to receive the full market value of the stock as a deduction instead

of having to pay the capital gains.

Stock

transferred as a donation to an eligible organization may be deducted by the

donor at the market value as of the date of transfer, IF it has been held for

over one year. If it was purchased less than one year ago, the donation is

limited to the basis (the purchase price) of the stock. In order to understand

how this helps your donors, let's walk through an example.

I purchased

100 share of ABC Corporation five years ago for $15 per share. In 2014, the

value is up to $20 per share. Assume I would like to give my church a $2000

donation. If I sell the stock, I will receive $2000 ($20 x 100 shares), but

will have to pay capital gains tax (15-20%) on the $500 increase in the value

of the stock ($2000-($15 x 100)). So now, instead of having $2000 available to

donate, if I'm in a 20% tax bracket, I only have $1600 available.

If I transfer

the 100 shares directly to the church, I can still take the full $2000

charitable gifts deduction from my taxes, but I don't have to pay any capital

gains tax, nor does the organization. For additional information, go to the

IRS website http://www.irs.gov/publications/p526/ar02.html#en_US_2013_publink1000229755 or talk to a tax specialist.

As a strong

believer in making it easy for your donors to give you money for your mission,

I encourage your organization to set up an investment account. Work with your broker to have a easily accessed set of

instructions on transferring stock to your account. Then let your donors know about the

option. There should be a designated person in the organization who has the

account information and transferring information for the donors to communicate

with. Do not list your account number in an email or on your website. As every

tax situation is unique, your donors will need contact their tax specialist for

specific assistance.

Once you

receive the donation, don't forget to acknowledge the donation. Church

Accounting: The How-To Guide for Small & Growing Churches explains

the various requirements for donations and gives examples for you to use. Your donor will appreciate the increased

ability to maximize their donation to better serve your organization's mission.

November 23, 2014

QuickBooks for Churches 2nd Edition

What a busy month! First Church Accounting: The How-To Guide to Small & Growing Churches and now the 2nd edition of QuickBooks for Churches and Other Religious Organizations has just been released as an e-book! The paperback version should be ready for shipping by December 5.

The 2nd edition includes a chapter on tracking in-house payroll through QuickBooks, what's new in the 2015 version of QuickBooks, how to track member accounts for mission trips & the like, and more based on reader responses.

I highly recommend bundling it with Church Accounting: The How-To Guide to Small & Growing Churches for a complete understanding of church accounting and to save $5. There is also a Combo Bundle with both books, the Premium QuickBooks file with the chart of accounts, preferences, etc., the Church Accounting Policy & Procedures Manual, and the Example Spreadsheet Package for only $64.95, a $15 savings!

Don't forget, religious institutions can now order QuickBooks through Techsoup.org for a fraction of the retail cost.

Let The Accountant Beside You make the transition easier!