Lisa London's Blog, page 2

January 14, 2016

Pick of the Month-Donovan's Bookshelf

http://donovansliteraryservices.com/pick-of-the-month.html

January 6, 2016

Praise from The Midwest Book Review for Darker the Night

“…a stunningly realistic, absorbing quality that will make it a powerful juxtaposition to Diary of Anne Frank, recounting the youth experience from quite a different vantage point and making it a special recommendation…"

http://midwestbookreview.com/mbw/jan_16.htm#donovan

December 10, 2015

Recording Unrealized Gains and Losses of Investment Accounts

Last week I wrote about receiving stock from donors. This

week, I’ll discuss how to record the investment earnings and change in values. If

your nonprofit or church has investment accounts, you will notice on the

brokerage statements the earnings may be divided into Realized and Unrealized

Income. Realized income is money earned and received into your account. Typical

examples are dividend income, interest income, gain (or loss) on the sale of

stock. Unrealized income/loss reflects the impact of current market conditions

on your holdings.

For example, assume the organization has 100 shares of stock

in American Airlines it purchased at $40, for a book value of $4000. If the

market price of American Airlines stock is $42 at the end of the quarter, the

organization has an unrealized gain of $200 ($2 per share x 100 shares). If the

stock price was $38, it would be an unrealized loss of $200. If American

Airlines paid a 3% dividend, the $120 ($4000*.3%) would be a realized gain.

To keep your accounting records accurate, you will want the

Statement of Financial Position and your Statement of Activities to reflect

both the realized and the unrealized gains and losses. Many smaller

organizations record them in a single investment income account, but I

recommend showing the realized

separate from the unrealized so the

governing council can see what has actually been earned versus market

fluctuations.

Using the example above, let’s walk through a sample journal entry.

Debit Credit

1120-Investment Account $320.00

4520-Realized Gain/Loss Investment $120.00

4530-Unrealized Gain/Loss Investment $200.00

The class can be your general/administrative class, or, if

the investment account is to support a specific program, the realized gain/loss

should be coded to the appropriate program or fund class. I prefer to keep the

unrealized gains and losses in the general/administrative class, so the

programs financials aren’t distorted by changing market conditions.

After the transactions are recorded, the ending balance in

the 1120-Investment Account should equal the ending balance on the brokerage

statement.

If your fiscal year end is December 31, you may

want to review my early post getting the financial statements cleaned up. Click

this link http://accountantbesideyou.com/blog/nonprofit-financials-ready-for-an-audit/

or use the search box on my QuickTips Blog page.

December 5, 2015

Recording the Receipt of a Stock Donation

The end of the year is close and, hopefully, donations are

pouring in. Donating stock instead of

cash to a nonprofit or church may have an additional benefit for the donor.

(Please note, I am not a tax expert and am not giving tax advice. Your donors

should seek the advice of their local CPA to see if this could be a benefit to

them.) IRS regulations allow for stock donated to be deducted by the donor at

the market value instead of the stock price when it was purchased. This means

that if a donor has 100 shares of stock he bought 5 years ago at $10 per share,

and the stock market value is $50 per share when he transfers it to your

organization, he would be able to deduct a charitable contribution of $5000.

In contrast, if he sold the 100 shares of stock, he would

have to pay capital gains tax on the $4000 gain. Assuming a 20% tax rate

($800), he would only have $4200 to donate ($5000 less the $800 taxes). If a

nonprofit is going to encourage their donors to speak to their tax specialist

about this option, there are a couple of things that should be done.

First, the organization needs to have an investment account

that stock may be transferred into. Secondly, the governing body should devise

a policy about what to do with any stock donated. Will it be sold immediately

and the cash invested with other funds, or will the stock be held until the

cash is needed for its stated purpose? Who is responsible for investment

decisions? Finally, procedures must be put in place to assure the donation is

acknowledged on a timely basis and properly in accordance with IRS regulations

on donor acknowledgements. For more

information on donor acknowledgements, check out Church Accounting: The How-To Guide for

Small & Growing Churches.

Now to the nitty-gritty. To record the receipt of stock, you

will want to set up an invoice under the donor’s name for the full market value

of the stock. If the stock was used to pay a pledge that has already been

entered, you can skip this step.

If you are using QuickBooks, go to Receive Payments. Enter the amount as the full market value. If

there were brokerage expenses, we will record those later as the donor records

need to reflect the value before any transaction expenses. You may add a PMT METHOD called Stock. The

value of the stock on the brokerage report may be slightly less than the pledge

due to a change in value from the time the donor authorized it to the time it

was recorded in your account. If so, QuickBooks will ask if you want to leave

as an underpayment or write off the extra amount. If it is a small amount,

choose the write off option. Save this payment, and your donor records will be

up to date.

Next you will need to go to Make Deposits. Change the Deposit

To option to the investment account the stock was transferred into. After

selecting the amount from the Payments screen, you can adjust the deposit for

any transaction fees. Enter the fee amount as a negative number on the next

line. You will also need to assign a general ledger account number to the

adjustment under the FROM ACCOUNT. I usually prefer to use the same donation

account the invoice/pledge was recorded to in order for the net donation to be

correct. Save the deposit.

If your organization sells the stock, make a journal entry

to record the transfer

Dr. Cr.

1100-Checking Account $4800

6381-Bank Service Charges* 200

1120-Investment Account $5000

*If the organization does a number of stock sales, set up an

Other Expense account for Investment Transaction Fees.

Now the Statement of Financial Position (Balance Sheet) and

Statement of Activities (Income Statement) reflects the donation properly. In the next blog post, I’ll show how to record

realized and unrealized gains and losses for investment accounts.

November 10, 2015

October 13, 2015

Endowment and Memorial Investment Accounts

Between classes and

accounts, assets and equity, it can get very confusing trying to figure

out how track all the related pieces of an endowment or memorial

account. Let’s separate the pieces to see how to record these in

QuickBooks.

In this example, a generous donor has donate $10,000 of

stock to seed an endowment fund. If you are going to keep this money in a separate

bank account from your other investments, you will record the initial receipt

as follows:

Account Type Debit Credit Class

1xxx Endowment Investment Asset 10,000

4xxx Endowment Donations Income 10,000

Endowment (Restricted)

Assuming $50 of quarterly earnings are to be transferred

to the general fund, the following entry

would be made.

1xxx Checking Asset 50

4xxx Investment Income Income 50 General Fund (Unrestricted)

The system (QuickBooks) assumes only one equity

account, so at the end of the year (or monthly or quarterly if desired), the

net change in assets (Donations less Expenses) needs to be recorded in the Restricted

Net Asset equity accounts. To do this,

run a P&L by class. Using our examples

above, we need to set up an equity account for the Endowment to record the

$10,000 net income.

3xxx Unrestricted General Fund Equity 10,000 Do Not Use

Class

3xxx Restricted Endowment Equity 10,000 Do Not Use Class

Now you will have a balance sheet

with an Endowment Investment Asset of $10,000 and an Restricted Endowment

Equity account of $10,000.

Please note: you can track

restricted accounts without separate bank accounts using the Equity account. It

would be treated the same way, only the asset would be your combined investment

account.

What's New in QuickBooks 2016-Is it Worth Upgrading?

It is October and that means

QuickBooks Desktop has a new release. If you are a nonprofit or church currently

running 2014 or 2015, there is no significant reason to upgrade. They have

improved some reporting and printing features, but most of the rest of the

improvements are more useful to businesses.Here’s a quick summary of the substantial changes.

of the bills due and the ability to sort how you see them. Bills can be paid or

copied from this screen.

E-Invoicing has been improved. This is a fee-based

service that allows you to email dues invoices or pledges directly from the invoice/pledge

screen with a link to allow the donor to pay via credit card or bank transfer

(ACH). It sends the invoice with a Pay Now link. If the customer uses the link,

the money is transferred into your organization's bank account and the

QuickBooks file is updated for the transaction, including the processing fee of

50 cents.Fiscal Year-to-Last Month Report Filter is

my favorite change. It may seem like a little thing, but I am always running

YTD reports and hated having to change the end date to the previous month.

Thank you, Intuit!Continuous Feed Label Printer Support allows

you to print to Zebra-compatible continuous feed printers.

Most of the other changes relate

more to businesses, for example ship-to address functions and custom fields in

item reports.

Please note: InUsing QuickBooks for Nonprofit Organizations and QuickBooks for Churches, I recommend playing

around with the sample non-profit company before setting up your own. Some users have told me the 2016 version does

not include a sample non-profit file. Ig you need one, I’ll be happy to furnish you with a backup file of a sample

company. Email me via

questions@accountantbesideyou.com.

April 15, 2015

The Case for Sending Donor Statements Quarterly

Communicating with donors is a great

way to keep your organization alive in their minds. Many donors only hear from the nonprofits

they support twice a year-once when they ask for money and again when they

receive their the annual donor statement. Quarterly donor statements are a good way to

thank your supporters, to let them know what good works are being done with

their money, and can be a check against fraud. Additionally, if your supporters

pledge or tithe, it is a pleasant way to show them how much is still due.

Let's take each point individually.

The donor statement should detail the amounts given and say "Thank You!".

I strongly feel that you should NOT ask for additional money. It leaves a better impression if the donor doesn't feel

like he only hears from you when you want something. Have your website and address listed- he

knows how to make a donation-but focus on thanking him.

In just a sentence or two, update

the donor on any accomplishments or on your various programs. This way you have

both thanked them and reminded them why they like to give you money.

Donor statements are a helpful tool

in guarding against fraud and mistakes. As I explain in Using QuickBooks for Nonprofit Organizations, Associations, & Clubs, you should include a line with a person's name and number to call

with any questions about their donations. This should NOT be the bookkeeper or

the person in charge of donor accounts. If the donor has sent a

donation that is not reflected in your accounting records, it needs to be

researched by someone other than the bookkeeper. It may have been recorded in

the wrong account, lost in the mail or stolen.

When a donation is recorded to the wrong

account, this can be easily fixed and new statements sent to the donors, but you may not have known of the error if you hadn't sent out the statement. If a check is lost in the mail, the donor can be approached for a replacement check. If the donor

tells you the check has been cashed, but it has not been deposited into your

bank account, it is time to investigate the possibility of fraud. Even if no fraud has occurred, sending out the

quarterly statement allows the nonprofit to find and correct errors.

If you are a nonprofit or church

with members who commit to an annual donation paid throughout the year, sending quarterly statements with

a Balance Due line is a nice reminder, without actually having to ask for the money. If you are using a donor management system, it should be easy to design a

statement to include both the donations made and the open pledge balance.

If you are using QuickBooks, getting the open donation amount included is a

little trickier. In QuickBooks for Churches & Other Religious Organizations and in a video on www.AccountantBesideYou.com,

I explain how to generate a donor

acknowledgement, but it only reflects all the donations received, not the

outstanding pledge amount. Luckily, a

reader introduced me to a great program that works with QuickBooks to easily

export the data and format the statements automatically. The statements print,

ready to be tri-folded and placed in #10 window envelopes. Not only does this

save time (and money) versus printing mailing labels, there is no chance of the

wrong letter being sent to a donor. For more information, check out the Nonprofit

Donor Statement Generator at accountantbesideyou.com/donor-statements.

Sending donors quarterly statements

of amounts donated and open pledge balances gives the nonprofit the opportunity

to communicate with its donor without asking for anything in return, to share

it accomplishments and status on its programs, to find and fix errors or fraud

early, and to inform donors where they stand on the donor promises. With

automation, the small amount of time and postage required should be more than offset by

the goodwill and other benefits.

March 23, 2015

Accounting for Gift Card Fundraisers

Many grocery

stores and other businesses offer gift cards to nonprofit organizations at a

discounted rate to use as a fundraiser. This allows the nonprofit to buy the gift cards at a

discounted value, sell them at face value, and keep the difference. If your organization participates in this

type of fundraiser, you will need policies and procedures to safeguard the

cards and account for the transaction properly.

Store cards are

like cash and controls should be in place to protect them. Keep the cards in a secure

location. Designate one person (without access to the accounting records) to be

responsible for handling the cards. When you purchase the cards, set up a log

like you would for a petty cash fund. On the log, record the total number of cards and their values. As the

cards are sold, note who bought them, the number of cards sold and the dollars

received. If they were used for internal purposes, i.e. to purchase food for

the Youth Group or to give as a thank you to volunteers, record the number of

cards used and the program to charge them to. At the end of each month, a separate

person should count the cards and reconcile them to the log.

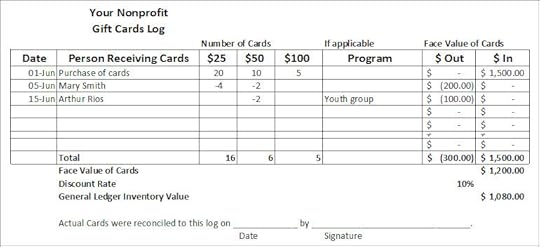

Here is an example of a Gift Card Log.

To save time, I've added this file to the Freebies tab under Nonprofits. You can download the Excel spreadsheet template to use for your organization.

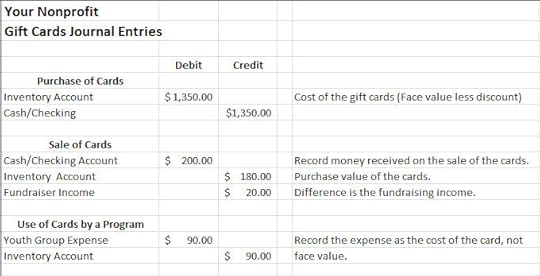

Recording the transactions

You will need to first set up an

inventory account on the balance sheet. Then record the purchase, sales and use of the cards as follows.

If you are using

QuickBooks, you can set up an item to automatically reduce the inventory

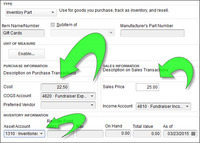

and record the income when you sell the item. First, make sure the Inventory Preference is active. Go to Edit, Preferences, Company Preferences, Inventory and purchase orders are active. Next, go to Lists, Item, New and select Inventory Part.

After you give it a name, input the cost of the card. Then the system will ask for a Cost of Goods Sold account. I prefer to put it to the Fundraiser Expense account as discussed in QuickBooks for Churches and Using QuickBooks for Nonprofit Organizations. The face value of the card is input in the Sales Price box and the Fundraiser Income account is selected. Don't forget to designate the Inventory account your recorded the original purchase to.

Set up a new item for each different type of card (i.e. $25, $50, etc.). Once the items are set up, you can record the sale of a gift card through the Sales Receipt screen or the Invoice screen. The system will automatically reduce inventory and record the sale with the related cost.

After the entries

are made, the ending balance on the card log should equal the inventory balance

on the balance sheet. If it does not,

investigate to see if cards are missing or if a miscalculation has been made.

If the cards are

given to volunteers to sell, you can keep track of the value of cards

outstanding, by using the Accounts Receivable option. Set up a new customer

account for each volunteer that will be taking the cards. If they are also a

donor, set up an separate Customer account for them as these transactions should not

be reflected on their year-end donor acknowledgments.

When issuing the

cards, set up a Customer Invoice for the number and amounts of cards received

by the volunteer. If you have set up the Item as explained above, the

system will automatically reduce inventory and record the sale. The accounts

receivable is increased for the face value of the cards.Once the cash is given to the organization

from the volunteers, it is treated as a payment of that volunteer's invoice.

You can use these

same concepts for other things your organization may sell like tee shirts or

books.

March 21, 2015

Should My Nonprofit or Church Upgrade to QuickBooks 2015?

If your nonprofit or

religious organization has been using the QuickBooks accounting system for several years,

you may be wondering if it is time to look at their newer versions. Each year, Intuit

(the maker of Quickbooks) offers a new version with some changes. Some years

these changes are significant; other years, they are more cosmetic.

The 2015 version

includes a number of improvements for the outside accountant, but not so many

for end user. If you are currently using QuickBooks 2013 or 2014, I'd wait to

upgrade after we see what will be introduced this fall for the 2016 version. If

you are using 2012 or earlier, however, I'd strongly suggest you consider

upgrading to QuickBooks 2015 version. The user interfaces are better. You can

copy/paste line items, scale reports, record bounced checks much easier and

there are better overview snapshots.

QuickBooks also

offers an online version, QBO (QuickBooks Online). It is a very different

program from the desktop version, but does give you the flexibility of a

cloud-based program. For a church or nonprofit, I'd recommend the desktop version, as you can purchase the 2015 desktop version of QuickBooks

Nonprofit Premier for only $45 from www.techsoup.org.