Michal Stawicki's Blog, page 2

April 10, 2023

Solopreneur: You Are Your Business!

Imagine a solopreneur or a small business owner with a very small team, who is still the heart and the brain of their company. What should be their priority?

Probably, they are responsible for marketing and sales, maybe for part of the operations or admin stuff. What should be their number one focus? Cash flow?

Paying taxes on time?

The prospecting and sales processes?

Documenting processes?

Time management?

Photo by RF._.studio from Pexels.

Photo by RF._.studio from Pexels.They all are crucial areas; however, their #1 priority should be self-care.

You see, the most frequent problem I encounter as a business coach is how little regard solopreneurs keep for themselves. Which I say, is totally upside down.

If you are the heart and brain of your business, you literally ARE your business. Without you, it will die. If you don’t function at the high level, your business will not function at the high level.

Or rather, it may function well for some time, but in the long-term, lack of self-care will get to you, and then it will destroy you and your business. Sometimes, the time horizon can be absurdly long (at least for our instant gratification culture), but in the end you will collapse, and your business will collapse too.

Cautionary StoriesI once coached a woman who had run her business successfully for two decades before her body gave up on her. She wasn’t able to move from her bed for a couple of months, and recovery took her another few months. During that period, she wasn’t able to work. Her revenue dried up. Her business was in as bad condition as she was.

This is not a lonely story of a single burned-out solopreneur. It’s the recurring story with most struggling and failed entrepreneurs. Yes, a cash flow problem or regulatory issue could have been the final blow to the business owner, but the same entrepreneur would easily have brushed off such a blow… if they prioritized their self-care.

Photo by Anna Tarazevich from Pexels.

Photo by Anna Tarazevich from Pexels.Prioritize your self-care, and the chances of your business’ survival skyrocket. Why? Because in the end, your business is only as strong as you are. Whatever can put you out of commission — health problems, relationship drama, mental state, spiritual struggle — can put your business out of commission.

On the other hand, if you are strong in each of the above areas, business struggles can barely scratch your armor. Your cash is low, but your health is great? You can work for 10–14 hours a day, 60–80 hours a week for a few weeks and generate some business.

Your taxes are overdue, but your relationships are strong? Your friends and family can lend or give you money.

Economic environment is bad, but you have a deep sense of purpose drawn from your spiritual beliefs? You will keep going no matter what.

Part II: Self-care Makes You Bulletproof

Part III: The Solopreneur’s Self-care Framework

March 31, 2023

Book Review: The Vacation Effect for Entrepreneurs

The Vacation Effect for Entrepreneurs is a small book, but worth its weight in gold. I already knew quite a few, various how-tos because I read another of Denise’s books back in 2022, The Busy Entrepreneur’s Guide To Creating A Lifestyle Business. I still found some golden nuggets in The Vacation Effect for Entrepreneurs. While the how-tos were golden, the inspiration and motivation were even more valuable.

Hey, I didn’t find any CONs of this book! Of course, you can nitpick that Denise’s approach may not be doable for every entrepreneur… You always can nitpick. But the author used my favorite approach: she painted the picture in front of readers and told them to take whatever they want and deem doable from her framework.

Instead of brainless nitpicking, let’s dive into the various excellent…

PROSof this book. The first and foremost of them is…

I loved the philosophy behind this book. Most employees live for the weekend, and that’s abhorrent. How can they waste five days a week and be miserable in their work only to party and enjoy life for two days?

Well, most entrepreneurs are even worse. They don’t even live for the weekend. They work non-stop. And while a majority of them enjoy their tasks more than an average employee, they have very little time to enjoy their lives.

The act of doing what you love and sharing it with others creates the joy.”

In the end, the Big Picture of The Vacation Effect for Entrepreneurs is this question: what we are hustling for? What are all those long hours and stacks of dollars for?

To enjoy your hobbies? To take care of your family? To spend time with your friends? To be free and travel? To be free and serve those less fortunate?

Then why does the hustle culture prevent you from all the above? If you are too busy to do any of the above in a meaningful amount, why are you even hustling?

2. The Story.Denise’s story is the most powerful component of this book. She needed to experience a tragedy to shift her philosophy. I especially loved this sentence:

And you certainly don’t have to wait for a fire or other tragedy to create the life you’ve always dreamed of.”

This is what I preach around the clock. My life had been going nowhere prior to 2012. I didn’t experience a single overarching all-changing moment. I just was sick and tired of being sick and tired. I started amending my life with small daily disciplines and slowly built the life I dreamed of.

Let’s face it: you may never live through a tragedy that would put you over the fence. You may wait and spend your whole life being at least half-miserable as Thoreau put it in the “Walden” – you may live your whole life in a quiet desperation.

Don’t wait for a tragedy. Don’t wait for a sudden enlightenment. Start creating the life you’ve always dreamed of, today.

Let Denise’s story inspire you to do so.

3. My Takeaway.Have the balls to remove 40% of your working hours; the magic will follow. Well, the other part of the Vacation Effect and magic is that you don’t spend this removed time on fretting and worrying about all you need to do. You spend it on living your dream life, NOW. As Denise puts it:

Forced hyper-efficiency and Freedom Days are just two sides of the same coin.

I may be less under the spell of busy-iness, but I’m under this spell nonetheless. I feel like what Denise proposes is impossible. Yet, she had done it and the results were extraordinary.

I’m thinking about many obstacles, I want to mitigate her radical approach: “OK, I will only work on what I love during those two days off.”

I’m all about small steps, and Denise’s recipe for acceleration seems to be too good to be true. Yet, she has done it, and she helps other entrepreneurs to do it.

Maybe in my conservative thinking, I’ll take only the Wednesdays off. Maybe, I’ll not work on Saturdays too. I don’t work many hours anyway, and my wife has weekends off and expects me to join her in leisure and household activities.

4. Excellent Delegation Tips.Every time Denise delegates something out, she gives her team a document with several points. Here they are:

• The project description – covers the details of what you want them to do.

• What does success look like? More context around what you want the end result to look like, what it will be used for, or how you will measure if it was done the way you wanted.

• The priority/deadline.

• Level of creative leeway – you let them know if you want their creativity or if there is a specific format or order it must follow.

• Level of authority – for example, are you wanting them to make a decision and sign up for the service, or present you with options?

• Is there an existing policy or procedure they should follow?

It all sounds too good to be true. The Vacation Effect for Entrepreneurs seems to scratch this itch to get massive results faster; to find a shortcut, a quick hack to grow your business, quickly. Usually, when I get to know any concept like that, I’m extremely skeptical.

But not this time. An extreme productivity (and results that follow it) is just a part of this book’s promise. The other part is that you can start living your life to the fullest today. You don’t have to wait for another decade or three till you “make it” to cross some items from your bucket list. You can do it next week.

And that’s even more alluring for me.

My subconscious mind resists from all its might that it cannot be so simple. But deep in my gut, I feel that Denise’s advice is sound.

Like with The Slight Edge message, I may resist for some time, but eventually I will take the plunge. The Vacation Effect for Entrepreneurs inspired me so.

March 19, 2023

Profit First: A Solution to Cash Flow Problems Plaguing Small Businesses

The number one sin when it comes to cash flow management in small business is not managing it at all. “I don’t know where it all goes” is not the right answer for the business owner. In fact, it is the answer that kills most small businesses. 82% of them, to be precise.

Cash flow deserves your attention, or else… “Or else,” in this case, means bankruptcy.

Photo by Tima Miroshnichenko from Pexels.

Photo by Tima Miroshnichenko from Pexels.Before you even start managing your cash flow, you need to have a clue about your costs and revenue streams. Not only about their volume, but also their nature. Not paying your contractor for a month or a quarter may not prove fatal, but not paying due taxes to IRS? It may be beyond fatal, depending on your business and private liabilities.

The same goes with revenue streams. It’s great you invoiced your customer for the job finished today. But when will the money appear in your bank account? In a week? Or maybe sixty days? You still need to pay your people and cover your bills in those sixty days!

Level #0: Tracking Photo by Karolina Grabowska from Pexels

Photo by Karolina Grabowska from PexelsIf you “don’t know where it all goes,” you need to start tracking your expenses (and income) immediately. If you are organized enough to have all the payments registered in one place, this is the perfect place to start. But small business is a wild creature prone to whims of the owner and the nature of the beast.

For example, I have dozens of income streams, and sometimes they are miniscule. Often, I cannot control how I’m getting paid. Amazon transfers my book royalties directly to my bank account in euro. Findaways pays me via PayPal. Customers from Reedsy pay me via Stripe. It already makes things more complex than they should be.

But that’s not all. I have a customer who transfers money to me regularly into my PLN bank account. Another, who pays me in Euro. If I get a Polish customer, they also pay me in Polish Zloty.

However, the revenue part of my business is simple comparing to the cost part. I have subscriptions paid via debit cards connected to my US dollar account. I have subscriptions paid via PayPal. I pay for Amazon ads with debit cards, in different currencies on different markets to save on the exchange rates. I pay my accountant in PLN – and my taxes and social security fees. I pay my virtual assistants via Wise.

It’s a crazy mishmash, and I track it all in Google sheets to have one place where I can see my real cash balance.

If your financial/accounting system doesn’t resemble a Frankenstein monster patched together from many different parts, tracking your finances should be a breeze. If it looks exactly like Frankenstein (like my maze of payments), you still need to track each incoming and outgoing cent. Even if you have to do it manually in a Google sheet.

Paraphrasing Peter Drucker: “You cannot manage what you don’t measure.”

Tracking your money gives you the idea – or precise numbers – of how much funds you really need on a monthly basis to operate.

Different Kinds of CostsThere are a few categories of costs you should be especially aware:

-tax and legal liabilities

-salaries

-recurring fixed costs

-operational costs

The first category is important because it can be the difference between living with an axe over your head or the axe chopping your business’ head off.

Salaries are of sensitive nature because your people have stomachs. Their kids too. If you don’t pay them, you may not have people to work for you next month.

Fixed costs are self-explanatory. If you have a brick-and-mortar business and you won’t pay the rent for your “bricks,” you will be out of business in no time. There are some categories of costs that simply must be paid so you can continue to operate.

Operational costs are something different – those are the costs necessary to deliver your products and services. In other words, they are dependent on the volume you deliver. For example, I pay a freelancer for creating the ads for my customers. The more ads we create, the more I pay, but if there is no activity, I pay nothing. Thus, this is not a fixed cost.

Different Income StreamsTracking only your costs is not enough, especially in an enterprise. You could’ve skipped it if you are an employee and receive the same check every month. However, in business the revenue is not only volatile, it also often comes from many different sources.

For example, my income comes from three main sources – book royalties, coaching, and my book advertising business. Yet, each of those sources divides further into more streams. My book royalties come from audiobooks, eBooks and paperbacks; from Amazon, Draft2Digital, Findaways, and PublishDrive. I don’t even count the sparse payments for foreign rights and other 1-time payments.

Level #1: Bank Accounts Photo by Kindel Media from Pexels.

Photo by Kindel Media from Pexels.Once you have a loose idea where your money comes from and where it all goes, you can get busy with setting up a simple system, which will show your cash flow at one glance.

In almost the whole civilized world, you need a bank account to run a business anyway. In most countries, it is required. Hence, you use what’s required to setup your cash flow solution.

The Profit First concept is based on the envelope system from the personal finance world. You get incoming money, and then you allocate your cash for specific purposes. And you do that all within your bank.

You need a few to several bank accounts for that purpose. First and foremost, you need the Incoming Account. This is where all your clients send their payments to. This is the only function of this account: to collect payments. You don’t use it for any other goal. You don’t pay ANYTHING from it: no taxes, bills, subscriptions. Nothing. It serves to accumulate the revenue streams.

Then, you need a few (or more) accounts for different purposes, like your grandma needed a few envelopes to manage her cash. You will need a minimum of four such accounts: taxes, owners, opex (operating expenses), and profits. It is recommended that the taxes and profits accounts are in a different bank and not easily accessible to limit the temptation of borrowing from them to pay yourself, your contractors, employees, etc. Once the money is transferred into those accounts it is untouchable.

You can make this system as robust as you prefer. I send owner’s pay to my private account, but then I allocate money further within digital envelopes: for mortgage, bills, Christmas gifts, car repairs, white goods, gas, and so on. The same goes for my business. I have a separate account from which I pay my VAs and a few accounts in different currencies to pay for goods and services. This is my way to lower the costs (I save on exchange rates) and to make sure I have the funds necessary to pay my various business bills.

You can also use the Profit First system to fund your future investments. Let’s say you want to hire a new person. You create a new bank account and name it ‘New hire,’ and each month you put there a slice of your revenue after taxes. When you will be ready to hire, you will have no headache where to get money for an additional salary. Also, allocating a part of your revenue in advance will clearly show you if your business is healthy enough to afford yet another employee.

When buying a piece of an expensive equipment, the principle is the same – keep setting aside a fraction of your revenue for a few months till you can actually afford it.

Level #2: Thresholds Photo by Tima Miroshnichenko from Pexels.

Photo by Tima Miroshnichenko from Pexels.OK, but how much of your revenue is dedicated to salaries, and how much for a new hire or equipment? This is where Profit First thresholds come into play. Exactly like your grandmother knew how much she should put into each envelope, you need to know how much to allocate into the bank accounts you created.

Profit First thresholds are the centerpiece of the whole system. You tracked your income and revenue streams, and you created the bank accounts, so you can now put the thresholds into use.

So, what are Profit First thresholds, and what do they do? Each of them is a simple percentage metric, which tells you how much of your revenue you should allocate into specific accounts.

Let’s stick to the simplest example: you have only five accounts – incoming, taxes, owner’s, opex (operating expenses), and profits. The incoming bank account is just a “bag” for collecting money. Then, the thresholds inform you how much to transfer to each of the remaining four accounts. Let’s say, 10% goes for taxes, 50% for owner’s salary, 35% for operating expenses, and 5% for profits.

You can have more bank accounts (a new hire…) and thresholds. Of course, the laws of the math require that all the thresholds sum up to 100%. So, if in the above example, you want to start setting aside money for a new employee, you need to open another bank account and assign a threshold to it. Let’s say, 5%. But where to get that 5% from? Stealing from Uncle Sam is a bad idea, so definitely not from the tax account. You can diminish your profits, but never to zero. Thus, take 4% from profits and 1% from owner’s. The new set of thresholds looks like this:

Tax: 10%

Owner’s: 49%

Opex: 35%

Profits: 1%

New hire: 5%

Sum: 100%

Seriously, you can have as many objectives connected to bank accounts, as you wish. Currently, I have seven in my business, and I’ll soon add the eighth because I’ve been delusional about my fixed costs and need to take the proper care of them.

What is the main benefit of Profit First thresholds? Automation. You don’t need to think about what to do with your money. Its destiny is already determined. When a client pays you $100, you put $10 in the tax account, you take $49 for yourself, save $5 for a new hire, set aside $1 of profit, and transfer $35 to your opex account.

You don’t need to fiddle with your money – ever again. You don’t need to steal from Paul to pay Peter – never again. You will always have the money to pay your taxes, bills, salaries… and you will always have some profit, even if it will be as tiny as 1% of your revenue.

How to assess your initial Profit First thresholds? Guesstimate! This is where tracking and analyzing past data pays off. If you have been in business for three years, you can estimate how much in taxes you really pay. I cannot tell you this. Not even an experienced accountant can tell you this out of the blue. Each business is different. The exemplary thresholds above are more suitable for a solopreneur with an online business – low revenue, so he consumes the main bulk of it; relatively low costs of running a business, relatively low taxes.

However, in case of a bigger brick and mortar business, the thresholds could’ve been very different: 0% of taxes, cos’ the business is in the red.

60% for operating expenses, including installments for the heavy equipment (thus no profits and high costs).

5% of owner’s salary, because the revenue is over a million, so it is enough for a modest lifestyle.

Photo by Karolina Grabowska from Pexels.

Photo by Karolina Grabowska from Pexels.Now, you have everything in place – bank accounts and thresholds. All you need to do is to use them, and keep using them.

The revenue comes to your incoming account. Every so often, you distribute the revenue among your bank accounts according to your Profit First thresholds.

In his book, Mike Michalowicz recommends doing it twice a month, on the 10th and 25th day of the month – thus you will have money for bills and salaries, which are usually paid at the middle or the beginning/end of the month.

But you can do it as often as it makes sense for you. Maybe you have such an abundance of cash that once a month is enough for you. Personally, I do it 4-7 times a month because I’m chronically short on cash (which only proves that I need to adjust my percentages). Yes, it obviously consumes more of my time, but the allocation of the funds is the business activity I enjoy the most. I don’t mind it at all; in fact, I’m always looking forward to it. I eagerly check my receivables if they summed up to a few hundred bucks and then play the Profit First game.

Which, by the way, is the way I recommend to anybody who starts implementing the Profit First system. The more often you are using it, the faster it becomes your habit. If you perform the funds allocation every few hundred bucks, in a few weeks it may become your second nature.

Michalowicz also recommends to login to your bank account once a day and check your accounts’ balances. This is the real benefit of the system: you are feeling the pulse of your business. Cash flow is like a blood circulation system for your organism. Sometimes blood flows slower, sometimes your pulse accelerates, especially when you increase your physical effort. Your overall health depends on your bloodstream. The health of your business depends on your cash flow.

Once every quarter, you use your tax and profit accounts to pay taxes and do profits distribution. At the end of the year, you may make a few serious decisions about investing your profits. That’s it. So much financial headache is blown out of the water with just a few daily, bi-monthly and quarterly actions.

Peace of Mind Photo by Karolina Grabowska from Pexels.

Photo by Karolina Grabowska from Pexels.If you properly implement the Profit First system, it provides peace of mind incomparable with any other “accounting” system. It eliminates dozens of daily financial dilemmas:

Should I pay this bill or that contractor?

Will this client pay before I need to process the payroll for my team?

If I pay my personal bills this month, can I still afford to pay my business’ bills?

Everything is predetermined and automated. The only decisions you need to make are about the allocation percentages and you will make them only every so often – you will cut your costs, so you will be able to allocate more for profits; or you will get a better feel for how high your real tax fee is and lower that threshold; or you will get a few new customers, so your overall revenue will jump, and you will modify Profit First percentages accordingly.

The beauty of this system is that it is so intuitive. You will have a look at your bank accounts every day. You will supervise the distribution of funds. You will quickly notice the places where you are short on cash. What is more, you will have concrete data and numbers to crunch, not just your gut feeling.

Like a bloodstream, your business’ cash flow needs constant adjustments. With the Profit First systems, making those adjustments comes naturally.

No More OverstretchAnother big benefit of Profit First is that it makes it really hard to be careless with your money. No more:

“Let’s buy this truck!”

“Let’s hire a new person!”

“Let’s move to a bigger office!”

You can do all of the above, but when following the Profit First system, you will have to find the place to get this money from. Should you cut your own salary? Increase revenue? Or maybe your threshold for the operating expenses was high enough that you can accommodate this investment? One glance at your data will provide you the right answer.

However, in most cases, I guess the answer will be: “Nope, we cannot afford this new shiny object.” Profit First grounds you in reality, provides a clear state of your bloodstream, I mean cash flow. It leaves no space for wishful thinking. It prevents you from making stupid and costly decisions.

In short, it saves your business’ butt from oblivion. 82% of small businesses go out of business because of their cash flow problems. Implement the Profit First system, and you will not be one of them.

March 10, 2023

5 Easiest Things to Do If You Struggle with Developing a New Habit

Photo by Helena Lopes from Pexels.com

In my practice, I’ve seen what people struggled with the most and what enabled them the most.

Creating new habits doesn’t have to be a slog. Here are five easy tips to eliminate the struggle from developing good habits:

1. Make It Tiny.By far, the #1 struggle with developing habits comes from inflated ambition. Our minds are bombarded by media with incredible transformation stories, so we want impressive results and we want them NOW. Or, better yet, yesterday. Thus, when people develop a new habit, the #1 mistake is trying to do too much too quickly.

You try to lose weight by pumping iron for 3 hours a day.

You try to write a book by writing for 5 hours a day.

You try to learn a new language by learning 199 new words every day.

It is too much. Your subconscious will quickly rebel against such overcommitment.

The solution? Make your habit tiny; a tiny habit is an activity that:

-you do at least once a day,

-takes you less than 30 seconds,

-requires little effort.

Additional hack: design a tiny habit, which you can do multiple times a day, preferably dozens of times a day. Developing a habit takes 66 repetitions on average. With a tiny habit, you can compress this process into a few days.

Take the free Tiny Habits course. It starts every Monday, takes less than an hour for the whole week, and in the process you will develop three new habits.

2. Celebrate Your Habit.Bad habits easily stick to us because they go hand in hand with our body’s reward system. You eat something sweet, and dopamine hits immediately. You yell at others, and you immediately feel powerful. You gulp alcohol, and you feel the boost of self-confidence in mere seconds.

However, good habits rarely can tap into this reward system so easily, if at all. For example, in the moment, working out or fasting is more of a punishment for the body, than a reward. Even purely intellectual habits, like reading or writing are, at best, neutral for our bodies.

Thus, in order to connote your good habit with a reward, you need to celebrate. That’s the fastest way to activate your body’s reward system, and the easiest way to make your habit pleasurable.

Here is what BJ Fogg, the inventor of the Tiny Habits framework, recommends for celebration:

Dr. BJ Fogg – 10 ways to cheer for your tiny successes from tinyhabits 3. Get Educated about Habits.

Knowing the habit science is not obligatory – I developed dozens of habits being clueless about it – but helpful. The Tiny Habits course gives an excellent pill of habit knowledge: small, but practical and digestible. I can also recommend my blog post series about habits:

Get to know what a habit loop is, how to pick the right triggers, etc.

4. Get Someone Onboard.We are VERY social animals. Don’t try to develop your habit by your own power. Leverage the help from others.

Photo by cottonbro studio from Pexels.com

Ideally, muster some support from someone who “has been there and done that” – had similar struggles, but overcame them and now has a habit you want to develop. Human beings learn by mimicry, this is how kids learn life. Just being around people who possess your desirable habit will “magically” rub off the habit from them.

But any support is much better than no support. Declare your goal. Talk with a friend. Find an accountability partner who wants to develop the same habit. Join a group focused on this habit. Get a coach.

Just involve minimum one other person in your personal quest.

5. Become Your Habit.Make it part of your identity: “I am a person who…”

If that rings false in your ears, you can always use the variation: “I am becoming a person who…”

When I got the idea to become a writer, I put in my personal mission statement a sentence, “I’m becoming a writer.” I couldn’t truthfully tell myself I was a writer, so I used this trick.

Back then, I had been so clueless that I didn’t even know what it meant to be a writer. It took me the whole month to figure out that writers write! Yet, repeating that sentence from my personal mission statement put my mind on the right track. Nowadays, part of my personal identity is “I am a person who writes every day.”

Identity is a powerful motivator. No excuse can get in its way. If you are clueless, you will figure it out. If you are exhausted, you will persevere. If you are discouraged, you will do your habit anyway.

Because this is who you are.

Start small.

Be mindful about generating a dopamine boost for your new habit.

Get familiar with the habit science.

Get some social support.

Adopt this new habit as a part of your identity.

This is how you make developing a good habit less of a struggle and more of an adventure.

Originally Published in Quora.

February 21, 2023

Book Review: Use Your Job to Quit Your Job

This is a very neat book, and I’m extremely grateful that it didn’t exist 10 years ago when I decided to start a side hustle.

Why? With the help of Use Your Job to Quit Your Job, I would have probably succeeded with some IT-related enterprise, because I had worked in IT back then. However, I SO much prefer being a writer and business coach

As Jake Lang, the author of the book, said:

The process outlined in this chapter is nearly foolproof; it has worked for me and my eight businesses, and it has worked for thousands of other entrepreneurs who have gone through the process(…)”

He meant in that fragment the process of estimating a baseline market size, but it applies to the whole Jake’s framework. It works. It bears the proof of practice – it worked for thousands. It is nearly foolproof.

Which doesn’t change the fact that the pesky me has found a few minor

And traditionally, I will start from them. Overall, the book is great, but there are some misconceptions and some statements too definitive to be valid.

1. Coaching.Simply put, coaching is the process of getting paid to help someone.”

Nope. That’s overly simple. If you clean a bathroom and are getting paid for that, you are helping someone – aaaand that’s NOT coaching. However, in the next paragraph, Jake clarified with a much better description of the coaching process:

(…) the client is responsible for sitting down and doing the work; you simply act as a sounding board and guiding voice.”

That’s much closer to what coaching is.

2. The Purpose of Business.The author states:

The purpose of a business is to make money.”

Jake got it very backward. He mistook the symptoms and the end effect. Saying that the purpose of business is to make money is like saying that the purpose of the human existence is to breathe, or to pump blood through one’s veins, or to drink, or eat.

None of the above are purposes. They are prerequisites. You need to breathe, your bloodstream must be in constant action, you need hydration and nutrition to function. Otherwise, you will die.

BUT!

It’s not your purpose. And the same is with your business. Of course, you need a cash flow to have a business. But its purpose is usually much higher than that. Maybe it’s your family, or personal freedom, or it is the vehicle you use to change the world for the better. I even know businesses which purpose is to share the Gospel!

Making money? Pshaw!

To Jake’s defense, he said further in the book:

The purpose of a business is to make money, so that’s what you should do: start selling right away.”

That’s closer to reality. Starting selling right away is like giving a spank to a newborn – so he starts sucking air, so he can breathe. If you neglect this, a newborn may suffocate, and sadly, have no purpose on this realm.

Start selling right away, and your business will start breathing. It may aim for the higher purpose; but first, you need to keep it alive.

3. Transitioning Out of Your Day Job.Sooner or later, following the Use Your Job to Quit Your Job framework, you will be able to say farewell to your day job. Here comes a piece of unfortunate advice:

Talk to your employer first.”

It’s not the worse advice in the world, but it assumes one thing: that your boss, or the company you work for, is decent. Jake probably had a great deal of luck in his life and worked only for decent people.

But there are companies out there you don’t want to give a warning shot. Sadly, they are common enough to make Jake’s advice conditional.

I say, always use your best judgement. I worked for several different companies, and I approached my transition differently with each of them. Your gut feeling will tell you whether or not to talk to your employer first, or if you simply give them a notice in the last possible moment.

I have no love for crappy employers. Your contract has a two-week notice period?!? Well, nobody prevented them from amending the contract with a 1-month or 1-year notice period. It’s their headache, not yours.

OK, enough of CONs. I’m the first to admit they are minor. They don’t negatively affect the main purpose of the book: using your day job to quit it altogether. Jake Lang’s book is full of good stuff, and here it comes.

PROs1. Stories, Stories, Stories.There are a zillion stories in Use Your Job to Quit Your Job, and that is a good thing. First of all, I hate the how-to books filled with questions and exercises but without any context. How do you even know you are doing them properly? It is just “do this, do that!” Thanks to the stories illustrating each phase of the process, it is obvious how you should go about specific exercises.

But this is just a minor advantage. The main benefit of many, many, many (did you get the point?) stories included in the book is that it’s easy to think that you can do it. Inspiration and a boost of self-confidence is something every person who wants to transit from employee to entrepreneur desperately needs.

You read Use Your Job to Quit Your Job and all the stories there, and you get the feeling that this is actually doable – for YOU. Yes, you can figure out what business to start. Yes, you can validate the idea. Yes, you can do the research.

Yes, you can quit your day job.

Photo by Ketut Subiyanto from Pexels.

And you don’t need to become a guru or dance on TikTok to do this. Your skills and experience is enough to win you freedom.

2. Framework, Framework, Framework.From my experience and observation, the longer you are stuck in a cubicle, the lower is your creativity and entrepreneurship (and life satisfaction!). Thus, providing the exact step-by-step framework for the whole process is essential.

I can get paralyzed by analysis, forever. I can self-doubt myself to the oblivion:

Is it a good idea?”

But what if…?”

Should I do this or that?”

Thanks to Jake’s guidance, you can go over the whole process, from even thinking about quitting your day job to actually giving the notice. No second guessing. Minimal self-doubt. You have the exact process to follow. And it works. It worked for thousands of individuals who used their day job to quit their day job.

3. Mindset, Mindset, Mindset.I love the main premise of this book: you need to make a living with your side hustle, which will eventually turn into the main hustle. So, you don’t have to start another Facebook, Tesla, Air B&B, whatever. You need to make about $50,000 a year.

Not $100k, not $1M, not a billion. Just fifty grand a year.

You don’t have to be uber-successful and drive a Ferrari. You don’t have to impress the whole world on social media with your mansion.

It makes the whole endeavor so much more doable – in your mind. And your mind is where everything happens.

Whether you think you can, or you think you can’t – you’re right.” – Henry Ford

I loved this mindset and approach. It turns off the internal critic and self-doubts. It is simply doable, let’s start.

If you can make $50k a year with your side hustle, you can certainly grow it to a bigger scale when it becomes your main hustle.

You don’t have to stay stuck at the $50k level, but this figure makes a perfect starting point. In the age of Internet hype, it is a refreshingly down-to-earth approach.

Those are the main PROs. There are others too – the book is well done, writing is engaging, I love the personal tidbits of Jake’s journey.

The Missing ElementHowever, this book lacks one piece: what if you hate what you are doing? Then, just the thought of doing more of what you are doing in your day job makes your stomach turn! You definitely don’t want to be miserable outside your employment too.

Obviously, it is not a crippling omission in case of Use Your Job to Quit Your Job. The whole premise of the book is to leverage what you are doing for your employer to build your own business and lifestyle. So, Jake couldn’t guide you if you don’t want to do it.

But I can.

When I decided to do my own thing, one thing I was sure of: it would have nothing to do with my day job in which I was miserable.

In the last decade, I tried multiple things. I created three new careers for myself: an author, a business coach and business owner.

At the beginning, I knew what I didn’t want to do, but I didn’t exactly know what I wanted to do nor what I’m good enough at to make a living. So, I explored the trial-and-error path.

WARNING: not leveraging your day job’s skills and experience is the longer path. I was once on a call with Dan Miller and asked him how long it should take to make a living. He said half a year. But that was six months leveraging what you already had and with a mentor’s help.

It took me five years of stumbling alone in the dark before I scaled down my day job to half time. It took me another five years before I quit it completely.

Yet, I’m happy with my choices. I feel more authentic and happy in what I’m doing now. I wouldn’t have exchanged it to anything I did in my day job.

Photo by Vlada Karpovich from Pexels.

I have the whole article on how you discover your own path to entrepreneurship which overlaps your passion, your skills, and a market demand:

https://www.quora.com/I-cant-seem-to-...

You need to know yourself. You need to find if there is a demand for what you want to do. BTW, the validation and brainstorming processes documented in Use Your Job to Quit Your Job can greatly help you with that.

And you need to bear with failures and have patience.

Success is a pile of failure that you are standing on.” – Dave Ramsey

If you lie under this pile because you quit, it is not a success. Don’t give up, keep trying, and eventually you will create your new career.

SummaryUse Your Job to Quit Your Job is an excellent book. If you don’t work for “the man,” become a man (or a woman  ). This book will show you exactly how to make it happen.

). This book will show you exactly how to make it happen.

It will also inspire you with many stories of folks just like you, who used this very framework to free themselves up.

This book is a great resource to get you out of the scary place at the beginning of this path into the dark unknown to “happily ever after.”

Recommended!

February 20, 2023

Solopreneurship Is a Myth

This is how Michael Gerber titled his famous book: The E-Myth (entrepreneur’s myth): I will do it all by myself.

Nope. If you try to succeed that way, you will burn yourself out. Your business growth will be capped by your own abilities and capabilities. Most likely, you will become the bottleneck of your business.

Humans are social creatures, all humans, including entrepreneurs. We want to believe in the lone strong wolf myth, but heck! – wolves are social animals too.

There is no more lonely occupation than that of an author. It is like a lone wolf myth epitomized. But after a decade in the self-publishing world, I tell you: the most successful authors cooperate with others.

They have their teams, or at least contractors with whom they cooperate on a regular basis. They are eager to get in touch with their readers. They value – and look for – feedback about their writing. They connect with other authors and share experiences, both in the business and craft aspects. They attend authors conferences. They have meetings with their readers.

Authors who do the above sell more books and make more money than those who try to perfect their craft in isolation and wait for the world to discover their genius.

Recap of How to Beat an Isolation as a Business Owner SeriesAre you aiming for excellence? Get out of isolation ASAP. Find someone you can discuss about everything with – especially about your worries and struggles.

Well, don’t do it in a random fashion. Your spouse may not be a perfect accountability partner or a coach. They are too close to be objective. Your mother had changed your diapers, so she may not take your business endeavors too seriously.

Look for your peers, someone you are looking up to (a mentor), or just a person good at listening, with a no-judgement attitude (a coach).

Each and every person who fits the above profiles will make a huge difference in your business (and life!).

Find an accountability partner, mentor, coach or join a mastermind. As soon as possible. The best time for that was 10 years ago, the next best time is NOW.

Don’t isolate yourself. Do yourself a favor and join a pack, so you can thrive.

Read other articles in the How to Beat an Isolation as a Business Owner Series:

Three Collaboration Success Stories in My Business

How Not to Be Lonely at the Top

Solopreneurship Is a Myth

February 10, 2023

How Not to Be Lonely at the Top

Isolation is the worst enemy. Collaboration is a path to success. OK, so how to actually get out of isolation as an entrepreneur?

There are four ways to do that, which I practiced myself and saw working. Plus, they are no secret, they were around for thousands of years, and they have been always working – because humans are social animals!

1. Accountability Setup.Get one person, just one, to keep you accountable for specific venue, goal or project. The most important thing in this method is consistency. If you are to meet once a month for an hour, do it once a month – every month. If you are to call each other every morning at 8 am, put it in your calendar and stick to the schedule.

The higher the frequency of the touch points, usually the better efficiency you achieve. I’m a firm believer in a daily accountability. It’s so easy to lose a project from your sight, if you have the whole month before the next touch base. Especially, if this is some side gig. However, daily interactions keep the project in front and center of your mind.

I saw that from the front row over 120 times as an accountability coach.

I’ve had an accountability partner since January 2021, and it worked great for both of us.

2. Mastermind.What is it? A few people meeting regularly and talking about their businesses. It’s different from accountability setup because it’s more than just accountability. Masterminding includes poking holes in your plans, pointing out your blind spots, and providing contacts and resources.

Daily mastermind is an overkill. The meeting should take about an hour, maybe even two, if the group is bigger. However, frequency still makes the difference. Weekly masterminds will provide more benefits than monthly ones.

3. Mentoring.Find someone wiser and more successful than you and spend time with them. Preferably, your mentor has the experience in your line of business.

In the official mentoring setup, your meetings should be focused on your business. However, if you just want to pick a mentor’s brain, you can do this in a social event, or even over a lunch.

4. Coaching.Coaching is not what most people think it is. It’s not transferring someone’s knowledge or expertise from them to you. It’s transferring your own knowledge or expertise from you to you.

A good coach is a great listener, so you can articulate your thoughts in front of them. Sometimes, in coaching you can hear what is going through your mind for the first time ever. Your coach will also keep you on track, don’t allow you to slip into the realm of excuses, limiting beliefs, and complaining.

Photo by Theo Decker in Pexels.com

You will discover your own solutions, which will work exactly where you are and with what you have – right now. You will also own those solutions, which removes a couple of main obstacles: low motivation or rebelling against methods imposed on you.

Read other articles in the How to Beat an Isolation as a Business Owner Series:

Three Collaboration Success Stories in My Business

How Not to Be Lonely at the Top

Solopreneurship Is a Myth

January 31, 2023

Book Review: Before You Begin

Jacob Coldwell is quickly becoming my new favorite author. I was delighted with his book, Listen Simply. I was even more impacted by Before You Begin.

The only CON I found in this book (and Listen Simply shares this affliction) is the speaker’s framework it sticks to:

Tell them what you’re going to tell them, tell them, and tell them what you’ve told them.”

I don’t mind summarizing the message in points. In fact, it helps me to retain whatever I read and learned. However, I passionately dislike (bordering hate) a preamble to the message: “In this book or chapter, I’ll tell you…” Sheesh, just tell me the message! Don’t waste my time! And don’t spoil the fun!

Each and every one of those introductions fell flat on me, and the message itself was delivered in so much more an impactful and better way. Eliminating those sections would’ve shortened the book by about 20% and made the reading experience 100% better for me.

OK, apart from that disadvantage, this book is full of amazing

This advantage may be purely individual for me, but I cannot resist mentioning it. Before Jacob dives into his Compass Framework, he explains his personal discovery, which led him to inventing this framework:

No matter how much we resist, ignore, or act otherwise, we can’t control life. When we operate from the premise that somehow we can control life, we unnecessarily place a huge burden on ourselves.”

I had Before You Begin on my Kindle for a few months before I started reading it. The exact day I started reading it, I had a coaching session as a coachee, which revealed my hidden desire to be in control of my life. Thus, the above fragment was a perfect opening for me. I could really relate, and it made me highly curious about all that follows it in the book.

In another fragment of the book, Jacob tells about his 12-year journey and how it was worth it to struggle for so long to arrive at the point he is now. I totally get it. My journey has been 10-years long. I’m still far away from where I want to be. And the journey was painful.

It made the pain and suffering of the past redemptive.”

It made what ended up being a 12-year journey worthwhile.”

Change takes time. A lot of it. My personal philosophy and beliefs took decades to construct and solidify. It will take some years before I could dismantle and reconstruct them.

2. Simplified Complexity.Life is not simple. Far from that. Relationships, hardships, successes, failures, attempts, wins, health, career, finance, personal growth, meaning and purpose of life, accidents, tragedies, serendipity… Human life is like a fast-moving kaleidoscope, whirling colorfully.

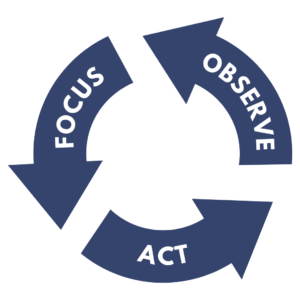

Yet, Jacob manages to break down the absurd complexity of our life into three simple steps: observe, focus, act.

Even the 1st step of the framework – observe – can introduce many positive changes in your life. Usually, we don’t take the time to stop and observe. We just react. The simple observation act can help you to detach from whatever goes on in your life, most importantly – from what’s going on in your head. Observation creates a space between your emotions and your reactions, so you can notice and recognize your emotions, instead of following them blindly.

Don’t get me wrong, emotions are needed and they always carry some valuable information, mostly about ourselves. But in the reactive mode they also severely cloud our judgement. You need to have high Emotional Intelligence (EQ) to manage your emotions in such a way that they don’t get into your way. Sadly, most of us aren’t that well EQ-skilled.

The first step to EQ is self-awareness. And observation is a great method to increase your self-awareness.

Two other steps of the Compass Framework are as useful as the first one. They can do wonders in isolation. In a loop, they do miracles.

3. Miracles.Before You Begin is full of great stories and real-life examples. This book is not a theoretical treaty. Jacob tested this approach on himself and practiced it with his clients.

The author skillfully sprinkles those stories throughout the book, so you will get not just dry knowledge, but also an inspiration to try this method in your own life.

4. Amazingly Deep Reflections.I highlighted over 40 fragments in this short book. Before You Begin reads more than well. It opens your eyes. Here is a sample of Jacob’s best:

The moments of life are always bigger than they appear. The tragedy is worth the redemption. “

Many people think they lack motivation when what they really lack is clarity.”

There is no way around the journey, and there is nothing wrong if “success” doesn’t happen immediately.”

5. Success.Typically we don’t say what isn’t true.”

Studying success is kind of a hobby of mine. At the end of Before You Begin, I found a few definitions of success that are both original and in accordance with what I’ve seen among top writers, artists, entrepreneurs, and sportsmen.

Success is being confident that if you stay the course, you’ll get to where you want to go.”

Why it is so important? Because knowing where you are going is not even half of the job. You need to actually go there, and it takes time. If you aren’t confident about your course, you will change it. Or you will quit. In the best-case scenario, that will delay your success.

Success also comes in the form of your being able to deal with uncertainty.”

This is huge. Uncertainty makes the process of progress so unpleasant. If I could deal with that, 80% of the struggle would have been gone.

Success is knowing that you can use what you have, that you have the ability to grow and get what might be needed, and the patience to hold off until later.”

Amen.

SummaryBefore You Begin is a great personal development book. If you, like me, find the writing style heavy, don’t let it stop you from reading this book.

It contains a universal framework that can improve your life in every area.

Give up the illusion of control in life. Observe. Focus. Act. Rinse and repeat.

In 10 or 12 years, or much faster, you may not recognize your life. You can redeem all your struggles and suffering into a new life, the life worth living.

Originally Published in Quora.

January 20, 2023

Three Collaboration Success Stories in My Business

In the first article in the How to Beat an Isolation as a Business Owner Series I explained how isolation turns smart business owners into morons. Today, read about the other side of the coin: success stories of collaboration in business.

I have an aesthetic taste of a brick and I didn’t know that. When I started my author career, my Fiverr designers created covers for my books according to my guidelines… and they were absolutely terrible!

While working on my third book, I’d already connected with other authors in Facebook groups. When I shared a mock cover for my next book, one guy from the group took pity on me and made a much better cover for me, for free. Then, he revamped covers for my first two books.

The results? With the release of Learn to Read with Great Speed, I finally broke the 100 sales in a month. When my fifth book became a bestseller three months later, I sold well over 200 copies of my previous books that month.

In September 2015, I joined a paid mastermind. The fee was $500 a month, and honestly, I couldn’t afford it. But I was invited personally by the millionaire who led that mastermind, and the first month was on him. In the worst-case scenario, I would’ve had a new experience.

Photo by ICSA in Pexels.com

David Rhodes, one of the mastermind’s members, got on a call with me and, within less than two hours, he examined the side gig I had and figured out how I can double my fees overnight. It was glaringly obvious when he presented the solution, but I simply couldn’t see that on my own. I’ve been in the Iron Sharpens Iron mastermind since then.

In December 2021, I got a new coaching client. She struggled a lot with her business. She was an excellent saleswoman, but everything else in her business limped along: cash flow, prospecting, time management, organization… Thus, she just had a 5-figure month in November and was left with one small project in December.

We worked every week, and I patiently pointed out all the blind spots I noticed. She started to track her finances, got a grip on her taxes, started prospecting consistently, and filled her pipeline.

I had no clue about her specific business. I just observed it from the outside with a fresh eye. Currently, she is getting new projects left and right, and she books new clients for November (it’s July!). Her revenue stabilized, and most importantly, she keeps more of it. Only because she had someone to talk with for an hour a week.

Read other articles in the How to Beat an Isolation as a Business Owner Series:

Three Collaboration Success Stories in My Business

How Not to Be Lonely at the Top

Solopreneurship Is a Myth

January 10, 2023

The Worst Enemy of Entrepreneurs (no, it is not the IRS!)

Photo by Startup Stock Photos in Pexels.com

Freelancers, solopreneurs, and business founders face the same enemy, and it is mostly invisible: isolation.

Isolation is the enemy of excellence.” – Aaron Walker

You are alone with your thoughts all day long. Even if you have a team, there are some limitations to what you can share with them.

Will they stay with you, if you admit you are not sure how you will pay their salary next month?

Wouldn’t the upcoming downturn in your industry scare them off to look for a job elsewhere?

So, you ponder those worries and issues alone, in isolation.

Small Business Administration says that problems with cash flow is the #1 reason why small businesses get out of business. I dare to disagree. Behind 95% of bankruptcy cases lurks isolation.

Entrepreneurs are human beings, and human beings are designed to thrive in a pack, not in isolation. Thus, alone, they do all kinds of stupid things, which they wouldn’t have committed, if they could share their burdens with others.

Let’s just have a look at some of the common cash flow issues. What are they? Let’s see:

-not separating your business and private bank accounts

-allowing third parties (a spouse who has no clue about your business!) to have access to your business accounts

-not tracking your incoming and outgoing money

-not setting aside funds to pay taxes

-allowing your customers to get away with late payments

-doing small “side gigs” for your customers for free

-underpricing your products and services

C’mon! Avoiding the above pitfalls is just common sense! Yet, a majority of businesses close their doors because they commit those obvious blunders.

Why? Because it is so easy to turn into a moron in isolation.

Almost all the other business afflictions can be tracked down to being ‘not excellent’ because of isolation: hiring the wrong people, taking the wrong customers, lack of clear marketing message, spending time on new projects without doing the market research, procrastination on important projects, putting out fires instead of preventing them… the list just goes on and on. And all the items on this list could’ve been avoided if you asked for feedback or shared your thoughts with someone else.

On the other hand, if you can get out of the self-imposed “loneliness at the top,” you can tap into your potential and grow much faster. Avoiding common pitfalls will obviously accelerate your progress, but so will new ideas and resources you will get access to thanks to collaboration.

Just one tiny example: a guy in the Smart Passive Income Pro community asked for recommendation of a cheaper email marketing provider. I recommended my provider – Bird Send. I’ve been saving about $25 a month with them over my previous provider. The guy who asked me is saving hundreds of dollars a month because of the enormous size of his email list. One answer, one resource can save you (or make you) a lot of money – but you won’t get them in isolation!

Alone you are blind, that’s why you are stumbling in the dark. You don’t know what you don’t know. Sometimes, you don’t even know what questions you should have asked.

However, your situation is clearly visible for others. They can point out your blind spots. They can help you excel. And I have success stories of collaboration in spades. Read about them in the following articles from this series:

How to Beat an Isolation as a Business Owner Series

Three Collaboration Success Stories in My Business

How Not to Be Lonely at the Top

Solopreneurship Is a Myth