Michal Stawicki's Blog, page 19

March 28, 2017

Thirty Eigth Income Report – May 2016 (-$176.4)

Are you curious about a one-year delay? I explained it in my first income report.

The beginning of May 2016 was crazier than usual, and that means quite a lot coming from me. During the first 6 days of May, I did a ton of prep work before the launch. I had been engaging my FB group; I wrote a book description and got it proofread.

During the first 6 days of May, I did a ton of prep work before the launch. I had been engaging my FB group; I wrote a book description and got it proofread.

I got the cover draft and put it for voting in various FB groups. I had been adding in the last-minute bullet points at the end of the chapters. I asked my friend to proofread those changes. I formatted the manuscript and created the draft version of the book in the KDP panel.

On 6th of May (well, it was 7th, 2 am in the morning for me), I published Making Business Connections That Count and hit a bed. It was the night from Friday to Saturday. I didn’t do much during the weekend; I only sent emails to my beta readers asking for reviews and posted a couple of FB live videos in FB groups.

The Buck Books promo was scheduled for Sunday, thus my frantic pace.

I went back to business on Monday after the Buck Books promo. I sent a broadcast to my email list. From then on, I slowed down to a normal pace.

The Cover Story

I have a funny (only in hindsight) story to relate about this launch. I got the cover drafts just a few days before the launch date. I harvested feedback in FB group during the night (for once the time difference between Europe and USA worked to my advantage) and sent my choice to HappySelfPublishing who did the cover for me.

The email got lost.

Luckily, I vented about the lack of cover in live video in FB group where the owner of HSP is active, and she went through their archive and sent me the cover in the morning. But I didn’t know about it, and I didn’t have a cover. I had to publish the book. I did it at 2 am, because I meticulously edited the cover, moving pieces of it over the image to cover the watermark of a stock photo. The image was crowded, and in the thumbnail size my very poor work wasn’t visible.

Find 10 differences

March 9, 2017

The 7 Money-saving Habits for Common Mortals

I have several money-saving habits. It’s hard to estimate exactly how much money each of those habits has brought me. But hands down, the most impactful is:

I have several money-saving habits. It’s hard to estimate exactly how much money each of those habits has brought me. But hands down, the most impactful is:

Paying Myself First

For years, I struggled with saving money. I had been saving a portion of my salary only to spend money on some substantial item like repairing my car after I drove straight into a tree; or something lavish like gambling on the stock market.

I had been earning good money—but I had no support from my family. I had no assets at the beginning and a family of five to support

My saving ratio was hoovering about 3-4% point. Then I read “Start Over, Finish Rich” by David Bach and got one main takeaway from it: pay yourself first.

The idea seemed a bit preposterous, our budget was tight and we had no leeway to put away a significant chunk of salary. What difference would have made saving money at the beginning of the month and not at the end of it, from leftovers?

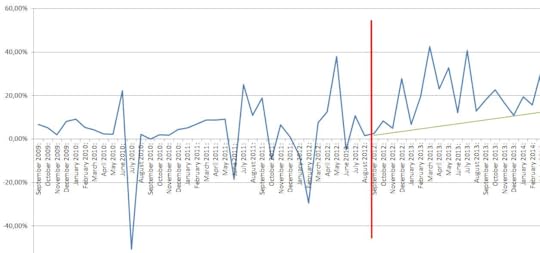

It did all the difference. (my saving ratio over time)

(my saving ratio over time)

In a few months’ time, my saving ratio skyrocketed to about 20%. Yet again I spent all of my savings when we bought our first house in 2014. For several months, we were almost as poor as during my time as a student—having two kids and on welfare. We survived on stipends, and student loans as our main sources of income.

But I rebuilt my savings… and spent them once again on the house renovation.  That was at the beginning of 2016.

That was at the beginning of 2016.

Still, I was able to save for those extraordinary expenses thanks to the “pay yourself first” rule.

I estimate that thanks to the difference between my previous saving ratio and the current one—plus the fact that my income grew by about 90% in the last few years—I ended up with equivalent of my 14 salaries in my pocket. I spent about 10 of them, but I could spent them in bulk on expansive things that improved quality of our life; not on trivia.

The Other Six Habits

No Addictions.

I don’t smoke; don’t drink alcohol; and never did recreational drugs. Those “habits” can consume a large chunk of your income.

The fact is, I’m no saint and I actually have a few “light addictions.”

I spent a small fortune on books and I have a hopeless sweet tooth. The last addiction I mentioned has downsized and became manageable in the last few years.

Paying With Cash.

I was about 30 years old when I paid with a debit card for the first time in my life.

Good for me.

Paying with a card can lull you into thinking that the money is not real. But the bills are real as well as the balances you have to pay.

Till this day, I prefer to pay with cash and I manually register every automatic/digital payment on an Excel sheet. It works wonders with your awareness—of where your money actually goes.

Not Eating Out.

I have family of five to feed. It’s much cheaper (and healthier) to buy ingredients and cook your own meals. In the last 5 five years, I’ve ate out maybe a couple dozen times—most of them when on delegation away from home.

No Impulse Buying.

Alright—let’s be honest—I do very little impulse buying although I’m not completely immune to the shiny promises of marketing.

But I’m totally not interested in brands and sometimes it works against me. I’ve bought the cheapest laptop in the store and I discovered it is absurdly slow. I have a lot of opportunities to practice my patience with it.

But 99% of time, it serves me well. I bought an old Mazda 626 about 10 years ago. I put into it almost double the initial price (half of which after that accident with a tree). But that’s still much less than half the price of a new car and I know quite a lot of folks who exchange a car every few years. That Mazda is a small fortune “saved”.

I don’t follow trends and I don’t chase shiny objects. I buy new items when I need them; not when I want them.

Tracking All Expenses.

I’m doing my best to register every single cent that’s going out of my pocket. I’ve tracked them in an Excel sheet since November 2012. I have quite a history in that file now.

Tracking sharpens your awareness. If you track your spending, it’s much harder to be ‘blissfully’ unaware how you spend your money and you think twice before wasting your money on trivial things.

Saving the Excess.

In 2015, I changed jobs and got a salary hike of 35%. I kept my expenses at the same level but did not dedicate all of it to savings.

I didn’t dedicate even a dime of it to pay bills or buy food. I spent a bit more on charity—saved 30%—and invested 20% into my business.

I used only about 40% of that additional increase on consumption, but not for trivial things. I was able to afford to buy my wife a gold ring, send my kids to summer camp, purchase a computer and four bikes.

I do the same with my royalties. I treat this income as additional to my base income.

I save it—invest it—or spend it bigger items like a mortgage contribution, buying a second car, or house renovation. I intend to do that with every additional dollar till I become financially independent.

What are your money-saving habits?

February 25, 2017

Thirty Seventh Income Report – April 2016 (-$764.2)

Are you curious about a one-year delay? I explained it in my first income report.

April 2016 was focused around publishing

Making Business Connections That Count

.

April 2016 was focused around publishing

Making Business Connections That Count

.Next to the everyday hustle of my day job and writing, I also completed a bunch of activities needed to publish a book.

I sent a broadcast to my email list asking for volunteers to beta-read the book. I incorporated their feedback and sent the manuscript to an editor.

I brainstormed some title possibilities, then consulted my email list about my ideas.

After deciding on a title, I ordered a cover design.

I created a Facebook group for my launch team and kept them engaged.

I twisted the arm of my mentor to write a foreword for my book.

When the manuscript came back from the editor, I approved her corrections. I also added some bullet points at the end of each chapter.

I scheduled the date of a Buck Books promotion for my launch.

I contacted some bloggers and influencers advocating the value of their contribution to the book launch.

And I did a whole bunch of other activities I didn’t note in my journal, like finding Amazon categories.

I love writing books, but publishing them with my crazy schedule is a pain in the butt. It significantly adds to my workload and leaves me exhausted.

Routine

After the season of Lent, I (most days) continued waking up at 4 am and working on my business before going to work.

I also continued my usual workload: writing 1,000 words a day (I wrote 32,000 words in April) and publishing at least one Quora answer a day.

I also tried to get traction on Medium. An article was quickly accepted by Better Humans publication, but another submission clearly got lost. I published a few articles on my own, but they got very little momentum.

Taxes

The tax office sent me an official note requesting a correction of my taxes. My accounting office mistook not only the amounts, but misunderstood—or misapplied—some regulations. Luckily, the tax office provided guidelines, and the corrections were straightforward.

In less than a month I received my tax return back. I had set aside a reserve fund, prepared to pay about 20% of my revenues in taxes, but it wasn’t necessary. I used this fund for investments and savings.

House renovation

My savings were quickly consumed by our home renovation. When we bought the house, it was habitable, but not finished.

In April we got a new facade. The construction crew we hired was awesome; they did the whole house’s facade within a week. And I paid them in cash from my book royalties.

The Income Report Breakdown

Income:

Amazon royalties: €479.75 ($542.12)

CreateSpace royalties: €22.63 ($25.57)

Draft2Digital royalties for 2015 and January 2016: $23.41

Coach.me fees: $33.46

Total: $624.56

Costs:

$150.75, VA’s remuneration

$30, View From the Top Community fee

$29, Aweber fee

$22.22, royalties split with co-author

$250, Business on Purpose mastermind

$15, promo of The Art of Persistence on The Fussy Librarian

$10.65, my business credit card yearly fee

$590, Making Business Connections That Count edition and proofreading by Archangel Ink

$100, Making Business Connections That Count cover

$191.14, my blog’s hosting

Total: $1388.76

Net Result: -$764.2

Ouch! That’s reality of book business. One month you earn 4 figures, the next you are several hundred bucks in red.

April was the beginning of the very sad period when I had to subsidise my business from my day job salary.

February 13, 2017

Text Me! Book Review

[image error] I enjoyed “Text Me!” very much. I’m in a good position to judge the content, because Kevin Kruse is doing the exact thing I’m doing. Only he is doing it much better.

I enjoyed “Text Me!” very much. I’m in a good position to judge the content, because Kevin Kruse is doing the exact thing I’m doing. Only he is doing it much better.

I’m a practitioner of what is taught in “Text Me!,” but I still managed to find numerous value bombs inside.

It is a very rare case when I simply cannot criticize a single thing about the book. Everything is perfect.

The book is short, but it does it good. Kevin didn’t have to fill paper with string of words because his publisher wanted a thick book. He said what he had to say in a concise format, but he covered the topic fully and in some depth.

First, the author preach the value of personal attention, Intimate Attention–as he called it–in a modern world of shallow or fake connections. For me, he preached to the converted, but if you really think that more followers and bigger email list are better (than a small and engaged list), you NEED to read this book.

I liked how Kevin mentioned many times the best practices of people we consider ‘too big to bother’ with personal connections with their followers. Multimillionaires, billionaires, rock stars, and other high profile folks are crushing it, one person at a time and story after story from the rich arsenal of stories confirmed that.

I found very useful the part about how big is each social media and for which particular demographics they work best. Kevin also very aptly described the current trends (“most Tweets [my own included] are automated click bait”).

Intimate Attention

I loved the glimpses into Kevin’s personal way of dealing with the Intimate Attention system in his own business. This is what I love the most about independent authors—they share their experience, not write textbooks. This is so important. A coaching platform with millions users mined their data and found that people who “have been there and done that” have FOUR times better chances to teach you a new skill, habit, or knowledge than ‘certified’ or ‘qualified’ coaches.

Kevin Kruse walks his talk and he is only a few steps ahead of me—an ideal role model.

And his lessons on how he deals with trolls, beggars, or complainers were enlightening.

The Value of Consistency

The real key isn’t volume, but rather consistency.

Kevin is absolutely right. I do in my business exactly the way he does. I reply to each email and message on social media.

But by no means, do I do it in the systematic way he does. I have no fixed schedule nor appropriate processes. And it shows.

I have 350 followers on Medium, 1900 on Quora, 650 on Twitter, and my email list consists of 1,300 names. His numbers are about 10 times better, because his consistency is 10 times better.

Pointing the Finger

I absolutely loved the honest way Kevin pointed out businesses and individuals who don’t walk their talk. Kevin paid thousands of dollars for product and services, but it meant close to nothing to providers. When he asked for contribution to his book, he got canned refusals.

I remember writing an article for Firepole Marketing in the same spirit three years ago. I pointed out businesses that assured on their websites that they reply to all messages and inquires. Some of them replied only to those that involved money. In most cases, their declarations were empty and I heard nothing back.

Firepole Marketing rejected my article, because “it reads too much like a rant—particularly in the mention of other bloggers and what they do.”

Well—unlike Firepole Marketing—Kevin wasn’t afraid to call the king naked.

Right Role Models

I also loved the part of the book with highly successful people’s mini-interviews. It provided more insight and perspectives about how Intimate Attention can be cultivated on different platforms.

I also noticed that every single one of those successful people said it was good for their business. Your Intimate Attention translates into money.

The Style

I’m a reader. I have read thousands of books in my life including about 1,000 non-fiction books. And I can tell you—Kevin Kruse is a great author. He knows how to write good books.

The content is actually useful and functional. Kevin illustrated practically every point in “Text Me!” with a story and this is the most effective method to leave a mark in readers’ memory.

When he jokes, he is really witty. I laughed out loud when he explained why giving his book the title “Intimate Attention” wasn’t the best idea.

When he demonstrated vulnerability sharing one of the stories of interaction with his reader, I cried with him.

Conclusion

After reading “Text Me!,” I’m seriously considering to dedicate an hour a day to connect with my audience.

True—I’m not in Kevin’s position yet; I don’t work full time in my own business. But if I truly want to grow it beyond the point where it will become my main source of income, I’d better pay more attention to the way I give my attention to my readers and clients.

There is verily no other way than connecting—one person at a time.

February 10, 2017

Thirty Sixth Income Report – March 2016 ($1012.92)

Are you curious about a one-year delay? I explained it in my first income report.

Life in March 2016 was routine and relatively uneventful.

Life in March 2016 was routine and relatively uneventful.

I hustled as usual, though the amount of time needed for my day job was still challenging (I found a couple of entries in my journal mentioning work at night).

Quora

My main focus was still Quora. That seemed to be the right strategy.

On the 17th of March, a friend forwarded me an article from Business Insider. One of my Quora answers was featured in it; I was named an author and they even provided a link to my Amazon profile. Wow, I spent a few months in 2015 trying to get into big publications—to no avail—and thanks to my hustle on Quora I had been ‘published’ in Business Insider.

To add a cherry on top, two days later my answers crossed the half a million viewings mark. Thanks to that exposure I really felt like a worthwhile author.

Oh, one more thing connected with Quora happened: I was contacted by an Indian personal development magazine and they asked me to write an editorial article for their issue about shyness.

Book Sales

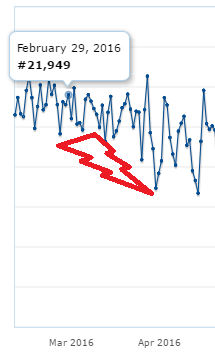

Not even dwindling sales changed my positive mood. And dwindling they were. The honeymoon period for Bulletproof Health and Fitness was long over and the sales trend was clear: down and down.

Not even dwindling sales changed my positive mood. And dwindling they were. The honeymoon period for Bulletproof Health and Fitness was long over and the sales trend was clear: down and down.

These sales statistics motivated me to continue work on my next book. I gathered feedback from beta readers, including my mentor Aaron Walker, edited the manuscript, polished it (as much as I could, which meant it still was very raw) and sent it to Archangel Ink for further processing at the end of the month.

Writing

The whole month I wrote mostly answers for Quora. I dedicated a week’s worth of writing sessions to an editorial article.

Lent

My plan—to wake up at 4 am work and go to the breviary prayer with my church community—went fairly well. On checking my journal entries from March, I’m amazed how much I was able to achieve before 6 am.

Varia

I still had a proofreader back in March (in the good ol’ times) and every few days I was sending her a few thousand words to proofread. I didn’t post my Quora answers without proofreading.

An accounting office almost finished work on my taxes. I had to revisit them, because they made some obvious mistakes in their calculations. It appeared they made errors when converting a couple of currencies.

Reporting global sales, especially if they are in fractions of dollars, is a pain in the ass. My tax adventures didn’t finish there, either, but hopefully all those hurdles have prepared me to do it better and faster this year.

That’s It

No big events. I just kept my face to the grindstone and plugged away. Priorities were clear: Quora; Lent; taxes; using opportunities as they arose and continuing the publishing process of the next book.

The Income Report Breakdown

Income:

Amazon royalties: €1081.91 ($1218.46)

CreateSpace royalties: €49.16 ($55.06)

Draft2Digital royalties for 2015 and January 2016: $119.75

Coach.me fees: $31.54

Total: $1424.81

A notable new position in my income report is Draft2Digital. Unfortunately, “the rest of the world” sells less than 5% copies I sell on Amazon. Usually much less.

Costs:

$150.87, VA’s remuneration

$30, View From the Top Community fee

$29, Aweber fee

$30.30, royalties split with co-author

$23, my editor’s income share in Bulletproof Health and Fitness

$22.12, Kindle business books of my mentors

$126, a payment for accounting office

Total: $411.89

Net Result: $1012.92

January 24, 2017

Thirty Fifth Income Report – February 2016 ($794.85)

Are you curious about a one-year delay? I explained it in my first income report. At the very beginning of February 2016 I invested $200 into producing my first audiobook. I decided to create it for A Personal Mission Statement: Your Road Map to Happiness, my first book ever published. It was very short, so […]

The post Thirty Fifth Income Report – February 2016 ($794.85) appeared first on ExpandBeyondYourself.

January 14, 2017

Goals for 2017

Goals. Once again. *sigh* Check out my first goal-post from 2014 to see what I feel about goal setting. Ambivalence is a mild word. In the last post, I revealed how well—or not, I achieved my goals in 2016. As usual, when it comes to me and my goals, it wasn’t a pretty picture. My […]

The post Goals for 2017 appeared first on ExpandBeyondYourself.

January 10, 2017

Goals 2016 Revisited

There is only an 8% chance you will succeed with your New Year’s resolution. Well, that’s the average of course. If you are an expert in habit building and know what you are doing—and most importantly have succeeded in the past—your chances are much higher. But most folks who make a New Year’s resolution are […]

The post Goals 2016 Revisited appeared first on ExpandBeyondYourself.

January 4, 2017

Thirty Fourth Income Report – January 2016 ($833.33)

Are you curious about a one-year delay? I explained it in my first income report. January 2016 started on a high note. When I checked my sales on the 2nd, I found I’d sold over 100 copies on the 1st of January. That was the first time ever that I’d sold over 100 copies of […]

The post Thirty Fourth Income Report – January 2016 ($833.33) appeared first on ExpandBeyondYourself.

Thirty Fourth Income Report – January 2016 ($834.43)

Are you curious about a one-year delay? I explained it in my first income report. January 2016 started on a high note. When I checked my sales on the 2nd, I found I’d sold over 100 copies on the 1st of January. That was the first time ever that I’d sold over 100 copies of […]

The post Thirty Fourth Income Report – January 2016 ($834.43) appeared first on ExpandBeyondYourself.