Kenneth Boyd's Blog, page 53

December 30, 2018

Xero vs. MYOB Review: Which Accounting Software Is the Better Choice?

The accounting software you choose can make or break your business.

Managing a business requires you to make dozens of important decisions each month, and you must constantly adapt to change. As your company grows, you’ll sell more items, hire more people, and process more transactions.

You need accounting software that can handle every type of business transaction, and software that is user friendly and easy to navigate. All of your systems must be designed to handle growth, including your accounting software.

This discussion compares Xero and MYOB accounting software, and which system I think is the better choice for business owners.

Are They Established?

For starters, you should know that both software packages are well established and have thousands of users. Each package is reasonably priced, and offers a good level of customer support.

In addition, both companies offer the ability to log in from a Mac, PC, tablet, or phone, and both systems can connect with dozens of other apps, and with your bank account.

Banking, Cash Management

No business can operate without sufficient cash, and your accounting software can help you monitor your cash balance, your customer receivables, and upcoming expenses.

Both systems offer a link to a bank account, and you can download activity from your bank to your accounting system. This feature allows you to match bank statement activity with your accounting transactions.

If, for example, you download information on three debit card transactions from your bank, you can match the bank activity with the expenses in your accounting software.

For example, here is the Xero cash, expense, and receivable dashboard:

Essentially, this process allows you to reconcile your bank account as bank activity is updated online. This is extremely valuable, because you can correct errors without waiting until the month end bank statement.

MYOB offers several more cash management features than Xero.

Invoicing

Both systems allow you to create invoices, and the fields for client, product type, and other data can autofill in the invoice. Even more important, you can be notified when a customer opens the email with the invoice, and customers can pay by credit card or debit card automatically.

Purchase Orders

Here is Xero’s purchase order screen:

Similar to the invoicing system, both software packages can autofill information into a purchase order (PO). After an automated approval, the PO can be emailed the supplier. You can sort POs by delivery date, expected arrival date, and by other criteria.

Expense Management

With each system, you can take a photo of a receipt or other expense, and link the photo to a formal bill. Once the bill is created, you can link the paid expense to the downloaded bank activity.

Below is a screenshot from MYOB’s system:

If you need to reimburse an employee for an expense, you can set up an approval feature for that particular bill.

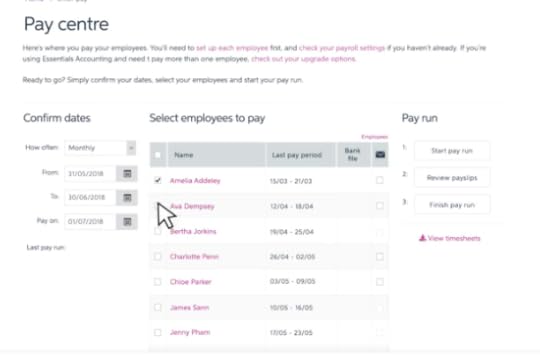

Inventory, Payroll

You can track sales, units in inventory, and items ordered for inventory delivery in real time. When you sell an item, both software packages will post to the sale (revenue) account, inventory account, and cost of sales accounts. Businesses can track average cost per unit, with is needed to calculate profitability.

Both systems offer payroll functionality, which can be the most time-consuming task for a business owner. You can maintain employee names, pay rates, and process payroll through the software.

Pricing

Both systems offer multiple pricing levels, and the differences are not substantial. On a monthly basis, the difference in cost between the two systems may be $10 a month of less. I can’t recommend one system over the other based solely on price.

My Recommendation

I recommend Xero over MYOB, because the screens are clearer and less cluttered, and I found Xero’s navigation process to be easier.

Best of luck in your business!

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

Image: Bullseye, Jeff Turner CC by 2.0

The post Xero vs. MYOB Review: Which Accounting Software Is the Better Choice? appeared first on Accounting Accidentally.

December 28, 2018

Financial Issues in Divorce

Divorce can be an extremely difficult process.

A divorce can create profound difficulty, with emotional and psychological repercussions. It’s important to remember, however, that divorce can also produce financial difficulty for both parties

When you marry someone, you agree to share all of your money and assets. When you break up, the assets have to be divided again. Here’s a little more information on the ins and outs of divorce and finances that can help you get through the process.

Legal Help?

Divorce is a legal process and, consequently, you may need help from a legal professional to see the process through.

If your marriage has ended on positive terms, you may come to mutual agreements and deal with the financial split yourself. But if not, a divorce attorney will be able to help to ensure that each person gets what they are rightfully entitled to. This can make the process a lot more streamlined and much faster.

How Assets Are Split in Divorce

If things do go to court, it’s a good idea to be familiar with how courts split assets. There are several factors that can determine how money is shared, including:

How long you and your partner have been together

Your age

Your ability to earn

Your role within the marriage

The lifestyle you have both become accustomed to

Dividing Property

While you will both have a right over your shared property, you clearly cannot just halve the property. So, who gets to keep it? Well, if one person isn’t willing to let go of the property, the court will encourage you to sell it and split the sales proceeds equally.

Maintenance

Sometimes one partner will earn a whole lot more money than the other, or the other spouse may not work out of the home. In situations such as this, the partner who doesn’t work, works fewer hours, or earns less, may contribute to your shared lifestyle in other ways, including child care.

Generally speaking, the court will encourage the person who earns more to contribute maintenance payments that will allow the other to maintain the same quality of life that they were used to within the marriage. These may be set for a period of time, or they may continue until the person receiving the payments enters into a new partnership.

How To Recover

If you go through a divorce proceeding, here are some steps you can take to recover financially.

The reason that people don’t diet, don’t exercise, and don’t resolve bad personal relationships is that change is hard. As a result, we don’t really, truly change and grow unless we’re in real pain. When we’re at that point, the pain of change is less severe than that pain of not changing.

Discipline and time

With discipline and time, I think most people can accumulate far more wealth than they think is possible. But growing wealth requires change- which is precisely why most people don’t make the effort. The changes I’m suggesting involve an old friend:

Delayed gratification

Some decisions are relatively small:

Dropping a subscription music service and just listening to the free version (Pandora, for example).

Making coffee at home two days a week, which means that you stop by Starbucksless often.

Buying afew more generic products when you go to the grocery store and Target. (I’m not going generic on salad dressing, however).

Since these are smaller decisions, the amount of gratification you’re delaying is small. You don’t mind listening the commercials on Pandora (I certainly don’t- I just turned down the sound), and the coffee at home isn’t bad.

Other decisions are much bigger. StudySoup wrote this great article on the average amount of money a college student saves by having a roommate. The average savings over four years is over $15,000. Now, having a roommate is a big sacrifice, because you lose a fair amount of privacy. If privacy is really important to you, it’s a true delay of gratification (until you graduate, get a job and can afford to live alone).

So, what do I get?

OK- so what do I get out of all this delayed gratification?

You build wealth- which can give you peace of mind.

Here’s a practical example: By making changes to your spending and building a savings account, you create a $1,000 emergency fund. If your car brakes down, you can pay for the repair.

Decide Carefully

As you can see, finances are a large part of the divorce process, and you need to ensure that you don’t leave your marriage with less than you’re entitled to. Hopefully, this information can help you to get what you deserve.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Financial Issues in Divorce appeared first on Accounting Accidentally.

How To Quickly Sell Your Property

Selling a property can be complicated, but you can increase the value of your property with these smart decisions.

There are several reasons why you may want to increase your property’s value:

Your investment property just isn’t increasing in value as much as you would like

You want to sell your property, and use the sales proceeds for some other purpose

You’re launching a new business venture, and need the sales proceeds to fund your startup

Selling a property can be a complex process, especially when you want to achieve a fast sale and generate a reasonable profit. The fact is that some properties that are simply not attractive enough for buyers, and you need to improve the property.

With that in mind, here is a guide to the steps that you need to take to ensure a quick sale and a high profit. For everything that you need to know, read on!

Make It Neutral

If the property that you are aiming to sell is packed full of patterns and colors, then you may want to consider neutralizing the space with a selection of calmer, more neutral tones to create a simpler space.

Everyone has their own taste in decor, which is why it’s important to make your property look and feel as neutral as possible, allowing a buyer to visualize themselves living there and making the space their own.

Take the time to redecorate the property, sticking to cool neutrals throughout. You can either hire a professional decorator to deal with this for you, or you can opt to go down the DIY route and deal with the painting and decorating yourself. The option that you opt for will, of course, depends on you budget.

Personalization?

One important aspect of selling success is removing personalization in the property.

The issue is that when a buyer sees the old owners’ personal things dotted around, it can make it hard for them to visualize themselves building a home in that place, and so by removing all personal effects you can create a sense of neutrality, allowing them to imagine what it would be like to live in your property.

Useful Services

The good news is that when it comes to selling your home, there is plenty of help and support available.

You aren’t alone – there are various services that you can opt to take advantage of and use to speed up the selling process. For instance, you could opt to use a site like Buying NM Homes to list your property, to help speed up the number of viewings, and to potentially sell your property.

There are various other useful services to take advantage of, from the services of a professional appraiser to the assistance of a realtor who specializes in your geographic area.

Update?

The last thing that you want is potential buyers visiting your property and thinking that it’s outdated and hasn’t been properly maintained, as this could put them off of making an offer.

If your property is older and slightly outdated, you will find it much harder to sell it at a good price. So it’s worthwhile taking the time to plan some updates to your property, to ensure that it’s not outdated, and that it looks as modern and well looked after as possible.

Wondering what areas to focus on when it comes to the upgrade? Areas such as bathrooms and kitchens are a good option, as an outdated kitchen or bathroom is not a nice space to have, so investing in these areas could be a worthwhile investment to make.

The fact is that if you want buyers to want to purchase your home, it’s vital that you take the time to upgrade any areas of your home that need changes, to increase your chances of getting a fast sale at an reasonable price.

Take Action

If you’re selling up and want a fast sale and a good price, it’s important that you take the time to take note of the tips and advice above.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post How To Quickly Sell Your Property appeared first on Accounting Accidentally.

December 20, 2018

Freelancing Careers That Pay More Than You Think

Working as a freelancer can be a financially rewarding career, and many businesses are looking to pay high rates to freelance experts.

When some people think of freelancing, they often believe that freelancers are broke. They think of careers that historically always paid pennies, such as struggling writers, authors, illustrators, and artists.

Although it’s still the case that many freelancers don’t make anywhere near the amount they deserve for their hard work and talents, it’s simply not the case that all are barely keeping their heads above water.

In fact, there are many freelancers out there who easily make a 6-figure income by working in less stressful environments than they once did as full-time employees.

Here are some of those careers that pay well, if you do expert-level work:

Copywriting

Although everyone can write, it doesn’t mean that everyone is a good writer, or that they enjoy the process.

Copywriters are people who write copy (blog posts, articles, white papers) that is designed to promote and sell a product or service, and they have a specific skill set.

Business owners who value their business and want to make more sales understand the need for effective communication, including the written word. To get their message out, owners bring in copywriters who work as freelancers, and they’re willing to pay well to get quality work completed.

If you know how to market your copywriting services (website, links to writing samples) and can actually get results for your clients, then you’ll have an easier time making a great income in this profession.

Graphic Design

Like copywriters, graphic designers have a very specific skill set that not everyone has.

If people want a good looking website, brochure or other type of marketing materials for their business, a graphic designer is who they’re going to use.

If you’re someone who’s great at designing, and putting colors and visual pieces together in a appealing way, then you could make a great career for yourself as a freelance graphic designer.

Consulting

Freelance consultants exist in every industry, from marketing and finance to areas such as taxes and senior legal services.

If you’ve got experience in a certain industry, and would like to turn this into a career where you can advise businesses and individuals, consulting is a great career choice for you. If you can make a positive impact, you can earn a high level of income and be in demand with amazing clients.

Teaching a Foreign Language

With the internet making it easier for us to connect with people from all over the world, there are more opportunities for working online. If you know a foreign language or even would like to teach English online, then you can do this without ever having to leave your house.

Assess Yourself

Before making the leap and becoming a freelancer, take a realistic look at yourself, and the type of work environment you prefer. If you’re comfortable working alone and with a minimal amount of direction, you can succeed as a freelancer.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Freelancing Careers That Pay More Than You Think appeared first on Accounting Accidentally.

December 19, 2018

3 Ways to Get Out of Debt and Improve Credit

Getting out of a tricky financial situation may seem like an uphill battle.

Your finances are already suffering, yet you’re supposed to pay both interest on what you owe and continue to fund your savings account somehow. If you’re earning less money than in past years, the problem can feel even worse.

Even though the situation may seem a bit hopeless, many people have managed to climb out of the debt hole. Here’s a handful of tips to get your personal finances back on track, so you can feel a bit more positive about the future, and get a full night of sleep for once.

#1 Negotiating With Creditors

Even though you’re the one who owes money, you can still negotiate with the creditors and come to an agreement that works for both parties. All they want, after all, is to have a plan so that they know when to get their money back – and that’s why you actually have a bit of leverage to negotiate with.

See if you’re not able to offer them a lump sum of money if they’re willing to write the rest of what you owe off. It may seem too good to be true but, by paying them a lump rather than little by little, the creditors are guaranteed to get some of their money back rather than chasing you down for the next decade.

If you don’t have any cash to offer them up front and nothing to sell, at the moment, which may solve the situation for you, there’s always an opportunity in Utah Money Center as you can use this money as leverage.

Just remember that you’ll need to stay on top of your debt from now on, build a better credit score, and always make those repayments on time.

#2 Build An Emergency Fund

While it may seem like a distant dream at the moment, building up a backup fund to have in case of emergency is exactly what you need for situations like this. It’s something you need to focus on as soon as you’ve got that phone call to the creditors over with.

The sooner you’re able to put money aside for rainy days, the better you’ll feel about the future.

The trick is to have about six months worth of expenses saved up, in case you should lose your job or have any other unexpected expenses. If this happens and you don’t have an emergency fund, you can be pretty sure that you’ll wind up in the same situation after just a short month or two.

#3 Working Out a New Budget

How you ended up with a bad credit score and debt is, of course, something you know better than any – but working out a new and better budget will give you a fresh start.

Have a look at this article to get started right away, and remember to work in the payments you have to make to your emergency fund as well.

They call it ‘paying yourself first’ to make it sound a bit better but it is, in fact, a payment you will have to prioritize in order to keep yourself out financial trouble.

Start Now

It won’t be easy, but the sooner you get started, the better you’ll feel about the future as well as your own ability to cope with difficult times.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post 3 Ways to Get Out of Debt and Improve Credit appeared first on Accounting Accidentally.

Smart Tips For Buying A Home

Whether you’re a first time buyer or you want to trade up and move to a bigger property, the chances are you are eager to get on with your home purchase.

Moving can be one of the most stressful things you undertake as an adult, but it doesn’t have to be. Financial concerns, logistics worries, and emotional issues can build up during a house move. However, when you’re thinking about purchasing a new pad, you should be following a strategy that will help reduce your stress as much as possible.

Take a look at this simple guide to making your house move go smoothly.

Do Your Research

Just because you have found a home that is cheap doesn’t mean that it’s a good deal.

The main facet of your home search should be location. You can always change the layout and decor of a dwelling, but you can never change where it is situated. If you see a designer show home but it’s in the center of a crime-ridden locality, it isn’t going to be for you.

Seek out a location that is established as producing prime real estate. This way, you can be sure of a sound return on your investment when it’s time to sell up and move on in a few years time.

Go onto property websites and check out the market forecasts for the future, as well as the history of any property that you might have your eye on. If it’s been sold three or four times in the past couple of years, the chances are that it’s not quite the dream home that you are looking for.

Critical Finance Issues

When you are thinking about your house purchase, you must seek out the most favorable mortgage for your requirements.

Both fixed and variable home loans have their merits, and it’s important that you choose the one that will allow you to manage your mortgage payments.

To prepare for your application, ensure that you limit your spending on big-ticket items for at least three months before you plan to apply for a mortgage. Ensure that you clear your credit card debt and don’t dip into your overdraft. You need to show the home loan lender that you are the epitome of a responsible borrower.

The Big Day

When you move, ensure that you have all of your ducks lined up in a row.

Your moving truck company should have been booked in advance, and you should have your phone next to you for your realtor to call and confirm the transfer of funds for the purchase.

In addition, your boxes should be packed waiting to be transported. Ensure that you have a pocketful of cash and a small box packed full of essentials to make the journey easier, and say goodbye to your old home. Remember, a home is the people you make it with, not bricks and mortar.

Plan For A Smooth Move

Banishing the stress from a home move isn’t easy. However, if you prepare your finances, plan your moving day, and approach your house search with military precision, you could be moving to your dream home in no time.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Smart Tips For Buying A Home appeared first on Accounting Accidentally.

December 18, 2018

4 Life Actions That Impact Your Personal Finances

Even the most organized person may not have all of their personal finance details in place.

You consider yourself to be a pretty organized and sensible person. When it comes to thinking about your future, you might think you have it all figured out. However, there are some financial decisions that you may not have considered.

The definition of financial stability includes more than where your next paycheck is coming from. You need to put plans in place, so that your love ones know what to do, should you pass away or become disabled.

Getting your finances in order and preparing for your future, however, requires some time and effort. Here are some important steps to take now.

1.Your Will

Planning for the disposition of your money and estate can be a hugely complicated process, especially when you’re new to everything.

You can never be too prepared when it comes to getting your will together, no matter how old you might be. Take a look at the following website and see how you could start preparing for your future.

Invest the time to ascertain your goals, evaluate your assets, and figure out what you would like to do with your possessions. Over time, these choices can be amended, so work with an attorney to set up a will.

2. Saving For Your First House

The reason that people don’t diet, don’t exercise, and don’t resolve bad personal relationships is that change is hard. As a result, we don’t really, truly change and grow unless we’re in real pain. When we’re at that point, the pain of change is less severe than that pain of not changing.

If you find saving for your first home to be difficult, read on.

With discipline and time, I think most people can accumulate far more wealth than they think is possible. But growing wealth requires change- which is precisely why most people don’t make the effort. The changes I’m suggesting involve an old friend:

Delayed gratification.

Some decisions are relatively small:

Dropping a subscription music service and just listening to the free version (Pandora, for example).

Making coffee at home two days a week, which means that you stop by Starbucks less often.

Buying afew more generic products when you go to the grocery store and Target. (I’m not going generic on salad dressing, however).

Since these are smaller decisions, the amount of gratification you’re delaying is small. You don’t mind listening the commercials on Pandora (I certainly don’t- I just turned down the sound), and the coffee at home isn’t bad.

OK- so what do I get out of all this delayed gratification?

You build wealth- which can give you peace of mind.

Here’s a practical example: By making changes to your spending and building a savings account, you create a savings account to purchase that first home.

3. Starting Your Business

If creating a business is something you have always dreamed of doing, it’s never too early to get your plans into place.

Start crafting a clear and concise business plan that outlines every detail of your idea. You will need a certain amount of capital to put into your business, but once your thoughts are on paper, you will be able to get started.

4. Making a Ten-Year Plan

A good ten year plan maps out everything you want to achieve in your life over the next decade.

You can never been too young to have a solid ten-year plan in place, so start thinking about it right now. Do you want to have a family? Own a certain car? Earn a particular amount of money? Write down all of your goals and you will be more likely to attain them in the future.

Feel Better- Plan

So think about all of these notions and put them into action as soon as possible.

Even if you’re a young millennial now, you won’t always be this way forever. You can conquer your goals and get organized for your future in a whole host of different ways. As soon as you have completed these steps, you’ll feel a lot more prepared for anything that comes your way.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post 4 Life Actions That Impact Your Personal Finances appeared first on Accounting Accidentally.

December 17, 2018

Unexpected Costs of Selling Your Home

How much does it cost to sell your home?

Selling your existing home to move to a new one can be very exciting. However, it can be expensive- and you need to be prepared for the some unexpected costs. Read these tips to get clarify on the costs you’ll incur when you sell your home

Closing Costs

Most people know they have to pay closing costs as a buyer, but as a seller, you will have some to pay too.

In addition, you’ll have to pay escrow expenses, as well as a pro-rated amount of property taxes and possibly homeowner’s association fees. These costs are often unexpected, if you’re on the selling end of the transaction.

Realtor Fees

When you sell your home through a realtor, they will charge a fee which is usually about 6% of the selling price. Your realtor may then split the fee with the buyer’s agent. You can sometimes negotiate a lower percentage, but the realtor may be less involved, and that can make it harder to sell your home.

Taxes

Not all cities or states will charge transfer fees, but where they do you can expect to pay a small percentage of the selling price. The average transfer tax in the US is $750.

If the house you are selling is a rental property (and not your main residence), you may need to pay capital gain taxes on the profit. In many cases, the gain recognized on your primary residence is not taxed, if you buy another home with the sales proceeds.

There are many 1031 exchange properties for sale, but for this to work, there are guidelines and rules you have to follow. Seek professional tax advice before you enter into a property transaction.

House Staging

Staging your house for the buyers market can cost anywhere for a few hundred to a few thousand dollars, depending on how much work you need to do, so you will need to factor it into your finances. There could be painting inside and out, carpet cleaning and some repairs. A house has to be in good condition if it is going to sell quickly and the staging to show it off can be vital.

Title Insurance

If there is anything not quite right with the title to the house, the buyer is entitled to title insurance. The seller typically has to pay for the insurance, and the premium is typically between $750 and $1,000.

Utilities

You’ll have to pay the final utility bills when you move out, so that no balance remains when you leave.

Attorneys Fees

A real estate attorney is not always needed, but if they are you can expect a bill of around the $1,000 region.

Be Ready

These costs can mount up, and unless you are going to have enough cash proceeds from the sale of your house, you will need access to other funds to cover these expenses.

You also have to consider the cost of the actual move. Moving companies generally make the whole experience easier, but their services do not come cheap.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

Image: Bullseye, Jeff Turner CC by 2.0

The post Unexpected Costs of Selling Your Home appeared first on Accounting Accidentally.

December 6, 2018

Shocking Product Development Mistakes You Can’t Afford To Make

Imagine you spend months, maybe even years, developing a new product.

It’s something you’ve poured your heart and soul into – not to mention a fair amount of cash. You’re excited to release it, hoping that the sales will fly so high that dollar signs appear in your eyes. But, when the product gets released, things don’t go as planned. It ends up being a total failure, and you’ve lost so much money.

For a lot of entrepreneurs, this is a situation that they’ve lived through.

All their hard work and effort goes to waste, and it can often end a business. When you take a look at why things failed, it tends to come down to at least one of these product development mistakes:

#1 Not Enough Product Testing

It’s essential that you test your product to make sure that it does what you tell customers it will do.

One or two tests isn’t going to cut it.

You can easily get different results from test to test, which is why this needs to be a continuous process. You also need to get different people to test your product, so you can see their experiences with it.

Person A, for example, might find it easy to use, while person B and C really struggle with one particular thing. Now, you can go away and fix that issue, so everyone is happier.

Keep testing your product throughout the development cycle as it helps you adapt the final version and iron out faults. Then, make sure you check the final product thoroughly to guarantee it will work.

#2 Not Safety Testing the Final Product

Testing your product to see if it works is one thing, but checking it to see if it’s safe is another.

There are thousands of potential issues with a product that can make it unsafe and cause injuries. Read any legal blog and you’ll find examples of products that have caused personal injuries and led to massive payouts that damage a business.

It can be a problem with the design that causes physical trauma, or there could be unsafe ingredients in a product that cause health issues. Either way, you need to safety test your product when the final version is ready for release. Get it safety certified and you’ll be good to go.

#3 Failing to do Market Research

Your market research must take place before you even think about thinking about developing your product.

You need to find out four things:

Does your product solve a problem?Do customers feel that the problem is urgent?How much are clients willing to pay for your solution?How big is the market for your product?

In essence, it’s the first stage of product development, because research shows whether or not there’s even a place for your product in the market.

A lot of people have a product idea and go straight into design and development. Then, when it’s ready, they start with the market research -only to find out there’s no place for it, and the demand isn’t there.

You must conduct extensive research to understand who will be interested in your product, how you can market it, and the key selling points. Then, you can design something that will actually be in demand.

#4 Only Marketing the Product After Release

Perhaps the most common error is marketing your new product after it’s released.

You’ve done the research, used it to help create the ideal product, tested it loads, and it’s ready to sell. The problem is, no one knows about your product other than a small group of people.

It’s vital that you work on marketing this thing way before it’s released.

There should be a lengthy build-up to the release date where you’re creating tension and spreading the word about this item that people really need. Your marketing strategy needs to place your product as a solution to a problem – something that will make a difference in someone’s life. Then, let people pre-order it -this is another thing that gets neglected.

Pre-orders mean you can essentially make sales before it goes on sale. When the product is ready, you know there are people with money already willing to pay.

#5 Rushing everything

The final mistake is simple; you’ve rushed everything.

From start to finish, all you’re concerned with is getting your product on the market quickly. You’re eager to see the cash, so you cut corners here and there.

Don’t ever do this!

Yes, you don’t want to drag things on forever, but know that slow and steady wins the race. Take your time, and you won’t miss glaring errors that can ruin your product if you release it.

If you’re about to create a new product, then make sure you don’t make any of these shocking mistakes!

You Can Pivot

Nearly all successful companies pivot.

After a failure, they find out why the product or service didn’t sell, and they make changes to create a more appealing product. Many companies pivot repeatedly, until the find the right customer niche.

Use what you’ve learned and pivot to create a successful business.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA

Exam for Dummies and 1,001 Accounting

Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog)

http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Shocking Product Development Mistakes You Can’t Afford To Make appeared first on Accounting Accidentally.

December 4, 2018

Why You Need to Take Out Life Insurance

Expect the unexpected.

It’s important to remember that certain situations in life can occur and they can really take you by surprise. Fortunately, there are certain things that you can do to protect yourself from unforeseen incidents or scenarios.

One option is to take out insurance policies.

Cheap Insurance?

There is no such thing as “cheap” insurance.

Why, then, do you see so many ads about “saving money on XYZ insurance?”

Consider this explanation and draw your own conclusions…

First, understand that insurance is one of the most heavily regulated industries, and each state has detailed rules about how insurance is offered, priced, and sold to consumers. Second, insurance companies hire more college math majors than just about any other industry.

Why?

Insurance is all about risk and probability, and these factors are evaluated by math majors- who become actuaries. Take car insurance, for example. The insurance company has a pool of people that are sold car insurance, and the premiums generated each month are supposed to cover insurance claims, business costs, and generate a profit.

What’s the risk that someone in the pool will have an accident? It’s based on historical data, probability, and other math calculations.

Given the heavy regulation and math component, there really isn’t “cheap” insurance- only insurance that covers less, or pays out less often. That cheaper insurance policy you see advertised may not cover all of your car’s damage if it’s totaled- only up to a dollar amount.

It’s not cheaper, it just pays out less in claims.

What Is Life Insurance?

A life insurance policy will ensure that your dependents receive a payout should your life be cut short, and this can be used to tide them over until they are able to provide for themselves. You can find out more about this here.

Choosing the Right Policy

Choosing the right policy to suit your needs is likely to be a long and drawn out process. But don’t try to cut corners. This is an important agreement that you will be entering into, so taking time to look through the details will benefit you. Scour the web for different policies and consider using price comparison sites to choose the most affordable option for you.

Low Deductibles?

Getting the balance right between premiums and deductibles can be difficult. Many people do not realize that they can adjust the features on their policy to reduce the amount of money they pay per month. If you set your deductibles at a higher rate, this means that your premiums will be lower as a consequence.

For those who are unaware, your deductibles relate to the amount that you need to pay before an insurer will pay out. Therefore, you also need to make sure that this is an amount you can afford.

Gritty Details

You should never sign a contract without reading each and every word of the policy, and without fully understanding the terms and conditions and the full implications. After all, there are a lot of insurance plans that come with hidden fees and terms that you really need to know about.

These terms come back to bite you if you are not careful, so make sure you read the details. Take as much time as you need to find the right insurance plan for you. It may take more time, but it will definitely be worth it in the end.

What About Payments?

Make sure to keep up with payments, because if you miss payments, your policy may be void. Consult your provider for more information on this subject.

As you can see, taking out a life insurance policy can be extremely beneficial for your loved ones. So, take a look at your options carefully.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Why You Need to Take Out Life Insurance appeared first on Accounting Accidentally.