Kenneth Boyd's Blog, page 52

January 7, 2019

Rent or Buy a Home? Know Your Options

Short you rent a home or apartment- or buy?

It’s a tough question to answer, and how you make your decision should be based on your age, income, personal relationships, and other factors.

As a young adult, save money for somewhere to live- maybe feeling as if we will never get to where we want to be. With house prices rising most of the time, accumulating enough money to purchase a home or apartment can be difficult.

However, buying a house isn’t the only option you can take when looking for somewhere to live, and today we will have a look at why you should consider renting instead.

What’s Your Commitment?

Unless you already have a partner and you are planning to settle down with kids in the near future, there really isn’t a need for you to rush into a mortgage.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

If you are free of commitments and able to move around as you please, renting something like Glamour Apartments might be a better option, because it’s a shorter commitment. When you buy a house, you commit loan payments that can last 20-30 years. With an apartment, however, you don’t have this worry at all. If you suddenly decide you want to move somewhere else, you can don’t without any issues.

The Benefit of Flexibility

Living in a house can be a big investment, and it can tie you to living in one place for a long time.

When you rent a house, you have some flexibility if you have a change in circumstances. If you decide you want to travel, for example, you can simply move out and not have to worry about paying off your bills and a mortgage while you are gone.

This is ideal for younger people who may not have settled on a particular city or career path.

Cost Savings

As a new homeowner, the biggest shock to the system is likely the cost of repairs around the house.

A burst pipe here and a rusty tap there can add up over time, and the costs can make things difficult for you when budgeting for the month. However when you rent a house, you aren’t responsible for these repairs and you can simply tell your landlord what needs doing so they can fix it.

Plus, you won’t have to think about decorating because it will all be done before you move in! It saves you both time and money on repairs and makes living so much less stressful.

Low Cost

As you will likely be aware, renting is cheaper than buying a house. When you pay for a mortgage, the cost will be much higher than simply renting a home. This is a massive difference, and it can make all the difference when you are young and trying to make your way in the world.

An Investment

Ultimately, everyone should strive to accumulate enough money for a down payment on a home. If you own your home, your mortgage payment will help you build equity in your house, which may be the biggest asset you’ll ever own.

Create a savings plan to purchase a home, and benefit financially from home ownership.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Rent or Buy a Home? Know Your Options appeared first on Accounting Accidentally.

The Hidden Costs of a New Hire

Managing your business requires you to make dozens of decisions every week, and growing your firm can be overwhelming.

There are many aspects of managing a business, including the need to manage client relationships, keep your employees happy, and deliver a quality product or service.

Finance may be the most challenging area of business management, and hiring employees is a big decision for any company. Use this discussion to learn about the hidden costs of hiring and managing your workers.

Where Are They?

Finding great job candidates is the key to success as a manager. If you hire the wrong person, you may spend a great deal of time and money to hire and train someone who is simply not a fit.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

If you’re considering a recruiting company to find candidates, keep in mind that these firms will typically charge a large amount for the service they provide, up to 25% of the first year’s salary.

Paying those level of fees can be challenging for a small business.

Along with these fees, you will also have to pay to process your new employees. This can involve criminal record checks, identity verification, and employee referencing, all of which will force you to spend more money. Of course, though, you can’t avoid these steps if you want a good team.

What Do They Know?

Employees can only be productive if they are properly trained.

Keeping your employees up to date with latest standards and laws will require a consistent training effort. People won’t be willing to learn things on their own time, making it crucial that you set aside training time during their working life.

While training may require a large investment of time and money, failing to train your staff will eventually cost you far more in worker mistakes and low productivity.

Getting Protection

Every firm must protect themselves from legal costs related to employee injuries.

The risk of injury to workers can vary greatly, depending on the type of work performed, the environment (indoor or outdoor), and the type of equipment used. Most states require businesses to carry workers’ compensation insurance, but you’ll need to create a safe work environment to minimize the costs.

Talk with an insurance agent to find out the proper types of insurance you need to protect your business.

Potential Backlash

If you make a hiring mistake, you may face some potential legal issues- and you need to take steps to protect your business.

Terminating an employee can be difficult, and you can read HasnerLaw.com for details which will show you why you have to be careful in this area. Taking action is difficult, but may be necessary to keep your business on track, and to find a new employee who is a better fit.

Watch Your Pocketbook

With all of this in mind, you should be feeling ready to take on the challenge of keeping the costs of your next hire down to a reasonable amount.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

Image: https://unsplash.com/photos/cHFlWGxrMy8

The post The Hidden Costs of a New Hire appeared first on Accounting Accidentally.

Smart Tips For Selling a Home

Your home may be the biggest financial investment that you will ever make.

Selling your home can have a massive impact on your personal finances, so do your homework before you sell. Are you planning to put your property on the market? If so, here are a few strategies to make your home sale a success.

Competition

What’s you’re reaction when you hear that a neighbor received the full asking price for their home?

Initially, you might be frustrated that their house sold and your home is still on the market.

But stop and think.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here

If a house in your neighborhood sells for the full asking price, you should view that as a positive. Buyers are attracted to your area, and that fact may increase the price you receive from a purchaser.

Instead of getting yourself wound up, take a deep breath, and do something about it. Go and have a chat to your neighbor. Find out what is different about their property compared to yours.

They may have spent a fortune on a new kitchen upgrade, or they may have an extra bedroom you don’t know about! Also, consider this: maybe they got lucky with a highly motivated buyer.

Don’t automatically assume you are doing something wrong. Investigate the circumstances of the sale to discover whether there are indeed improvements you can make so your sale goes through like your neighbors. Also, quality estate agents, like Red Hawk Realty, will be able to shed some further light on why your neighbor’s property has sold and yours has not.

Being angry about it will get you nowhere! Instead, use your neighbor as a source of research and inspiration. They’ve sold their home, so they will probably have no qualms about providing you with a few secret tips to help you sell yours.

Is It Unique?

Do you have an unusual house?

A unique home can attract a huge amount of attention, but the only if the price is right.

Estate agents have many different factors they take into account in order to value a home. However, a lot of these factors rely on precedent. They evaluate past performance in order to determine what people would be willing to pay for your property.

But, if they have never seen a house like yours before, what are they going to compare it to? For an unusual home, use the following three factors to determine the value of your property…

What kind of buyer will your home appeal to? Get a better idea of the type of people who are interested in your unique home, and the price they might pay.

Appeal: Ok, so your home may be unique, but does it have all of the selling points a buyer would want? Is there plenty of space? Are there any added extras that could clinch the deal, such as a swimming pool?

Just how unique? Value lies within the true character of the home in these instances. Is your property unique because it has history, i.e. someone famous lived in it during Georgian times? Or, have you simply updated it so much it looks nothing like anything anyone else has ever seen before?

Consider all of these factors if your home is unique or unusual.

Do Your Homework

Selling a home will have a big impact on your personal finances, so do your homework. Take steps to prepare your home for sale, and work with a realtor who can determine a reasonable selling price for your home. Use these tips to sell your home for an attractive price.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Smart Tips For Selling a Home appeared first on Accounting Accidentally.

January 6, 2019

How to Take Charge of Your Online Bookkeeping Process

Operating your business requires you to make dozens of decisions each week, and managing growth creates even more challenges.

To streamline your business operations and prepare for growth, you need get the most out of an online bookkeeping system. Use these tips and take charge of your online bookkeeping process.

A Definition

Bookkeeping is the process of using source documents to post accounting transactions, and your accounting results are used to generate the financial statements.

Assume, for example, that you receive a bill from a vendor, and you want to pay the bill. The bill is your source document, and that document is used to post an increase in expenses and a decrease to cash in your accounting records.

When you automate your bookkeeping process, you’ll quickly see a number of benefits:

Start With the End in Mind

It may seem odd, but you should consider how your accounting records might be used years down the road.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

At some point, you may want to raise capital by selling ownership (stock) to investors, or you may need to borrow money to fund operations. Looking even farther down the road, you may decide to sell your company.

Investors, lenders, or a potential buyer all want to see a well-organized set of accounting records. Bookkeeping software helps you minimize errors, work quickly, and generate an accurate set of financial statements each year.

Start using software sooner than later, so you can maintain a set of financial statements for each year of company operations.

Get Rid of Paper

Bookkeeping software allows you to back up on the cloud, and to minimize the use of paper files.

Consider, for example, the hundreds of bills you receive each year. Rather than keep paper files, you can scan and save each bill, and the bill can be electronically filed with the accounting entries posted to pay the bill.

Assume, for example, that you want to review a $200 payment to Standard Office Supply posted on November 15th. Your bookkeeping software can display the image of the bill, along with the expense account and the check number used for the transaction. This level of documentation makes it much easier to review accounting transactions.

Where’s Your Chart?

Your chart of accounts is a listing of each account name and number you use to operate your business, and you should add and delete accounts as needed. Bookkeeping software makes it simple to make changes to your chart of accounts.

Say, for example, that you’re expanding a restaurant that you operate. You’re adding more space in the kitchen, and purchasing more ovens, refrigerators, and other equipment. Each of these new assets should be posted in your accounting system as a fixed asset, so that you can post depreciation expense.

With bookkeeping software, you can quickly create a new account name and number, and the new account will be an option that you can choose when you post accounting activity. If you need to post $500 in depreciation expense for the new Sub-Zero refrigerator, your accounting system can access the account name and number automatically.

Maintaining a useful chart of accounts make your accounting records and financial statements more accurate.

Keep Vendors Happy

Paying your vendors on time is important, so that you can order quality products and services from a reliable supplier. When you receive a bill, you can set up payment reminders in your bookkeeping software, so that you can pay on time, and possibly take advantage of discounts.

Assume that your restaurant orders meat from Hillside Meat and Fish. Hillside offers a 5% discount on invoices paid within 10 days, and you make a note in your software system. If you have sufficient cash available, you can respond to a software alert and pay the invoice to take advantage of the discount.

Bookkeeping software helps you manage your bills and available cash flow.

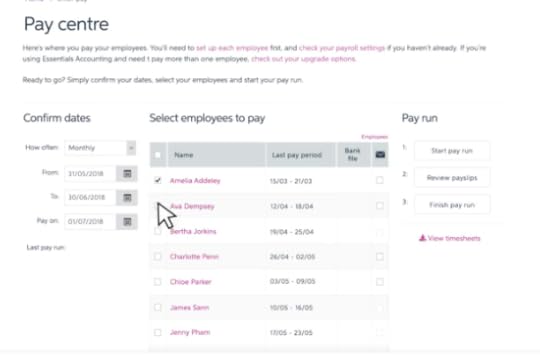

Avoid Payroll Problems

Processing payroll may be the most time-consuming task for a business, and using software can make a huge difference. Payroll requires these four steps:

Data collection: Workers fill out a W-4 form, so that the employer can calculate the correct amount of tax withholdings from gross wages.

Pay calculation: The company computes tax withholdings, and subtracts withholdings from gross pay to determine net pay.

Payments: Workers are paid by check, or by direct deposit.

Reporting: The firm reports tax withholdings to the federal and state taxing authorities, and forwards the payments withheld.

As an employer, you may also have to calculate withholdings for company benefits, such as insurance coverage.

Bookkeeping software allows you to collect data and store it online. The software calculates net pay, and you can link your accounting system to your company bank account. Workers can be paid electronically, and your software can generate the withholding forms.

Do You Know Total Costs?

You can’t price your products and services correctly, unless you know the total costs you incur.

If, for example, you want to generate a $10 profit per baseball glove manufactured and sold, you need to know the total costs incurred to manufacture, package, and ship each glove. If total costs are $60, you need to price each glove at $70.

Bookkeeping software helps you track and document each cost you incur in your business, and you’re less likely to miss an expense. Using software allows you to price your product correctly to generate a targeted level of profit.

The Payoff

Purchasing and installing bookkeeping software requires time and effort, but the payoff more than justifies the cost. Use software to operate more efficiently, and grow your business profitably.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

Image:

consulting meeting client b2b freelancer

(CC by 2.0)

The post How to Take Charge of Your Online Bookkeeping Process appeared first on Accounting Accidentally.

January 5, 2019

Find Your Cash

Where’s all of your cash?

Understanding your personal finance situation can be a challenge, and not having a handle on your finances is frustrating. You’re working hard- but where did all your cash go?

Here are some ways that you can generate more cash, and keep more of the cash you earn.

Ask For More

Here’s something that not many people think to do, but should: ask for more money! Your salary isn’t set in stone. It can be adjusted.

Companies aren’t in the habit of just handing out raises at random, but, because they know the cost of replacing a worker, are usually pretty receptive to the idea.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

This story can help you plan for a salary negotiation.

A Story

I smiled.

“Yes- I think that number is reasonable, given my skill set and what you need.”

The next one who speaks loses- and I didn’t say a word.

Andy, the CEO thought for a minute. He had asked me three times if I was willing to come off (come down) on my salary demand, and I wasn’t willing to. There were a few reasons why:

High-risk position: The CEO was “creating a position for me”, which meant that I wasn’t replacing an existing job position. As I find out later, the CEO had come up with this new position idea after meeting me- which made it that much more risky. There was a higher risk that this job might not work out, and I wanted to be paid for taking that risk.

Others in similar roles: I was interviewing in 1997 for a role selling a corporate retirement product to corporations. The product was complex and had a long sales cycle. When I interviewed, I noticed that the people in similar roles were all older than me, and all well-qualified. If the firm had money to pay them, they have the resources to pay me.

#1- Willing to walk away: Most importantly, I had other options and was willing to walk away. This attitude is critical for both salary negotiations and if you’re pricing work as a self-employed person (as I am now). Everyone needs to belief that they can find another job or another client. You need the willingness to say: “I appreciate it, but I can’t meet your needs.”

I’ve used that phrase a lot over the years- feels good to say it every once in awhile.

Ironically, my son has NO hesitation telling people no when the money isn’t right. He’s a recent college graduate and a freelance film and video producer. That skill will serve him well as a self-employed person.

Get What You’re Owed

There’s a lot of money in the world, and if you’ve been wronged in one way or another, you have some options to recover funds you’re due.

Compensation for, say, an accident that wasn’t your fault and which left you with an injury, won’t just come to you. You need to fight for it. If you find yourself in this position, then take a look at this lawyer’s website, and fight your corner.

You shouldn’t be left out of pocket because of costs attached to something that wasn’t your fault; the legal system has a process in place to prevent that from happening.

Is Your Money Working?

If you’ve got a lump sum of money just sitting in the bank, then there’s a chance that you’re wasting an opportunity to build your income. Instead of putting a lump sum in a savings account, look at investing it.

Of course, this isn’t something that you should blindly jump in to; research is needed. Talk it through with a financial advisor, and come up with a strong plan of action for putting your money to work.

Home and Vehicle

If you don’t have any excess cash because all your money is going towards maintaining your home and vehicle, then put them to work!

You can look at getting a tenant for your home, for example – it might bring in enough cash to cover the mortgage payment, if you live in a popular and desirable area.

For your car, you can list journeys you’re making on ridesharing websites. It won’t bring in mountains of cash, but it’ll ensure that your travels don’t cost anything – and that’s a pretty big deal.

Take Action

If you have the courage to take action, you can find more cash and improve your financial situation.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Find Your Cash appeared first on Accounting Accidentally.

Will Freelancing Work For You?

Many people are working as a freelancer these days, and a number of these professionals will stick with freelancing for the rest of their careers.

Freelancers enjoy the flexibility that allows them to work where they want, when they want- and to choose work that is interesting.

But there’s a big challenge: you have to keep looking for business.

At least in the early years, freelancers may be forever chasing the next contract, and there may not be a letup. There’s definitely no time for vacations, because you don’t get paid!

With this in mind, will freelancing work for you? Can you eventually find a decent work/life balance?

The 24/7 World

Even if you dipped your toe into the world of freelancing, and haven’t made the leap just yet, you will no doubt be aware of the fact that it’s a business where you can’t “stop”.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

You many have clients and potential contracts all over the world. So, to survive and earn a decent wage, we’ve got to adopt a 24/7 mindset.

But after a while, working at this pace may overwhelm you.

If you are spreading yourself thin, especially as contracts are concerned, you may find yourself distracted, or the numerous impending deadlines means that you are eternally frazzled. This is something that many working parents can empathize with, and many freelancing parents can empathize with this even more so!

Attempting to keep it together, while you’re on the road, doing your best to deal with a conference call while driving at the same time can result in a car crash! Sure, this is the worst case scenario, but it’s an excellent example of what happens when you are trying to keep tabs on numerous projects and live your life at the same time.

What’s the solution?

Taking Yourself Out Of The Situation

Freelancing feels like a roller coaster. For many of us, the panic can set in- if you get off it, are you going to be able to get back on?

But this is where perspective is vital. You need to decide if this lifestyle is good for you. But in order to do this, you’ve got to look at what’s important. For example, if you have family members and people that depend on you, that pressure alone can threaten to unravel the best of us.

So, as painful as it may be, you’ve got to manage your time away from the freelance way of life. Freelancing is about being self-sufficient, and this is a skill we’ve all got to have in order to thrive in this type of career.

Freelancing while constantly on the go in life means we got to learn to develop our internal strength as well as finding ways to develop our work skills.

Making Improvements

You may experience a great deal of anxiety as a freelancer, because you’re operating without a safety net. However, your work will become less demanding as you develop a customer base and don’t have to market to new prospects to find a new project. Successful freelancers find ways to manage their schedules, and to find down time.

If you’re passionate about freelancing, your income and lifestyle can improve over time.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

Image:

Consulting meeting client b2b freelancer

(CC by 2.0)

The post Will Freelancing Work For You? appeared first on Accounting Accidentally.

January 2, 2019

Smart Decisions to Recover From a Workplace Injury

Dealing with a workplace injury can be stressful.

You need medical help to regain your health, and to return to work. At the same time, you may feel the financial pressure of not being able to earn an income.

The first step is to get immediate medical attention, and you should keep a personal health insurance policy in place for these issues.

If you feel that the injury is directly related to work, you may be able to pursue a remedy through your workplace. If your employee isn’t responsive- or won’t take appropriate responsibility- you may have to hire an attorney and investigate your legal options.

Here’s an example of a workplace injury, and how an insurance claim is filed.

When it comes to compensation claims, there are many different incidents that can lead to a successful claim. This includes everything from car crash incidents to product liability cases and more.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

As an example, a vibration white finger claim is a type of workplace accident that impacts tens of thousands of people each and every year. Read on to understand the injury, and if making a claim against the employer is a reasonable path to pursue.

What Is the Injury and Symptoms?

Vibration white finger actually is often referred to as hand-arm vibration syndrome. It is an injury that is caused because of frequent use of hand-held vibrating machinery.

Of course, people can experience a variety of different symptoms. Symptoms include pain in lower arms and hands, numbness, and tingling.

Basis for a Legal Case

To receive compensation for a workplace injury, you must prove these points:

You received the injury through no fault of your own

You saw a medical professional after the injury

The medical professional diagnosed the injury

To understand whether or not you have a legitimate case, seek the help of a personal injury attorney. If you’re successful, you may be compensated for the suffering you have experienced, and the injury-related costs you have encountered to address the injury. Keep receipts and records for any medical costs.

FAQs About Claims

If you have been injured in the workplace, you may have some questions about hiring a lawyer and the payout claims process. Consider these points:

Will my employer fire me if I make a claim? This is often a major concern for a lot of people. If the incident was not your fault, your employer typically will know that they need to compensate you and they will have insurance in place to cover a claim. If they were to fire you, they would only make a bad situation worse, as you would then have grounds for unfair dismissal.

How long have I got to make a claim? The time limit on personal injury cases is commonly three years from the date of the accident. If your injury has developed over time, you typically will have three years from the date of your diagnosis. You should make your claim as quickly as possible, however, as the details will be fresh in your mind and evidence will be easier to gather.

Ask For Help

A workplace injury can create physical, emotional, and finance problems, so ask people for help to get through it. Find a Doctor and an Attorney that you trust, and get support from friends and family.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Smart Decisions to Recover From a Workplace Injury appeared first on Accounting Accidentally.

5 Action Steps For a Happier Year Ahead

Maybe it’s time for a new start.

Around the holidays can be a good time for us to have fun, and to be helping others. But as the holidays become a distant memory, you may feel the drudgery of getting through January and February.

How can we maintain a happy outlook?

Life can get overwhelming, for sure, but there are still plenty of things that we can be doing to make sure that we are happy each day. Here are a few of the things that you could be doing now, to make sure that you have a happy year ahead.

Eat Well

They say that we are what we eat, and that is never more true than when it comes to how we feel.

In-depth content, comment, meet peers: Join Conference Room. Watch the video, join here.

Although we might like the idea of fast food and processed junk food, we all know the feeling when we have overindulged a little, right? We can feel healthier and much happier when we eat foods that are full of nutritional value. So think about having your plates full of bright and colorful, “good mood” food.

Life’s Details

Take on some of those annoying tasks that you’ve been putting off for a while.

Now is the time to get on top of it all and get back in control. For example, you may have been thinking about mortgage rates and wanting to change your provider for a while, but just haven’t done anything about it. If that is the case, then this is the kind of thing you need to stop putting off.

Sort out one of your long-delayed tasks, and you’ll feel less overwhelmed, and happier.

Random Acts of Kindness

It can be hard to be down on yourself and feeling sad when you are doing nice things for other people. Of course, what you are capable of doing is going to be different for different people. But doing some random acts of kindness as you go about your days is going to be a big help on your journey to being happier.

Plan Downtime

We all need some downtime where we don’t have to do anything and we can just relax.

It can be important for our mental health, as well as our physical health. This downtime allows us to be more mindful and be more considerate and deliberate in what we are doing. We can plan, and use the time to do things just for us. All of which is going to help you to be much happier as you go about your year.

Forgive- Then Forget

Forgiveness is something that can be easier said than done. And often, we are the one that benefits from forgiving someone, rather than the person that wronged us.

It can be hard for us to be happy when we don’t feel truly happy because we are harboring feelings of ill-will. This doesn’t mean that you have to let someone toxic back into your life or anything like that, but it can do wonders for your level of happiness.

Good luck this year!

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post 5 Action Steps For a Happier Year Ahead appeared first on Accounting Accidentally.

December 31, 2018

Tax Planning Tips for 2019

Preparing your tax return can be complicated, but it’s critically important to submit an accurate return.

The 2018 tax year is even more complicated, because of the changes in the rules. Tax changes seem to happen every year, but there are some things you can do to minimize your tax bill.

For the 2018 tax year, the standard deduction amount was increased to $12,000 for individuals, $18,000 for heads of households, and $24,000 for married couples who file jointly. The standard deduction applies to people who do not have enough itemized deductions to exceed the threshold.

Bunching Deductions

Do some planning and consider when a particular income or expense will impact your tax return.

Expenses that are due in the first few days of the next year can be paid before the end the current year. This allows you to recognize more expenses and reduce your current year tax liability.

Speak with an accounting expert regarding income and gains that you may incur shortly before the end of the current tax year. In some cases, the income or gains can be pushed into the next year, which reduces your current year’s tax liability.

This all gets very complex, and you should seek the help of someone such as Brunoro Law to make sure it is done in the right way and complies with current tax laws.

Max It Out

In 2018, the maximum amount you can pay into your retirement plan is $18,500, unless you are over 50, and then it is $24,500. This reduces your taxable income and helps to secure your financial future. If you cannot afford to contribute the full amount, pay as much as you can and at least try to match any employer contributions.

Your invested dollars are tax-deferred and grow tax-free.

Give It Away

Donating to charity to help with your accounting and tax liability does not have to be in the form of cash. You can donate items that are still of good quality and write off the market value as an itemized deduction on your taxes.

The IRS says that charity donations to private organizations are limited to 30% of your adjusted gross income and for public charities, the limit is 50%.

To get the tax deduction in the 2018 tax year, you must have made the donation by the close of the tax year and must have a receipt to prove it.

Charity donations are part of the standard deduction thresholds, so it’s important to time the donation correctly to benefit the most from the tax deduction.

Other Strategies

There are other ways to reduce your tax bill, including:

Tax-loss harvesting to reduce the tax due on investment gains;

Taking the required minimum retirement plan distributions, if you are older than 70 and a half years;

Using the annual exclusions gifts

If you are confused and want to be certain to keep your tax bill as low as possible, seek out professional tax advice.

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Tax Planning Tips for 2019 appeared first on Accounting Accidentally.

December 30, 2018

Xero vs MYOB: Accounting Software Comparison

The accounting software you choose can make or break your business.

Managing a business requires you to make dozens of important decisions each month, and you must constantly adapt to change. As your company grows, you’ll sell more items, hire more people, and process more transactions.

You need accounting software that can handle every type of business transaction, and software that is user friendly and easy to navigate. All of your systems must be designed to handle growth, including your accounting software.

This discussion compares Xero and MYOB accounting software, and which system I think is the better choice for business owners.

Are Xero and MYOB Established?

For starters, you should know that both software packages are well established and have thousands of users. Each package is reasonably priced, and offers a good level of customer support.

In addition, both companies offer the ability to log in from a Mac, PC, tablet, or phone, and both systems can connect with dozens of other apps, and with your bank account.

Banking & Cash Management

No business can operate without sufficient cash, and your accounting software can help you monitor your cash balance, your customer receivables, and upcoming expenses.

Both systems offer a link to a bank account, and you can download activity from your bank to your accounting system. This feature allows you to match bank statement activity with your accounting transactions.

If, for example, you download information on three debit card transactions from your bank, you can match the bank activity with the expenses in your accounting software.

For example, here is the Xero cash, expense, and receivable dashboard:

Essentially, this process allows you to reconcile your bank account as bank activity is updated online. This is extremely valuable, because you can correct errors without waiting until the month end bank statement.

MYOB offers several more cash management features than Xero.

Invoicing

Both systems allow you to create invoices, and the fields for client, product type, and other data can autofill in the invoice. Even more important, you can be notified when a customer opens the email with the invoice, and customers can pay by credit card or debit card automatically.

Purchase Orders

Here is Xero’s purchase order screen:

Similar to the invoicing system, both software packages can autofill information into a purchase order (PO). After an automated approval, the PO can be emailed the supplier. You can sort POs by delivery date, expected arrival date, and by other criteria.

Expense Management

With each system, you can take a photo of a receipt or other expense, and link the photo to a formal bill. Once the bill is created, you can link the paid expense to the downloaded bank activity.

Below is a screenshot from MYOB’s system:

If you need to reimburse an employee for an expense, you can set up an approval feature for that particular bill.

Inventory and Payroll

You can track sales, units in inventory, and items ordered for inventory delivery in real time. When you sell an item, both software packages will post to the sale (revenue) account, inventory account, and cost of sales accounts. Businesses can track average cost per unit, with is needed to calculate profitability.

Both systems offer payroll functionality, which can be the most time-consuming task for a business owner. You can maintain employee names, pay rates, and process payroll through the software.

MYOB vs Xero Pricing

Both Xero and MYOB offer multiple pricing levels, and the differences are not substantial. On a monthly basis, the difference in cost between the two systems may be $10 a month of less. I can’t recommend one system over the other based solely on price.

My Recommendation

I recommend Xero over MYOB, because the screens are clearer and less cluttered, and I found Xero’s navigation process to be easier.

Best of luck in your business!

This post is for educational purposes only.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

Co-Founder: accountinged.com

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

Image: Bullseye, Jeff Turner CC by 2.0

The post Xero vs MYOB: Accounting Software Comparison appeared first on Accounting Accidentally.