Steve Bull's Blog, page 58

April 11, 2024

Can Our Veggie Gardens Feed us in a Real Crisis?

Musings from someone who has tried and failed to grow all their own food

A haul from the Author’s urban farming operation in Portland, Sept. 15, 2007, set out for CSA members to pick up (Photo C.H.White)

A haul from the Author’s urban farming operation in Portland, Sept. 15, 2007, set out for CSA members to pick up (Photo C.H.White)This is one of my all-time most popular essays, originally written in July, 2019, in response to massive flooding in farmland in the US Midwest but reposted several time since then because there’s always some crisis underway that can negatively affect farming. This year’s news peg is the fact that March was the tenth month in a row that set a record for hottest on record.

Whenever there’s a crisis that might affect the food supply, people suggest to “plant a garden.” If only it were that simple.

I used to be a small-scale organic farmer so take it from me: totally feeding yourself from your own efforts is very, very challenging. Though some friends and I tried over multiple seasons, we never succeeded, or even came anywhere close.

First of all, consider what you eat. Yes, you. What do you eat at home? At work? When you go out? Okay, what percentage of that can be raised in the bioregion where you live? If you have trouble answering this question, don’t feel bad. I would guess that the proportion of the US population with practical agricultural knowledge is lower than in any other society in history.

Looking at the subset of your current diet that can be grown in your area, is it enough to live off of? Is it well-balanced and does it provide enough calories? If not, what will you add to fill it out? This is purely an exercise of course, but there’s the rough draft of the menu you’re going to survive on. How will that work? I mean logistically?

…click on the above link to read the rest of the article…

Study identifies atmospheric and economic drivers of global air pollution

Credit: Pixabay/CC0 Public Domain

Credit: Pixabay/CC0 Public DomainCarbon monoxide emissions from industrial production have serious consequences for human health and are a strong indicator of overall air pollution levels. Many countries aim to reduce their emissions, but they cannot control air flows originating in other regions. A new study from the University of Illinois Urbana-Champaign looks at global flows of air pollution and how they relate to economic activity in the global supply chain.

“Our study is unique in combining atmospheric transport of air pollution with supply chain analysis as it tells us where the pollution is coming from and who is ultimately responsible for it,” said lead author Sandy Dall’erba, professor in the Department of Agricultural and Consumer Economics (ACE) and director of the Center for Climate, Regional, Environmental and Trade Economics (CREATE), both part of the College of Agricultural, Consumer and Environmental Sciences (ACES) at Illinois.

“There is a direct link between a country’s level of production and how much air pollution is emitted. However, production may be driven by demand from consumers in other countries. We use supply chain analysis to quantify the links between production and consumption. This helps us to understand how production in one country is linked to domestic and foreign demand,” he added.

The researchers traced the movement of pollutants through the atmosphere to understand the flow of emissions, using simulations developed by Nicole Riemer, professor in the Department of Climate, Meteorology & Atmospheric Sciences, College of Liberal Arts & Sciences at Illinois; for analytical purposes, they divided the world into five sections: the United States, Europe, China, South Korea, and the rest of the world. South Korea is located downwind of China, and it serves as an example of how a small country can be affected by pollution from a much larger upwind neighbor.

…click on the above link to read the rest of the article…

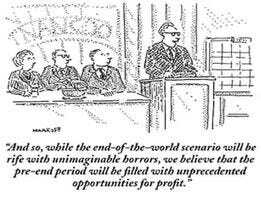

The “Business” of Central Banking—Usury and Tax Farming

Central banking is “a great business to be in, where you print money, and people believe it.”

That’s what the head of New Zealand’s central bank said recently in an unscripted moment of candor.

It led me to wonder about the nature of this strange “business.”

Let me put it into the simplest and most concise terms.

Central banks create fake money out of thin air and loan it to governments at interest.Governments use violence and threats of violence to extract taxes from average citizens to pay the interest on the fake money the central banks created out of thin air.Like the mafia, they can deploy violence to ensure there is no competition to their privileged racket.That’s the unvarnished truth about central banking.

In short, it’s the business of usury and tax farming.

(To me, a more practical modern meaning of usury is “enslaving people with financial trickery.” Central banking clearly fits the bill.)

The central bank is a powerful wealth transfer mechanism that enables governments to harvest the productive efforts of their citizens efficiently and surreptitiously.

The central bank’s currency debasement transfers wealth from savers to those closest to the money printer, namely governments and their cronies.

The central bank’s real mandate is to transfer as much wealth as possible via currency debasement to the political class without causing alarm among the plebs. Ideally, it happens gradually so nobody notices, like a child taking only a little money out of his mother’s purse each day so she doesn’t notice.

However, sometimes their theft spirals out of control, and it’s impossible for the plebs not to notice.

Consider this.

The Federal Reserve—the central bank of the US—has printed more fake money in recent years than it has for its entire existence.

…click on the above link to read the rest of the article…

Only 57 producers are responsible for 80% of all fossil fuel and cement CO2 emissions since 2016 – new report

Just 57 companies and nation states were responsible for generating 80% of the world’s CO₂ emissions from fossil fuels and cement over the last seven years, according to a new report released by the thinktank InfluenceMap. This finding suggests that net zero targets set by the Paris climate change agreement in 2015 are yet to make a significant impact on fossil fuel production.

The report uses the Carbon Majors database, established in 2013 by Richard Heede of the Climate Accountability Institute, to provide fossil fuel production data from 122 of the world’s largest oil, gas, coal and cement producers.

The InfluenceMap report tells a sobering but informative story of the state of production in these high-emitting industries. Cement and fossil fuel production has reached unprecedented levels, with most of the emission growth traceable to a relatively small number of large companies.

The troubling reality is that the lack of progress of these large fossil fuel companies means the world will need to undertake ever more stringent and steep decarbonisation trajectories if countries are to meet the Paris agreement goal of keeping warming well below 2°C.

The Carbon Majors database highlights how critical it is for companies and countries to be held accountable for their lack of progress on emission reductions. Companies need to define exactly how best to align with the Paris goals, and then monitor and track their progress.

To address this need, our team of researchers from the Universities of Queensland, Oxford and Princeton developed a framework that outlines strict science-based requirements for tracking the progress of companies against Paris-aligned pathways.

By applying this framework to the Carbon Majors database in a follow-up study, our team mapped production budgets for 142 fossil fuel companies against several Paris-aligned global scenarios of the Intergovernmental Panel on Climate Change.

…click on the above link to read the rest of the article…

World’s biggest economies pumping billions into fossil fuels in poor nations

G20 countries spent $142bn in three years to expand operations despite a G7 pledge to stop doing so, study finds

The world’s biggest economies have continued to finance the expansion of fossil fuels in poor countries to the tune of billions of dollars, despite their commitments on the climate.

The G20 group of developed and developing economies, and the multilateral development banks they fund, put $142bn (£112bn) into fossil fuel developments overseas from 2020 to 2022, according to estimates compiled by the campaigning groups Oil Change International (OCI) and Friends of the Earth US.

Canada, Japan and South Korea were the biggest sources of such finance in the three years studied, and gas received more funding than either coal or oil.

The G7 group of biggest economies, to which Japan and Canada belong, pledged in 2022 to halt overseas funding of fossil fuels. But while funding for coal has rapidly diminished, finance for oil and gas projects has continued at a strong pace.

Some of the money is going to other developed economies, including Australia, but much of it is to the developing world. However, richer middle income countries still receive more finance than the poorest.

The most recent G7 pledge, in the study, is to phase out all overseas fossil fuel funding by the end of 2022. The OCI study concentrates on the period from the beginning of the fiscal year of 2020-21 for each country, to the end of the fiscal year of 2022-23.

However, the researchers also found that Japan had continued to make new fossil fuel investments overseas in the past few weeks, up to mid-March 2024, exploiting loopholes in its promise to end fossil fuel funding.

The World Bank provided about $1.2bn a year to fossil fuels over the three-year period, of which about two-thirds went to gas projects.

…click on the above link to read the rest of the article…

Large-scale factory farms have become the biggest source of water pollution in the U.S.

The EPA can change that.

Your hotdogs and burgers may be doing more than feeding friends at a barbeque.

Large-scale factory farms and confined feedlot operations have become the biggest source of water pollution in the United States.

The Environmental Protection Agency (EPA) announced plans to monitor factory farm pollution back in 2005 — but it has yet to actually do so. We can’t afford to wait any longer.

Factory farms, also known as concentrated animal feeding operations or CAFOs, generate millions — if not billions — of gallons of waste each year. In fact, the largest factory farm has been known to generate up to 369 million tons of waste per year. And while every animal produces waste, this level of highly concentrated manure can wreak serious havoc on the health of the environment and on the public.

When massive amounts of fertilizer, animal waste and other pollutants aren’t managed properly, they foul our waterways and release harmful chemicals like ammonia and methane into the environment. Extended exposure to these potent chemicals can result in serious health consequences such as asthma, bronchitis, pneumonia and other respiratory diseases.

Additionally, animal waste can leach toxic heavy metals and nitrates into waterways. Elevated nitrate levels in our drinking water can be dangerous for our health, and even cause low oxygen levels in infants and low birth weight.

These risks are why the EPA announced plans to monitor factory farm pollution almost 20 years ago. However, the agency has yet to release finalized plans to observe factory farm pollution and ultimately make decisions based off of the observations. This delay has allowed factory farms to continue emitting hazardous pollutants without sufficient oversight.

It’s the EPA’s duty to hold major polluting industries responsible and to safeguard public health and the environment in the process.

April 5, 2024

Today’s Contemplation: Collapse Cometh XCVI–Technological ‘Breakthroughs’, Ponzi Schemes, and ‘Green’ Energy

February 3, 2023 (original posting date)

Monte Alban, Mexico. (1988) Photo by author.

Monte Alban, Mexico. (1988) Photo by author.Technological ‘Breakthroughs’, Ponzi Schemes, and ‘Green’ Energy

A collection of my recent comments on posts/articles that have been shared with me via FB groups/pages. I share these to provide further ‘insight’ into where I am coming from in my understanding/learning but also to share the differing opinions/beliefs that exist (see the last/third conversation).

January 31, 2023

Post by CM via Peak Oil FB group: Article posted (https://www.freethink.com/space/space-planes?utm_medium=Social&utm_source=Facebook#Echobox=1675103347) and introductory paragraph:

“On January 19, Washington-based startup Radian Aerospace came out of stealth mode, announcing that it had secured $27.5 million in funding to develop the Radian One, a first-of-its-kind space plane that flies into orbit after taking off horizontally from the ground.”

CM’s introduction: I doubt, it’ll ever be developed.

My comment: Almost all such projects, breakthroughs, magical solutions, etc. are never developed or become a literal money pit. This is one of the ways ‘hope’ is kept alive, but also how many fund their careers. Near-limitless cheap and clean fusion energy is one such animal. Always just another handful of years away. Keep funnelling funds to the industry/research teams and we can achieve it…nothing is impossible for humanity if we put our collective minds to it.

January 30, 2023

Some back and forth dialogue between SC and me in response to my last Contemplation via Degrowth FB group:

SC: The high immigration growthist policies of Canada and Australia amounts to a continuation of colonization. It seems indigenous people are so caught up in the rhetoric of diversity that they don’t call it out as such. ??

Me: That’s true. I do believe, however, that the primary purpose of such immigration policies is not for the virtue-signalling reasons provided to the masses by the government but to keep the Ponzi that is the economic system sputtering along for a few more quarters/years. With domestic populations not reproducing at a fast enough rate to keep an economy expanding, so-called ‘advanced’ economies need to steal ‘consumers’ from other countries. Much tougher for the ruling caste to extract their profits from the ‘national treasury’ when an economy is contracting.

SC: Very true. I’m glad you don’t fall into the fallacy of fearing an aging population, too, btw. https://population.org.au/discussion-papers/ageing/

Me: I would argue that the fears around a demographic cliff are mostly held by and perpetuated by economists that know (but cannot divulge openly) that our monetary/financial/economic systems are little more than a complex and very fragile Ponzi scheme (that they have helped to create and inflate). In fact, the truth of the matter is probably closer that everyone knows these are little more than Ponzi schemes but given we are all caught up in them and completely dependent upon them we all look the other way…

SC: Yeah, I’m not so sure there are so many aware people… mixed feelings if it’s true ay…

Me: I think it’s part and parcel of our ability and tendency to deny reality. See the work of Ajit Varki https://psycnet.apa.org/record/2020-08774-006

A rather contentious back and forth (with several others involved as well that I have not included) with one individual on the Peak Oil FB group we are all members of. The comments are in response to an announcement by AZ that he is interviewing Geological Survey of Finland geologist Simon Michaux and seeking questions to ask:

SP: Perhaps ask him why his assumptions on the amount of infrastructure required for energy transition is so radically different than other professional energy system modelers (who have actually had their work peer reviewed). Specifically, he assumes 150X the level of stationary battery storage requirements of others. This error then drives his other (now spectacularly incorrect) conclusions about the levels of resources required. https://twitter.com/aukehoe…/status/1594084375972712448…

Me: Auke Hoekstra’s career depends almost entirely upon the narrative he is peddling. All his income appears to come from the idea that investment in renewables is well worth it. Research grants (as a university researcher at Eindhoven University of Technology). Capital investments (as program director of Neon Research and Zenmo.com). He is highly incentivized to persuade others that investment in renewables (and his research) is worthwhile; and that critics of this are wrong. Not sure I see such bias in Simon Michaux’s work.

SP: it’s not just Auke. He just compiled the most articulate single response I have seen. It’s pretty much every single professional energy systems designer. The utilities, the capital, the whole space. Not one single professional thinks multiple days of battery storage are necessary. Let alone weeks. But then along comes Simon with his PowerPoint, and a bunch of media articles start popping up about how energy transition is not possible because we can’t build enough batteries, based on Simon’s bad forecast. At best, it wastes everybody’s time debunking his nonsense. More likely it adds enough fear uncertainty and doubt that we lean on fossil a while longer, with all the associated ecological impacts. He isn’t helping.

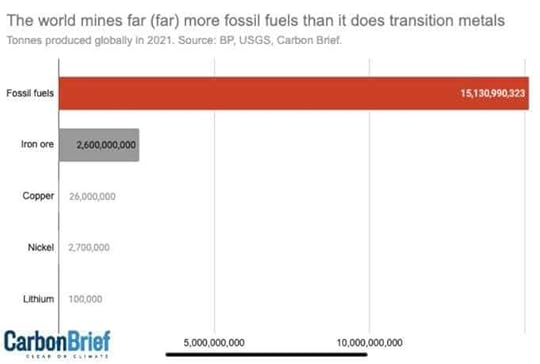

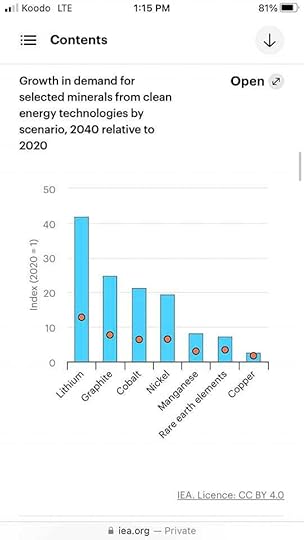

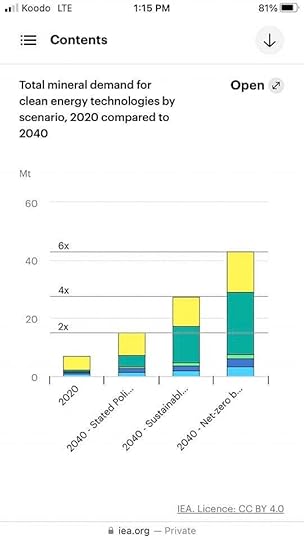

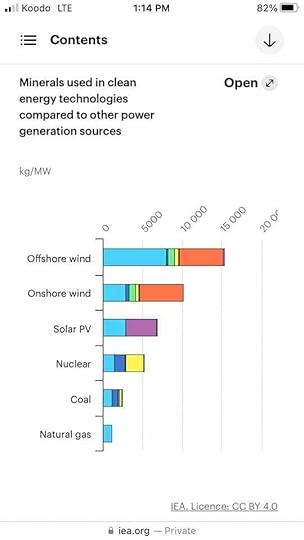

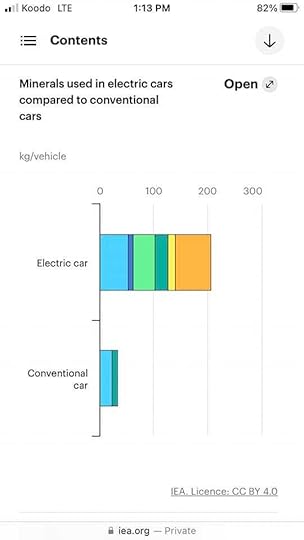

Me: What I find ‘interesting’, given you raise the issue of ecological impacts, is how often (always?) the ecological destruction that accompanies ‘renewables’ is left out of the equation; especially given its destruction has led to extreme biodiversity loss, probably our more and most pressing negative impact of our ecological overshoot. Those who cheerlead a shift from fossil fuels deny/ignore/rationalise away those impacts from the huge amount of fossil fuels that are still required (and may be in perpetuity) to produce alternatives and all the mining for the mineral resources to make them functional. Rare (in fact, mostly nonexistent) is the recognition by renewable cheerleaders (most who claim to be supporting it for its positive environmental/ecological aspects) that they too would destroy our natural world — particularly given how much destruction would be required to even replace a fraction of what fossil fuels currently provide.

SP: the “ecological destruction” from (most responsible) renewables (meaning not palm oil, gen 1 biofuels, etc) is minuscule compared to the fossil sources they are replacing. These impacts are not ignored. They are just a whole lot less worse. The ugly trend of the last year is that when new cleaner tech shows up, all the sudden the hard right “come and take it” types that will not stop burning oil for any reason, are suddenly environmentalists that give a sit about child labor in the Congo. Over just that one specific thing. It’s a delaying tactic, and somebody is paying for a campaign to signal boost that narrative over the last few months.

Me: As Upton Sinclair has been credited with stating: “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!” You seem to have (conveniently?) overlooked the dependency of non-renewable, renewable energy-harvesting technologies upon fossil fuels; so, if your argument is based upon ‘renewables’ being less destructive then fossil fuels, there is a huge gap in your logic…and you are simply rationalising away the environmental/ecological destruction that accompanies complex technologies.

SP: let’s make it crayon-level simple: I assert that renewables are capable of making more renewables, and enough net energy in top of it to keep something resembling civilization running. Others on here assert that because the systems are currently running in fossil, when they switch to renewables they will somehow cease to operate, and therefore transition to renewables is impossible. I find this assertion absurd on its face. We have and will go around in circles in this until so much of the system is transitioned that folks like Eric have to find a new asteroid or something else to profess the imminent collapse of civilization over. All of this is a distraction from the OP, which is about Simon’s work. I pointed out an error, and so far the only refutation of that has been character attacks on me or the authors I cite. Not anything to do with the actual substance of the argument.

Me: Having renewables capable of making more renewables is an assertion that may be true on a small-scale level but there is no proof in the pudding that this can be done at a scale required to support much of anything, and certainly not what most would consider ‘civilisation’. For the sake of argument, let’s assume this is possible. This does nothing to address the continued ecological destruction that would result from it. Nothing. The mining. The processing of materials. The transportation. The construction. The after-life disposal/reclamation. All are destructive and will simply compound negatively the already fragile situation we have created over the past couple of centuries of unfettered growth.

SP: really? Because we extract many orders of magnitude more fossil fuels (which cannot be recycled at end of life) than we do the minerals required for energy transition. The amount of mining required will be vastly reduced. You could counteract all new mineral requirements for energy transition by reducing the amount of land used for cow pasture by 1%.

Me: As for pointing out that those who tend to push for ‘renewables’ tend to have a vested interest (almost always economic in nature) in that narrative is not a character attack. It is a reminder that ‘objectivity’ is rare, if even at all possible, when attempting to support one’s beliefs…this is true for all of us. Now ramp up ‘renewable’ resources to ‘replace’ fossil fuels and take a different look at the chart you shared. I am not arguing in favour of fossil fuels. I am arguing both are destructive and we cannot continue to do anywhere close to the damage we are already doing. Pushing for renewables to replace fossil fuels is attempting to sustain the unsustainable while continuing to destroy the planet.

This is why the energy transition will be reliant on the mining industry

This is why the energy transition will be reliant on the mining industryMinerals like cobalt, lithium, and nickel are common in the make-up of a range of tech products. Image: Unsplash/…www.weforum.org

And finally, let’s not lose sight of the inconvenient fact that almost every promise of decarbonising/cleaning up/electrifying/net zeroing the industrial processes needed for ‘renewables’ are not based upon present, at-scale realities but upon accounting gimmicks, laboratory or small-scale prototypes, and as-yet-to-be-hatched chickens. There is nothing presently in place that comes remotely close to the promised land of “…in the future…” (and by the way, please invest in our research…)

SP: You just aren’t paying attention. Here is a good starting point on green steel. There is a ton out there on cement too. https://twitter.com/valenvogl/status/1620085082718617603…

Me: We all believe what we want to believe…including magical solutions that will allow humanity to continue pursuing our utopian dreams on a finite planet. I think we will leave it at agreeing to disagree. In a world of quickly declining surplus energy, continuing population growth (many with aspirations to achieve higher economic ‘prosperity’), significant diminishing returns on increasing resource scarcity, a complex yet gargantuan Ponzi-type economic system predicated upon hundreds of trillions of dollars of unplayable debt (quadrillions if we include derivatives and shadow banking), escalating geopolitical tensions, building totalitarianism, overburdened planetary sinks, massive biodiversity loss, increasing frequency and power of extreme weather events, etc., etc., I have a very, very, very difficult time having faith in all the as-yet-to-be-hatched techno-promises (especially at scale) particularly since they tend to be coming from those who profit from the continuation of the narrative that all problems are solvable — as long as we believe and divert lots of money/resources to them…

*****

If you’ve made it to the end of this contemplation and have got something out of my writing, please consider ordering the trilogy of my ‘fictional’ novel series, Olduvai (PDF files; only $9.99 Canadian), via my website — the ‘profits’ of which help me to keep my internet presence alive and first book available in print (and is available via various online retailers). Encouraging others to read my work is also much appreciated.

Crude, Food Prices Jump As Looming Israel-Iran Conflict Spark 1970s Oil Shock Fears

Larry MacDonald of The Bear Traps Report penned a very informative note last month that outlined, “2023-2024 look a lot like 1973-1974.” He said, “We’re one event away from a 1970s-style stagflation explosion…” History books remind us that the 1973 oil embargo shook the global energy market.

We were reminded of MacDonald’s note because the global benchmark Brent is currently being subjected to a major repricing event of geopolitical risk as Israel makes preparations for a potential retaliation by Tehran after a precision strike in Syria earlier this week killed top Iranian commanders.

“The market now knows that some kind of retaliation from Iran will likely come, but it doesn’t know when and where and what, and that creates a great discomfort and nervousness,” Bjarne Schieldrop, chief commodities analyst at SEB AB, told Bloomberg.

On Thursday, UBS desk trader Alexander Gray outlined several bullish factors into Brent’s surge that has the benchmark around $91/bbl handle:

Rally / buying right into the 14:30 New York energy close – suggests heavy index fund prepositioning ahead of GSCI roll onset tomorrow where energy will be weighted in the indexGeopolitics – reports of potential attacks within Iran and also potential retaliation toward Israel following Monday’s airstrikes.Bullish consensus and flow – a number of Street strategists have been out today talking about upside risk toward the $95-100 range in crude. Meanwhile, flows here have skewed toward upside buying in the options spaceTechnicals – Front-month WTI crude oil just completed a ‘golden cross’ technical formation with the 50- and 200-day moving average crossover. The front month is aimed at $88.58 above; $91.08 is key as the 76.4% Fibonacci retracement level in Brent… which is precisely where Brent is trading at this moment..…click on the above link to read the rest of the article…

Video: Canadians Plunged Into Poverty. Can’t Afford to Eat! Sign of Major Economic Collapse

This video vividly describes economic collapse and the plight of poverty in Canada, without however focussing on the underlying causes, nor the historical context.

Remember the March 11, 2020 Lockdown. Destabilizing the social, political and economic structure of 190 sovereign countries cannot constitute a “solution” to combating the virus.

The Lockdown consisted in “The confinement of the labor force” coupled with “The paralysis of the workplace”. Economics 101. I ask my students. What Happens?

Chaos of the Real economy. The March 11, 2020 Lockdown initiated a process of economic and social crisis Worldwide. It has contributed to a wave of bankruptcies and poverty.

The unspoken truth is that a non-existent pandemic launched in March 2020 has provided a pretext and a justification to precipitate the entire planet into a spiral of mass unemployment, bankruptcy, extreme poverty and despair.

Michel Chossudovsky, Global Research, April 4, 2024

For details and analysis see: The Worldwide Corona Crisis, Global Coup d’Etat Against Humanity, by Michel Chossudovsky, PDF Ebook, Pages: 164, 15 Chapters, Price: $11.50 FREE COPY! Click here (docsend) and download.

***

Canada is going through an economic collapse.

Food charities have a waitlist.

Is there any sign of utter economic collapse than people who cannot afford to feed themselves?

Why is this happening?

Watch the video below.

Something Broke In Markets On Thursday

This Friday is going to be a session for active short-term traders, and it will likely be unpleasant for investors.

Something broke in markets on Thursday. There are a few things that worry me about the latest bout of risk aversion. This is in context that I’ve been an unrelenting stocks bull since the December Fed meeting…

But now I’m uneasy…

The Thursday selloff confused people.

Initially, many blamed the comments from Fed’s Kashkari about there potentially being no US rate cuts this year.

However, a quick look at a few charts shows that (a) yields fell rather than climbed, so his hawkish lines did not impact, and (b) equities started selling off before his headlines.

It’s never a good sign when people struggle to identify why stocks have a relatively large swoon.

If an asset is weak without an obvious catalyst, it suggests that it can really get destroyed if a genuine risk materializes.

For good order, the weakness in E-minis coincided with the oil price rise that in turn followed the Netanyahu headlines.

We have key US data this morning at a time of vulnerability for the market in terms of the Fed narrative.

We’ve run a long way on the idea of the Fed being dovish despite a strong US economy.

We’re getting closer to the point where we must acknowledge that either the Fed won’t be easing soon, OR the economy is in more trouble than we thought.

It means that we’re in the unusual-in-recent-times setup where a big surprise in either direction could hurt stocks today.

(For clarity and consistency, I would only see this as a multi-week consolidation/retrenchment and not some long-term bearish turning point).

…click on the above link to read the rest of the article…