Steve Bull's Blog, page 232

May 5, 2022

World’s Largest Fertilizer Company Warns Crop Nutrient Disruptions Through 2023

The world’s largest fertilizer company warned supply disruptions could extend into 2023. A bulk of the world’s supply has been taken offline due to the invasion of Ukraine by Russia. This has sparked soaring prices and shortages of crop nutrients in top growing areas worldwide; an early indication of a global food crisis could be in the beginning innings.

Bloomberg reports Canada-based Nutrien Ltd.’s CEO Ken Seitz told investors on Tuesday during a conference call that he expects to increase potash production following supply disruptions in Russia and Ukraine (both major fertilizer suppliers). Seitz expects disruptions “could last well beyond 2022.”

Seitz said the conflict plus Western sanctions on Russia and Belarus has reduced fertilizer supply on global markets and could reshape crop nutrient trade, thus creating even more supply uncertainty.

“Could there be a change in global trade patterns as a result? We think that’s a possibility,” he said.

Fertilizer disruptions could be a multi-year event. Already, farmers worldwide are reducing fertilizers, which may threaten yields come harvest time. The repercussions could be huge: Lower yields may exacerbate the food crisis.

Here are the latest signs commercial farmers worldwide are reducing fertilizer usage because of higher prices or shortages.

Revealed last week, SLC Agricola SA, one of Brazil’s largest farming operations, managing fields of soybeans, corn, and cotton fields in an area larger than the state of Delaware, will reduce the use of fertilizer by 20% and 25% .

Coffee farmers in Brazil, Nicaragua, Guatemala, and Costa Rica, some of the largest coffee-producing countries, are expected to spread less fertilizer because of high costs and shortages. A coffee cooperative representing 1,200 farmers in Costa Rica predicts coffee output could slip 15% next year because of soaring fertilizer costs.

…click on the above link to read the rest of the article…

Collapse Is Happening Before Our Eyes

Collapse Is Happening Before Our Eyes

Collapse Is Happening Before Our EyesAnalysts and authors, myself included, have been warning about the collapse of the dollar as the global reserve currency for years. I described this prospect in my first book, Currency Wars (2011), and in several other books in the years since.

This process can take many years. For example, the decline of sterling as the leading global reserve currency played out over 30 years from 1914 (the beginning of World War I) to 1944 (the Bretton Woods conference).

Still, events today are playing out so quickly that the collapse is happening in front of our eyes.

It’s no longer a matter of a major event on the horizon; it’s occurring in real-time. Russia has just linked the ruble to gold at a rate of 5,000 rubles to one gram of gold. China is discussing with Saudi Arabia the prospect of paying for oil in yuan.

Israel is likewise considering taking yuan in exchange for its high-tech exports. China and Russia are creating new payments systems to avoid U.S. sanctions. You get the point.

Foreign Central Banks Aren’t Dumb

Central banks have been net buyers of physical gold since 2010. Countries all over the world are considering dumping dollars for fear that they will be next on the list to have their dollar assets frozen or seized the way the U.S. seized the dollar-denominated assets of the Central Bank of Russia.

That makes sense. What’s the point of holding dollars in your reserve positions if the U.S. can freeze those accounts on a whim? Americans tend to take dollar strength for granted, but that’s a mistake. It’s helpful at times like this to get a foreign perspective.

…click on the above link to read the rest of the article…

Dawn of Everything Conclusion

Preface. Clearly for their conclusion to make sense you’ll need to read the book and see the evidence for yourself. Since they challenge just about all of the ideas currently in fashion, you can find some pretty damning reviews of their book, but do not believe them, the several I’ve read entirely misstate what was actually written, the old straw man fallacy of inventing something that they didn’t say and shooting it down. And their attitude is not at all “we’re right, you’re wrong”, no, quite the opposite. They’re hoping to stir up fruitful avenues of inquiry, different and more meaningful ways of looking at the past, and my hope is that rather than try to invent a steady state / degrowth economy, that ecologists will team up with experts in anthropology and archeology to discuss the best sustainable ways of life from the past, how to avoid authoritarian kings, brutal agricultural societies, and more.

Here is part of their summary, and at greater length below (though they are constantly summarizing arguments throughout the book, another reason you need to actually read it).

“In trying to synthesize what we’ve learned over the last 30 years, we asked question such as “what happens if we accord significance to the 5,000 years in which cereal domestication did not lead to the emergence of pampered aristocracies, standing armies or debt peonage, rather than just the 5,000 years in which it did? What happens if we treat the rejection of urban life, or of slavery, in certain times and places as something just as significant as the emergence of those same phenomena in others?

…click on the above link to read the rest of the article…

May 4, 2022

May 3, 2022

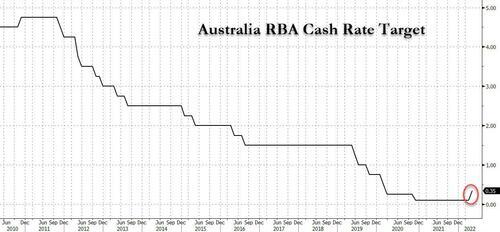

Australia Shocks With Bigger Than Expected Rate Hike, As Lowe Admits Embarrassment At Being So Wrong

In our preview of what was expected to be Australia’s first rate hike since 2010, we said that consensus expects a 15bps rate hike to 0.25%, with a handful of bank still expecting a hold (including CBA, Goldman and HSBC) and nobody expected a greater than 15bps rate hike. Well, everyone was wrong, because a few hours ago, Australia’s central bank – one of the developed world’s last remaining doves turned hawkish – and joined the global tightening bandwagon when it increased interest rates by more than any economists anticipated, rocking markets with a bigger-than-expected interest-rate hike in the middle of an election campaign and signaled further hikes to come, sending the currency and bond yields higher, while stocks slumped.

Abandoned his pledge of just two months ago to remain patient, Reserve Bank Governor Philip Lowe topped economists estimates by raising the cash rate 25 basis points to 0.35%, defying expectations for a hike of 15 basis points. It was the first time borrowing costs had been lifted in an election campaign in almost 15 years. That move and suggestions that more hikes will follow sent benchmark three-year bond yields soaring through 3% for the first time in eight years.

“The RBA managed to wrongfoot every forecaster and even the market — no one was braced for 25 basis points,” said Sean Callow, a senior currency strategist at Westpac Banking Corp. Economists’ consensus was for a 15 basis-point hike.

Pouring gasoline on the hawkish case, the RBA forecast for 2022 is that headline inflation will accelerate to about 6% and core inflation will rise to around 4.75%. The RBA targets inflation of 2-3%. In response to a question about why the RBA had previously guided against rate hikes, Lowe said that “Inflation has surprised everyone on the upside.”

…click on the above link to read the rest of the article…

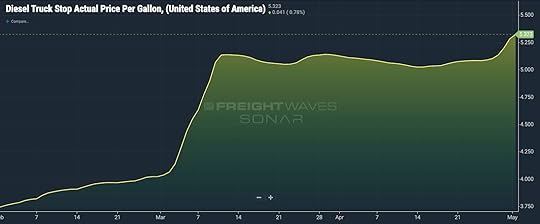

Why every American should care that diesel prices are surging across the country

The cost of diesel fuel impacts truckers and the entire economy. (Photo: JIm Allen/FreightWaves)

The cost of diesel fuel impacts truckers and the entire economy. (Photo: JIm Allen/FreightWaves)Gasoline prices are increasing almost daily, pinching the wallets and pocketbooks of nearly all Americans with cars. However, as bad as that news is, diesel prices are surging even more across the country. Today’s truckstop retail diesel prices hit a new record of $5.32/gallon. Since February 1st, national truckstop diesel prices have increased by $1.57/gallon. For an owner-operator whose truck gets 6.5 miles per gallon, this equates to a cost increase of $0.24 per mile.

Diesel’s importance to our economy

To many Americans (including politicians), diesel prices are so removed from their version of reality that they often dismiss the importance of diesel to the U.S. and global economies. However, diesel is the fuel that drives the economy and leaves major industries vulnerable to cost shocks.

Without diesel fuel, the U.S. economy would collapse in a matter of days. Our supply chains would completely shrivel, almost overnight.

Trucks use it to haul our goods across the country. Of all Class 8 trucks (the big ones), 97% use diesel. No, Elon Musk is not going to save us here. When Tesla announced the Semi in 2017, Musk projected that over 100,000 would be produced by 2022. Today there are less than 20, mostly prototypes.

Trains also depend on diesel to transport products across the country. Almost every train in the country depends on diesel for energy.

A BNSF train hauls coal. (Photo: Flickr/Aaron Hockley)

A BNSF train hauls coal. (Photo: Flickr/Aaron Hockley)Even a large portion of our electricity is indirectly powered by diesel. Over one-fifth (22%) of our electricity in the United States comes from coal. Diesel-powered trains transport coal to power plants across the nation.

Diesel is also critical to our imports and exports, because 80% of the ships that transport products via the ocean are powered by diesel.

…click on the above link to read the rest of the article…

May 2, 2022

China and Russia are working on homegrown alternatives to the SWIFT payment system. Here’s what they would mean for the US dollar.

Russian President Vladimir Putin and Chinese President Xi Jinping. Getty ImagesSome Russian banks have been banned from SWIFT, a cross-border messaging service for banks.India was reportedly considering a Russian proposal to use the SPFS for payments in rubles.Moscow is also working with Beijing to connect to the Chinese messaging system.

Russian President Vladimir Putin and Chinese President Xi Jinping. Getty ImagesSome Russian banks have been banned from SWIFT, a cross-border messaging service for banks.India was reportedly considering a Russian proposal to use the SPFS for payments in rubles.Moscow is also working with Beijing to connect to the Chinese messaging system.In the aftermath of Russia’s unprovoked invasion of Ukraine, some Russian banks were banned from SWIFT, the Belgium-based messaging service that lets banks around the world communicate about cross-border transactions. The ban has hampered cross-border transactions for Russia’s trade and financial systems, isolating the country economically.

Now, both Russia and China are looking to establish alternatives to the US dollar hegemony.

Russia is touting an alternative ruble-based payment system called the System for Transfer of Financial Messages (SPFS). The system was set up in 2014. In late April, the country’s central bank said it would start

China’s Cross-Border Interbank Payment System (CIPS) — which processes payments in Chinese yuan — also has potential to replace SWIFT. The system has an expansive network of 1,280 financial institutions, said Peter Keenan, the cofounder and CEO of Apexx, a payments provider that used to work with Russia’s domestic Mir payment card. That’s compared to SPFS’ much smaller network of 400 users.

There are few alternatives to SWIFT, Keenan told Insider: “This is one of the reasons why Russia is looking to CIPS and an alternative for Asian payments specifically.”

Here’s how China and Russia’s SWIFT alternatives could cause disruptions in the global payments system and the dollar’s dominance.

…click on the above link to read the rest of the article…

The People Behind DHS’s Orwellian “Disinformation Governance Board”

A “Disinformation Governance Board” has just been created and is going to be run by the Department of Homeland Security. Their primary goal is going to be to “police” what is deemed to be “misinformation” or “disinformation.”

No clarification has been given as of yet as to what this policing will mean, but it has been pointed out that the creation of this new Disinformation Governance Board is going to have the full strength of the DHS behind it.

DHS Secretary Alejandro Mayorkas said, “the goal is to bring the resources of (DHS) together to address this threat.”

Nina Jankowicz has been chosen to head up the new disinformation office as the executive director.

Nina Jankowicz

Nina Jankowicz

Nina JankowiczJankowicz received her MA in Russian, Eurasian, and East European Studies from Georgetown University’s School of Foreign Service. A full list of the staff at the Walsh School of Foreign Service at Georgetown University can be found here.

Some of the current faculty/staff members within the Walsh School of Foreign Service are:

Rebecca KatzShantayanan DevarajanThomas BanchoffMadeleine AlbrightJankowicz also spent time previously working with the Woodrow Wilson International Center for Scholars (also called the Wilson Institute) in the past as a disinformation fellow. A full listing of their staff can be found here.

Some of the current staff members, faculty, and associates at the Wilson Institute include:

Cynthia Arnson – Director of the Latin American ProgramShihoko Goto – Director for Geoeconomics and Indo-Pacific Enterprise/Deputy Director of the Asia ProgramDuncan Wood – VP for Strategy and New Initiatives; Senior Advisor to the Mexico Instituted; Interim Director of the Global Europe ProgramLonnie Bunch III – Secretary of the Smithsonian Institution…click on the above link to read the rest of the article…