Steve Bull's Blog, page 180

October 11, 2022

Even The Banksters Are Being Forced To Admit That The U.S. Economy Is Really Starting To Come Apart At The Seams

It’s wake up time. For months, there has been a tremendous amount of denial out there. So many of the “experts” assumed that the Federal Reserve and other central banks had everything under control and that things would “return to normal” before too long. But that hasn’t happened. Instead, the wheels seem to be coming off the bus and nobody seems to know what to do. The Fed appears to be determined to keep raising interest rates in a desperate attempt to fight inflation, and this has forced other central banks all over the globe to raise rates as well in order to keep their currencies from absolutely tanking. But all of these interest rate hikes are taking us into a major global economic downturn, and central bankers in Europe are literally screaming at the Fed to end the madness.

It’s wake up time. For months, there has been a tremendous amount of denial out there. So many of the “experts” assumed that the Federal Reserve and other central banks had everything under control and that things would “return to normal” before too long. But that hasn’t happened. Instead, the wheels seem to be coming off the bus and nobody seems to know what to do. The Fed appears to be determined to keep raising interest rates in a desperate attempt to fight inflation, and this has forced other central banks all over the globe to raise rates as well in order to keep their currencies from absolutely tanking. But all of these interest rate hikes are taking us into a major global economic downturn, and central bankers in Europe are literally screaming at the Fed to end the madness.

But the Fed is not going to end the madness, and so things are going to get really bad.

In fact, Bank of America is now projecting that the U.S. economy will lose 175,000 jobs a month during the first quarter of 2023…

As pressure from the Fed’s war on inflation builds, nonfarm payrolls will begin shrinking early next year, translating to a loss of about 175,000 jobs a month during the first quarter, the bank said. Charts published by Bank of America suggest job losses will continue through much of 2023.

“The premise is a harder landing rather than a softer one,” Michael Gapen, head of US economics at Bank of America, told CNN in a phone interview Monday.

In my opinion, if our job losses are that small during the first three months of next year I think that will be a huge win.

…click on the above link to read the rest of the article…

Bank of England intervenes in bond markets again, warns of ‘material risk’ to UK financial stability

The Bank of England raised rates by 0.5 percentage points Thursday.Vuk Valcic | SOPA Images | LightRocket | Getty Images

The Bank of England raised rates by 0.5 percentage points Thursday.Vuk Valcic | SOPA Images | LightRocket | Getty ImagesLONDON — The Bank of England on Tuesday announced an expansion of its emergency bond-buying operation as it looks to restore order to the country’s chaotic bond market.

The central bank said it will widen its purchases of U.K. government bonds — known as gilts — to include index-linked gilts from Oct. 11 until Oct. 14. Index-linked gilts are bonds where payouts to bondholders are benchmarked in line with the U.K. retail price index.

The move marks the second expansion of the Bank’s extraordinary rescue package in as many days, after it increased the limit for its daily gilt purchases on Monday ahead of the planned end of the purchase scheme on Friday.

The Bank launched its emergency intervention on Sep. 28 after an unprecedented sell-off in long-dated U.K. government bonds threatened to collapse multiple liability driven investment (LDI) funds, widely held by U.K. pension schemes.

“The beginning of this week has seen a further significant repricing of UK government debt, particularly index-linked gilts. Dysfunction in this market, and the prospect of self-reinforcing ‘fire sale’ dynamics pose a material risk to UK financial stability,” the bank said in a statement Tuesday.

…click on the above link to read the rest of the article…

October 10, 2022

Anthony Blinken Raises The Pucker Factor On Dissent: Taibbi

After publishing “On John Lennon’s Birthday, a Few Words About War” last night, old friend and former Moscow Times editor Matt Bivens* and I discovered we’d written on the same topic.

You can find Matt’s excellent essay here.

He notes a big thing I missed. A series of ominous statements was buried in Secretary of State Anthony Blinken’s recent joint press conference with Canadian Foreign Minister Mélanie Joly, trumpeting the “tremendous opportunity” the Nord Stream blasts afforded to remove “the dependence on Russian energy.”

A few public figures questioned those comments, but Blinken said something else that was worse. The relevant passage:

I also made clear that when Russia made this move, the United States and our allies and partners would impose swift and severe costs on individuals and entities – inside and outside of Russia – that provide political or economic support to illegal attempts to change the status of Ukrainian territory…

We will hold to account any individual, entity, or country that provides political or economic support for President Putin’s illegal attempts to change the status of Ukrainian territory. In support of this commitment, the Departments of the Treasury and Commerce are releasing new guidance on heightened sanctions and export control risks for entities and individuals inside and outside of Russia that support in any way the Kremlin’s sham referenda, purported annexation, and occupation of parts of Ukraine.

There’s no way to know what a State Department official might believe meets the definitions of “political support,” support “in any way,” the “Kremlin’s sham referenda,” or any of a half-dozen phrases in that passage. This is why the negative precedent of government watch lists after the PATRIOT Act was important…

…click on the above link to read the rest of the article…

Want to save the oceans? Stop recycling plastic

If you put your plastic in your recycling bin, there’s a decent chance it will end up in the seas off east Asia. If you put it in landfill, it’s going nowhere

Plastic in a river in Manila, the Philippines, where a significant amount of Western ‘recycling’ plastic is sent (Photo: Noel Celis/AFP/Getty)

Plastic in a river in Manila, the Philippines, where a significant amount of Western ‘recycling’ plastic is sent (Photo: Noel Celis/AFP/Getty)Recycling plastic is a bad idea and, until we can be sure of where it’s going, we should stop doing it. We should put plastic in the landfill, instead.

This sounds like a really spicy hot take, but it’s not. I think it is pretty much accepted among people who study these things. The oceans are full of plastic, and that’s bad – but none of the plastic in the oceans comes from a British landfill. It almost all comes from developing-world countries, and by recycling we make the problem worse.

About 0.05 per cent of plastic waste in the UK is “mismanaged” – that is, dropped as litter or dumped into the environment, or left in open landfill. By contrast, in India, that figure is over 20 per cent – 400 times higher. China is comparable, at about 19 per cent.

In the Philippines, that figure is about 6.5 per cent, still more than 100 times the UK level but not quite as dramatic. But the Philippines is a collection of small islands, so plastic litter easily reaches small rivers there and ends up in the sea. Malaysia, similarly, has less of a problem with mismanaged waste, but large percentages of what is mismanaged ends up in the sea. So the average bit of plastic in one of those countries is pretty likely to end up in the sea.

…click on the above link to read the rest of the article…

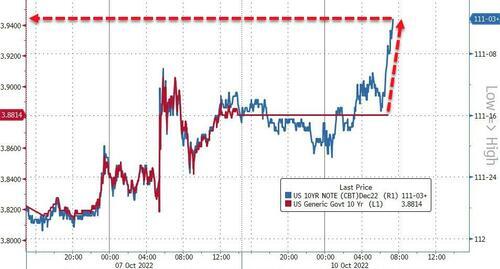

BoE’s New Support Plan Fails As UK Gilt Yields Explode Higher

Update (1030ET): Despite The BoE promises to do almost ‘whatever it takes’, long-dated gilt prices are collapsing today. 30Y gilt yields are up a stunning 34bps now, soaring towards crisis highs…

What next for BoE?

The pain in the UK is spreading to US yields (remember US bond market holiday today but futures trading)…

10Y UST yields are implied around 6bps higher for now.

* * *

Over the weekend, Band of England (BoE) Deputy Governor Dave Ramsden indicated that the bank intends to charge forward on interest rate hikes, suggesting that this is the only way to tame the ongoing inflation crisis.

“However difficult the consequences might be for the economy, the MPC must stay the course and set monetary policy to return inflation to achieve the 2% target sustainably in the medium term, consistent with the remit given to us.”

Just two days after that statement, BoE on Monday announced further measures to ensure financial stability in the U.K., building on its intervention in the long-dated bond market.

Specifically, The BOE said it will:

Double the size of its auctions to purchase long-dated UK government bonds to £10 billion a day until Oct. 14 , when the BOE plans to close that program as previously announcedLaunch a Temporary Expanded Collateral Repo Facility, or TECRF, that will run beyond the end of this week until Nov. 10 . Its purpose is to enable banks to ease pressures in LDI funds through liquidity insurance operations.Temporary expansion of collateral it accepts under its existing Sterling Monetary Framework to include corporate bonds.Additionally, regular repo-related operations also remain available to help.

So far, investors haven’t taken up as much of the support as the BOE has offered. In the eight auctions to date, the BOE bought just £4.6 billion of bonds, about 12% of the £40 billion capacity of the program.

…click on the above link to read the rest of the article…

Russia Launches Large-Scale Strikes On Some 20 Ukrainian Cities In Response To “Terrorist” Crimea Bridge Blast

A series of major explosions rocked Kyiv and several locations across Ukraine on Monday, following Russian President Vladimir Putin blaming Ukrainian special services for the “terrorist” blast which partially disabled the Crimean bridge that links Russia to the peninsula.

Ukrainian President Volodymyr Zelensky confirmed the fresh missile attacks in a statement posted to Telegram, saying that the new “missiles hitting” are part of the Kremlin trying to “wipe us off the face of the Earth,” and that: “Unfortunately, there are dead and wounded.”

Image of widespread destruction in Kiev & other cities are widely circulating on social media.

Image of widespread destruction in Kiev & other cities are widely circulating on social media.At least 100 strikes were carried out, with many cruise missiles launched from Russian warships in the Black Sea. Putin in a televised announcement said he ordered attacks on military, energy, and communications targets specifically in response to the Crimea bridge attack.

“If attempts to carry out terrorist attacks continue, Russia’s response will be severe and at the level of the threats facing it. Nobody should be in any doubt,” Putin warned. He threatened that more might follow: “If attempts to commit terrorist acts on our territory continue, the responses from Russia will be harsh and their scale will correspond to the level of threat to Russia,” he added, addressing a meeting of his Security Council. “No one should have any doubts.”

Russia’s defense ministry also affirmed it hit “all the assigned targets” – which in some cases appear to have been civilian infrastructure in the Ukrainian capital. Regional sources are listing that over 15 significant cities were targeted and suffered severe damage, including Kiev, Rovno, Lvov, Ternopol, Ivano-Frankovsk, Khmelnitsky, Zhitomir, Kremenchug, Kropivnitsky, Krivoy-Rog, Odessa, Zaporozhie, Dnieper, Poltava, Kharkov. Additional smaller cities and towns were hit as well.

…click on the above link to read the rest of the article…

Dutch dilemma: What is Europe willing to do for more natural gas?

Modern global society is steeped in the idea of trade-offs, the notion that one must suffer losses to obtain desired gains. This prepares the way for disingenuous leaders to explain why sacrifices are necessary to reach supposedly exalted goals. Usually those sacrifices are made by the powerless in society; they are certainly not made by the leaders who call for sacrifices nor by the wealthy and powerful who benefit from them.*

This coming fateful winter season in Europe is likely to include a lively debate about whether the Dutch should make a perilous trade-off on behalf of an energy-starved Europe. So far, the Dutch have been firm about closing one of the world’s largest natural gas fields, Groningen, no later than 2024—even in the face of severe European gas shortages resulting from the loss of gas from Russian pipelines.

The reason for that firmness has to do with the damage earthquakes are inflicting on the buildings located above and around the field, earthquakes related directly to withdrawal of Groningen’s gas. In the northeastern part of the country, some 1200 earthquakes have severely damaged 27,000 buildings to the point that they are uninhabitable. About 3,300 structures have been demolished. A 2015 study reported that 152,000 homes need to be reinforced. As a result the government has been reducing gas withdrawals to mitigate the problem with an eye toward closing the field. Closing the field also comports with the government’s greenhouse gas reduction goals.

But, will the Dutch be able to withstand calls for increasing production from Groningen as the European winter arrives?

…click on the above link to read the rest of the article…

With A Third Of French Gas Stations Experiencing “Supply Shortages”, Energy Giant Seeks Urgent Wage Talks

Just days after we reported that France had tapped its strategic fuel reserves to resupply a growing number of gas stations that had run dry due to a nearly two-week long strike of refinery workers, with Government spokesman Olivier Veran urging consumers not to panic-buy only to achieve the opposite results, on Sunday the French Energy ministry announced that almost a third of French petrol (that’s gasoline for US readers) stations were experiencing “supply difficulties” with at least one fuel product (up from 21% on Saturday), as French energy giant TotalEnergies offered to bring forward wage talks, in response to union demands, as it sought to end the strike that has pushed French to the bring of a historic energy crisis.

“Provided the blockades will end and all labor representatives agree, the company proposes to advance to October the start of mandatory annual wage talks,” it said in a statement. The talks were initially scheduled to start in mid-November.

In response, Union representatives earlier told Reuters the strikes staged by the CGT, historically one of France’s more militant unions, would continue even as unions said they are willing to begin negotiations next week.

They have disrupted operations at two ExxonMobil sites as well as at two TotalEnergies sites, sending French gasoline inventories sliding. Over roughly two weeks of industrial action, France’s domestic fuel output has fallen by more than 60%, straining nerves across the country, as waiting lines grow and supplies have run dry.

Car drivers queue to fill their fuel tanks at gasoline pumps at Auchan gas station in Petite-Foret, France, October 6, 2022

Car drivers queue to fill their fuel tanks at gasoline pumps at Auchan gas station in Petite-Foret, France, October 6, 2022…click on the above link to read the rest of the article…

October 9, 2022

German government furious as ‘friendly countries’ charge ‘astronomical prices’ for gas

Germany’s energy situation is dire, and the Nord Stream pipeline explosions have only worsened its geopolitical and economic outlook

German Economy and Climate Minister Robert Habeck waits for the arrival of the Prime Minister of the Netherlands Mark Rutte at the foyer of the chancellery in Berlin, Germany, Tuesday, Oct. 4, 2022. (AP Photo/Markus Schreiber)

German Economy and Climate Minister Robert Habeck waits for the arrival of the Prime Minister of the Netherlands Mark Rutte at the foyer of the chancellery in Berlin, Germany, Tuesday, Oct. 4, 2022. (AP Photo/Markus Schreiber)Germany has become extremely reliant on liquified natural gas from the United States to keep its industrial sector and economy afloat, and since the Nord Stream gas pipeline explosions, Germany has become even more dependent.

The pipeline explosion changes the entire geopolitical position of Germany, as it cut off any hope Germany had of restarting relations with Russia and regaining access to cheap gas supplies, which have served as the bedrock of the country’s industrial sector.

Given the circumstances, Germany is growing angry over the “sky-high” gas prices it has to pay from so-called “friendly countries.”

‘Our great-grandchildren will pay for this’ – Germany’s plan to borrow €200 billion in ‘shadow’ debt to pay for gas price cap criticized by federal audit office

Germany wants to borrow €200 billion to support gas prices using a budgetary trick

Federal Minister of Economy Robert Habeck has criticized the high cost of delivering liquid gas to Germany. He says that even “friendly countries” have sometimes demanded “astronomical prices,” Habeck told the Osnabrücker Zeitung. He said there is need for further discussion in order to bring prices down.

“I think such solidarity would also be good for curbing gas prices,” emphasized the politician with a view to the government in Washington.

…click on the above link to read the rest of the article…