Steve Bull's Blog, page 104

August 31, 2023

‘We are damned fools’: scientist who sounded climate alarm in 80s warns of worse to come

James Hansen, who testified to Congress on global heating in 1988, says world is approaching a ‘new climate frontier’

The world is shifting towards a superheated climate not seen in the past 1m years, prior to human existence, because “we are damned fools” for not acting upon warnings over the climate crisis, according to James Hansen, the US scientist who alerted the world to the greenhouse effect in the 1980s.

Hansen, whose testimony to the US Senate in 1988 is cited as the first high-profile revelation of global heating, warned in a statement with two other scientists that the world was moving towards a “new climate frontier” with temperatures higher than at any point over the past million years, bringing impacts such as stronger storms, heatwaves and droughts.

The world has already warmed by about 1.2C since mass industrialization, causing a 20% chance of having the sort of extreme summer temperatures currently seen in many parts of the northern hemisphere, up from a 1% chance 50 years ago, Hansen said.

“There’s a lot more in the pipeline, unless we reduce the greenhouse gas amounts,” Hansen, who is 82, told the Guardian. “These superstorms are a taste of the storms of my grandchildren. We are headed wittingly into the new reality – we knew it was coming.”

Hansen was a Nasa climate scientist when he warned lawmakers of growing global heating and has since taken part in protests alongside activists to decry the lack of action to reduce planet-heating emissions in the decades since.

He said the record heatwaves that have roiled the US, Europe, China and elsewhere in recent weeks have heightened “a sense of disappointment that we scientists did not communicate more clearly and that we did not elect leaders capable of a more intelligent response”.

…click on the above link to read the rest…

August 29, 2023

Climate Change Has Come Full Circle

Photo by Mike Newbry on Unsplash

Photo by Mike Newbry on UnsplashOur modern technological civilization was born out of fossil fuels. Coal. Oil. Natural gas. To this very day most of our industry, transportation and agriculture is still powered by these incredibly dense, portable, storable sources of energy. There is a fly in the ointment though: the burning of these ancient accumulations of carbon comes with releasing a lot of CO2 into the atmosphere. So far so good, however, I still regularly stumble upon commentators (and commenters) who question whether all this burning of fossil fuels is the cause of climate change (if it is changing at all). According to some this is a recent “woke” theory emerging from backroom discussions of the World Economic Forum, in order to make us all obedient and to deprive hard working people of the great gift of fossil energy. Well, let’s have a look at the history of the topic, to see if it’s based on actual measurement data and science in its classical sense or its indeed just a recent scare. Who knows, we might even gain some insight into some of the conspiracy theories while we’re at it.

Upuntil the late 1980’s the state of our climate didn’t seemed to be too much of a concern. One could even believe that we were headed towards another ice age without being labelled a climate change denier. Fossil fuels were deemed to be a universal good and very few thought that their use could put an end to human history. This state of blissful ignorance didn’t mean that there were no ominous warnings given beforehand. After all who could recall all the scientific studies made a hundred years earlier…?

…click on the above link to read the rest…

Will This Fall Be the Fall of Falls?

This 25 minute video with Matthew Piepenburg and myself is probably one of the most important discussions that we have had.

For years we have both warned investors about the consequences of a system based on unlimited money printing, debt creation and money debasement.

The world economy and the financial system is now on the cusp of a precipice.

No one can forecast when the coming violent turn will come.

It can take years or it can happen tomorrow.

Future historians will tell us when it happened.

In the meantime investors have one duty to themselves and their dependents which is to protect their wealth from total destruction.

Money printing and debt creation have taken markets to dizzy and unsustainable levels.

Since Nixon closed the gold window in 1971, both global and US debt is up over 80X!

And asset markets have been inflated by this fake money with the Nasdaq up 120X and the S&P up 44X since 1971.

But the bubbles are not just in stocks but also in bonds, property, art, other collectibles etc, etc.

In our view, the time to pay the Piper is here and now. The consequences will be costly, even very costly for the investors who ignore this major risk.

Just as bubble assets can go up exponentially they can implode even faster.

RISK OF MARKETS FALLING 50-90%

Sustained corrections of 50% to 90% in stocks and bonds are very possible and when the bubble bursts it will go so fast that there won’t be time to get out or to buy insurance.

Whether the Everything Bubble turns to theEverything Collapse today or tomorrow, the time to protect your assets is before it happens which means NOW.

…click on the above link to read the rest…

The West Is Losing Control Over the Gold Price

An important change has unfolded in the global gold market. The East has been driving up the gold price, predominantly in late 2022 and the first months of 2023, breaking the West’s long standing pricing power.

Gold bazaar in Turkey. Pricing power in the gold market has recently shifted to the East.

Gold bazaar in Turkey. Pricing power in the gold market has recently shifted to the East.Until recently, Western institutional money was driving the price of gold in wholesale markets such as London, mainly based on real interest rates. Gold was bought when real rates fell and vice versa. However, from late 2022 until June 2023 gold was up 17% while real rates were more or less flat, and Western institutions were net sellers. Most likely, Eastern central banks, and Turkish and Chinese private demand, lifted the price of gold.

IntroductionFor about ninety years, up until 2022, there was a pattern of above-ground gold moving from West to East and back, in sync with the gold price falling and rising. Western institutions set the price of gold and bought from the East in bull markets. In bear markets the West sold to the East. For more information read my article: The West–East Ebb and Flood of Gold Revisited.

If we zoom in on the period from 2006 through 2021 the main reason for Western institutions to buy or sell gold was the 10-year TIPS rate, which reflects the 10-year expected real interest rate (“real rate,” in short) of US government bonds.

The physical gold price was predominantly set in the London Bullion Market and to a lesser extent Switzerland. Gold trade in London can be divided in three categories:

…click on the above link to read the rest…

August 28, 2023

Hedging the End of Fiat

It is slowly coming clear that the fiat dollar’s hegemony is drawing to a close. That’s what the BRICS summit in Johannesburg is all about — rats, if you like, deserting the dollar’s ship. With the dollar’s backing being no more than a precarious faith in it, it is bound to be sold down by foreign holders. Being only fiat, it could even become valueless, threatening to take down the other western alliance fiat currencies as well.

How do you protect your paper wealth from this outcome? Some swear by bitcoin and others by gold.

This article looks at what is likely to emerge as a replacement currency system, and concludes that from practical and legal aspects, bitcoin and the entire cryptocurrency industry will fail with fiat, while mankind will return to gold, as it has always done in the past when state control over currency fails

Introduction

It is gradually dawning on market participants that the era of fiat currencies is drawing to a close. Monetarists, who first warned us of the inflationary consequences of the expansion of money and credit were also the first to warn us that the slowdown in monetary expansion would lead to recession, and since then we have seen broad money statistics flatline, with bank lending beginning to contract. This is interpreted by macroeconomists as the end of inflation, and the return to lower interest rates to stave off recession.

Unfortunately, this black-and-white interpretation of either inflation or recession but never both has been challenged by bond yields around the world which are rising to new highs. And the charts tell us that they are likely to go considerably higher. Consequently, conviction that inflation of producer and consumer prices will prove to be a temporary phenomenon is infected with doubt.

…click on the above link to read the rest…

August 27, 2023

It Bears Repeating: Best Of…Volume 1

A compilation of writers focused on the nexus of limits to growth, energy, and ecological overshoot.

With a Foreword and Afterword by Michael Dowd, authors include: Max Wilbert; Tim Watkins; Mike Stasse; Dr. Bill Rees; Dr. Tim Morgan; Rob Mielcarski; Dr. Simon Michaux; Erik Michaels; Just Collapse’s Tristan Sykes & Dr. Kate Booth; Kevin Hester; Alice Friedemann; David Casey; and, Steve Bull.

The document is not a guided narrative towards a singular or overarching message; except, perhaps, that we are in a predicament of our own making with a far more chaotic future ahead of us than most imagine–and most certainly than what mainstream media/politics would have us believe.

Click here to access the document as a PDF file, free to download.Ecological doom-loops: Why ecosystem collapses may occur much sooner than expected

Credit: Anna Kucherova / Shutterstock

Credit: Anna Kucherova / ShutterstockAround the world, rainforests are becoming savanna or farmland, savanna is drying out and turning into desert, and icy tundra is thawing. Indeed, scientific studies have now recorded “regime shifts” like these in more than 20 different types of ecosystem where tipping points have been passed. Around the world, more than 20% of ecosystems are in danger of shifting or collapsing into something different.

These collapses might happen sooner than you’d think. Humans are already putting ecosystems under pressure in many different ways—what we refer to as stresses. And when you combine these stresses with an increase in climate-driven extreme weather, the date these tipping points are crossed could be brought forward by as much as 80%.

This means an ecosystem collapse that we might previously have expected to avoid until late this century could happen as soon as in the next few decades. That’s the gloomy conclusion of our latest research, published in Nature Sustainability.

Human population growth, increased economic demands, and greenhouse gas concentrations put pressures on ecosystems and landscapes to supply food and maintain key services such as clean water. The number of extreme climate events is also increasing and will only get worse.

What really worries us is that climate extremes could hit already stressed ecosystems, which in turn transfer new or heightened stresses to some other ecosystem, and so on. This means one collapsing ecosystem could have a knock-on effect on neighboring ecosystems through successive feedback loops: an “ecological doom-loop” scenario, with catastrophic consequences.

How long until a collapse?

In our new research, we wanted to get a sense of the amount of stress that ecosystems can take before collapsing. We did this using models—computer programs that simulate how an ecosystem will work in future, and how it will react to changes in circumstance.

…click on the above link to read the rest…

August 24, 2023

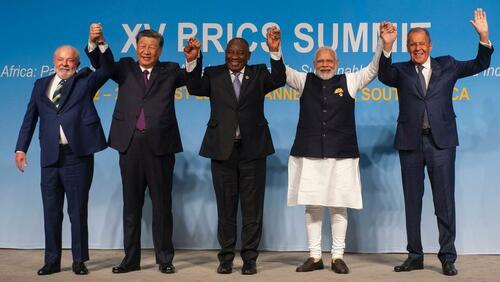

Xi, Putin Hail First BRICS Expansion In Over A Decade As Gulf Oil Powers Join

At a moment China and Russia have envisioned the future of BRICS as fundamentally an anti-Western bloc of developing nations, the Gulf oil powers Saudi Arabia and the United Arab Emirates have been formally invited to become members, which marks the bloc’s first expansion in over a decade.

“The membership will take effect from the first of January, 2024,” South African President Cyril Ramaphosa said, adding that additionally Argentina, Egypt, Ethiopia and Iran will be added to the fold next year.

Brics pool photo, via NY Times

Brics pool photo, via NY TimesChina’s President Xi Jinping hailed the rare expansion, beyond the current large economies of China, Russia, Brazil India, China and South Africa as “historic”. He said it will “inject new impetus into the BRICS cooperation mechanism and further strengthen the power of world peace and development.”

President Putin too congratulated the soon to be newest members, saying in a video message, “I would like to congratulate the new members who will work in a full-scale format next year.”

“And I would like to assure all our colleagues that we will continue the work that we started today on expanding the influence of BRICS in the world,” the Russian leader added. Indian Prime Minister Narendra Modi also hailed the expansion which he said will strengthen the bloc.

Saudi Foreign Minister Prince Faisal bin Farhan’s statement said, “the special, strategic relations with the BRICS nations promotes common principles, most importantly the firm belief in the principle of respect for sovereignty, independence and non-interference in internal affairs.”

He vowed in words before the BRICS conference on Thursday that the kingdom will be a “secure and reliable energy provider,” and noted that total bilateral trade between Riyadh and BRICS countries exceeded $160 billion in 2022, the Saudi foreign minister said.

…click on the above link to read the rest…

The global bank credit crisis

Globally, further falls in consumer price inflation are now unlikely and there are yet further interest rate increases to come. Bond yields are already on the rise, and a new phase of a banking crisis will be triggered.

This article looks at the factors that have come together to drive interest rates higher, destabilising the entire global banking system. The contraction of bank credit is in its early stages, and that alone will push up interest costs for borrowers. We have an old fashioned credit crunch on our hands.

A new bout of price inflation, which more accurately is an acceleration of falling purchasing power for currencies, also leads to higher interest rates. Savage bear markets in financial and property values are bound to ensue, driving foreign investors to repatriate their funds.

This will unwind much of the $32 trillion of foreign investment in the fiat dollar which has accumulated in the last fifty-two years. And BRICS’s deliberations for replacing the dollar as a trade settlement medium could not come at a worse time.

Global banking risks are increasing

Gradually, the alarm bells over credit are beginning to ring. Monetarist and Austrian School economists are hammering the point home about broad money, which almost everywhere is contracting. It is overwhelmingly comprised of deposits at the commercial banks. And this week, even China’s command economy has had credit problems exposed, with another large property developer, Country Garden Holdings missing bond payments.

A global cyclical downturn in bank credit is long overdue, and that is what we currently face. Empirical evidence of previous cycles, particularly 1929—1932, is that fear can spread though the banking cohort like wildfire as interbank credit lines are cut, loans are called in, and collateral liquidated…

…click on the above link to read the rest…

August 23, 2023

Just released–It Bears Repeating: Best Of…Volume 1

A compilation of writers focused on the nexus of limits to growth, energy, and ecological overshoot.

With a Foreword and Afterword by Michael Dowd, authors include: Max Wilbert; Tim Watkins; Mike Stasse; Dr. Bill Rees; Dr. Tim Morgan; Rob Mielcarski; Dr. Simon Michaux; Erik Michaels; Just Collapse’s Tristan Sykes & Dr. Kate Booth; Kevin Hester; Alice Friedemann; David Casey; and, Steve Bull.

The document is not a guided narrative towards a singular or overarching message; except, perhaps, that we are in a predicament of our own making with a far more chaotic future ahead of us than most imagine–and most certainly than what mainstream media/politics would have us believe.

Click here to access the document as a PDF file, free to download.