Craig Pirrong's Blog, page 13

May 27, 2024

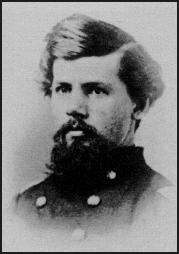

Wounded in the Georgia Woods, 160 Years Ago Today

Today is Memorial Day. It is also the 160th anniversary of the grievous wounding of my maternal great-grandmother’s uncle, Eli Hatfield. Hatfield’s 46th Ohio Veteran Volunteer Infantry was advancing as part of the 4th Division, XV Corps, Army of the Tennessee outside Dallas, Georgia when attacked by dismounted Confederate cavalry. (On this day the 46th was attached to the third brigade of that division, though it was part of the second brigade). Fighting without earthworks* the 46th suffered 1 killed and 10 wounded, including Eli.

The main Battle of Dallas occurred the next day. The 46th suffered heavier casualties repelling the assault of Bate’s division, including regimental commander Henry Giesy.

Eli’s wound was a bad one–a minie ball to the left arm just below the shoulder joint. Too close to the torso for amputation, the 46th’s surgeon resected the shattered bone, leaving Eli’s arm dangling at his side for the remainder of his life. (My great-grandmother said he was “Uncle Eli with the dead arm.”)

The survival rate from this surgery was very low, about 10 percent. In contrast, the survival rate from amputation was around 75 percent.

This wound was the culmination of a series of misfortunes. Eli did not have a good war. He was captured at Shiloh (where the 46th held the very right flank of the Federal army–not quite the 20th Maine at Gettysburg, but their stand was crucial). He spent several months in Cahaba (Alabama) Prison, which was not quite Andersonville but wasn’t Club Reb either. Paroled and exchanged, he returned home to Ohio but did not return to his unit, claiming that his imprisonment had rendered him unfit for service. Despite notes from his doctor (seriously–they are in his service file) the army disagreed, and Eli reported to the 46th in time to participate in the assault on Tunnel Hill at the Battle of Chattanooga. He survived the grueling (but unnecessary) march through appalling weather of the XV Corps to relieve Burnside at Knoxville, and a winter in camp at Chattanooga. He fought with the 46th at Resaca and during other skirmishes in the Atlanta Campaign, before his rendezvous with a bullet at Dallas 160 years ago today.

Eli returned to Ohio after a period of convalescence in Nashville. (Just imagine the agony of the jolting wagon or ambulance ride over rough Georgia roads to the Western and Atlantic Railway, and the subsequent train rides north over rickety rails to Nashville, and then home). He lived a long and productive life. He fathered four children (one born in November, 1865, a mere 18 months after his wounding), and died in 1899.

The 1880 Census lists his occupation as “engineer.” Of what I am trying to figure out. On a railroad? For a coal mine (one of his brothers and two of his nephews worked in the mines)? Given his rural upbringing, and the fact that virtually all his family were farmers or laborers, his profession is something of a surprise, and I am curious to learn how that came about.

He is buried in a small cemetery just east of Columbus:

Eli’s brother John also served in the 46th. John’s military records state that he was 18 when he enlisted. However, he was only 16. He enlisted a month after Eli, which combined with lying about his age suggests some parental resistance to his serving.

Unlike his brother John survived 4 years of war without a scratch, and apparently without serious illness: he is recorded as present every month for these four years–his service file is quite boring compared to Eli’s. Quite remarkable considering that his service included Shiloh, the Siege of Vicksburg (where disease was as deadly as bullets), the Second Battle of Jackson, Chattanooga, Resaca, Dallas, Noonday Creek, the assault on Kennesaw Mountain, the Battle of Atlanta (22 July), Ezra Church, Griswoldsville, the March to the Sea, the March Through the Carolinas, and Bentonville, as well as nearly continuous skirmishing during the Atlanta Campaign.

After muster out, life in Ohio was apparently unappealing to John, so he settled on a farm in Valley Falls, KS, where he died in 1915. He also fathered four children. His obituary in the Valley Falls New Era read:

Comrade Hatfield was well known in this community, took an active interest in church and G. A. R. Circles, liked to hear the bugle call and to the last enjoyed the camp fire stories, at all their gatherings and has a large circle of relatives and friends who will morn his departure. The G. A. R. Post took charge of the services at the grave.

Quoted in Find a Grave.

An old soldier who faded away, and who like many others considered his military service the high point of his life.** Eli’s feelings are unrecorded, or at least I have not found any record. Objectively it was the low point. But he survived and carried on with life.

Theirs are just two Civil War stories. I am glad to know them, and to be able to tell them.

*The report of the commander of the 46th records that the regiment dug shallow entrenchments after repelling this Confederate assault.

**A paternal ancestor corresponded nostalgically with comrades from the Bavarian Army (he was from the Palatinate, which was part of Bavaria at the time) long after he had emigrated to Chicago.

May 25, 2024

Effing Around With Delta Force, and Finding Out With Extreme Prejudice

A weird and disturbing story out of Carthage, North Carolina. A Chechen, living in Chicago (but an illegal immigrant–go figure!) was shot dead by a Delta Force colonel on the colonel’s property. (NB: there are very few colonels in Delta Force. In fact, there may only be one: 1st SFOD-D (D for Delta) commander is a colonel’s billet. So this may have been the commander of Delta Force).

The narrative–pushed by the dead guy’s family and various anti-American sources–is that the deceased Mr. Daraev was but a Dreamer, trying to start a new life in America, innocently and diligently doing his work, gunned down by a trigger happy American special operator.

To start with, yes, if a Delta Force guy pulls the trigger on you, you will almost certainly be dead. But they aren’t trigger happy. In fact, they are the most disciplined soldiers on the planet. If they pull the trigger on you it is because you need to be dead. Stat. Fuck around with them and find out. In the worst way possible.

There are so many absurdities in Dreamer Daraev’s cover story. He supposedly worked for a contractor for a utility company, and was photographing to document work he had completed on a power line adjacent to the DF guy’s property.

But:

Daraev did not have any utility equipment, utility clothing or identification during the time of the shooting.

Moreover, the company he allegedly worked for was formed only in December, 2023. It is foreign-owned, but operates out of New Jersey. What North Carolina utility would hire a new company from out of state to bring down an illegal immigrant all the way from Chicago to work on its lines? Is this just another job Americans won’t do?

But it gets better! The company is owned by a Moldovan (!) whose previous occupations include dishwasher, and a business that sold ice. In Alaska. (Whether to Eskimos the news reports don’t say).

Yeah. That’s who I’d turn to to work on my power lines in the southern pines.

Chechnya. Moldova. Is your Spider Sense tingling?

Journalists (including Jen Griffin at Fox) have contacted the company repeatedly, and I’m sure you’ll be shocked–shocked!–to learn that it didn’t answer the phone or respond to email. Probably because Mr. Moldova ain’t around to answer it anymore.

Uhm, has anybody contacted the utility to see whether it actually hired an out-of-state fly by night company to work for it? With all the concerns about infrastructure security–including from Russian threats–it would be gob smacking if it did. Hell, it takes more than five months for companies to approve new contractors at all.

Have no fear though! The government is on it:

The incident has been reported to the U.S. Department of Labor as well as the Occupational Safety and Health Administration.

This follows other incidents, including an attempt by two Jordanian illegal immigrants to access the Marine base at Quantico–something that the military tried to cover up–as well as numerous other attempted incursions on CONUS bases by Chinese nationals.

Chechens working for an almost certain Russian cutout stalking American special operators on American soil is extremely disturbing. Even more disturbing is the cone of silence over this event. It almost seems like the administration doesn’t want you to notice!

And you know it doesn’t because it signals a complete breakdown in security facilitated by a complete collapse of the national borders.

At least this story has a happy ending. The next one may not.

May 23, 2024

A Fascinating Flashback to the Halcyon Days of Floor Trading In Chicago

This Brokers, Bagmen, and Moles podcast really took me back. It tells the complex and convoluted tale of the FBI sting operation on the floors of the CBOT and CME, and the trials that followed in the 1987-1990 period.

I worked for an FCM (located in the CME building at 30 S. Wacker) during one year that the sting occurred. Leo Melamed appears prominently in the podcast (and not in a good way, I might add): I frequently saw him in the elevator there. I had just started teaching at Michigan in January 1989 when the Chicago Tribune (to the fury of the FBI and DOJ) broke the story of the investigation. In something of a Walter Block moment, I wrote a paper (not published, nor even submitted) explaining, and to some extent justifying, the conduct that put some traders in jail (though not the right ones, from the perspective of podcast producer Anjay Nagpal).

I hadn’t thought about that paper in a long time, but the podcast resurrected it from the recesses of my memory. In a nutshell, as described in the podcast, a major aspect of the allegedly fraudulent conduct engaged in by floor brokers and locals revolved around the issue of “out trades.”

Out trades were an inherent feature of floor trading. Out trades were mistakes. Two traders could trade, and agree that they traded with one another, but disagree on the price. Those were relatively easy to resolve. Bigger problems occurred when, say, ABC said he sold to XYZ and XYZ said he didn’t buy from ABC. Or when ABC said he sold to XYZ and XYZ said he sold ABC.

These types of errors were endemic in the bustle and commotion of the pits. And they were often material. In essence, if an out trade occurred when a broker traded for a customer, and the error was detrimental to the customer, the broker had to make up the loss. In the case of ABC being a broker, and the price moved down subsequent to the time the trade should have occurred, and the broker corrected the error by selling for the customer at the lower price, ABC had to pay the customer the difference. If the error worked in the customer’s favor, he got to keep the benefit.

Especially in volatile markets and for big orders, six figure errors were not unheard of, and five figure errors were pretty common.

In essence, brokers were short a random number of options (the randomness being due to the unpredictable nature of out trades). This was a cost of doing brokerage business, and could be an appreciable cost.

And this was the hook for my paper. The bulk of the allegations against the traders was that in the aftermath of an out trade, a broker would make a trade with a local (i.e., an independent floor trader) that was profitable to the broker, but unprofitable to the local. This local was called the “bagman,” hence the middle word in the title of the podcast (and a book). The broker would later pay back the local by making off-market trades that cost customers money but were profitable for the local. For example, selling to the local at a price below the best bid in the pit.

When I first read the allegations, this struck me as an insurance arrangement, and hence the paper was titled (if I recall correctly–I’m looking for an old copy) “Broker Fraud as Out Trade Insurance.” In essence, the losses from out trades were spread out among all (or least many) of the broker’s customers. The bagmen were like insurance companies: eating a loss was a claim. The profits from off-market trades were the premiums. The customers paid the premiums in the form of unfavorable trading prices. (I also argued that broker associations, also controversial, were in large part an insurance arrangement).

My argument was that this was plausibly an efficient arrangement, as it led to a more efficient sharing of out trade risk, where out trade risk is inherent to open outrcry trading, just as fire risk is inherent to owning a house or accident risk is inherent to driving.

So were customers hurt? Well, if these practices were indeed insurance, customers actually benefited. A more efficient sharing of out trade risk reduced the cost of supplying brokerage services. With a highly competitive market for brokerage services, this lower cost would be passed on in the form of lower commissions, or better service, or more perks (like picking up bar tabs or losing more to the customer on the links).

Of course, it was almost certain that some of this type of trading was not undertaken to insure out trade risk. Some brokers no doubt took advantage of the widespread nature of the practice (where its ubiquity was driven by its putative efficiency) to rip off customers on some trades. However, as I argued in the paper, the ultimate effect of that kind of behavior on customers was mitigated by competition among brokers. The ability to harvest those kinds of illicit profits reduced the reservation commission that brokers charged.

(In making this argument, I riffed on an example from (then) Donald McCloskey’s price theory/micro text. He argued that the practice whereby shipyard labor cutting wood on sailing ships pocketed and sold shavings from the wood they cut had little impact on the cost of building or repairing ships, because labor market competition reduced wages by an amount commensurate with the value of the wood thus taken. McCloskey used this to illustrate the idea–originating with Adam Smith–of compensating wage differentials).

So the argument was basically not only was this not worth a federal case (or what was at the time the most expensive FBI investigation in history), it was arguably efficient, or at most a victimless crime (in equilibrium, anyways).

Other allegations included things like trading after the close. Again, in many cases this could be viewed as efficient, and beneficial to customers: trading at the close was often insanely chaotic, making it impossible to execute all orders before the bell rang.

Labor unions know that one of the most effective ways of disrupting a production process is to “work to rule”, i.e., adhere strictly to every agreed upon rule. In any tightly coupled system (e.g., an assembly line, an airline operating on a schedule, or a trading floor), allowing for some play in the joints–some departures from strict adherence to the rules–can allow it to operate more efficiently. Strict adherence to the rules would likely have interfered substantially with the efficiency of the floor trading process.

Or think of the mess that an NBA game would be if refs called every foul. “No harm no foul” is a reasonable way to call a game.

To the outrage of other defendants–who claimed that nothing untoward happened on the floor–the lawyer for two defendants (a guy named David Durkin, interviewed in the last episode of the podcast) argued that yeah, this stuff happened all the time, and it wasn’t fraud. He didn’t make exactly the same argument as I did, but his argument rhymed with mine. That is, the intent of these violations of the rules was not to defraud, which would be necessary to achieve a criminal conviction. (The argument was not tested at trial. For perfectly understandable reasons, guys facing RICO charges and 20 years in Club Fed took a deal and pled out for terms of 8-10 months. One could argue that the relatively big delta between the deal and the penalty if they had lost reflected the government’s assessment that the argument could have indeed been persuasive to a jury.).

Take it as you will. All I can say is that nothing in the podcast made me change my mind from what I came to believe 35 years ago. (Time flies!)

The podcast delves deeply into the genesis of the investigation. This material was pretty new to me. I had heard nothing previously to challenge the public explanation that ADM’s Dwayne Andreas was ticked off (no pun intended) at being ripped off by the floor, and sicced the FBI on the exchanges. But after listening to the podcast, like Nagpal I find it unpersuasive. Would that really be sufficient motivation for the DOJ and FBI to launch such an ambitious investigation? (Perhaps they didn’t realize how hard it would be, and doubled down once they got in–the sunk cost fallacy at work.). Was it really aimed at the exchanges themselves, or the bigwigs there? Was it really launched to investigate mob money laundering? After all these years, these remain open questions, despite Nagpal’s dogged efforts to answer them.

The podcast also featured extensive interviews with various traders–some convicted, some not, and some not even charged. Those brought back memories of the floor in all its glory, color, character, and characters. And the accents! Having been away for years, the distinctive Chicago accents were truly noticeable and entertaining: at the time, as a fish in those waters, they would have seemed to be normal.

My only criticism of the podcast is in its attempt to draw Big Lessons. Nagpal’s big lessons were: (a) this conduct was rife; (b) it was fraudulent and harmed customers; (c) it was so rife that bigwigs–notably Leo Melamed–participated in it; (d) the fact that the bigwigs skated was a travesty of justice; and (e) the episode demonstrates the fundamental flaws in exchange self-regulation.

Here Nagpal gets preachy. Though in the last episode (in which Durkin plays a prominent role) he does start to wonder whether the bad stuff really wasn’t so bad after all, and that some of the bad guys really weren’t that bad.

As someone who wrote a lot about self-regulation in the 90s in particular (in large part due to the experience of dealing with it in the aftermath of the Ferruzzi episode), I am surely not in the self-regulation hallelujah chorus. However, I vigorously disagree with Nagpal’s contention that putting the futures exchanges under the aegis of the SEC would represent an improvement (not least because stock exchanges regulated by the SEC are also self-regulatory organizations). In the case of the investigation of the floor, the assumption that self-regulation failed presumes that the conduct was truly predominately fraudulent: as argued above, that’s debatable.

And yes, exchange governance is political–as discussed in detail in my 1995 and 2000 JLE articles. But government regulation is politicized too.

Overall, though, those are quibbles. In laying out in detail the complex facts, and letting the principals speak at length, Brokers, Bagmen, and Moles sheds considerable light on a long forgotten but epochal moment in the history of Chicago’s exchanges. It’s a kind of unvarnished history and I hope that others make similar contributions before the old floor traders, like old soldiers, just fade away like the sound in the pit after the closing bell.

May 18, 2024

The Tragedy of G. K. Warren

Outside of relatively specialized Civil War publications (which are shrinking in number), one seldom sees reference to Major General Gouverneur K. Warren. Hence it was a pleasant surprise to see a rather lengthy article about him in The Epoch Times of all places.

G. K. Warren

The article ends with a discussion of Warren’s “Unjust Fall” during the Battle of Five Forks in April, 1865, when a furious Philip Sheridan unceremoniously relieved Warren of command of the V Corps, believing that Warren was too slow in attacking.

Warren’s relief–and particularly Sheridan’s refusal to reverse it, or apologize for it after the heat of battle had passed even though his victory was complete–was indeed unjust. The part of the V Corps under Warren’s direct observation advanced into a vacuum, rather than attacking Pickett’s Confederates directly as Sheridan wanted, because of the fog of war, and in particular unfamiliarity with the Confederate dispositions due in large part to the heavily wooded terrain. It was the kind of thing that happened numerous times during the war, and which happens in every war.

But although Warren’s fate was decided on in the smoky Virginia woods on 1 April 1865, it was written long before, and was in many ways emblematic of the history and culture of the Army of the Potomac and the clash between that culture and U.S. Grant and his coterie–which prominently included Phil Sheridan.

Philip Sheridan

Warren was an engineer by training. Indeed, his greatest service in the war was his direction of two brigades to the vacant Little Round Top at Gettysburg while serving as the AoP’s Chief Engineer. After Gettysburg, he became a corps commander, first in temporary command of II Corps after W. S. Hancock’s wounding at Gettysburg, then in permanent command (until Five Forks) of the V Corps. Warren brought an engineer’s mindset–precise, deliberate, and cautious–to corps command. This drew the ire of Grant and his circle, who during the Overland Campaign and the Petersburg Campaign were repeatedly frustrated by what they perceived as Warren’s lack of aggressive spirit.

In his defense, one could say that based on experience, especially at the Wilderness and after, caution in attack was prudent, and aggressiveness foolhardy. But Grant was not alone in his frustration with Warren. Even before Grant’s arrival in Virginia, AoP Commander George Gordon Meade had been furious with Warren for failing to attack as ordered at Mine Run (in November, 1863). Meade was also harshly critical of Warren’s caution at the Wilderness on 5-7 May 1864, and tension between Warren and Meade, not to mention Warren and Grant, was pronounced throughout the balance of 1864 and into 1865.

Warren also had a touchy personality, resented criticism, and argued with his superiors constantly–Meade in particular. The intense mental and psychological stress of the brutal Overland Campaign only aggravated Warren’s (and Meade’s) tempers and mutual dislike.

Thus, Warren was skating on very thin ice when Grant’s grand offensive against Lee commenced in March, 1865. His assignment to cooperate with and support Phil Sheridan made falling through it almost inevitable.

Sheridan was everything Warren was not, and vice versa. The former was blunt and hyper-aggressive, the later high strung and sensitive, and as noted above cautious rather than offensive-minded, especially after the 11 shattering months of combat in Virginia in 1864-5. Sheridan had come originally from the western theater (brought by Grant to command, though he had not served extensively with him and had not commanded large cavalry units), and from the start clashed with the AoP establishment which he found lacking in the will to do what was necessary to win the war. (Note his confrontation with Meade in over how to deploy the cavalry the immediate aftermath of the Wilderness, which led to Grant turning him loose to raid Richmond, resulting in the death of Jeb Stuart and little else).

Whereas Warren was something of an intellectual, by army standards (the engineers were, in general), Sheridan was anything but. He finished 34th (out of 55) in his West Point class: Warren was second in his. Sheridan had been suspended for a year for threatening to bayonet an upperclassman. Warren’s conduct record was exemplary.

Sheridan had won smashing victories in the Shenandoah Valley in September-October 1864, and had wreaked destruction in the Valley afterwards–a “hard war” policy that the AoP had shrunk from since its formation. Sheridan was viewed by the AoP as something of a barbarian.

Thus, Warren represented everything that Sheridan despised, and epitomized everything Sheridan found wrong with the AoP. Sheridan was looking for a chance to get rid of him, specifically asked Grant for the permission to do so (before Five Forks), and did it at the first opportunity on a flimsy pretext–even after Warren had extricated Sheridan and his cavalry from a difficult situation at Dinwiddie Court House on 31 March.

In the box of 1 April 1865, Sheridan was clearly in the wrong. But in the large, he was in the right. Men like Gouverneur Warren were not going to win the Civil War. Hard men, relentless men–men like Sheridan, Sherman, and Grant–were, and did.

Warren was thus a tragic figure, in a war chock full of them. He was a good man, but in the wrong position. You would almost certainly find Warren to be much preferable as a companion to the brusque, relentless, and blunt (“the only good Indian I ever saw was dead”) Sheridan, and you can genuinely pity his fate. But good companions are typically not cut out to be good commanders, especially in total wars. The sons of bitches are. And Phil Sheridan was one of the Civil War’s leading sons of bitches.

May 16, 2024

Putin Doubling Down on the Same Bad Hand

I’m back. A little play. A lot of work.

What to start back with? Russia, I guess.

The war in Ukraine grinds on. The supposed big news is Russia launching attacks near Kharkiv/Kharkov. Many interpret this as a sign of Ukraine’s impending doom. I disagree.

Yes, Russia did make some initial gains. There is some controversy regarding why. Initial reports were that Ukraine had not built fixed defenses in a 10 km wide region near the border with the Belgorod Oblast because engineers would have been too vulnerable to Russian artillery fire while attempting to perform the work. More recently, however, it has been claimed that defenses were planned–and paid for–but little or no work was done.

These explanatons are not mutually exclusive, of course: maybe the work was not completed due to the perceived vulnerability. However, a sadly realistic alternative explanation is that Ukraine’s endemic corruption is to blame, and that the contractors pocketed the money and did no work.

Whatever the reason for the relatively undefended border, Russia has still incurred heavy casualties to take a few slivers of territory, and their advances have slowed to a crawl after the initial gains.

Moreover, the threat from this attack to Kharkiv, let alone to Ukraine’s overall position, is limited. For one thing, the total Russian forces involved–an estimated 50,000 (including tail as well as tooth)–is hardly big enough to take a city as large as Kharkiv, especially if it is being attrited at the rate of 1,000 plus per day.

For another–and more importantly–as is occurring virtually everywhere else on the frontline, Russia is mounting infantry assaults, in company-size packets. Armor is used mainly to ferry troops from the rear and drop them off, before scurrying away. Or trying to scurry away: even then drones are inflicting substantial vehicle losses on the Russians both coming and going.

The infantry attacks are basically bum rushes offering no prospect for breakthrough and exploitation. As has been seen elsewhere on the front, at heavy cost they permit shoving back the front for a few kilometers at most, take considerable time to do even that, and culminate relatively quickly.

Moreover, with the prospect of receiving more artillery ammunition, Ukraine will be able to inflict even more devastation on these attacks without risking its own (scarce) infantry.

So why are the Russians doing this? Perhaps as an economy of force move to draw Ukrainian troops away from other locations. Perhaps in the thought that more progress is achievable here than where the main efforts have ground on for weeks. 10 kilometers here rather than 5 kilometers to the south.

Elsewhere on the front, for weeks Russia has been aiming at Chasiv Yar as a follow on for their glorious victory in Avdiivka. Putin had reportedly ordered Chasiv Yar to be taken by 9 May, Victory Day in Russia.

Well, it wasn’t. And even if it had been, it just shows what a simulacrum of military greatness Putin’s Russia represents. Whereas 9 May 1945 represented the conquest of Berlin–a massive city defended by a greatly diminished but still formidable opponent–a victory at Chasiv Yar on 9 May 2024 would have represented the taking of an obscure, modest town from a scraped together (but scrappy) military lacking pretty much everything.

Despite the absence of a crowning victory at Chasiv Yar (which even then would have only been a way station in a long campaign to come, rather than a war ending event like the taking of Berlin), the Victory Day Parade went on in Moscow nonetheless. But it was a shadow of its former self, with basically only Putin’s praetorian guard and a single tank–a WWII T-34 no les–showcasing military might (or lack thereof).

Sad.

The other big news has been Shoigu’s defenestration as defense minister, and his replacement by technocrat Andrei Belousov. Not just a technocrat, but an economist no less.

This is also being reported breathlessly. Yes, it may indeed represent a strong reflection of Putin’s intentions. Namely, that he is girding for a long war, which will require a substantial reinvigoration of Russia’s defense production. (Note that most of Shoigu’s recent public appearances were at defense plants, where he exhorted the employees about the need for greater efforts.) That is, that Belousov is intended to be a modern day Lloyd George, who drastically reformed Britain’s munitions manufacture in 1915-1916 by taking control away from a bureaucratic and overly traditional War Office.

Yet, intentions and results are worlds apart, and there is substantial reason to believe that Belousov faces a hopeless task.

Russian defense production and procurement is rife with corruption. Even if Belousov is not corrupt (and it is hard to believe that anyone who became a deputy prime minister in Russia is not corrupt), that doesn’t mean that he has the ability to root out the pervasive corruption that is present at every level of the Russian military establishment. Moreover, he is an outsider, and the Russian military does not respect outsiders, and is indeed deeply resentful of their interference.

In the coverage of Belousov’s appointment, I have not seen anyone mention Anatoly Serdyukov’s ill-starred tenure as Defense Minister. (Shoigu replaced Serdyukov 10 years ago.)

Like Belousov, Serdyukov was an economic official (Tax Minister) whom Putin appointed–wait for it–with “the main task of fighting corruption and inefficiency in the Russian armed forces” (in the words of Wikipedia, which are accurate). (Sound familiar?) Due to his former career as manager of a furniture manufacturer and merchandiser he was sneeringly referred to as the “furniture dealer” throughout the military, who fought him hammer and tong. After several years of conflict, he was eventually brought down by an allegation of corruption (for which Putin eventually granted amnesty).

Although Serdyukov achieved some reforms, they were superficial–as the experience of the war in Ukraine demonstrates. I do not expect Belousov will fare any better. This is a case of meet the new boss, same as the old old boss.

Moreover, Belousov faces structural problems that would greatly complicate his challenge even absent corruption and internal opposition. Labor shortages are acute. There is a fundamental tension between finding enough men to feed into the meat grinder and finding enough men to make the weapons they carry or ride into the meat grinder. And although sanctions have not been crippling, they have substantially impeded Russian weapons production, especially of more advanced equipment. The impending resupply of ammunition, anti-aircraft missiles, and the like to Ukraine will also increase the losses that the Russian factories have to make good.

There is also the question of the impact of this on Russian military command. Belousov is obviously not going to have a clue about operational matters. So does this mean that Putin will exercise even more control? Or will this give a freer hand to Gerasimov and the other generals, who have proven to be incompetent, callous bumblers? Regardless, there is certain to be a disconnect between the Defense Ministry and military operations.

One last note. The Defense Ministry reshuffle is not the only change at the top. Somewhat surprisingly, Nikolai Petrushev, former FSB head, Secretary of the Security Council of Russia, and all around dark dude suspected by some to be the real power behind the throne in Russia, was also removed from his post and designated for assignment–and days later the assignment has not been announced.

This is surprising, to me anyways. Petrushev’s son (sometimes mentioned as an eventual Putin successor) did receive a promotion from Agriculture Minister to Deputy Prime Minister, which suggests that Petrushev is not totally on the outs and destined for an accidental fall from a window. But this is Russia, so who knows?

In sum, all the “changes” of the past days–a new offensive, ministry shakeups–are highly unlikely to herald a major shift in the dreary drama playing out in Ukraine. A mini-offensive here, a cabinet reshuffle there, won’t alter the fundamental realities of the military situation. Yes, they signal that Putin is doubling down, but they don’t improve his hand in the slightest.

May 1, 2024

One Tool Lina Bashes Away At Non-Competes With Her Market Power Hammer

Well, the FTC done gone ahead and done it, implementing a broad prohibition on “no compete” clauses in contracts. As with most recent FTC rules and court cases, it brings to mind Coase’s observation to the effect that some people see a market practice they don’t understand, their immediate conclusion is that it is some sort of nefarious exercise of market power.

The FTC’s main bugaboo is that non-competes create lopsided bargaining power in favor of firms. Such bargaining power per se should not give rise to antitrust concerns. And indeed, lopsided bargaining power may be an efficiency enhancing feature that makes both firms (the supposed beneficiaries) and employees (the alleged victims) better off.

One needs to remember that there are at least two stages here. Ex ante, when the employer and employee agree on terms to a contract, which may or may not include the non-compete clause (and the employee can reject an offer that includes one), and ex post, when the employee has found a potentially superior outside opportunity and would like to get out of the restriction. The bargaining power under non-competes is unbalanced in the ex post stage.

A threshold issue is why would the employer and employee agree ex ante to an arrangement that is inefficient, i.e. reduces their joint wealth? If the benefit of the restriction to the employer is smaller than the cost to the employee, there would be a bargain without the non-compete that would make both parties better off. Crucially, this is true regardless of the distribution of bargaining power. Thus, it is highly likely that the mutual agreement to employment contracts including non-competes indicates that they are efficiency enhancing.

This then raises the question: what is the source of efficiency at the ex ante stage that induces the parties to enter into an arrangement that ties the employee’s hands and limits his/her bargaining power ex post?

Property rights economics provides an answer. In a zero transactions cost world, who owns assets is irrelevant. (The Coase Theorem.) However, if certain things are non-contractible (because, for instance, they cannot be verified by 3rd parties like courts), transactions cost are positive and the distribution of asset ownership matters, and can impact efficiency. It matters precisely because it can affect bargaining power ex post.

The owner of assets has bargaining power over non-owners with whom he contracts: he can withhold the employee’s access to the asset, thus depriving him/her from any benefits from it.

This can affect efficiency because it affects incentives to invest ex ante. The party with the bargaining power (the asset owner) extracts most of the rents from the relationship between the two parties. That affects that party’s incentive to make (non-contractible) investments that increase the amount of ex post rents to be split between employer and employee because he gets the lion’s share of these gains.

Placing the bargaining power in the hands of the party who is best able to make rent-increasing investments therefore leads to better investment decisions, and to greater surplus to be divided between the parties.

Designing contracts that allocate ex post bargaining power unevenly can therefore improve incentives ex ante, and crucially, make both sides better off–including the putatively disadvantaged party. Disadvantaged ex post, anyways.

Non-compete clauses, by the FTC’s own admission–hell, lament–allocate bargaining power. Property rights economics suggests that is likely a feature, not a bug. Crucially, it can explain why these clauses come into existence in the first place.

Firms can make non-contractible investments in their employees’ general human capital. Moreover, apropos my recent post on learning by doing, firms can increase knowledge and information by increasing their output or scale. If employees can walk across the street and sell that knowledge and information to others the firm’s incentive to invest in employees’ human capital or engage in actions that lead to employee learning by doing is reduced. However, with non-competes firms have the bargaining power that allows them to extract those ex post rents, which preserves their incentives to make non-contractible investments in generalized employee human capital, including human capital generated as the result of experience/learning by doing..

The real conundrum with non-competes is the one common to all arrangements relating to the production and dissemination of information. There are static losses if information already in existence is sold at a price above its marginal cost–effectively zero–or not sold/transferred at all. However, if information is transferred at a zero price, but is costly to produce, too little is produced. This is effectively a dynamic effect.

The same tension/trade-off exists with patents and copyrights. The ex post trade in costless information is restricted in order provide incentives to create it in the first place. Non-compete clauses that allow firms to extract most of the rents associated with knowledge production in their employees provides similar incentives.

I would also note again (as I have in earlier posts) that non-competes don’t create bargaining power ex ante, and restricting them will therefore not affect the distribution of gains at the contract formation stage. However, the magnitude of the gains to be split will be smaller in the absence of non-competes if they have the incentive effects discussed above.

Non-competes are a form of vertical restriction. Such restrictions often–and I would say typically–have efficiency rationales. Indeed, these rationales often relate to attempting to restrict free riding on information. Think of Lester Telser’s argument about resale price maintenance, or research on things like exclusive dealing and exclusive territories. Non-competes clearly relate to property rights in information, and therefore eliminating them will have baleful consequences.

But the Lina Khan FTC only has a market power hammer in its tool box, and is therefore bashing away at what is likely an efficiency enhancing contract feature that has nothing at all to do with the exercise of market power qua market power.

April 29, 2024

Learning by Doing in Solar, Even if Proven, Would Not Imply Solar Was Subsidized Too Little, Too Late

The estimable Francis Menton has noted repeatedly that the “energy transition” has set loose upon the world a host of innumerates who assure us that they know best when in fact they know less than nothing. And perhaps to coin a phrase, I would add that they are ineconimate, i.e., know nothing about economics. Arrogance and ignorance is a lethal combination. Such people will make us poor, and likely shivering in the dark.

Alas, the mind eating virus has even infected many who were once sensible, or at least periodically sensate or sentient. Such as the FT’s Tim Harford. (I am guessing that the brain eating ameobae at the FT have finally gotten to him.)

Harford wrote that instead of saying “I could’ve had a V8” 40 years ago, we should have said “I could’ve subsidized solar and then all our energy and climate problems would have been already solved.”

In a nutshell, Harford invokes learning by doing, which he refers to as Wright’s Law in honor of an aeronautical engineer in the 1930s who first identified this phenomenon. It has since been documented in numerous other areas, starting probably with Liberty Ships in WWII.

Yes, LBD is a thing. It has been part of the theory of economic growth since at least the 1970s, starting most notably with Paul David’s work on the antebellum cotton spinning industry in the US, and earlier than that even with work by Kenneth Arrow. Robert Lucas taught about it in the economic growth undergraduate (!) course I took as a small child at Chicago in 1981, FFS. (What a privilege and experience it was to be in that course.) I was so taken by the subject that my paper for George Stigler’s economic policy course in 1982 (when he won the Nobel Prize) examined empirically learning by doing at the Springfield and Harpers Ferry Arsenals prior to 1860. It’s hardly a new idea, or an unexplored one.

Alas, there are numerous problems with Harford’s application of LBD/Wright’s Law to solar.

One issue is: who is to say that the highly touted reductions in the cost of solar aren’t due to LBD?

That is, since cumulative output in solar panels has indeed increased dramatically over the years, learning would presumably have taken place and that plausibly accounts for some of the cost reductions. Harford himself says “PV is now so cheap that the question is moot.” So, perhaps LBD did its work.

Empirical evidence would be nice. And at most what Harford is saying is that we could have learned earlier. But if the learning has taken place (as evidenced by it being “so cheap”), albeit belatedly, solar should be taking over the world now, without subsidies, right?

Further, if Harford really means that too little learning has taken place, or it has occurred too late, then that would require (a) externalities/spillovers in learning, (b) the large subsidies to solar (which Harford pooh-poohs) were in fact too small and/or too late to generate the right amount of learning at the right time, and (c) market participants were unaware of the spillovers and did not take obvious steps to internalize them. He provides support for none of these.

With respect to externalities, it is not obvious that LBD effects are largely external to firms. Firms may be able to keep the benefits of their experience largely to themselves. To the extent they are internalized, there is no rationale for subsidies, and competitive firms will treat current production in part as an investment in future lower costs and expand output accordingly without need for government support or protection.

(NB. Non-compete agreements may be one way firms attempt to keep the benefits of experience internalized. I will soon write a post on the idiocy of the FTC’s ban of such agreements.)

I have analyzed LBD in the US shale sector in detail. I have found extensive learning effects, but the evidence for learning spillovers is weak. A firm’s own experience contributes more to its productivity than collective industry experience. This is evidence that learning is internalized.

Further, firms respond rationally to spillovers–by trying to internalize them. Mergers, consolidation, and concentration are means of internalizing learning. I note that consolidation is coming to shale only after more than a decade after the industry dramatically increased output and drilling experience.

In shale, it is plausible that much of the learning is done by service firms who internalize the benefits. Thus, even to the extent that industry experience explains productivity improvement, to the extent that service firms who, well, service the industry are the ones who generate this learning, these industry experience effects may be internalized as well.

That is, just because there is learning by doing, doesn’t necessarily mean that there are learning spillovers of the type that justify subsidies (or tariffs) to increase output (and hence learning). And if there are, there are strong economic incentives to internalize them. And if there aren’t, there’s no justification for subsidization. (David’s work on the cotton industry addressed the question of whether tariffs to stimulate domestic cotton cloth output were justified because of learning spillovers.)

All of these factors undercut the argument that the PV industry learned too little, too late. Where is the evidence that PV is unlike shale, and characterized by large learning spillovers which industry participants did not attempt to internalize through merger or other means? (I would also like to highlight the irony that Harford’s argument would imply that shale, for which there is actual evidence of LBD, should have been subsidized decades ago.)

Harford also has a myopic focus on PV cost, and fails to consider the total cost of renewables, including solar. Like other renewables, solar has intermittency and diffusiveness problems. Moreover, it has large and predictable output fluctuations (e.g., the “duck curve” problem in which solar output plunges when the sun starts to set). Due to these inherent features, useful solar will require beyond revolutionary innovations in battery technology (something Menton has analyzed in detail) that are not anywhere on the horizon.

(I note that battery technology has been the subject of massive research. It has also experienced tremendous growth in cumulative output, which has presumably contributed to learning. Yet it is nowhere even close to being an economical way to address output variability for renewables.)

Word to the wise: we are not going to be able to learn our way out of the sun rising, and more importantly setting. Or out of rain, clouds, and hailstorms. Or out of voracious needs for land to site renewables. Or out of the difficulties of disposing defunct panels.

Solar is part of a complex energy system. The cost of solar panels is actually among the least important aspects of the cost of relying on solar as a source of energy.

And talk about hindsight. Harford laments our failure to gaze into the distant future and foresee with precision the obsession with CO2 and climate change, and supersize solar panel output in time to provide cheap solar power when those obsessions became manifest. Yeah, and I should have invested in Apple when Harford says we should have subsidized solar. Or Bitcoin in 2013.

In sum, Harford’s woulda, coulda, shoulda lament in the FT is yet another example–as if more were needed–of the intellectual vacuity of those hyping the “energy transition.” Harford invokes a respectable economic concept–learning by doing–but does so in a superficial way that betrays a complete lack of understanding of it. And in a way that also betrays a lack of understanding of the real challenges of transforming an extremely complex energy system. Cheap solar panels may be a necessary condition for a cheap transition, but it’s hardly a sufficient one, or indeed, even likely an important one.

Alas, learning by doing doesn’t appear to apply in the writing of newspaper columns.

April 20, 2024

Why Do Governments Repeatedly Engage in Energy and Environmental Boondoggles?

In the Wealth of Nations, Adam Smith famously wrote:

By means of glasses, hotbeds, and hotwalls, very good grapes can be raised in Scotland, and very good wine too can be made of them at about thirty times the expense for which at least equally good can be brought from foreign countries. Would it be a reasonable law to prohibit the importation of all foreign wines, merely to encourage the making of claret and burgundy in Scotland? (WN IV.ii.15)

This came to mind when reading this Bloomberg article about an “efuels” venture:

At its plant, electrolyzers break down water into hydrogen and oxygen, using electricity generated from nearby wind and solar farms. The hydrogen is then transported to a reactor, where it meets CO2 captured from local refineries, setting off a series of complex chemical reactions aided by patented catalysts. The result is a synthetic fuel with the same chemical properties as its fossil fuel-based cousins.

Yes, this process can create “equally good” fuel as traditional hydrocarbons. But at what cost? Well, they could tell you, but then they’d have to kill you:

How Infinium fits into that future remains to be seen. Schuetzle is tight-lipped about the company’s exact plans. While acknowledging that Infinium’s e-fuel is “more expensive” than conventional fuel, he didn’t disclose the cost difference.

Probably not the 30x of Adam Smith’s Scottish wine, but evidently a large enough multiple to frighten the horses if disclosed.

Because of this cost differential, this industry will come into existence only as the result of heavy-handed government policy, in the form of subsidies, kneecapping competitors (namely traditional fuels), or more likely both. And echoing Smith, the question becomes “is it a reasonable law or policy to rig they system to favor this technology, merely to encourage the making of efuels?”

Smith did not answer his question because it answered itself. And the same is true of mine.

To repurpose an old joke, the government wants to address climate change in the worst way, and it is. Picking technologies that are feasible but exorbitantly costly in order to achieve a putatively desirable objective is a tried and false modus operandi of government. And this has been especially true of environmental and energy policies in the United States going back to the dawn of the EPA in the early 1970s, and the energy crisis of the mid-to-late 1970s.

I recall the “synfuels” boondoggles of the late-70s, e.g., making oil from shale. No, not the shale revolution you might be thinking of that actually resulted in the economical production of vast amounts of crude oil and natural gas, but taking shale rock in Wyoming with embedded hydrocarbons, subjecting it to energy intensive transformations (redolent of those described above for the efuels project) to produce oil at vastly higher cost than even the then-elevated price of conventionally produced oil. The government spent billions back when a billion actually meant something on this effort (and other synfuel efforts). And every dollar was wasted.

And reading the Bloomberg article demonstrates that the government, in its wisdom, is doing Adam Smith one better: it wants to mandate technologies that don’t really exist (unlike Smith’s “glasses, hotbeds, and hotwalls”):

Some regulators seem to agree with that thinking. The EU will phase out government subsidies for e-fuel made with fossil fuel-sourced CO2 by 2041.

In its place, governments will mandate that efuels be made from CO2 obtained from air capture, a technology that the Bloomberg article describes as “nascent” but is more accurately described as “pie in the sky” (literally, in this case).

This generation of efuels will come into existence only as the result of government diktat, just as the first generation–ethanol and biodiesel–did. And the efuel technological greenhouse forcing is just one small part of an array of mandating of technology choices, all in the name of fighting global warming. The electrification of everything is if anything a more extreme example: the EPA’s mileage mandates (intended to make ICE vehicles uncompetitive with EVs), its emission standards for fossil fuel generation, and the lavish subsidization of inefficient (because diffuse and intermittent) renewables are if anything more egregious than growing the efuels industry like orchids.

But bureaucrats are geniuses, and will only do what’s best, right? Right? To disabuse yourself of such notions, refer back to the synfuels case discussed above. Or consider two more recent examples.

One was the European policy to force the replacement of gasoline engines with diesel ones in passenger vehicles, with the unintended–but totes foreseeable–result of increased particulate emissions (and widespread fraud by automakers to conceal that). Europe had to jettison that policy, so it has substituted another: eliminating ICE vehicles altogether. I’m sure that will work out swell.

Another that I find particularly rich is the sulfur standards for marine fuels introduced in 2020. In another unintended (but again foreseeable) consequence, the resulting reduction in particulate emissions is allegedly contributing to global warming. The irony behind this (compounded by the fact that efuels funder Bill Gates is also a fan of this technology) is demonstrated by serious proposals–recently experimented with–to inject particulates into the atmosphere to, yes, mitigate global warming.

So why do governments repeatedly adopt excessively costly policies to address putative problems? One part of the answer is hubris combined with the knowledge problem: they think they know a lot more than they do. But that’s not the entire answer.

At root, I think the more fundamental driver is public choice-related. Specifically, specific technologies have specific constituencies who would benefit from their subsidization (or other forms of policy support). They exert influence on legislators and bureaucrats to implement policies that favor them. (It is not a coincidence, comrades, that Bill Gates and the like have connections with many of these schemes.)

In contrast the effects of policies such as a carbon tax or cap and trade are much more diffuse and far less predictable because the ultimate outcome would be determined by market processes in a complex system. Adjustments would occur on myriad margins, not just by large firms but billions of individuals. The winners and losers in such a process are unknown, unknowable, and highly diffuse–these are not the concentrated interests that exert disproportionate influence on public policy.

(NB: I am not endorsing a carbon tax or cap and trade. I merely assert that they would be better ways of reducing carbon emissions than subsidizing or mandating technologies to do so. An exercise in the Theory of the Second Worst, if you will.)

In sum, political systems produce bad “solutions” to problems because of the very nature of politics, a nature that Mancur Olson and others pointed out years ago. A nature in which “public choice” means that the public gets screwed.

April 13, 2024

Would You Believe . . . Ukraine Refinery Attack Edition

As I noted in a previous post, the Biden administration has tried to restrain Ukraine from attacking Russian oil refineries. The previous reason, as set forth by SecDef Lloyd “AWOL” Austin, was that these attacks would disrupt world energy markets.

Translation: these attacks would increase gasoline prices which scares the bejesus out of an inflation-battered administration in an election year.

But apparently the administration decided that wasn’t a very good look. Too obviously self-serving, and perhaps too dissonant with its the-war-in-Ukraine-is-a-vital-US-national-interest one.

So, would you believe, the administration is REALLY concerned on humanitarian, just war grounds:

Assistant Secretary of Defense C. Wallander says Russia has been destroying Ukraine’s energy system since the start of the war, but Ukraine shouldn’t strike back:

— Visegrád 24 (@visegrad24) April 11, 2024

“Ukraine must comply with high standards of warfare, it’s part of European democracy”

??? pic.twitter.com/bKZKR4FyFQ

Nah, we wouldn’t believe that, actually. Especially since this oh-so high minded critique of Ukrainian military tactics has heretofore been completely absent from American policy makers’ discourses. It’s obviously a lie to cover the election-obsessed administration’s true motivations. That is, AWOL Austin committed the Kinseyan gaffe of speaking the truth, and this gaffe had to be cleaned up.

This justification is also utterly ridiculous on myriad grounds. For one thing, as Rep. Scott pointed out, why should Ukraine fight asymmetrically, but in a bad way, taking blow after blow to its civilian targets but not striking back. For another, oil refineries are a legitimate military target, given (a) Russia’s armies in Ukraine run on the fuel they produce, (b) fuel exports are a material source of revenue for the Russian government, and (c) the Kremlin is clearly concerned about higher fuel prices, and the potential effect they would have on support for the war.

For yet another, in military conflicts in the modern age the United States has made attacking enemy energy assets a primary target. In WWII, the most effective element of the strategic bombing offensive (and one that probably should have been introduced earlier) was the attacks on Germany synthetic fuel production. (The attacks on the oil fields at Ploesti, Romania in 1943 less successful, but the April-August 1944 attacks did materially restrict fuel supplies to the Wehrmacht and Luftwaffe). In Gulf War I, one of the first targets of American air strikes (after Iraqi air defenses were dismantled in the first wave) were Iraqi electric power plants, which were attacked with graphite bombs. Soon after, the US turned its attention to, yes, Iraqi oil refineries. In 1999 the US unleashed graphite bombs on Serbian power plants.

The US, in other words, has long recognized the strategic importance of enemy energy production, and has made it a priority target. So why shouldn’t Ukraine?

And note that given the previous history, Wallender is implicitly accusing the United States of violating the laws of armed conflict.

It’s actually quite disgusting that the administration covers its nakedly political motivations with high sounding blather about “the laws of armed conflict” and the “standards of European democracy.” Maxwell Smart was funny. These clowns are not.

April 9, 2024

To Call Biden Administration Energy Policy “Schizo” Is an Insult. To Schizos.

Not surprisingly given its avatar, the Biden administration is a picture of drooling incoherence. This is especially true when it comes to energy policy and the Russo-Ukrainian War and especially the intersection of these.

Case in point. The administration constantly asserts that it is a vital US interest for Ukraine to prevail and Russia to lose. Secretary of State Blinken went so far as to promise that Ukraine would join Nato, despite the fact that this is akin to waving a red flag in front of a bull (in the form of Putin). Ukraine must win! We must provide massive military aid! UKRAINE MUST WIN! FREEDOM AND OUR DEMOCRACY ARE AT STAKE!

But not if it raises the price of gasoline in an election year, apparently. In recent months one of Ukraine’s most successful gambits has been drone attacks on Russian oil refineries. These attacks focused on distillation units, the disabling of which sharply cuts refinery output. As a result, Russian refined product output is supposedly down around 10-15 percent, exports of gasoline have been banned for six months, and the country is desperately seeking imports of gasoline from Kazakhstan. This is a serious economic blow to Russia, and also crimps military efforts which are obviously dependent on fuel supplies.

Further, the impact is likely to be long lasting because repairs depend on foreign parts and foreign expertise that Russia cannot readily obtain due to sanctions.

These attacks are also mirror images to Russia’s relentless bombardments of Ukrainian energy facilities, especially electric power generation.

Especially given the trivial resources devoted to the campaign (which is carried out using drones), this is arguably one of the most effective measures that Ukraine has implemented in the two plus years of war.

So given the allegedly existential stakes in a Ukrainian victory, the administration is gung ho in its support for these attacks, right? Right?

Wrong! The administration, first in the form of the execrable Ichabod Crane doppelgänger Jake Sullivan, then in the form of the utterly embarrassing Secretary of Defense Lloyd “AWOL” Austin, is intensely pressuring Ukraine to cease its campaign against Russian refineries.

Why? Because it might raise gasoline prices. It’s an election year dontcha know:

Defense Secretary Lloyd Austin warned that Ukraine’s recent attacks on Russian oil refineries risk impacting global energy markets https://t.co/3LgO2UfzHg

— Bloomberg (@business) April 9, 2024

The incoherence is only compounded when you consider the administration’s antipathy for fossil fuels in its obsession over climate change. The administration thinks that fossil fuels are really, really bad, m’kay, and wants to reduce sharply their use. What better way to do that but to make them more expensive?

Now that I mention it, none, actually. Demand curves slope down. So for the climate change obsessed, burning Russian refineries and the consequent increase in fuel prices is a good thing. A great thing, according to the theory of the second best! And something that harms our alleged arch enemy to boot! What could be better?

Well, what could be better to someone who thinks logically is the real question. The freak out over the refinery attacks is clearly symptomatic of people who refuse to think logically. People who apparently elide the word “foolish” from Ralph Waldo Emerson’s epigram that “a foolish consistency is the hobgoblin of little minds.”

The administration’s draining of the Strategic Oil Reserve is another example of its foolish inconsistency.

There are many other examples. One that also checks the Russia and energy boxes is the insane pause on US LNG development approvals. This will also “impact global energy markets,” and not in a good way. And in particular not in a way that helps those whom we hope will help Ukraine.

When European natural gas prices reached stratospheric levels in the immediate aftermath of Russia’s invasion of Ukraine, Biden proclaimed that the US had Europe’s back, and would replace Russian gas with good ol’ ‘Merican LNG.

Suckers!

The administration’s obsession with keeping down the most visible price of energy (that paid at the gas pump) also clashes starkly with an array of other policies that will dramatically increase the cost of energy. The push towards electrification of everything, with the electricity generated by renewables, is just one example. Renewables are not cheap. They are expensive. Hella expensive–just look at how much higher electricity costs are in jurisdictions here (e.g., California) and abroad (e.g., Denmark and Germany) where renewables penetration is highest. Driving up demand (e.g., by penalizing the use of ICE vehicles) of a high cost resource is a recipe for higher energy costs. Much higher.

The force feeding via vast subsidies of high cost efuels and hydrogen will also inflate energy costs, though here (not coincidentally) the cost will be concealed in your tax bill and higher interest rates (required ot get people to buy US debt).

In sum, to call Biden administration energy policies “schizo” is an insult. To schizos. It is full spectrum contradiction and incoherence that simultaneously strives to lower energy costs and raise them, and to protect Russia while demonizing it.

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers