Rick Falkvinge's Blog, page 12

December 2, 2014

Law Enforcement is Inherently Tragic

Quality Legislation – Zacqary Adam Xeper: Debate always rages over what should be legalized, what should be banned, when police should or shouldn’t use violence, and who belongs in jail. We believe crime is a problem, and that we can solve problems by making them into crimes. But crime is a symptom. When a law is broken, it means something in society has gone deeply wrong.

Most legal systems, and the popular attitude surrounding the law, are little more than revenge fantasies. We punish people who disobey the law, not because it will fix whatever wrong they’ve committed, but because it feels like they deserve to suffer. We tell ourselves that the threat of punishment deters people from breaking the law, even without a shred of evidence to support this, let alone common sense. There are plenty of harmless behaviors that are illegal, and plenty of very harmful behaviors that are legal. There are lots of horrible things each and every one of us could do, every day. But we don’t, for a long list of reasons — and “because I could go to jail” is often very far down that list. For both people who abide by the law and people who break it, whether a legislative body approves of your actions is almost always a complete afterthought.

We tell ourselves that threats of punishment work, even though they rarely do, because we don’t want to face the fact that a broken law is a failure state. A bug in the system. An error message on the blue screen of society. If a law is so just, so moral, so representative of what a democratic society believes is “the right thing,” then why would anyone ever break it? Why would you have to enforce a good law?

When somebody breaks a law, it means one of two things:

The law is unjust

Something prevented this person from behaving properly

Those are the only two possibilities. There is no third option of “well, maybe some people are bad people,” and it’s time we called the belief that criminals aren’t created by their circumstances what it is: social science denial. If you believe that people rob stores because they have “poor moral character” or whatever, then your point of view is no more valuable than someone who thinks dinosaurs are a hoax or that the measles vaccine is ruining your indigo child’s crystal aura, and I’m not going to waste any more time refuting you.

There is nothing to celebrate when somebody is arrested, convicted, imprisoned, or even given a slap on the wrist and set free. For some reason — whether out of complacency, ignorance, or just plain delusion — most of society does not treat the work of law enforcement as the regrettable, preventable tragedy that it is. It’s easier to cope with when the solution is simply to repeal a dumb law, or to legalize something that never should have been banned in the first place. It’s harder when we have to accept the fact that somebody turned to something we all can agree is wrong — something like theft, murder, assault, libel, fraud — and they turned to this because doing the right thing wasn’t working.

Poverty, illness, toxic cultural norms, broken bureaucracy, fear, even traffic congestion — these are what drive people to do the wrong thing. We criminalize the behaviors that they cause and expect them to go away, but they don’t. We blame the people who break our laws because we don’t want to blame ourselves. We ought to be grieving every time a ticket is written, a handcuff is locked, a cell door swings shut, a gavel slams down to punctuate a sentence.

Instead, we create justice systems that incentivize and celebrate punishment, patting police and prosecutors on the back every time they nail somebody regardless of whether the world is better off because of it. From municipalities that excitedly raise revenue from parking tickets instead of fixing their parking problem, to district attorneys who proudly jail murderer after murderer while people keep getting murdered, the entire culture of law and order is completely warped and backwards.

Laws shouldn’t have to be enforced. This may be a utopian ideal — a world with no struggle, no scarcity, no disagreement, and everybody happily obeying a common consensus of appropriate behavior all the time — but that’s not an excuse not to try. Every engineer knows that a system will always have bugs and flaws, but that’s not a reason to accept them. When that system is society itself, the system that runs our entire world, we should be less accepting of flaws than in any other case. Let’s acknowledge that law enforcement is a kludge, a hack, a quick and dirty fix that shouldn’t have to be there, and work to prevent it from ever having to happen.

November 19, 2014

Swarmops Approaching Launch. Want To Be Part Of It? Fund It Maybe?

Swarm Management: Swarmops is approaching launch. This is the back-end software that allowed the Swedish Pirate Party to beat its competition using less than one percent of their budget, but now generalized for any organization’s use – business or nonprofit. It’s also the only software in existence to do bitcoin-native automated accounting and cashflow.

I believe that adding shiny happy blinking gadgets isn’t the crucial thing to make an operation competitive: instead, it’s removing the old painful obstacles that makes the big difference to competitiveness.

When I founded the Swedish Pirate Party, I had a simple philosophy: the many people shouldn’t have to deal with pain points at all. If there was anything boring and painful, it would be touched by as few people as possible. There was no organizational software that met this simple principle – instead, all back-end software seemed to require the many people to do as much work as possible for the accountant. Just creating an expense report was usually a nightmare.

So I started writing the back-end software for the Swedish Pirate Party myself. It turned out to be absolutely instrumental. (To reclaim an expense in Swarmops, you upload a receipt, fill in its amount and what it’s for, and that’s it.)

Along the same vein, I wanted decisions to be made as far out to the edges as possible, where the most tactical information was. As long as everybody has bought into the overall vision, the best decisions are made at the information sources. There was no software for this either. Swarmops does that too.

This software turned out to be absolutely instrumental in allowing the Swedish Pirate Party to win in 2009, despite having less than 1% of the budget of the competition. The philosophy – in management, organization, and software – had literally made the organization two orders of magnitude more cost-efficient.

Lawrence Lessig famously stated that Code is Law. I’d say it is much more than that: any organization is confined to what its internal processes can handle. The processes determine what must be done, and what can’t be done. And those organization processes are usually determined by very old-fashioned back-office software. Conversely, those who don’t have the painful back-end accounting and bookkeeping can’t do simple but powerful things like delegate budget responsibility or refund simple expenses.

I set out to change that.

Writing accounting and activist/personnel software sure doesn’t sound very sexy. Then again, neither does expense reporting. Despite that, Expensify was a company that set out to remove that pain point from organizations with the simple mission of making expense reports not suck. It’s now a dominant player.

There are many of these old problems lying around that we just don’t consider because we take the pain they bring for granted, and get all giddy when we see new shiny things instead. But removing that pain from an organization is what gives it speed and agility – not to mention let the energy go toward the organization’s mission instead of to old-fashioned pain.

(There was even an insanely successful Kickstarter campaign for more efficient shoelaces the other month. Imagine that. Anybody who says there aren’t any old pain points to solve is simply wrong.)

So what does Swarmops do?

Swarmops enables tens of thousands of people in an organization to cooperate with little friction, and is geographically aware to boot, so you always have local points of contact. Those people can be volunteers, members, whatever. “Participants.”

Swarmops decentralizes authority to the edges of an organization, where the best decision-making information is available.

Swarmops makes accounting not suck by automating it and doing it all in the hidden background. It was never rocket science anyway.

Swarmops makes an organization transparent by providing real-time data on its health to everybody in the organization. No more waiting several weeks for the quarterly statement. This is realtime stuff.

Swarmops does bitcoin-native cashflow on full auto.

If this sounds familiar and I’ve spoken about some of it before, it’s because I have. It’s the administration system for the Swedish Pirate Party, which was absolutely crucial in allowing us to decentralize to the point where we became the biggest party in the most coveted demographic, despite having less than 1% of the competition’s budget. At that point, it was known as PirateWeb, and was a strictly internal tool.

Some two years ago, I started generalizing it under the name Activizr. However, I realized that in order to make it usable, there would need to be a whole lot of back-end work – installability, maintainability, getting rid of proprietary packages – before that could happen. That’s what I’ve been doing since I first mentioned Activizr, now Swarmops. Now it installs with a standard apt-get, and loads all its data as needed.

But I can’t do this alone.

I’ve been taking this to baseline production level. Now, this needs to scale up if it is to complete and go from good to great.

It’s getting decent attention, but development is going too slow, and Swarmops needs a richer skill set. In particular, I’m not a UX engineer and usability is absolutely key to take a system like this from good to great. (As is mobility, but that’s on the roadmap.)

There’s a crowdfunding going that will enable Swarmops to go from good to great. And yes, of course there are perks for contributing.

Do take a look at the development sandbox to get a feel for it! All the data there is reset every night, so play away. The Swarmops code is also available on Github, and needless to say, it’s public domain.

At this point, Swarmops needs:

Pilot installations. There are a few organizations wanting to take Swarmops for a test drive, and more are welcome. It needs exposure to the famous “real-world conditions”.

Developers developers developers. The code is on Github and any contributions are welcome. Most development is in JavaScript and jQuery, with minor additions to a C# backend.

Funding! The case for going from good to great involves getting some full-time support staff, and design! Do visit the ongoing crowdfunding and consider pitching in?

Design and UX. Going from good to great, or even from useful to great, requires design and usability skills in amounts that Swarmops has not had access to.

Do you want to be a part of this? There’s a group on Facebook named Swarmops Developers – drop on by!

You could see Swarmops as the software counterpart to the book Swarmwise.

Photo by Anna Jumped from the German Piratenpartei’s General Assembly.

November 10, 2014

Bitcoin, The Beginning Of Open Source Governance?

Quality Legislation – Nozomi Hayase: In my previous article on this site, “Bitcoin, Open Source Movement for Decentralized Future”, among many other issues I addressed some concern about the existence of early adopters and this apparent inequality within the Bitcoin ecosystem. I argued how in the Bitcoin network, the accumulation of money is not easily translated into power over others. Someone asked me to further elaborate on this. Here I will explore how the Bitcoin ecosystem offers a different model of governance and how within it, our familiar notion of power can be redefined to mean something radically different.

Before we jump in, for clarification, I would like to note that when I say Bitcoin, I am talking about the underlying technology of the blockchain (which is much more than currency), along with its decentralized network, and also blockchain-based cryptocurrencies in general. Bitcoin might not be the final currency that ends up bringing us into a decentralized future, but it has opened the door. If it fails, it will only be because there is an even better cryptocurrency to replace it.

Culture of Ownership and Control

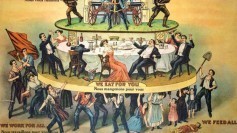

First of all, let’s look at the larger context behind the existing oligarchical system run by the 1%. This can help us understand a posited decentralized Bitcoin system and how it is so fundamentally different from current centrally organized societies.

We live in the culture of ownership and control. The current system has evolved with the idea of “representative democracy/government” as a model of governance (especially in the context of the U.S.). At a global level, it is manifested in governing structures and interlocking bureaucratic organizations such as the UN and IMF that have been set up by the industrialized first nations (North Asia, Europe and North America). This model of representation requires accountability. Elected officials and anyone in positions of power have the potential and tendency to abuse that power, as humans are inherently corruptible. For this reason, it has been an accepted fact that safeguards of “checks and balances” are necessary to ensure the basic idea of “consent of the governed.”

The problem of any centralized governing system is that it naturally creates levers of control. Representation only works in combination with checks and balances on power. In recent years, we have seen how this system of accountability has weakened, as representation has become more and more used as a cover or an instrument by those in power to exercise their agenda and domination. What we have seen over the decades is a corporate takeover of governments, creating an interlocking power of states and corporations that Mike Lofgren describes in his essay “Anatomy of the Deep State.” Just one example is how transnational corporations use treaties like Trans-Pacific-Partnership (TPP) to deny the sovereignty of countries and control the international rules and lawmaking in regards to trade, agriculture, medicine and exclusive rights.

One avenue of creation of this deep state is the cozy relationship between the government and monopolistic banks (as in the private Federal Reserve consortium holding the power of unlimited monetary printing). In the case of the U.S. dollar and its status as world reserve currency, the power it has created has become a tool to advance U.S. hegemony in the world. It is not just the political system that the 1% hijacked, but also other primary pillars of society, namely media, legal and financial institutions. They have all been turned into complex patronage networks that serve U.S. foreign policy and corporate greed and vice versa. This has led to the forming of invisible governance structures, including a two-tiered justice system and the creation of expert opinion that facilitates camouflaged democratic processes to engineer consent.

More and more people are becoming aware of this hidden force of control. The 2008 economic meltdown and institutional failure woke people to the fact that the system of and balances is broken beyond repair. The unfolding global crisis of legitimacy, followed by a cycle of protests in recent years is a testimony of a deep systemic breakdown of Western liberal democracy. It is within this socio-political climate that the invention of blockchain technology emerged.

New Open Source Code of Governance

Bitcoin brings a radical departure from the governance model of the old world. It is an encryption-based currency, something that evolved out of the cypherpunk movement. It follows trends of decentralization that have emerged through the internet in recent years (Bittorrent, Free Software and Open Source Movements and collaborative production platforms like Linux and Wikipedia).

The Bitcoin protocol is open source. Anyone can freely use, modify or share it. The seed of it is based on a culture of sharing that diverges from the dominant corporate culture’s practice of ownership and control and its mindset of proprietary use that restricts or rent-seeks users and prioritizes private profits over all else.

The essence of this game-changing invention is distributed trust (solving the problem of double-spending without third party reconciliation). Bitcoin solves the scaling issue of trust. With its decentralized security, we can now create a more open and inclusive society at a global scale. This elimination of the need for a third party intermediary enables the following:

Representation as option,

Individual autonomy in relationship to others

The principle of distributed consensus

Default global jubilee/ redistribution of wealth

Voluntary taxation/innovation without permission

If truly understood and the technology is developed to its full potential, the heart of Bitcoin’s revolutionary effect lies in challenging the fundamental of what most of us were taught to believe about democracy, namely the common notions of check and balance of power and consent of the governed.

Bitcoin offers a potentially more efficient and inviolable model of governance than the current systems of representation. Instead of trying to hold those in power accountable, we can directly participate in vital parts of society and this individual empowerment over time can more and more remove the levers of control over others in society. The idea is that when more people start to govern themselves with collaborative smaller communities and engage in direct democracy at a larger level, there aren’t so many avenues for individuals or institutions to exploit others. I am going to present some core concepts of a decentralized society step by step. First let’s look at the idea of representation as an option.

Representation as Option

In the realm of payment systems, for instance, author and technologist Andreas Antonopoulos talked about how Bitcoin can introduce a recourse capability (bitcoin payments are designed to be irreversible), independent from the payment system itself. Currently, services like Visa and MasterCard have a monopoly and consumers who use Visa for instance don’t have a choice but to use the dispute resolution that comes with the payment system. With Bitcoin, one can choose a different risk management and fraud protection by using multi-signature transactions according to one’s needs. This opens up a previously monopolized market for arbitration services and customers can have a choice and can readily employ a particular company and a group to represent or carry out specialized tasks.

In the context of broader society, we are now locked into monopoly of electoral politics as a product of representative government. It comes with a package of a two party duopoly (particularly in the U.S.) and corruptible politicians. It appears that we have had no choice but to accept it, no matter how the system is rigged. With the Bitcoin security protocol, a totally new voting infrastructure can be built that may solve many of the problems that permeate the current electoral process. When technology is developed, it can open up accessibility and encourage people’s direct participation on issues that are currently dealt with by elected officials or a professional class that are often divorced from the interests of everyday people.

With transparent and secure voting processes enabled by the blockchain, the electoral arena can be transformed in a way that manifests the uncompromising power of citizens. In this we can still have representation where we wish, but it would be an option chosen by individuals freely. In fact, the idea that encompasses the very notion of this representation as an option is already emerging. For instance, the Pirate Party in Berlin put forward the concept of liquid democracy, which is a way to delegate one’s vote to trusted individuals who are more knowledgeable about an issue. Those who are engaged in this are the ones who have power to assign certain responsibilities anew each time and withdraw that trust when it is appropriate. If this were coupled with direct voting on laws as practiced in Switzerland or with citizen ballot initiatives typical in some US states, a completely new decentralized method of lawmaking could emerge.

This shift of power in governance is ultimately what many have wanted and tried to create in the wake of Occupy Wall Street. Occupy was a collective effort to move away from the electoral arena. Many people felt that the solution is not about voting for a better political candidate or creating a new party within the dysfunctional system, but totally transforming or walking away from the current system as it is too corrupted and flawed at its core.

The global Occupy Movement was to some degree an effect of the decentralization of information that came about with social media and organizations like WikiLeaks challenging the gatekeepers of institutionalized media. This was a testimony of what would happen if information is freed and people are able to inform each other without corporate or government intermediaries. Yet, this was the just beginning.

For people to be able to act on what they know requires a freeing of money from central control. There had to be a way of creating value and sharing it with one another that is independent from the state. The deeply transformative aspect of blockchain-based crypto-currencies is the Swarm effect it creates, generating new streams of economic activity. This in turn sustains and expands the decentralized network. With its first application as currency, Bitcoin is the next wave of decentralization of information, this time in finance.

Individual Autonomy in Relationship to Others

The second key concept of the Bitcoin ecosystem is autonomy and self-governance. Decentralized networks inherently empower individuals. With this power comes responsibility. A Bitcoin open society is not a utopian society. There is risk of failure in every system and indeed in this each person is challenged to become more informed and learn how to be responsible. A great example was seen with the demise of Mt. Gox. The Bitcoin system is outside of the purview of regulatory authority so it offered no consumer protection. Because governments no longer intervene on behalf of the people, each individual gains more responsibility to govern themselves.

For instance, users of cryptocurrencies need to educate themselves about how new decentralized security systems work and how crucial it is for them to keep their private keys in their hands and not trust centralized exchanges like Mt. Gox which was basically operating in the old paradigm, doing fractional reserve banking. This is a world of “buyer beware” where each person needs to become more careful and face the consequences if their judgment falters. This is also a system that allows inadequate companies to fail, unlike in deregulated capitalism that removes risk for powerful corporations and hands them monopoly power to exploit. Even if they screw up or break the law, no one goes to jail.

As I pointed out earlier, one part of taking responsibility means individuals can use third party arbitration and risk management on their own terms. In this case, an individual’s chosen company will perform a service of “representation” for them. This replaces institutionalized, coerced trust as with massive monopolies like VISA or commercial banks. As more and more people directly engage in making decisions about aspects of their lives that used to be handled through bureaucracy, they can take ownership of their own actions and what they create. When people are connected to their own will, they are less divorced from the consequences of their actions. This helps cultivate a sense of individuality and awakens a sense of shared responsibility that is defined through a deeper web of interconnectedness.

A Principle of Consensus

In the existing hierarchical society, those at the top of the system enforce domination through pulling the levers of control. With regulatory tools and laws, they create monopolies in markets and through consolidation of media engage in secrecy and manipulation of information to engineer false consent of the governed.

The problem with monopolistic behavior is that it artificially creates dominance of a particular company, product or political perspective through manipulation and then shields the entity from competition with little checks and balances on abuse of power. For instance, a tech giant like Google didn’t become this massively influential and powerful company on their own merits, purely chosen and supported by consumers. It involved the engineering of consent through constructing a façade of a friendly and progressive image while hiding their decrepit roles such as becoming a private arm of the NSA, as Julian Assange exposed in his new book “When Google Met WikiLeaks.”

The dominance of a particular company or idea itself is not a problem as long as it has attained its status through legitimate means and is truly subject to challenge. If Google became popular only because people genuinely like their service, then their popularity would be a result of a kind of democratic election process through the market. Yet if Google attains dominance in the market through colluding with the government and rigging competition, this presents a problem.

Domination through monopoly is an imposition upon individual freedom. It fundamentally undermines the democratic process. Unlike this systemic domination that works through the logic of “power over”, the Bitcoin decentralized system fosters an environment that creates “power with.” Access to the network is open to anyone who chooses to be in it and it responds to every node equally. The protocol of algorithmic consensus introduces a new rule in the market and at a larger societal level. It encourages a rule of consensus among those who choose to be a part of the Bitcoin network. This is a principle where no one is made to act against their will or their best interests.

This is a shift away from the idea of “consent of the governed”, which is held as a vital principle in the old model of governance. This form has now become mostly corrupted by central power and has come to actually mean “manufactured consent.” In the old system of representative democracy, there was an unexamined assumption that there is always a preselected class in society outside of the general populous that must govern and the role of individuals is reduced to mean one that gives consent to that external force of governance.

The principle of consensus starts with the premise that individuals have a certain autonomous power and that if they wish to, they can temporarily grant that power to institutions and other individuals on their own terms. In this, the source of legitimacy lies in ordinary people and they know that they are the ones who temporarily assign certain tasks, granting authority to others and they can withdraw it anytime they want.

This new rule of consensus embedded in the Bitcoin protocol is supported by the genius incentive structure of the currency. Many people ask what is Bitcoin backed up by? I say what gives it value is the powerful network effect of all participants’ commitment to decentralization. We saw it during Occupy in the form of the general assembly and horizontal decision making processes. The circle of consensus back then was protected by each person’s commitment to the decentralized networks. Similarly in the Bitcoin network, the circle of computers spread around the world are working to ensure this decentralized network of globalized trust.

The more people invest their time and energy and participate in a network like Bitcoin miners and developers, the greater the shared responsibility that each carries to steward this decentralized ecosystem. The self-regulation and organizing of this ingenious network can be seen in how whenever a mining pool gets too concentrated, the miners disperse to avoid a 51% attack because such concentration could destroy their common value and the network in which they are invested.

The transition into a Bitcoin ecosystem brings a shift of values not only in a literal sense of weakening or replacing the value of fiat currencies, but also a shift toward human values that we hold in society. These are values such as transparency, individual autonomy and mutual aid that spring naturally from decentralization. The principle of consensus lies at the heart of these attributes.

Global Jubilee and Redistribution of Wealth

Bitcoin is a global phenomenon. With waves of disruption, it is shaking up our preconceived notions of the world. It opens eyes to other parts of the globe that have mostly been invisible over the horizon from the West. The vast majority of the global population has been exploited and long hidden under the shadow of Western civilization.

It is interesting how in discussions regarding the disparity between 1% vs 99%, many people focus only on inequality within Western society (or their own country). The long history of colonization of the ‘third world’ we are currently benefiting from for cheap resources and goods is often not talked about. In debating changes in the economy, the world for many has come to mean the West instead of the whole Earth. In most of these discussions about the viability of Bitcoin decentralization and paradigm shifting, many don’t take into account the reality of the Global South.

This Western civilization was built up through the British Empire (the old colonization after the age of exploration that began the extraction and transference of wealth from the South to the North) and upon which the current U.S. Empire was built. It has morphed into the world’s first global corporate empire (new colonization in the industrial age, oppressing people in the south with debt and poverty, in the East with sweatshops and resource extraction and control by military occupation in the Middle East).

Right now, currency is imposed upon us. Under the reign of this corporate empire, countries have no choice but to accept the U.S. dollar as a world reserve currency. It is backed by the world’s largest military force. Here, the 1% has the power to control people through the money they accumulate. But more importantly they are the printers of the money and control its flow. The rich wage class warfare through the tax code and loopholes that allow them to live off the value that workers create. They also use financial instruments such as debts as a weapon. Instead of bombing a country, those in power can indenture third world countries, steal their resources and make people act against their will.

Each person’s direct participation in a peer-to-peer network creates a ripple that disrupts the patronage payment network of states and corporations. This can be done, not by protesting, but through each person acting as if they are already free. We can halt the operation of extractive capitalism, free the flow of human labor and creativity stagnated by financial colonization (through rent seeking and financial exclusion) and redirect it to generate a real economy of, by and for the people.

The Bitcoin network frees the flow to the world that has been captured by financial institutions. This technology can be used to help the unbanked and underbanked begin creating a new world economy and its activity on their own terms. This alone could create, through the virtually inevitable Bitcoin takeover of the remittance industry, a massive redistribution of wealth. In the long term it may facilitate the healing of a long history of oppression.

The invention of the blockchain technology emerged in the midst of a financial crisis and the old world around it is already starting to crumble. With currency crises, a massive spiraling tower of debt and the end of the oil age are all signs pointing to an imminent global system failure. The writing is on the wall, as the BRIC countries are moving away from the petro-dollar and the U.S. is now desperately trying to hold onto power by creating crises in Ukraine with Russia and Syria with ISIS.

In this context, blockchain based crypto-currencies can be seen like a phoenix rising from the ashes of the global corporate empire. They play a key role in moving us into a new decentralized civil society. When the petrodollars weakens, it is likely to bring the U.S. empire down along with it. All empires eventually fall. When this one falls, what would happen to the mountain of usurious debt? This could potentially lead to a default debt erasure, a kind of global jubilee. This also may lead to flattening the imbalance of wealth between the West and so-called “third world nations.”

Voluntary Taxation/Innovation without Permission

Bitcoin is the world first stateless currency regulated by algorithm. As more people move into this autonomous network, the states and banks lose power to infinitely print money. Taxation becomes more voluntary (as it is difficult for governments to confiscate people’s bitcoin when they are maintained in a decentralized ecosystem). This means the influence of government weakens. They have to beg for money to set the military in motion. Once they cannot pay soldiers, much of their coercive power dissipates.

By choosing to embrace stateless decentralized crypto-currencies, people can exercise financial freedom and associate freely with their fellows. The Bitcoin ecosystem is a fertile ground for diversity. Unlike the old world of empire where one particular nation or group of corporations exerts dominance, this is an environment where many different communities can co-exist and foster a society within which people create their own currencies and generate value based on each person’s affinity and voluntary association.

With crowd-funding, crowd-lending and micropayment, more people now have a way to direct the flow of their own will and exchange of value. This creates innovation on the edges where we no longer have to ask for permission. This is already happening. Many bitcoin early adopters use their invested money to fund startups and build new innovation and infrastructure for the Bitcoin decentralized world.

To conclude, in the Bitcoin ecosystem, power formerly used for control in the old system can be transformed into individual autonomy and a network of collective decision-making that fosters mutual aid. Bitcoin doesn’t create a totally equal society such as generating equal distribution of wealth, as this was not intended in the design of its protocol. As I see it, the revolutionary force of this technology is to offer everyone an equal opportunity to interact, transact and associate freely with one another.

I see Bitcoin as a technology that simply enables decentralized consensus. This alone cannot determine the outcome of decision-making. Ultimately it is the responsibility of each individual who participates in this process and the collective decision-making of all people that would determine the direction of society.

Bitcoin opens the door to new forms of governance with more direct democracy. Those who choose to use it can live into the attributes of a decentralized society and redefine relationship and actions in this new context of interconnectedness. The Bitcoin world is not perfect and there is much improvement needed, but in my view, it is a far better system than the existing apartheid society where a majority of people are excluded from vital decision making, with the destiny and wealth of humanity controlled by a tiny elite. Bitcoin makes possible open source governance. The power to decide the course of one’s own destiny is now in the hands of ordinary people.

September 25, 2014

Bitcoin, Open Source Movement For Decentralized Future

Cryptocurrency – Nozomi Hayase: It all started with a white paper published in 2008. An unknown innovator under the pseudonym Satoshi Nakamoto outlined an open source protocol for a public ledger that has come to be known as Bitcoin – which among other things is a peer-to-peer form of

digital cash. Five years since its inception, more people are coming to recognize the revolutionary force behind the underlying technology

of the Bitcoin blockchain that enables this decentralized network to achieve consensus amongst strangers at a global scale.

The disruptive force this innovation brings to existing systems is enormous. From potentially replacing the remittance industry to empowering the underbanked and those whose currencies are tightly controlled and subject to hyperinflation, the world is just beginning to see its effects in the financial realm. This capacity of Bitcoin to transform society is attracting activists and global citizens dedicated to promoting equality and a more just world. In particular, the ability of the blockchain’s decentralized trust to build a truly peer-to-peer platform for transactions is a very powerful force for those who seek to flatten the current hierarchical system that favors the one percent oligarchs who have their hands on the levers of power.

Yet as with any new invention in its early phase, many are still skeptical and hesitant to get behind this technology. They call for a more critical examination of Bitcoin as a digital currency. One argument revolves around perceived inequalities embedded within the design of the currency that create certain privilege of early adopters. The contention is that Bitcoin is centralized; that roughly half of all bitcoins belong to around 927 individuals. If true, this puts half of the world’s Bitcoin currency in the hands of a tenth of a percent of all accounts. A Washington Post published an article called, “Forget the 1 percent. In the Bitcoin world, half the wealth belongs to the 0.1 percent”. It called out Bitcoin’s apparent inequality and highlighted the gap between those who own Bitcoin and those who don’t.

All new technology takes time for mainstream adoption and in the beginning it is inevitable that the user base and innovator pool are relatively small. This is certainly true with Bitcoin. Compared to the situation in its early stages, bitcoin adoption now is moving very quickly. That said, what lies beneath this concern about the imbalance between users appears to be a fear that Bitcoin early adopters could end up replacing the current 1% oligarchy of bankster gangs of Wall Street and Goldman Sachs and would simply recycle the old world order of robber-baron capitalism. So the question arises, could Bitcoin’s revolutionary potential be overshadowed by this imagined pitfall, or worse yet become just another tool for neoliberal forces? By engaging this question, we can deepen our understanding of the genius and revolutionary potential of this innovation.

Perhaps the ideal currency in the minds of some of those who criticize Bitcoin’s perceived design of inequality is one that could bring all of Bitcoin’s positive features without creating so-called ‘early adopters’. For this to happen, coins would need to be premined and distributed to all people equally while still achieving the massive hashing power needed to secure the system from any external force determined to hijack or compromise it. This all sounds good, but practically speaking, who has the resources to set it in motion and bring it to that point?

These kinds of efforts might be achieved at a local and smaller scale, like Auroracoin in Iceland, even though it was reported that the experiment stumbled with problems in its design that caused a dramatic drop in value. In addition to scale vulnerability of the blockchain hashing power with a smaller currency, the larger question remains regarding how to effectively challenge the current global cartel of Western financial institutions that have over the years undermined sovereignty of local communities and destroyed whole countries through limiting access to payment networks, debt peonage, rent seeking and money printing. How is it possible to create a common currency that connects people around the world in a truly peer-to-peer way without it being intermediated or hijacked by a patronage network of states and corporate banksters that regularly steal from the commons and act against the interests of the people?

Decentralized Organizing

The creation of Bitcoin and its ecosystem follows a trend of decentralization that has emerged in recent years, such as the Occupy movement’s leaderless horizontal organizing, the Free and Open Source Software movement and collaborative production like Wikipedia and Linux. In traditional movements, a group of individuals or a particular organization takes the lead and organizes the cause. Activists generally struggle to fund their efforts, as altruism does not get rewarded financially in the current extreme capitalistic environment. Across the board in struggles for social justice, funding is often the most challenging issue. Identified leaders communicate the purpose of a project and rely on existing networks and systems for funding and material support. Oftentimes for the sake of efficiency and lack of alternatives, such organizing tends to crystallize into another form of hierarchy.

In addition, over the years, the old methods of dissent and social change have been shown to be less and less effective. Establishment forces target leaders and recognized organizers as a point of control for co-option and weakening movements. This is likely one reason why the inventor of Bitcoin decided to be anonymous and minimize his influence in the operation. Any open declaration of resistance against state and corporate power will not go unnoticed and a direct confrontation with the establishment is inevitable if what is created is at all effective. Such efforts are often met with attacks and in most cases easily squashed.

In a case of building Bitcoin network, the hashing infrastructure of the Bitcoin blockchain needed to attain a stable and impervious size before it could go truly viral and gain more mainstream appeal. Early on, Satoshi Nakamoto appeared to have strong concerns for protecting the development of the software against any just such external threats. This revelation surfaced in Julian Assange’s latest book “When Google Met WikiLeaks”. In a footnote, the founder of WikiLeaks depicted an alliance with Bitcoin community that goes back years before this new cryptographic invention matured into the currency of contagious courage it has become (bitcoin was eventually used to support funds for WikiLeaks and Edward Snowden).

In December 2010, just after WikiLeaks faced the unlawful financial blockade imposed by Bank of America, Visa, MasterCard, PayPal and Western Union, a debate emerged on the Bitcoin Forum, concerning a risk that using bitcoin for donations to WikiLeaks could “provoke unwanted government interest in the then nascent crypto-currency”. Responding to one poster who welcomed such challenge, Nakamoto emphasized the importance of protecting the software development at this early stage. “Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change and the heat you would bring would likely destroy us at this stage.” Six days later Nakamoto disappeared from the Bitcoin community. WikiLeaks read the analysis, agreed with his view and decided to postpone launching the Bitcoin donation until the currency attained stability.

Perhaps past protest and resistance movements can teach us something. In order for the creation of an alternative system to be truly effective, it needs to be subversive and under the radar until it gains strength. In a sense, Bitcoin is a living example of such an effective decentralized organization. After 5 years of existence, it has created the largest global network of supercomputing power. It has now grown to such a level that it is virtually impossible for one nation-state or corporation to undermine or hijack the network.

Swarm Effect

The idea of blockchain crypto-currency was put forward in 2008. The following year the Bitcoin software was launched and the first blockchain network came into existence by miners producing and transacting bitcoins. Someone had to do the early work of building of this open source ledger and securing the system at a time when few would even believe it possible or support this innovation. Where did the impetus for this work come from?

The unfolding process of the growing Bitcoin ecosystem can be looked at as an expression of a phenomenon called the “Swarm”. Rick Falkvinge, founder of the first Pirate Party describes the Swarm as a new style of organizing. He explains how this differs both from an egalitarian way of working where no single person or group has authority for guiding the process. He notes how it is a “scaffolding set up by a few individuals that enables tens of thousands of people to cooperate on a common goal in their life.” Falkvinge describes a Swarm is driven by voluntarism. People join the cause because they believe in the idea. There is no leader, but each person’s action inspires others and guides the Swarm in moving forward together.

Bitcoin is an open source project that generates a Swarm effect. From outside, this might appear mysterious or unsettling with its lack of a traditional core. Some have difficulty believing there is no controlling authority and are compelled to try to unveil a “ghost outside the machine”. Whether it is innovation or activism, people tend to first look for some subversion behind a seemingly progressive idea and then look for individuals or entities that are possibly pulling strings to divert the original intention. This can be a healthy skepticism, yet in the case of Bitcoin, there is no company, director or physical entity. There are no CEOs, no offices; no group of individuals running the operation.

At this time, the origin of the blockchain technology has been traced only to an anonymous unknown creator. The idea itself is not attached to a particular individual or group. It is somewhat similar to the way the online collective Anonymous express themselves as simply “ideas without origin” and claim that “there is no authorship … no control, no leadership, only influence, the influence of thought”.

Bitcoin is simply an ingenious idea and an open source computer code that anyone can read, take up, modify and develop. Whoever created it didn’t give it only to specific people, but instead made it accessible to everyone in the world. Doug Carrillo, founder of Bitstop.co tweeted, “Satoshi’s greatest gift was uniting all the intelligent, altruistic, visionary people from all over the world working on Bitcoin”. The impulse that got this global currency enterprise going was this gift of protocol.

#Satoshis greatest gift was uniting all the intelligent,altruistic, visionary people from all over the world working on #Bitcoin .

— Doug Carrillo (@docBTC) September 8, 2014

Incentive Structure

One notable characteristic that emerged within the Swarm surrounding the Bitcoin ecosystem is the creation of an unique form of volunteerism. Volunteering is generally associated with charity; one gives time, resources and skills for free. Traditionally one does not expect their work to be compensated. The Bitcoin ecosystem generates a new volunteerism in the form of innovation without permission, where those who engage both generate and expand new economic activity simply by creating, acquiring or using the currency. The value they create and the efforts that support it are rewarded in a way that strengthens the system as a whole, while further encouraging innovation on the edges. This all works with a network effect where voluntary peer-to-peer interaction creates and expands an autonomous zone impervious to patronage and monopolization. Each person moves toward something they believe in, while building a kind of common wealth that inspires further participation.

This is made possible through one particular feature of the Bitcoin currency. When we look at Bitcoin technology as a distributed trust foundation upon which global society is building a network that empowers everyone, we can begin to understand the brilliance of its design and why its first application is an open source mineable currency.

With a cap of 21M, Bitcoin has a fixed monetary policy. This design seems deflationary in fiat economy terms, yet Bitcoin’s infinite divisibility (8 decimal points and more if consensus is reached) makes it possible to accommodate any level of economic growth. Some view this design as an inherent flaw, arguing that it rewards early adopters and encourages hoarding, yet this element has played a crucial role in the development of the blockchain. It provided a way of building a global public asset ledger through integrating a reward structure by means of increasingly difficult proof of work tied to network capacity and value expansion.

This all functions as an incentive for volunteerism by creating the Swarm, which creator of Netscape and early web browsers Marc Andreessen characterizes as “a four-sided network effect”, namely “four constituencies that participate in expanding the value of Bitcoin”. Andreessen explains these 4 participants as “(1) consumers who pay with Bitcoin, (2) merchants who accept Bitcoin, (3) “miners” who run the computers that process and validate all the transactions and enable the distributed trust network to exist, and (4) developers and entrepreneurs who are building new products and services with and on top of Bitcoin”. This design, combined with unparalleled flow and infinite divisibility creates an open source network effect – not just squared, but cubed.

The Bitcoin incentive structures have shown to be very effective. Bitcoin is expanding infrastructure with ATMs and exchanges and improved POS interfaces. When people are invested enough in something, it motivates them to solve challenges that come along the way. In fact, it has generated enough incentive to make people keep the network decentralized and avoid the issue of a 51% attack (the phenomenon of concentration of a hashing majority and temporary takeover by one mining pool). Each member of the global mining pool has a strong incentive to strengthen and maintain the integrity of the system.

Many early adopters put resources into creating new start-ups to support the ecosystem. After becoming the first major retailer to accept Bitcoin globally, Overstock announced it would donate four percent of cryptocurrency revenue to foundations that promote the use of digital currency in the world. A new Bitcoin Exchange in Norway is reported to donate 5% of their profits to charities fighting poverty.

Bitcoin is an open source project that is self-organized and crowd-sourced by all who are involved in it. Early adopters are like shareholders who also can take responsibility for maintaining the system. Although justification of the percentage of reward accruing to them may be debatable, if we look at how vital their role was in building the system and the risk they took early on in supporting the innovation, it looks different. One should also note that their accumulation of bitcoin was not made through cheating, manipulation and exploitation like with fiat and debt ownership, so we may be compelled to draw more nuanced conclusions about this perceived inequality.

Genesis Block and the Network of Affinity

So what was the idea encoded in protocol that set this in motion? Bitcoin is a neutral technology, yet the genesis of the idea is not neutral. It had clear political implications. The Bitcoin protocol emerged during the financial crisis of 08 and the creator was aware of how badly governments were handling monetary policies. The first block of the Bitcoin blockchain known as the genesis block includes the following quote in its metadata. “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Although this might have been intended to be just a timestamp, his choice of this Times of London article as a date of proof might give a sense of his background motivation.

Satoshi’s white paper pointed to the “inherent weakness of trust based model” of the existing financial system and proposed “an electronic payment system based on cryptographic proof” as a viable alternative. The Bitcoin open source protocol was a response to the crisis of the existing centralized financial system. Over time, this has created a network of affinity through voluntary association and mutual aid based on trust in the common person.

In this network, individuals out of themselves turn their computers into mines. Out of themselves they create start-ups and test the system. Some might be driven to earn bitcoin or build a cutting edge business, while others are motivated by a principle and vision of a decentralized future and redistribution of power. Whatever the motives driving users, miners and innovators, by choosing to be a part of Bitcoin network, they are all bound by one shared idea – that of supporting and maintaining the integrity of the public ledger for all the world to use.

This may remind us of what fueled the Occupy Movement. In fall of 2011, people from all walks of life came together in lower Manhattan. There were socialists, libertarians, housewives, anarchists and teachers. Those whose houses were foreclosed, students with onerous debt, businessmen – all came together because they could see how the system was rigged against them. They were not willing to put up with the current hierarchical financial and economic system that is run and controlled by the 1%. Their shared frustration became a network of affinity bringing people together to engage in efforts to solve problems of corrupt hierarchical institutions and false forms of representation. Through activating trust in one another, they attempted to create a peer-to-peer decentralized network. They were willing to work together and abide by this particular protocol of consensus and egalitarian form of decision-making.

Bitcoin is a similar social movement empowered by decentralized consensus decision-making processes. While the Occupy movement was crushed by a brutal police force as it tried to build decentralized networks on existing centralized corporate occupied territory, with Bitcoin, a whole new network is built upon a distributed trust platform that is structurally autonomous and out of reach of any private third party authority. We now have an alternative to over-centralized social forms that were programmed to manage wealth and resources for the rich and powerful and can enter into a network of peers impervious to these forces of control.

As noted, some see and criticize the existence of privilege within this Bitcoin network of affinity. Yet the issue of equality disparity was brought up even within the 99%. Concerns surfaced within Occupy that it was not truly addressing issues of racism and class divides. In the U.S, the Occupy movement arose mostly out of white middle-class issues such as mortgages and student loans, while for people of color in US cities like Oakland and Detroit, the oppressive issues were more about police brutality, not having grocery stores in their community and lack of the basic work and means to fulfill the needs of everyday life.

The same thing might be said about the Bitcoin network, as it is potentially composed of people of different backgrounds, nationalities, cultures or economic classes, within which there is clear inequality. This is really a reflection of our current social structure that carries a long history of colonialism in the form of Western hegemony. Despite all the differences, there is one thing in common. Participation in the blockchain network is voluntary. Both with the Occupy network motto of “In Each Other We Trust” and with Bitcoin, those who are in it choose to join because they see what an improvement it is over the current system and how it could at least offer benefit beyond monopolized rent seeking for oligarchic powers.

Whatever incentives bring people into the network, by joining they are working to build on the genesis idea that brought them together. It is to eliminate the need for central authority and replace hierarchical third party based representative forms of governance with a truly peer-to-peer decentralized trust network. They do this by each person simply participating and becoming the change they wish to see in the world.

Beyond Levers of Control

Perhaps in transitioning into the Bitcoin ecosystem, the biggest challenge we face is the limit of our ability to imagine. Corporate colonization has not only created vast inequality of wealth by way of an economy based on exploitation and wars, but its real damage was creating a poverty of the mind that cuts humanity off from its connection to the earth. It captured the imagination into materialistic economy of exploitation and extraction and many no longer think with the earth as the First Nations used to do.

We are now so used to centrally planned and hierarchically organized societies, it is difficult for many to imagine how a truly decentralized society might work. People are conditioned by the old paradigm and tend to look for levers of control even where there are none. They cannot even imagine a system that does not create such points of control. So when faced with the idea of a Bitcoin 1%, so called early adopters, it is easy to automatically apply the current reality of the 1% that can print money at will, create debt slavery and rent seek at every choke point. Some fail to understand how radically different the Bitcoin ecosystem is from the existing centrally controlled economy and forms of governance.

Let’s examine this more closely. The existing fiat world is organized by physical and social confinement of populations within nation-state boundaries, where sovereignty of nations ostensibly determines currency and monetary policy. Creation of currency has been enforced by monopolies by means of taxation. This central authority creates levers of control that are now mostly co-opted by corporations. These levers prevent ordinary people from fully counting themselves in as the true source of legitimacy. It creates a chain of command where institutions and professionals can gain power to coerce others to serve the interests of those at the top of the hierarchy and make people work against their own interests.

In this environment, accumulation of money can be easily translated to power and corruption. We see how this has panned out in history. Those who have money can control the flow, get to the top of the system, buy politicians and even take over governments. As a result, we now have a massive inequality where a tiny percent of the population, 0.001 percent controls access to the majority of the wealth and transactional flow of the entire world.

In the last few decades, this corruption reached an extreme level after taking the dollar off the gold standard, with the Federal Reserve and other private central banks (private corporations) using this power to print money out of thin air. With this and the monopolization of banks and payment systems, they maintained massive power to fund divisive resource wars and debase currency through inflation. This is now destroying the middle class and slowly turning the whole population toward a medieval-like debt servitude. Bitcoin completely challenges this system of control through enabling a decentralized network that cuts out third parties that create monopolies and insidious levers of control.

Money as Flow

In the Bitcoin distributed trust network, there are no choke- and checkpoints. Currency gains its true meaning – pure flow. What would it be like if currency functions as flow rather than a form of control? As we move into a more decentralized future, the current hierarchical institutions and central authorities lose power. In the Bitcoin network, accumulation of money is not easily translated into power over others. All that those 1% Bitcoin adopters can do with their acquired money is to spend it. They cannot interfere with or undermine the integrity of the value transfer network. They cannot print more and debase the whole system and they can’t rent seek each transaction.

So let’s imagine a scenario where they try to buy up all the media, lobby politicians and buy real estate and land. With new blockchain based social media and forms of crowd-funding and micro-payments, it will become harder for big media organizations to own the airwaves, to control and dictate narratives. Also, it would be difficult for individuals and corporations to buy up politicians, as their transactions are transparent in the blockchain and private agendas would be harder to hide. Besides, politicians will themselves become increasingly irrelevant as taxation is completely transformed in a Bitcoin world.

In a Bitcoin ecosystem, the familiar world crumbles. It is an entirely new world. A 1% here looks a lot different than the 1% in the current fiat world. This is a world where people interact through voluntary association rather than coerced will. The current monopolies seen in the existing financial system would become difficult to maintain. It makes the government more transparent and eventually more accountable.

Perhaps the larger ramification of the blockchain invention is the potential of code to facilitate an equal application of law that ensures the principle of consensus. If a Bitcoin 1%er wants to buy land from farmers or even buy whole cities, the land owners would have to be willing to sell. People won’t as easily be manipulated and forced to act against their will. In a Bitcoin decentralized society, farmers and others have a choice to say no and this ability of each person to decide what to consent to defines personal power.

In the world created through this two-way voluntary participation, accumulation of money or goods means isolation. If one wants to create a society of control and domination, it would have to be a little pond kingdom where one can maintain an illusion of control. But the same rules of consensus apply and the participation in this pond is also voluntary. Everyone can freely choose what kind of community and people they wish to associate with.

As the two worlds interface at this early stage, some voice concern about the current 1% trying to buy up bitcoin. But if they do this in order to maintain the current power which they gained in the fiat world, they will shoot themselves in the foot. They cannot buy out the system, but can only buy into the new network just like everyone else, which would only lead to expanding and strengthening the decentralized network and accelerating the demise of the fiat system itself and the illegitimate authority that goes with it.

New Sovereignty

The Bitcoin network creates decentralized consensus at a large scale without anyone in the middle. Can we really understand the significance of this and imagine what a future created through a truly peer-to-peer network looks like?

With the invention of the blockchain, we are entering into a new era. Security expert and technologist Andreas Antonopoulos describes how up till 2008, sovereignty created currency. He notes how the world of sovereign currency ended in 2008 and that after 2008, currencies could be created by individuals. When broadly adopted, these currencies create their own sovereignty and purchasing power.

The current sociopolitical system is built on a long history of colonization. Western civilization has a dark past of violence, brutal subjugation of indigenous people to enforce domination and resource extraction. This unredeemed shadow is carried on even now as a force that has morphed into a pervasive globalized corporate power with its privatization and financialization of everyday life.

While the concept of sovereignty in the current nation-state paradigm is based on a colonial mentality where independence of a country was attained through conquest of others, the blockchain invention opens a door for a new kind of sovereignty, one that is not based on the logic of control and domination, but through mutually shared ideals and voluntary association.

Bitcoin is the world’s first stateless currency that transcends borders in a similar way as the Internet. Its unmediated flow delivers more power to the periphery. As a result it could dissolve the hegemony of U.S. empire and end the monarchy of the petrodollar that controls flows of oil, finance and global geopolitics. This could potentially shrink the wealth gap between the Global South and the North. For the first time in history, humanity has the option to really heal the wound of long history of brutal colonization; to end major wars, transform poverty and inequality and move toward a more humane world. Humanity has a chance to embark on a new path, where technology of Western society is used to serve for the wisdom of indigenous cultures and together create a new civilization.

If we let the imagination follow its natural current freely, it leads into a future where collective creativity can solve the centralized problems of the old world. Even if Bitcoin as money dies tomorrow, that will only happen because a better designed blockchain cryptocurrency has come to replace it.

We don’t know exactly where this will go, as this kind of thing has never occurred before. But one thing is certain: The invention of the blockchain has already changed the world forever. No one can think of this world in the same way as before. The blockchain has already unleashed the flow of radical imagination, becoming the waves of uprising of a decentralized future.

September 17, 2014

Anti-Piracy is Class Privilege

Diversity – Zacqary Adam Xeper: Internet monitoring, copyright monopolism, and other methods of stopping filesharing aren’t an industry defending itself from economic damage. They’re a concerted effort to deny access to culture, tools, and information to working-class people in industrialized nations, and everyone else in the rest of the world. And the worst part is, it reinforces itself by turning struggling artists against struggling fans.

The attitude that looks down on people who “just want free stuff” and “don’t want to pay for things” is one coming from great economic privilege. If you’re able to afford expensive software, or you have no problem accessing culture through hundreds of 99 cent downloads and multiple $8 per month subscription services, good for you. If you have access to the financial services needed to pay for these things, that’s fantastic. But billions of people around the world don’t. Billions of people who have access to the Internet — but not much else — can only get their culture, their information, or their tools from The Pirate Bay.

It is socioeconomic bigotry to look down on these people, and to decry what they do as evil piracy when they couldn’t do the so-called “right” thing if they tried.

It’s equally supremacist to look down on working-class and non-Western filesharers for not sucking it up and abstaining from downloading anything. Privileged people have this idea that because access to the latest Foo Fighters album isn’t something essential like food or water, you’re a deplorable, petty little thief if you go and “steal” it anyway. These “luxuries” of entertainment and joy are only for the rich, for the people fortunate enough to have access to credit cards, for people who live in a country deemed economically “important” enough for culture to be approved for distribution in their region.

It’s very easy to tell other people that they don’t need things when you’re fortunate enough to be able to have them.

If you think it’s so easy to survive without access to all the culture you want, when you want, try giving it up. Call your bank and have them freeze all of your accounts for a while, and don’t use anything you that you can’t buy with the amount of cash available to someone living on poverty wages. See what it’s like to live without your Netflix like that, even with the added privilege of knowing that you can terminate the experiment whenever you want.

The problem is even starker when you look at operating systems and creative software. These are tools of production, and under the copyright industry’s system of oppression, people who can afford these tools have a direct socioeconomic advantage over the people who can’t. The reason filesharing is branded as “piracy” is because it pokes a hole in that domination. It takes away the upper class’s stranglehold on producing culture, whether for the purpose of making money or simply having a voice.

Some economically disadvantaged people also consciously declare themselves pirates as a form of political protest — against intellectual property, a company’s business practices, or what have you. There are absolutely a minority of people in a position of economic privilege who also do this, who are able to afford the asking price of the things they download for free and fileshare purely for political reasons. If this political act offends your sensibilities — because it’s not “real” civil disobedience if you avoid consequences, and not a “real” boycott if you still get the product — that’s barely any less pearl-clutchingly pompous than spitting on people who fileshare out of necessity. But I want to reiterate, people who are both able to afford the copyright industry’s asking prices, and who also choose piracy as a form of protest, are a very small minority. The pirate who can pay and chooses not to is largely a strawman.

Perhaps there are people in a “gray area” — the ones who can’t afford Photoshop and certainly not Maya, but maybe it wouldn’t kill them to spend a few dollars on iTunes. I’d like to remind you that nobody has any right to judge how poor people handle their money. Nobody has any right to say somebody doesn’t qualify as “poor” because they own such luxuries as a refrigerator and an Xbox, or because they’re dependent on upper- or middle-class family members for a slightly more comfortable lifestyle than eating roach-infested ramen. By extension, nobody has any right to tell people that their filesharing is out of necessity or out of a political crusade. It can be one, or the other, or both. And it’s absolutely elitist to say that it’s illegitimate.

Nobody gets to decide who’s being poor correctly. Not rich people, not poor people. And the latter is equally a problem, when poor people moralize at other poor people for not respecting property rights enough. Just like how people of color can internalize racist narratives, LGBT people can internalize homophobia, and women can internalize patriarchy, you don’t have to be upper class to be classist. Anyone can buy into the bullshit of classism and perpetuate it, even though it’s against their own interests. And nobody internalizes copyright classism like starving artists.

On -isms

In case it’s not clear, the definition of “classism,” “sexism,” “racism,” etc. we’re using here is from social justice theory, i.e. a culture-wide system of domination by one group of people over another. It’s not a synonym for one individual having a prejudice. A poor person who hates rich people is not “reverse classist.” That’s a prejudiced poor person. But there’s no culturally-pervasive system that gives their prejudice any power.

Maybe you’re a struggling artist, writer, coder, or other creative person who has a hard time feeling sympathy for all the people who enjoy the fruits of your hard work and don’t give you anything in return. You know what? I am too. I published a book that nobody bought when I was 16, I had a failed Kickstarter when I was 21, and by 24 I’ve had empty donation boxes at more film screenings and presentations than I can count. This is not because people are mean, cruel, and callous. This is because everybody else is just as broke as I am.

When there’s not enough money to go around, only about 1% of artists ever get any of it. It doesn’t go to the best 1% of artists (and if you think it does, please read all three books in the Fifty Shades of Gray trilogy and then get back to me). It goes to the luckiest 1%. That’s just the way this screwed up world works.

We need to stop internalizing classism and believing that it is a crime to be poor, and that people without money don’t deserve nice things. It starts with refusing to believe that you, yourself, are financially struggling because it’s your own fault, that you’re not good enough, or that your situation is the result of anything besides an accident of what family you were born into. That’s what happens when we internalize bigotry: we hate ourselves just as much as the people like us.

So if we really care about the injustice towards struggling artists who can’t make any money from their hard work, let’s direct our rage at the people and institutions that are reinforcing economic inequality. Don’t take it out on the people who just want to distract themselves from how broke we all are with some free Game of Thrones.

August 11, 2014

Liberties Report – Week 31, 2014

Civil Liberties: How the copyright industry, prison industry, and pharma industry are complete counterindicators of the public interest. Published on Sunday, August 10.

(Technical notes: Those who have watched the previous episodes can see the technical details taking shape. There are still some audio issues, notably in getting the sound mix from the lapel microphone and the ambient room microphones right, but this has been improving week by week. Also, there seems to be a problem with the phantom power circuits when only using one mic input and leaving the other unloaded, creating a high-pitched bynoise.)

Comments for further improvement welcome! The last batch of comments here (about a month ago?) were tremendously helpful, and I may post another episode here from time to time (not every week) as heartbeats.

August 5, 2014

Why The Proposed New York Bitcoin Regulations Are Absolute, Total Bullshit

Cryptocurrency: New York’s Department of Financial Services has presented draft regulations for bitcoin trade that are an absolute heap of bullshit, and that’s even before going into what the proposal actually says. The propsed regulations require a so-called “BitLicense” in order to trade in bitcoin with residents of New York and with everybody else in the world. The problem is, that’s an absolute joke from a legal standpoint, completely ignoring the very concept of a jurisdiction.

At last, the proposed regulations for bitcoin trade were published for comments. The bitcoin community has been absolutely furious, but nobody’s going into the fundamentals of the proposal: that it asserts authority over the entire world on the basis of being located in New York.

That’s no more possible – or enforcable – than if the President of Iran asserted authority over the entire world on the basis of being located in Teheran.

Here’s the (proposed) deal: the proposed regulations say that any company, no matter where in the world, doing bitcoin business with a resident of New York must have a so-called BitLicense. The first problem with this is that this BitLicense doesn’t limit itself to regulating the trade between the company and the resident of New York; it asserts authority over any person, no matter where in the world, doing business with that company, which is also located no matter where in the world.

So regulators of New York are asserting authority over trades taking place between a business in Slovenia and a client in Malaysia, based on the idea that the business in Slovenia may also have clients in New York. In technical terms, this is absolute, total bullshit.

To pull a parallel: imagine if Iran determined that any web site offered to Iranians must implement Shari’a laws, not just when offered to Iranians, but when offered to anybody on the flimsy basis that it is also offered to Iranians. This is how batshit insane the asserted authority of the BitLicense proposal is.

I see it as a way to try to deliberately fragment the bitcoin trade into unworkability. If every single patch of land publishes their own requirements for bitcoin trade, and asserts that their requirements apply everywhere, we’ll have an impossible patchwork of 246 legal frameworks that all bitcoin companies must follow, full of multiple contradictions everywhere. It’s nothing short of a deliberate sabotage.

(246 is the number of countries in the world, with the US counted as its 50 states plus DC.)

So while it’s not exactly illegal to assert authority outside of your own jurisdiction like this, it’s completely unenforceable, for the simple reason that when a person in Malaysia trades with Bitstamp in Slovenia, the NYPD has no right to interfere neither in Singapore nor Slovenia. It’s out of their jurisdiction, which literally means that New York doesn’t get to set any rules whatsoever.

But it goes beyond that. The New York regulators don’t have authority to regulate the Slovenian business Bitstamp, or any other non-US business, even for its clients in New York, either. When I choose to do business with a Californian company from my home base in Stockholm, Sweden, I understand and accept the ridiculously fundamental fact that a business in California operates under Californian law, and that Swedish police and justice has absolutely no say whatsoever in how it chooses to operate. Nor does the Swedish judiciary have any say in how I choose to do business with foreign entities, as long as I don’t bring home contraband.

This means that New York regulators are limited to regulating businesses physically operating in New York, and only businesses physically operating in New York. That’s what “jurisdiction” means. That’s what “enforcement” means. New York Police simply doesn’t get to say how a Slovenian business operates, regardless of whether citizens of New York choose to do business with it, on the simple basis that the NYPD doesn’t get to bloody invade Ljubljana.

The entire proposal is bullshit from its assertion of authority onwards.