Rick Falkvinge's Blog, page 11

February 11, 2015

Copyright Monopolist Claims Legal, Non-Infringing Use Of Your Own Property, Without Asking Unnecessary Permission Anyway, Is Like AGGRAVATED RAPE

Copyright Monopoly: In a fuming blog article, David Newhoff claims that non-infringing, legal uses of copyrighted works – that is, of people’s own property – are like “aggravated rape” when made without unneeded consent of the monopoly holder. Newhoff tries to scold the crucial concept of “fair use” in copyright monopoly doctrine, the concept which explicitly says that some usages are not covered by the monopoly and therefore not up to the monopoly holder, and ends saying that if you don’t grant permission and can’t set limits, it’s “aggravated rape”. Just when you think copyright monopoly zealots can’t sink any lower, they surprise you with one of the few creativities they’ve ever shown.

The copyright monopoly, which is not property but a form of Industrial Protectionism (IP) and therefore a limitation on property rights, is subject to a constant barrage of attempted re-branding to “property” by monopolists who want to strengthen their monopoly. In many regards, copyright monopoly punditry are like religious fanatics in this regard – the idea that their monopoly is just harmful is so hard to digest, that facts and empirical observations just be damned.

But in this article, which is about “fair use”, meaning exceptions to the copyright monopoly where it just doesn’t apply – and therefore about when the copyright monopoly holder can’t set limits and doesn’t get to grant or deny permission over non-infringing uses of a creative work, Newhoff really sets a new limbo bar:

[image error]

David Newhoff: If the copyright monopoly holder doesn’t get to grant or deny permission, and doesn’t get to set limits, like with a fully-legal fair-use case, it’s like aggravated rape against the copyright monopoly holder

Do note here that Newhoff is not saying that copyright monopoly infringement is like aggravated rape. That would be bad enough. Newhoff is saying that taking actions that fall outside of the scope of the monopoly, without treating them as though they were monopolized and restricted anyway, i.e. doing something fully legal with your own property, is like aggravated rape.

This goes far, far beyond the usual silliness of claiming that copyright monopoly infringement “is stealing” (which, as a reminder, the U.S. Supreme Court has handed down a firm judgment saying it isn’t in any way, shape, or form).

Civil liberties activists have sometimes been poking fun at the excessive rhetoric from copyright monopolists, saying it’s not stealing but rather arson, or maybe kidnapping. In a brilliant application of Poe’s Law, which says good satire can’t be reliably distinguished from zealot fundamentalism, it seems liberties activists just can’t possibly keep up with the increasingly ridiculous – and audacious, not to mention outright revolting – things asserted by copyright monopolists.

[image error]February 7, 2015

The Consequences of Ancillary Copyright for Press Publishers

Copyright Monopoly – Martin Doucha: European Commissioner Günther Oettinger is still contemplating whether he should propose the German Ancillary Copyright for Press Publishers on the EU level. I would like to help him make the right decision by exploring the consequences of such legislation.

Throughout this article, I will refer to news aggregation services and search engines as “aggregators” and to press publishers simply as “publishers”. I will use the German law as reference but also consider some alternative options, both better and worse. This kind of analysis requires the assumption that aggregators will eventually start signing licence contracts according to the law. However, I do not expect them to give in very easily for the reasons stated below as well as for the sake of their bottom line. The worst consequences of ancillary copyright can be summarized into the following short list:

Deterioration of search result quality

Deterioration of news quality due to publishers’ cheating

News search fragmentation

Entry barriers for startup aggregators

Interaction with other laws

But before exploring these problems in depth, let’s clear one very important misconception. Aggregators provide an important free service to the public which has significant indirect beneficial effect on publishers’ revenue. Calling it free advertisement would be accurate description. Publishers’ willingness to give Google a royalty-free license almost immediately in order to get the full advertisement service again is the best evidence of how beneficial this service is to publishers on its own. However, it is not evidence of any need to regulate some dominant position held by Google. Publishers could have collectively given the same royalty-free license to any other single aggregator instead with pretty much the same result for their bottom line. The aggregator in question would be immediately catapulted to the top, taking Google’s place as #1 news aggregator in Germany for the simple reason that it would be the only aggregator with a fully functional service.

The most obvious reason why ancillary copyright might have detrimental impact on search result quality are licensing issues. When aggregators do not have licence to index certain news articles, those articles cannot appear in search results, plain and simple. The German law includes provisions about collective rights management but VG Media, the collecting society in charge of news aggregation, is not authorized to issue statutory blanket licences (see their collective licence terms, in German). This will force aggregators to deal with lots of unnecessary copyright bureaucracy and severely restrict their ability to index articles.

Another reason, depending on the metric used to distribute royalties to publishers, could be malicious search engine optimization (SEO). In other words, publishers cheating to bend the metric in their favor and therefore get more money. Malicious SEO is already a major problem and all search engines spend a lot of effort fighting it in order to give you what you search for instead of click bait and spam. On the bright side, solution of this problem is usually as simple as delisting known offenders. However, finding those offenders in the first place is the hard part.

Depending on the metric used to distribute royalties again, publishers may also use other ways of cheating that do not manipulate search ranking. VG Media for example licenses news content of its members in exchange for fixed percentage of the aggregator’s worldwide revenue related to use of licensed content. Claiming worldwide revenue is a sensible precaution against the aggregator formally moving revenue to another country. But it also creates very tempting opportunity for abuse. Let’s suppose that Google accepts those terms. I wouldn’t be surprised in the least if worldwide interest in German news, particularly articles licensed from VG Media, suddenly skyrocketed the very next day. But only on Google News, for some mysterious reason.

It’s extremely hard to avoid using some sort of user traffic statistics as the royalty distribution metric. Even though aggregators would pay a fixed percentage of revenue, a collecting society might use traffic reported by aggregators as an internal metric to distribute the collected money among its members. User traffic also becomes an unavoidable metric when aggregators themselves have to split money between multiple publishers/collecting societies in the same area. Aggregators will most likely take great care to have some clear limit on total royalties to be paid. So publishers will compete among themselves to get the biggest cut from a fixed amount of money. This competition who can inflate their traffic through the aggregator the most will be very expensive, of course. So if royalties from aggregators become bigger income for publishers than revenue from advertisement on their own news websites, publishers won’t hesitate to cut budgets for news reporting and spend the money on cheating harder.

If you think something like that couldn’t possibly happen, you should read about MP3.com’s Pay for Play which had the same problem 15 years ago. The publishers’ decision whether to write high quality news reports or cheat harder in royalty distribution metrics really comes down to which of the two is more profitable.

As I have said earlier, the collecting society in charge of news aggregation in Germany is not authorized to issue statutory blanket licences. This enables big aggregators to sign exclusive contracts with individual publishers, locking their news content away from other aggregators for the duration of the contract. Today, you can search all news conveniently through any aggregator. But imagine that the big aggregators split up the news landscape so that content from certain publishers is only searchable through their service.

Such fragmentation would obviously have negative impact on search result quality. But it would also put many small publishers out of business. Small publishers are not important enough to get a fair licence deal from big aggregators, perhaps even any deal at all. While ancillary copyright is in effect, collective rights management is their only hope to get indexed and stay in business. However, big aggregators will refuse to sign any collective licence deals because that would undermine their effort to push big publishers into exclusive contracts.

Exclusive contracts between content producers and middlemen are the standard business practice in most existing copyright-based industries. Look at music industry, movie industry or video game industry for examples. In this case, aggregators will become the copyright-empowered middlemen who get to decide which content will reach the public. The question is not “if” but “when”.

Most of the above will also create unnecessary barriers for startup aggregators. New aggregators need to fill their service with content before they can get any revenue. While ancillary copyright is in effect, broad collective rights management with reasonable licence terms is even more indispensable to them than to small publishers. Search fragmentation through exclusive contracts will therefore create the biggest barrier.

Another barrier may arise if collective rights management does not cover the full extent of monopoly granted by ancillary copyright. Many innovative aggregation ideas which require transformative use of indexed content may be abandoned in early stages only because collective rights management does not license the necessary transformative uses and signing enough contracts directly with individual publishers before the startup runs out of funding would be impossible.

Raising new barriers for startup companies is completely antithetical to European Commission’s stated priority of creating a single EU digital market.

Here I want to focus on possible future proposal of “search engine neutrality” which is a particularly dangerous territory for legislators who don’t understand technical details of running a search engine. For example, the proposal may inadvertently outlaw countermeasures against malicious SEO, which would open the floodgates to extremely aggressive malicious SEO techniques and render search services mostly useless.

It may be very tempting to try solving some of the above problems by legislating that aggregators have to index everything they can (I will call it “compulsory indexing”). Even with sufficient exceptions against abuse (like malicious SEO), this will require statutory blanket licensing with no opt-out for publishers. Otherwise aggregators won’t be able to pay what the publishers will ask for. While ancillary copyright is in effect, aggregators have only one bargaining chip: delisting content. Compulsory indexing takes this bargaining chip away and forces aggregators to either accept every single whim of each publisher, or shut down the whole service.

Aggregators are most likely well aware that compulsory indexing would make them completely powerless in licence negotiations. So if compulsory indexing ever comes into effect without statutory blanket licensing, aggregators will just save themselves the trouble and shut down their service right away. However, the combination of compulsory indexing with statutory blanket licensing turns ancillary copyright into plain old tax.

Dear Commissioner Oettinger, I hope this article will help you clear your doubts about proposing ancillary copyright on the EU level. If this is the first time these issues have been brought to your attention, your advisors are doing a bad job. If you still want to bankroll press publishers so badly, a simple special tax on aggregators would achieve that goal with none of the potentially disastrous side effects described above. There is no reason for dressing it up as copyright with all the superfluous arcane complexity that stems from giving somebody a statutory monopoly. Unless you want to pretend for PR purposes that it’s not a tax.

But if you still think that ancillary copyright is a good idea, go right ahead and shoot the whole EU in the foot. Your exercise in futility will only demonstrate how destructive the whole concept of copyright, of permission culture, is to the digital world. So far, existing copyright laws have always been applied to crush new innovative services before they could mature and demonstrate their potential benefits to everybody, including creators. Now, for the first time in decades, we can watch brand new copyright rules tearing apart established services which have already fully demonstrated their global value. Part of the EU digital market will be set back to the early beginning of the century by ancillary copyright, with little hope of future progress.

Many thanks to Mikuláš Peksa for researching details about German ancillary copyright which are not available in English.

February 3, 2015

Bitcoin; Crypto Key Unlocking The Autonomy Of Trust

Cryptocurrency – Nozomi Hayase: Bitcoin, once ridiculed as money for geeks and then condemned as a tool for criminals gained much wider understanding from the mainstream in the last year. More people are realizing that Bitcoin opens doors to financial freedom. With it, we can transfer any amount of money anytime, anywhere in the world instantly, securely and without permission. What enables this truly peer-to-peer transaction is Bitcoin’s underlying technology of the blockchain and its core invention of distributed trust. This is portrayed as a shift into trusting math instead of central banks and governments. Some critics view it as cold algorithms replacing the human trust that is a foundation for healthy society. But is this true? What does decentralized trust mean?

Before we dive into this question, let’s first look at the model of trust in existing systems. Virtually every human interaction in society is based on trust. As society developed into modern nation-states, interaction that was experienced in small communities faced the issue of scalability. To solve this problem, society became more and more centrally organized, implementing representation as a form of governance. In this model of centralization, access to the network is closed, with only a few having full credentials to view and administer the system. Entry and participation into such a network required permission from these appointed administrators and necessitated the walls and borders around its spoke and hub structures.

For instance, to assure the equal application of laws and guarantee the basic functioning of the legal system, we need to trust police, lawyers, judges and politicians. In this case, trust is derived from a central authority through a careful vetting process that separates experts from non-qualified actors and is delivered through layers of bureaucracy. No matter how good the intentions are of those who created it, systems of representation enable levers of control that have always been susceptible to corruption.

Over time, the divide between those who govern and all others widens, making the whole system vulnerable to single points of failure and internal abuse of power. Once elevated, these experts are increasingly divorced from the interests of the common people. Those who manage the networks become a new class of professionals. They hold all keys to the castle and guard the hierarchical structures of power distribution.

This centralization of trust often results in disempowerment of ordinary people, where legitimacy and authorship is transferred from citizens to institutions, politicians, lawyers and economists. As a result, much of the power to make vital decisions about ones own life tends to be forfeited, along with the right to trust one another to freely associate, innovate and build community on shared values.

Permission to Transact

The current financial system as a part of centralized society mediates essential human interaction. Modern transaction systems have been drastically altered from a form of exchange experienced in ancient times. In his book, Debt: The First 5,000 Years, anthropologist David Graeber (2011) described how before the invention of coin or cash, money was a credit arrangement. He dismantled the economists’ myth of barter as the origin of money. Contrary to how most people have been taught, in those times when people exchanged goods with one another what they were actually doing was a form of giving – as a neighborly favor.

He explained how in ancient Mesopotamia, exchange was based on horizontal social relations expressed in the sense of our indebtedness to one another; you helped me, so I feel I owe you and wish to give in return for your favor. Long ago in these small communities, humans were using an elaborate credit system to keep tabs on those favors and account our obligations toward one another. Back then, people were more able to interact face-to-face and develop trust. Economic interests that bind people were more direct and close to neighborly favor, with individuals genuinely wanting to help one another. A balance was struck when the favor was returned.

Money in the modern state has become extremely centralized. It has come to function as debt, transforming social relations into power dynamics and installing interest obligation that is abstracted from interaction between everyday people. Graeber described how this was advanced further through the invention of debit and credit cards, which has recently created a largely cashless society. He noted how the shift into transacting digital currency through the modern credit system has transformed the relationship of those who engage in monetary exchange:

“All of these new credit arrangements were mediated not by interpersonal relations of trust but by profit-seeking corporations and one of the earliest and greatest political victories of the U.S. credit card industry was the elimination of all legal restrictions on what they could charge as interest” (p. 368).

In the realm of finance, the schism between ordinary people and ‘experts’ has taken a form of creditors and debtors. In modern times, the basic human action of borrowing, lending and exchange has been mediated by private companies, banks and payment processors such as Chase, Visa and MasterCard. One’s ability to transact with one’s fellows now largely requires permission from these mega corporations.

The Man in the Middle

Through institutionalizing a monopoly that removes and outlaws effective competition, money printers and creditors can now act like the new Kings who dictatorially direct and divert the flow of finance. Predatory lending and the gutting of anti-trust and usury statutes that had once protected ordinary people have now normalized a kind of extractive debt peonage, while these investment firms and bankers institutionally protect their obscene profits and investments (gambling) with zero interest credit made available through central banks who print money out of thin air. They set contracts on their terms because they know that our crucial transactions depend on their monopolized trust. Individuals have largely become unable to freely choose whether to enter into a relationship or negotiate the terms of a contract without this unelected man in the middle.

Third party authority of a centralized system has interests quite different from that of the individuals exchanging goods or services. For example, someone who lives in the U.S. wants to purchase goods from Indonesia, uniting her interest in enjoying the product with the seller’s desire to share the product with an agreed upon means of exchange. When interests are joined and based on genuine goodwill, it can be a real exchange, creating value for both parties. However, the middleman in a centralized Visa or Western Union-like payment system has no real relation to the shared interest between the buyer and seller beyond the collection of transaction fees and maintaining their monopoly within the system. These third parties act as gatekeepers to authorize the transaction, thus controlling access to the financial network. This unregulated rent-seeking behavior has now exploded, leading to a system of private taxation that is obscenely profitable. The result is that the wealth distribution today is quickly coming to resemble that of the medieval era.

We may be tempted to view such a system as based on trust. In reality, this is disingenuous. It is actually a system based on obedience and coercion. It is another form of control camouflaged as a necessary service. Private companies lock people into a relationship based not on equality of peers but on an imbalance of power through this monopolized payment system and the arbitration that comes with it. Centralized trust discourages the two parties from developing personal relations out of themselves and freely determining the course of their own transaction. With charge-backs, payday loans, massive transfer fees and subprime mortgages and without the individual’s capacity to set terms of contract and rights to exchange, we have become automatons programmed to dutifully obey rules set by the controlled market vultures that get fat by extracting massive wealth from the 99.9 %.

Trust is something that can never be required or enforced from outside. Grown organically, it is the basis for any meaningful human interaction and will only be developed through a relationship based on equal peers. For trust to be possible, each person needs to freely form relationships out of themselves, independent of power structures that might interfere with that process.

In Each Other We Trust

Why do we need these private companies to mediate interaction? Why do we need their authority in basic human activities such as exchange, innovation and sharing? The simple answer is, we don’t! Bitcoin currency as the essential unit of value and the payment network of the blockchain replaces trust in governments and banks with mathematics. Its distributed consensus network simply eliminates the need to trust anyone.

Silicon Valley tech entrepreneur and author Andreas Antonopoulos describes Bitcoin’s security model as trust by computation:

“Trust does not depend on excluding bad actors, as they cannot ‘fake’ trust. They cannot pretend to be the trusted party, as there is none. They cannot steal the central keys as there are none. They cannot pull the levers of control at the core of the system, as there is no core and no levers of control.”

Math guarantees the integrity of the system without anyone needing to trust one particular person or company. With ‘In Crypto We Trust’, what is eradicated is not human trust, but the mandated trust in a third party. Bitcoin solves the scaling problem of ‘In Each Other We Trust’. By removing the need for any central authority, cryptographic security of mathematics unlocks autonomy of trust; the ability for each person to directly and freely choose who to associate, interact or exchange with. With this, our innate capacity for trust that has been compromised by the artificial system of hierarchy can now be restored.

This new stateless currency distributes peer-to peer digital cash and enables neighborly favor at a global level that once was experienced only in a local community. The blockchain, a transparent global asset ledger keeps track of everyone’s transactions and facilitates circulation of currency as social relations.

Blockchain-based cryptocurrencies bring the source of legitimacy in the realm of finance back to individuals. Anyone can download a simple application on a computer or smart phone and by keeping their own private keys, they can start their own money system or bank. It is an open source network where each person can freely enter into relationships bound only by simple mathematical rules that set out an agreement on how to exchange value.

The unmediated flow of finance directed through networks of equal peers has the potential to dissolve the abstracted stagnation of onerous debt and foster a trend of reciprocal exchange based on our own indebtedness to one another. With this independence achieved through algorithmic regulation, we can now claim the power of consensus and create a new global civil society upon the foundation of trust in our fellows.

January 17, 2015

Putin’s Unreported Genius On Ukraine: Currency Warfare

Europe: Putin did not invade Ukraine to invade Ukraine, but as a genius invasion against the U.S. Dollar. Almost all media have missed the high-level geopolitical chess at play and focused so narrowly on the individual moves, that they’re completely missing the big picture. There’s currently a war about what reserve currency the world should use – and the U.S. is poised to lose.

We can see this in how biased the reporting is toward Western political actions being favorable and working. The sanctions are not only not working, they were a trap for the U.S. Dollar in the first place. Putin has been the one in control of the situation for the past decade and more, and he’s playing a long-term game.

Any reporter who regurgitates the oft-repeated statement that Western sanctions are the cause of Russian economic problems is 100% wrong. Not just wrong on details or nuance, but wrong in the worst “politicians-are-right-because-they-said-so-themselves” type of way.

Background

Putin is trying to unsettle the U.S. Dollar’s reserve-currency status. If that succeeds, the U.S. Empire will collapse like a house of cards. Today, if you live in Germany and want to buy something from China, you must first purchase U.S. Dollars from the U.S., and then exchange those USD for the goods you want from China. This means that the U.S. is literally in a position to print as much money as they want, and the world is supporting consumption levels in the U.S. that go way beyond their means – not to mention a military that is vastly overstretched.

The key to maintaining this reserve-currency status lies in the vital energy trade. As long as energy (oil, gas, uranium, coal) is traded in USD, the USD is a reserve currency for all other trade. The usual term for this lock-in arrangement is the “petrodollar” – the connection between the USD and oil trade which reinforces the USD’s de-facto status as default trade currency.

Putin has spent the past 15 years making the world’s largest economy – Europe – completely dependent on Russian energy: oil, natural gas, and uranium. Europe cannot do without Russian energy at this point in time.

However, it is still traded in US Dollars. And Russia is not in a position to demand that its customers start paying in Rubles or something else than USD at this point. It needed to get its customers to demand the ability to pay for Russian energy in something else than USD. If Russia could make her own energy trade happen in something else than USD, the United States’ overstretched empire would collapse in short order.

So what could Russia possibly do to cause its energy customers to demand settlement for Russian energy to happen in something else than USD?

Russia needed its customers to ban trade in US Dollars – or needed the US to ban Russian customers from using the US Dollar when buying energy from Russia.

Russia needed sanctions from the United States, so its energy supply to Europe couldn’t be denominated in US dollars anymore.

So how do you willingly cause the US to invoke sanctions? You need to provoke the international community in a way that goes well beyond acceptable behavior, but does not meet the bar for a military response. That’s a very delicate dance to perform.

Putin needed a non-NATO country to harass in order to lay the intended trap for the U.S. Dollar.

Invading Ukraine

Hence the invasion of Ukraine, a series of moves that have defied any normal military routine. It has been constant and consistent provocation, but has equally consistently not met the bar for a military response from the West.

And Obama took the bait hook, line and sinker, and issued the sanctions in question against the Russian economy. Western media has falsely and parrotly portrayed these sanctions as successful, when they were the desired outcome all along from the Russian side.

Putin’s invasion of Ukraine was not an invasion of Ukraine. It was a trap for the US Dollar, a trap that sprung perfectly.

And in the months that have followed, Russia has successfully withdrawn from the petrodollar, which has negative exports for the first time in 18 years. The trap is working perfectly, despite the current fall (crash) in oil price that has other causes entirely.

So now, when the largest French energy company Total is looking to exploit a new large Russian natural gas project in Yamal, a joint venture with Russia’s Novatek and China’s CNPC, it is going to invest “yuan, euros, rubles… anything but the US Dollar”. And it doesn’t care that it’s not using the USD. It’s not allowed to and it doesn’t care. This is the company with the CEO that went on record saying there’s no reason to uphold the petrodollar, and who died in a plane crash shortly after making that statement.

This is geopolitics at high levels, where laws do not apply.

In effect, Putin has successfully defeated the US Empire by defeating the petrodollar, unless Obama has a last-ditch ace up his sleeve at this point.

Finally, there is an impression in Western media that Putin would be “incapable” of sophisticated schemes like this – that Vladimir Putin would be an unsophisticated simpleton. That image doesn’t pass the simplest of smell tests.

Putin is the president of Russia. Russian power is cutthroat to unimaginable levels. To not just reach the top, but also stay at the top, you need to be long-term, cynical, and results-oriented to levels not even understood in the West. Long-term as in taking 15 years to set the bait by making Europe dependent on Russian energy. That’s why Putin comes across as “mad and irrational” to Western policymakers; the Russian thought processes are more ruthless than anything relatable in the West.

But “mad and irrational” doesn’t make somebody a Russian president. “Mad and irrational” makes somebody a Russian homeless. Therefore, Western media are either painting a propagandistic picture of Putin on purpose, or not understanding the utterly pragmatic way of thinking. Therefore, claims that Putin is unpredictable and irrational don’t pass the simplest of smell tests. To the contrary, he’s genius and he’s a very very skilled power player.

Shale Oil and the Ruble

Now, the Russian economy and the Ruble are failing short-term, but not because Russia is locked out from access to the dollar; that part is helping the Russian economy. The reason the Russian economy is failing is because half of their GDP is based on fossil fuels, and that U.S. domestic oil production has halved the cost of oil.

But that’s a different story, and one that hurts the United States almost as much as it hurts Russia. That’s primarily Saudi Arabia flexing its muscles and also trying to outcompete the United States and Russia and Iran, which is another problem entirely.

January 14, 2015

Hilarious: Activists Turn Tables On Political Surveillance Hawks, Wiretap Them With Honeypot Open Wi-Fi At Security Conference

Activism: Activists from the Pirate Party’s youth wing have wiretapped high-level political surveillance hawks at Sweden’s top security conference. They set up an open wi-fi access point at the conference and labeled it “Open Guest”, and then just logged the traffic of about a hundred high-ranking surveillance hawks who argue for more wiretapping, and who connected through the activists’ unencrypted access point. They presented their findings in an op-ed in Swedish this Tuesday.

The yearly security conference of Folk och Försvar (“People and Defense”) in the ski resort of Sälen is considered Sweden’s top security conference, with all relevant ministers of the cabinet present, all surveillance representatives present, and generally everybody present who would argue in public that surveillance of other people than themselves is the best idea since sliced bread.

At this conference, activists Gustav Nipe and Elin Andersson set up a honeypot open wi-fi, and labeled it “Open Guest”. About a hundred of the worst surveillance hawks used the honeypot access point during the conference. The activists were logging all so-called “metadata”: which servers were contacted and how. They present their findings in an op-ed in Swedish.

They start out by noting that it is borderline trivial to use this metadata from just casual browsing to uniquely identify the individual using the open wi-fi network, even manually combing through the collected data:

Analysis of the traffic metadata enables us to draw conclusions about which individuals were using our network. Visiting high-volume websites like the Aftonbladet tabloid won’t say much about the user in question, but when this is followed by connections to “mail.agencyX.se” and surfing on pages about a particular small city, the roster of possible candidates is dramatically reduced.

They also note that the people who are responsible for the very security of the country happily use open and unencrypted wi-fi to fetch governmental correspondence, and draw some conclusions from that:

On several occassions, we logged connections to mail servers of governmental agencies. Using an open, unencrypted network to read governmental correspondence is not good. For example, we saw connections to the mail server for the Swedish Civil Contingencies Agency (“Myndigheten för Samhällsskydd och Beredskap, MSB”). The agency’s mission is to develop society’s ability to prevent and deal with serious accidents and contingencies. We consider it problematic that their personnel is nowhere near sufficiently trained in information security.

But most of all, they wanted to make a statement against those who seed distrust and call for everybody else to be wiretapped, and seem to have succeeded well in doing so. They argue that they’re using the very same methods that the GCHQ, the NSA, and the FRA are using, albeit on a much smaller scale. They end their published findings thus:

In closing, we are happy to report that we have found no traces whatsoever of preparations of terrorism in our surveillance. However, we do note that people need to get much better at using the net in a secure manner.

Much kudos.

January 10, 2015

Freedom Of Speech Is Not A Religion Of Hate

Freedom of Speech – Zacqary Adam Xeper: The cartoonists at Charlie Hebdo did not deserve to die. As a believer in free speech, I’m now supposed to go beyond that sentiment and lionize them as martyrs, fearlessly expressing themselves and standing up for the principles of freedom. I can’t do it. I will mourn for their deaths but I will not glorify their hate speech.

I will not defend the people who murdered the staff of Charlie Hebdo. Those murders were completely unjustifiable. I will mourn the dead because they are human beings, and I’m sure that they were loved by their families and were, in many ways, good people. But I refuse to make the slain cartoonists into saints for the one thing they most clearly did wrong with their lives: their racist, witless work which had no redeeming social value other than to spread hate.

The attack on Charlie Hebdo was a calculated, strategic move not intended to avenge the honor of the prophet Muhammad, but to fan the flames of Islamaphobia and racism. To incite good-intentioned, predominantly white Westerners into gleefully sharing racist and reprehensible caricatures masquerading as “satire” was exactly what the terrorists wanted. Because most Muslims — especially French Muslims — aren’t interested in terrorism. In fact, one of the police officers killed in the crossfire was a Muslim, but the attackers didn’t care. Muslim collateral damage was the point. The terrorists believed that Muslims will become a lot more interested in extremism and be easier to recruit, if we take the bait and begin to treat them with hate.

Says Jacob Canfield:

Charlie Hebdo is a French satirical newspaper. Its staff is white. Its cartoons often represent a certain, virulently racist brand of French xenophobia. While they generously claim to ‘attack everyone equally,’ the cartoons they publish are intentionally anti-Islam, and frequently sexist and homophobic.

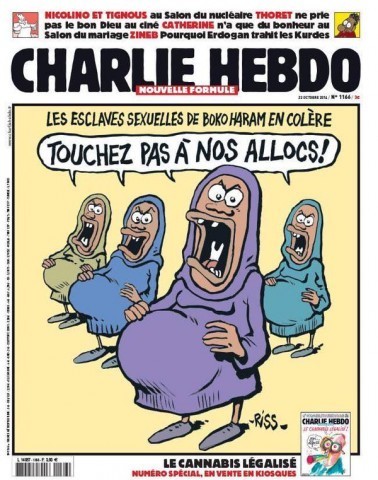

I mean, look at this shit:

That roughly translates as, Boko Haram’s sex slaves are angry — “Hands off our child benefits!” Yes, it’s a cartoon asserting that women sold into sex slavery and bred like animals by a Nigerian terrorist group are welfare queens. That pretty much sums up the tone of Charlie Hebdo’s “courageous” “satire.” It exists for no reason other than to reinforce a widely-held bigotry, an advertisement that reminds us to “be racist!” instead of “buy Coca-Cola!” A reminder that absolute free speech applies to vapid, lazy hate speech, which nobody needed to be reminded of. This is the kind of crap we’re supposed to be exalting as freedom fighting.

It’s disappointing to see more talented satirists coming to the defense of Charlie Hebdo’s lazy work out of sheer reflex. It doesn’t even have anything to say beyond hate. Even South Park, that sacred cow of nothing being sacred, tends to refrain from pointless insensitivity when you really critically analyze it, and it’s even gotten downright progressive in regards to marginalized groups recently.

We boorishly push the billions of peaceful, non-violent Muslims to condemn the extremists who tarnish their culture, and to apologize for their religion and race (and no, saying “Islam is not a race” when you’re talking entirely about brown people is bullshit). If Muslims are supposed to apologize for people who turn their religion of peace into a religion of hate, then why isn’t there an onus on us to condemn people who use our religion of free speech to spread hateful things?

Yes, that’s right. I called freedom of speech a religion.

The way hate speech apologists talk about free speech isn’t all that different from religious fundamentalism. To them, free speech is a dogma to uphold out of a pious, idealistic duty, and it’s almost as esoteric as some aspects of Islam. They champion the idea that even the most reprehensible, hateful screed is to be defended and protected, that even appalling callousness and ignorance is defensible. They ignore the reason why freedom of terrible speech is protected.

It’s not that it wouldn’t be a wonderful, amazing, fantastic thing to rid the world entirely of hate speech. It’s that we can’t do it without causing more problems than we solve. We can’t come up with a consensus on where to draw the line between truly toxic hate that will contribute to pseudospeciation and convince people to engage in discrimination and violence, or harmless insensitivity or a simple misunderstanding. When hate is so deeply ingrained in a culture that people can be racist without knowing it, some people can engage in hateful speech that reinforces discriminatory ideas without even realizing it. So we refrain from legally punishing hate speech — fining, imprisoning, or executing people — simply because we’ll never be able to come up with a legal framework that doesn’t cause collateral damage.

That’s another thing: freedom of speech is a legal construct. There’s a reason why you can be banned from a comments thread for being an asshole, or fired from your public-facing job for making reprehensible statements, without having your freedom of speech violated — free speech is specifically a freedom from being punished by the state for your beliefs and expressions. Maybe you could argue that extralegal institutions, like online forums, social media, or employers ought to strive to replicate the principle and idea of free expression. But sometimes people want to be free from your speech too, and that’s why at smaller scales in private settings, that option is left to our individual discretion.

But let’s not forget the historical context that birthed freedom of speech. Freedom of speech was never about your right to shout “fuck” in a public place, or to make fun of somebody of a different creed or color than you. Freedom of speech was about your right to criticize the state, the authorities, and other officials who would otherwise have the power to imprison you. Freedom of speech was created to defend speaking truth to power, not to defend punching down on people with less power than you. We begrudgingly allow hate speech as an escape valve,

And this is why I really, emphatically cannot defend Charlie Hebdo’s racism and xenophobia. Hate speech is in no danger. Violence against it is so rare as to be newsworthy. It is not being threatened. It does not need to be defended.

Western Islamophobia is mainstream. Defending Charlie Hebdo’s cartoons is the safest, least subversive position one can take. It is like making a principled stand for ice cream. Everybody loves ice cream. You’re not a hero for standing for it. What Charlie Hebdo ostensibly stands against — terrorism and violence motivated by a perversion of Islam — is a stance that is literally as popular as ice cream. You are going to have a very, very hard time finding a significant number of people in the West who will tell you that Islamic extremism is okay, even if the only people you ask are Muslims.

The uglier ideas that leak out from Charlie Hebdo’s cartoons — the orientalist caricatures of Muslims that deliberately mark them as “other,” the ignorant and inaccurate portrayals of laziness, ignorance, and barbarism — these ideas also need no help. Muslims, even those who are only Muslim culturally and don’t practice or study the faith much at all, face hate and discrimination in the West every day. Their dietary restrictions and prayer rituals hurt no one; their attitude towards women is more nuanced than blanket “oppression,” and many wear hijab and identify as feminist; they are by all measures perfectly ordinary people who just happen to have a different religious and ethnic background than most Westerners. (In fact, in France, “Muslim” is often used as a politically correct term for disparaging people of Middle Eastern and North African descent regardless of how religious they are) They are the victims of a widespread, mainstream irrational hatred, and if anyone’s freedom is at risk and in need of defense, it is Muslims’.

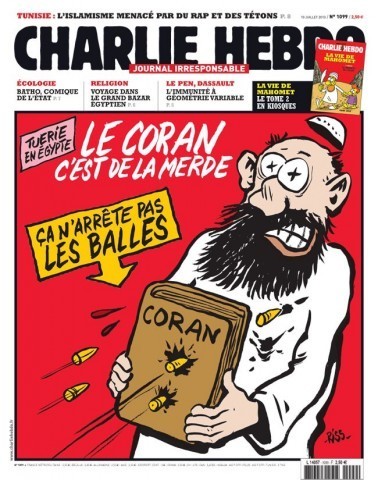

In 2013, after a massacre of Muslim protesters in Egypt, Charlie Hebdo had this to say:

“The Qur’an is shit. It doesn’t stop bullets.”

Today, a Muslim paper has yet to draw a cartoon saying that the the Declaration of the Rights of Man doesn’t stop bullets. Because that wouldn’t be funny.

Asghar Bukhari further contests the idea that this is harmless fun:

The elites narrative was simple, a left-wing magazine, had produced ‘satirical cartoons’ about all religions and politicians, some of them about the Prophet of Islam — Only the Muslims took offence (subtext because their backward barbaric religion was alien and intolerant).

Imagine today’s spurious and conceited argument being used by the Nazi’s — could a German newspaper hide behind the claim it also made fun of white Germans? How unjustified that only the Jews complained so! After all Germans didn’t complain when they were made fun of — those backward Jews and their greedy religion didn’t understand free speech!

I’m going to keep flirting with Godwin’s Law here — itself turning into an anti-intellectual device used more to stifle criticism and discourse than anything else — and quote an eloquent series of tweets from activist @ThatSabineGirl:

Last year a neighbour threatened to kill me, I had to move. Civilization doesn’t need to fall far for trans [people] to be in serious danger. This is why publishing hate speech, creating online spaces that feed it is so dangerous. ‘Free speech’ people defend our dehumanisation, and marginalised people will be the first to suffer, while liberals say ‘Well nobody saw it coming.’

Liberals who defend hate speech need to come clean about their reasons for doing so. It’s not high minded ‘free speech’ idealism. We know that, because liberals are among the first trying to silence the impolite speech of marginalised people. Liberals value hate speech more highly than the speech, or even the lives, of marginalised people. Witness ‘liberals’ gleefully distributing racist cartoons and shutting down discussion of their racist nature. Their actions speak louder than their ‘free speech’ bullshit words.

The real attacks on free speech will soon come. It’ll be attacks on the speech & association of Muslims, & any other groups they can tie on. Meanwhile the racist caricatures in the media will continue, and probably get worse. Public shaming of Muslims is already occurring, in form of demanding they prostrate themselves in apology & contrition for their religion. We know where this leads.

Marginalised [people] & ‘SJWs’ are already being made out to be inferior, while being caricatured as having influence and money. Sound familiar? The scapegoating is already long underway. Marginalised people are singled out, made out to be external threats rather than just oppressed citizens. The ‘workshy’, the disabled, the left wing, are being demonised and blamed for the suffering the [government] is inflicting on the people. So anyway, that’s how fascism happens, so let’s avert it instead of going headfirst towards it, yeah? People talk about Nazi Germany as if it just happened, and nobody saw it coming. People saw it coming. They were just silenced and ignored. People didn’t speak out. Hitler didn’t do magic, he didn’t hypnotise his supporters. He gave them the scapegoat they wanted, a people who were already hated. And what are politicians doing now? They’re giving you scapegoats, people you already hate. Us. [Paragraph breaks mine]

This is the deep irony of hate speech apologism — the fact that treating “freedom of speech” with the same bastardized fundamentalism as Islamic extremists is leading us in a dangerous, fascist direction. In beating the drum of what they call “freedom,” apologists for hate speech may end up brining about the authoritarianism they claim to hate so much. All’s well if it doesn’t harm them, perhaps.

Perhaps extremists who claim to uphold free speech have the right to one sense of superiority over extremists who claim to uphold Islam: the speech extremists don’t literally kill anyone. This reminds me of Randall Munroe’s position on free speech:

I can’t remember where I heard this, but someone once said that defending a position by citing free speech is sort of the ultimate concession; you’re saying that the most compelling thing you can say for your position is that it’s not literally illegal to express.

Congratulations on not literally taking a Kalashnikov and shooting anyone who disagrees with you. Do you want a cookie?

This monstrous massacre was not an attack on free speech. In the wider sociopolitical context, it was a strategic retaliation for violence by Western governments, for decades of Muslims around the world being made into an underclass who were subjected to bombings, invasions, resource theft, and systemic humiliation. The attack was targeted not at anyone who dropped the bombs, but instead at people who instead cheered for them. That’s not excusable. Murder is not the appropriate response to hate speech, and it’s unlikely that had they instead killed someone more directly responsible for the deaths of Muslims that it would have helped anything either. But this was an incredibly rare attack. In the grand scheme of things, the freedom to be racist and the freedom to marginalize is under no threat. The only freedom in true need of defending is the freedom to be outside the mainstream. I fear publishing this article more than anyone should reasonably fear publishing an Islamaphobic cartoon.

Why did so few newspapers around the world dare print a Charlie Hebdo cartoon on their front page? Maybe it wasn’t out of fear. Maybe it was because they weren’t very good cartoons.

It goes without saying that nobody deserves to be murdered for drawing a shitty cartoon, though.

January 5, 2015

Understanding Bitcoin And Its Disruption Through Its Roots

Five years since the invention of Bitcoin, currency as its first application has made significant inroads into the global financial system. Its disruptive effect has shaken up taken for granted notions of money and inflamed the imagination as to what money could be. Bitcoin is characterized as decentralized stateless currency. Some critics call it money with a Libertarian bent, designed to promote a new capitalism, while many economists are quick to judge its perceived deflationary design as a fatal flaw. Yet Bitcoin does not fit any existing paradigm. It can best be understood on its own merits within the framework through which the technology itself emerged.

The idea of Bitcoin was first introduced in 2008 in a white paper published under the pseudonym Satoshi Nakamoto. It solved a distributed consensus problem that effectively eliminated the issue of double spend. The blockchain, Bitcoin’s underlying technology is a public asset ledger that records and keeps track of anything of value. This distributed database works in tandem with the Bitcoin network as a payment system and bitcoin currency is both a store of value and an unit of exchange.

The impetus for Bitcoin didn’t emerge out of vacuum. It coalesced from various creative experiments and ideas and the architecture behind it was developed over the years. On July 20th, 2010, the mysterious creator Nakamoto pointed to the origin of the Bitcoin protocol saying, “Bitcoin is an implementation of Wei Dai’s b-money proposal on Cypherpunks in 1998 and Nick Szabo’s Bitgold proposal.”

Bit gold as Precursor of Bitcoin

Nick Szabo is a legal scholar and cryptographer known for his research in digital contracts. Prior to coming to his concept of bit gold, he had explored money more deeply than standard monetary theorists. Szabo looked at money in the past beyond its use for transaction in markets and within the larger context of governing systems in society. He examined Carl Menger’s account of the origin of money, which is treated as a classical theory in economics. According to Menger’s theory, money that predates the invention of coinage is thought of as emerging through markets where commodities were bartered. While agreeing with part of this view, Szabo brought a more complete picture, arguing that the origin of money preceded commodity markets in the form of collectibles such as shells. He pointed out how “the double coincidence of wants problem occurs not only in barter exchanges, but in other transactions that were as or more important than barter to hunter-gatherer societies: paying tribute, paying legal fines, bride price, and mortuary distribution (inheritance).”

Szabo thoroughly spelled this out in his essay titled Shelling Out — The Origins of Money, where he examined money as an evolutionary artifact of the species, drawing from anthropology and evolutionary science. He traced the precursor of modern money to concrete objects like wampum that were used by our ancient forebears. Calling them collectibles throughout the essay, he noted how their main function was “a medium of storing and transferring wealth.” Szabo analyzed how “for a particular commodity to be chosen as a valuable collectible, it would have had, relative to products less valuable as collectibles”, durability, security from accidental loss and theft and ease of mutual approximation of value.

He noted how “the unforgeably costly commodity repeatedly adds value by enabling beneficial wealth transfers … the cost, initially a complete waste, is amortized over many transactions.” This principle also applies to precious metals. He found precious metals to have “unforgeable scarcity due to the costliness of their creation” and that this provided value largely independent of any trusted third party. Yet at the same time, along with the issue of non-useability in the modern era for online payment, he acknowledged the problem in the expensiveness of metals to be used for repeated common transactions requiring a trusted third party to mint them into coins and transport them etc.

In his bit gold proposal paper, he also recognized the problem in current economy with reliance on trust in a third party for value, with modern paper money creating inflationary and hyper-inflationary tendencies through central authority control and such practices as fractional reserve lending. Thus, he called for a protocol whereby “unforgeable costly bits could be created online with minimal dependence on trusted third parties, and then securely stored, transferred, and assayed with similar minimal trust.” With the breakthrough of Nakamoto’s distributed consensus, this idea of production and secure circulation of costly bits came to fruition in the open source Bitcoin protocol.

Money as Token for Reciprocal Altruism

Bitcoin is made to digitally replicate the process of mining gold. Digital currency theorist Noel Jones explains how Bitcoin’s value is derived from “an object’s intrinsic worth”, specifically “real computational work that takes energy–no different from the energy used to dig gold from the ground.” This set Bitcoin apart from fiat money whose value is dictated from above and makes it possible for it to have real value outside of state decree.

So what is Bitcoin’s value that is determined through a network free from traditional control? This goes back to Szabo’s discovery of money emerging out of social relationships having to do with intrinsic human nature. In his exploration into the origins of money, Szabo came to see how the existence of primitive forms of money revealed that money is tied to human instinct, specifically the “desire to explore, collect, make, display, appraise, carefully store, and trade collectibles.” He also noted human species’ acts of cooperation outside one’s kin; something evolutionary psychologists call “reciprocal altruism” and pointed out how money was connected to this innate universal human instinct.

By bringing out evolutionary biologist Richard Dawkins’ idea of money as a “formal token of delayed reciprocal altruism”, he elucidated how these forerunners of money provided a “fundamental improvement to the workings of reciprocal altruism, allowing humans to cooperate in ways unavailable to other species.” For instance, he noted how the advent of collectibles enabled high trade by replacing otherwise needed trust and long term relationships and how it also served as insurance for foods shortages, as it created a source of surplus by trading what people cannot immediately consume or store. It also allowed humans to pass wealth on to the next generation.

He described how between tribes, collectibles were used to tally favor and it helped overcome the limitation of memory and keep track of who did what. This prototype of money functioned as a kind of ledger to strike a balance of favor replacing the need for remembering complex social relations as well as covering what modern tort or criminal law does to settle disputes and remedy damages to avoid revenge and wars.

In this sense, collectibles were a vital invention that could facilitate trade and transactions as social relations to help people cultivate fraternity beyond one’s own kin and expand social bonds with humanity at large. As Szabo put it, “lowered transaction costs for all these kinds of transactions meant greater familial, political, legal and economic cooperation — i.e. the enhancement of kin altruism as well as reciprocal altruism and the mitigation of aggression.”

Contrary to modern money that has become abstracted and is often associated with wars, violence and seen as a cause of human misery, historical money was really not the root of all evil, as per its current reputation. It was then more the opposite. This original money was grounded in nature and as a medium of exchange was a token for reciprocal altruism. Value was created through human interaction based on a striving toward manifesting the innate nature of cooperation. How has it come to be that modern money ceased to circulate as a vital evolutionary tool and got abstracted from its intrinsic human value created in relationship, as when two or more are gathered in the spirit of mutual aid and brotherhood?

Nation-State Sovereignty

Gold and other commodities paved the way for mankind to go beyond tribes to develop a sense of belonging to the larger community through complex social agreements. The wealth of the earth came to be divided into geographically based territories, an artificial confinement within borders, which in time became mostly managed by central governance of a monarchy or the state.

Rick Falkvinge described how the origins of modern nation-state governments lies in the power and duty to perform civil arbitration and its first function was to settle disputes and determine who is right by appointed judges. He noted how “it was established that nation-state government owned and controlled the ledger of assets”, controlling the record of who owns what, even changing ownership. He pointed to how this expanded into collecting taxes without consent. Structures of governance were centrally organized around state authority over the public ledger with legislation of laws, issuing of national ID, voter registration, land registry and marriage certificates.

This sovereignty was largely made through the logic of conquest and domination of survival of the fittest. Throughout history, many wars and conflicts revolved around rights of miners and possession of gold or access to valued commodities. The Age of Discovery was another name for modern state colonization. In the European expansion into the Americas and the coasts of Africa, they found whole new worlds to explore and exploit. With genocide of indigenous people and plunder, the Europeans claimed the right to ownership of these properties that belonged to the earth. Civilization of the world was moved toward European nation state terms and social relations were defined by the Western idea of progress.

Governance came to be structured in the form of technological and geographically driven empires, having the nation with the most military might and control of resources at the center. For a time, it was the British Empire. Since then, the center of power has shifted to the United States as it became the greatest aggressor in the world, attempting to overthrow democratically elected governments through military intervention and coups. With the rise of corporate power and deregulated cowboy capitalism, the Anglo-European alliance expanded, creating the world’s first truly global empire.

The Central Authority of the Empire

Through the sovereignty of the state and its controlled asset ledger, fiat money was created as legal tender by government decree. With monopolized national currency, money ceased to circulate as a medium of exchange that would primarily carry two way peer-to-peer interests.

Sovereign currency became an instrument for state organization to aid the growth of national GDP and in recent decades to maximize corporate profits. We can see a prime example of this political control in the case of the U.S. dollar. In recent history, one pivotal moment of outright rejection of money as token for reciprocal altruism occurred at the turn of the century. The creation of the Federal Reserve in 1913 took the power to create money away from the government and the people it supposedly represents and gave it to private corporations. Karen Hudes, the former World Bank lawyer noted how the U.S. dollar is financed by debt issued by the Federal Reserve instead of the Treasury and called this debt a fabrication in which bankers load onerous interest obligation on the people. Now this corporate control over the global asset ledger and crucial points of extraction transformed national currency to carry a private agenda, supported by the creation of the petrodollar.

In the last century, oil has become an engine underlying industrial societies. Those who control oil resources have come to gain greater control of global geopolitics. Like adventurous American eagles who had no fear of soaring away into the heights of lofty visions, unregulated greed gained vast political power that was then inserted into every transaction by taking over and maintaining control of the oil spigot as well as money printing and flow.

After the dollar was accepted as the international currency for most trade through the 1944 Bretton Woods Agreement and gained status as the new global King, another crucial event happened with President Nixon’s declaration to drop the gold standard in 1971. With this, the dollar became nothing other than high-grade paper issued by the U.S. Government, but printed by profiteering private banks. The next step was a digitization of financial transactions made between computers, through which the melding of the world’s financial markets into a single global organism was cemented.

The expansion and abstraction of money delinked from any intrinsic value and from the interests of the local community created new levers of power and promoted endless derivatives, manipulation and bidding up of asset values. Now through the paper markets, prices of precious metals were suppressed and as Bill Holter articulated in the article Loss of Control, the price of almost everything became subject to central control. This ability to create money out of thin air along with U.S. military hegemony gave U.S. based corporations tremendous power to rule global finance and trade and extract wealth from virtually anyone. Through dollars becoming the world denominator, corporations could dictate their vision of society by directing wars to maintain their power over energy and finance in the world.

The Debt Ponzi Scheme

Those who control the ledger control savings for future generations and control the outcome of disputes. They ultimately can control the destiny of an entire population. Global patronage networks of elites bound together through mutual bond and stocks have monopolized the global financial system. The revolving doors of central banks and private investment firms like Goldman Sachs have created one ledger to rule them all, injecting narrow selfish interests into digital numbers on a computer screen. Now through privatized asset ledgers, the elites can govern virtually every transactional flow, undermining the sovereignty of entire nations by engaging in financial war and colonization. This broke the bond of universal humanity and turned social relations into a new class system of creditors and debtors; in other words masters and slaves. Through their extractive power, transnational corporations use control points like the IMF to create forever indebted nations in the Global South and also control populations in the West through mortgage, student loans and credit card debts.

What are these debt interests imposed upon people by third parties foreign to local communities? Debt comes from the entitlement of a small segment of society and their unearned claim to the monetary systems of the world. Money has become a token of this ungrounded superiority; the world now supposedly owes these elites, who thus feel they should be treated above everyone else. This grandiosity has morphed into American exceptionalism, where unsustainable upper middle class living standards are normalized and nations of consumers are allowed to live beyond their means with massive trade deficits at the expense of the majority of the world and its vast pool of exploited labor. Manipulated numbers on the ledgers are converted into a manufactured sense of moral obligation, forcing all to participate in systematized violence of growing debt pyramids.

The 2008 financial meltdown followed by the bailouts of Wall Street banks began to expose this ponzi scheme; economy had become one big speculative casino at the people’s risk. With endless derivatives and government’s quantitative easing (QE), central banks have frantically been trying to taper the bubbles before they burst. Countries like Greece and now Ukraine on the fringes of Europe are the first ones to experience this devaluation into third world status. It was in the midst of this emerging global financial crisis of central government that the invention of the blockchain emerged.

New Gold Standard

Bitcoin is a global public asset ledger that does not rely on the sovereignty of any state. It self-regulates through algorithm. Like gold, this piece of mathematics enshrined in computer code resists the corrosive forces of outside manipulation. It safeguards society from man’s inflated grandiose self and the urge to have power over others, repeatedly shown in the tampering of banked funds as well as currency debasement and confiscation seen in Argentina and Cyprus. Bitcoin frees wealth from the control of privatized ledgers and enables individuals to determine social relations, liberating interactions and expressions that had been marginalized or denied. Furthermore, as commodity money, Bitcoin brings back the gold standard and aids the process of creating new economies outside of state and corporate control.

What is the gold standard? In the past few centuries, it was implemented as a monetary policy among nations. The gold standard is like aligning with an internal law of mother earth that organically generates and regulates its own economy. No one can control the supply of gold as it cannot be created out of thin air. Its supply is limited and the value is derived from energy scarcity as the mining process is resource intensive and gets more difficult the deeper you go to mine it. Contrary to neoliberalism’s doctrine of infinite growth, the earth embodies a reality of finite supply. There is a very deep wisdom expressed in Mahatma Gandhi’s eloquent words: “The world has enough for everyone’s need, but not enough for everyone’s greed.”

An economy based on a gold standard was a more realistic one, at least one in harmony with the finite earth. It was based on the understanding that people can have according to need and the expansion of supply is made possible according to real demand and not greed. Bitcoin has a cap of 21 M. It will take more than 100 years (till the year 2140) to finish mining all bitcoins. This process is self-organized through miners competing to solve difficult mathematical problems in something called proof-of-work. The difficulty is programmed to slow mining growth and correspond more naturally with the demand and supply of the market.

This built-in scarcity is true to the reality of the earth’s finite resources. There is a natural limit to economic growth and here wealth creation coincides with actual resources. This is a move away from the infinite growth model, where wealth creation becomes abstracted from the reality of everyday people and promotes an environmentally destructive cycle of overproduction and endless consumption. In a sense, Bitcoin follows nature’s law, yet at the same time it is vastly different than gold as a medium of exchange and so implements a very unique gold standard.

The New Economics of the Network Effect

Traditionally, currency based on the gold standard had an issue of a shortage of monetary supply or liquidity -of not being able to accommodate growth of liquidity to demand, say for the world economy in an increasingly globalized world. Some economists argue that gold-like deflationary currency was the scourge that caused the great depression. Yet, unlike physical gold, Bitcoin is extremely portable and highly divisible (bitcoin can be divided into 8 decimal points and more if consensus is reached). In other words, infinite divisibility solves the problem of liquidity in the traditional gold standard. Also, unlike the gold standard of the past that was set by the state, Bitcoin’s elimination of the need for third party trust breaks the bond between sovereignty and currency. As the world’s first transnational currency, the gold standard for Bitcoin is set by the sovereignty of emerging global civil society.

All this brings about an inversion of fiat currency. Fiat currency is debt-based and multiplies; when more money is printed, it loses quality, inflating its supply while decreasing value. On the other hand, Bitcoin as an asset-based currency gains value through the network effect. As more people enter the network, it divides and the total net value of the network and each node increases. This network effect radically shifts the concept of wealth. While in the current monetary system, wealth is thought of as something to be attained by competing, extracting and multiplying, Bitcoin starts with a premise that we already have all the wealth we need to accommodate the whole economy and all of humanity and this wealth is circulated by giving, receiving and sharing with one another directly.

Bitcoin is an offspring of the open source culture of the Internet and distributes a sharing economy that promotes collaboration and innovation. Contrary to mainstream media hype around the Silk Road and the demise of Mt. Gox, the fastest growing use of Bitcoin is actually now in charity and tipping. As a fluid gold of the digital age, Bitcoin is the Internet of money and it flows like no other currency has before. It naturally splits and moves everywhere securely in both small and large increments very cheaply. Its built-in scarcity functions as a reward for early adopters and attracts investors. This helps kick-start a new economics with a living standard more in balance with the Earth. To repeat the wise man’s words, the world has enough for everyone’s need but not for everyone’s greed. Earth is finite, but our willingness to share can create infinite common wealth to feed and put roofs over everyone in the world.

With its new fluid gold standard, Bitcoin reduces the tendency for wealth creation without work, which was listed as one of Gandhi’s seven deadly sins. This is because decentralized money makes things like rent seeking, private control and extractive economic activities much more difficult. Also, contrary to bitcoin critics’ argument that its deflationary design incentivizes hoarding, Bitcoin actually discourages extreme wealth accumulation, as the only way for it to gain value is through wider adoption, division and sharing. Furthermore, hoarding is just another word for saving. It cultivates an instinct in people to not to buy things that they don’t need and each person can take a more active role in regulating greed and unnecessary consumption.

New Era of the Global Commons

As currency wars and financial crises continue toward an inevitable end game, the invention of the blockchain heralds a new era of global commons. It can bring a departure from the old world of empire and create a new state of peaceful co-existence, regarding everyone as equal peers, where special interests of single groups, nations or corporations are no longer held out as superior and given the right to control or exclude others from access to world finances.

The blockchain belongs to mankind as a common-wealth ledger that can benefit all. With this public asset ledger, a new form of organizing society becomes possible. Entry into the network is voluntary and open to anyone who is willing to abide by the set of mathematical rules, regardless of nationality, race, gender and credit history. This distributed time-stamped ledger can strike onerous debt. Our willingness to account for past colonization can bring retribution through innovation. The late Hal Finney, who was considered to be one of the earliest bitcoin pioneers once urged early adopters to put their “unearned wealth to good use.” Balance of power can be brought by including those unbanked and underbanked who have been impoverished for so long through this extraction-based economy.

The invention of Bitcoin coincides with peak oil and the beginning of the end of industrial civilization. Blockchain distributed consensus can challenge the elite corporate and crony consensus that is backed by lobbyists and war financiers of oil and nuclear industries, who are currently dictating energy and monetary policy around the world. Bitcoin as a technology of the information age can help decentralize energy by harnessing the power of globally spread supercomputers that are the heart of Bitcoin network with the abundant sun through naturally decentralized solar power. Bits of sunshine rays can redeem abstract digital numbers, restoring our intrinsic connection to nature.

This new gold of the sun can link money back to peer-to-peer social relations based on our kinship as members of humanity. It can facilitate transaction as a cultural practice of reciprocal altruism to awaken our indebtedness to one another and cultivate shared responsibility for the human species who owe so much to the Earth.

The lifting of control over the global ledger puts the power of consensus into the hands of ordinary people. In this time of climate change and endless resource wars, survival of the fittest has reached the point of threatening the survival of the planet. We are now faced with a time of decision in human history; a choice between paths of destruction led by the oligarchic 1% or an evolution of the species. Do we want to stagnate the Earth’s wealth in the hands of the few or make it flow for all as our common wealth? The invention of the blockchain calls for our radical imagination that can meet challenges with courage and bring creative solutions to the problems of our time.

Bitcoin concept photo by Cybrbeast.

[image error]

December 15, 2014

Bitcoin Is To Credit Cards What The Internet Was To The Fax Machine: So Much More

Civil Liberties: Many are still seeing bitcoin as just a currency, as just a transaction mechanism. Its underlying technology is far more than that. It has the ability to reduce governments to spectators rather than arbiters, the power to make wars cost-inefficient, and the power to decentralize power itself.

The past three weeks have carried a bitcoin special on Liberties Report, starting out with examining the bitcoin currency itself, moving on to looking at the power of the underlying blockchain technology, and finally discussing how much power in society rests with controlling the ledger and the implications of disrupting that.

Parts one, two, and three –

Transcripts:

Part One

Good evening, and welcome to Liberties Report week 47. Tonight’s a bitcoin special, the first of three parts, where we’ll go over why most people are focusing on the wrong thing with regards to the nascent cryptocurrency.

Most people, when they discuss bitcoin, appear to discuss its exchange rate. And sure – it has been an excellent investment, increasing its value by five orders of magnitude since 2009. Whatever amount you put in then, now has five more zeroes after it. There are few – if any – investments that can match.

And yet, bitcoin’s relevance as an investment pales for its relevance in every other aspect. The exchange rate frankly doesn’t matter. Not any more than its ability to provide enough value to the people who want to use its value.

What matters is that one person or a group of people using a Japanese-sounding name solved a very hard problem in 2008 that made it unnecessary to have a trusted party – like a bank – to keep track of the economy. Instead, the economy could be a group knowledge, the same way a language works – a phenomenon where nobody and everybody is responsible for maintaining the group knowledge of its changing nature.

So they built a bank that had no central point of control, but where everybody was aware of all the accounts all the time instead – just like everybody speaking a language share the knowledge of the words and their meanings.

I did my first bitcoin transaction early 2011. It was: – on a Sunday, – value of cup of coffee, – to a friend on the other side of the planet, – instant, – no fees, – nobody able to track, prevent, seize, – no blockades applied, – did not log on to a bank; did not identify at all.

When you use bitcoin for the first time like this, that’s when the penny really drops. You feel like you’ve just jumped 40 years into the future.

When you do this, you realize that the notion of a distributed economy is going to just dropkick today’s financial sector and banking as a concept. Bitcoin is going to do to banks what email did to the postal services.

And in such a system, just like you can’t point a gun at somebody and have them change the meaning of a word in a language, you can’t point a gun at somebody and have them change what or how much somebody owns – and that’s entirely regardless of whether that gun is legal or illegal.

Yes, that means law enforcement can no longer seize money. Nor prevent transactions. Nor apply any kind of blockade on the national or individual level.

Some people in law enforcement have complained to me that our elected representatives are unable to make laws that regulate such an economic system. I counter with the observation that a parliament is equally unable to legislate about a language, and yet, a language is arguably very democratic. How could it be seen as undemocratic if the state of the economy shifts from one form – the commandable – to another – the state of a language, the shared group knowledge?