Tyler Cowen's Blog, page 59

January 13, 2015

Austrian business cycle theory continues to make a comeback

Just read the abstract from the latest NBER working paper by Òscar Jordà, Moritz HP. Schularick, and Alan M. Taylor:

Is there a link between loose monetary conditions, credit growth, house price booms, and financial instability? This paper analyzes the role of interest rates and credit in driving house price booms and busts with data spanning 140 years of modern economic history in the advanced economies. We exploit the implications of the macroeconomic policy trilemma to identify exogenous variation in monetary conditions: countries with fixed exchange regimes often see fluctuations in short-term interest rates unrelated to home economic conditions. We use novel instrumental variable local projection methods to demonstrate that loose monetary conditions lead to booms in real estate lending and house prices bubbles; these, in turn, materially heighten the risk of financial crises. Both effects have become stronger in the postwar era.

The piece is called “Betting the House,” and you will find some non-gated copies here. And to my Austrian-oriented readers, please don’t let this evidence push you away from more synthetic accounts of what is going on…

Here is FTAlphaville coverage of the paper. And here is an interesting paper on interest rates and equity extraction.

Scott Sumner’s new career

…involves working with me! Here is Scott:

I have spent the past 6 years trying to do two jobs at once, my teaching job at Bentley and lots of blogging/writing/speaking on monetary reform. I am pleased to announce that from now on I’ll be able to focus on monetary policy. Through a very generous donation of Kenneth Duda (a Silicon Valley entrepreneur who is supportive of market monetarism), the Mercatus Center has created a new program on monetary policy, and appointed me as director. I’m sure people will have some questions about this, so let me provide a bit more detail.

A few months back I began raising money to set up a NGDP futures market. At the time, Ken Duda offered to support the project with a large donation. He also expressed an interest in supporting my NGDP targeting in any way he could. Initially he suggested setting up a foundation to promote monetary reform, and having me direct the foundation. I thought it might make more sense to work within an institution such as a university or a think tank, where I could get managerial support. We eventually decided to embed the project within the Mercatus Center.

There is more at the link. Of course at George Mason and Mercatus we are all very excited about this.

Assorted links

1. Long interview with Janos Kornai (pdf).

2. New ways your car will monitor you. And how well can computers judge your personality?

3. Kurosawa’s favorite movies. A good list.

4. Barbaric Icelandic markets in everything.

5. Profile of Jerry Brito and Coin Center.

6. Scroll down for research on France and Muslims.

The Effect of Police Body Cameras

The first randomized controlled trial of police body cameras shows that cameras sharply reduce the use of force by police and the number of citizen complaints.

We conducted a randomized controlled trial, where nearly 1,000 officer shifts were randomized

over a 12-month period to treatment and control conditions. During ‘‘treatment shifts’’

officers were required to wear and use body-worn-cameras when interacting with members

of the public, while during ‘‘control shifts’’ officers were instructed not to carry or use the

devices in any way. We observed the number of complaints, incidents of use-of-force, and

the number of contacts between police officers and the public, in the years and months

preceding the trial (in order to establish a baseline) and during the 12 months of the

experiment.

The results were that police use of force reports halved on shifts when police wore cameras. In addition, the use of force during the entire treatment period (on shifts both using and not using cameras) was about half the rate as during pre-treatment periods. In other words, the camera wearing shifts appear to have caused police to change their behavior on all shifts in a way that reduced the use of force. A treatment that bleeds over to the control group is bad for experimental design but suggests that the effect was powerful in changing the norms of interaction. (By the way, the authors say that they can’t be certain whether the cameras primarily influenced the police or the citizens but the fact that the effect occurred even on non-camera shifts suggests that the effect is primarily driven by police behavior since the citizens would not have been particularly aware of the experiment, especially as there would have been relatively few repeat interactions for citizens.)

It is possible that the police shaded their reports down during the treatment period but complaints by citizens also fell dramatically during the treatment period from about 25-50 per year to just 3 per year.

Here’s a graph of use of force reports before and during the treatment period.

Police cameras will have some negative effects. When a police officer is accused of something will lawyers have the right to subpoena years of camera footage looking for anything problematic? Think about the OJ case. Perhaps tape should be erased after one year.

Nevertheless, the results of the study are impressive. More generally, I worry that there is no solution to the problem of government mass surveillance but at the very least we can turn the cameras around and even the playing field.

January 12, 2015

Poker markets in everything

All-In Kitchen, which will be opening in Haggerston, London, will see diners’ success at the poker table determine how much they pay for their meal.

There is more here, via Mark Thorson. And here are some Chinese cars with guppy tanks.

Can the inflationary erosion of G lead to austerity?

In response to my earlier post, Kevin Drum attempts to identify the problem of austerity by graphing real, per capita government spending in the United States. But choosing real government spending can be a misleading way of measuring the contribution of fiscal policy to aggregate demand. (The per capita decision also can be partially disputed on the grounds that government is producing some national public goods.)

Real cuts in government spending, when due to inflationary erosion of G, will not in general be identifying a problem of aggregate demand. And aggregate demand is what we are considering here, not potential problems with supply provision (e.g., how many children are getting vaccines?), which are well identified by looking at the real variables.

Take two societies, each with flat nominal government spending. One society has price inflation of five percent, the other ten percent. In the latter case real government spending is falling by ten percent, a bigger decline than for the first society. But can we properly conclude that the second society will be having a bigger problem of aggregate demand? No, the price level is going up ten percent! The erosion itself is being caused by higher nominal demand.

If real government spending is declining because of price inflation, that fact, taken alone, is unlikely to be associated with an aggregate demand problem. After all, we are not talking about inflation induced by oil price hikes. We are talking about inflation pushed along by…demand.

One of the trickiest problems in economics is knowing when the “real” variable can be a misleading metric.

More generally, consider this Marcus Nunes post: “For the whole period depicted in the chart the correlation between real output growth and real G growth is significantly NEGATIVE!” That is of course in part the result of an identification problem (fiscal policy often becomes more active in bad times), but look at the last few years of the chart only. What you will see is a murky story that, no matter what machinations and Ptomelaic epicycles you may get from some of the more polemic Keynesians, is not well illuminated by Keynesian economics in the traditional sense.

Here are some other chart comparisons.

It is fine to say it is murky. It is murky. Murky, murky, murky. But from that we should not conclude that fiscal policy is extremely effective, as it probably is not in most cases. That is part of what murky implies.

Here is Scott Sumner with questions for Keynesians, all of them on the mark, read the whole thing.

NB: If you read this post as arguing “there was no aggregate demand problem in years ????”, go to community college!

Or if you read this post as saying “Cowen thinks nominal government spending is the correct measure of austerity…and that is wrong…”, well, go back to high school! There is no “correct measure,” it depends on the question you are asking and even then more than one measure may be relevant.

Kevin Drum on Charter Schools

Kevin Drum reports two factlets.

Kevin Drum reports two factlets.

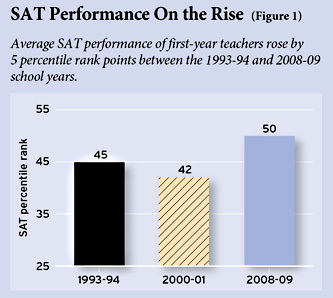

First: Neerav Kingsland says that SAT scores of new teachers are rising and that most of them are staying in teaching for at least five years. He comments: “If I was going to bet on whether American education will improver, flatline, or get worse — I would look very hard at the academic performance of teachers entering the profession, as well as how long these better qualified teachers stayed in the classroom. The aforementioned data makes me more bullish on American education.”

Second: Adam Ozimek says we’re selling charter schools short when we say that on average they do about as well as public schools. That’s true, but there’s more to it:

I would like to propose a better conventional wisdom: “some charter schools appear to do very well, and on average charters do better at educating poor students and black students”. If the same evidence existed for some policy other than charter schools, I believe this would be the conventional wisdom.

….The charter sectors’ ability to do better for poor students and black students is important given that they disproportionately serve them….53% of charter students are in poverty compared 48% for public schools. Charters also serve more minority students than public schools: charters are 29% black, while public schools are 16%. So not only do they serve more poor students and black students, but for this group they relatively consistently outperform public schools.

How much do subsidies to community college attendance matter?

That is a new NBER Working Paper by Angrist, Autor, Hudson, and Pallais. Here is the sentence of interest for the recent community college initiative:

Awards offered to prospective community college students had little effect on college enrollment or the type of college attended.

Do note that some other kinds of awards appeared to be more effective, so this is not an anti-subsidy result per se. And here is a new Bulman and Hoxby paper on federal tax credits and the demand for higher education (not just community colleges):

We assess several explanations why the credits appear to have negligible causal effects.

Making these programs work is not so easy. Reihan Salam offers good points, so does Arnold Kling.

What is the rate of return on community college?

Here is a 2010 research paper (pdf) by Schenk and Matsuyama, and here is one sentence from the abstract:

Our results show returns are six percent for those completing a community college degree.

Other work shows that fewer than forty percent of those who start will finish with a degree-based reward and that number may be lower yet for the marginals who are not currently enrolled. Of course those who do not complete will waste some time and money along the way, although the learning may raise their productivity somewhat.

The overall return on additional subsidies to community college participation is therefore…?

The initial pointer is from @herdingbats.

Assorted links

1. Book preview for 2015. Good stuff, including volume four of Knausgaard, a new Stephenson, a new Gaiman, a new Ishiguro, a Philip Glass memoir, perhaps the Niall Ferguson book on Kissinger will be interesting too. Here is another preview list. And who was nominated for a literary Nobel Prize in 1964.

2. The pick-up culture that is Chinese.

3. Another (right-wing?) view on why the leading public intellectual economists are left-wing. And more from Krugman.

4. Voodoo and Haitian mental health. And the culture that is Singapore.

5. Sri Lanka’s surprise (positive) political transition.

6. Summers responds to Andreessen on secular stagnation.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers