Tyler Cowen's Blog, page 581

December 17, 2011

The quality gradient

"In assassinations, there are gradations of respect," said Gladki. "The lowest is strangling. If you strangle someone, it is a sign of severe disrespect." Using a pistol, he said, is "50/50" – kind of an OK, but not brilliant way to be killed. "And then there is the Kalashnikov. To be shot by a Kalashnikov assault rifle is the ultimate form of respect. It is a very good death for a Russian."

From the same FT article, "Who Runs Russia?", don't forget this:

Indeed, the basic functions of organised crime – protection rackets, narcotics, extortion and prostitution, have increasingly been assumed by the Russian state.

Assorted links

1. How Neanderthal how are you?

2. How much do top chess players earn?

3. How the "Sarko trade" is bailing out Spain, and Interfluidity on same general topic.

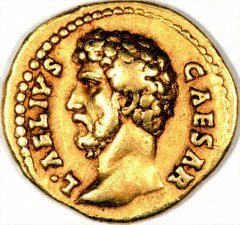

Roman Empire More Equal than the United States

In The Size of the Economy and the Distribution of Income in the Roman Empire, a careful paper published in the Journal of Roman Studies in 2009, Walter Scheidel and Steven Friesen estimate the size and distribution of the Roman economy at its demographic peak around the middle of the 2nd century c.e.

We conclude that in the Roman Empire as a whole, a 'middling' sector of somewhere around 6 to 12 per cent

of the population, defined by a real income of between 2.4 and 10 times 'bare bones'

subsistence or 1 to 4 times 'respectable' consumption levels, would have occupied a fairly

narrow middle ground between an élite segment of perhaps 1.5 per cent of the population and a vast majority close to subsistence level of around 90 per cent. In this system, some 1.5 per cent of households controlled 15 to 25 per cent of total income, while close to

10 per cent took in another 15 to 25 per cent, leaving not much more than half of all income for all remaining households.

Thus, in Rome the top 1.5% controlled 15-25% of income while in the United States around 2007 the top 1% controlled 23.5% of income thus suggesting slightly more inequality in the United States. Scheidel and Friesen calculate a Roman Empire gini coefficient of .42-.44 again perhaps slightly less than the U.S. coefficient of around .4-.45 depending on source.

Interestingly, the Roman State did not manage to collect that much:

Given a GDP of somewhere

around HS17–19bn, annual state expenditure of approximately HS900m would have

represented an effective tax rate of approximately 5 per cent of GDP, which is the same as

for France in 1700. This finding confirms Hopkins's claim that the imperial government

did not capture more than 5 to 7 per cent of GDP and that Roman taxes were fairly low.

The overall public sector share of GDP was somewhat larger depending on the scale of

municipal spending, while the overall nominal tax rate had to be higher still in order to

accommodate taxpayer non-compliance, tax amnesties, and rent-seeking behaviour by

tax-collectors and other intermediaries. Moreover, we must not forget that Italy's immunity from output and poll taxes required the public sector share in the provinces to exceed

the empire-wide average. These various adjustments allow us to reconcile our GDP estimate with reported nominal taxes of around 10 per cent of farm output on private land

reported in Roman Egypt and somewhat higher rates in less developed regions where

enforcement may have been more difficult.

(Thus, despite the aqueducts Rome may not have done that much for the people after all.)

Hat tip to Tim De Chant at Per Square Mile who has further discussion.

Is there a Peltzman effect from AIDS treatment in Africa?

Somewhat, it seems. Plamen Nikolov, a job candidate from Harvard, reports (pdf):

AIDS treatment provides enormous mortality benets to infected individuals but because it immunologically insulates people from more risk-taking, it could, in theory, stir perverse behavioral responses. Therefore, the response of sexual behavior to AIDS treatment in Africa is an important input to predicting the path of the epidemic. Existing estimates from observational studies suggest limited behavioral response, but they fail to take into account possible differences across individuals seeking treatment. Using an encouragement design field experiment conducted in South Africa, I estimate behavioral responses subsequent to AIDS treatment. I find moderate negative responses to treatment for HIV + individuals and mixed results for HIV

The economy that is Singapore, disloyalty cards

Coffee shops around the world have employed loyalty card schemes for many years, but now we've come across an interesting twist on the idea. In Singapore, a collaborate scheme aims to benefit eight of the city's best independent cafés with the Be Disloyal disloyalty card.

The Be Disloyal disloyalty card — created by digital creative agency Antics, blogger Cortadito.sg and eight of Singapore's independent coffee shops — was designed to encourage consumers to discover different coffee venues while bringing businesses together to grow as a vertical. From September until the end of this month customers can pick up a disloyalty card from one of the eight participating cafés. The card is stamped each time they purchase a coffee from one of the other seven cafés and, once the card is full, they return to the original café to receive their free coffee.

Competing with large chain brands can be difficult for small businesses, but teaming up with similar smaller companies can create stronger competition. Inspiration here for independent businesses in any industry!

The link is here and for the pointer I thank @amelapay, and more from her here.

December 16, 2011

The ongoing development of the Austro-Chinese business cycle

That's not the only title I could have given this post, here goes:

Beijing's suburban Miyun County is going to build a large European-style town within five years and no one will be allowed to speak Chinese there, said the county mayor.

Wang Haichen said a local village would be turned into a 67-hectare English castle with 16 courtyards of unique houses. It will offer visitors souvenir passports and ban Chinese speaking to create the illusion of being abroad, Beijing News reported today.

So far 4.5 million yuan (US$708,300) has been invested to transform 16 peasant courtyards in Caijiawa Village into English-style dwellings. Wang told the newspaper that each of the 16 peasant households had received 30,000 yuan of government subsidy.

The county mayor insisted that one courtyard had been turned into a boutique hotel. "We built a laundry center to supply clean bed linens to the 16 households free of charge," Wang said. "We are considering to offer them bicycles and electric bikes next year."

The article is here, and for the pointer I thank M Kaan. I predict it will end badly!

Flushing bleg

Where should we eat in Flushing, Queens, Sunday morning? Hsieh hsieh!

Harvard fact of the day

In 2010, 31 percent of the graduating (undergraduate) class reported taking a job in financial services, source here, pointer from Dylan Matthews.

Assorted links

1. A theory of flattery inflation.

3. "Sheep can do better," and dolphin-whale cooperation, and taxi auction markets in everything.

4. Long article on on-line, for-profit education; how much of it is arbitraging public school dollars?

5. There is no great stagnation (with music).

6. A survey of the Target2 debate and its importance.

It is finally being recognized that the eurozone made a major policy breakthrough

Yields on short-term peripheral sovereign bonds are plunging, despite the fact that EU leaders appeared to make little progress at their highly-anticipated summit last week.

Pundits continue to expound on the flaws of the eurozone but markets are telling a different tale.

That's because the European Central Bank may have already introduced roundabout measures that will solve some of Europe's big problems—it's making investing in peripheral sovereign debt a huge profit opportunity for banks.

Theoretically, financial institutions will be able coin money by borrowing ultra-cheap from the ECB and buying higher yielding sovereign debt.

Here is the story, and you will recall my earlier post here. Karl Smith asks how this fits in with the treatment of collateral, and here is also a more skeptical take on the arbitrage. My view is not that banks will find the arbitrage opportunity overwhelming (that is unclear), rather my view is that public choice mechanisms will operate so that desperate governments commandeer their banks to make this move, whether the banks ideally would wish to or not. Make no mistake about it, this is doubling down and raising the stakes. It's funding debt through more debt. It's wrong to say the summit accomplished nothing, or consisted merely of empty, unenforceable pledges of austerity, although it did that too.

At this point you have to be asking whether it is better to simply end the eurozone now, no matter how painful that may be. Unless of course you are an optimist about Italy reaching two percent growth, or Germany becoming fully cosmopolitan. As a politician I probably could not bring myself to pull the plug, but as a blogger I wonder if that might not, at this point, be the wiser thing to do. Current crisis aside, does anyone out there see the euro's governance structure — even with reforms — as even vaguely workable?

Addendum: Do note also that the ECB has made no strong promise to continue this program, and indeed it is not in a position to make a credible commitment, most of all on the quality of collateral issue. That means a lot of ups and downs, shifting credibility, and the gains could well collapse quickly.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers