Tyler Cowen's Blog, page 556

February 1, 2012

Assorted links

1. Is the Volcker Rule simply a bad idea?

2. The blog of Simon Wren-Lewis.

3. The price-quality gradient for hamburgers.

4. Profile of Jonathan Haidt, one of the titans.

5. Robert Trivers (another one of the titans) has a blog post.

6. Good Kaufmann poll of what economics bloggers think (pdf).

Why is the quality of American governance so low?

Frank Fukuyama writes:

Conversely, I would argue that the quality of governance in the US tends to be low precisely because of a continuing tradition of Jacksonian populism. Americans with their democratic roots generally do not trust elite bureaucrats to the extent that the French, Germans, British, or Japanese have in years past. This distrust leads to micromanagement by Congress through proliferating rules and complex, self-contradictory legislative mandates which make poor quality governance a self-fulfilling prophecy. The US is thus caught in a low-level equilibrium trap, in which a hobbled bureaucracy validates everyone's view that the government can't do anything competently. The origins of this, as Martin Shefter pointed out many years ago, is due to the fact that democracy preceded bureaucratic consolidation in contrast to European democracies that arose out of aristocratic regimes.

The post is interesting throughout.

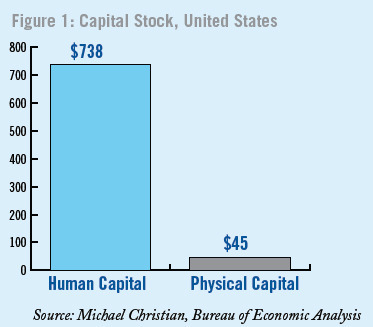

Human Capital

Nick Schulz has an interesting introduction to recent work on immigration and human capital that includes this figure:

The human capital stock is probably over-estimated since it imputes the value of non-market time at market wages but even counting non-market time at zero (not correct either) would give a human capital stock of $212 trillion, about 5 times the physical capital stock. Thinking about human capital reminds us that debates about immigration and education are debates about investment.

January 31, 2012

Youth unemployment across Europe

Assorted links

1. How they almost gave "Vertigo" a different title.

2. The Dynosphere.

3. Who will write the piece on Mormon Keynesianism?, and Spain does have a public debt problem (in Spanish, by XSiM, full blog here), and A Crisis in Two Narratives (Raghu Rajan).

4. Good R.A. analysis of recent British economic performance.

Non-neutral and wealth effects, once again

Construction makes up less than 5 percent of employment but accounts for more than 40 percent of the large swings in the job-filling rate during and after the Great Recession. Leisure & Hospitality accounts for nearly a quarter of the large drop in recruiting intensity during the Great Recession.

That is from Davis, Faberman, and Haltiwanger, here is more.

In Praise of Private Equity

Excellent piece by Reihan Salam on private equity and how Bain fit into the larger picture of a dynamic economy.

The difficult truth that virtually no politician is prepared to acknowledge is that the road to job creation runs through job destruction.

…Chad Syverson, an economist at the University of Chicago's Booth School of Business, found that what separates top firms from bottom firms is, typically, a large difference in productivity, with the top ones producing almost twice as much with the same measured input. This creates an almost irresistible temptation for investors. If Firm X, languishing at the 10th percentile in terms of productivity, could somehow be overhauled to match the productivity levels achieved by Firm A, at the 90th percentile, the potential for profit would be huge. Note, however, that halving "measured input" in order to double productivity will often mean shedding the weakest performers and giving those who remain the tools they need to do their jobs better and faster. Private equity does exactly this.

What Mitt Romney discovered was that American corporations sometimes had to be dragged, wailing and whining, into a state of efficiency. As a management consultant at Bain & Company, Romney had studied successful firms and then told other firms how to replicate their strategies. But those firms had come of age in the fat years of American corporate dominance, when many believed that the Japanese could do little more than manufacture cheap toys and textiles, and many were reluctant to accept his newfangled advice. It eventually became clear that if Romney and his cohort were going to remake American business, they'd have to raise money to make their own investments. Spurred by the senior partners at Bain & Company, Romney and his merry band of consultants established Bain Capital.

I wish Romney were as eloquent in his defense as is Salam.

A simple theory of why so many smart young people go into finance, law, and consulting

The age structure of achievement is being ratcheted upward, due to specialization and the growth of knowledge. Mathematicians used to prove theorems at age 20, now it happens at age 30, because there is so much to learn along the way. If you are a smart 22-year-old, just out of Harvard, you probably cannot walk into a widget factory and quickly design a better machine. (Note that in "immature" economic sectors, such as social networks circa 2006, young people can and do make immediate significant contributions and indeed they dominated the sector.) Yet you and your parents expect you to earn a high income — now — and to affiliate with other smart, highly educated people, maybe even marry one of them. It won't work to move to Dayton and spend four years studying widget machines.

You will seek out jobs which reward a high "G factor," or high general intelligence. That means finance, law, and consulting. You are productive fairly quickly, you make good contacts with other smart people, and you can demonstrate that you are smart, for future employment prospects.

The rest of the world is increasingly specialized, so the returns to your general intelligence, as a complementary factor, are growing too, in spite of your lack of widget knowledge. "Hey you, think about what you are doing! Are you sure? How about this?" often sounds bogus to outsiders but every now and then it pays off and generates a high expected marginal product.

Both supply and demand sustain this Smithian equilibrium.

There are other factors of relevance, as explained over a very good session last night; the people there comprised about half of my Twitter feed.

David Brooks on the new Charles Murray book

Roughly 7 percent of the white kids in the upper tribe are born out of wedlock, compared with roughly 45 percent of the kids in the lower tribe. In the upper tribe, nearly every man aged 30 to 49 is in the labor force. In the lower tribe, men in their prime working ages have been steadily dropping out of the labor force, in good times and bad.

People in the lower tribe are much less likely to get married, less likely to go to church, less likely to be active in their communities, more likely to watch TV excessively, more likely to be obese…

It's wrong to describe an America in which the salt of the earth common people are preyed upon by this or that nefarious elite. It's wrong to tell the familiar underdog morality tale in which the problems of the masses are caused by the elites.

The truth is, members of the upper tribe have made themselves phenomenally productive. They may mimic bohemian manners, but they have returned to 1950s traditionalist values and practices. They have low divorce rates, arduous work ethics and strict codes to regulate their kids.

Members of the lower tribe work hard and dream big, but are more removed from traditional bourgeois norms. They live in disorganized, postmodern neighborhoods in which it is much harder to be self-disciplined and productive.

Remember when "rage" used to mean "Radical Alternatives to Government Enterprise"? Murray's book will bring rage of a different kind, because it strikes rather directly at how political views are based on emotional feelings about the deserved status of various social groups (RH: "Politics isn't about policy.") Here is more. If you are wondering, my copy of the book arrives today. Perhaps my review will consider whether economic forces are driving the social ones, or vice versa.

Sherlock Holmes v. Sherlock

Sherlock Holmes: A Game of Shadows is ok so long as you are expecting a comic book adventure along the lines of Captain America or Iron Man (natch) and not a detective-mystery ala Sherlock Holmes. A smart character requires smart writers and in this movie the producers saved the money for special effects.

In contrast, the British TV series Sherlock is a must see. Sherlock reboots Holmes into our world. Yet despite advancing in time some 130 years when Sherlock first meets Watson he says, exactly as in the original, "You have been in Afghanistan, I perceive." A shiver ran down my spine.

Sherlock is fast-paced but clever. It's written by two Doctor Who vets who invest Holmes with wit, originality and intellect, rather than the quasi-magical powers found in the aforementioned movie. The chemistry between Holmes and Watson is clear – one understands in this version what is lacking in many others, these two need each other.

The first season has only 3, 90 minute, episodes but a second season just ran in Britain and I expect it will soon be available in the U.S.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers