Tyler Cowen's Blog, page 541

February 28, 2012

How good are the upper classes?

Seven studies using experimental and naturalistic methods reveal that upper-class individuals behave more unethically than lower-class individuals. In studies 1 and 2, upper-class individuals were more likely to break the law while driving, relative to lower-class individuals. In follow-up laboratory studies, upper-class individuals were more likely to exhibit unethical decision-making tendencies (study 3), take valued goods from others (study 4), lie in a negotiation (study 5), cheat to increase their chances of winning a prize (study 6), and endorse unethical behavior at work (study 7) than were lower-class individuals. Mediator and moderator data demonstrated that upper-class individuals' unethical tendencies are accounted for, in part, by their more favorable attitudes toward greed.

That is an abstract from Paul K. Piff, Daniel M. Stancato, Stephane Coté, Rodolfo Mendoza-Denton, and Dacher Keltner. There is a gated version of the paper here, a Wired summary here. Dozens of other sources covered the paper on-line but virtually all fell afoul of mood affiliation (something is wrong with the wealthy and here is a chance to disapprove of them), and a very large number made the subtle shift from "upper class" to "wealthy," which of course is not the same.

We need to be cautious in our interpretation of these results. Of the seven tests, two of them showed that people driving more expensive cars are more in a hurry and more likely to cut off others or not yield. That's not praiseworthy, but hardly a major moral condemnation. Several of the tests involved people being asked to imagine they were high class, not actual "high class" people themselves. To that extent we are testing the lower class view of the upper classes, noting that I would not use those terms as given. One of the tests showed that social class did not matter once we adjust for a person's attitude toward greed. A positive attitude toward greed is positively correlated with social class, but it was also easy enough to "prime" the lower class individuals to feel the same way, suggesting that extreme context dependence will hold here.

Let's view these results in light of the literature as a whole (I haven't seen any journalistic source do this). Very often in studies the highest trust, lowest corruption societies in the world are the relatively wealthy Nordic countries, not poor countries. There is plenty of evidence that it is low and falling incomes — not wealth — which helped to explain voter support for fascism. Consumers are eager to buy products from companies such as Apple, and they regard the wealth of the shareholders, and the high profit margins, as a sign they will get a high quality product, not a reason to fear a rip-off. (Can you think of many cases where consumers deliberately seek out lower-class suppliers to minimize the chance of rip-off?) The work of Garett Jones shows that high IQ predicts greater cooperativeness.

That all said, allow me to speculate. If I were playing bridge, and my opponents were wealthy, I really would expect them to cheat more, say with regard to the exchange of illegal cues between partners. For one thing cheating requires some smarts and for another it requires some confidence that it can lead to victory. I expect Vlade Divac to flop more to draw a foul, or expect Kobe Bryant to work harder to manipulate a referee, than I would expect from a lower-status rookie player.

One simple hypothesis — which for now I will take as the default, when you sum up all the evidence — is that high-status people cheat more at games and less at many other activities, including those of real life. (They are also in more of a hurry on the road.) That's very different than how this paper is being reported, and it's also a much more interesting hypothesis.

Addendum: Kevin Drum comments.

Assorted Links

1. Google's Policy by the Numbers blog features my post on The Innovation Nation versus the Warfare-Welfare State (no new info for loyal readers but an interesting signal.) Buy Launching.

2. Atheist leaders of the civil rights movement.

3. Federal Reserve Bank of Richmond's Region Focus with introductory material on patents. early childhood education, and NGDP targeting.

4. Google's bug bounty program.

5. An Illustrated Guide to Criminal Law: Attempt. Excellent.

6. Ron Paul, rock star.

Assorted links

1. Has there been a financial incentives bubble? A short essay by Mihir Desai.

2. Paul Krugman has a forthcoming book, and the optimal sequencing of reform, with regard to Star Wars.

3. The nationalist argument for more immigration.

4. New report on the Milwaukee voucher experience (pdf).

5. The culture that is Nordic (nice picture of single women, safe for work).

Disaggregating the investment drought

You can click twice to see this Excel file on investment.

That is from Spencer England of Spencer England's Equity Review. He writes to me:

I think a major reason for the difference between net and gross investment is the growing share of Info Tech (IT) in business fixed investment. IT now accounts for over half of real business investment. But IT has a much shorter life span than traditional business equipment or investment in structures.

It is like going up a down escalator –you have to run harder just to stay even.

Here is a previous post on the investment drought, with another good picture. Karl Smith offers some related remarks, though I do not focus on transportation as he does, rather given his framing I would put more emphasis on our inability to replace industrialization with something comparably important.

New results on the economics of discrimination

There is a new and excellent paper by Uri Gneezy, John List, and Michael K. Price (gated version here, $5 charge for non-university readers), here is one good excerpt:

…in the automobile repair market, we find that the disabled receive offers that are 30 percent higher than the offers received by the abled. One possible reason for this disparate treatment is search cost differences — one would expect search to be more costly for the disabled. Under this scenario, such agents might search less and repairmen might capitalize on that fact. To test this conjecture, and identify the underlying nature of discrimination, we employ a complementary field experiment where during the offer process all agents note that "I am getting a few price quotes." Upon having our agents make this simple statement, we find that offer distributions become isomorphic.

The paper has much more of interest.

February 27, 2012

Assorted links

1. John Romano reviews Niall Ferguson.

2. How bad are things in Portugal?

3. Erland Josephson passes away.

4. Bolivia's wheelchair riots.

5. What happens to fancy dining in the suburbs?

An anecdote of Athens

A friend and I met up at a new bookstore and café in the centre of town, which has only been open for a month. The establishment is in the center of an area filled with bars, and the owner decided the neighborhood could use a place for people to convene and talk without having to drink alcohol and listen to loud music. After we sat down, we asked the waitress for a coffee. She thanked us for our order and immediately turned and walked out the front door. My friend explained that the owner of the bookstore/café couldn't get a license to provide coffee. She had tried to just buy a coffee machine and give the coffee away for free, thinking that lingering patrons would boost book sales. However, giving away coffee was illegal as well. Instead, the owner had to strike a deal with a bar across the street, whereby they make the coffee and the waitress spends all day shuttling between the bar and the bookstore/café. My friend also explained to me that books could not be purchased at the bookstore, as it was after 18h and it is illegal to sell books in Greece beyond that hour. I was in a bookstore/café that could neither sell books nor make coffee.

From @economistmeg, here is more, none of it especially encouraging. She is, by the way, one of the very best people to follow on Greece and the eurozone.

Excess Reserves and Intraday Credit

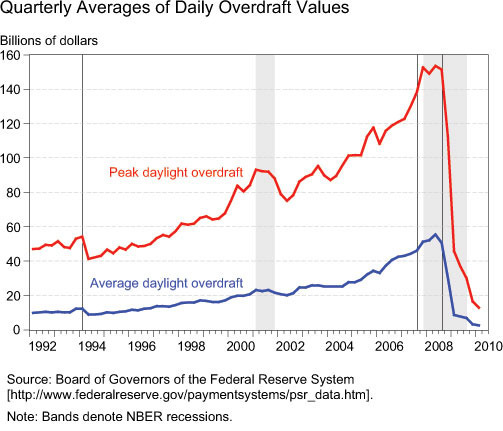

In my 2008 post, Interpreting the Monetary Base Under the New Monetary Regime, I argued that the massive increase in bank reserves was neither a necessary harbinger of inflation (as people on the right feared) nor a sure sign of a liquidity trap (as people on the left claimed) but rather represented, at least in part, a sensible aspect of the new regime of paying interest on reserves. I wrote:

When no interest was paid on reserves banks tried to hold as few as possible. But during the day the banks needed reserves – of which there were only $40 billion or so – to fund trillions of dollars worth of intraday payments. As a result, there was typically a daily shortage of reserves which the Fed made up for by extending hundreds of billions of dollars worth of daylight credit. Thus, in essence, the banks used to inhale credit during the day – puffing up like a bullfrog – only to exhale at night. (But note that our stats on the monetary base only measured the bullfrog at night.)

Today, the banks are no longer in bullfrog mode. The Fed is paying interest on reserves and they are paying at a rate which is high enough so that the banks have plenty of reserves on hand during the day and they keep those reserves at night. Thus, all that has really happened – as far as the monetary base statistic is concerned – is that we have replaced daylight credit with excess reserves held around the clock.

A post today at Liberty Street Economics, the blog of the New York Federal Reserve illustrates and explains how the excess reserves have reduced transaction costs in the payment system and risk to the Federal Reserve.

The last chart shows the level of intraday credit extended by the Federal Reserve to Fedwire participants, measured as the daily maximum amount extended by the Federal Reserve. There has been a dramatic decline in the amount of credit extended since the expansion of reserve balances in October 2008. The reduced level of daylight credit has the benefit of reducing the risk exposure of Federal Reserve Banks, as well as the Federal Deposit Insurance Corporation's (FDIC) fund. Indeed, the expected losses to that fund would be greater if some of the assets of a failed bank had been pledged to a Federal Reserve Bank to collateralize a daylight overdraft, as the collateral would not be available to pay other creditors of the bank. With a greater amount of reserves in the system, banks largely "prepay" for their liquidity needs by maintaining large reserve balances with which to fund their outgoing payments.

Follow Acemoglu and Robinson on Twitter

China fact of the day

The richest 70 members of China's legislature added more to their wealth last year than the combined net worth of all 535 members of the U.S. Congress, the president and his Cabinet, and the nine Supreme Court justices.The net worth of the 70 richest delegates in China's National People's Congress, which opens its annual session on March 5, rose to 565.8 billion yuan ($89.8 billion) in 2011, a gain of $11.5 billion from 2010, according to figures from the Hurun Report, which tracks the country's wealthy. That compares to the $7.5 billion net worth of all 660 top officials in the three branches of the U.S. government.

The wealth gap between legislatures holds with statistically comparable samples. The richest 2 percent of the NPC — 60 people — had an average wealth of $1.44 billion per person. The richest 2 percent of Congress — 11 members — had an average wealth of $323 million.

The wealthiest member of the U.S. Congress is Representative Darrell Issa, the California Republican who had a maximum wealth of $700.9 million in 2010, according to the center. If he were in China's NPC, he would be ranked 40th. Per capita income in China is about one-sixth the U.S. level when adjusted for differences in purchasing power.

That is via Shanghaiist, via @AlbertoNardelli via @AnnieLowrey.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers