Tyler Cowen's Blog, page 485

July 6, 2012

Twitter is slow and stalling, so here goes

Sad how the current outsourcing debate is turning so many progressives into old school economic nationalists.

That’s from me.

The culture that is Germany

Hard to believe, but ultimately not a surprise:

In the United States, many lament that it takes students too long to graduate. In Germany, the School of Economics and Management in Essen is suing Marcel Pohl, for $3,772 that the institution lost in tuition revenue when he finished a bachelor’s degree and a master’s degree in 3 semesters, not the 11 that would have been expected, UPI reported. The university declined to comment. Pohl said, “When I got the lawsuit, I thought it couldn’t be true. Performance is supposed to be worth something.”

The link is here. He went through the course material so quickly by divvying up the lectures with two friends of his, and sharing the resulting notes, thus attending only a fraction of the lectures the school was offering to him. Here is a German language account, consider this gem of a passage:

“Sie sagen, sie bestellen jetzt eine Cola, und haben nur ein halbes Glas und sagen: Dann möchte ich auch nur ein halbes Glas zahlen. Das ist ja auch völlig in Ordnung. So, sie haben aber die ganze Cola nur furchtbar schnell ausgetrunken und sagen: Jetzt möchte ich nur die Hälfte zahlen. Das geht einfach nicht.”

Just imagine if he had had on-line options.

July 5, 2012

From Austan Goolsbee

Of all the public reactions to last Thursday’s surprise ruling from the Supreme Court on the Affordable Care Act, one of the most interesting came from the markets: Nothing happened.

Here is more, “The Supreme Court Rules, Markets Yawn.”

Assorted links

1. One summary of the Libor mess.

2. Williamson responds to Scott Sumner.

3. Cloned horses may now compete internationally.

4. Health care progress in Rwanda.

5. Deaf German blogger reads lips and tweets, but only in two languages (no Danish).

Does Larry Bird hate Adam Smith?

From Christopher Veldman:

I saw this interview with Larry Bird on ESPN yesterday and thought you might find it interesting.

“‘The one thing that bothers me the most is guys taking big pay cuts for a year to go down there and try to win a championship,’ Bird told ESPN. ‘There’s a lot of guys who like to ride the coattails of the best and they’ll take a pay cut just to have an opportunity to win that ring.’”

Joseph Cropsey has passed away at age 92

The Iceland dust-up

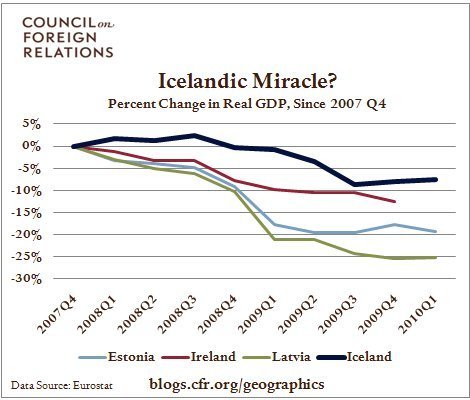

There has been enough coverage that I won’t summarize the entire debate, suffice to say that Krugman offered a picture like this:

Some writers from the CFR (I am not completely sure how to attribute authorship), offered this picture, along with some analysis and links (and further pictures). The key point is that the second picture considers a longer time horizon, and all of a sudden the relative performance of the different countries has changed:

They argue that in this light, looking over the longer time horizon, the Icelandic story appears mediocre rather than impressive relative to some of the other small countries. A few points:

1. Arvind Subramanian argues we should look at per capita growth and also PPP vs. market exchange rates, read here.

2. Arvind’s point aside, that the pictures give different impressions is more important than either picture taken alone.

3. The second picture brings value-added to the debate, and it suggests stories which the first picture taken alone does not. I’ll come back to that.

4. The debates have mixed together a few different questions, such as “how well have the countries done?,” “how well have the countries’ policies done?,” and “should we be looking at both pictures?” Since the answer to the first two is obviously agnostic — too soon to tell — I will focus on the last of these questions and the answer is yes, we definitely should be looking at both pictures.

Krugman’s response, once you get past the inappropriate insults, doesn’t serve up much. He has arguments against the view “Don’t look at the first picture” but no good arguments against “Look at both pictures very carefully and integrate.”

Ryan Avent offers a more polite response here. He focuses on convergence (maybe we should have expected the Baltics to have outperformed Iceland, so a tie means Krugman wins), but this estimate suggests the fixed exchange rate did not really cost the Baltics much in the way of convergence points. In any case I fear the goalposts are being shifted and what we know about convergence and its speed is iffy anyway; for instance anyone worried about bad monetary policy, and opposing 1980s style RBC theories, should be a convergence pessimist for the short run.

Most importantly, there is still no argument against looking at both pictures in a serious way.

So what additional thoughts come to mind looking at the second picture, which you might not get so much from the first picture alone? Here are two:

a. Some countries simply may be more volatile than others, and this may or may not have to do with their policy responses. I’ll note Cowen’s Second Law, namely that there is a literature on this and the people who work in that literature consider this to be a plausible proposition (which does not mean it is here the operative explanation, however).

b. The size of an initial run-up, possibly bubbly at that, is correlated with the size of the later collapse and also the difficulty of recovering from that later large collapse.

There is a literature on that too, start here, it is not an absurd proposition by any means.

By the way, did I mention a 2009 IMF Staff Report which concluded that Latvian “output exceeded potential by 9 percent in 2007.”? That supports the relevance of b) and possibly a) as well, and it discriminates against Krugman’s story of the peak being a point reattainable through policy management.

I take Krugman to be suggesting something like c): all the relevant information for understanding performance is contained in post-bust policy, so we needn’t look at earlier years and in fact doing so may mislead us.

Yet this attempts to pre-settle the dispute by putting all of the explanatory burden on post-crash policy. In general commentators often overattribute results to policies and in any case we should not build in this bias a priori.

Are you a fan of Dani Rodrik’s “every country is different” hypothesis? If so, you probably should think that both graphs are important. Country characteristics don’t morph away overnight, so earlier data points should matter for understanding current policy results.

If we look carefully at both pictures, I say we still don’t know what is going on, but we do have a richer sense of the possibilities.

From now on these two pictures should be shown and considered together.

July 4, 2012

*Your Sister’s Sister*

I found this film to be a minor masterpiece. It incorporates Girard, Shakespeare, how uncertainty eases deals, and some interesting and possibly true claims about two vs. three-person bargaining games. It is a deep and politically incorrect question to ask why the movie does not start with the Coase theorem already working. I cannot reveal its Straussian propositions about “loser men” without spoiling the plot surprises.

Note: the characters in the film do not seem to consume much information.

David Gordon emails me on the workplace

Tyler,

I enjoyed reading your excellent post on the Crooked Timber workplace coercion piece. Many of their complaints also hold for the university classroom, e.g., limits to free speech, students have no say in what work is required, etc.; and often there are costs to refusing to enroll in classes the student finds onerous, such as failing to obtain the desired degree. But I doubt Bertram and his friends would regard this situation as coercive.

Best wishes,

David

Nor is it always easy to switch schools…

Who in power would really be any different?

A new report shows that Hollande faces a tougher budget situation than had been expected (by whom? Not me.). Here is one bit:

“There will be tax increases; there will be spending cuts,” said the finance minister, Pierre Moscovici, last week. “But I reject any talk of austerity. We must avoid a budget policy that hurts economic activity.”

But it is not clear how the government plans to go about that, since both spending cuts and higher taxes tend to depress already lackluster economic activity even further. Nicholas Spiro, who runs a sovereign risk consulting agency in London, said that the report by the auditors “throws the scale of the fiscal challenge facing Mr. Hollande into sharp relief.”

And this:

But thus far the Hollande government has not been specific about any spending cuts, only tax increases. It will not raise the value-added tax on consumption, but says it will repeal an increase in the tax instituted by Mr. Sarkozy. Nor has the government outlined any structural reforms to reduce unemployment, which remains at a record high in the euro zone.

At least they are trying to get people away from using the misleading word “austerity.” But it is funny how they too are finding it necessary to engage in some form of fiscal consolidation.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers