Tyler Cowen's Blog, page 442

October 10, 2012

Assorted links

1. Is economics becoming more mathematical?

2. Can algorithms help explain art and what you like?

4. Caplan reviews the new James Flynn book.

5. The wisdom of slime trails.

6. New update on Honduran charter cities, lots of detail. Or try this link if that one doesn’t work.

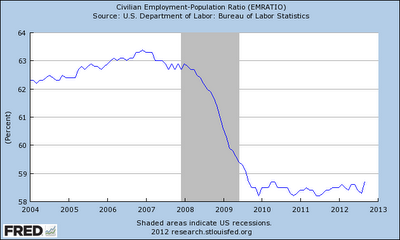

Multiple equilibria?

That’s what I think of when I see that picture.

Trust was broken, most of all in the financial system, but like a wet spill this has soaked into many parts of the economy and polity.

Labor hiring is an investment, and we must move to higher levels of investment for the labor market to recover. For the most part, that is no longer a problem of nominal stickiness, as the quality of jobs has been varying for years, along with some wage adjustments. The nominal wage stickiness fairy was dominant in 2009 but is today just another spirit.

Employers are reluctant to hire stale labor, at any real wage, because they fear the associated morale problems. (Or at the requisite real wage, disability pay or idleness is a more attractive option for the worker.) This is partly fear, partly rational statistical discrimination. Employers will hire stale labor only when an extreme boom requires them to. Such an extreme boom must be seen as grounded in perceived increases in real wealth and justified increases in trust. That probably won’t come anytime soon, but we are inching our way back to it and someday it will come again. Solving the stale labor problem requires a very different path of recovery than solving the nominal wage stickiness problem.

In one very real sense, the economy is well below potential output (though less than many people think, due to the great stagnation). In another very real sense, that gap cannot be exploited in the short run by reflationary policy. Once again, it requires a reestablishment of trust. Trust is more easily broken than repaired.

In one very real sense, there is a significant demand shortfall. Yet repairing that demand shortfall requires many building blocks. Nominal reflation (which I favor) is only one of those building blocks. The others are rooted in trust and perceived real wealth, which are both slower to repair and require different policy instruments, plus the mere passage of time.

Under the multiple equilibria view, it is possible for employment and the real wage to recover together, albeit slowly. Under the nominal stickiness view, median real wages still need to take yet a further whack; oddly it is the Keynesians who are committed to the most extreme form of a TGS thesis.

It is time to integrate macroeconomics with institutional economics.

Imprisonment and infant mortality

Here is a new study by Christopher Wildeman (pdf):

This article estimates the effects of imprisonment on infant mortality using data from the United States, 1990-2003. Results using state-level data show consistent effects of imprisonment rates on infant mortality rates and absolute black-white inequality in infant mortality rates. Estimates suggest that had the American imprisonment rate remained at the 1973 level—the year generally considered the beginning of the prison boom—the 2003 infant mortality rate would have been 7.8% lower, absolute black-white inequality in the infant mortality rate 14.8% lower. Results using micro-level data from the Pregnancy Risk Assessment Monitoring System (PRAMS) show that recent parental incarceration elevates early infant mortality risk, that effects are concentrated in the postneonatal period, and that partner violence moderates these relationships. Importantly, results suggest that recent parental incarceration elevates the risk of early infant death by 29.6% for the average infant in the sample. Taken together, results show that imprisonment may have consequences for population health and inequality in population health and should be considered when assessing variation in health across nations, states, neighborhoods, and individuals.

October 9, 2012

Jodi Ettenberg’s *Food Traveler’s Handbook*

I am a big fan of this book. The Amazon link is here, and the Kindle edition should be coming in less than a week.

What’s the chance of rain?

…the for-profit weather forecasters rarely predict exactly a 50 percent chance of rain, which might seem wishy-washy and indecisive to consumers. Instead, they’ll flip a coin and round up to 60, or down to 40, even though this makes the forecasts both less accurate and less honest.

That is from Nate Silver’s new and excellent The Signal and the Noise: Why So Many Predictions Fail — But Some Don’t. The profile of Robin Hanson appears on p.201.

Assorted links

2. Cheapskates, pessimists, and food trucks, by me, on countercyclical assets.

3. On Spufford’s theology, with a link to chapter one.

4. Rogoff on technological unemployment, and interview with John List.

5. How the word “entitlement” became a negative.

6. IMF reform appears stalled.

Lunch with Tyler in Seoul

Tyler and I are here in Seoul for different conferences but we arranged to meet for lunch in Insadong. I arrived early and found a restaurant which didn’t look at all like it was frequented by tourists. Feeling pleased, I met with Tyler and indicated my suggestion.

“Looks ok,” he said, not sounding enthused.

“But Tyler,” I replied slightly miffed, “look inside, no one is smiling or laughing. It must be good.”

“Excellent point,” he conceded “but come look at this place” and he proceeded to walk behind a row of stores and down a small alleyway pointing to a tiny restaurant, “Do you see the sign?” I read the sign he was pointing to, “No English.”

“Ah,” I replied, “a good signal” and, after looking inside, “and no chairs either.”

Needless to say, the meal was delicious.

What does the cost disease imply about the public sector?

Matt Yglesias has a good post on the recent Steven Pearlstein column. Here is Matt:

…people need to start paying much more attention to questions of tax efficiency. It’s overwhelmingly likely that we’re going to want the public sector to be a larger share of the economy in 10, 20, 30, 40 years than it is today and we need to find relatively growth-friendly ways to make that happen.

Here is Pearlstein:

From a political perspective, Baumol’s most important insight is that government spending must grow as a percentage of the economy. Most of the services that are provided by, or financed by government — health care, education, criminal justice, national security, diplomacy, industry regulation, scientific research — are those that suffer most acutely from Baumol’s disease. That’s not because of incompetence or self-interest on the part of public servants or even the socialist instincts of Democratic politicians — it’s in the nature of those activities.

To demand, as Republicans do, that government be held to some historical average as a percentage of the economy stubbornly ignores this reality. It would condemn the country, as John Kenneth Galbraith once put it, to a future of “private affluence and public squalor.”

Let’s for the purposes of discourse take the cost-disease argument, and this classification of sectors, for granted. I would stress that there are two different ways of measuring the relative size of government in the economy. The first is as expenditure share, say as a fraction of gdp, and that indeed may well go up because of Baumol’s argument (I’ll return to this).

The second question concerns the real value of outputs from government, as measured from the consumer side. If government outputs increasingly cost more to produce, should not a substitution effect kick in and lead us to prefer, at the margin, a higher proportion of productivity enhancement-enjoying private sector outputs? In common parlance, if flat screen TVs become much cheaper, buy more of them.

This implication often receives less stress from cost-disease advocates and you will note that it militates in favor of substituting away from government outputs.

There is a further implication. What goes up on the expenditure side is the share of any given governmental output in gdp. If we substitute out of government outputs enough, the total share of government output, as an expenditure fraction of gdp, could go up or down in an optimum. If the elasticity of demand is sufficiently high, flat screen TVs can become an increasing share of gdp and government social workers a smaller share. Right now for instance internet commerce is a growing share of gdp as measured in terms of expenditures.

In any case, moving away from expenditure shares and back toward output: if government responds optimally, we end up with government as a smaller share of real output over time, yet at higher costs. Surely that is a recipe for cynicism, justified or not.

How much would it matter if we deregulated health insurance across state lines?

Allowing insurance sales across state lines comes up perennially as a way to drive down the cost of health care.

Conservatives argue that allowing a plan from a state with relatively few benefit mandates – say, Wyoming – to sell its package in a mandate-heavy state (like New York) would give consumers access to options that are more affordable than what they get now.

Liberals tend to argue this is a bad idea, contending that it would create a “race to the bottom,” where insurers compete to offer the skimpiest benefit packages.

A new paper from Georgetown University researchers suggests a third possible outcome: Absolutely nothing at all will happen. They looked at the three states – Maine, Georgia and Wyoming – that have passed laws allowing insurers from other states to participate in their markets. All have done so within the past two years.

So far, none of the three have seen out-of-state carriers come into their market or express interest in doing so. It seems to have nothing to do with state benefit mandates, and everything to do with the big challenge of setting up a network of providers that new subscribers could see.

“The number one barrier is really building that provider network that’s attractive enough to get patients to sign up,” said lead study author Sabrina Corlette. “To do that, you have to offer providers attractive reimbursement rates, which makes it difficult to get them in network.”

Corlette and her colleagues talked to insurers and regulators in all three states. And they heard this barrier come up again and again: Entering a new state is really difficult, whether there are benefit mandates or not. “We kept hearing about the cost of building a provider network that’s strong enough to market,” she said.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers