Tyler Cowen's Blog, page 419

December 7, 2012

Threats

If the deal is rejected [as would appear to be the case], Mr Huang said he would tell “the whole world that Iceland doesn’t welcome Chinese businessmen”.

Here is more, and here is background and here is my previous blog post on this episode.

Assorted links

1. Profile of James C. Scott, including on anarchism but not just.

2. Sex in cheese.

3. Camille Paglia, on women she does and does not like.

4. Has government funding of science become too conservative?

5. Which sector, other than punditry, is benefiting from the “fiscal cliff” chatter?

The Palestinian Emirates?

From Barry Shaw:, this is also known as the “eight-state solution”:

Dr. Mordechai Kedar of Bar-Ilan University, a Middle East expert…calls his alternative “the Palestinian Emirates.”

He visualizes eight emirate-type city states with designated borders that will incorporate the Arabs within them. The rest of the land can be populated by the inhabitants, whether they be Jews or Arabs, living and behaving with respect and deference to the inhabitants of the various city-states. The states shall be granted sovereignty. They shall be granted surrounding land for expansion and development. Road systems in vacant lands shall be developed for transport of people and commerce, both Jewish and Arab.

If Palestinians could “vote with their feet” across these various Emirates, it would be interesting to see what kind of policies would evolve, relative to what is produced by currently existing forms of political participation.

Here is a web site devoted to the concept, with one more detailed account here. I should add that there are versions of this idea which do not add all of the “baggage” found on this web site.

In presenting this material, I am not seeking to have MR commentators reprise all of the usual debates on the broader topic of Middle East peace or lack thereof. Nonetheless I had never heard this idea before, and so I am passing it along.

*My Struggle: Book One*, by Karl Knausgaard

Imagine a Norwegian Proust, albeit more concrete and with less repetition. The Amazon link is here, and you will notice that all nine Amazon reviews give it five stars. Here is a James Wood review from The New Yorker. Here is Wikipedia on the author. Here is a good blog review. Note this is only one out of six volumes, from Norway.

I would put this among the greatest Continental novels of the last fifty years and not at the bottom of that tier. It is not often that one discovers such books.

How much do charter schools really matter?

I’ve seen so many people discuss this topic, but Yusuke Jinnai seems to be making progress on the question. Here is part of his abstract:

In this paper, I propose a new empirical approach to identify the impact of charter schools on local traditional schools. Specifically, I define direct impact as the effect of introducing charter schools on traditional-school students in grades that overlap with charter schools’ grades, while indirect impact is defined as the effect on students in non-overlapping grades. Unlike prior research work, which estimates the effects of charter school entry at the school level, I examine the impact at the grade level by exploiting the variation in gaps between grades offered by charter schools and grades at nearby traditional schools.

Using student-level panel data from North Carolina, this paper shows that the introduction of charter schools does not induce any significant indirect impact but generates a positive and significant direct impact on student achievement. Distinguishing between the two distinct impacts and taking into consideration both traditional-school and charter-school students, my study finds overall positive effects of introducing charter schools on student achievement. I also demonstrate that such overall effects would have been underestimated by 85% in the literature, since previous work identifies the impact of charter school entry at a moment when the direct and indirect impacts are likely to be mixed.

Finally, I argue that the direct impact consists of student sorting effects and competitive effects and, by controlling for unobserved peer characteristics, demonstrate one-quarter of the positive direct impact is driven by the former while three-quarters result from the latter.

The paper is here, and Yusuke is on the job market from Rochester this year. His entire portfolio of papers on education appears to be quite interesting.

Here is a related post on school choice in Sweden, from Modeled Behavior.

December 6, 2012

Assorted links

1. Garett Jones and the role of Fannie and Freddie.

2. The Bloomberg best books of the year list.

3. Rogoff comments on the stagnationists, and are we running out of phosphate reserves?

4, MIE: precious friends become precious gems.

5. Christmas video about macro, will offend some of you. Worth a view in any case! By John Popola, and it considers Malthus on aggregate demand.

6. Outcompeting the driverless car (does the theory of comparative advantage apply to dogs?), caveat emptor.

What the Beckworth diagram really means

From my earlier post, here it is again (and Beckworth here, with links to critics, Krugman here, and see also @ProfSufi on Twitter):

As Scott already has stressed, this is about whether the liquidity trap makes the Fed impotent.

My view is this: The Fed cannot very well control ngdp during a credit collapse (parts of 2008-2009) but it can control ngdp in a so-called “liquidity trap.”

I view my theory as consistent with this graph, rather obviously consistent.

Scott and I think David believe something more like: “The Fed can always control ngdp.”

That means they have to think Bernanke made a huge error and indeed they do think that. (I think Bernanke was slow to react along the longer-run ngdp forecast dimension, but I am more sympathetic to B. than they are, as I don’t think currency is such a useful substitute for collapsing credit, contra Fama 1980.)

Here is the key question: what do the liquidity trappers think?

That this ngdp path is a coincidence? That fiscal policy has been keeping it on an even keel in more recent times? (Implausible for 2010-2012, given other claims they make about fiscal policy, plus implausible more generally.) That some other process — which? — drives the ngdp path?

The problem with the debate, so far, is that we don’t yet know which clear alternative theory of 2010-2012 ngdp determination the liquidity trappers are proposing.

Sufi, by the way, is complaining that Beckworth (and others) are passing over Romer and other empirical pieces on stimulus, but David is pretty clearly covering “the multiplier contingent upon a reaction function of the monetary authority, with the monetary authority moving last and having control over ngdp.” I have discussed these matters with David and he is not behind the academic discussion here but rather very often ahead of it. He has a clearer theory of ngdp determination than do the liquidity trappers, even if I do not agree with his theory in every regard.

I would very gladly have a more transparent debate on ngdp path determination, noting in advance that I personally do not think it would go very well for the liquidity trap hypothesis.

Addendum: This paper surveys some relevant issues from the theory side, although it is not my preferred approach.

Taxi Tip Nudge

NYTimes: New York’s cabbies howled when the city began forcing them to take credit cards. Some even went on strike, calling the requirements a kowtow to tourists and a burden on drivers.

But two years later, the back-of-the-cab swipe has emerged as an unlikely savior for New York’s taxi industry, even as other cities’ fleets struggle to find fares in a deep recession.

The saving grace appears to be a simple nudge. Before the credit card swipe system the average tip was around 10% but the computer offers three tip sizes 30%, 25%, 20% and the average tip has now risen to 18-22%!

Joshua Gross estimates, that this simple nudge has increased the income of taxi drivers by $144 milion per year. Had the drivers demanded this increase via an increase in rates it probably never would have happened.

Sometimes it can be better to be nudgy than pushy, even in New York.

Hat tip: Cheap Talk.

December 3, 2012

Korea fact of the day

Korea is now the world’s second-largest exporter of missionaries after the United States.

That is from Daniel Tudor, Korea: The Impossible Country, which is quite a good overview of the place.

Sentences to ponder

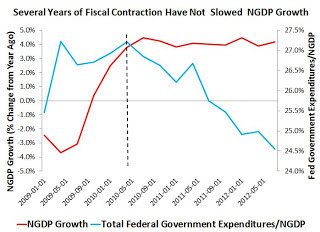

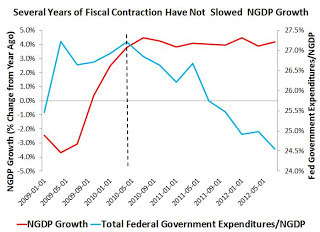

This first figure shows that aggregate demand growth has not been affected by a tightening of fiscal policy since 2010. Specifically, it shows that nominal GDP (NGDP) growth has been remarkably stable since about mid-2010 despite a contraction in federal government expenditures.

That is from Macro and Other Market Musings, and there is another good picture at the link. I understand full well that this is “unadjusted” and one may well argue “growth could have been stronger.” I’ll simply note that I’d like to see discussions of fiscal policy accompanied by this picture as a starting point for analysis.

I would not, by the way, endorse the author’s conclusion about crashing into the fiscal cliff;; for one thing uncertainty and sectoral effects would be significant and would interact negatively with AD effects, even under perfect Fed policy.

For the pointer I thank David Levey.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers