Tyler Cowen's Blog, page 405

January 19, 2013

Why are budget issues urgent now?

Paul Krugman considers that question, Matt comments also. I would offer a few points:

1. One might prefer, for macro reasons, to start with fiscal consolidation a year from now rather than now. But still the question can be considered with that slight shift of time frame if need be.

2. One major problem is that America is aging, and benefit cuts or decelerations will become successively harder to achieve as the years pass. There will be many more elderly voters and the elderly as a voting bloc are already quite effective at getting their way.

3. As the years pass, our health care establishment becomes increasingly geared to require especially high revenue streams. It becomes successively harder to back out of an excessively costly health care system. Do you believe it would have been easier to put in a more unified and more efficient system of health care assistance in say 1969? Probably so, and this is simply the mirror side of that belief.

4. Whether one likes it or not, U.S. politics phases in benefit cuts, or benefit decelerations, only slowly. Grandfathering is much preferred, so that a critical mass of elderly voters will support the changes and arguably this is more fair as well. That means one must start relatively early to have a significant cumulative fiscal impact over time.

4b. David Henderson makes numerous good points, here is one: “people can adjust better when they have more time to adjust. If the Social Security formula is altered for the future, people can have longer to save to make up for the higher benefits they would have got but will not get. That’s the argument for doing something about it now rather than later. Remember what happened in 1981 when OMB Director David Stockman tried to cut the early retirement benefit by about one third for people retiring only a few years later. That got nowhere. People looking at a one-third reduction in their retirement benefits who are planning to retire in a few years will not look on that kindly. But what if some previous Administration had announced in 1962 a gradual reduction in the early retirement benefit for people retiring in the early 1980s. Those people would have had much more time to plan.”

5. Krugman has written about why raising the retirement age is a bad way to make up for fiscal gaps and I agree with many of his arguments. Nonetheless I would insist on taking the continuing survival of such proposals as a kind of datum, indicating just how many other (possibly more sensible) proposals are complete political non-starters. Let’s learn and draw inferences from the popularity of “raise the retirement age” proposals rather than merely condemning them.

6. The threat is not that future benefits will have to be cut (if that were the case, cutting benefits now would be an odd solution, as Krugman notes). The threat is that future benefits cannot be cut or slowed and that the U.S. will spend far too much on consumption and the elderly, along with having excessively high taxes and permanently slower growth.

7. I am puzzled by Matt’s argument that government cannot easily save for the future. Even if one accepts it as stated, government could subsidize private consumption of health care and other amenities less than it does. That would be easy to achieve.

8. Morgan Stanley estimates that most developed economies are, when unfunded liabilities are taken into account, in some manner insolvent. Or ask how the fiscal picture would look if the standards for private pension funds were applied to the government.

Maybe my reading is missing it, but I don’t see that Krugman pays much if any heed to political lock-in arguments. Overall I do not see entitlement spending paths as very easy to alter, mostly for political reasons. One plausible scenario is simply that it is already too late and has been too late for some time (the rejection of managed care in the 1990s?), although denouement (which does not have to mean default) remains a ways away. If you are fiscally and/or growth doomed anyway, hurry at the margin will indeed seem of not much extra value. But that is on net hardly an argument for fiscal complacency.

January 18, 2013

*A Course in Behavioral Economics*

That is the new book by Erik Angner, with very good exercises and problem sets, and it appears to be very useful indeed. Here is the book’s home page. Here is Angner’s home page.

Assorted links

2. When male CEOs have kids, employees make less money (speculative).

3. Claims about religion and the great stagnation.

4. Martin Ford on Paul Krugman on robots (I think the post is mistitled by the way).

5. Is this a new golden age for American opera?

How will offices evolve?

Designers talk of digital walls, which have sensors embedded so you can interact with them.

Or, if you want the professor’s technical explanation, “dye sensitised solar cells with titanium oxide layers on a surface with light absorbing dye molecules adsorbed on surface which can generate electricity”.

These walls will build up a profile of you and change your working environment accordingly.

This could mean the lighting around your desk dims slightly when you arrive, or a pre-determined microclimate is created for your meeting.

Nano state

The technology that enables this interaction, known as “nano-coating”, will basically turn your cold, unfeeling office into an expressive medium

It could mean the moment you enter the building your workspace starts preparing itself for your imminent arrival – even if you are hot-desking.

Here is more, via Michelle Dawson.

Does Cable TV Ripoff People Who Don’t Like Sports?

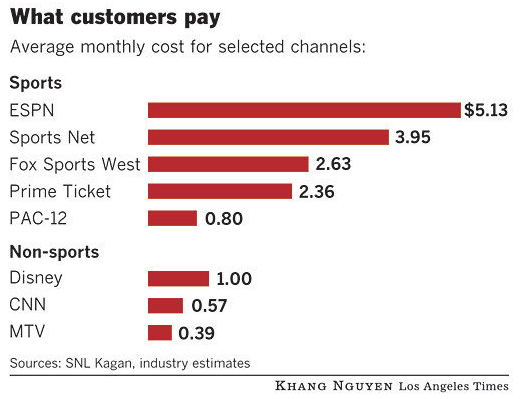

Recently the LATimes ignited a firestorm of anti-sports commentary by arguing that people who don’t watch sports are being ripped off by Cable TV.

A key concern is that the higher bills driven by sports are being shouldered by subscribers whether they watch sports or not.

…”I pay $98 a month for cable and half of that is for sports?” said Vincent Castellanos, 51, a fashion stylist who lives inLos Feliz. “I’ve never once gone to a single sports channel. I wasn’t even aware I was paying for it. I want my money back. Who do I call?”

Derek Thompson at The Atlantic corrected some of the numbers but agreed with the analysis:

If you watch sports, millions of pay-TV households who never click on their ESPN channels are subsidizing your habit. If you don’t watch sports, you’re one of the suckers paying an extra $100 a year for a product you don’t consume.

Kevin Drum demanded a la carte pricing so that:

“sports fans would be forced to pay the actual cost of their sports programming without being subsidized by the rest of us.”

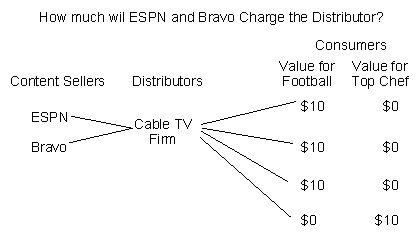

I don’t watch sports very often but I think the commentators have misunderstood the economics of Cable TV and the math of content provision. Let’s consider a simple model, there are content providers such as ESPN and Bravo, distributors such as the cable company and consumers. Let’s assume that there are 4 consumers, 3 of them value football at $10 and Top Chef at $0 and one vice-versa so the model looks like this:

How much will ESPN and Bravo charge the distributors? Bilateral bargaining between content sellers and distributors can be complex but for the point I want to make we can assume that the distributors simple pass on their input costs to consumers. In this case, ESPN will charge the distributor $30 and Bravo will charge $10, the maximum that they can get.

Here is where the LA Times and the others go very wrong – they reason that $30 of the $40 charged is due to sports so each person is paying $7.50 for football ($7.50*4=$30) and $2.50 for Top Chef ($2.50*4=$10) and, therefore, the Top Chef viewer is being ripped off because 3/4 of their bill is going to support programming they never watch! Mathematically this is as true as any other division of total cost but conceptually it makes little sense. Consider, for example, what happens if we add football viewers. With 9 football viewers, ESPN will charge $90 and Bravo $10 and thus the LA Times would conclude that the Top Chef viewer is even more ripped off than before–90% of their bill is going to football! It’s very odd, however, that the ripoff of the Top Chef viewer gets bigger even as the price that they are charged and their viewing habits aren’t changing! Also as we add more football viewers the per-subscriber charge for Bravo gets smaller and smaller, with 10 viewers it’s only $1. Implicitly the LA Times is suggesting that this number represents what a la carte price would be or could be but that’s nonsense–whatever Bravo’s a la carte price would be it doesn’t get lower as we add more football viewers.

Conceptually it’s much clearer to say that each person is being charged $10 for the programming that they most want to watch. Moreover, the reason that Cable TV firms bundle is precisely because by making the demand for their product more homogeneous they can increase profits. In other words, the best bundle for the Cable TV firm is one in which everyone does in fact value the bundle equally.

The bottom line is that there is no reason to think that Top Chef viewers are subsidizing football.

January 17, 2013

The robot restaurant

The Robot Restaurant opened in Harbin in June and has taken the F&B industry in China further into the mechanized world. Robot Restaurant staffs a total of 20 robots as waiters, cooks and busboys. Turns out Noodle Bot might need to expand its repertoire if it hopes to compete with Robot Restaurant’s 18 different kinds of service robots.

Upon arrival, Usher Robot welcomes customers to the restaurant and directs them to the seating area. Patrons can then place their order, which is relayed by humans to one of the four the robot chefs who are able to cook various styles of dumplings and noodles. The robot chefs even determine the temperature and ingredients for each dish and usually take about 3 minutes to prepare the average order. These robot chefs are no slouches either. The kitchen staff is able to prepare a menu of over 30 dishes–perfect for a family dinner.

Waitress robots carry the food to customers by following a track that uses sensors placed under the floor for spatial awareness. Additionally, each robot comes equipped with its own sensors, helping it to avoid obstructions such as a kid that’s in its way.

The robots were designed and built by a local firm, the Harbin Haohai Robot Company. Each robot costs between 200,000 to 300,000 Chinese yuan (US$31,500 – US$47,000) with an additional 5 million yuan (US$790,000) invested into the restaurant itself. With the average Robot Restaurant meal costing less than 62 yuan (US$10), the restaurant is not meant to earn Harbin Haohai money. Instead, it turns out the restaurant is just a brilliant piece of marketing.

The story is here, there is more here, and for the pointer I thank Daniel Klaus. By the way, here is a related 2010 MR post but it seems the robots are getting better.

January 15, 2013

Adam Posen on Japanese fiscal stimulus

The case for continued deficit spending in Japan ended by mid-2003.

…The additional stimulus in Japan is counterproductive because it adds to the long-term costs without addressing Japan’s real problem: a return to deflation and an overvalued exchange rate. The BoJ pursuing a higher inflation target through large-scale purchases of a wide range of assets, as Mr Abe and his economic adviser Koichi Hamada rightly advocate, would be sufficient and appropriate.

Here is much more (FT). You will note that Posen is in general famous for being an advocate of stimulus for the UK and he is no enemy of Keynesianism or aggregate demand analysis.

A separate vote for the debt ceiling is a bad idea

Japan fact of the day

The unemployment rate is 4.1 percent.

In recent discussions of Japanese fiscal stimulus, this point could use a little more…emphasis.

Here is one source for the data.

Assorted links

1. Economic freedom rankings for the states of India (pdf, and revised link here).

2. My interview with Yale School of Management on cultural globalization.

3. Do chimpanzees actually care about fairness?

4. The David Brooks syllabus on humility, for his course at Yale.

5. Do guns protect us from tyrannical government?

6. Will the end of sleep push down wages? (By the way, does sleep make it easier to save?)

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers