Tyler Cowen's Blog, page 387

March 11, 2013

Calgary notes

They refer to themselves as Calgarians, which makes them sound more closely related to science fiction than in fact they are. On Saturday I walked around in a sweater only. In the span of little more than an hour, I was told numerous times that Calgary and southern Alberta have more U.S. citizens living there than any other region in the world.

Canada just had a very good job creation month. About a third of the Albertan provincial budget comes from resource revenue, and bitumen prices have been falling, leading to some tough fiscal choices.

The city has elected a Muslim mayor.

On Snowquester virtually all flights out of DC were cancelled, even though Reagan National Airport had literally no snow. Only Air Canada was flying a normal schedule and thus I arrived.

There are some excellent food choices in Calgary, although it is a city for ordering main courses, not appetizers.

There is no good reason to turn down a trip to Calgary, even in the winter.

Assorted links

1. Obscene titles for refereed journal articles.

2. Video about concrete tents.

3. Video about how the Japanese are demolishing one building.

4. Ryan Avent on labor force participation and structural unemployment.

5. New blog on monetary economics.

6. Do the Democrats face a demographic problem of their own?

7. A tale of status competition (and read the comments too).

The jobs of the future?

Katherine Young, 23, is a Google rater — a contract worker and a college student in Macon, Ga. She is shown an ambiguous search query like “what does king hold,” presented with two sets of Google search results and asked to rate their relevance, accuracy and quality. The current search result for that imprecise phrase starts with links to Web pages saying that kings typically hold ceremonial scepters, a reasonable inference.

Her judgments, Ms. Young said, are “not completely black and white; some of it is subjective.” She added, “You try to put yourself in the shoes of the person who typed in the query.”

How smart do you need to be to do this? How well-educated? How is the quality of your work to be judged? The full article is here, interesting throughout.

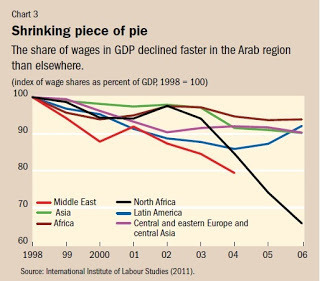

Wage share of gdp in Middle East and North Africa

Testing Doux Commerce in the Lab

In a famous priming experiment it was shown that changing the name of a prisoner’s dilemma type problem from “The Community Game” to “The Wall Street Game” reduced the amount of cooperation. The suggestion is that Wall Street evokes in the mind concepts of exploitation and self-regarding behavior thus making these behaviors more likely. Wall Street is a very particular aspect of capitalism, however, what about the idea of markets and trade more generally? Montesquieu famously noted that

Commerce is a cure for the most destructive prejudices; for it is almost a general rule, that wherever we find agreeable manners, there commerce flourishes; and that wherever there is commerce, there we meet with agreeable manners.

In fact, market economies are associated with greater levels of trust and cooperation, so might we not expect markets and trust to be associated in the mind? Al-Ubaydli, Houser, Nye, Paganelli, and Pan (the list includes several GMU colleagues) prime experimentees with words associated with markets and then have them play a trust game; they find evidence in support of the hypothesis:

Using randomized control, we find evidence that priming markets leaves people more optimistic about the trustworthiness of anonymous strangers and therefore increases trusting decisions and, in turn, social efficiency. Given the general mechanisms by which priming affects behavior–that an individual’s mental representation of markets is the result of the individual’s experiences with markets–we can interpret our results as evidence in favor of the hypothesis that market participation increases trust.

…Absent markets, economic interactions with strangers tend to be negative. Market proliferation allows good things to happen when interacting with strangers, thus encouraging optimism and leading to more trusting behaviors. Participation in markets, rather than making people suspicious, makes people more likely to trust anonymous strangers. Our results seem therefore to corroborate the idea of doux commerce….We stress, however, that this is cautious evidence; a wider array of evidence is necessary for the solidification of this conclusion.

March 10, 2013

InTrade has closed down

Their somewhat mysterious announcement, which refers to financial irregularities, can be read here.

*The Alchemists*

The author is Neil Irwin and the subtitle is Three Central Bankers and a World on Fire. This is very likely a very good book. If my quick perusal is accurate, I like how Irwin refers to Trichet as “the president of Europe.” There is also a very interesting chapter on the Swedish central bank of the 17th century.

Canada projection of the day

In Toronto, 63 percent of the population will be foreign born by 2031…In Vancouver, the foreign-born population will be 59 percent.

That is from the quite interesting The Big Shift: The Seismic Change in Canadian Politics, Business, and Culture and What it Means for Our Future, by Darrell Bricker and John Ibbitson. If you are into the “how should the Republican Party reinvent itself?” question, this book is a must-read. That’s not so much my thing, but it’s also a fascinating introduction to the new ethnic politics in Canada and why so many Canadian immigrants have seen fit to vote for the conservatives.

Assorted links, some of them sporting

1. A long Bill Simmons paean to the theory of winner’s curse, and are sports fans less prone to depression?

2. Update on Moneyball strategies in baseball.

3. (I view the Dutch example as supporting my point, actually, noting that the platforms of far left socialist parties won’t match up to interests very well in any case).

4. The sport of picking locks.

5. The Great Portuguese hollowing out., and does the U.S. risk a fiscal tipping point?, by Jim Hamilton.

6. The home advantage plays virtually no role in objectively-evaluated individual sports, as opposed to team sports.

Realism on Infrastructure Investment

Keith Hennessey has an excellent post on government infrastructure investment. Here are his key points:

Capital investment by government often pursues multiple policy goals, some of which conflict with maximizing productivity growth. If you’re investing for long-run growth you’ll invest differently than if you also have goals to maximize short-term job creation and to change the future balance of energy sources to reduce greenhouse gas emissions (for instance). The pursuit of multiple policy goals lowers the expected economic growth benefit of public capital spending.

Geographic politics distorts and often dominates government investment in physical infrastructure. Highway funds and airport funds especially are allocated in part based on which Members of Congress have maximum procedural leverage over the spending bill. Even if you could somehow get Congress to stop earmarking infrastructure spending (good luck), and even if you could rely on the Executive Branch not to allow their own political goals to influence how they allocate funds, local geographic politics would come into play at the state level, since much federal infrastructure spending flows through State governments. This is where reality most falls short of a valid theoretical starting point for increasing productivity and long-term growth.

Non-geographic politics can distort government capital spending. This is principally an Executive Branch concern, as we saw with the Obama Administration’s decision to throw good money after bad to postpone Solyndra’s failure. And rent-seekers come out of the woodwork, looking to leverage their connections to government officials to win infrastructure investment contracts.

Once “investment” is favored, everything gets relabeled as investment. The Obama Administration has been particularly guilty of this; almost every spending increase they propose is an “investment” of some sort. We should allow them some rhetorical leeway, and we should recognize that government has other reasons to spend money than just to maximize future economic growth. At the same time, it’s misleading when they claim that increased government spending that serves other policy goals (some quite legitimate) also increases future economic growth.

There’s a difference between government investments in the commons and government spending that primarily benefits individuals. A new airport benefits all who use it. A scientific research grant benefits the researcher and society as a whole if his research advances our understanding. A subsidized student loan is an investment in human capital, but the return on that investment accrues mostly to the student and his or her family. That’s not wrong, it’s just having a more limited effect on increasing long-term growth for society as a whole.

Government investment in physical infrastructure is slow. The Administration learned this as they tried to force money out the door in 2009 for “shovel-ready jobs” that turned out not to be there. This doesn’t mean you don’t build roads and improve ports and airports, it just means the short-term fiscal stimulus argument for this type of spending is weak.

Government investment in physical infrastructure is intentionally expensive because of “prevailing wage” requirements, championed by construction labor unions, that mandate the government must pay more for workers than an aggressive private firm might be able to find in the labor market.

We should evaluate the marginal productivity benefits of additional investment. The President sometimes argues that building the national highway system was good for growth, therefore his specific proposal to increase highway spending is good for growth, too. But those are different investments, and we need to examine the marginal benefits (and rate of return) on the specific incremental investments he is now proposing. The transcontinental railroad definitely increased national economic growth, but that doesn’t mean the feds should subsidize a costly California bullet train with questionable growth benefits.

International comparisons of government infrastructure are silly. U.S. government capital spending should be determined based on what will most increase U.S. productivity without comparison to what other countries are doing. If American ports are clogged and that is harming our trade and slowing American economic growth, then we should upgrade our ports. We shouldn’t instead improve our airports because other countries have shinier ones. We have a different geography, a different economy, and different infrastructure needs than does China, or Japan, or Dubai or France. It is crazy to suggest that the U.S. should build bullet trains because China is doing so.

Government investment faces no market discipline. Capital investment in a private firm can face some of the above challenges—a CEO, for instance, might want a new facility built in his hometown rather than where it will produce the highest rate of return. Or a firm might reject an investment that would maximize its’ workers’ productivity because that investment is inconsistent with the firm’s broader strategic goals. But these firms ultimately face the discipline of the market to curb their excesses. Government does not, and in some cases policymakers are rewarded by their election markets to distort infrastructure investment even farther from its growth-maximizing ideal.

Government capital investment financed by raising taxes on private capital investment will slow long-term economic growth. While in theory there probably are government infrastructure investments with very high rates of return, all of the above reasons suggest that in practice the actual rate of return on government-directed investment is going to be lower than in the private sector. If you advocate raising capital taxes (on capital gains and dividends, for instance, as Senate Democrats appear poised to do) at the same time you argue for increased government capital spending, you’re shifting capital investment from the private sector to the public sector. That will slow long-run economic growth rather than increase it.

As Hennessey notes and as I second this is not a denial that “smart government capital investment can increase productivity and contribute to faster long-run economic growth.” Instead, it’s an argument for caution but also for more thought about how to make government investment smarter. See also Tyler’s related comments.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 845 followers