Tyler Cowen's Blog, page 35

March 1, 2015

*The Age of the Crisis of Man*

That is the new book by Mark Greif, and the subtitle is Thought and Fiction in America, 1933-1973. I very much enjoyed grappling with this one. One of my more recent views is that the thinkers of the mid-twentieth century are in fact, as a whole, extremely underrated. They are not old enough to be classic and not new enough to be trendy or on the frontier. Their world faced problems which seemed totally strange to us in the 1990s, but which are starting to sound scarily relevant and contemporary. Yet our world is largely ignorant of their wisdom and creativity, in part because they often sounded dumb or schlocky or maybe they even were in some ways.

This book is sprawling, and while clearly written at the sentence-to-sentence level, it assumes some fair degree of background knowledge. Nonetheless for an intellectually-minded reader it is an excellent way to jump into the world inhabited by Karl Jaspers, Ortega y Gasset, Flannery O’Connor, and Thomas Pynchon.

Leon Wieseltier has some interesting remarks on the book. Here is another interesting (if overlong) review, by Richard Marshall. Here is an excellent Adam Kirsch review, the best review as review.

February 28, 2015

What if everyone lived like Mr. Money Moustache?

Over at Vox, Mr. Money Moustache notes:

The first trick is to remind yourself that buying something — pretty much anything — is very unlikely to improve your long-term happiness. Science figured this out for us long ago, but not many people got the memo. Go to your junk electronics drawer and look at your old flip phones or your dusty iPad 1. Look at the clothes you’ve recently pruned from your closet that are now headed to the Goodwill. You traded a lot of good dollars for those, not very long ago at all. Are they still making you happy today?

And:

…I try to get people to think of things in 10-year chunks at a minimum and then move on to a lifetime perspective. For example, spending $100 per week on restaurants equates to a $75,000 hit to your wealth every ten years, compared to keeping that money and just investing it in a conservative way.

If I understand him correctly, he recommends a very high savings rate and very early retirement.

From an individual point of view, my worry is that happiness may not go up much in this early retirement and in fact it may go down; people seem to enjoy working, which is good for their health and their social involvement. Perhaps Mr. Money Moustache derives a sense of purpose from spreading this gospel, but most people would end up bored and indeed frustrated if they retired at age thirty as he has (apparently) done.

From a social point of view, if everyone did this, productivity would collapse. Workers over the age of thirty make the world go round, and teach and pass down skills to others. When you retire involves an external cost or benefit, and retirement can come either too early or too late.

I’ll note in passing that my “dusty iPad 1″ gave me an enormous amount of pleasure, as does my later iPad. And I wish my old flip phone still worked! Sadly, it is no longer still making me happy today.

Addendum: Ryan Decker comments.

Did China really grow at seven-something percent last year?

The latest year-on-year data, from January, highlight the danger. The consumer price index dropped to 0.8%; the producer price index fell by 4.3%; exports contracted by 3.3%; imports were down by 19.9%; and growth of broad money (M2) slowed by 1.4%.

Moreover, the renminbi has come under downward pressure, owing partly to economic recovery in the United States, which has fueled capital outflows. Given huge declines in industrial profit growth (from 12.2% in 2013 to 3.3% last year) and in local-government revenues from land sales (which fell by 37% in 2014), there is considerable anxiety that today’s deflationary cycle could trigger corporate and local-government debt crises.

Just askin’…that is from Sheng and Xiao, there is more here.

Saturday assorted links

1. The fiasco that is the Nicaragua canal.

2. 15 year old makes 500k a year in the babysitting business.

4. Bryan Caplan’s totally conventional views. And Scott Sumner on those views, and whether Bryan is consistent in his views on love.

5. How the culture that is German views Yanis (video, unusual, not like Bryan’s conventional views. Or is it?).

6. My earlier post Modeling Vladimir Putin.

That was quick…

Greece called into question on Saturday a major debt repayment it must make to the European Central Bank this summer, after acknowledging it faces problems in meeting its obligations to international creditors.

There is more , most of all showing the Greeks have not obtained much leverage from the talks. They are in a deep liquidity squeeze, even post “agreement.” The Bundestag overwhelmingly approved last week’s “deal,” whereas the Greeks don’t even want to vote on it. So who won that round? The on-paper ability to be flexible with a primary surplus — that isn’t real any more — just isn’t worth very much right now.

Hong Kong fact and projection of the day

Hong Kong is a tough marriage market for women because of the city’s skewed gender ratio — 876 males for every 1,000 females, a gap predicted to worsen to 712 to 1,000 by 2041.

That is from Julie Zhu at the FT.

February 27, 2015

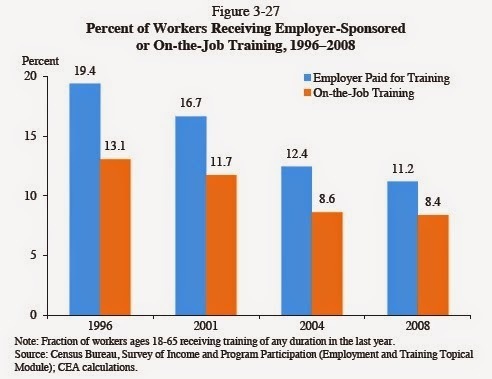

The decline in on-the-job training

How durable and valuable is the Draghi put?

Michael Pettis has an excellent short essay on this point, here is one (scary) excerpt:

A debt crisis must be resolved quickly because there is a self-reinforcing component within the process that can be extraordinarily harmful. High levels of sovereign debt create uncertainty about how the costs of resolving the debt will ultimately be assigned. This uncertainty causes growth to slow by adversely changing the behavior of a wide variety of stakeholders in the economy (as I will describe later). As the economy slows, contingent liabilities within the banking system rise, tax revenues decline and fiscal expenditures rise, all of which push up sovereign debt levels even further and increase both the cost of resolving the debt and the uncertainty about how the costs will be assigned. The consequence of this self-reinforcing deterioration in the sovereign balance sheet is, at first, a slow grinding away of the economy until the market reaches some point, after which the process accelerates and debt can spiral out of control.

Hat tip goes to the ever-excellent The Browser.

Assorted Friday links

1. How important is cutlery design anyway?

2. The Palestinian city without water.

3. Good further story on the machinations of LSU professor Johnny Matson, but Michelle Dawson should be getting more of the credit for this expose. It was her earlier stream of tweets which led to the uncovering of these rather dubious practices.

4. Should we remove investor-state dispute settlement from free trade agreements?

5. China wars against Tocqueville. And Putin’s teenage fan club. Full slideshow is here.

6. Meta-IRB.

7. Keith Hall, formerly of Mercatus and GMU, will be the new CBO director.

Price Ceilings

This week we released two new sections of our principles of economics class, price ceilings and trade. Most textbooks discuss how price ceilings create shortages and deadweight loss. Modern Principles delves much deeper to explain how price controls impede the operation of the price system creating economic discoordination and a misallocation of resources.

The introductory video is short but it covers a lot of economics.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers