Tyler Cowen's Blog, page 17

April 7, 2015

Cowen Sachs live stream

The End of Asymmetric Information?

At Cato Unbound, Tyler and I ask whether the age of asymmetric information is ending and what implications this may have for regulation and markets. The Browser offers an excellent precis:

At Cato Unbound, Tyler and I ask whether the age of asymmetric information is ending and what implications this may have for regulation and markets. The Browser offers an excellent precis:

Sensors and reputation systems allow buyers to know what sellers know, principals to know what agents know, and vice-versa. Akerlof’s arguments have been overtaken. Any interested party can have access to information about product quality, worker performance, the nature of financial transactions. “A large amount of economic regulation seems directed at a set of problems which, in large part, no longer exist”

The end of asymmetric information will make markets work better but also governments. Here is one bit:

Many “public choice” problems are really problems of asymmetric information. In William Niskanen’s (1974) model of bureaucracy, government workers usually benefit from larger bureaus, and they are able to expand their bureaus to inefficient size because they are the primary providers of information to politicians. Some bureaus, such as the NSA and the CIA, may still be able to use secrecy to benefit from information asymmetry. For instance they can claim to politicians that they need more resources to deter or prevent threats, and it is hard for the politicians to have well-informed responses on the other side of the argument. Timely, rich information about most other bureaucracies, however, is easily available to politicians and increasingly to the public as well. As information becomes more symmetric, Niskanen’s (1974) model becomes less applicable, and this may help check the growth of unneeded bureaucracy.

We discuss used cars and Akerloff’s model for lemons, moral hazard problems, principal-agent problems, reputation mechanisms, computable contracts and much more.

We will be joined in future discussion by Joshua Gans, Shirley V. Svorny, and Jeff Ely.

April 6, 2015

The transcript of my talk with Peter Thiel

You will find it here. Here is one excerpt:

TYLER COWEN: New York City, overrated or underrated?

PETER THIEL: That’s massively overrated.

TYLER COWEN: Why?

PETER THIEL: We had a 25-year boom in finance, from ’82 to ’07. I think that’s slowly ebbing, slowly abating. It’s going to be increasingly regulated, and so if you want a long/short blue state trade, you want to be long California, short New York. The long/short red state trade, by the way, is you want to be long Texas, short Virginia.

If you ask, what do Virginia and New York have in common, and what do Texas and California have in common? Both Texas and California are very inward-focused places. California, both the Hollywood version and the Silicon Valley version, are very focused in on themselves. Texas is also a very inward-focused place.

What Virginia and New York, or let’s say DC and New York City, have in common is that they’re centers of globalization. Finance is an industry that’s fundamentally leveraged to globalization, and DC is fundamentally leveraged to international geopolitics.

I would bet on globalization slowly being in abeyance. I think with the benefit of hindsight, we will realize that 2007 was not just the peak year of the finance boom, but also the peak year of globalization, like maybe 1913. Happily, it hasn’t resulted in a world war, at least not yet, but I think we are in this period where globalization is steadily pulling back.

And so you want to be in places or industries that are levered to things other than globalization.

Self-recommending…The YouTube and podcast versions are here.

Will youth sports disputes be improved by the intervention of the courts?

When Audrey Dimitrew won a spot on a club volleyball team in Chantilly, Va., the 16-year-old hoped to impress varsity coaches and possibly college coaches.

But when her coach benched her and the league told her she couldn’t join another team, the action shifted from one court to another — she and her family sued.

…The lawsuit is one of a number filed across the country in recent years as families have increasingly turned to the courts to intervene in youth sports disputes. Parents upset that their children have been cut, benched, yelled at by coaches or even fouled too hard are asking judges to referee.

The culture that is American youth sports, there is more here, via Michael Rosenwald.

Bleg for Cancun, Mexico

Your answers here will help everyone at APEE, so please tell us what else should one do besides the usual? Where is the truly good food to be had, including cocina economica? I thank you all in advance for your assistance.

Bleg for Merida, Mexico

I haven’t been there for thirty years, what do you all recommend for a short stay? And where can we find good marquesitas, pib x’catik, caballeros pobres, pucheros, and chancletas? Among other delicious treats.

Measurement education sentences to ponder

And at Utah Valley University in Orem, the school developed its own early warning system, called Stoplight, which uses academic and demographic details about students to predict their likelihood of passing specific courses; as part of the program, professors receive class lists that color-code each student as green, yellow or red.

The article, on anti-cheating software, is of interest more generally, via Michelle Dawson.

April 5, 2015

Are S&P 500 firms now 5/6 “dark matter” or intangibles?

Justin Fox started it, and Robin Hanson has a good restatement of the puzzle:

The S&P 500 are five hundred big public firms listed on US exchanges. Imagine that you wanted to create a new firm to compete with one of these big established firms. So you wanted to duplicate that firm’s products, employees, buildings, machines, land, trucks, etc. You’d hire away some key employees and copy their business process, at least as much as you could see and were legally allowed to copy.

Forty years ago the cost to copy such a firm was about 5/6 of the total stock price of that firm. So 1/6 of that stock price represented the value of things you couldn’t easily copy, like patents, customer goodwill, employee goodwill, regulator favoritism, and hard to see features of company methods and culture. Today it costs only 1/6 of the stock price to copy all a firm’s visible items and features that you can legally copy. So today the other 5/6 of the stock price represents the value of all those things you can’t copy.

Check out his list of hypotheses. Scott Sumner reports:

Here are three reasons that others have pointed to:

1. The growing importance of rents in residential real estate.

2. The vast upsurge in the share of corporate assets that are “intangible.”

3. The huge growth in the complexity of regulation, which favors large firms.

It’s easy enough to see how this discrepancy may have evolved for the tech sector, but for the Starbucks sector of the economy I don’t quite get it. A big boost in monopoly power can create a larger measured role for accounting intangibles, but Starbucks has plenty of competition, just ask Alex. Our biggest monopoly problems are schools and hospitals, which do not play a significant role in the S&P 500.

Another hypothesis — not cited by Sumner or Hanson — is that the difference between book and market value of firms is diverging over time. That increasing residual gets classified as an intangible, but we are underestimating the value of traditional physical capital, and by more as time passes.

Cowen’s second law (“There is a literature on everything”) now enters, and leads us to Beaver and Ryan (pdf), who study biases in book to market value. Accounting conservatism, historical cost, expected positive value projects, and inflation all can contribute to a widening gap between book and market value. They also suggest (published 2000) that overestimations of the return to capital have bearish implications for future returns. It’s an interesting question when the measured and actual means for returns have to catch up with each other, what predictions this eventual catch-up implies, and whether those predictions have come true. How much of the growing gap is a “bias component” vs. a “lag component”? Heady stuff, the follow-up literature is here.

Perhaps most generally, there is Hulten and Hao (pdf):

We find that conventional book value alone explains only 31 percent of the market capitalization of these firms in 2006, and that this increases to 75 percent when our estimates of intangible capital are included.

So some of it really is intangibles, but a big part of the change still may be an accounting residual. Their paper has excellent examples and numbers, but note they focus on R&D intensive corporations, not all corporations, so their results address less of the entire problem than a quick glance might indicate. By the way, all this means the American economy (and others too?) has less leverage than the published numbers might otherwise indicate.

Here is a 552 pp. NBER book on all of these issues, I have not read it but it is on its way in the mail. Try also this Robert E. Hall piece (pdf), he notes a “capital catastrophe” occurred in the mid-1970s, furthermore he considers what rates of capital accumulation might be consistent with a high value for intangible assets. That piece of the puzzle has to fit together too. This excellent Baruch Lev paper (pdf) considers some of the accounting issues, and also how mismeasured intangible assets often end up having their value captured by insiders; that is a kind of rent-seeking explanation. See also his book Intangibles. Don’t forget the papers of Erik Brynjolfsson on intangibles in the tech world, if I recall correctly he shows that the cross-sectoral predictions line up more or less the way you would expect. Here is a splat of further references from scholar.google.com.

I would sum it up this way: measuring intangible values properly shows much of this change in the composition of American corporate assets has been real. But a significant gap remains, and accounting conventions, based on an increasing gap between book and market value, are a primary contender for explaining what is going on. In any case, there remain many underexplored angles to this puzzle.

Addendum: I wish to thank @pmarca for a useful Twitter conversation related to this topic.

Sunday assorted links

1. The full research on Hayek and Gibraltar. It turns out the full story is not so bad for Hayek after all.

2. Reversible Yanomami blood markets in everything. And the many faces of Tatiana Maslany (Orphan Black).

3. The reprivatization of art works.

4. Henry recommends recent science fiction. And interview with Lydia Davis.

6. What happened in Indiana, and Clive Crook too.

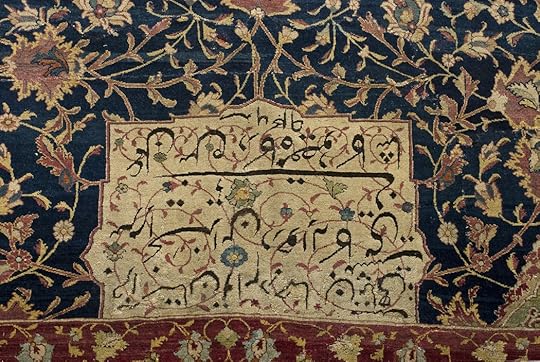

Which are the best Persian carpets?

I think there are three which stand above all the others:

1. The Ardabil carpet, at the Victoria & Albert Museum in London. Here is one on-line image, here is an excerpt. I find this angle useful, but nothing compares to the real thing.

2. The “Tree Carpet” in the Philadelphia Museum of Art.

3. Jagdteppich (“Hunting carpet”), Museum für Angewandte Kunst, Vienna. Here is one excerpt. Try this too. Here is a full length view.

Those are the three best, or so it seems to me.

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers