Colleen Cross's Blog, page 12

November 8, 2011

Ponzi Schemes - 5 Signs to Look For

Ponzi schemes haven't changed alot since Charles Ponzi's postage stamp scheme in the 1920's. So why do people keep falling for them? Because the promise of riches is simply too good to pass up. But promise is an empty one.

Ponzi schemes are especially popular during times of low interest rates or uncertain markets, like we have today. But if something sounds too good to be true, it often is. Here are five signs to look for.

1. Unusually high returns with little or no risk

All investments have ups and downs, and anything earning a consistent return, even in a down market is a red flag. Successful investors might beat the market some of the time, but not all the time. Ponzi schemes often have little variation in the return for year to year, despite market variations. If you are earning twenty percent when markets are declining, there's a chance it might not be real. These investment vehicles are often touted as "little" or "no risk", often giving some vague explanation about hedging risk. A key sign is offering a guaranteed minimum return in a short period of time, or a minimum annual return. Beware.

2. Unregistered Investments

Run, don't walk away from unregistered investments. Registered investments have the protection and scrutiny of securities regulators and are a source of information on a company's products, servies, managment and finances. Ask yourself one question- why is this investment unregistered? What are they trying to hide?

3. Unlicensed sellers

Most Ponzi schemes involve unlicensed sellers, simply because they need to stay under the radar to perpetuate their scheme.

4. Secretive or complex strategies

If an investment can't be explained well enough for you to understand, don't buy it. At best it is meant for a more sophisticated investor. At worst, and more likely, the seller is trying to obscure the investment because it is a fraud. Never invest in something you don't understand.

5. Issues with paperwork

Never invest in anything without a prospectus. A prospectus details the nature of the investment, risks, strategy, and rights and obligations of all parties. No paperwork? Forget it.

Other signs are errors or strange transactions on account statements, or absence of information when you request it. Excuses and delays mean there are problems.

6) Difficulty in getting payment- Any investment should be segregated from other funds held by the seller. Redemptions should be immediate. For some illiquid investments or large redemptions, this could take a few days if there are underlying assets that need to be sold in order to return funds. But never longer. Being "talked out" or promised even higher returns if you roll-over your investment instead is another common sign.

6) Difficulty in getting payment- Any investment should be segregated from other funds held by the seller. Redemptions should be immediate. For some illiquid investments or large redemptions, this could take a few days if there are underlying assets that need to be sold in order to return funds. But never longer. Being "talked out" or promised even higher returns if you roll-over your investment instead is another common sign.

In my next post I'll look at tell-tale signs a Ponzi scheme is about to go bust.

Colleen Cross

www. colleencross.com

Author of Exit Strategy

Ponzi schemes are especially popular during times of low interest rates or uncertain markets, like we have today. But if something sounds too good to be true, it often is. Here are five signs to look for.

1. Unusually high returns with little or no risk

All investments have ups and downs, and anything earning a consistent return, even in a down market is a red flag. Successful investors might beat the market some of the time, but not all the time. Ponzi schemes often have little variation in the return for year to year, despite market variations. If you are earning twenty percent when markets are declining, there's a chance it might not be real. These investment vehicles are often touted as "little" or "no risk", often giving some vague explanation about hedging risk. A key sign is offering a guaranteed minimum return in a short period of time, or a minimum annual return. Beware.

2. Unregistered Investments

Run, don't walk away from unregistered investments. Registered investments have the protection and scrutiny of securities regulators and are a source of information on a company's products, servies, managment and finances. Ask yourself one question- why is this investment unregistered? What are they trying to hide?

3. Unlicensed sellers

Most Ponzi schemes involve unlicensed sellers, simply because they need to stay under the radar to perpetuate their scheme.

4. Secretive or complex strategies

If an investment can't be explained well enough for you to understand, don't buy it. At best it is meant for a more sophisticated investor. At worst, and more likely, the seller is trying to obscure the investment because it is a fraud. Never invest in something you don't understand.

5. Issues with paperwork

Never invest in anything without a prospectus. A prospectus details the nature of the investment, risks, strategy, and rights and obligations of all parties. No paperwork? Forget it.

Other signs are errors or strange transactions on account statements, or absence of information when you request it. Excuses and delays mean there are problems.

6) Difficulty in getting payment- Any investment should be segregated from other funds held by the seller. Redemptions should be immediate. For some illiquid investments or large redemptions, this could take a few days if there are underlying assets that need to be sold in order to return funds. But never longer. Being "talked out" or promised even higher returns if you roll-over your investment instead is another common sign.

6) Difficulty in getting payment- Any investment should be segregated from other funds held by the seller. Redemptions should be immediate. For some illiquid investments or large redemptions, this could take a few days if there are underlying assets that need to be sold in order to return funds. But never longer. Being "talked out" or promised even higher returns if you roll-over your investment instead is another common sign.In my next post I'll look at tell-tale signs a Ponzi scheme is about to go bust.

Colleen Cross

www. colleencross.com

Author of Exit Strategy

Published on November 08, 2011 06:00

November 4, 2011

Exit Strategy Settings - Buenos Aires, Argentina

Buenos Aires is a wonderful city - some call it the Paris of South America. The food, wine, people and weather are spectacular. It also has some wonderful old buildings that I used as a setting in Exit Strategy.

I can picture Clara and Vicente living in this apartment in the upscale Recoleta disctrict - the sounds of the city drifting up from the streets below.

Find out more at http://www.colleencross.com/ or follow me on Twitter: @colleenxcross.com

Published on November 04, 2011 09:00

November 1, 2011

Exit Strategy Settings - Argentina

Igauzu Falls, Argentina

I love Argentina, and South America in general. That's why I chose it as one of the settings for Exit Strategy.

Here's a view of the amazing Iguazu Falls, which form part of the border between Argentina and Brazil. It is second only to Niagara Falls for the greatest annual water flow, which explains why one of the world's largest dams is located nearby. You wouldn't want to paddle too close to this part - known as Devil's Throat. This just might be where Vicente Sastre disappeared, though Iguazu doesn't give up its secrets easily.

Nearby is Ciudad del Este, Paraguay, where Ortega takes care of business. It's at the center of the Triple Border area, a notorious global hot spot for organized crime, contraband, terrorists and spies.

We visited the falls from both the Argentine and Brazil sides - it is truly amazing and one of the natural wonders of the world. The butterflies are fancy and even have lucky numbers (see the 88 on the wings below). This butterfly just stayed on our friend's hand for at least twenty minutes as she walked along the trails. A free ride I guess!

Published on November 01, 2011 10:00

October 28, 2011

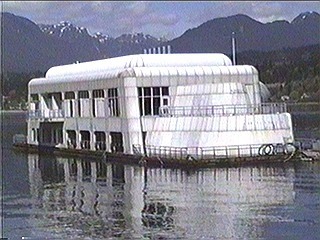

Exit Strategy Trivia

Remember the McBarge? If you lived in Vancouver during the eighties you might have heard of it. McDonald's had a floating restaurant at Expo '86. It was located near Science World on the fair grounds at False Creek, and you had to cross a pedestrian bridge to get on board.

If you've visited the False Creek area you'll know it's not there today. So where did it end up? It was floated up the Burrard Inlet, discarded in the eastern reaches of the inlet like some half-eaten Happy Meal. You can still see it from the Westcoast Express commuter train that runs along the water.

McDonalds wanted to keep it on after the fair, but discussions with the city didn't get anywhere. So it sits abandoned, although at least one movie has used the boat as a set. Every few years there is talk of resurrecting the barge for a variety of uses - everything from another restaurant to a homeless shelter.

The McBarge also plays a part in Exit Strategy, book one of the Katerina Carter suspense series.

Find out more at colleencross.com or follow me on Twitter: @colleenxcross.com

Published on October 28, 2011 09:39

October 25, 2011

Exit Strategy - Diamond Fingerprinting

All diamonds are pure carbon, but minute impurities in each stone identify the mine and the host rock they are extracted from. This is their "fingerprint." Until recently, specialized equipment did not exist to detect these impurities. Now experts can inventory these "fingerprints" and match them to a mine with the same chemical composition. This can provide a diamond's provenance, aid in proving theft, and enable recovery of stolen diamonds.

As you can imagine, security at diamond mines is extremely high. Despite that, criminals have infiltrated mines and found creative ways to steal diamonds, such as swallowing them, hiding them on their bodies, lobbing diamond-filled tennis balls over fences, and even flying them out on homing pigeons!

As you can imagine, security at diamond mines is extremely high. Despite that, criminals have infiltrated mines and found creative ways to steal diamonds, such as swallowing them, hiding them on their bodies, lobbing diamond-filled tennis balls over fences, and even flying them out on homing pigeons!

An inventory of fingerprints from every mine in the world would also allow verification of the diamond's source and legitimacy. Or, in the case of Exit Strategy, allow it to be traced back to the scene of the crime.

How can a fraud investigator expose a diamond laundering scheme? Find out in Exit Strategy - book one in the Katerina Carter fraud investigator suspense series.

http://www.colleencross.com/

As you can imagine, security at diamond mines is extremely high. Despite that, criminals have infiltrated mines and found creative ways to steal diamonds, such as swallowing them, hiding them on their bodies, lobbing diamond-filled tennis balls over fences, and even flying them out on homing pigeons!

As you can imagine, security at diamond mines is extremely high. Despite that, criminals have infiltrated mines and found creative ways to steal diamonds, such as swallowing them, hiding them on their bodies, lobbing diamond-filled tennis balls over fences, and even flying them out on homing pigeons! An inventory of fingerprints from every mine in the world would also allow verification of the diamond's source and legitimacy. Or, in the case of Exit Strategy, allow it to be traced back to the scene of the crime.

How can a fraud investigator expose a diamond laundering scheme? Find out in Exit Strategy - book one in the Katerina Carter fraud investigator suspense series.

http://www.colleencross.com/

Published on October 25, 2011 14:35

October 21, 2011

Exit Strategy – Diamond Laundering – Part Two

Diamonds have long been used by criminals, terrorists and other unsavory types as a form of currency. Unlike money, it escapes detection under money-laundering rules, and is easier to conceal.

That's one reason the Kimberly Process was initiated by South African diamond-producing states. They met in Kimberly, South Africa with a goal of thwarting the conflict or "blood" diamond trade, to ensure diamonds trades were not funding violence.

Today Kimberly process diamonds account for 99.8% of all diamonds traded. The United Nations General Assembly adopted a landmark resolution supporting the Kimberly Process Certification Scheme (KPCS), setting out the requirements for controlling rough diamond production and trade.

Members certify rough diamonds as 'conflict-free', and participating states must meet stringent legislation, enact strict export, import and internal controls and commit to transparency and exchange of statistical data. Trade is restricted to other members only, and all international shipments must have a KP certificate. Effectively, legitimate diamond cutting houses can only buy KP diamonds.

Members certify rough diamonds as 'conflict-free', and participating states must meet stringent legislation, enact strict export, import and internal controls and commit to transparency and exchange of statistical data. Trade is restricted to other members only, and all international shipments must have a KP certificate. Effectively, legitimate diamond cutting houses can only buy KP diamonds.

The Kimberly Process certification scheme has dramatically reduced the flow of conflict diamonds, and has also benefited developing countries by stabilizing economic development and reducing corruption.

Of course criminals will always find a way around it. Find out how in Exit Strategy - book one in the Katerina Carter fraud investigator suspense series.

http://www.colleencross.com/

That's one reason the Kimberly Process was initiated by South African diamond-producing states. They met in Kimberly, South Africa with a goal of thwarting the conflict or "blood" diamond trade, to ensure diamonds trades were not funding violence.

Today Kimberly process diamonds account for 99.8% of all diamonds traded. The United Nations General Assembly adopted a landmark resolution supporting the Kimberly Process Certification Scheme (KPCS), setting out the requirements for controlling rough diamond production and trade.

Members certify rough diamonds as 'conflict-free', and participating states must meet stringent legislation, enact strict export, import and internal controls and commit to transparency and exchange of statistical data. Trade is restricted to other members only, and all international shipments must have a KP certificate. Effectively, legitimate diamond cutting houses can only buy KP diamonds.

Members certify rough diamonds as 'conflict-free', and participating states must meet stringent legislation, enact strict export, import and internal controls and commit to transparency and exchange of statistical data. Trade is restricted to other members only, and all international shipments must have a KP certificate. Effectively, legitimate diamond cutting houses can only buy KP diamonds. The Kimberly Process certification scheme has dramatically reduced the flow of conflict diamonds, and has also benefited developing countries by stabilizing economic development and reducing corruption.

Of course criminals will always find a way around it. Find out how in Exit Strategy - book one in the Katerina Carter fraud investigator suspense series.

http://www.colleencross.com/

Published on October 21, 2011 13:09

October 19, 2011

Exit Strategy - Diamond Laundering - Part One

Money laundering has been around for many years, but did you know about diamond laundering?

Most countries have anti-money laundering laws, requiring banks and other financial institutions to report large or suspicious deposits and transfers. Fraud investigators know that following the money is always the best way to find the perpetrator behind the crime.

Criminals get around this by using cash-based businesses, (restaurants and casinos are favorites) as a front. High volume, low dollar cash transactions from many customers makes it difficult to trace the money's source. The downside is that this type of money laundering can be labor-intensive. It is also easier to detect with today's computing technology.

That's where diamonds come in. They're easy to conceal, have a recognized store of value and a well-developed market.

Whether it's African rebels exchanging conflict diamonds for arms or cash, drug dealers settling their bill with South American drug cartels, or terrorists financing terrorist cells, diamonds have long been used as a form of money. Of course, you can't exactly make change from a diamond. It's not divisible like money, and splitting it up destroys its value. Someone will eventually convert it into cash - on the black market, or by trying to sell rough diamonds to cutting houses in India, Belgium or other major global markets. Conflict diamonds are another story. Diamond cutting houses can only buy those diamonds certified under the Kimberly Process. More about that in my next post.

Whether it's African rebels exchanging conflict diamonds for arms or cash, drug dealers settling their bill with South American drug cartels, or terrorists financing terrorist cells, diamonds have long been used as a form of money. Of course, you can't exactly make change from a diamond. It's not divisible like money, and splitting it up destroys its value. Someone will eventually convert it into cash - on the black market, or by trying to sell rough diamonds to cutting houses in India, Belgium or other major global markets. Conflict diamonds are another story. Diamond cutting houses can only buy those diamonds certified under the Kimberly Process. More about that in my next post.

How does a fraud investigator expose a diamond laundering scheme? Read Exit Strategy - book one in the Katerina Carter fraud investigator suspense series.

http://www.colleencross.com/

Most countries have anti-money laundering laws, requiring banks and other financial institutions to report large or suspicious deposits and transfers. Fraud investigators know that following the money is always the best way to find the perpetrator behind the crime.

Criminals get around this by using cash-based businesses, (restaurants and casinos are favorites) as a front. High volume, low dollar cash transactions from many customers makes it difficult to trace the money's source. The downside is that this type of money laundering can be labor-intensive. It is also easier to detect with today's computing technology.

That's where diamonds come in. They're easy to conceal, have a recognized store of value and a well-developed market.

Whether it's African rebels exchanging conflict diamonds for arms or cash, drug dealers settling their bill with South American drug cartels, or terrorists financing terrorist cells, diamonds have long been used as a form of money. Of course, you can't exactly make change from a diamond. It's not divisible like money, and splitting it up destroys its value. Someone will eventually convert it into cash - on the black market, or by trying to sell rough diamonds to cutting houses in India, Belgium or other major global markets. Conflict diamonds are another story. Diamond cutting houses can only buy those diamonds certified under the Kimberly Process. More about that in my next post.

Whether it's African rebels exchanging conflict diamonds for arms or cash, drug dealers settling their bill with South American drug cartels, or terrorists financing terrorist cells, diamonds have long been used as a form of money. Of course, you can't exactly make change from a diamond. It's not divisible like money, and splitting it up destroys its value. Someone will eventually convert it into cash - on the black market, or by trying to sell rough diamonds to cutting houses in India, Belgium or other major global markets. Conflict diamonds are another story. Diamond cutting houses can only buy those diamonds certified under the Kimberly Process. More about that in my next post. How does a fraud investigator expose a diamond laundering scheme? Read Exit Strategy - book one in the Katerina Carter fraud investigator suspense series.

http://www.colleencross.com/

Published on October 19, 2011 12:30

October 7, 2011

Never Look Away - Linwood Barclay

I miss summer already, but one nice thing about autumn is that it gives us more time to read. And there's nothing like a good thriller to make you glad you're inside--and behind locked doors.

Linwood Barclay's Never Look Away is a taut, suspenseful page-turner with multiple plots and twists. Jan and David Harwood live in the small town of Promise Falls, where life is pretty much predictable. Just the perfect time & place for David's life to turn upside down when Jan suddenly disappears. Many twists and turns will keep you flipping the pages, and I guarantee you will not guess the ending. It will definitely keep you up past your bedtime too!

This is the first Linwood Barclay book I have read. I'm putting the rest on my to-read list. Loved it!

Get the Book

Published on October 07, 2011 21:09

September 17, 2011

Change Your Thinking - Change Your Life

Just re-read Brian Tracy's classic - very inspiring! Though many of the examples in the book relate to earning more money and enriching your career, you can apply it to any facet of your life. It makes you think about what's really important to you. The exercises at the end of each chapter give you the tools to really change your life. I highly, highly recommend this book - it can make your good life into a great one!

Link to Book

http://www.colleencross.com/

Link to Book

http://www.colleencross.com/

Published on September 17, 2011 12:24