Dave Grossman's Blog

October 15, 2025

Round Up: Cathay F Award Space + Transfer Bonus, Marriott Promo, Amex’s New “Trip Cancel Guard®”

If you’ve been wanting to try Cathay Pacific’s First Class product (and why not? it’s a great product in a world of dwindling “true F” cabins to try), there’s a boatload of availability. Gary from View from the Wing flags the exact dates in this post.

You can also connect onwards to the rest of Asia or Australia or New Zealand.

Of note:

There is a transfer bonus! Not specific to any airline, you can register here before converting from American Express, Citi, Capital One. or Bilt Rewards. (Also a good time to consider a limited time credit card offer for 100,000 points to replenish!) Cathay Pacific AsiaMiles has long had a quirk where more is less! If you book a First Class segment to Hong Kong and then Business onwards (since most routes own’t have F), AsiaMiles reprices the mileage due to LESS than the F segment would be alone. This is because now a % of your entire trip is at a lower class of service and they politely prorate. Taxes/fees will rise, though. I also got an alert from Thrifty Traveler about this deal, also with dates. You can subscribe to their alerts with $20 off using our referral link .This space is not being made available to oneworld partners. You’ll need AsiaMiles.I haven’t been on Cathay Pacific in First in over a decade but have fantastic memories of it.

Cathay Pacific First Class

Cathay Pacific First ClassThis picture looks like it was just yesterday, right? RIGHT?

Fun fact: That was my very first 3 cabin international First Class redemption circa 2011  I’d been redeeming for Business Class for years, not knowing what I was missing out on!

I’d been redeeming for Business Class for years, not knowing what I was missing out on!

Marriott Bonvoy *finally* has a new promotion available to everyone after many months of targeted offers that mostly serve to anger those not targeted. Unfortunately, the promo available to everyone won’t feel very good when you hear that *some* people have offers for 5 elite nights from a stay of just one night, up to 2 times.

The global promo is:

From October 28, 2025, to January 10, 2026, registered Marriott Bonvoy members can earn 2,025 bonus points on up to three stays, plus an additional 2,000 bonus points on each stay with Marriott Bonvoy Outdoors.

Registration is open here now through December 27, 2025. (I might suggest trying the general promo page link first in case you have a better offer?)The promotion earning period is for eligible paid nights completed between October 28, 2025, and January 10, 2026, and is applicable only to stays booked on a points-eligible rate (“Qualifying Rate”), excluding Award Redemption Stays, at properties participating in Marriott Bonvoy.Stays at BVLGARI, The Ritz-Carlton Yacht Collection, Marriott Executive Apartments®, and owner-occupied weeks at Marriott Vacation Club®, Grand Residences by Marriott®, Marriott Grand Residence Club, Sheraton Vacation Club, Westin® Vacation Club, The Ritz-Carlton Club®, The St. Regis Residence Club®, and The Luxury Collection Residence Club® are not eligible for this promotion.One place where Hyatt really outshines Marriott is that, in their promos, award stays count. Not with Bonvoy…

I’ll wind up getting one 2,025 bonus but certainly would not have gone out of my way to book Bonvoy for it (in the same way I wouldn’t select Hilton just for their most recent promo). Then again, I haven’t actually seen a Hyatt promo in I don’t know how long…

American Express Launches Trip Cancel Guard®American Express has just launched this new quasi-insurance product (though it’s decidedly NOT insurance and can be bought in conjunction with actual trip insurance) which will let you claim up to 75% of the cost of a flight that you cancel within certain parameters.

You can see all the details on the Trip Cancel Guard landing page.

You have to follow some very specific parameters in that you need to add coverage within 30 days of booking and more than 5 days before a flight, the trip must be at least $300 (including taxes and fees) but less than $20,000 (not a problem on the high side!). You’ll pay 10% of the cost of the flight. If you cancel, the airline can’t issue you a voucher or the Cancel Guard is not eligible. But if the airline won’t give you anything back, you can file a claim for up to 75% of what you are out of pocket.

You can book at AmexTravel and add seamlessly (including with points) but you can also add at the Travel Guard landing page directly if you book via a third party or directly with an airline.

I think the actual utility of this is probably not so great with most US carriers offering refunds to vouchers, but if you book something somewhat speculatively (perhaps a great sale, but you are uncertain of final plans), it could make sense.

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount - all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted. Terms apply. Get This Offer

.sc-offer{

display:inline-flex;

flex-wrap:wrap;

border: 1px;

border-style: solid;

border-color: #D2B48C;

padding: 1em;

font-family: 'Muli', Sans-serif;

}

.sc-offer .col{

padding: 8px;

}

.flex-direction{

flex-direction:row;

}

.offer-image{

width:33.33%;

}

.offer-image img{object-fit: cover; width: 100%;}

.offer-text{

width:66.66%;

}

@media screen and (max-width: 500px) {

.flex-direction{

flex-direction:column;

}

.offer-image{

width:32px;

height:auto;

}

.offer-text{

width:100%;

}

}

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

October 14, 2025

Bilt Gets Ready for Points Earning Mortgages

When Bilt raised their last round of funding which valued the company at over $10 billion dollars, it included an announcement that UWM (United Wholesale Mortgages) had invested $100 million dollars into the round. So even in July, we knew who the launch partner would be for mortgages, something we’ve long known was “eventually” coming.

Today’s announcement doesn’t add a ton onto what we’ve already know (if you were paying attention!) but it does give us more of a sense of when this will all happen and that is early next year.

The press release states “The phased rollout of services between UWM and Bilt will begin in early 2026. Full product details, implementation timelines, and the transition process for existing UWM customers will be announced in the coming months.”

And there is how they specifically describe the Bilt / UWM partnership as far as earn:

● Earn Bilt Points with every on-time mortgage payment through Bilt’s reward program, ranked as the highest-value rewards currency in the market;

● Experience the industry’s fastest, most seamless, and cost efficient origination

process through UWM;

● Access exclusive neighborhood benefits including special offers from more than

40,000 local merchants nationwide, making homeownership more rewarding beyond

the four walls of one’s home;

● Earn Bilt Points during origination—Bilt’s 5+ million members can earn points on

their monthly payments when working with UWM brokers.

I have just a couple of questions (which I have posed to Bilt but have not heard back yet).

One is if this only applied to brand new mortgages or might it apply to refinances? I’m sure there are many people that would love to refi and start earning points for their mortgage. The second, which is obviously trickier, is if there will be rate parity on loans originated via Bilt vs without. One would hope the rates will be identical and the loan originator is considering the points as a marketing fee the same way they would be paying any middle man. If so, there is likely (we still need to see earn rates!) a HUGE reason to choose the Bilt network for a mortgage. Frankly, if I am being offered 6% without Bilt points or 6% with Bilt points, it’s a pretty obvious choice.

Also note that this confirms that, at least in phase one of this rollout, you won’t just be able to throw any old mortgage on to your Bilt credit card.

My guess (hope?) is that they plan to roll it out this way first and *eventually* get to where they are on rent payments – any lender, one way or another.

Thoughts?Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Rove Miles Adds “Loyalty Eligible” Bookings + Get 1,500 Rove Miles with Promo Code

If you still haven’t heard of Rove Miles, you’re about to.

For years I have been begging for a company to offer portal bookings that were “direct bookings” in exchange for a much lower earn rate to compensate for the significantly lower commission these bookings earn.

As of today, Rove Miles is doing just that.

First, you’d be forgiven if you haven’t yet heard of Rove Miles. It took me a bit of time to get up to speed with them. I met up with Max, one of the co-founders, a few weeks ago in NYC and they definitely appear to have a firm understanding of this market, perhaps best shown by how far. they have gotten in such short time.

They have a number of useful transfer partners (and I expect more to come):

Aeromexico RewardsCathay Pacific AsiaMilesEtihad GuestFinnair Plus (which means all Avios programs via transfers)Air France Flying BlueHainan Airlines Fortune Wings ClubAir India Maharaja ClubQatar Privilege Club (again, that means any Avios in the end)Thai Airways Royal Orchid PlusTurkish Airlines Miles&SmilesVietnam Airlines LotusmilesAccor Live Limitless (ALL): 1.5 to 1 ratioThey even have two limited time transfer bonuses going on at the moment: 20% to both Air France Flying Blue and Finnair Plus.

The main way to earn Rove Miles is booking flights (earn 1X-10X miles, but yes, that is a portal booking, booking hotels (previously only prepaid, but you get the miles immediately and I have seen as high as 71X on hotels and yes, that means you could book a $1,000 hotel and earn 71,000 miles, usable immediately), and shopping rewards (like Rakuten).

With this announcement, Rove users can book Loyalty Eligible hotels directly on Rove’s platform—and still earn hotel points, elite night credits, and status benefits in addition to Rove Miles.

To celebrate the launch, Rove is offering double Rove Miles on all Loyalty Eligible hotel bookings through October 31, 2025—totaling 10x Rove Miles per $1 spent—in addition to any hotel points and credit card rewards earned.

When available, Loyalty Eligible rates will appear in search results right next to standard rates. Once booked, these reservations sync seamlessly with each user’s hotel loyalty account.

To celebrate this launch (which, if I have not been clear enough about, I love!) I have two things to note:

I asked for something for MilesTalkers – and I got it. If you are new to Rove Miles , use my link and get 1,500 Rove Miles immediately on account creation. You don’t need to even complete a booking to earn those 1,500 miles. But you will only get 1,500 miles if you signup by October 21st! After that, you’ll get 500 miles when signing up from the same link. There are a few other blogs out there with the same offer but none have better.I asked Carissa Rawson, Director, Travel and Marketing for Rove, to host a Facebook Live for the MilesTalk Facebook group . We are going to do that on Monday October 20th at 3pm ET (yes, a recording will be available if you can’t make that time). That will be your opportunity to “Ask Rove anything” about literally anything. Carissa will demo the platform for us, including the new “Loyalty Eligible Hotels” feature and then you can ask anything you want. Feel free to start dropping any questions or comments in the Comments below and we’ll make sure they are answered on the Live. Here is a direct link to RSVP for the Facebook Live .I know you can already get rewards for direct bookings going through portals. For instance, Rakuten will give you 4X on a Marriott booking today and those can be earned as American Express Membership Rewards points (and soon you’ll be able to earn Bilt points via Rakuten). But that’s not consistent. At any time I might want to book a hotel that is paying only 1X or 2X on Rakuten or another portal but is still 5X at Rove. That is when it will be easy to choose Rove.

I will note that as of now these are prepaid bookings, but you can cancel them according to the terms of the specific booking. Rove is the merchant of record, so use a credit card that has a bonus multiplier for (all) hotels. Also, it might be a bit confusing in the UI to tell which bookings are eligible once you click into the hotel. Right now the best clue is the 10X earn. On the next screen it will either say something like “World of Hyatt Eligible.”

Happily, if you do accidentally choose a non-eligible rate you will see a warning that says: This is a preferred rate through Rove, which is not eligible for loyalty benefits with World of Hyatt. View World of Hyatt rates here.

I *assume* Cashback Monitor will soon be showing the 5X on Rove (10X until October 31, 2025) for comparison as well…

Below are some images of the Loyalty Eligible Hotels feature:

Rove Miles – Loyalty Eligible Hotel Bookings

Rove Miles – Loyalty Eligible Hotel Bookings Rove Miles – Loyalty Eligible Hotel Bookings

Rove Miles – Loyalty Eligible Hotel Bookings Rove Miles – Loyalty Eligible Hotel Bookings

Rove Miles – Loyalty Eligible Hotel Bookings Rove Miles – Loyalty Eligible Hotel Bookings

Rove Miles – Loyalty Eligible Hotel Bookings Rove Miles – Loyalty Eligible Hotel Bookings

Rove Miles – Loyalty Eligible Hotel Bookings Rove Miles – Loyalty Eligible Hotel BookingsThoughts?

Rove Miles – Loyalty Eligible Hotel BookingsThoughts?Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

October 13, 2025

How to Evaluate the Amazon “Pay 714 Amex Points” Offers

If you are a savvy Amazon shopper that also has rewards credit cards, you are no doubt familiar with the “Pay One Point” offers.

We have a compilation of Amazon Pay One Point offers that we update regularly, and last week during a two day “Prime Days” sale, we found a new round of offers from American Express Membership Rewards.

These offers generally let you (if you have a linked rewards card and are targeted) redeem just one point in order to get a variable discount which could be 15%, $15, 40% or $60 (with a minimum purchase). Those are obviously no brainers. Even if you only get 15% off up to $100 in spend, you are getting $15 off total – and these can be spread out over multiple purchases though they will expire at an unknown time so it’s best to not sit on them too long.

(This is the Amex link to check if you are targeted. We may earn a commission on items purchased from Amazon when you use our links. Thanks for your support if you do.)

Amex first floated a trial balloon of requiring 714 points instead of one point a couple of years ago, but then they went away and we went back to one point. This makes the math harder because we value 714 Amex MR points at about $12 using a value per point of 1.7 cents. That value assumes using Amex airline/hotel transfer partners for max value.

But Amazon will only redeem those same 714 point for $5. So you are spending about $12 to get $5 off, a delta of $7.

That means that you need to evaluate your own deal to see if it’s worthwhile.

This is the deal I just got:

Put another way, 40% off up to $60 with 714 points means I can get 40% off up to $150 which maximizes that $60 off. I do have to spend $7 net in points (use $12 in points; get $5 off). That brings me to a still *very* profitable $53 back. Even if I needed to split the purchase in two because I didn’t have $150 to spend in one shot, I could still justify spending $14 to save $60.

But what if my offer was the much less desirable 15% off, up to $15, when you spend 714 points?

It’s easy to completely dismiss that, right? Well, the truth is that I’d feel like I got a horrible deal, but I’d do it anyway.

The math would simply be worse. I’d spend $7 (again, I’m spending $12 worth of points but getting $5 off at checkout) and save $15. That’s still $8 free. Worth breaking a sweat over? Not really. Do it or don’t. But the point is that even this “worst offer” is worth $8.

The catch on that is that you do need to spend most or all of the offer in one shot for it to be worthwhile. If you spend less than $50 for 15% off, that’s the breakeven to actually lose money doing it, so don’t do that!

Caveat: if you always spend your Amex points for twice our average of 1.7 cents each, for an average of 3.4 cents each, or if you have very few Amex points and are saving for a premium cabin redemption, I would say to save your points rather than burn them on the 15% offer.

Why did I write all this? Because when I posted the offers last week, there seemed to be a lot of confusion about if the deal was still a deal or if it was completely worthless, so I thought I’d break down the nuance.

If you didn’t do the deal during Prime Days, don’t worry… the Pay One or Pay 714 Points deals didn’t expire then, so you can still check if you are targeted. And if you need some help on the math, come on back

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount - all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted. Terms apply. Get This Offer

.sc-offer{

display:inline-flex;

flex-wrap:wrap;

border: 1px;

border-style: solid;

border-color: #D2B48C;

padding: 1em;

font-family: 'Muli', Sans-serif;

}

.sc-offer .col{

padding: 8px;

}

.flex-direction{

flex-direction:row;

}

.offer-image{

width:33.33%;

}

.offer-image img{object-fit: cover; width: 100%;}

.offer-text{

width:66.66%;

}

@media screen and (max-width: 500px) {

.flex-direction{

flex-direction:column;

}

.offer-image{

width:32px;

height:auto;

}

.offer-text{

width:100%;

}

}

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

October 9, 2025

Conrad Algarve Review

I’d long wanted to visit the Conrad Algarve in the south of Portugal. For so long, in fact, that I can’t even remember how it got into my head in the first place! But when we finally planned a long-awaited summer trip to spend 10 days exploring Portugal, I knew the time had come.

Our stay cost $0, despite cash rates of about 800 Euro (just under $1,000) a night. For our four night stay, we used 3 Hilton Honors Free Night Reward certificates from a combination of the Hilton Honors Aspire and Hilton Honors Surpass® credit cards plus 90,000 points for the 4th night (It now appears to be 100,000 points per night for a standard room – still a great deal in season, giving you about 1 cent per point in value for your Hilton Honors points).

We also knew we’d be able to each use our $200 bi-annual Hilton Aspire credit card resort credits at this property, so that was a nice $400 rebate that we used to treat ourselves to massages while our son enjoyed some activities at the kids club (which I’ll highlight a bit below).

The hotel is certainly posh! No question about it.

The Algarve is an expensive area that attracts what would best be described as the Hamptons crowd, but I’ll explain in a bit how surprised (disappointed) we were with the area as a whole compared to expectations.

When you arrive, you’ll no doubt notice fancy sports cars near the valet stand. Michael Jordan was apparently a guest at the Conrad just a few weeks prior. I do think that, if you are looking for luxury in this part of the Algarve (about 15 minutes from Faro), the Conrad is THE spot.

And it is a GORGEOUS hotel.

Conrad Algarve

Conrad AlgarveI’d let them know in advance that it was a special occasion (our 5th wedding anniversary) and also that we were hoping for an Diamond upgrade since standard rooms are tight with a toddler and Hilton Honors has no realistic way to book suites with points (I mean, you CAN, but at more than ten times the points cost of a standard room and also you cannot use certificates – so it wasn’t a real option).

When we checked in, unfortunately there was no standard suite available (and truly, there wasn’t) but they did leave a bottle of champagne in the room and that was greatly appreciated!

But I want to also mention that this Diamond upgrade request turned into the most gauche part of the stay….

There have been many times where I’ve stayed at a hotel and, when no upgrade was available at check in, an offer is made to contact me if one opens mid-stay with the option to move. I’d generally wind up declining as moving rooms is a hassle, but it depends on the room assigned and the suite available.

I’ll also note that Hilton does not require any meaningful upgrade in its terms and conditions, so the hotel didn’t do anything wrong as it relates to the Hilton Honors program.

But what happened next blew my mind.

On the second night, we were offered an upgrade for the last two nights, but as follows:

We would like to follow up regarding your request to upgrade the room. We are pleased to inform you that a King Deluxe Suite has become available for the last two nights of your stay.

The supplement for this suite is currently €439. As a Diamond member booking directly, you’re eligible for a complimentary upgrade upon arrival, which unfortunately wasn’t possible earlier due to the lack of availability. However, we are happy to offer you a special discounted rate of €375 for this spacious suite.

Please let us know if you would like to proceed, so we can make the necessary arrangements and adjustments to your booking.

So, while they’d said it would have been complimentary when we checked in (if available), they were giving us an incredible €64 off the public rate to move halfway through the stay. I could not feel that Diamond member “thank you for your loyalty” any more than at that moment! Even my wife (who very much sits on the sidelines with regards to my fanatical loyalty program obsession) gave me a huge WTF look and asked me how in the world that was a real email. Then they called to follow up and my wife answered and said something to the effect of “Are you serious with this? It feels like a slap in the face to offer a 15% discount on what would have been complimentary for our status” and they confirmed that was indeed the offer. We declined.

The other time we felt like it was a bit of a nickel and dime hotel was at dinner the first night when we asked for water and were informed that water could not be provided unless we paid $12 for a bottle. It was the only hotel on our 16-day trip in Europe that a hotel wouldn’t provide tap water. The waiter even said the hotel waiter was filtered and safe, but they were instructed not to provide it.

Conrad Algarve Pizza / Main Restaurant

Conrad Algarve Pizza / Main Restaurant And yet, there was so much about the resort that was the TOTAL OPPOSITE of these and truly generous, which actually made it all the more confusing.

The parking, including valet was free for everyoneThe family pool had tons of free inflatables available. I’ve never seen this before and it was fantastic. It could be that it was a way to keep people with kids away from the main pool – and if so, well done! It worked!They did give us the bottle of champagne in the room on arrival for our anniversary.Though the restaurant wouldn’t provide water, there were unlimited small boxes of water available at reception all the time on request.The Diamond breakfast was PHENOMENAL. More on that below, but it is really above and beyond what was required of a Hilton Honors property.Diamonds are also offered both a complimentary welcome drink AND a complimentary bottle of local wine with a meal at their restaurant. Complimentary Wine for Diamond Guests (1X / stay) – Conrad Algarve

Complimentary Wine for Diamond Guests (1X / stay) – Conrad AlgarveOK, so with all of that out of the way……

The RoomThe standard king room was well appointed, although the bathroom was quite awkward in that you could only turn the light on from outside and you also could not lock the door. Let me tell you that whoever thought that non-lockable sliding doors on a bathroom door was the way to go does not have kids….

The bath and shower were both nice, the room was a comfortable size, and we had a great view of the construction of condos next door. But it was from the top floor!

Conrad Algarve

Conrad Algarve

Conrad Algarve

Conrad Algarve Conrad Algarve

Conrad AlgarveHonestly the view didn’t bother me since we weren’t there to be in the room, but yes, I suppose that it was hard to consider it to be a preferred room when while it was on the highest floor, it literally viewed a construction site. But I know they were quite full, so no big deal.

Conrad AlgarveThe Property / Pools

Conrad AlgarveThe Property / PoolsThe property was mostly the pools (two of them), plus the spa – which had its own pool –the Kid’s Club, and the restaurant. The food at the restaurant was all good as was the service and, if not for the water thing, we probably would have dined there a second time. They did have a nice feature where someone from the Kid’s Club would have activities during the earlier hours, but we were on a late schedule and somehow wound up missing those times at both breakfast and dinner each night.

Conrad Algarve – Both Pools

Conrad Algarve – Both Pools Conrad Algarve Main Pool

Conrad Algarve Main Pool Conrad Algarve Main Pool

Conrad Algarve Main PoolThe higher pool was intended for those without kids and the lower pool was for families.

As I mentioned above, they didn’t explicitly ban families from the higher pool, but with only the lower pool having a shallow section (plus a small, very shallow mini-pool for infants/ younger toddlers) and a ton of inflatables, all of the families wound up at the lower pool, even though only the upper pool was heated. Then again, it was in the 90’s during our stay so the water was warm enough.

Conrad Algarve Family Pool

Conrad Algarve Family Pool Conrad Algarve Family Pool (And Small Toddler Splash Pool in the Back)

Conrad Algarve Family Pool (And Small Toddler Splash Pool in the Back) Conrad Algarve Family PoolKid’s Club

Conrad Algarve Family PoolKid’s ClubThe Kid’s Club was very interesting in that it was only available at an additional charge. But it actually worked just fine like that! There was a morning session, a lunch session, and an afternoon session. I only recall the cost of the afternoon session as that is what our son did one of the days and it was 3.5 hours for 45 Euro, from 1 to 4:30.

Conrad Algarve Kid’s Club

Conrad Algarve Kid’s Club Conrad Algarve Kid’s Club

Conrad Algarve Kid’s Club Conrad Algarve Kid’s Club

Conrad Algarve Kid’s Club Conrad Algarve Kid’s Club

Conrad Algarve Kid’s ClubThe reason I didn’t mind the cost was that it meant the club had very few kids in it and they therefore had a very good staff to kid ratio which made us feel much more comfortable leaving him for a few hours, which we’d never done before.

They also had set activities planned for each day, things like making food or arts and crafts projects – in additional to general play time and even light outdoor activities like soccer.

Conrad Algarve Kid’s Club Activity Schedule

Conrad Algarve Kid’s Club Activity ScheduleHe had a great time and the staff all seemed very friendly and on top of things, so it worked out very well. It seemed to be one of our son’s favorite kid’s clubs so far.

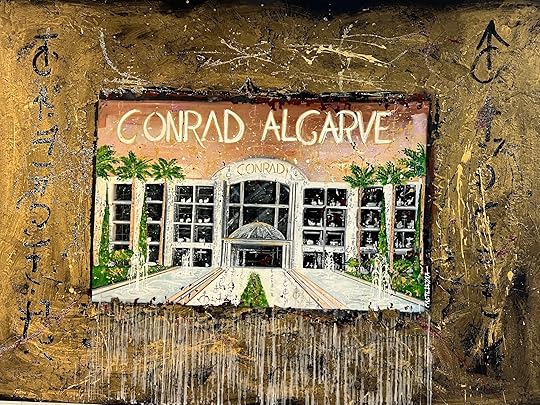

BreakfastFor Gold and Diamond members, everything was included – no restrictions.

There was an extensive buffet, and you could also order anything at all off the menu – even things that were on the buffet if you just wanted something freshly made. Here was the menu of what was available beyond what was on the buffet, which also featured a chef’s plate of the day which varied each day.

Conrad Algarve Breakfast (Gold/Diamond)

Conrad Algarve Breakfast (Gold/Diamond) Conrad Algarve Breakfast

Conrad Algarve BreakfastYou could also order any coffee drink you wanted. No limits on anything and they were fantastic about allergies as well.

Conrad Algarve Breakfast

Conrad Algarve Breakfast Conrad Algarve Breakfast

Conrad Algarve Breakfast Conrad Algarve Breakfast

Conrad Algarve Breakfast Conrad Algarve Breakfast

Conrad Algarve Breakfast  Conrad Algarve Omlet

Conrad Algarve Omlet Conrad Algarve Breakfast

Conrad Algarve BreakfastThe food was all delicious as was the coffee and I looked forward to breakfast each day.

SpaWe both had massage treatments which were reasonable and good, but I want to mention that Diamond members do get complimentary access to the spa facilities which include a bit of a water circuit, a cold plunge, two shower “experiences,” a sauna, a steam room, and one of those things of ice pellets you can use on sore spots.

The BeachIt’s important to know that while the Conrad contracts a beach area, all beaches in Portugal are public by law. So while the Conrad provides a shuttle to their beach club, it’s actually a public beach club with absolutely no preference given to guests. They can’t even reserve beach chairs for you at the hotel. First come, first served. The surf at their beach is also on the rougher side. We took a chance and drove to a different local beach but that was quite an adventure as the beach club renting chairs at that beach was full but we had success in passing some cash to the attendant at a hotel on the beach and securing two chairs there which was just as good. That said, the beach wasn’t too special and if you are planning a trip to this area for the beaches, be aware that while these may be decent beaches, they are far from what you might expect if you’re used to, for example, Caribbean beaches.

Add to that the challenge of not even knowing if you’ll be able to get chairs when you arrive and I’d say to just stick to the pools at the resort.

The Local AreaThere’s a small complex across from the resort with a few restaurants and shops which is an obvious choice if looking to go off property. For one meal we went to an incredibly local place where the was one man taking orders from one written board and also doing all the cooking. Interesting stuff. We had one meal at the Italian restaurant across the street which was pretty good. Our last meal was at a place called KoKo which was on a golf course and was pretty much overpriced mediocre food with super uninterested waitstaff and lots of kids just running all over the place so I’d avoid that one.

Faro was about a 30-minute ride away of you want to see an actual town in the Algarve without going too far.

The StaffEveryone was super nice, full stop. Once we got the concierge helping us, we had everything sorted and he gave great advice and followed up by WhatsApp as promised.

A weak link was that although they have this one wonderful concierge, the front desk agents apparently are all told to be concierges as well.

So, on our first morning, we made the mistake of asking a front desk agent for the concierge. She said she was *also* a concierge and we began asking about the beaches and tours and restuarants, etc. Everything wound up being “let me ask my colleagues and get back to you.” She didn’t actually seem familiar with the area, a conclusion we reached after an hour with our kid going absolutely nuts from how long it was taking.

The icing on the cake was that we asked her to try and reserve us beach chairs and make lunch reservations at a beach club (not the Conrad’s) for the next morning and while she probably did make many calls that went unanswered, she didn’t let us know she was unsuccessful until 1:45pm the next day. Mind you we were asking about…. The next day!

By the time we got her email we’d already made our own way to whatever beach we found and had already had lunch. Did she think we were just waiting all day to see if she could come through? That was a bit ridiculous. It was *after* that when we found the real concierge.

Long story short – only trained concierges that REALLY know the intricacies of an area should be acting as concierges. It’s far worse to give bad advice or flat out not know how things work and have a guest lose time or lose out on activities because you didn’t know. She should have told us when the concierge would be in and we’d have saved an hour of our time and gotten things right from the start.

OverallI think you can tell it was a bit of a mixed bag. An overall beautiful property with nice staff and quite a bit of generous treatment for Hilton elites (while at the same time, you know, not always). Solid pools and it does a great job making families with children feel very welcome while at the same time taking nothing away from the upscale feel for those without children.

If you are using Hilton points or Free Night Rewards, the hotel is certainly a solid choice. Now you know some pros and cons and can decide for yourself if it’s for you.

If you’ve been, or are thinking of going, let me know in the comments!

Thoughts?Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Capital One Shopping Adds Marriott Gift Cards as Redemption Option

Capital One Shopping (not the portal where you earn Capital One miles, but Capital One Shopping specifically – where you don’t even need a Capital One credit card to use it) is a portal that I have a love / hate relationship with.

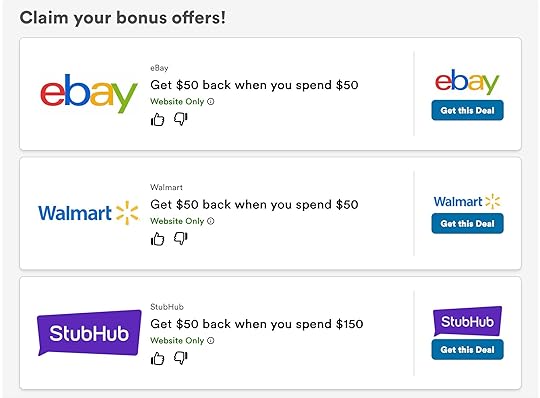

I love how rich the offers can be. I mean, look at these offers below. I actually just used the Walmart one, spending $52 and getting back $50. And it actually tracked!

But that last comment about it tracking is why I also hate Capital One shopping. I’ve had to submit support tickets for more shopping trips for not receiving owed rewards than I have gotten automatically. Based on some of the commenters on this post I wrote about why I was done with Capital One Shopping, I’ll eventually have them tell me they won’t credit any more of their own mistakes, so I look forward to that.

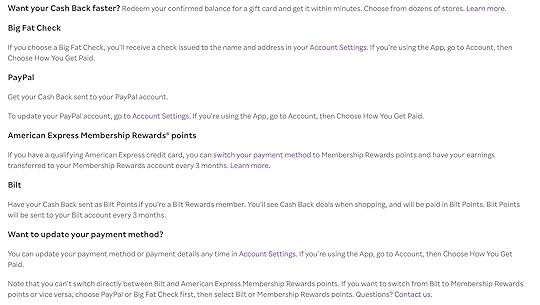

The other issue is that you can only cash out your earned rewards for gift cards and for quite some time, those options have been very meh. I did once enjoy a Hulu gift card, only for the gift card to not actually work at Hulu.

So when I saw Marriott gift cards available for cash out last night, I jumped. (Funny enough, I see that Nick @ Frequent Miler discovered the same, had the same reaction, and also cashed out for Marriott  Nick’s articles on C1 Shopping were how I first got into it, for better or worse!). You can cash out for up to $2,000 per gift card, so I took my unredeemed earnings and went all in for a $400 gift card.

Nick’s articles on C1 Shopping were how I first got into it, for better or worse!). You can cash out for up to $2,000 per gift card, so I took my unredeemed earnings and went all in for a $400 gift card.

My gift card arrived within about 2 minutes, so that was nice and easy.

But jump quickly, since gift cards are somewhat personalized by account and the good stuff always vanishes quickly, leaving you with things like Boscovs and LL Bean…..

Thoughts?

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount - all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted. Terms apply. Get This Offer

.sc-offer{

display:inline-flex;

flex-wrap:wrap;

border: 1px;

border-style: solid;

border-color: #D2B48C;

padding: 1em;

font-family: 'Muli', Sans-serif;

}

.sc-offer .col{

padding: 8px;

}

.flex-direction{

flex-direction:row;

}

.offer-image{

width:33.33%;

}

.offer-image img{object-fit: cover; width: 100%;}

.offer-text{

width:66.66%;

}

@media screen and (max-width: 500px) {

.flex-direction{

flex-direction:column;

}

.offer-image{

width:32px;

height:auto;

}

.offer-text{

width:100%;

}

}

October 7, 2025

Bilt Adds Etihad Guest as 20th Transfer Partner

Yes, 20. Not bad!

As of today, you can transfer your Bilt Rewards points to Etihad Guest.

Amex, Citi and Capital One all transfer to Etihad Guest, according to our matrix of transferable points, so most of you already likely have a route to transfer to Etihad Guest with or without Bilt having them as a transfer partner.

Also, it’s easy to forget, or not know, that Etihad has what is probably the least consumer-friendly cancellation policy around. When we think of using miles for flights, we (these days) think of easy cancellations.

I know I will often use miles at almost any cost for a trip far out so I know I can cancel and get my miles back pretty easily (Alaska will keep their $12.50 partner booking fee and JetBlue will put the taxes and fees into a credit valid for a year, for example, so it’s not necessarily 100%). Otherwise you get a voucher goof for a year on most US carriers, which is generally fine, but maybe not so much if you don’t fly that airline often.

But Etihad goes the other way and, on top of the fact that its miles hard-expire after 3 years (I just redeemed 5,200 expiring miles for a $30 Amazon gift card at least!) they are incredibly punitive with nearly all cancellations per the below chart from their website:

Ticket issued before19 Jun 2025 as GuestSeatTicket issued/reissued

from 19 Jun 2025Time to departure Value Comfort Deluxe Within 24 hoursXX X75%1 to 7 days75%75% 75%50%8 to 21 days50%50% 50%25%More than 21 days25%25% 25%Free

Indicates fee as a percentage of the fare

Business Class awards via EtihadGuest seem to “start” at Comfort but even with that, as soon as your 24 hour risk free deadline passes, they best you can do is 25% of your miles back. And then, per this Award Wallet post, they may use some convoluted formula, which I honestly don’t 100% understand after reading it 3 times, to give you back miles instead of cash for the cash part of your booking.

Now, Etihad Guest can still represent some great value. While I’d definitely prefer to book Eithad flights using a partner like AAdvantage (1st choice) or Air Canada, Etihad has some pretty awesome pricing on JetBlue where a Mint seat from the East Coast to the Caribbean will run you just 40,000 Etihad Guest miles. You can also use them on AA flights, but the sweet spot that existed there for a long time is long gone…

I’ll summarize with:

Happy to see another new Bilt partnerBilt points are more valuable than their other transfer partners you may already have access to, so Bilt would be a last resort on a transfer to EY.Make sure you have studied up on Etihad Guest before trying to transfer any points over…Thoughts?Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

October 6, 2025

HUGE: (Soon) Earn Bilt Points via Rakuten!

The leak machine is on, and reports are coming out of both View from the Wing and Reddit that the Help section on Rakuten seems to have added Bilt as an earning option alongside American Express Membership Rewards.

This means that the new member promotion to get $50 or 5,000 points will be able to be earned as Bilt points real soon, though not that only the Help section is updated with the Bilt info and as of this second, you can’t yet actually switch to earning Bilt – but I will as soon as it’s live!

Below is the updated help section.

I love my Amex points, but Bilt points are pretty undeniable more flexible (and therefore valuable) with their roster of transfer partners including Hyatt, Alaska, and JAL… and even portal redemptions are at 1.25 cents vs 1 cent with Amex.

But the best part of Bilt transfers is for sure their Rent Dat (1st of the month) deals which sometimes, though not always, includes an outsized transfer bonus based on Bilt tier level with 100% transfer bonuses (1:2) coming around more often than they should for Platinum members (which does require 200,000 Bilt points earned or $50,000 spent on the card in a calendar year, so by no means is the average Bilt user Platinum, I know…) but are still outsized at all tier levels. (You can see a historical list of Bilt transfer bonuses here).

And as I mentioned before, if you are new to Rakuten, you can get 5,000 points when you join and spend $50 on *anything* via Rakuten within 90 days. That referral offer has been extended and you can wait for Bilt to come online, but you can also signup now and simply switch to Bilt later as the Help terms clearly say….

Will you need a Bilt credit card or just a Bilt Rewards account?

Good question! I *think* you will need a Bilt credit card because you do need a linked Amex MR account to earn Amex. However, we’ll have to wait for it to be live to know for sure, since I wouldn’t put it past Bilt to open this up to all members that link a Bilt Rewards account. We’ll know either way soon!

Who else is excited to switch to Bilt on Rakuten?

Thoughts?Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Hilton Launches the Outset Collection

The Outset Collection is Hilton’s 25th brand. They say the “Outset Collection will join Hilton’s robust Lifestyle portfolio, which also includes NoMad, Canopy, Curio Collection, Graduate, Tapestry Collection, Tempo and Motto.”

In positioning the brand, they say that the “Outset Collection will feature a range of hotels, with upscale finishes and story-driven design.”

From the press release, it sounds like it’s going to be a bit of a catch-all brand for independent hotels that tend towards the upscale side of things, but I don’t think they will all necessarily be full service as they also say “food and beverage offerings will vary across the brand, based on market demand, guest sentiment or hotel experience, ranging from cafes with light bites to full lunch and dinner concepts.”

My hunch is that it will be a bit of a hodge hodge of hotels that lean to the upscale side of things. You can certainly have a hotel without a robust food offering that is still a fantastic hotel, of course, although I tend to think of anything Id consider luxury to have at least one upscale dining option.

Personally, I find it a bit tough to keep track of 25 brands and why I might want to choose it for any particular stay and might have preferred to see these aligned with a Curio or Tapestry collection, but presumably these are going to be hotels they don’t think fits that mold….

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount - all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted. Terms apply. Get This Offer

.sc-offer{

display:inline-flex;

flex-wrap:wrap;

border: 1px;

border-style: solid;

border-color: #D2B48C;

padding: 1em;

font-family: 'Muli', Sans-serif;

}

.sc-offer .col{

padding: 8px;

}

.flex-direction{

flex-direction:row;

}

.offer-image{

width:33.33%;

}

.offer-image img{object-fit: cover; width: 100%;}

.offer-text{

width:66.66%;

}

@media screen and (max-width: 500px) {

.flex-direction{

flex-direction:column;

}

.offer-image{

width:32px;

height:auto;

}

.offer-text{

width:100%;

}

}

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

October 3, 2025

[Offer Extended to 10/15/25] New Mesa Card Offer for 50,000 Points

This offer has been extended to October 15, 2025. Same promo code.

For those unfamiliar with the Mesa Card, it’s a credit card designed for those with mortgages. While everyone waits for Bilt to offer mortgage payments (which will be amazing), Mesa is already here giving you points on your mortgage.

If you ARE familiar, I’ll cut to the chase:

There is a new best ever offer to apply for this card.

You’ll get 50,000 Mesa points after you apply through this link (you’ll need to be on a phone as it will have you download the Mesa app), enter the code SEPT50 in the application, and then spend $12,000 in the first 3 months to earn the 50,000 bonus points.

Available through 9/30/2025. You must use the offer promo code at application to enroll in the offer!

It’s no secret and Gary at View from the Wing has even noticed that it should be possible to double dip once Bilt opens that up, since Mesa doesn’t actually charge your card for the mortgage payment; it simply requires proof of the payment to award the points!

The no-annual fee Mesa card’s points are transferable (more on that in a second) and the card comes with a bunch of statement credits which is unusual for a no-annual fee card.

So that is up to $725 in statement credits to offset…. no annual fee?

Then on top of that you get the points monthly for your mortgage (1 point per dollar) as long as you spend $1,000 on the card each month. That can even be in a bonus category like child care (which nobody is getting for under $1,000 a month…).

Mesa Card Bonus CategoriesIt even has unique bonus categories:

Earn 1X Mesa Points for every $1 of your monthly mortgage payments – up to 100,000 points annually. Subject to spending $1,000 in purchases on your card in the same statement period as your mortgage payment.3X Mesa Points on home & family expenses —home improvement, decor, maintenance, utilities, and daycare¹.2X Mesa Points on everyday purchases—groceries, gas, EV charging, & more¹.1X Mesa Points per $1 spent on all other eligible purchases¹.1 Rewards Terms and Conditions here.

Mesa Card Airline and Hotel Transfer PartnersI’ll need to go into more detail on these another time, but for now, many of you will already know what to do with a majority of these transfer partners. The only one that might be new to you is the Air India Maharaja program and the most talked about sweet spot there is booking United flights domestically: Flights under 600 miles in coach is 3,500 points or 7,000 in First. The next tier which would be something like New York to Chicago is 5,500 points in coach or 11,000 for First.

Airlines (all 1:1):

Air Canada AeroplanAir India Maharaja ClubFinnair Finnair PlusHainan Airlines Fortune Wings ClubSAS EuroBonusThai Airways Royal Orchid PlusVietnam Airlines LotusMilesHotels:

Accor Accor Live Limitless (This is a 1.5 : 1 transfer ratio)Apply for the Mesa Card (and don’t forget to use promo code SEPT50 by September 30, 2025!

Questions?Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards .

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.