Stuart Jeanne Bramhall's Blog: The Most Revolutionary Act , page 1328

June 26, 2015

EU begins military intervention in Mediterranean

*

*

At their meeting in Luxembourg on Monday, European Union (EU) foreign ministers agreed to the commencement of a military mission against so-called people smugglers in the Mediterranean Sea. EU governments plan use warships, fighter jets and drones to destroy smugglers’ boats – even if they’re full of refugees.

I suppose mass slaughter is one solution to the refugee problem. It’s also a war crime under the Geneva Conventions.

Originally posted on Counter Information:

Originally posted on Counter Information:

By Martin Kreickenbaum

25 June 2015

At their meeting in Luxembourg on Monday, European Union (EU) foreign ministers agreed to the commencement of the EUNAVFOR Med mission against so-called people smugglers in the Mediterranean Sea. The programme plans to target refugee boats and involves a massive expansion of intelligence and police powers.

The first phase of the operation is to begin within days. It involves intelligence agency spying on alleged smuggling organisations and networks in North Africa, particularly Libya.

Agents are to locate targets and identify boats and suspected masterminds, before forwarding this data to the command centre. With this information, refugee boats will be intercepted, confiscated and destroyed on the high seas in the second phase of the operation. The third stage allegedly involves the deployment of Predator drones, Tornado fighter jets and military divers on the coast and in Libyan ports.

The military operation is a response to…

View original 1,158 more words

June 25, 2015

The Ugly Story Behind the Laetrile Cover-Up

Second Opinion: Laetrile at Sloan Kettering

Eric Merola (2014)

Film Review

Second Opinion is a documentary about the deliberate cover-up of an alternative cancer treatment by Sloan Kettering Cancer Center, America’s foremost cancer research institution, and Dr Robert Moss, the Sloan Kettering science writer who exposed the cover-up.

As strange as it may seem Sloan Kettering themselves did the definitive research showing that Laetrile (aka Amygdalin and B17) is effective in small tumors in early stage cancer. Sloan Kettering even went so far as to apply to the FDA (in 1974 and 1975) for permission to conduct human Laetrile trials.

A year later, under massive pressure from the National Cancer Institute and American Cancer Society (both receive major funding from Big Pharma), the top brass at Sloan Kettering reversed themselves and falsely claimed that twenty laetrile studies over four years showed no beneficial effect whatsoever. As one commentator observed, if cancer patients could buy laetrile (made from apricot pits) for seventy-seven cents, they would never pay $70,000 for cancer chemotherapy.

Sloan Kettering Researcher Kanematsu Sugiura

The chief laetrile scientist at Sloan Kettering was an eight-five-year-old Japanese researcher named Kanematsu Sugiura. Sugiura was with the Center for over sixty years. His twenty studies showed that laetrile slows tumor growth, reduces lung metastases and relieves pain with small cancerous tumors.

Neither Sugiura nor Moss ever claimed that laetrile is a “cure” for cancer. Like chemotherapy, it merely slows the progression of the disease. However, unlike chemotherapy, it doesn’t cost tens of thousands of dollars. Nor does it cause hair loss, extreme nausea and lethargy or immune shutdown.

Americans Defy FDA Ban on Laetrile

Although laetrile is far safer than the poisons used in chemotherapy, the FDA banned in in 1962. In the late seventies when Sugiura was doing his research, more than 70,000 Americans (one-tenth of all cancer patients) were illegally smuggling laetrile into the US from Mexico. There was also an extremely strong grassroots pro-laetrile group affiliated with the John Birch Society. They successfully lobbied 19 states to pass legislation authorizing laetrile use. They also persuaded Ted Kennedy to hold congressional hearing on laetrile. According to Moss, it was the pressure of these hearings that led Sloan Kettering to do additional (deeply flawed) studies which they claimed contradicted Sugiura’s findings.

Moss Starts Underground Newsletter

Since mainstream media refused to interview Sugiura or publish his findings, Moss decided to bring them to public view by starting an underground newsletter for Sloan Kettering employees called Second Opinion. In addition to exposing the Sloan Kettering campaign to discredit Sugiura, it also published articles about labor disputes, nursing and patient complaints and a clearly racially based dismissal.

Owing to its immense popularity, Second Opinion attracted mainstream media attention. In 1977, this culminated in a press conference in which Moss was forced to go public. Predictably he was fired and blackballed from the industry.

His wife helped out by getting a job, and Moss became a free lance writer, publishing The Cancer Industry in 1980. He has published a total of fifteen books about the capture of cancer treatment by the profit interests of powerful pharmaceutical companies. In 1991 he became an (unpaid) adviser to the National Institutes of Health on alternative and complementary cancer treatments.

In 2014, two German researchers finally (after forty years) replicated Sugiura’s findings. They have plans to launch human studies.

Unfortunately, since I first watched this documentary, the producers have made it pay per view. People can either pay $4.99 or wait till one of the Torent sites makes a free download available.

June 24, 2015

Citizen Gardens Grow 40% Of Nations Food In Russia — Why Not Here?

*

*

While the percentage of food grown by Russia’s dacha has fallen since then it is still a massive contribution to the nation’s food and forms an important part of their rural heritage. Take a walk through the street’s of Russia’s cities, like St. Petersburg, and you will find people selling herbs, fruit, berries and vegetables from their dacha gardens. Unlike many cities in Europe and the USA, Russian cities are peppered with small corner shops (below right) selling locally grown food in all shapes, colours and sizes still carrying their native Russian soil.

Originally posted on Finding Truth In an Illusory World:

Originally posted on Finding Truth In an Illusory World:

In 2011 the dacha gardens of Russia produced 40% of the nation’s food.

How much land do you need to grow all your food? This is a dacha garden in Russia where there is a strong tradition of growing your own food.

40% of Russia’s Food is from Dacha Gardens

In 2011, 51% of Russia’s food was grown either by dacha communities (40%), like those pictured left in Sisto-Palkino, or peasant farmers (11%) leaving the rest (49%) of production to the large agricultural enterprises. But when you dig down into the earthy data from the Russian Statistics Service you discover some impressive details. Again in 2011, dacha gardens produced over 80% of the countries fruit and berries, over 66% of the vegetables, almost 80% of the potatoes and nearly 50% of the nations milk, much of it consumed raw.

While many European governments make living on a small-holding very…

View original 620 more words

June 23, 2015

Savings Pools: Opting Out of the Banskters’ Money System

One way I’m opting out out of the debt-based Wall Street banking system, is by joining a local interest-free savings pool. A group of neighbors is investing their savings in a savings pool – rather than a bank – and to use the savings pool to loan money to one another. We’re using a model designed by the (New Zealand-based) Living Economies Trust. The model is based on the Swedish JAK members’ Bank, founded in 1965. The Jord Arbete Kapital (Land Labor Capital) Bank doesn’t charge or pay interest on its loans. With its loans financed solely by members’ savings, it operates outside of the Wall Street capital market.

As of November 2011, the JAK Bank had a membership of 38,000 and accumulated savings of 131 million euros. Of this 98% had been loaned out to members.

How Savings Pools Differ from JAK Bank

Savings pools maintain the JAK Bank’s tradition of interest-free transactions but differ from the Bank’s model in several respects:

• Savings pools are private arrangements between members with regular personal contact.

• Executive decisions are made by pool members themselves rather than a paid management team.

• Pool costs and charges are virtually zero.

• Each member’s savings are held in trust for that member – they don’t become joint property and can only be spent if the member agrees.

Our local savings pool meets monthly, and all savings pool decisions are consensus-based. Individual members may abstain on special loan proposal they disagree with by declaring their own balance unavailable for that specific purpose.

Tracking Savings as Dollar-Months

Savings are tracked as dollar-months rather than balances. In other words, pool statements reflect both the amount a member has contributed and the length of time they have made the funds available.

A member wishing to borrow other members’ money proposes a payment schedule and offers something of value as security to make sure the debt is covered. If the group agrees, the pool transfers to the borrower the loan amount and any balance the borrower may have saved. One month later, the borrower begins a series of installment payments, with half going to repay the loan and half going to reciprocate the pool’s contribution

When borrowers ask the pool to accept interest-free installment payments, it’s not enough to merely repay the loan. They must also make their own savings available for long enough to match the consideration other members have accorded them. This is called reciprocity.

The Advantage of Reciprocity Over Interest

Despite this reciprocity contribution, the amount repaid to a savings pool is always far less than the compound interest charged on a bank loan. With a mortgage, for example, the interest paid is usually more than the original loan. Although the borrower ends up with a house, they have nothing to show for all their interest payments.

In contrast, a savings pool borrower ends up with the purchased asset and savings, which may be withdrawn as soon as the loan agreement is complete.

Supported borrowing is also encouraged. Pool members may gift cash to ease a borrowers reciprocity contribution and reduce their monthly payments.

People wanting more details on the mechanics of savings pools can consult two excellent articles by The New Economics Party and Project Wairarapa

photo credit: occupy_Citibank_24_4_13_DSC_0121 via photopin (license)

June 22, 2015

IMF Humiliates Greece, Repeats It Will Keep Funding Ukraine Even If It Defaults

*

*

Predictably, the IMF commits to continue funding the fascist government in Ukraine – even if they default. Not so with Greece’s populist government.

Originally posted on Counter Information:

Originally posted on Counter Information:

By Tyler Durden

Global Research, June 20, 2015

Zero Hedge 19 June 2015

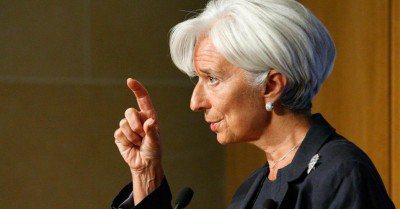

One week ago, we were stunned to learn just how low the political organization that is the mostly US-taxpayer funded IMF has stooped when, a day after its negotiators demonstratively stormed out of the Greek negotiations with “creditors”, Hermes’ ambassador-at-large Christone Lagarde said that the IMF “could lend to Ukraine even if Ukraine determines it cannot service its debt.”

One week ago, we were stunned to learn just how low the political organization that is the mostly US-taxpayer funded IMF has stooped when, a day after its negotiators demonstratively stormed out of the Greek negotiations with “creditors”, Hermes’ ambassador-at-large Christone Lagarde said that the IMF “could lend to Ukraine even if Ukraine determines it cannot service its debt.”

In other words, as Greece struggles to avoid a default to the IMF on debt which was incurred just so German banks can remain solvent and dump trillions in non-performing loans to US hedge funds and Greek exposure, and which would result in the collapse in the living standards of an entire nation (only for a few years before an Iceland-recovery takes place, one which Greece would already be enjoying had it defaulted in 2010 as we said…

View original 317 more words

June 21, 2015

Local Currency Update: Opting Out of the Bankster Money System

According to the Guardian, renewable energy provider Good Energy has agreed to accept the Bristol pound in payment for electricity and gas bills. The company claims to be the first in the world to accept payments in local currency. Bristol residents already use the Bristol pound to pay for groceries, bus fares and council tax (ie real estate taxes).

The Bristol Pound is an alternative currency launched in 2012 to help keep cash in the local community, as opposed to the deep pockets of multinational corporations.

Run as a not-for-profit partnership with Bristol Credit Union, the Bristol pound is the first city-wide local currency in the UK and the largest alternative to Britain’s national currency (pounds sterling). There are approximately 750,000 Bristol pounds in circulation.

Local or complementary currencies are an ideal way for communities to opt out of the corporate money system. Their use has expanded exponentially since the 2008 downturn, especially in European countries like Greece, Italy and Spain. Devastating austerity cuts have left millions in southern Europe with no access to euros, the official currency.

My town New Plymouth has their own local currency, the New Plymouth talent, though it’s not as widely circulated as the Bristol pound. We also have a Time Bank (which I’ve just joined), which allows members to earn time credits providing services for other members. They can use these credits (instead of money) to purchase services from other members. It’s a great alternative for unemployed, retired and disabled residents who are short on cash due to the economic downturn.

June 20, 2015

Who Cares About Obama’s Sanctions?–Shell and BP Invest Big In Gazprom

*

*

Russian sanctions are for small businesses and sissies. The big players like BP and Shell ignore them.

Originally posted on ThereAreNoSunglasses:

Originally posted on ThereAreNoSunglasses:

[SEE: BP to Pay Rosneft $750 Million for Part of Siberian Oilfield]

Gazprom and Shell fuse together

By Tom Bailey

Gazprom and Shell’s strategic deal will help both companies tap into new markets as those in Europe become heavily subscribed

Gazprom and Royal Dutch Shell have agreed to a strategic cooperation deal at the St Petersburg International Economic Forum

Gazprom, the world’s largest extractor of natural gas, has signed a strategic deal with oil and gas producer Royal Dutch Shell. Termed The Agreement of Strategic Cooperation, a Gazprom press release claims that it will ensure cooperation between the two countries “across all segments of the gas industry, from upstream to downstream, including a possible asset swap.” The deal will help Gazprom penetrate new markets as those in Europe become saturated.

The deal will help Gazprom penetrate new markets as European markets

become saturated

Alexey Miller, Chairman of the…

View original 189 more words

June 19, 2015

Oil Economics Made Easy

Afterburn Society: Beyond Fossil Fuels

Richard Heinberg (2015)

Film Review

Afterburn Society is about the economics of energy, specifically the energy produced by fossil fuels. The subject of economics is like bad-tasting medicine for a lot of people. However Post Carbon Institute Fellow Richard Heinberg’s jargonless, down-to-earth delivery makes the experience quite painless and even pleasurable.

Heinberg begins by tracing the history of agriculture and manufacturing. Prior to the late 19th century, there were only two sources of energy. People either relied on their own muscle power or they employed traction animals or slaves (ironic, isn’t it, how fossil fuels replaced slavery?).

In contrast, our modern-day food industry relies heavily on fossil fuels to run farm machinery, for plastic packaging (derived from oil), to transport food to market, for nitrogen fertilizer (derived from natural gas) and as a source of herbicides and pesticides (derived from oil).

It takes 350 gallons of oil a year to feed one American and seven Calories* of fossil fuel to produce one calorie of food.

The Law of Diminishing Returns

Heinberg goes on to explain the law of diminishing returns as it pertains to oil production. Over the last eight years investment in oil production has soared, while output per dollar invested has steeply declined. From 1997-2005, oil companies spent $1.5 trillion to produce 86 million barrels of oil a day. Between 2005-2013, they spent $4 trillion to produce 3 million barrels a day.

Industry data reveals conventional oil production peaked in 2005 and has been declining ever since. Most of the new oil production has come from more costly and risky technologies, such as fracking and deep sea oil drilling. The use of these new technologies has increased the cost of oil extraction. This, in turn, has led the price of oil to skyrocket from $27 a barrel in 2000 to $100 a barrel in 2014.

The higher price of oil means a higher return for oil companies. This, in turn, enabled more costly and controversial technologies, such as fracking and deep sea oil drilling have come onboard. They only became economically viable when the price of oil passed $70-80 a barrel.

EROEI

Oil production costs aren’t only increasing in dollar terms, but in terms of the energy required to extract new oil. Heinberg predicts that by mid-century, it will require as much energy to extract a unit of oil and natural gas as that unit will produce when it’s burned. At that point, fossil fuels will cease to be a viable energy source, though they may continue to be useful in producing plastics, synthetic fabrics and other petroleum byproducts.

Overall surplus energy will steeply decline when this happens, as renewable energy technologies have a much lower EROEI (Energy Return on Energy Invested) than fossil fuels. For example, solar energy has an EROEI of 2.5-5 to 1 (2.5-5 units returned for every unit invested), in contrast to oil’s EROEI of 30 to 1. Biofuels, with an EROEI of 1 to 1, are even worse. Their only purpose is to return a profit to government subsidized biofuel merchants like Archer Daniels Midland. They’re useless as an energy source.

The steep decline in surplus energy will translate into major social change, as nearly all of our energy use will be geared towards producing new energy (i.e. food production).

The Recent Drop in Oil Prices

In my view, the only shortcoming in this presentation was Heinberg’s failure to address the steep drop in oil prices that began in June 2014 (from $100 to $48 a barrel, recently leveling off around $60 a barrel). He does discuss it in a December 19, 2014 article The Oil Price Crash of 2014

In brief he attributes the temporary price drop to a decrease in demand (due to deepening recession in China, Japan and Europe), coupled with increasing supply (due to the frantic pace of fracking in the US). Normally when there’s a mismatch in supply and demand, it falls on Saudi Arabia (the world’s top oil exporter) to ramp down production. This time the Saudis have refused to cut back production.

Their motivation is a matter of speculation. According to Heinberg, the most likely reasons are a desire to destroy the US fracking industry (small fracking companies are going bankrupt in droves – they’re up to their eyeballs in debt and fracked oil is only profitable above $70-80 a barrel) – and to punish Russia and Iran (whose economies are totally dependent on oil and gas exports) for meddling in Syria and Iraq.

*A measure of energy, a Calorie is the amount of energy needed to raise 1 kilogram of water 1 degree Centigrade.

June 18, 2015

Greece’s Proposals to End the Crisis: My intervention at today’s Eurogroup

*

*

The Greek position in Brussels – straight from the Greek finance minister and undiluted by corporate media lies and distortions.

Originally posted on Yanis Varoufakis:

Originally posted on Yanis Varoufakis:

The only antidote to propaganda and malicious ‘leaks’ is transparency. After so much disinformation on my presentation at the Eurogroup of the Greek government’s position, the only response is to post the precise words uttered within. Read them and judge for yourselves whether the Greek government’s proposals constitute a basis for agreement.

View original 2,912 more words

June 17, 2015

THE DAY THE MUSIC DIED: The Men Who Killed John Lennon (Archive)

*

*

Mark Chapman was only a patsy, just like Lee Harvey Oswald. And he never had a trial – only a sentencing hearing – because he was “pressured” to plead guilty.

Originally posted on RIELPOLITIK:

Originally posted on RIELPOLITIK:

Source – ahabit.com

– Jose Joaquin Sanjenis Perdomo, this is the spy and professional assassin who killed John Lennon. Perdomo was tasked to provide security for Lennon at the rock star’s upscale apartment complex, the Dakota, the night of the murder. He was an anti-Castro Cuban exile and member of Brigade 2506 during the Bay of Pigs Invasion in 1961, a failed CIA operation to overthrow Fidel Castro.

Joaquin Sanjenis had worked closely with convicted Watergate burglar Frank Sturgis for about ten years on the CIA’s payroll, and in retrospect, it is safe to conclude that Nixon was behind Lennon’s murder.

Sturgis falsely claimed that Perdomo had died in 1974, and since Nixon was essentially starting over in 1980, (as Ronald Reagan’s secret adviser) Sturgis and Nixon obviously handpicked the right man for what they considered to be, “the right job”.

This story gets even more bizarre, given the story…

View original 1,787 more words

The Most Revolutionary Act

- Stuart Jeanne Bramhall's profile

- 11 followers