Vijay Narayan Govind's Blog

July 31, 2018

July 29, 2018

Identity theft

While use of a pseudonym or alias is not necessarily unlawful, identity theft is the deliberate use of someone else's identity, usually as a method to gain a financial advantage or obtain credit and other benefits in the other person's name,] and perhaps to the other person's disadvantage or loss. The person whose identity has been assumed may suffer adverse consequences if they are held responsible for the perpetrator's actions. Identity theft occurs when someone uses another's personally identifying information, like their name, identifying number, or credit card number, without their permission, to commit fraud or other crimes.

The term identity theft was coined in 1964 and can take many forms including Identity cloning and concealment, Criminal identity theft, Synthetic identity theft, Medical identity theft, Child identity theft, Financial identity theft.

Internet services or software with Internet access can be actively used to defraud victims or to otherwise take advantage of them; for example, by stealing personal information, which can even lead to identity theft. A very common form of Internet fraud is the distribution of rogue security software. Internet services can be used to present fraudulent solicitations to prospective victims, to conduct fraudulent transactions, or to transmit the proceeds of fraud to financial institutions or to others connected with the scheme. Internet fraud can occur in chat rooms, email, message boards, or on websites.

Published on July 29, 2018 05:49

June 16, 2018

Jam Auction

In this scam, the confidence artist poses as a retail sales promoter, representing a manufacturer, distributor, or set of stores. The scam requires assistants to manage the purchases and money exchanges while the pitchman keeps the energy level up. Passersby are enticed to gather and listen to a pitchman standing near a mass of appealing products. The trickster entices by referring to the high-end products, but claims to be following rules that he must start with smaller items. The small items are described, and 'sold' for a token amount—with as many audience participants as are interested each receiving an item. The pitchman makes an emotional appeal such as saying "Raise your hand if you're happy with your purchase", and when hands are raised, directs his associates to return everyone's money (they keep the product). This exchange is repeated with items of increasing value to establish the expectation of a pattern. Eventually, the pattern terminates by ending the 'auction' without reaching the high-value items, and stopping midway through a phase where the trickster retains the collected money from that round of purchases. Marks feel vaguely dissatisfied, but have goods in their possession, and the uplifting feeling of having demonstrated their own happiness several times. The marks do not realize that the total value of goods received is significantly less than the price paid in the final round. Auction/refund rounds may be interspersed with sales rounds that are not refunded, keeping marks off-balance and hopeful that the next round will refund.

Published on June 16, 2018 04:12

May 1, 2018

Money laundering

The term "money laundering" dates back to the days of Al Capone; Money laundering has since been used to describe any scheme by which the true origin of funds is hidden or concealed.

Money laundering is the process by which large amounts of illegally obtained money (from drug trafficking, terrorist activity or other serious crimes) is given the appearance of having originated from a legitimate source.

Published on May 01, 2018 05:52

February 15, 2018

Lottery scams

You received an email or a letter that you have won a large sum on an overseas or online lottery. If you respond to the fraudster, you’ll immediately be asked to supply personal information and copies of official documents as proof of identity. The fraudsters can then use this information to steal your identity. Once you have provided your personal information, the fraudsters will ask you to pay various fees – for example: taxes, legal fees, banking fees etc. – so that they can release your non-existent winnings. Each time you make a payment, the fraudsters will come up with a reason why your winnings can’t be paid out unless you make another payment. They’ll also give you reasons why the fees can’t be taken out of your winnings and have to be paid upfront. The fraudsters may also ask for your bank details, saying they will pay your winnings directly into your bank account. But if you hand over your bank details, the fraudsters will use them to empty your account. Remember that genuine lotteries thrive on publicity. If they ask you to keep your win a secret it’s likely to be a fraud. Typically, many fraudulent lotteries have bad spelling and grammar – see this as a warning that fraudsters are at work.

Published on February 15, 2018 09:36

January 11, 2018

Mystery shopping

A fraudulent confidence trick (a form of advance fee fraud) perpetrated on people in several countries who wish to be mystery shoppers.

A person is sent a money order, often from Western Union,or cheque for a larger sum than a mystery purchase he is required to make, with a request to deposit it into his bank account, use a portion for a mystery purchase and fee, and wire the remainder through a wire transfer company such as Western Union or MoneyGram. The money is to be wired immediately as response time is being evaluated. The cheque is fraudulent, and is returned unpaid by the victim's bank after the money has been wired.One scam involved fraudulent websites using a misspelled URL to advertise online and in newspapers under a legitimate company's name.

Valid mystery shopping companies do not normally send their clients cheques prior to work being completed, and their advertisements usually include a contact person and phone number. Some fraudulent cheques can be identified by a financial professional. A legitimate company that occasionally sends prepayment for large transactions says "We do occasionally fund upfront for very large spend purchases but we use cheques or direct bank transfers which should mean you can see when they are cleared and so can be sure you really do have the money."It is standard practice for mystery shopping providers evaluating services such as airlines to arrange for the airfare to be issued beforehand at their own expenses (usually by means of a frequent flyer reward ticket). In any case, it is unlikely that any bonafide provider would allocate a high-value assignment to a new shopper or proactively recruit new ones for that purpose, preferring instead to work with a pool of existing pre-vetted experienced shoppers.

Published on January 11, 2018 17:50

December 24, 2017

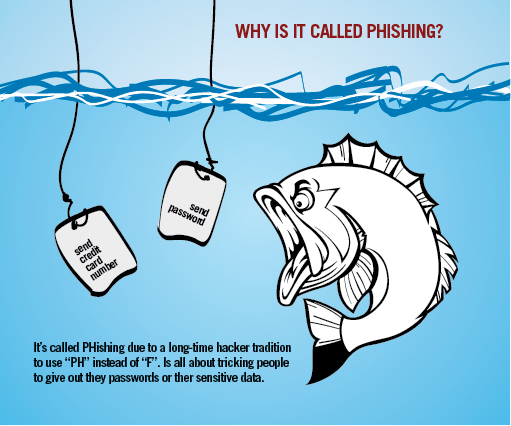

Phishing

Phishing operates by sending forged e-mail, impersonating an online bank, auction or payment site; the e-mail directs the user to a forged web site which is designed to look like the login to the legitimate site but which claims that the user must update personal info. The information thus stolen is then used in other frauds, such as theft of identity or online auction fraud.

A number of malicious "Trojan horse" programmes have also been used to snoop on Internet users while online, capturing keystrokes or confidential data in order to send it to outside sites.

Published on December 24, 2017 04:52

November 19, 2017

Pump and dump schemes

Stock promoters and manipulators first purchase large quantities of stock, then, artificially inflate the share price through false and misleading positive statements. Pump and dump is a common form of microcap stock fraud, though in more sophisticated versions individuals or organizations buy millions of shares, then use newsletter websites, chat rooms, stock message boards, press releases, or e-mail blasts to drive up interest in the stock. Very often, the perpetrator will claim to have "inside" information about impending news to persuade the unwitting investor to quickly buy the shares. When buying pressure pushes the share price up, the rise in price entices more people to believe the hype and to buy shares as well. Eventually the manipulators do the "pumping" end up "dumping" when they sell their holdings. The expanding use of the Internet and personal communication devices has made penny stock scams easier to perpetrate.

Published on November 19, 2017 04:46

September 6, 2017

Pink Tuna Scam

Pink Tuna Scam Fish lovers across European Union are being warned in the face of a tuna scam. Fraudsters are reportedly coloring low-quality cuts of tuna - and selling it off as premium fish. "Millions" of portions are being dyed pink to make them appear more fresh and expensive. According to official figures, the underground market is making scammers hundreds of millions of pounds per year. The colouring of tuna is believed to mainly occur in Italy, France and Spain. But the cuts could easily find their way across the continent, experts have warned.According a European Commission document seen by the industry magazine IntraFish, consumers across the EU are paying £174million for fish that is illegally treated with vegetable extracts containing high levels of nitrites.This gives the fish the purple reddish hue of high-quality tuna.Reports suggest five million tuna portions - equivalent to 500 tones - are being altered to appear fresh.This potentially doubles their value price, and the practice is dangerous given the fact tuna is not eaten raw.The portions could also contain high levels of histamines that can cause people to suffer allergic reactions.Enrico Brivio, EU spokesperson for Health, Food Safety, Environment, Maritime Affairs and Fisheries, told IntraFish that action was being taken to stop the practice across the bloc.“There is a close collaboration between the EU Food Fraud network and the fish industry to stop this alleged illegal practice,” he claimed.

Fish lovers across European Union are being warned in the face of a tuna scam. Fraudsters are reportedly coloring low-quality cuts of tuna - and selling it off as premium fish. "Millions" of portions are being dyed pink to make them appear more fresh and expensive. According to official figures, the underground market is making scammers hundreds of millions of pounds per year. The colouring of tuna is believed to mainly occur in Italy, France and Spain. But the cuts could easily find their way across the continent, experts have warned.According a European Commission document seen by the industry magazine IntraFish, consumers across the EU are paying £174million for fish that is illegally treated with vegetable extracts containing high levels of nitrites.This gives the fish the purple reddish hue of high-quality tuna.Reports suggest five million tuna portions - equivalent to 500 tones - are being altered to appear fresh.This potentially doubles their value price, and the practice is dangerous given the fact tuna is not eaten raw.The portions could also contain high levels of histamines that can cause people to suffer allergic reactions.Enrico Brivio, EU spokesperson for Health, Food Safety, Environment, Maritime Affairs and Fisheries, told IntraFish that action was being taken to stop the practice across the bloc.“There is a close collaboration between the EU Food Fraud network and the fish industry to stop this alleged illegal practice,” he claimed.

Fish lovers across European Union are being warned in the face of a tuna scam. Fraudsters are reportedly coloring low-quality cuts of tuna - and selling it off as premium fish. "Millions" of portions are being dyed pink to make them appear more fresh and expensive. According to official figures, the underground market is making scammers hundreds of millions of pounds per year. The colouring of tuna is believed to mainly occur in Italy, France and Spain. But the cuts could easily find their way across the continent, experts have warned.According a European Commission document seen by the industry magazine IntraFish, consumers across the EU are paying £174million for fish that is illegally treated with vegetable extracts containing high levels of nitrites.This gives the fish the purple reddish hue of high-quality tuna.Reports suggest five million tuna portions - equivalent to 500 tones - are being altered to appear fresh.This potentially doubles their value price, and the practice is dangerous given the fact tuna is not eaten raw.The portions could also contain high levels of histamines that can cause people to suffer allergic reactions.Enrico Brivio, EU spokesperson for Health, Food Safety, Environment, Maritime Affairs and Fisheries, told IntraFish that action was being taken to stop the practice across the bloc.“There is a close collaboration between the EU Food Fraud network and the fish industry to stop this alleged illegal practice,” he claimed.

Fish lovers across European Union are being warned in the face of a tuna scam. Fraudsters are reportedly coloring low-quality cuts of tuna - and selling it off as premium fish. "Millions" of portions are being dyed pink to make them appear more fresh and expensive. According to official figures, the underground market is making scammers hundreds of millions of pounds per year. The colouring of tuna is believed to mainly occur in Italy, France and Spain. But the cuts could easily find their way across the continent, experts have warned.According a European Commission document seen by the industry magazine IntraFish, consumers across the EU are paying £174million for fish that is illegally treated with vegetable extracts containing high levels of nitrites.This gives the fish the purple reddish hue of high-quality tuna.Reports suggest five million tuna portions - equivalent to 500 tones - are being altered to appear fresh.This potentially doubles their value price, and the practice is dangerous given the fact tuna is not eaten raw.The portions could also contain high levels of histamines that can cause people to suffer allergic reactions.Enrico Brivio, EU spokesperson for Health, Food Safety, Environment, Maritime Affairs and Fisheries, told IntraFish that action was being taken to stop the practice across the bloc.“There is a close collaboration between the EU Food Fraud network and the fish industry to stop this alleged illegal practice,” he claimed.

Published on September 06, 2017 23:39

July 23, 2017

Dropped Wallet scam

The dropped wallet scam usually targets tourists. The con artist pretends to accidentally drop his wallet in a public place. After an unsuspecting victim picks up the wallet and offers it to the con artist, the scam begins. The artist accuses the victim of stealing money from the wallet and threatens to call the police, scaring the victim into returning the allegedly stolen money. Cases have been reported in eastern Europe.

Another version of the dropped wallet scam is a bit more complicated and works alot like the pigeon drop. It's played on a place of travel like a railway or airport. The con man will yell after you something like "Hey. You dropped your wallet". Come over into your personal space and hand you the wallet and start walking away. The point of the scam is chasing the con man down saying it's not my wallet. You both look inside and find high end credit cards and valuables. You also find a phone number. Often for a doctor. You call the number and the person answers. Thanking you for finding his wallet this person who just got on a train or a plane or something will tell you that his assistant will pick up the wallet at some gate or just outside, he tells you that there is a big reward for you that his assistant will pay you. Now the conman gets in a hurry to catch a train or a plane himself. You want to split the reward since he found the wallet so you hand over some of your own cash as he runs of. Of course the assistant never shows up and all you have is a cheap wallet with fake credit cards in it.

Published on July 23, 2017 08:41