Jimmy Song's Blog, page 4

December 31, 2018

2018, the Year Bitcoin Separated from the Pack

The past year has been a turbulent one for Bitcoin, but then again, what year isn’t? Bitcoin is disruptive and real disruption means that there’s bound to be significant volatility.

It can be more fun going down

It can be more fun going downIn this article, I’m going to examine what’s happened in the past year and how it has affected Bitcoin, specifically with respect to the rest of the market surrounding it.

Social ActivityAt its core, Bitcoin is a social innovation. Money itself is a social convention and introducing a new money is a social innovation and can fairly be called a social movement. As a social movement, Bitcoin has started to distinguish itself in 2018.

To the general public, 2017 was a year when Bitcoin was lumped together with every other “cryptocurrency” and treated as the same class. This is still true to a large extent today, but the events of the past 12 months have put some daylight between Bitcoin and all the other coins.

The reasons for this change in perception are many, but it starts with the obvious. So many ICOs, altcoins and the centralized teams that run them have simply not delivered. Their predictions on how their coin would be used have not come true, their expectations about price growth have not come to pass and their tech wasn’t as easy to make as they said.

Every altcoin white paper and their subsequent excuses

Every altcoin white paper and their subsequent excusesThe centralized teams are discovering that raising money, particularly in a bull market, is a lot easier than building a real product that has a market fit. The ICO token buyers are discovering that tokens don’t go up forever and that economic models which depend on continuous new money have stopped working. The traders are realizing that most of these tokens have very little to no liquidity and have stopped trading them to the degree they once did.

The lack of building and the hype surrounding all of these projects are clear in hindsight and this has caused a significant change in perception. Bitcoin works today and continues to build services that people continue to find valuable. Everything else is looking for a use case.

As a result, what we have now are altcoin teams that have lost their credibility. This is reflected in the lack of desire by people to hold these coins, which causes a significant dip in price, which we’ll get to in a bit. But before we go there, let’s take a look at the technical activity.

Technical ActivityBitcoin continues to build services that people are using. The lightning network has grown exponentially in the past 12 months and the demand for lightning based hardware, software and services continue to grow.

Furthermore, there’s been significant progress on privacy in the form of MuSig, Taproot, Graftroot, Dandelion, Neutrino and other projects. These are all real innovations with real developers that have delivered. In addition, Segwit adoption has continued to grow from 2017 as exchanges, users and businesses have begun to recognize the economic incentives at play.

In other words, Bitcoin has been in the enviable position of allowing the market to determine what’s desirable instead of some central authority. This is another point in which Bitcoin’s advantage as a decentralized system shows itself.

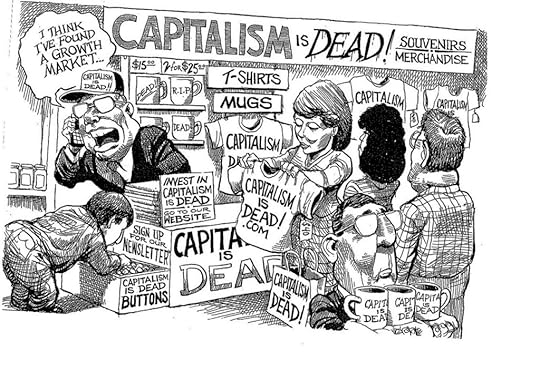

How altcoin development is done

How altcoin development is doneAltcoins continue to use a centralized model of development which too often results in products and features the market doesn’t want or need. One of the very few ICOs that at least delivered something is Augur, which after 2 years finally launched in July. Augur hit a peak of 265 users on July 10th and have only proceeded to lose users since then. They average around 25 users a day on their platform, which is a crazy $3.65M of market cap per daily user. Amazingly, this is one of the success stories for an altcoin/ICO!

What we saw in 2018 is that having lots of “developer activity” is not the same thing as producing something the market wants. Bitcoin has distinguished itself by releasing features that are actually used, and not duds that aren’t like so many altcoins.

Economic ActivityThe biggest movement in 2018 has been the price. Bitcoin has dropped 85% from its all-time high and there may be more dropping to go. The volatility in Bitcoin, however, is nothing compared to almost every other altcoin. Ethereum, Ripple, BCH/ABC and EOS, which are the next 4 “cryptocurrencies” in terms of market cap, have all dropped over 90% from their all time highs in terms of BTC. The lack of liquidity, the lack of delivery, the lack of security and so on may have contributed, but more importantly, the hype on these assets were off the charts during 2017.

Bitcoin had a lot of hype going into December of 2017, but that paled in comparison to the relative hype seen in so many of these altcoins that have failed to hold their value. What this led to was a lot of malinvestment which is currently being culled. Because so much of the money ended up in the centralized organizations of these coins, many have had to lay a lot of people off.

The result has been that Bitcoin has been less volatile than these altcoins, which is crazy to say given how volatile Bitcoin has been!

2018, when weak hands got stronger or got out

2018, when weak hands got stronger or got outUltimately, the drop in price has shaken out a lot of weak hands that came in to Bitcoin during 2017. The people that have Bitcoin at this point are less susceptible to hype, more attuned to real utility and more aware of what actually matters.

In a sense, Bitcoin has on net gained more true believers and gotten rid of all the people that didn’t believe. In other words, Bitcoin has gotten rid of the bad investors.

ICOs and altcoins, on the other hand, have centralized teams where it’s not so easy to get rid of bad leadership and so continue to pursue paths that are sub-optimal. In addition, they continue to have large burn rates and a shrinking runway. To make matters worse, their legal status is not clear and the conditions look ripe for shenanigans of one type or another.

ConclusionWhat this past year showed is what Bitcoin Maximalists have been saying all along. Bitcoin is different because Bitcoin is decentralized. The advantages of decentralization are often subtle and easy to dismiss, but they are real benefits.

In Bitcoin, entrepreneurs decide what innovations will happen with their money and effort. In altcoins, central committees decide what innovations will happen. In Bitcoin, individual actors create products that use it. In altcoins, central committees commission other entities to build things for them.

Bitcoin has separated itself from the other cryptocurrencies and will continue to do so going forward.

December 5, 2018

Tips on Getting Through a Bear Market

The bear market in BTC has lasted almost a year now and it’s a hard place to be. Holding onto assets as they drop is a difficult thing to do and getting through this market takes a lot of character.

In this article, I am going to lay out some advice on how you can hold and not get yourself squeezed out of the gains that will eventually come.

Why is Bitcoin Dropping?!?!?A lot of people get upset during bear markets. Their anger isn’t as intense at first as most expect the initial drop to be temporary. It’s only as the bear market continues that people get more and more upset.

The expectation is specifically that Bitcoin would be going up, or at least stay steady. That is, people are expecting some sort of linear progression. Because the average gain in Bitcoin has been X% over the past 7 years, they expect that to continue.

Of course, nothing in the real world, including Bitcoin, is that linear. Things grow in spurts and that is entirely normal. Bitcoin, for example experienced multiple crashes of up to 80%+.

The real reason for being upset is that at core, there’s a desire to make money without really working. Indeed, if Bitcoin were to go up at a nice, steady rate, there would be no need to earn a salary. But we’re getting ahead of ourselves. Let’s first look at the bad of a bear market.

Why a Bear Market SucksFirst, bear markets suck because of financial pressure. Stress, especially stress that you’re not equipped to handle can break you financially. If you are over-leveraged or un-hedged, bear markets are when you will get squeezed out of your positions. Getting squeezed is when you can’t afford to wait until you’re proven right. And that sucks.

The first rule of investing is to not get wiped out and bear markets are where that rule comes into play the most.

Second, bear markets suck because of social pressure. It’s not enough that there’s financial pressure, but the I-told-you-so’s of the critics that come out at every bear market can be a lot to bear (pun intended). Having to listen to all your friends and relatives that do the same can be even worse. Unlike the bull runs when people treat you like a genius, bear markets humble you socially.

Third, bear markets suck because of less opportunities to make money. During bull runs, there are lots of different startups and projects that are looking for people of all kinds of talents. The opportunities to make money seem unlimited and if you have a track record, you can make a lot of money consulting, advising, marketing, etc. in salary and contract jobs. During bear markets, however, things get much harder. People start seeing you as irrelevant and projects that were flush with money suddenly start caring about budgets.

Why a Bear Market is GoodFirst, bear markets are good because they clear the malinvestments of the bull market. During a bull run too many projects raise too much money on extremely flimsy theses. Some in this past one raised over a $100M on just a whitepaper! The level of malinvestment in this space over the past couple years has been insane and many of those projects are going to disappear. This is a good thing as the resources from those projects can better be deployed to more useful endeavors. The correction in the markets make better companies and institutions per Austrian business cycle theory. In other words, money goes from bad actors to people that know what they’re doing. That’s a very good thing.

Second, bear markets are good because they reveal what’s really important. In the pressure-packed crucible of a bear market, only the truly useful survive. We can find out what’s really important to people because bear markets are when people make discriminating choices about what they want. They don’t buy just any ICO anymore. They start scrutinizing what they see. They start making choices more rationally and carefully. They stop FOMOing and start DYORing. A smarter market is a good thing because better allocation of capital leads to a more prosperous society via wealth creation.

Third, bear markets are good because they teach you to work smart and hard. In a bull market, jobs are easy and the expectations are small. In a bear market, employers are much more discriminating and hire out of need. That means that as a candidate, you have to provide real value, which means working smart and hard. Bear markets are when you get cut for not providing real value and you won’t get hired unless you bring something good to the table.

Fourth, bear markets are good because it develops your character. A lot of people complain about the early adopters of Bitcoin and how they “got lucky”. Long term holders didn’t get lucky, they had conviction. A lot of people bought Bitcoin in 2010–2011 but a lot of them also sold because it was, to them, a plaything, a gamble, a trade thing. They didn’t bother understanding Bitcoin very deeply or perhaps they did and weren’t convinced. It’s not so easy to hold for a long time and bear markets are the reason. When something drops 80%, do you keep holding? It’s easy to say you will in a bull market. Going through the bear market and continuing to hold takes conviction. You also have to make sure you don’t get squeezed out of your positions, so you can’t be a spendthrift or buy things you can’t afford. You have to plan for the future carefully and be diligent in sticking to your values. A bull market gives you room for everything. A bear market makes you make some difficult choices. If you get through it making the right ones, that’s how your character develops.

ConclusionBear markets are a necessary part of any economy, especially when there’s malinvestment as there has been in the past few years. The redistribution of resources to productive things people want from things people don’t want is the major benefit. There’s been too much skew the last couple years in the cryptocurrency space. There needs to be a realignment based on real utility, not just promises.

Getting through this realignment is not easy, but if you can come out the other side with your Bitcoins intact, this will be worthwhile because you’ll have earned the gains from the next bull market.