Jimmy Song's Blog, page 3

November 14, 2019

On Altcoin Valuation

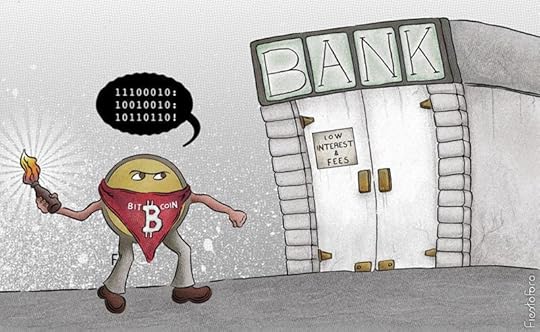

Bitcoin has value because it’s decentralized digital money. It has a stock/flow ratio that continues to increase and a scarcity enforced by a highly credible monetary policy that no physical asset can ever have. In addition, Bitcoin has a huge network which has made it the Schelling Point, security that’s extremely expensive to subvert and a history that no crypto asset can match. Some nascent research has suggested that stock to flow is a fundamental measure of value for Bitcoin, which makes sense as Bitcoin is really decentralized.

Altcoins are a different story. They all lack the one major innovation that Bitcoin has: decentralization. This means that altcoins are fundamentally different from Bitcoin and are closer to fiat money. Their central points of failure can and have been used by outside parties to influence or even control. Centralization is why the stock to flow model does not work at all for altcoins but does so for Bitcoin. So what gives altcoins value? Why do altcoins have any price?

In this article, I hope to explore this very question. Do altcoins add valuable new technical features? Are their buyers hoping for a path towards decentralization? What made Litecoin successful while its earlier, very similar cousin Fairbrix fail? Why did coins with a large premine like IxCoin fail while one like Ethereum succeed? To what can we attribute these relative successes and failures?

The Myth of Technical InnovationTalk to any altcoin holder and they will inevitably argue that their coin is the one with the most interesting features. They argue that their coin will revolutionize some industry by doing something that will make the tokens worth more, usually through some convoluted set of hand-wavy incentives. The hope, of course, is that their coin will be “the next Bitcoin” as a result of some new feature and become the new Schelling Point for a global currency.

This is little more than wishful thinking as any holder of previous pretenders to the throne can tell you. From Feathercoin to Auroracoin to Steem, there have been many coins that offered some supposed technical advantage but failed to maintain traction, let alone dethrone Bitcoin.

The technical features include stuff like faster block times, proof-of-something other than work, change of hashing algorithms, change in monetary policy, expansion of block size, promises of privacy, a utility for a particular service, solving some problem in some specific industry and so on.

All of these are at best wishful thinking as their community is limited to the demoralized and/or deluded token holders that continue to hope for a miraculous Bitcoin dethronement. The technical merits of the “innovations” are often found severely wanting (Turing complete smart contracts), if not outright fraudulent (Bitconnect), but even the few that have some merit are so hopelessly lost in a quagmire of badly designed incentives that they solve no real world problems.

All that is to say that technical innovation in altcoins is almost always a complete miss. Real innovation finds a market. These altcoins haven’t found any real users for their stated goal and very few have managed to have any volume of any kind whatsoever.

As most altcoins are open source, forking the coin and changing a few parameters to create a technical clone is quite simple. If technology or features were the basis of value, technical clones would have significant value. Such clones don’t, so this indicates technical features are not the reason for their value.

No, what separates the valuable altcoins from the valueless is not technical improvements at all, but something else.

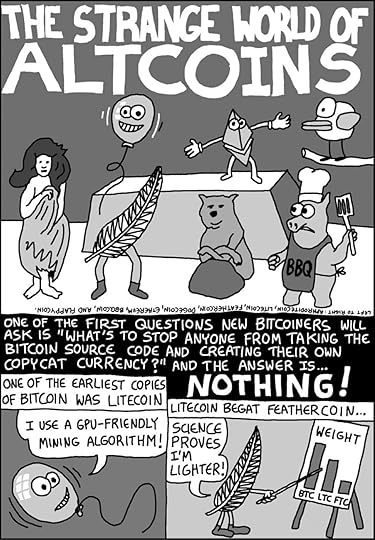

The Story of Litecoin and FairbrixThe story of altcoin valuation starts here because Fairbrix and Litecoin are two very similar coins. They have the same proof-of-work, a similar launch date (2011) and the same creator: Charlie Lee.

Both of these coins were based off of Tenebrix, which was an altcoin launched in 2011 using a then-new proof-of-work algorithm, Scrypt and a slightly faster block time versus Bitcoin’s 10 minutes. The community at the time objected to Tenebrix because of a large premine, leading Charlie Lee to fork Tenebrix to create Fairbrix. Much like how Zclassic would fork Zcash much later, Fairbrix was a clone of Tenebrix without the premine.

Of course, Fairbrix went nowhere and therein was the brilliance of Charlie Lee’s strategy. He took the same features and created another coin, Litecoin and branded it better. He changed the block time from 5 minutes to 2.5 minutes and worked out a few bugs and gave the coin much better marketing. His most keen insight as he would say to many people over the years, is that he gave Litecoin a catchy slogan: Silver to Bitcoin’s gold.

From a technical standpoint, this was a minimal set of new features. The one major change in the coin is the change in the proof-of-work algorithm which was copied from Tenebrix. The effort into integrating Scrypt was not exactly great engineering. For example, the block hashes in Litecoin are indistinguishable from transaction hashes. This is not the case in Bitcoin as block hashes all start with a bunch of 0-bytes, making block hashes obvious. Likewise, none of the small design errors in Bitcoin, like the OP_CHECKMULTISIG off by one bug or the 4-byte timestamp were corrected. Litecoin was essentially a clone with a few minor tweaks and good marketing.

There were a lot of coins created in the 2011 era that haven’t really survived, including IxCoin, SolidCoin, Geistgeld and Litecoin’s brother Fairbrix and father Tenebrix. The marketing deathblow for some would be a premine, which many in the community would condemn, but as Fairbrix shows, the lack of a premine didn’t guarantee an altcoin’s success, either. What made Litecoin popular was its clever marketing and technical features had very little to do with its success.

So why did these coins show up when they did? Mid-2011 was the first major Bitcoin bubble, going from less than $1 earlier in the year to $30 by July. All of the above-mentioned coins came shortly after the bubble popped starting in August. Many call this the “Scambrian explosion” of 2011. Given that all these coins started shortly after the bubble, there would seem to be at least some correlation. We would see similar Scambrian explosions in the subsequent bubbles of 2013 and 2017.

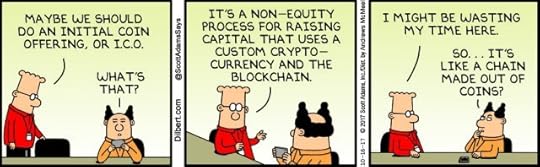

Mastercoin vs. Counterparty vs. EthereumFast forward to 2013 and we can see another group of altcoins entering the picture. Mastercoin launched that summer, followed by Counterparty a few months later and the Ethereum presale in early 2014. All three were after the same mantle, that of a platform for launching new tokens. Mastercoin was dubiously the first to do a token presale before any product was built, or what we would today call an ICO. Mastercoin’s presale followed shortly after the April 2013 bubble during the summer of 2013. The token would languish for years until the 2017 pump.

Counterparty was a response to Mastercoin, requiring Bitcoins to be burned instead of donated. Bitcoins had to be sent to an address which would require breaking some cryptography to redeem in order to get XCP tokens. Counterparty launched a few months after Mastercoin in 2013.

Of particular interest was the fact that after Ethereum’s ICO in 2014, all of the supposed new technical capabilities of Ethereum (the capabilities of the Solidity language) were added to Counterparty. Ethereum responded by showing that the Counterparty smart contract platform could just as easily be done on Ethereum. In essence, the two coins were feature-for-feature at the same level.

What made Ethereum much more successful than either Mastercoin or Counterparty was the unprecedented amount of marketing that went into the token sale. Not only was the ICO amount far larger than any previous one (30,000 BTC), but the premine that they had was sold to the public as a good thing, as a way to fund continuing development and marketing. As Vitalik has said, he made premines acceptable in a way that the 2011 batch of coins did not.

I’m not sure what universe Vitalik is in, but where I’m from, 67% is not “small”

I’m not sure what universe Vitalik is in, but where I’m from, 67% is not “small”The marketing driving the ETH presale dwarfed that of any other coin coming before and as a result, despite a lot of similarities in feature sets to Counterparty, Ethereum was able to succeed in the 2017 bull market in a way that the other tokens did not.

To say that this looked crazy to any rational investor at the time Ethereum launched is to understate the case. The complete lack of investor protections in their token sale and the ridiculous 72M premine made, for many, ETH dead in the water. In addition, there were several high-profile delays in launching as well as funding problems during the year and a half they spent building Ethereum.

Technically speaking, there are so many shortcomings in Ethereum that they’re planning to scrap the entire infrastructure for Ethereum 2.0! There have been numerous documented problems from the DAO to the Parity Bug to the fact that ETH addresses lack a checksum. Yet all of these problems have essentially been ignored by the market. The technical realities of Ethereum do not seem to matter to the investors.

In other words, Ethereum was able to overcome all of those problems with what can only be described as insanely effective marketing. In a sense, Ethereum is the precedent for all the different coins that have raised billions without any code or investor protections. They’ve also shown that even hopelessly insecure systems can thrive with enough marketing. When it comes to altcoins, marketing overcomes all.

The Curious Case of RippleXRP was the first token to be entirely premined and launched in 2012. Interestingly, the token languished in the sub-billion market cap range all the way until 2017, when it rode the wave of the Bitcoin bull market to a cool $127 billion market cap at its peak. Somehow, XRP wasn’t a part of the April 2013 or November 2013 bubbles and yet burst through during the 2017 one.

So what changed? How was an asset that was languishing for a good 5 years suddenly so popular? There seem to be several reasons, with more effective marketing during the bull run being one and the low unit price being the other.

The main marketing message for Ripple was always that they would be a coin that’s for corporations and big institutions. It’s an excellent marketing story as no other coin at the time of its creation claimed that mantle.

In addition, there appeared on Twitter the XRP Army in 2017 which relentlessly promoted the coin. Ripple Labs also sent out many press releases which, even when unrelated to XRP, caused the price of the token to go up. Having a corporation at the center seems to have aided the marketing efforts of XRP as it was much easier to send out press releases and throw parties and so on that would bring publicity.

In other words, by 2017, Ripple Labs stepped up their marketing game by leveraging its advantages as a corporation.

From a technical standpoint, Ripple is extremely centralized with software that calls home to upgrade and no way to resolve differences between different database states. Yet the marketing of Ripple and the XRP army obscure this on a daily basis. Technical reality and marketing, it seems, don’t need any alignment whatsoever.

Other altcoins since then have gone even further, creating or promising to create ecosystems in exchange for fully premined tokens. These tokens amount to gift cards to a store that has yet to be built and has no products or services yet with vague promises of opening at some point in the future.

BCH and BSV vs other BTC hard forks2017 brought on another class of altcoins, which gave an airdrop to Bitcoin holders. BCH was the very first hard fork coin, but it did not stop there. 2017–2018 brought a lot more hard forks like Bitcoin Gold, Lightning Bitcoin, Bitcoin Private and many others which have not fared nearly as well. This is despite many of these coins having better technical features. Bitcoin Private, for example, inherited Zclassic’s shielded transactions (which in turn came from ZCash). Lightning Bitcoin has guaranteed 1 minute block times. Bitcoin Clean uses less energy and Bitcoin Interest gives owners staking income.

Why did these coins fail in comparison to BCH? What appealed about BCH was not the technical differences, like larger blocks or a lack of Segwit, but the marketing capabilities of people like Roger Ver, Calvin Ayre and Jihan Wu. Roger Ver uses the bitcoin.com domain to mislead people into thinking BCH is Bitcoin and Jihan Wu at one point forced customers of the popular Antminer series of Bitcoin miners to pay in BCH.

“I made bitcoin what it is today, and I’ll do it again with Bitcoin Cash” — Roger Ver

Though utterly wrong about his influence on BTC, Roger Ver has the correct assessment of his role in BCH. Marketing has given BCH a huge advantage over the other hard fork coins. Roger Ver has spent a good deal of money sponsoring many conferences to promote BCH and bitcoin.com in 2018 (this has largely stopped in 2019).

The split between BCH and BSV is another precautionary tale as the market cap before the split was higher than the combined total after the split. The split in marketing efforts reduced the overall effectiveness leading to a lower combined market cap. Calvin Ayre and Craig Wright apparently had some marketing value for BCH which was lost to BSV.

Technically speaking, BCH has had a lot of documented problems and continues to put out dubious features. Note as with Litecoin, a lot of the design errors from Bitcoin like the OP_CHECKMULTISIG off-by-one bug or a 4-byte timestamp in the blockheader are not fixed, despite ample opportunity in the numerous hard forks since August 1, 2017 to do so.

Again, none of this seems to matter to the BCH holders. Marketing trumps all.

Why Altcoin Marketing WorksMarketing in crypto has a virtuous feedback cycle as anyone that buys a token tends to market the token to other people via word-of-mouth much more than any other product. The incentives are such that holders of a particular token do a lot of additional marketing for the coin, essentially for free. Altcoin creators euphemistically call such people their “community” which help promote the coin without any cost to the altcoin marketers. As such, the marketing money spent on altcoins has had out-sized returns.

Thus, the biggest factor for a large altcoin valuation is effective marketing and to a lesser degree the coordination of such efforts. Ironically, the more centralized an altcoin is, the better it tends to do. It’s not a coincidence that Ethereum and Ripple are the second and third biggest by market cap. They have strong centralized teams, one a foundation, the other a corporation that excel at effective marketing. BCH, which is fourth by market cap as of this writing, also has that same marketing centralization around Roger Ver, who owns the very valuable bitcoin.com domain.

Altcoins that aren’t good at marketing tend to do worse over time, even if they have strong technical teams. This includes coins like Monero, ZCash, Grin and Decred, all of which have strong cryptographers and programmers on their teams but struggle to do effective marketing. Still other altcoins have neither good marketing nor good technical teams and these do the worst of all.

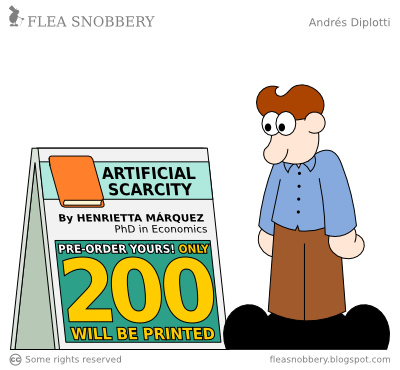

The game that altcoins are playing is one of effective marketing. The most valuable coins have managed to create demand almost purely through marketing. In other words, the demand is largely artificial. The technical efforts can easily be copied, but marketing dollars cannot. This also explains why so many altcoins spend so much money on conference sponsorships, parties, airdrops, online ads and charitable contributions. The market cap of a coin tends to reflect the effectiveness of the coin’s marketing efforts.

Altcoin TrendsThere are some clear trends on popular altcoins. Most altcoins are created right after a major Bitcoin bull market, going all the way back to 2011. Most altcoins, when they pump, do so at launch and during Bitcoin bull markets, which are clearly times when effective marketing is easiest when new s̶u̶c̶k̶e̶r̶s̶ ̶a̶r̶e̶ ̶b̶o̶r̶n̶ investors come in.

The technical details of a particular coin don’t seem to matter all that much. There’s no “fundamental” value to the technology or feature set, given that cloning coins is easy. Instead, technical “features” are more valuable for marketing purposes. All this is to say that the big reason altcoins have any value at all is because of marketing.

The bull markets also give these coins a fresh lease on life through renewed marketing efforts. They all ride the coattails of Bitcoin’s bullish runs. Even during these bull runs, altcoins still fail if they’ve stopped marketing.

ConclusionSo what does this all mean practically? This is good news for traders because it turns out the technical facts for altcoins don’t really matter! Traders can base their altcoin trades on market perception and not have to bother with any due diligence of difficult-to-understand products.

For investors, however, the conclusion should be jarring. Technical competence or utility potential do not matter at all for price. The market caps of altcoins only indicate how good a job the token’s marketing departments have done, not anything fundamental about the coin, like the quality of developers, the soundness of the idea or even the existence of a product. Popularity cannot be used as a proxy for technical competence, product potential or returns. Popularity for an altcoin does not indicate anything other than marketing effectiveness. Reality bears this out.

As a result of being able to hack past the normal due diligence that happens with an asset through really good marketing, there are a lot of scams in the altcoin space. The lack of fundamentals combined with the out-sized role of marketing has led to a perfect combination that make scamming lucrative and nearly risk-free. Many investors that could do no wrong in late-2017/early-2018 are now heavily underwater as a result.

Which ones are scams and which ones are legitimate? Given the very skewed incentives, the only reasonable thing to do is to treat every altcoin as a scam until proven otherwise. We can only hope that the market has learned in time for the next Bitcoin bull run.

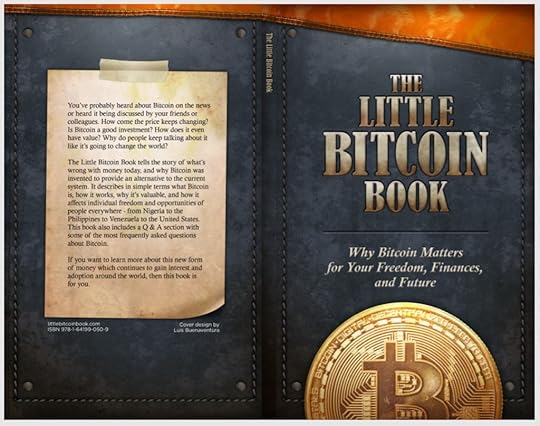

November 12, 2019

How to Write a Book in 4 Days

About a year ago, I was talking to someone about how difficult it was to get myself to write. I had been working on a book for O’Reilly and Associates for about 9 months at that point and had talked to other authors who acknowledged the same problem. Many authors find that books take a long time to write with 2 years being the norm. The 14 months that I took for my book was relatively fast, according to my editors.

Why is book writing so slow?It occurred to me that there must be a better way. After all, I’m a programmer and I’ve done crazier, more daunting tasks in a much shorter amount of time . What was different? Why was writing a book, or more specifically, getting into a flow to write so hard?

The problem was motivation. It’s easy to get stuck in a pit of despair with a large hill to climb. In the situations where I was most in the flow, the main motivators were a clear purpose, a clear goal, and most importantly, other people depending on me. Could a book be written the same way an application is prototyped? That is, quickly and iteratively as in a design or coding sprint? Could you really write a book in a week or less?

I became obsessed with the book sprint idea and I started mentioning it to some friends. I found that the coordination to create the right environment is pretty difficult given that everyone has obligations. The book sprint idea would have to wait to be paired with the right project that would be worthy of such coordination.

The ProjectThe project was not something I had expected to get involved in. I’ve been a programmer for a long time and though I care about human rights, it’s not something I’ve been actively involved in during my 20+ year career. Everything changed when I met Alex Gladstein. He invited me to have dinner with some folks from the Human Rights Foundation who had a real use for Bitcoin, the subject of the book I had just written. It turns out that Bitcoin is helping lots of people in distressed places with authoritarian regimes. I learned a lot about what they were doing and we promised to keep in touch.

Alex called me a short while later asking me if I would review a book idea he and a co-author had. The idea was how Bitcoin was changing society, especially in the realm of human rights. This would necessarily require some description of Bitcoin and why a government couldn’t control it, so they wanted my review.

Bringing Together a Book SprintThey wanted to pitch me on the idea, but I wanted to pitch them on book sprinting to see how well it could work.

You would think most people would tell me I’m crazy to think that a book can be written so fast, but reactions are consistently the opposite. Most people think right away that writing a book in a week is possible. This is likely because we’ve all done herculean tasks in a short amount of time. Maybe you were in a group project in college or managed to recreate the whole application in a crazy week before release at a startup. We’ve all done something superhuman with a group of people over a short amount of time. These are often some of our best memories and proudest moments.

In the end, we were enthused about book sprinting this project and we decided to gather some more people. After some discussion about who would be good for the project, we ended up with 8 people for a 4-day sprint in August. We weren’t sure at all if that would be enough time, but we decided to give it a go.

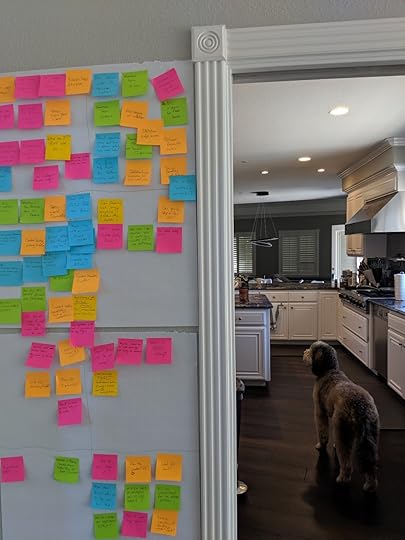

The SetupWe managed to get a place where we could all sleep, eat and work in early August. We wanted to be free from distractions to just work on the book. We had plenty of coffee, a good amount of food and lots of post-it notes and pens. We even had a gym, swimming pool, and a nice kitchen to cook our food.

We all brought our laptops, had a lot of places to discuss one-on-one, other places to work quietly and still other places to discuss everything in a group setting. We made liberal use of food delivery services and relaxed every evening.

Figuring Out What to WriteTaking a lead from design and code sprint principles, we started by getting into the mind of our target audience. We did an exercise where we each described the audience we had in mind. We wanted a good idea of where they would be at before reading the book, so we did a little role play to get into character. We asked our hypothetical audience member what they knew about Bitcoin, what their impressions about it were and what their biggest questions were.

We also wrote down what their reviews would be after reading our book. These served later as something like acceptance tests for our book. Everything we would write later had to be evaluated on whether it would help readers get to the review we wanted.

Now that we knew where our audience was before and after the book, it gave us a good idea what knowledge the reader lacked. We then listed everything possible that could help the reader get from point A to point B on separate post-it notes. We then put them on the wall and started organizing them together.

OrganizingWe gathered at the sticky-filled wall and started to organize the ideas into groups. There were some obvious categories to write about, but some seemed to be completely out on their own. After an hour or so, we managed to group them and label what would become our chapters.

We put the chapter titles on bigger post-it notes and started discussing what the table of contents would look like. What sort of flow through these topics would help the readers? How could we get the reviews we wanted? What started as ten chapters were combined and shrunk to six chapters in an order that was both engaging and clear.

At this point we were at the end of Day One, but we felt really good about where we were. We knew what topics we needed to write about (chapters), and topics each chapter needed to cover (post it notes in each chapter). The only thing left were the actual words.

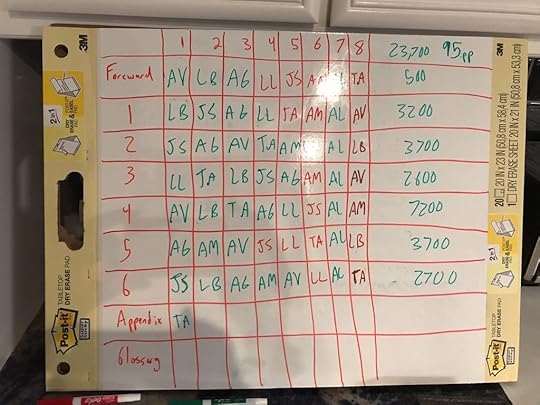

WritingThe next two days went surprisingly fast. We assigned first drafts and kept a record of who reviewed what chapter on a whiteboard so everyone could see. Everyone wrote, re-wrote, edited, re-edited and every chapter was seen by everyone. The only rule was that when you got to the chapter, you could edit, add or delete anything. The mentality that we had was one of group ownership. This or that section wasn’t any one person’s it was all of ours. We checked in every 3–6 hours, ate together, hosted some guests who dropped by and slept when we could.

There’s something to be said about working in close proximity to one another in this environment. Whenever anyone got stuck, they asked for clarification or asked others for thoughts on the topic. There really wasn’t any room for writer’s block as we knew that everyone else was depending on us. The first drafts of each chapter were completed in about 6 hours. Each round after that took about 3 hours each. Everyone added their own perspectives in each round of edits. Sometimes whole sections would be added. Other times, there would be illustrations or stories here and there, and still others improving the style.

At the end of the Day Three, we had a manuscript with the content but not quite the voice we wanted. Still, we sent the book out for review by trusted friends who fit the audience profile. In the meantime we started to make the voice in the book consistent. We found that the book worked better by rearranging the longest chapter into a Q&A section at the end of the book.

ReviewThe last day was spent on a lot of copy-editing. Asking questions such as: Is this concept clear to someone that doesn’t know anything about Bitcoin? Did we mention this concept yet by this time in the text? What other illustrations do we need?

The review process is where we found that we had some conflicts. Should we include this section or that? How much detail does this particular section need? There was a lot of disagreement and hence a lot of talking through what we needed to change. It’s easy to see why. There was a lot of effort that sometimes got deleted and it’s easy to feel slighted.

In the end, we reviewed the whole book, rewrote certain parts and uploaded the laid out book to Amazon which can be seen here.

ConclusionI can say with confidence that book sprinting is very different than traditional book writing. There was a lot more energy, creativity, and excitement in sprinting instead of the slog, dread and boredom of the normal process. Of course, there was also more conflict, discussion and throwing away, but overall, the trade-off was totally worth it.

I was shocked at the quality of what we could achieve in such a short time. I’m very proud of how the book turned out and I am sure my co-authors would say the same. This might be a good time to mention them by name: Timi Ajiboye, {cryptonight}, Alex Gladstein, Lily Liu, Alex Lloyd, Alejandro Machado, and Alena Vranova. I can say confidently that this book brought us together in a way that no conference or group meeting could.

The key piece seems to be what we did the first day where we agreed on what we were trying to write. That helped guide a lot of our discussions and made disagreements less personal.

If there was anything I would change, it would be to involve an editor from the beginning. A lot of passages needed fleshing out and others needed tightening up. Trying to make the voice a little more consistent from the beginning would have helped a lot.

That said, the sprinting process was incredibly enlightening about what can be done when a group is motivated. We made a book describing why Bitcoin matters in four days! I know for myself that I’ll try more book sprints. You can see the results for yourself here.

June 5, 2019

Why ICOs Are Broken

ICOs, also known as utility tokens, have dominated the cryptocurrency industry for the past three years. They’ve been credited with Ethereum’s growth, a new financing model and a gateway to a decentralized future. But what are utility tokens, really? Economically, what do they do and what value do they add?

This article will show that utility tokens have no real utility and that they’re schemes to extract fees on transactions from a decentralized application. Those applications, in turn, have little to no chance of traction because of the friction introduced by these tokens. In other words, this article will show how ICOs, despite being championed as vehicles of value creation, actually destroy value.

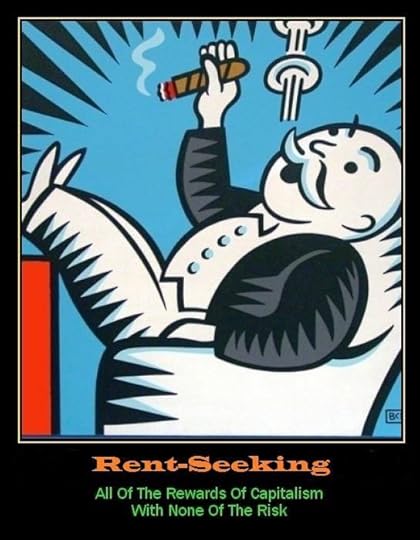

But before we get to all that, we need to define an important concept: rent-seeking.

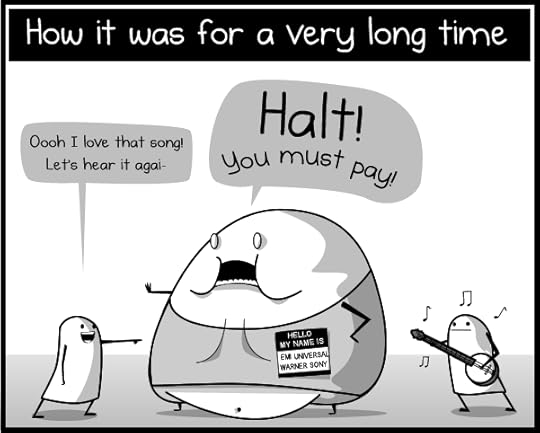

Defining Rent-SeekingRent-seeking is the process of extracting money from a transaction without adding value. The easiest way to describe rent-seeking is taxing some activity without doing anything useful. Think of a typical government bureaucrat who rubber stamps whatever comes through, say in the copyright office. That person doesn’t add anything, but extracts a tax on these transactions by getting a salary.

Rent-seekers make money without doing very much. As every management consultant knows, large corporations have many people who do very little. These are your rent-seekers and they manage to wiggle their way into cozy corners of the market that lack natural competition, such as monopolies, or where their transactions are mandated by regulation.

Why Rent-Seeking is AttractiveRent-seeking is popular because there’s not much work or risk involved. People like earning in excess of the work they put in. The bigger the gap, the better. This is why so many Ivy League graduates pursue careers in Banking and Finance despite lacking any particular inclination toward those fields. Those fields are rife with rent-seeking opportunities with enormous wealth potential.

The tragedy of rent-seeking is that it’s a net negative to society. Instead of producing goods or services, rent-seekers simply collect taxes that create unneeded friction. That friction is stealing from the productive value creators to fund the unproductive rent-seekers.

Why Rent-Seeking ExistsThe existence of rent-seeking is strange, especially in a supposedly market economy. How is it that someone who is a drag on the economy is allowed to exist in an efficient market? Shouldn’t other companies without rent-seekers destroy the companies with rent-seekers in the free market?

This would be correct in a true market economy. Unfortunately, western economies (or any other for that matter) are nowhere near true market economies. A true market economy requires sound money and that’s precisely what these economies lack.

Economies based on fiat money funnel new money to preferred groups, who in turn have an unfair advantage over everyone else. Preferred groups use this advantage to build regulatory moats around their industry and create something akin to a monopoly to essentially force everyone to use them.

This is most obvious in government monopolies such as the public education system and government agencies, but it’s also true of large banks, and through them, large companies. Every large bank gets access to insanely low interest rates which allows them to re-lend those funds on a fractional-reserve basis for a large, no-risk gain. Should those funds get paid back, they make money, and should those funds not get paid back, they get a nice bailout. Those profits, in turn go to the rent-seekers who feast off of the heads-I-win-tails-you-lose situation.

Newly created funds also go to large companies as they’re seen as least risky. This isn’t necessarily because they’re great businesses, but because the likelihood of bailouts is higher when companies are larger. The large companies in turn have a huge advantage over smaller competitors with a much larger war chest. Often, this war chest is used to buy out their competitors.

In essence, fiat money creates a lot of rent-seeking opportunities. The excess money created in fiat money systems finds its way to people that don’t add anything, generating friction in what’s supposed to be an efficient market. This is why government and corporate bureaucracies exist.

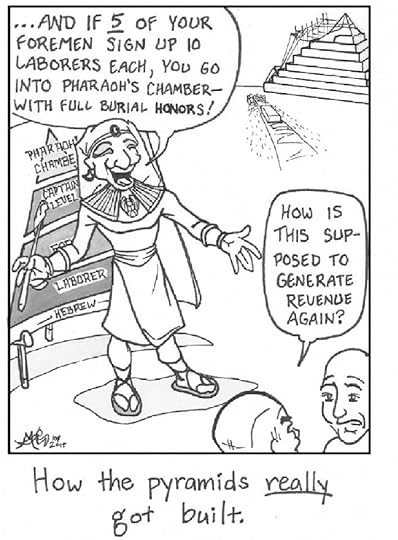

ICOs, Democratizing Rent-Seeking!What ICOs have done is formalized the rent-seeking process. A utility token’s nominal value is the utility value, such as being able to place a bet in a dApp. But due to the dApp being restricted by the token, anyone wanting to use the dApp must go through the holders of the tokens. Instead of using an existing currency, the peddlers of ICOs offer early buyers the “opportunity” to be a gate-keeper for the dApp. In other words, utility token holders are rent-seekers that get to tax people that want to use the dApp.

Of course, adding such friction to an application is bound to dampen the uptake of the application, and that’s exactly what we’ve seen. Utility tokens are almost never used for the dApp and instead used for pure speculation. You can think of this situation as a group being sold rent-seeking positions, only to find that there aren’t enough transactions coming through to justify having paid so much.

Far from making dApps useful, utility tokens almost certainly doom dApps to failure. Utility tokens not only lack utility, but detract from whatever utility a dApp might have by introducing friction. The only people that use the token are the holders whose expected profits from taxing dApp transactions are much lower than they anticipated. The only utility consumption of the token tends to be by these holders, who reason that by using the dApp they can create the perception that the dApp is useful and drive up speculative demand for their tokens.

Taking advantage of the human desire for rent-seekingThis process illuminates the clever way in which ICOs have operated. ICOs use the carrot of potential rent-seeking opportunities as a way to entice buyers. When the application doesn’t end up being popular, the buyers are left holding the bag. Tokens meant to make them rich are the very thing that prevent the dApp from succeeding.

This is sadly how Ponzi/Pyramid schemes work. They promise some easy rent-seeking opportunities to gullible people who in turn expect to make money for doing very little work. Unfortunately, the utility demand for the token is non-existent, so the only demand left is the speculative demand. Speculative demand requires more and more buyers, creating an unsustainable bubble.

In other words, utility tokens, because of their utility-killing nature, require more and more gullible people or the whole scheme falls apart.

Ethereum, Rent-Seeking from ICOsOne might point to Ethereum as an exception to the rent-seeking rule based on the fact that it has been the platform of choice for “successful” ICOs. Ethereum has been successful because it’s taxed every such ICO. Anyone who wants to create an ERC20 token has had to transact in ETH. Every ETH holder is able to rent-seek off of those that want to buy rent-seeking opportunities!

In other words, the Ethereum token has done well precisely because it’s found more greedy and gullible people that want their own rent-seeking opportunities. The prospect of being able to be at the top of a new pyramid of rent-seeking has tempted and suckered them.

ETH has successfully taxed lots of these schemes and ICOs are really new layers of a Pyramid scheme or new suckers in a Ponzi scheme. It’s not a surprise then that so many tokens have tried to compete in this market as being at the top of a Pyramid scheme is enormously profitable. Every dApp “platform” (e.g. EOS, TRON, NEO, etc) is essentially trying to be at the top of a new pyramid so that they don’t have to pay a tax to Ethereum!

ConclusionUtility tokens are rent-seeking devices. Because access to the application is bound to those tokens, they act as a way to tax anyone that wants to use these “decentralized” applications. Such rent-seeking introduces friction, which is why there have been so few people that have used these applications.

About the level of sophistication of ICO token buyers

About the level of sophistication of ICO token buyersThe honest way to build applications would be to use an existing currency like Bitcoin, USD or even ETH. Instead, ICOs are creating their own money and enticing early adopters with rent-seeking potential. This is a Ponzi/Pyramid scheme in a different guise.

Utility tokens are rent-seeking vehicles that doom applications to failure. The sooner people realize their economic purpose, the better off we’ll be.

May 20, 2019

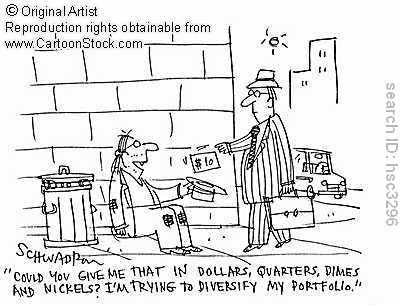

Why Cryptocurrency Diversification Makes Little Sense

Anyone coming into crypto realizes very quickly that there are a lot of different coins out there. Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash, Tron, Cardano… How is an investor supposed to figure out which ones to invest in?

There are many arguments to be made about why diversification in cryptoassets makes little sense, including the network effect of money, but in this article, I’ll make another argument as to why adding altcoins to a portfolio that has Bitcoin makes very little sense.

Why Diversify?The traditional reason for diversification is to optimize the risk/reward ratio. By buying, say, 10 different stocks instead of 1, the thinking goes, you can reduce volatility and downside since your eggs are spread in many baskets. The purpose is reduction of volatility and downside to minimize the risk/reward ratio. There’s a whole field devoted to doing this called Portfolio Theory, but the goals of diversification are pretty clear: reduce the risk of permanent loss and reduce volatility.

When someone chooses 10 stocks for a portfolio, the stocks typically already meet some minimum requirements. For example, they’ve met some requirements by the SEC in terms of transparency, their history is available to the market and they’re under threat of penalty if they cook their books. This is to ensure that the marketing story about a stock has to conform to the underlying reality, especially their prospects and financial condition.

Diversification in this context may make sense because there’s reason to believe that the story being told about the stock by the company is at least close to being true. The unstated assumption is that the risks and rewards around a stock are understood. That is, the error bars around the risk are not too big and there are good reasons to believe that the companies being considered are telling the truth. Hence diversification in a stock setting make sense if the risks and rewards are reasonably understood.

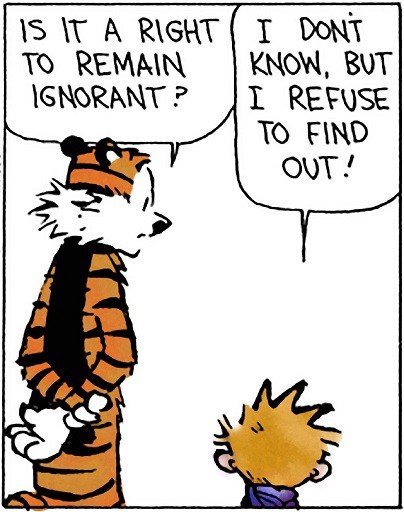

The Story vs. Reality of a CryptocurrencyThe reality of a cryptocurrency is in the code which, unfortunately, is very dense, hard to read and impossible to understand for a large amount of people. Because cryptocurrencies exist in the digital realm, the code and the network that secures it is the reality. While the ability to analyze the underlying reality is there, it’s just not practical for most people, even experienced developers, to study the code underlying a cryptocurrency in less than a few months.

On the other hand, there is usually an abundance of marketing material about a cryptocurrency. These are stories of what the technology underneath can do and speculate on use-cases envisioned by the creators. These are often whitepapers that purport to show the details of the actual system, but are not rigorously defined like code is. This is documentation that’s more understandable, and often precedes any code that gets written.

In cryptocurrency, because of the difficulty and/or expense of evaluating the underlying reality (that is, the code), the marketing story is used as a shortcut. A few may evaluate the code (if it’s available), but most use the marketing story because it’s cheaper and easier.

Disconnect between Story vs. RealityThis brings up the question, just how divergent is the marketing story vs. the underlying reality? As brought up earlier, in a stock market, the two cannot diverge much without some serious penalties. In cryptocurrency, there is no enforcement mechanism to force the story and the reality to conform. Instead, there are incentives to over-promise on the story and under-deliver on the reality.

Embellishing the marketing story will result in higher price as most people will use this shortcut for their evaluation. What’s more, the reality doesn’t need to be delivered immediately and that gives the coin’s developers plenty of excuses to delay. Given that it’s an order of magnitude harder to disprove a story than to tell it, the over-promising has a good chance of not needing much defending beyond “we’ll get to it later”. In other words, exaggeration in marketing doesn’t cost much but adds a lot of token buyers. This is in contrast to the stock market where such exaggeration will incur some penalty.

Under-delivering the reality is another clear win for the coin’s development team. Promises that cost too much to deliver don’t have to be delivered at all. After all, they often already have the money. What they do deliver has no need to meet any sort of technical standards, either. Since it’s costly to evaluate the code that they do deliver, most people just stick with the marketing story and don’t bother much with the technical reality. The implementation, can be a complete mess, the security unaudited, the tests unwritten and nobody would be the wiser.

What we find is that the incentives are such that there’s much reason to over-promise and under-deliver. The perceived reward, which is essentially a quantification of the marketing story, is thought to be high. Since that’s the metric most people use, the price reflects a very optimistic future. As a result, the risk/reward ratio gets very high as permanent loss of capital becomes more and more likely.

In this sort of environment, it’s no wonder that so many scams have run amok.

The ConsequencesBy having so many people rely on the marketing story instead of the technical reality, and given the incentives of over-promising and under-delivering, we have ourselves a giant mess of an industry. Most coins are not vetted beyond the marketing story making sense (and sometimes, not even that!), and result in a giant inverted trust pyramid with the founder at the bottom.

The technical reality is usually only understood by a few and everyone else trusts that what the creators put into the whitepaper reflects reality. There is nothing to really enforce that the story and reality conform, and instead the information about the coin comes from a small number of people that created the coin. ZCash might have some incredibly interesting technology, but there was a counterfeiting for a very long time. And this is one of the more responsible altcoins, so how much more are the other ones hiding vulnerabilities?

This means that most coins in the industry have very high risk profiles. Most of them have no hope of achieving what they purport in their marketing story. Most have no track record of delivery and can be fairly characterized as unresearched. If these were stocks, they’d be sent to the pink-sheet and have a very low price due to the risk premium. Diversifying into unresearched pink sheet stocks doesn’t reduce risk, nullifying the point of diversifying.

What about Bitcoin?You may be asking at this point, isn’t this true of Bitcoin? That would be a fair question, but the answer would be no. The reason is because Bitcoin has been pored over technically by thousands, if not tens of thousands of people over the years. Even when the whitepaper first came out, it wasn’t the same environment we see today, where near anything got an investment. When Bitcoin launched, few people were running nodes or mining, let alone trading it for anything valuable. The incentives for over-promising or embellishing the story weren’t there. Furthermore, the whitepaper accurately described Bitcoin and over-delivered. In fact, the whitepaper was written after the code!

Furthermore, given that Bitcoin was the first coin, Bitcoin has had a much larger scrutiny of its codebase. The obvious evidence for that is that altcoin creators often have to scrutinize the Bitcoin codebase to create their own coin. In addition, there are over 500 contributors that have had merged pull requests, making it the largest open source cryptocurrency project.

What about an altcoin that’s forked from Bitcoin?At this point you might be wondering about coins that don’t diverge from Bitcoin very much. Litecoin, Bitcoin Cash, Bitcoin SV and others are essentially small tweaks to the Bitcoin codebase.

There are two questions that we have to ask here. First, what are the changes from Bitcoin? Second, how maintained is the codebase?

The first question is usually the easiest to answer and usually, the main difference is that the altcoin is centralized. The technical difference is generally small enough that including such a coin is not going to reduce risk or decrease volatility, nullifying the reason for diversification.

The second question is the much more important one. If the coin doesn’t maintain the codebase in the same way as Bitcoin, then it’s got a bigger risk. This may come in the form of a smaller development team, less developer activity or quality of merged pull requests. The changes to the code since forking can be evaluated to determine the underlying technical reality. This, too, is expensive and slow so most people don’t do it.

The case against including forked altcoins is simply that the quality is worse and that there’s no risk reduction. In other words, these coins can fairly be characterized as “worse” Bitcoins which don’t add the desired properties of risk reduction and volatility reduction to a portfolio.

So What Diversification Makes Sense?We know Bitcoin is different from altcoins in many ways. First, Bitcoin is decentralized while altcoins are not. Second, Bitcoin at its creation did not have perverse incentives, whereas altcoins at their creation did. Third, Bitcoin has the largest market cap value.

Any exposure to this space, then, requires Bitcoin at a minimum. The question, then, is, what else do you put into your portfolio?

The answer here is to do your own research. The data out there is mostly marketing material, full of exaggerations and difficult or even impossible promises. As the non-Bitcoin coins carry pink-sheet stock level risk, the scrutiny needs to be much higher, not lower, than that put into Bitcoin. Thus, real research means evaluating the code.

If you don’t know how to read the code, or worse, if the code is closed source or not written yet, that should be a complete non-starter. The technical reality of the currency cannot be verified.

If you’re capable of reading the code, but don’t want to put in the time to do so, that’s also a non-starter. There simply isn’t enough assurance with such coins to know that the marketing story and technical reality aren’t divergent. Reliance on anything else, including the opinions of people on Twitter and YouTube are likely based on the biased marketing material and/or kickbacks and not the code, which has no obligation to conform to reality.

This, in turn, means that there will have to be a significant amount of research put in to qualify a cryptocurrency as investable. Given that the market caps and/or liquidity of most coins are tiny, the time researching such assets simply isn’t worth the effort as they’re likely uninvestable anyway.

ConclusionDiversification in cryptocurrencies makes little sense. The marketing story and underlying reality are incentivized to diverge and proper evaluation of each coin very expensive. Investing in altcoins without looking at the code is the equivalent of diversifying into random pink-sheet stocks without doing any research. Such an action would add risk and volatility, not reduce it, nullifying the whole point of diversification.

In addition, given the incentives at play, looking at the code is itself likely a waste of time. This is why the pink sheet market volume is so tiny versus the NASDAQ or NYSE.

The one cryptocurrency that is sensible to invest in is Bitcoin, because it’s been qualified through its unique birth and continued maintenance through its 10 year existence. Diversification of a portfolio by adding Bitcoin really can add upside, reduce risk and reduce volatility (if it’s counter-cyclical). Adding unresearched altcoins does not and hence makes no sense.

May 13, 2019

Lessons Learned from Teaching Over 500 Developers or: Why You Should Level Up

This is the text of the talk I gave on May 12, 2019 at the Magical Crypto Conference in New York City.

My name is Jimmy Song and I teach Bitcoin development. Just as a show of hands, how many of you have read the whitepaper? How many of you know how to code? How many of you have contributed to an open source project? How many of you have contributed to Bitcoin Core?

My goal here today is to inspire you to understand Bitcoin better and take you from one level to the next. I’ll do that through some of the insights I’ve gained by teaching over 500 people and make it applicable to you by showing you what’s effective in your journey toward understanding.

The ClassThe first thing to learn about my class is why people take it. One reason is because Bitcoin is rather intimidating. The impression that a lot of people get is that Bitcoin is a super-security conscious network where a small screw-up could lead to a lot of money loss. That would be correct. The security implications and rather daunting for someone starting out and having someone guide them in their learning is a huge incentive.

Another reason is because Bitcoin is difficult to understand. It’s not an easy technology and most people have a hard time learning on their own. I’ve had people tell me that they spent 6–18 months trying to learn the technology on their own before giving up and taking my course.

The last reason is because a lot of people want the motivation of taking the course to get them into gear. The investment that people need to make in terms of time and money is quite a lot and that helps people get into the right state of mind to take the learning seriously.

I encountered all of these issues when I was getting started coding in Bitcoin, back in 2013. Back then, the documentation was sparse and any sort of learning platform, non-existent. One of the reasons I created this class and wrote my book was to help developers not suffer as I did.

The structure of my class is a 2-day workshop that consist of 8 hour days. The one major exception to this was a half-semester graduate class I taught at the University of Texas, which was split up into 7 weeks for 2.5 hours each. Since some of that class time was spent on exams, the total number of hours ended up being about the same. The students code a library for themselves that does a lot of what any Bitcoin library would do. They are positioned to learn together with peers that are basically starting from the same place.

ReadThe first learning is that most people think they know more than they do. It’s easy enough to talk about concepts, but presenting the details usually results in some real light bulb moments. Here’s one student’s evaluation of the course:

To be honest, if it wasn’t for the scholarship I would never have considered attending Programming Blockchain. More than the cost, I arrogantly thought that having a computer science background meant that I somehow already understood Bitcoin or that I could always fill in the gaps with a bit of light reading. How would a two day seminar help?

Oh man what a wake up call! Within a few short minutes of sitting down, reality set in. The scope of the task ahead was made clear. We were to digest a semester’s worth of new material in two days whilst solving programming puzzles at unrelenting pace. The average technical ability was insanely high and I felt like the dunce of the class!

It was a indeed a huge challenge, but one that was immensely satisfying. Each puzzle would build upon the previous ones, until we finally built up enough layers of understanding to create, parse and verify transactions and blocks with our own code. Now we can build our very own wallets!

The second learning is that near everyone is surprised by how much they learn in two days. We cover a lot of material, though, to be clear, we only really cover a small portion of all that goes into Bitcoin. The reason people are able to do this are three-fold.

First, because people are setting aside two days and in a setting where this is the only thing that they’re doing, they are truly focused on the task at hand. Yes, people still check their email and social media accounts between sessions, but sitting in a classroom for 8 hours with no other responsibilities really helps.

Second, because people have to code, the lectures really harden. The implementing helps students get a good grasp of what was just learned in concept.

Third, because they have peers, there’s a desire to keep up. Much like how crossfit incentivizes people into putting more effort than they would alone, being in a classroom setting motivates people to keep up with everyone else.

What does this mean for you? Well, first, if you want to understand Bitcoin, you’re going to have to do some reading/watching/listening. This could range from the most basic concepts to the most critical code. Why should you do this? As I’ll make clear later, this is really good for your investment! And finally, if you want to really absorb the information, you’re going to have to set aside time to really focus.

CodeThe next learning I want to emphasize is that concept is not code. The example here is of public key cryptography. Most people, at a high level understand that only a private key can create a signature and a public key can verify it, but do they really understand how it works? Most don’t. Implementing the code requires a much deeper understanding of the concept to make things work. What I’ve noticed with my students is that they have some general idea of how something works when they come in and a bit more when I lecture, but they don’t really understand until they code.

The beauty of coding is that there are no ambiguities. You can’t hand wave over anything. You have to be clear in what you mean and be precise in what you ask the computer to do. That level of rigor is helpful to understand what’s going on.

This in turn leads to appreciation for the coders that actually implement Bitcoin. Core developers are held in high esteem already, but learning about various concepts and how they’re implemented inspires gratitude. For example, UTXOs are a concept that many people know, but when students learn about how transactions are constructed, they gain a true appreciation of how elegant a solution Satoshi made to make keeping track of the ledger simple.

Another such example are Merkle Proofs. When students learn how you can prove a transaction is in a set without knowing the entire set, they’re surprised at its cleverness. The forethought involved in adding the Merkle Root to the block header is something students really start to appreciate.

Lastly, Segwit really tends to blow peoples’ minds. Generally, their reaction is, “Why was this so controversial?”. They see how it helps the network and cleverly makes things backwards compatible and how it really doesn’t break any precedents since they learn about pay-to-script-hash beforehand.

What does this mean for you? At the risk of getting banned from Twitter, learn to code! Not only is this good for your Bitcoin investment, but it’s great for your career. If you think that only programmers take my class, you would be wrong. I’ve had accountants, hedge fund managers, project managers and many other professions take my course. Knowing the bare metal, so to speak, helps in almost any endeavor involving technology and this is definitely true of Bitcoin. How do you get started? Find a group to learn with. This will help the same way that a yoga class or a crossfit class helps you get fit. You can hack your inner social animal to your advantage.

TeachAnd this segways nicely into my next point. People learn a lot better in groups. Part of the reason is because you have peers that can help you. This helps both the helper and the helpee. The helpee obviously gets another explanation from another perspective. The helper is forced to articulate the knowledge in a clear way that another person can understand.

This is why I believe diversity in a classroom helps a lot. For a long time, my classes were mostly men. This is to be expected, I’m male and I generally know best how to market to people in my demographic. When Elizabeth Stark started helping me recruit women for some scholarships, I noticed something. First, the classes were a lot more fun to teach. Different perspectives mean that you get questions phrased differently. I’m forced to explain things in more complete ways as a result. Second, I noticed the students enjoyed the class more, too. The group dynamics in a learning environment seem to get better with more diversity. My favorite class that I’ve taught happened a year ago here in New York City. Due to Elizabeth’s recruiting efforts, we had a diverse group of 37 students.

After the two-day class we usually go for a drink nearby to unwind a little. We hang out, have a good time and talk about Bitcoin. What I noticed about the New York class is that we hung out for a good 6 hours after the class. Everyone enjoyed being with each other so much that we just kept hanging out!

Lastly, it turns out a lot of students enjoy explaining to others. Justin Moen, Stepan Snigirev, Pierre Rochard, Hugo Nguyen are all known in the industry for their explanations and teaching. They’re all alumni of my course. Each has found that explaining Bitcoin to others is a great way to learn themselves.

What does this mean for you? Well, teach! As they say, if you really want to learn something, teach it. Teaching forces you to learn the topic thoroughly as we all want to avoid embarrassment. But more subtly, it helps us to practice defending Bitcoin against attack.

There are so many ridiculous claims by altcoiners out there. For example, Ryan X Charles recently claimed that lightning nodes are money transmitters. Helping educate others through teaching helps people understand what’s going on.

How can you do this? Go to a local Bitcoin meetup and ask to present. Or use Medium to write an article. The level of rigor required for creating teaching material will really help you understand Bitcoin.

ConclusionSo here are some takeaways for you. First, realize that understanding Bitcoin is hard. Yes, Bitcoin is simpler and more secure than altcoins, but it’s still not easy to understand. What you think you understand, you can always understand better.

Second, understand Bitcoin deeper through reading/coding/teaching. This is not only good for you, as you’ll understand your investment better, but also good for the ecosystem.

Which brings me to my next point. The ecosystem is you! The traditional centralized way of running things is all based on trust. Trust ends up being about credibility, and in a darker way, about discrediting others. This generally leads to a lot of politicization of said entity as someone that can play that game usually ends up taking control.

This is the path that altcoins are going down. Ethereum, for example, has set up a cult of personality around Vitalik. Their system is so hopelessly complex and so few people understand how it works that very few people even bother setting up a full node. Instead of looking at new features critically, they end up trusting whatever Vitalik says. In other words, they’re trusting, not verifying.

Bitcoin is about verifying, not trusting. Many of us run full nodes so we can verify the transactions ourselves. That’s what makes the network decentralized. It’s also important to make the understanding of Bitcoin decentralized as well. Instead of trusting such-and-such person, we should be able to evaluate what they’re saying. That’s how we stay decentralized, by making Bitcoin a real meritocracy with critical evaluation of the code.

Now that said, this doesn’t mean that you need to understand the subtleties of possible security breaches in every line of code. I just want you guys to take one step toward verifying and one step away from trusting. In other words, I want you to level up! Only by understanding better yourself will we get stronger as a community. Thank you.

Some books you can read to start on this journey are my book, Andreas’s book, Grokking Bitcoin, Inventing Bitcoin, The Bitcoin Standard and Bitcoin Money.

May 8, 2019

Reorg Scenarios: Binance Hack Edition

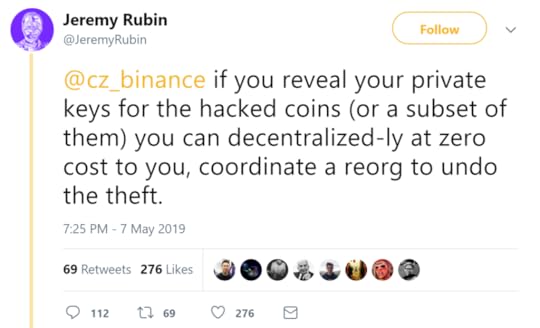

Binance was hacked on May 7th, 2019 for 7000 BTC. Soon after we saw this tweet from Jeremy Rubin:

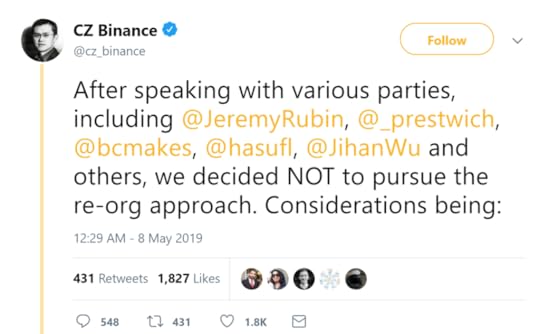

This apparently led Binance to consider a reorg attempt which, according to the CEO of Binance, Changpeng Zhao (aka cz), was scuttled after some consultation with a few people:

In this article, I’m going to go over the incentives behind a possible chain reorg. In a sense, I already calculated how much it would cost Binance to attempt a reorg in this tweetstorm. A more full discussion of the consequences are what I seek to put here.

A DisagreementIn this tweet, you can see Ari Paul and Adam Back come to a bit of a disagreement:

Essentially, Adam is saying reorgs like this won’t happen, Ari is arguing that the incentives are such that a reorg is possible. Who’s right? Well, that’s where we need to do some game theory analysis. Let’s begin with the most basic scenario:

A Simplistic ModelLet’s assume a very simple model where 100% of the hash power helps Binance.

This is the easiest scenario to analyze. We suppose that Binance gets in contact with every mining pool (unlikely), come to an agreement on how much to compensate each miner (likely for some, but unlikely for others), and get a consensus. We assume for the moment that no one disagrees (highly unlikely) and that no one would set up an alternate pool to mine the much longer chain.

First, let’s examine what a fair amount to compensate the miner would be. If a miner has 10% of the network hashing power and the reorg started 100 blocks after the attack, the miner would be giving up 10 blocks worth of rewards, or 125 BTC along with fees. You might be thinking that in the reorg chain, they would be getting roughly 10% of the block rewards, so this would cancel out, but that’s not true. They could be mining the original chain for 10% of the block rewards during that time, which means they would be losing 125 BTC by helping Binance. Thus, they would need to be compensated for the block reward and fees for the blocks they already mined in the original chain by Binance. For the sake of this scenario, let’s say each block has 0.5 BTC fees per block, or 130 BTC total.

That’s not all! There’s also the risk premium in case anything goes wrong. If nobody goes with Binance’s reorg chain other than this miner, that’s wasted hash power that they could have put into the original chain. Binance would have to agree to either compensate that risk or be on the hook for the hash power wasted if their effort does not succeed. This would be a significant part of the compensation, but for the sake of keeping this article short, let’s ignore for now.

So if Binance starts trying to reorg 100 blocks after the theft, they would essentially have to pay 1300 BTC to recover 7000 BTC, netting them 5700 BTC. You can consider this to be the ideal scenario from Binance’s perspective as they recover a large chunk of the money.

What are the consequences of a scenario like this? The most obvious is that such a thing would prove Bitcoin to be centralized, since if Binance can force a 100 block reorg, any sufficiently powerful entity could do the same thing. There would be many double-spend attempts and anyone that transacted in those 100 blocks after the theft would have to go through the massive headache of figuring out what happened. In fact, it’s possible there would be thefts from exchanges in the form of double-spends at a scale larger than the original 7000 BTC amount! There would be significant disruption for everyone who is transacting on the Bitcoin network as nobody would take 3–6 confirmations going forward given what Binance would have been able to do.

In other words, exchanges, merchants, users would all have at a minimum, giant headaches to deal with and much worse, have to deal with a lot more pain in the form of possible double-spends and so on. And we haven’t even gotten to what the thief would do!

Thus, this scenario is highly unlikely as all the people that would experience pain in this scenario would put up some resistance.

A More Contentious AlternativeThis would be a contentious fork and a race to be the longer chain. Overtaking with 55% of the hash power for a 100 block reorg means that it would take on average 1000 blocks (~2 weeks in this scenario). The variance on that is also fairly high, with 500 blocks and 1500 blocks being fairly common in that scenario. Even at 99%, it would take 101 blocks (~20 hours) to overtake.

But that’s assuming everyone stays on the same side the whole time. In a scenario like this, both sides are going to want to lure miners from the other side. The original chain has the advantage because of the 100 block lead it has at the start.

On the side of the original chain are exchanges, merchants, users that don’t want a 100+ block reorg. They would all likely compensate miners on the original chain. They could do this fairly easily: spend a UTXO valid only on the original chain with a high fee. If the fees on the original chain get high enough, many miners will be tempted to switch.

One particular user on the original chain needs to be pointed out, and that’s the thief. They likely will make similar transactions (UTXOs from the theft transaction are perfect for this) to compensate miners with high fees on the original chain.

On the other side is Binance. They would have to combat all the exchanges, merchants and users, not to mention the thief, to get a longer chain.

The thief has 7000 BTC from Binance, so they are incentivized to spend up to that amount. Binance would have to spend 1300 BTC + whatever the thief is willing to spend + whatever the exchanges/merchants/users are willing to spend. This is clearly a losing battle. Unless the desire to punish the thief is worth at least 1300 BTC (or 13 BTC * number of confirmations in the theft tx), this scenario doesn’t work for Binance.

ConclusionThere are more complicated scenarios, especially with all the offline mining equipment out there, but all of them are pretty easy to analyze. The thief can incentivize miners, so it’s a losing battle for Binance, where they’ll have to pay for each block reorganized plus whatever they lost in the theft.

Much like how a prolonged lawsuit really only benefits the lawyers, the only people that benefit in a reorg scenario are the miners. The money flows from the disputed transaction (Binance or the thief) to the miners. At a deep level, this is what the Bitcoin protocol was designed to be, very expensive to change.

There’s a reason people don’t go around trying to reorg, even in the aftermath of large thefts. A reorg doesn’t just hurt the thief, but it also hurts everyone else. There’s a huge collective incentive to not change history.

May 7, 2019

Why Blockchain is Not the Answer

There’s a persistent myth that blockchain tech is brand new and that if only given enough time, somebody will make something that’s useful for something other than money. This is what I call the “blockchain, not Bitcoin” syndrome and in this article, I’m going to dispel the myth that uses for blockchain are just around the corner, that they’re going to add decentralization to all the things, and that it’s some revolutionary new tech.

The concept is about as bankrupt as the company whose logo which this imitates.Blockchain not Bitcoin is 5 years old already

The concept is about as bankrupt as the company whose logo which this imitates.Blockchain not Bitcoin is 5 years old alreadyCorporate obsession with blockchain started in 2014, shortly after Bitcoin got on their radar. Instead of paying attention to the revolutionary, innovative, decentralized and digitally-scarce money that is Bitcoin, they instead took a concepts from the software and called it “blockchain”.

Multiple industry groups were found at this time, like Hyperledger and R3 as well as companies like Digital Asset Holdings that tried to create a market around this tech.

What they had in common was the use of the word blockchain as a panacea for a bunch of problems in all sorts of industries. In typical corporate fashion, they took the word “blockchain” and bastardized it to mean whatever they wanted it to mean.

Ignorance meets hypeThe life that the word “blockchain” took on around 2015 was incredible. Tons of people, especially people that weren’t technical, often with only a vague sense of how Bitcoin worked, were saying things like “I believe in the technology, but I don’t believe in Bitcoin”. This was apparently the “consensus” response for business-types that wanted to seem like they were current on the technology.

You can understand why for two reasons. First, Bitcoin’s reputation from 2011 to 2015 or so, and to some degree today, was unsavory. Bitcoin was associated with activities like buying drugs, paying for an ad on backpage or even being an anarcho-capitalist/libertarian/Ron Paul crazy. Second, by praising the technology, an executive could appear to be on the leading edge of something that’s too technical for others to question effectively.

In other words, endorsing “blockchain” and not Bitcoin gave many business-types the appearance of expertise and knowledge about the topic without all the unsavory connotations associated with Bitcoin at the time. What’s clear from the subsequent actions is that they had no idea what blockchain was and seeded the consequences of their own ignorance.

Their ignorance led to mediocre engineers with very little understanding of incentive systems, game theory or even public key cryptography to masquerade as blockchain experts. These “experts” bamboozled business-types into believing that the solution to the biggest problem for a particular industry could be built with a blockchain, some developers and some money. But we’re getting ahead of ourselves. Before the full fledged “blockchain, not Bitcoin” syndrome caught fire, plenty of fuel in the form of hype preceded it.

Blockchain: the Panacea for All IllsThis pretense of knowledge led to books like The Blockchain Revolution, which promised fixes to pretty much every sector in the economy while giving just enough tantalizing technical concepts in vague enough terms that many executives felt the adolescent fear of missing out on the new technical trend of “blockchain technology”.

To be fair, many were taken in by promises of solutions to real problems for their industry. For health care, “blockchain” would somehow make patient history available to care providers at exactly the right time without violating patient privacy. For law, “blockchain” would somehow create perfectly fair contracts without the need for expensive lawyers. For supply chains, “blockchain” would somehow prove whose fault it was that some parts were substandard or that not enough parts were delivered. For art, music and TV, “blockchain” would somehow reward the creators what they were due while combating piracy and taking out the middle men. For online ads, “blockchain” would somehow make tracking accurate, reduce fraud and take out the many different middle men that collectively take a large portion of the profit. We could go on and on and on about the impossibly difficult problems that “blockchain” supposedly would solve.

It’s not a coincidence that these promises correspond to giant problems in each industry. Blockchain became a blank canvas onto which any problem could be painted as being solvable. Literally hundreds of startups and industry consortiums, many using ICOs, promised to solve the biggest inefficiencies in every industry using “blockchain”.

Many of these startups were created by veterans of a given industry who thought that the only missing piece was developers to write the blockchain system that would solve everything. They reasoned that they had the expertise to know what the problems were and that getting a few blockchain experts would be all that would be needed to make their industry so much better and create tremendous profit for themselves.

The Reality of BlockchainThis would work if only these developers could deliver on what the industry veterans wanted! How hard could it be to make a flawless, auditable, decentralized, encrypted database that execute terabytes of smart contracts quickly and efficiently using oracles that check each other using zero-knowledge proofs? Surely a few lines of code in Solidity could create a scalable, provably correct, maintainable system that would solve the biggest pain points of industry X, right? Well, no.

No, because no such explanations exist

No, because no such explanations existBlockchain became a meaningless buzzword that meant “solving the biggest challenge in industry X” using fancy jargon to convince people that the challenge could be met. The reality was far different. What most of these startups discovered is that blockchain is not a panacea. They ran head first into problems that we’ve known for a long time like the oracle problem, or the consensus problem, or the analyzability of Turing-complete contracts, or the free rider problem. It turns out blockchain, far from being a panacea is actually a hindrance to creating these solutions because of the requirement, at least nominally, of decentralization.

To make matters worse, the developers tasked with creating these systems were often completely ignorant about user and node incentives and possible exploits in an adversarial environment.

The Utter FailureThe results of such shenanigans are sadly predictable. When you promise more than you can deliver with mediocre talent in a technology that few people understand, you’re not going to be able to deliver much. Most of these efforts have accomplished nothing. The few that created proof-of-concepts have not progressed to full-fledged products. The few products that have launched have very little traction (less than 2000 users per day is considered a complete failure for an app or website).

Despite all this, ICOs touting decentralized blockchains for industry X, enterprise blockchain efforts to optimize Y and even public blockchains for some service Z continue to be touted as the future. Several different arguments generally come up when this discrepancy between promises and results are pointed out.

How can you be sure nothing will come out of blockchain technology other than Bitcoin?It’s true, it only takes one counterexample to disprove my thesis that blockchain is really only useful for sound money. However, without bastardizing the word blockchain, the essence of what blockchains provide is decentralized, authoritative, expensive to alter data. This is not a surprise as these properties are exactly what you want for sound money like Bitcoin.

Unfortunately, what non-monetary projects generally need, given that it’s software for an industry that’s regulated, changing and growing, is a centralized, upgradeable and scalable system. Each need is made greatly more difficult when combining with a blockchain. In other words, blockchain is the wrong tool for the job.

Even if by some miracle a popular app is created on a blockchain, a centralized equivalent without the extraneous blockchain will be cheaper, faster, more reliable, more maintainable while having the exact same single points of failure as the “decentralized” blockchain-y version. Or put another way, any popular dApp is destined to lose against a centralized competitor on cost, speed, features and scale.

So many people are working on this! Something has to come out of it.Lots of people working on something doesn’t mean desires magically turn into reality (see: alchemy, cold fusion, flying cars, etc).

That’s even overstating the point. Flying cars are at least possible. What most of these projects are working on are square circles or perpetual motion machines: decentralized services that have centralized control, that is, logical impossibilities.

I can hear my critics now, “Jimmy is against experimentation, entrepreneurship and trying new things!” This is a classic bait and switch tactic. Experimentation is fine to start. Pouring more money into failed experiments is just putting good money after bad. These “blockchain” experiments have a history of being futile and have little basis in reality. They are wastes of capital and human effort and don’t lead to any useful goods or services. All they do is allow charlatans to rent-seek.

Lots of money has gone into it! Someone is going to come up with something!Certain engineering challenges are simply not a matter of funding, they are a matter of innovation. What’s worse, when a company is handcuffed by being required to use a particularly cumbersome technology like blockchain, there’s even less chance of anything coming out of it. This is the classic error of a solution looking for a problem. And no, more money won’t magically find you a profitable market problem for which a blockchain happens to be the most optimal solution.

Conclusion

Conclusion“Blockchain, not Bitcoin” is not a new idea. The past five years have produced nothing with this so-called “blockchain” technology and we’re unlikely to see anything in the next five. The only thing that blockchain seems to be good at is promising to fix the biggest problems while delivering very little and consuming tremendous capital.